A Gold Classics Library Selection

Pompous Prognosticators

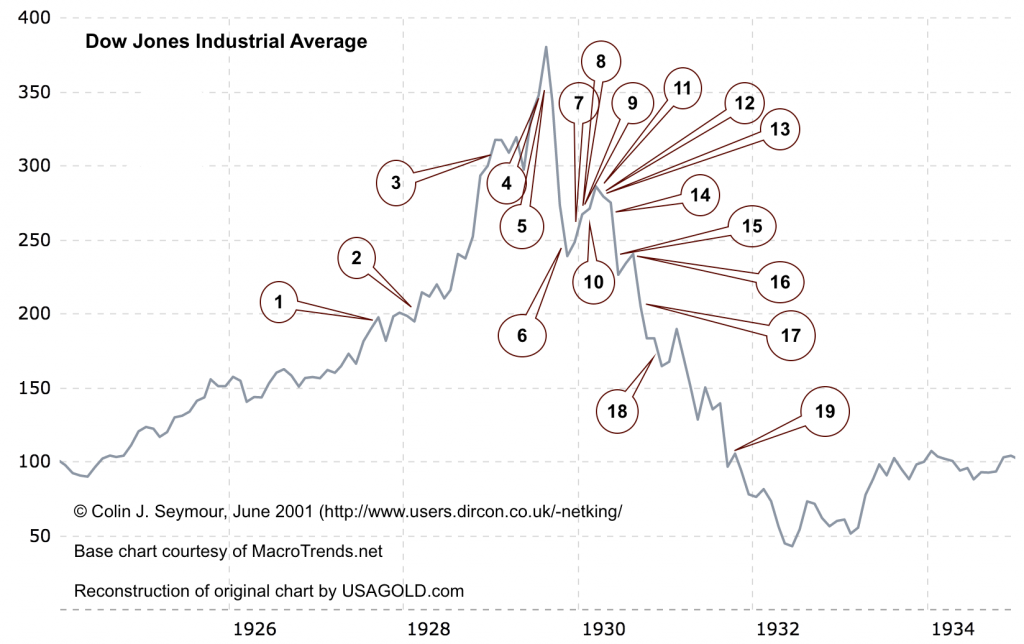

Optimism abounds as stock market crashes – 1928 to 1932

by Colin J. Seymour

May 2001 (Rev. August 29, 2001)

Chart locations are an approximate indication only. For relvance to 2001, scroll down to “Fast forward”

1. “We will not have any more crashes in our time.” – John Maynard Keynes in 1927 [NB: The authenticity of this one is a little suspect]

2. “I cannot help but raise a dissenting voice to statements that we are living in a fool’s paradise, and that prosperity in this country must necessarily diminish and recede in the near future.” – E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

“There will be no interruption of our permanent prosperity.” – Myron E. Forbes, President, Pierce Arrow Motor Car Co., January 12, 1928

3. “No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquility and contentment…and the highest record of years of prosperity. In the foreign field there is peace, the goodwill which comes from mutual understanding.” – Calvin Coolidge December 4, 1928

4. “There may be a recession in stock prices, but not anything in the nature of a crash.” – Irving Fisher, leading U.S. economist, New York Times, Sept. 5, 1929

5. “Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months.” – Irving Fisher, Ph.D. in economics, Oct. 17, 1929

“This crash is not going to have much effect on business.” – Arthur Reynolds, Chairman of Continental Illinois Bank of Chicago, October 24, 1929

“There will be no repetition of the break of yesterday… I have no fear of another comparable decline.” – Arthur W. Loasby (President of the Equitable Trust Company), quoted in NYT, Friday, October 25, 1929

“We feel that fundamentally Wall Street is sound, and that for people who can afford to pay for them outright, good stocks are cheap at these prices.” – Goodbody and Company market-letter quoted in The New York Times, Friday, October 25, 1929

6. “This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan… that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years.” – R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

