Daily Gold Market Report

UPDATE – Goid’s sharp turn to the upside has to do with the surge in unemployment claims. It leaves room for the Fed to pause rates at next week’s FOMC meeting. It is up $28 at $1970. Silver is up 86¢ at $24.37.

__________________________________

Gold up marginally as choppy price performance continues

Five up years, five down years during the summer months since 2013

(USAGOLD –6-8-2023) – Gold is up marginally this morning in the follow-up to yesterday’s sell-off. It is up $7 at $1949.50. Silver is up 28¢ at $23.79.In a recent client briefing, Gold Newsletter’s Brien Lundin offers a couple of explanations for gold’s choppy price behavior over the past month.

“For gold,” he says, “it seems that algos are simply keying off the rising yields part of the equation and ignoring the cheapening currency implications.… Again, not much to report on, and certainly nothing different from what I’ve been saying over the past few weeks. The Fed is likely to pause at next week’s meeting, but I believe that gold and bonds are already looking ahead at the possibility of a pivot — actual rate cuts — by the fall. That would mean something more than a recession has popped up and, needless to say, this would be extremely bullish for metals and miners. In the meantime, we’re smack dab in the summer doldrums already.”

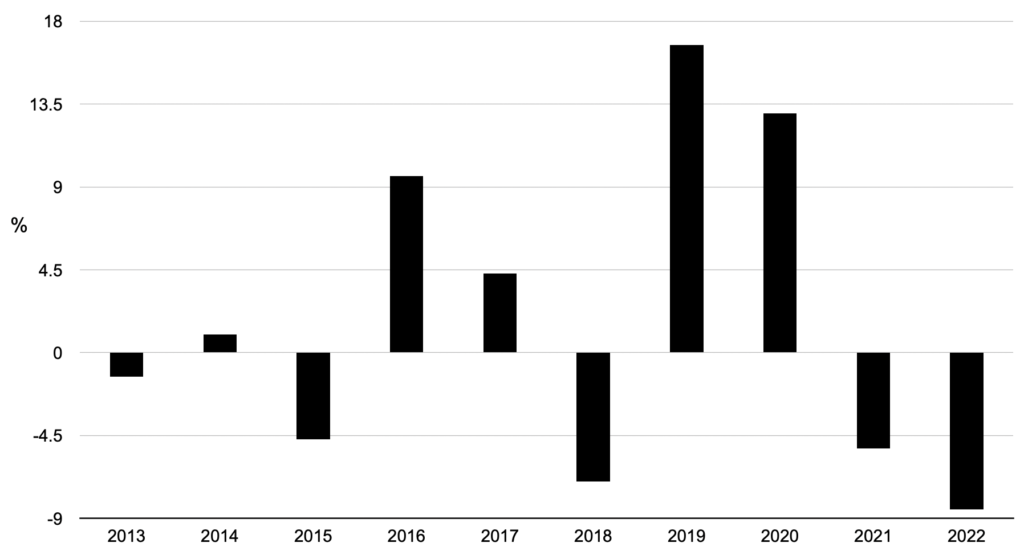

Editor’s note: Though trading and volumes in the gold market do tend to fade during the summer months, it has been a mixed bag over the past ten years in terms of price performance. We have had five down years and five up years, June through August, since 2013. Perhaps the old dictum to “sell in May and go away” is changing in this era of the portable office and instantaneous news availability.

Gold price performance

(%, June through August 2013-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: TradingView.com