Monthly Archives: May 2023

Platinum demand predicted to surge this year, leaving a near 1-million-ounce deficit

CNBC/Hannah Ward Glenton/5-16-2023

USAGOLD note: CNBC reviews platinum’s prospects for the rest of the year……

Gold could rally to a new record high if the US defaults and investors flee to safety

Yahoo!Finance/Filip DeMott/5-14-2023

USAGOLD note: Oanda’s Edward Moya says he would not be surprised at a $100 uptick in the gold price if the U.S. defaults.

The Deutsche Bundesbank and gold: A bond that never breaks?

The Alchemist/Wolfgang Wrzesniok-Rossbach/5-11-2023

“Over the next few years, the gold reserves literally exploded. By 1959, when the European Payments Union was replaced by the European Monetary Agreement, Germany had already received 1,584 tons of gold from its European partner countries. As a result of further inflows from the Bretton Woods system, among others, the Bundesbank’s total holdings reached 2,344 tons by the end of 1959, and the inflows continued steadily.”

USAGOLD note: Germany owns the second-largest stockpile of gold in the world at 3,355 tonnes. “T]he knowledge of the existence of this treasure,” says Wrzesniok-Rossbach, “clearly allows many Germans to sleep better in light of the many financial and economic policy imponderables in the

present day.

Investors go for the gold as prices surge, poll finds

USAGOLD note: A Gallup poll finds that 26% of Americans view gold as the best investment over the long run – a two-fold increase over last year. Only 18% cited stocks and mutual funds in the best investment category while 34% favored real estate.

Daily Gold Market Report

Gold subdued despite breakdown in debt ceiling talks, Powell’s hint at rate pause

UBS sees gold at $2100 by year-end, $2200 by March 2024

(USAGOLD – 3/22/2023) – Gold remained surprisingly subdued in early trading despite a breakdown in negotiations on the debt ceiling and Fed chair Powell’s hint that a rate pause was forthcoming. It is down $2 at $1978. Silver is down 3¢ at $23.90.

In a recent client update, Swiss-based UBS points out that, despite gold’s choppy trading of late, it is still 8.2% higher on the year and predicts “it’s likely to break its all-time high later this year with multiple mid-to-longer-term drivers.” Those drivers include “robust” central bank demand, “broad” US dollar weakness, and recession-related safe-haven flows. It sees gold hitting $2100 by year-end and $2200 by March 2024. “The direction of a weakening dollar is clear,” it states, “with the US Fed having signaled a pause in its current tightening cycle after 500 basis points of rate hikes over the past 14 months. Other major central banks, meanwhile, remain on track to do more to fight inflation.”

Favorite web pages

Daily gold and silver price history

1968 to present

Our Daily Gold and Silver Price History pages are among the heaviest traffic pages at the USAGOLD website. The archived data is licensed from the ICE Benchmark Administration and the London Bullion Market Association and Netdania Creations and run from 1968 to present. FOREX prices for the day are posted as a live feed and then frozen at the end of each trading day. These pages are frequented by data gatherers of all descriptions from professors and their students to market professionals and investors – all interested in gold’s price performance both over the long run and within specific time constraints for their own research purposes.

Daily Gold and Silver Price History is another of the quiet pages at USAGOLD that garners significant global interest particularly when the market is moving or breaking news warrants more than average interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion, and analysis as it happens.

We invite your visit. We encourage your bookmark.

USAGOLD’s

Daily gold and silver price history pages

A Gold Classics Library Selection

Extraordinary Popular Delusions And The Madness Of Crowds

Charles Mackay in his Extraordinary Popular Delusions and Madness of Crowds, written in 1841, unwittingly provides us one of the better studies of modern market behavior. I doubt Mackay would have guessed that his book would be read, digested and taken as revelation by readers in the 21st century. At the same time, he probably would have not been surprised that the pull of the same dark gravity that caused people to throw their fortunes at tulip bulbs in Holland, or land they never had a hope of seeing in the New World, would be omnipresent in the age of computers, instantaneous communication, and the nearly infinite availability of market analysis. The highly successful speculator and gold investor Bernard Baruch (1870-1965) put his blessing on this book as one of the secrets to his success on Wall Street.

