Monthly Archives: May 2023

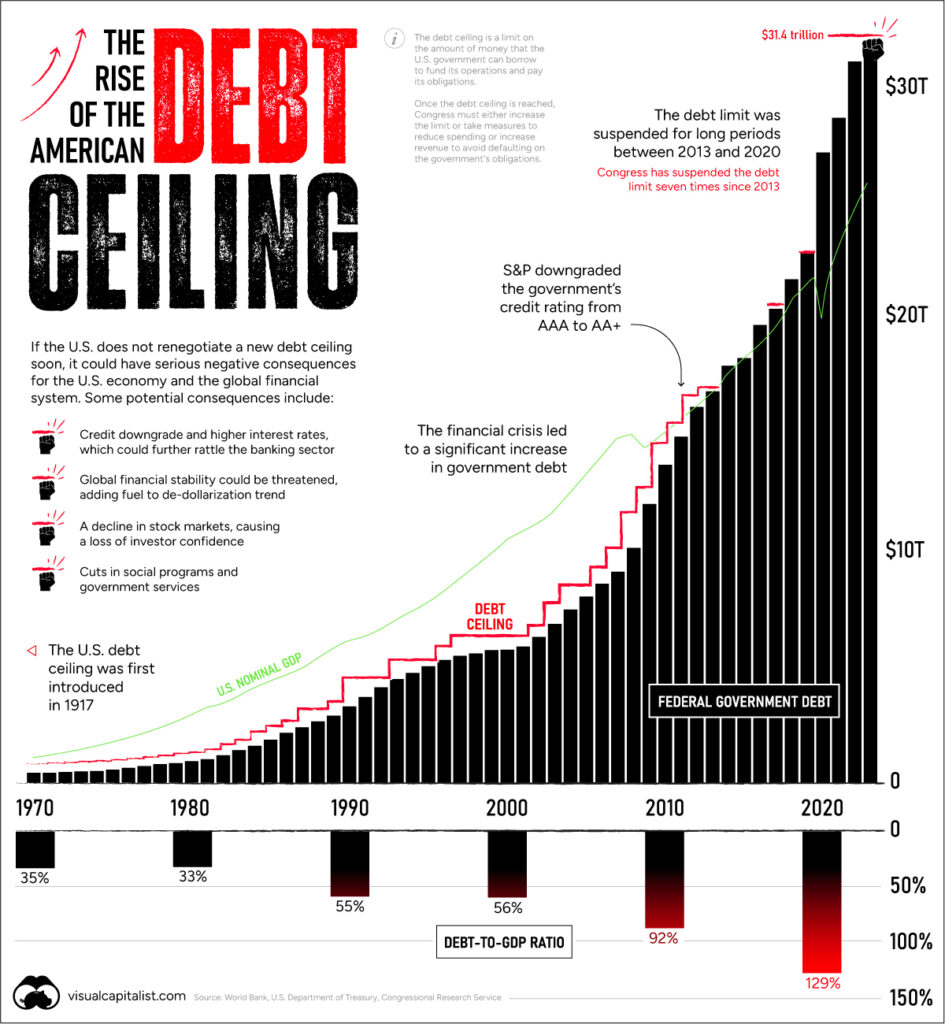

Charting the rise of America’s debt ceiling

USAGOLD note: For those curious about the history of the debt ceiling ………

The Visual Capitalist/Dorothy Neufeld and Nick Routley/5-17-2023

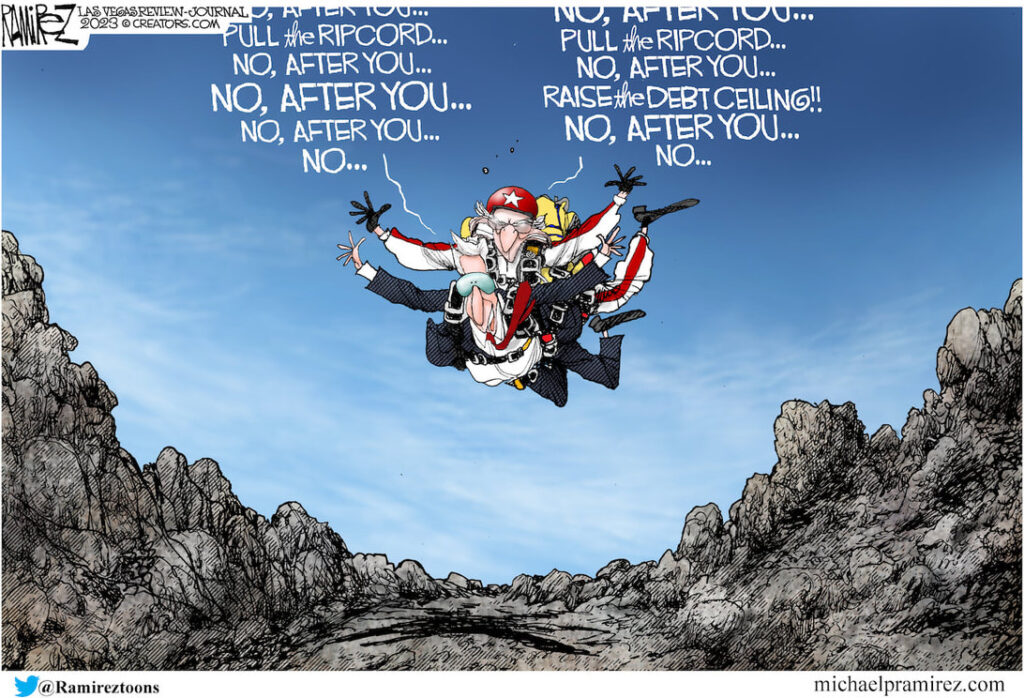

‘Raising the debt ceiling is nothing new. Since 1960, it’s been raised 78 times. In the 2023 version of the debate, Republican House Majority Leader Kevin McCarthy is asking for cuts in government spending. However, President Joe Biden argues that the debt ceiling should be increased without any strings attached. Adding to this, the sharp uptick in interest rates have been a clear reminder that rising debt levels can be precarious. Consider that historically, interest payments on the U.S. debt have been equal to about half the cost of defense. More recently, however, the cost of servicing the debt has risen, and is now almost on par with the defense budget as a whole.”

Ray Dalio says debt-ceiling debate sets stage for ‘disastrous financial collapse’

MarketWatch/William Watts/5-18-2023

“Increasing the debt limit the way Congress and presidents have repeatedly done, and most likely will do this time around, will mean there will be no meaningful limit on the debt. This will eventually lead to a disastrous financial collapse.‘”

USAGOLD note: A settlement on the debt ceiling is not the end of the road, according to Dalio. It is more a beginnning than an end. He worries about a debt crisis led by bank runs “being a run on the central bank.” The repercussions of a settlement could end up being just as deadly as a default.

Why investors are going gaga for gold

Financial Times/Gillian Tett/5-19-2023

USAGOLD note: Though Tett focuses on gold’s safety in the context of the debt ceiling wrangle (which she sees as still unsettled), she also sees major changes underway in the way both private and professional investors view the metal in the context of longer term economic and financial trends.

‘Too much latency’: Elon Musk slams the Fed for reacting too slowly to economic challenges

MarketsInsider/Zinya Salfiti/5-17-2023

“The Federal Reserve’s delayed reactions to policy challenges mean there probably will be a tough few months ahead for the economy, Elon Musk has said.… ‘Basically, the data is somewhat stale, so the Federal Reserve was slow to raise interest rates. And now I think they’re going to be slow to lower them,’ the Tesla, Twitter and SpaceX boss added.”

