Author Archives: Opinion

Deep recession to force full percentage-point fed cut Double Line warns

Bloomberg/Anchalee Worrachate/7-25-2023

USAGOLD note: Sherman thinks that the Fed will be slow to act in the face of a hard recession and then be forced to “unleash the biggest cut since the pandemic struck.” We should add that Doubletree’s Jeff Gundlach consistently has been among the most bearish Wall Street commentators.

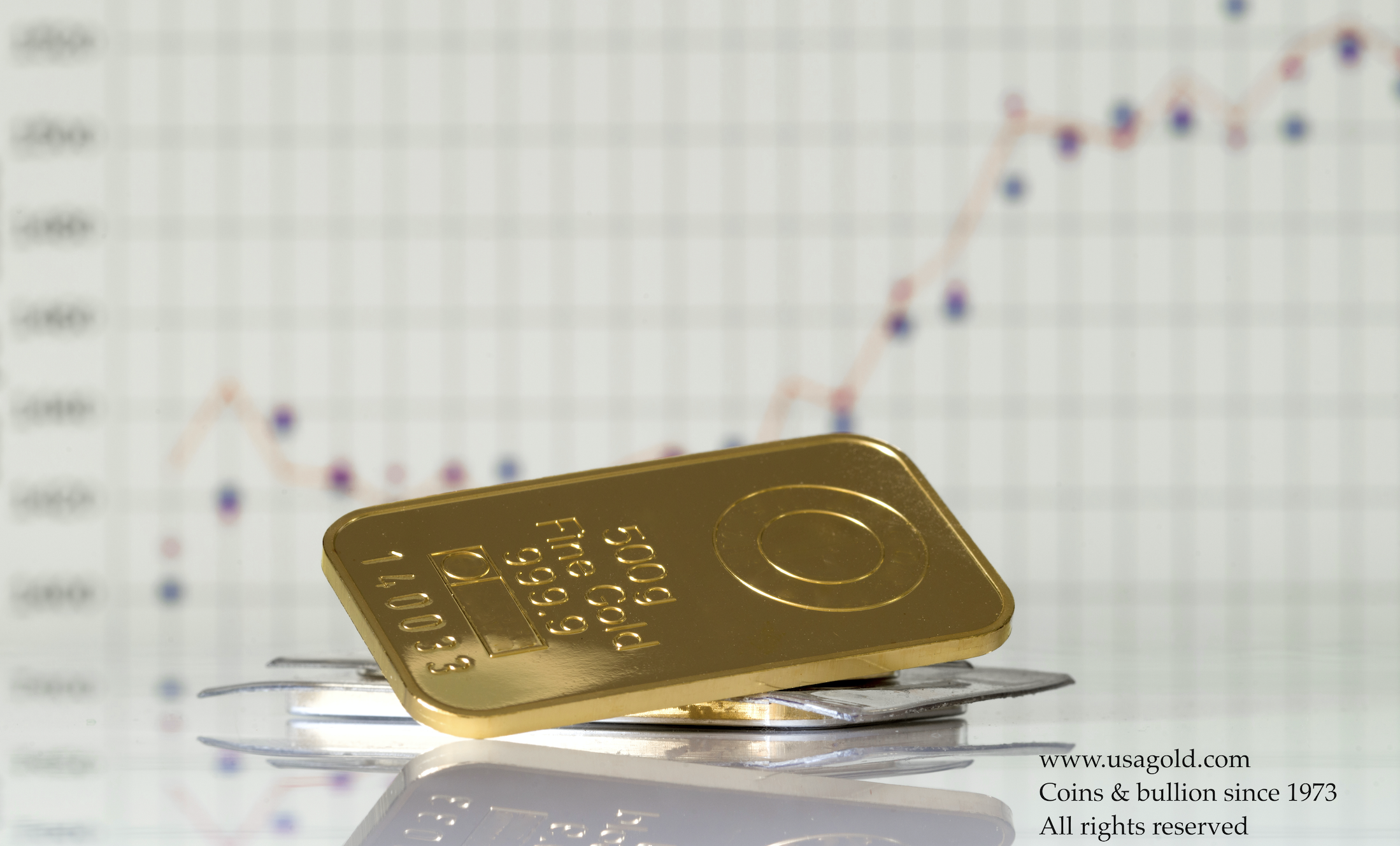

Gold could hit record high of $2,500, says WisdomTree

“Gold is on track to hit a new record high of $2,225 per ounce by this time next year, according to Nitesh Shah, head of commodities and macroeconomic research at WisdomTree. However, if things go right, the precious metal may shoot even higher to $2,500 per ounce.”