Said Baruch:

“Have you ever seen in some wood, on a sunny quiet day, a cloud of flying midges — thousands of them — hovering, apparently motionless, in a sunbeam? …Yes? …Well, did you ever see the whole flight — each mite apparently preserving its distance from all others — suddenly move, say three feet, to one side or the other? Well, what made them do that? A breeze? I said a quiet day. But try to recall — did you ever see them move directly back again in the same unison? Well, what made them do that? Great human mass movements are slower of inception but much more effective.”

So we bring you Charles Mackay and his Extraordinary Popular Delusions with our own sense of mission. If the rising generations now receiving their education, or even their more jaded elders, find application in their own investment philosophy, then the purpose of this Gold Classic Library entry has been served. Complicated and timelessly revealing, here you will find examples of herd behavior, delusion, mania, craftiness, and financial loss and gain. Solomon taught us that there are no new things under the sun. Mackay teaches us how we might recognize the signs and that the crowd gone mad is a matter to be reckoned with in almost every era.

Fewer Treasurys, more JGBs in the cards for Japan life insurers

NikkeiAsia/Toshihiro Sato and Kosuke Iguchi/5-10-2023

USAGOLD note: Japanese life insurance companies have been an important part of the demand picture over the past twenty years. The Council of Foreign relations puts the total holdings of foreign bonds by Japanese private investors (of which life insurers is one component at $740 billion) at $3 trillion. One investment manager stated the problem plainly. “After accounting for hedging costs, investing in Treasuries has no appeal in terms of yield.”

James Grant: ‘The Fed is problem No. 1 in American finance.’

MarketWatch/Mark DeCambre/5-14-2023

USAGOLD note: Grant says that the suppression of rates has created “all manner of distortion in American finance.” So much so, that it is impossible to know where the next shoe is going to drop. That level of uncertainty will make it difficult for investors to find a place to park capital. So what should an investor be buying? Gold, Grant says…… A long-time critic of Fed money-printing policies, Grant holds nothing back in this interview.

Wall Street becomes preferred destination for gold miners over London

Financial Times/Harry Dempsey and William Langley/5-13-2023

USAGOLD note: In making the announcement, AngloGold pointed out that Wall Street listed companies trade at a “significant premium” – an incentive difficult to overlook.

Short and Sweet

Copernicus on the debasement of money

“Although there are countless scourges which in general debilitate kingdoms, principalities, and republics, the four most important (in my judgment) are dissension, [abnormal] mortality, barren soil, and debasement of the currency. The first three are so obvious that nobody is unaware of their existence. But the fourth, which concerns money, is taken into account by few persons and only the most perspicacious. For it undermines states, not by a single attack all at once, but gradually and in a certain covert manner.” – Copernicus, Essay on the Coinage of Money (1526)

Few know that Copernicus applied his genius to the insidious effects of currency debasement. The ground-breaking essay linked above probably influenced both John Maynard Keynes (See below) and Thomas Gresham of “bad money drives out good” fame. Supply Side Blog’s Ralph Benko says Copernicus’ essay “has been translated into English several times yet those translations remained difficult to obtain for students of the monetary arts and sciences. It has remained mostly the property of elite historians.” Above we link Edward Rousen’s translation that you might keep company with the knowledgeable elite.

It cost 8¢ to mail a one-ounce letter in 1973 as indicated by the commemorative Copernicus stamp shown above. It costs 55¢ today – an illustration of his assertion that currency debasement “undermines states, not by a single attack all at once, but gradually and in a certain covert manner.” The post office increased the cost of mailing a letter by 5¢ – to 55¢ – beginning in 2019.

