Bank of America’s Hartnett sees 20% dollar selloff, turns bullish on gold

Markets Insider/Benzinga/4-14-2023

“According to the most recent ‘The Flow Show’ from Hartnett, markets are entering a new period of conflict, geopolitical isolationism, populism, fiscal excess, state intervention, regulation and redistribution. These factors will result in a world with 3%-4% inflation and 3%-4% interest rates.”

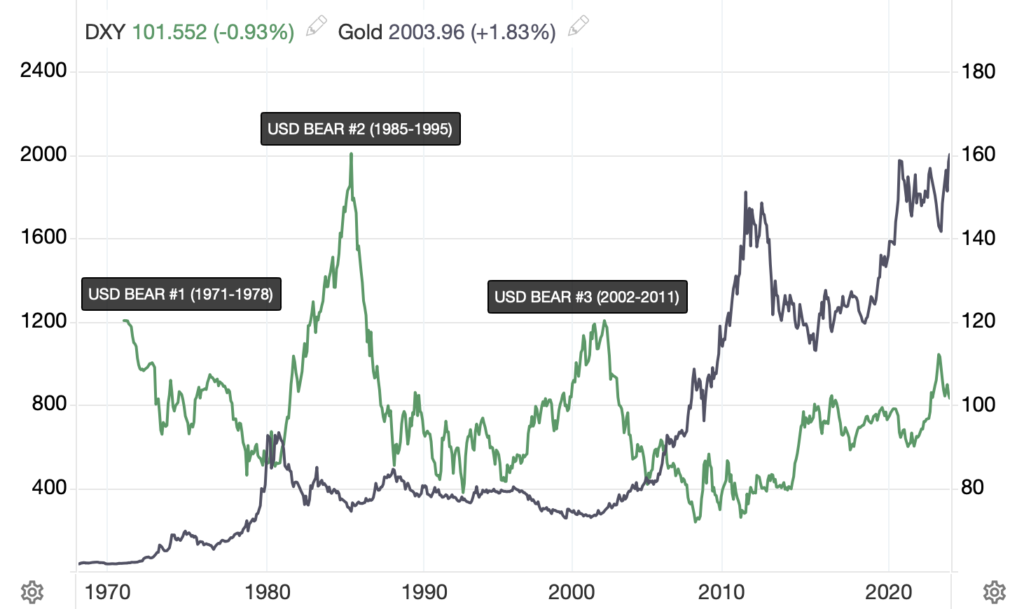

USAGOLD note: Hartnett is highly respected on Wall Street, so this forecast will not be taken lightly……He sees the dollar entering its fourth bear market in the last 50 years. The chart below shows the relationship between the US Dollar Index (DXY) and gold. A 20% decline would take the DXY back to the 80 level, implying the potential for an upside move in the gold price.

US Dollar Index and Gold

(1970 to present)

Chart courtesy of TradingEconomics.com • • • Click to enlarge