“Buying of sound, seasoned issues now will not be regretted” – E. A. Pearce market letter quoted in the New York Herald Tribune, October 30, 1929

“Some pretty intelligent people are now buying stocks… Unless we are to have a panic — which no one seriously believes, stocks have hit bottom.” – R. W. McNeal, financial analyst in October 1929

7. “The decline is in paper values, not in tangible goods and services…America is now in the eighth year of prosperity as commercially defined. The former great periods of prosperity in America averaged eleven years. On this basis we now have three more years to go before the tailspin.” – Stuart Chase (American economist and author), NY Herald Tribune, November 1, 1929

“Hysteria has now disappeared from Wall Street.” – The Times of London, November 2, 1929

“The Wall Street crash doesn’t mean that there will be any general or serious business depression… For six years American business has been diverting a substantial part of its attention, its energies and its resources on the speculative game… Now that irrelevant, alien and hazardous adventure is over. Business has come home again, back to its job, providentially unscathed, sound in wind and limb, financially stronger than ever before.” – Business Week, November 2, 1929

“…despite its severity, we believe that the slump in stock prices will prove an intermediate movement and not the precursor of a business depression such as would entail prolonged further liquidation…” – Harvard Economic Society (HES), November 2, 1929

8. “… a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall.” – HES, November 10, 1929

“The end of the decline of the Stock Market will probably not be long, only a few more days at most.”

– Irving Fisher, Professor of Economics at Yale University, November 14, 1929

“In most of the cities and towns of this country, this Wall Street panic will have no effect.”

– Paul Block (President of the Block newspaper chain), editorial, November 15, 1929

“Financial storm definitely passed.” – Bernard Baruch, cablegram to Winston Churchill, November 15, 1929

9. “I see nothing in the present situation that is either menacing or warrants pessimism… I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress.” – Andrew W. Mellon, U.S. Secretary of the Treasury December 31, 1929

“I am convinced that through these measures we have reestablished confidence.” – Herbert Hoover, December 1929

“[1930 will be] a splendid employment year.” – U.S. Dept. of Labor, New Year’s Forecast, December 1929

10. “For the immediate future, at least, the outlook (stocks) is bright.”

– Irving Fisher, Ph.D. in Economics, in early 1930

11. “…there are indications that the severest phase of the recession is over…” – Harvard Economic Society (HES) Jan 18, 1930

12. “There is nothing in the situation to be disturbed about.” – Secretary of the Treasury Andrew Mellon, Feb 1930

13. “The spring of 1930 marks the end of a period of grave concern…American business is steadily coming back to a normal level of prosperity.” – Julius Barnes, head of Hoover’s National Business Survey Conference, Mar 16, 1930

“… the outlook continues favorable…” – HES Mar 29, 1930

14. “… the outlook is favorable…” – HES Apr 19, 1930

15. “While the crash only took place six months ago, I am convinced we have now passed through the worst — and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us.” – Herbert Hoover, President of the United States, May 1, 1930

“…by May or June the spring recovery forecast in our letters of last December and November should clearly be apparent…” – HES May 17, 1930

“Gentleman, you have come sixty days too late. The depression is over.” – Herbert Hoover, responding to a delegation requesting a public works program to help speed the recovery, June 1930

16. “… irregular and conflicting movements of business should soon give way to a sustained recovery…” – HES June 28, 1930

17. “… the present depression has about spent its force…” – HES, Aug 30, 1930

18. “We are now near the end of the declining phase of the depression.” – HES Nov 15, 1930

19. “Stabilization at [present] levels is clearly possible.” – HES Oct 31, 1931

20. “All safe deposit boxes in banks or financial institutions have been sealed… and may only be opened in the presence of an agent of the I.R.S.” – President F.D. Roosevelt, 1933

Fast forward… year 2001

Future of US economy “very bright”-Fed’s Broaddus

“Despite the current slowdown, however, intermediate and longer-term prospects for the U.S. economy are still very bright” – Federal Reserve Bank of Richmond President Alfred Broaddus, in a speech to the Virginia Housing Coalition, June 14, 2001.