“By a continuing process of inflation governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.” – John Maynard Keynes, The Economic Consequences of Peace (1919)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to protect your savings from being confiscated in a covert manner?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

‘The Fed is way late and they’ve already screwed it up.’

MarketWatch/Jonathan Burton/5-11-2023

USAGOLD note: McCullough includes precious metals in his list of favored investments. He says we are already in a recession.

Daily Gold Market Report

Gold attempts to gain traction as we close out a less-than-stellar week

Bloomberg strategist: Current inflation lull perfect opportunity to load up on inflation hedges

(USAGOLD – 5/19/2023) – Gold is attempting to gain traction this morning as we close out what’s been a less-than-stellar week. It is up $7 at $1967. Silver is up 9¢ at $23.67. Saxo Bank‘s Ole Hansen sees gold as “consolidating within its well-established uptrend.” The bank maintains its “bullish outlook,” he says, “with the biggest short-term challenge being the risk of long liquidation from momentum-focused hedge funds, a group of speculators that have been strong buyers in recent months.”

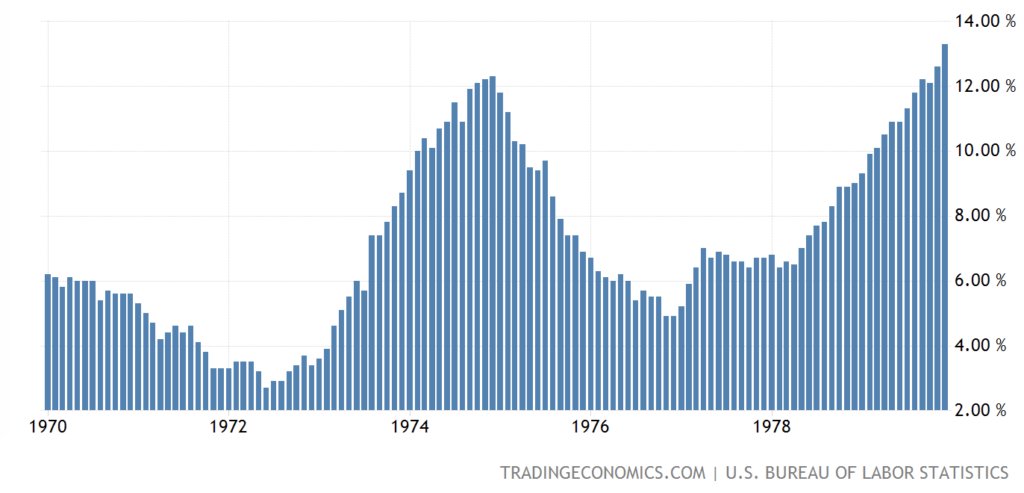

Bloomberg macro strategist Simon White believes “the current lull in inflation offers the perfect opportunity to take advantage of cheap inflation hedges before price growth starts to accelerate again.” He goes on to say that “the stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a ‘one-shot’ problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation. Inflation hedges that look cheap today thus won’t be cheap for very long.” [Source: Zero Hedge]

Headline inflation during the 1970s

Chart courtesy of TradingEconomics.com

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The [2008] crisis convinced me that greed, ego, fear, short-sightedness, group-think and other human foibles have at least as much, if not more, to do with financial behaviour as rational thinking does.”

Mike Silva

Former chief of staff to New York Fed president Tim Geithner

(Speech to the LBMA, October 2018)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

America’s fiscal comedy has never been so deadly serious

YahooFinancee-The Telegraph/Ambrose Evans-Pritchard/5-12-2023

“It is barely two years since 147 Republicans in Congress voted to overturn the presidential election, in spirit with the mob that stormed Capitol Hill on January 6 2021. Whether or not you deem this insurrection to be an attempted coup, it indisputably tells us that time-honoured conventions in Washington no longer apply. Anything can happen.”

USAGOLD note: Investors for the most part take a ho-hum approach to the debt celing but as we have mentioned before there is sizable group of analysts and pundits, like Evans-Pritchard, who are less than casual about the situation.