USAGOLD note: Wisdom Tree sees a convergence of influences taking gold to all-time highs.

A $500 billion corporate-debt storm builds over global economy

Bloomberg/Jeremy Hill and Lucca De Paoli/7-18-2023

USAGOLD note: The possibility of a full domino effect cannot be ruled out, in our view, and it could begin anywhere without warning.

What happened in Beijing? Here’s two theories on why the dollar dropped after Yellen’s visit

MarketWatch/Steve Goldstein/7-19-2023

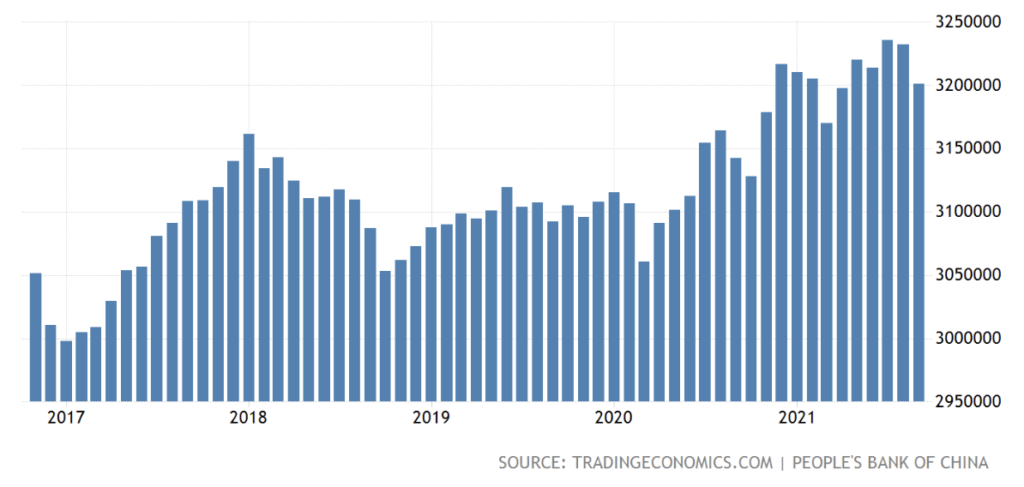

“Kevin Muir, a former institutional trader that blogs at The Macro Tourist, said China didn’t like what they heard from Yellen so the country decided to send a message. ‘China has $3.2 trillion in FX reserves. Their biggest position will be the U.S. dollar and don’t think they will be shy about using it,’ he says.”

USAGOLD note: A long-held market fear resurfaces – China weaponizing its dollar reserves. It can sell or swap for gold or other currencies. It can continue to refrain from buying U.S. Treasures.

China US dollar reserves

Chart courtesy of Trading Economics

Gold should be dead, but somehow it’s still adding value

MarketWatch/Brett Arends/7-15-2023

USAGOLD note: Arends has never been an ardent supporter of gold, but in this article he reluctantly makes concessions.… To make a long story short, a portfolio that includes a 10% gold diversification over the long run does better than one that doesn’t. How would a 20% diversification look?

Goldman chief economist cuts recession probability to 20%, dismisses yield-curve inversion

MarketWatch/Steve Goldstein/7-18-2023

USAGOLD note: Hatzius, in fact, believes the economy is going to grow “albeit below trend pace.”

The decline and fall of the U.S. dollar

The Heritage Foundation/EJ Antoni/7-13-2023

“The U.S. dollar’s reserve currency status is one of America’s greatest strengths, but President Joe Biden seems hellbent on toppling the dollar from its throne through both his domestic and foreign policy agenda. Americans need to pay attention because we’ve seen this movie before, and it doesn’t end well.”

USAGOLD note: The Biden Administration is only one of the players undermining the dollar. Congress is equally culpable as is the Federal Reserve which is quick to turn to money printing at the first signs of a crisis.