Treasury Secretary Sees ‘Golden Age’- “[the country is] on the edge of a golden age of prosperity… I think we’re not doing badly for the kind of correction that we’re in right now… It’s easy to find gloom and doom, but consumers are hanging in there, their spending rates are still quite good… The contraction occurred … in the investment sector, where we had an overexpansion.” – Treasury Secretary Paul O’Neill, on ABC’s “This Week.”, Sunday June 24, 2001.

Economy Likely Up Over Next Year – Commerce Secretary Don Evans “Over maybe the next year, I certainly expect it (U.S. economic growth) to return to those kind of levels of (potential) growth” [between 3.0 percent to 3.5 percent] – US Commerce Secretary Don Evans to a Washington news conference, Wednesday August 29, 2001.

Aren’t these just a little disturbing after reading the prognostications from 1927-1933?

Colin Seymour – http://colinjs.com/finan/prognost.htm

References:

Many of the above quotations don’t have a reference to a source that you could look up in a library, such as a newspaper from the relevant era, or a learned journal, or a book complete with ISBN or Library of Congress numbers. We should therefore always be cautious in accepting the face value of such quotes. Nevertheless, I am sure most of these things were really said or something very close.

http://www.provide.net/~aelewis/gold/goldbear.htm

http://hv.greenspun.com/bboard/q-and-a-fetch-msg.tcl?msg_id=0016hr

http://sane.org.za/news_may99/money_matters.htm

http://www.srsr.org/toppage12.htm

http://www.sterling-asset.com/chrtmar99.htm

http://csf.colorado.edu/longwave/oct99/msg01538.html

“Only Yesterday” by Frederick Lewis Allen and “The Great Crash 1929” by John Kenneth Galbraith (mainly HES quotes) [thanks to Susan J. Barretta]

For Further Reading:

Black Thursday: October 24, 1929 [Newspaper headlines]

The 1929 crash [Newspaper headlines with charts]

Bang! went the doors of every bank in America

“… on March 6, 1933, Franklin Roosevelt, just sworn in for his first term as President, suddenly shut all 18,000 banks in America, aiming to overhaul them as fast as possible, and so reestablish people’s faith in government and America’s banking system…”

Depression, Radio and FDR

“Soon after his inaugural address, on March 12, 1933 Roosevelt held his first chat in an effort to quell the rising national panic over the banking crisis. By March 4th 5,000 banks had closed their doors and 36 States had suspended banking completely. Approximately $2.5 billion in individual savings were lost. Consequently, people were withdrawing their savings in droves, a situtation that only worsened the problem”

The Great Depression and the New Deal

“… when the banks reopened, the American public entrusted them with their money once more, which actually made the banks solvent. Merely by restoring public confidence in the banking system of America, Roosevelt saved it…”

Understanding How Glass-Steagall Act Impacts Investment Banking and the Role of Commercial Banks

“… by 1933 the U.S. was in one of the worst depressions of its history. A quarter of the formerly working population was unemployed. The nation’s banking system was chaotic. Over 11,000 banks had failed or had to merge, reducing the number by 40 per cent, from 25,000 to 14,000. The governors of several states had closed their states’ banks and in March President Roosevelt closed all the banks in the country…”

BANKING ACT OF 1935

“AN ACT To provide for the sound, effective, and uninterrupted operation of the banking system, and for other purposes”

Main Causes of the Great Depression [Gusmorino, Paul A., III., (May 13, 1996)]

The Great Depression 1920s-1941

Copyright © 2001 by Colin Seymour. All Rights Reserved. Reprinted by USAGOLD with permission of Mr. Seymour. No further reproduction without permission.

Reprinted with permission.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

1-800-869-5115

[email protected]

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.