‘Speculative markets are an accident in the making’

Credit Bubble Bulletin/Doug Noland/5-12-2023

A couple of notable insights from Doug Noland, released Saturday:

“Bonds and stocks rallied immediately on the release of CPI data, with television analysts scurrying to try to explain the spirited bullish market reaction. The explanation was in market positioning, rather than in data minutia. There has been significant hedging around key economic releases, certainly including CPI and non-farm payroll reports. And with markets remaining resilient over recent months, Greed is on the side of those writing derivative ‘insurance’ – with Fear weighing on buyers. Holders of hedges have ‘weak hands,’ meaning they have limited tolerance for additional losses. So, the basically in line CPI report spurred an immediate unwind of hedges and squeeze dynamics in both Treasuries and stocks. Rallies, however, were relatively short-lived.”

“It’s intriguing. Inflation proving stickier than expected had no impact on expectations for a dovish pivot. The same for persistently tight labor markets and general economic resilience. In this I see corroboration of the thesis that the rates market is pricing probabilities of some type of accident forcing the Fed’s hand. The banking crisis is a potential accident. The ‘X-date’ fiasco could blow up. In general, speculative markets are an accident in the making. But I’ve been positing over recent years that the vulnerable Chinese Bubble was likely a factor in persistently low Treasury and global sovereign yields.”

Stagflation is much more likely than Deflation – prepare accordingly

Blain’s Morning Porridge/Bill Blain/5-9-2023

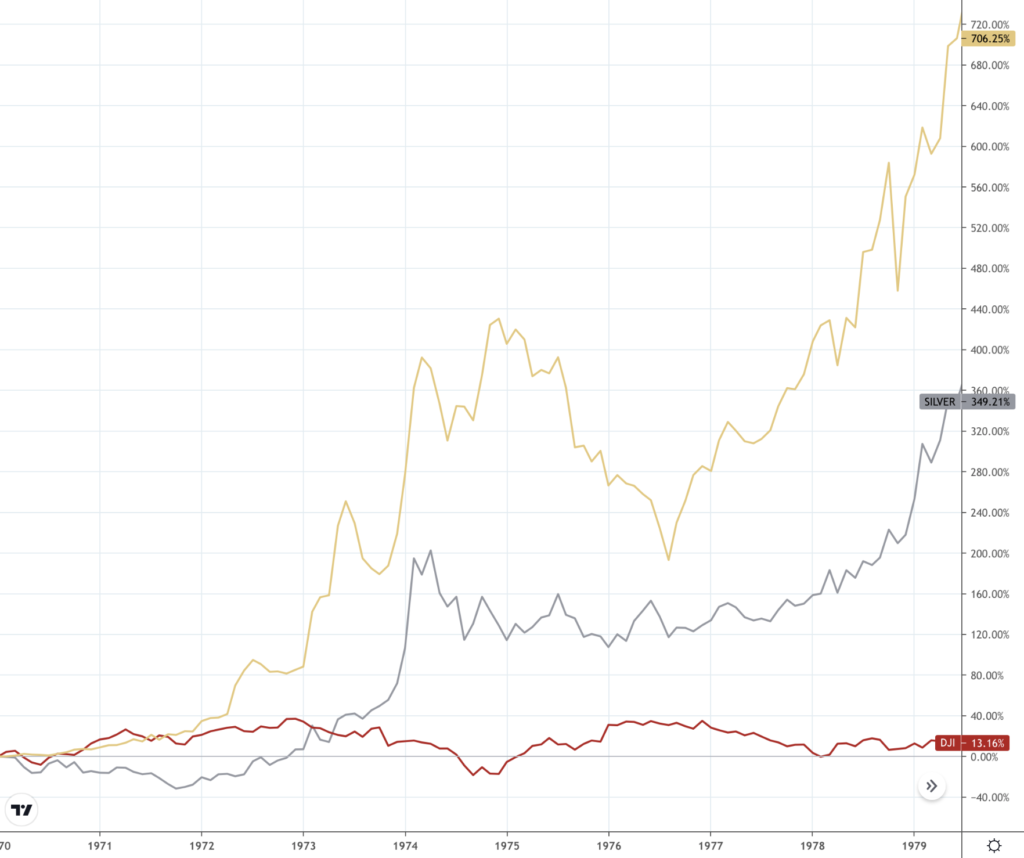

Gold, silver and stocks performance 1970s

(% change)