Pozsar on the ‘monetary divorce’ from the dollar

Zero Hedge/Tyler Durden/7-17-2023

“Gold is definitely something that’s coming back as a theme… we are seeing this more and more in the data that especially the countries that are not geopolitically aligned to the US are shunning Treasuries and shunning the dollar and they are buying gold instead.”

USAGOLD note: Pozsar elaborates on the evolving monetary system and the dollar and gold’s role in it.

Markets are propelled by what hasn’t happened

Bloomberg/Mohamed A. El-Erian/7-1 7-2023

USAGOLD note: It’s been a year of surprises and unexpected serenity…… El-Erian offers food for thought in this Bloomberg piece.

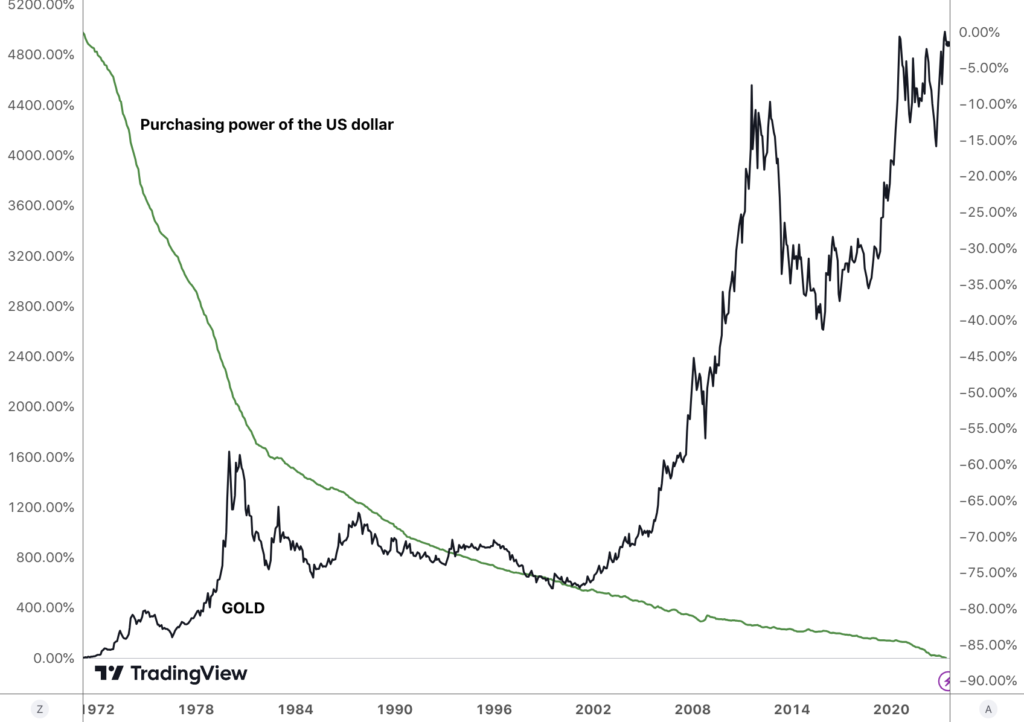

Dollar’s busted bull run has doomsayers calling end of era

Bloomberg/Alice Atkins and Carter Johnson/7-16-2023

“The greenback’s worst slump since November has a bevy of strategists and investors saying a turning point is finally at hand for the world’s primary reserve currency. If they’re right, there will be far-reaching consequences for global economies and financial markets.”

USAGOLD note: Whatever it does against other currencies in the short term, the dollar’s history over the long run has been one of steady debasement and loss of purchasing power, and that era, in our view, is far from over.

The purchasing power of the US dollar and gold

(%, 1971-present)

Chart courtesy of TradingView.com • • • Click to enlarge

Battle lines are drawn

Credit Bubble Bulletin/Doug Noland/7-14-2023

Selected quotes

“I’m challenged to find significant evidence Fed policy is ‘starting to bite hard.’ My analytical framework prioritizes financial conditions. Generally, tighter market liquidity conditions presage tighter lending, slower Credit growth and weakened demand. Markets lead economic performance – not vice versa. Booming markets generate self-reinforcing liquidity, loose conditions and asset inflation, which work to bolster confidence and boost spending.”