Chart courtesy of TradingView.com • • • Click to enlarge

“Yesterday, I noted a number of banks quietly rowing back expectations Central Banks are about to start reversing the recent run of rate hikes – putting cuts back to 2024. Macro hedge funds are shorting rate cuts. What do they know that we don’t? They’ve got a view on sticky inflation and how central banks will respond.”

Short and Sweet

‘Wannabes’ and ‘Gonnabes’ not the real thing

‘Put differently, as long as humans remain tangible, it is likely that they maintain a desire to hold real and tangible assets. Very few companies on the US stock exchange, for example, are older than 50 years. By comparison, gold has existed for thousands of years and any gold coin or gold bar will most likely outlive any company and their stocks and bonds. Put together, it is unlikely that a company that sells claims on gold, such as a gold ETF, will beat physical gold’s longevity.” – Dick Baur, Professor of Finance, University of Western Australia (Why ‘digital gold’ won’t ever kill off the real thing)

Wannabe and gonnabe paper gold and silver will never pass for history’s time-honored store of value – nor will it be mistaken for actual gold coins or bars stored nearby should the cold wind blow. By the way, adding the word, blockchain, to a paper gold product might enhance its marketing appeal, but it changes nothing in terms of its usefulness to the true safe-haven investor. The instrument is still paper gold and little more than a price bet.

Don’t wannabe a ‘wannabee’?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

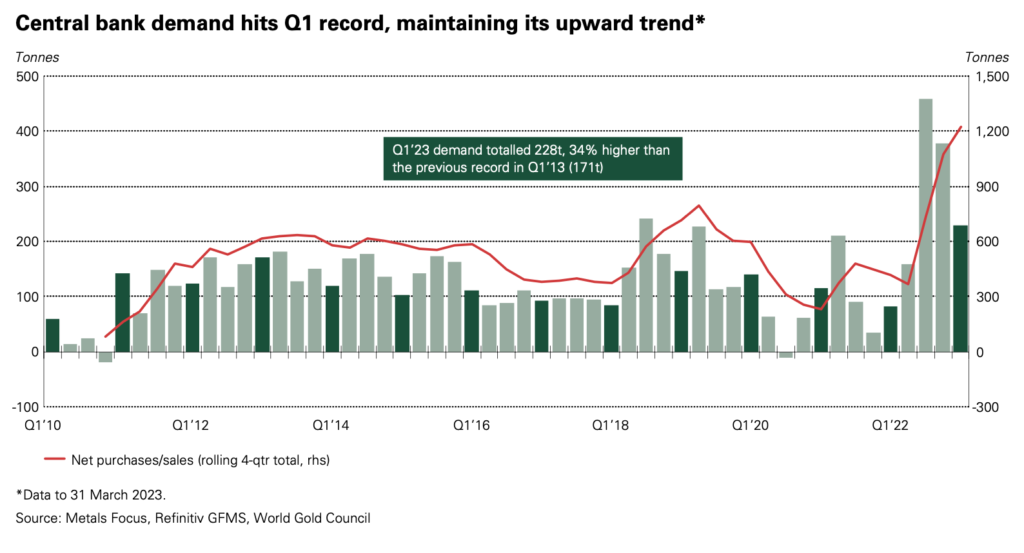

World Gold Council Demand Trends – Q1, 2023

World Gold Council/Staff/5-5-2023

“Q1 saw diverging trends in gold investment demand: a small decline in gold ETF holdings versus hearty bar and coin buying.”

USAGOLD note: There are no real surprises in the World Gold Council’s first quarter Demand Trends report just a continuation of the positive trends that have been in place since last year. That includes strong central bank and private investor demand. One standout statistic – first quarter central bank demand was 34% higher than the previous Q1 record in 2013.

Chart courtesy of World Gold Council • • • Click to enlarge

Daily Gold Market Report

Gold drifts lower as debt ceiling concerns dissipate

Grant calls Fed ‘the No. 1 problem in American finance.’

(USAGOLD – 5/18/2023) – Gold drifted lower this morning as debt ceiling concerns dissipated and rate uncertainty continued to hang like a dark cloud over financial markets. It is down $6 at $1977. Silver is down 22¢ at $23.60. James Grant, the editor of Grant’s Interest Rate Observer, believes the Fed is “problem No. 1 in American finance.” He says that the “past 10 or 12 years in respect to Fed policy and the general suppression of the rate of interest has sowed the seeds for the regional-banking problems, the debt drama, the debt ceiling.”

“I think that the basic idea of buying up bonds,” he told MarketWatch in an interview last week, “and thereby suppressing longer-dated interest rates in the hopes of generating rising asset prices and thereby stimulating the economy by dint of people spending the proceeds of their capital gains, this idea that the Bernanke Fed surfaced in 2010-11 I think it is a very, very dicey proposition longer term. I don’t think it work.” Grant says he has been identifying more things to sell than own in the present environment, but he remains bullish on gold.

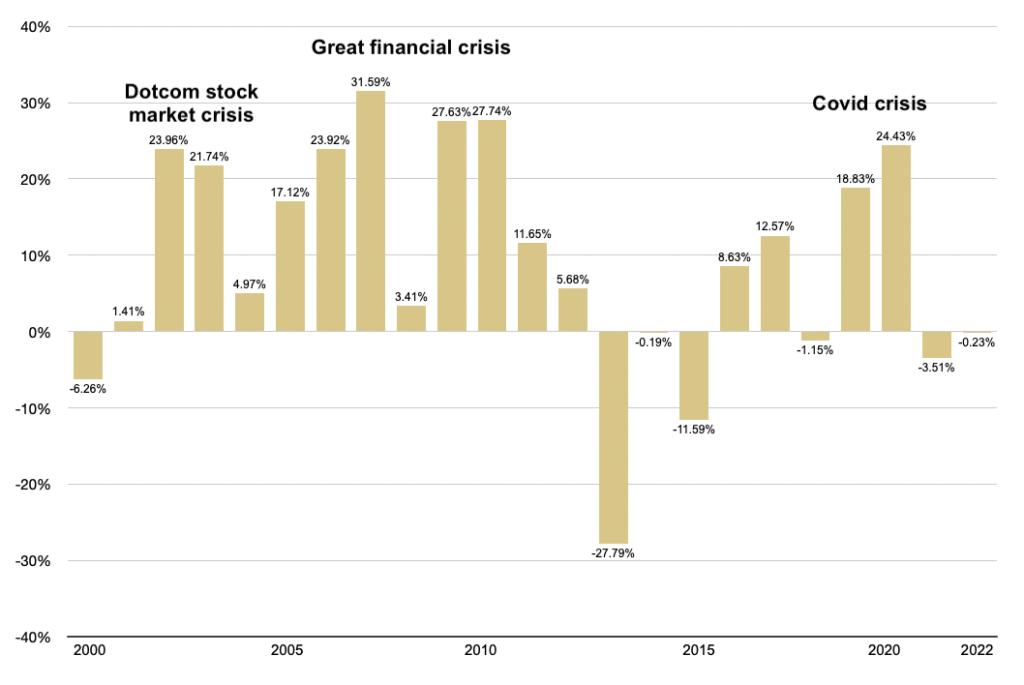

Gold returns and financial crises

(2000-present)

Chart by USAGOLD [All Rights Reserved] • • • Data source: MacroTrends.net • • • Click to enlarge