. . . . . . . . . . . . . . . . . . . . . . . .

“I see inflation ebbing and flowing – with much more flow than ebb over time. But what conventional analysis sees as the previous inflation normal, I view as aberrational. Inflation risk remains highly elevated in New Cycle Dynamics. This exceptionally hot weekend will remind us of newfound climate hostilities. And there is deglobalization, with heightened China tensions adding to trade, supply-chain and pricing uncertainties.”

. . . . . . . . . . . . . . . . . . . . . . . .

“Bubbling markets readily disregard myriad stability risks. Inflation is seen in full retreat, with policy tightening having about run its course. Recession risks have dissipated. It’s difficult for me to imagine a backdrop of greater stability risk. Inflation risk remains highly elevated. The risk of bursting financial Bubbles is extreme. Fed rate increases have failed to tighten market conditions, with speculation and speculative leverage becoming only more acute. And fearless markets are more confident than ever that underlying fragilities ensure central bankers won’t risk bursting Bubbles.”

Taking the temperature

Oaktree/Howard Marks/7-10-2023

USAGOLD note: The wisdom of Howard Marks at the link……

Simon White: In real terms, equities likely to be one of the poorest performing asset classes

Zero Hedge/Simon White/7-11-2023

USAGOLD note: White is Bloomberg’s macro strategist. He says, “We have several of the same dynamics today as in the 1970s.”

The mystery of gold prices

Yahoo!Finance-The Economist/Buttonwood/7-13-2023

USAGOLD note: Since the turn of the century, gold has responded most directly to crisis. Much of this Economist article focuses on gold as an inflation hedge. We feel misses the point about gold,i.e. why people buy it. Too, we do not see where it sheds much light on the mystery of gold prices.

Why the Fed’s fumble on inflation leaves the economy vulnerable to stagflation

MarketWatch/Peter Morici/7-11-2023

USAGOLD note: Morici, an economist at the University of Maryland, sees inflation as staying in the 4% range while economic growth runs at less than 2%. That, he says, is stagflation.

Is gold in a new bull market phase?

Goehring & Rozencwajg/6-23-2023

USAGOLD note: In this interview, Rozencwajg reiterates the firm’s long-term target for gold at $12,000 to $15,000. “It has always been our long-term forecast on gold,” he said.

Hanke adocates full dollarization for Argentina – replacing the peso with the dollar

MarketsInsider/Zahra Tayeb/7-10-2023

USAGOLD note: If Argentina replaces the peso with the dollar, it will give up its economic sovereignty. The frontrunner in Argentina’s upcoming election, Javier Milei, also believes Argentina should dollarize.

The graveyard of empires; The top investments as the world order collapses

International Man/Nick Giambruno/7-2023f

Cartoon courtesy of MicahelPRamirez.com

“The US government’s total failure in Afghanistan—the longest war in American history—signifies a crucial moment and turning point in world history. The Soviet Union collapsed about two years after the Red Army was defeated and withdrew from Afghanistan. As we approach the second anniversary of the American retreat, could a similar fate be in store for the US?”

USAGOLD note: Giambruno believes “an ocean of money’ will pour difficult to produce monetary alternatives – namely gold and bitcoin – as the dollar loses its “privileged position.”

Ageing population is a long-term threat to economy, warns Andrew Bailey

Yahoo!Finance/Melissa Lawford/7-9-2023

USAGOLD note: The demographic imbalance is often overlooked, but, as Bank of England’s Andrew Bailey points out, it remains among the top influences on the contemporary economy,

Stoeferle interviews Pozsar

GoldBroker/Ronnie Stoeferle/7-4-2023

“Yes, I think [central bank gold buying] is going to accelerate. I think reserve management practices, the way central banks manage their foreign exchange reserves, is going to go through transformative change over the next five to ten years. There are a number of reasons for this. One reason is that geopolitics is a big theme again; we are living through a period of ‘great power’ conflict.” – Zoltan Pozsar

USAGOLD note: If you are in the mood for a deep dive into the complexities of global finance, you will find much to consider in this interview with Zoltan Pozsar. “I think gold is going to have a very special meaning, simply because gold is coming back on the margin as a reserve asset and as a settlement medium for interstate capital flows.” The old becomes the new.