USAGOLD note: Musk goes directly to the heart of the matter. Is the culture at the Fed its own worst enemy? Musk has said that the Fed is too busy looking in the rearview mirror to see what’s ahead.

Daily Gold Market Report

Gold trades marginally lower as financial world awaits debt deadlock outcome

Where will the US find the buyers for the looming debt deluge if/when the deadlock ends?

(USAGOLD – 5/25/2023) – Gold is trading marginally lower this morning as the financial world awaits the outcome of the deadlocked Biden-McCarthy negotiations. It is down $10 at $1949.50. Silver is down 12¢ at $23.03. Even as Wall Street frets about a possible federal government default and all it implies, a new worry has surfaced: Where will the United States find the buyers for the deluge of debt likely to follow a settlement? MarketWatch yesterday put that figure at $1 trillion by the end of August – five times the normal issuance over a three-month period.

Granite Shares’ Will Rhind attributes gold’s positive performance thus far in 2023 – up 7.6% – to investor concerns about a potential debt default with the banking crisis, a weaker dollar, and higher inflation also acting as tailwinds for the yellow metal. “The story is all about gold,” he says in a CNBC interview. ”[It’s] the only major metal to remain firmly in the green for this year.…Gold is really serving its purpose at the moment as a way for people to park money in a noncorrelated asset as they worry about what might happen. Certainly, [to] hedge themselves against the probability of something falling out of bed with the debt ceiling.”

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“It’s extremely important to know history, but the trouble is that the big events in financial history occur only once every few generations. In the investment environment, memory and the resultant prudence regularly do battle with greed, and greed tends to win out. Prudence is particularly dismissed when risky investments have paid off for a span of years. John Kenneth Galbraith wrote that the outstanding characteristics of financial markets are shortness of memory and ignorance of history. In hot times, the few who do remember the past are dismissed as relics of the old, lacking the ability to imagine the new. But it invariably turns out that there’s nothing new in terms of investor behavior. Mark Twain said that ‘history does not repeat itself, but it does rhyme,’ and what rhymes are the important themes.”

Howard Marks

Oaktree Management

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

JPM Asset Management says markets are right to bet on US rate cuts

Bloomberg/Ruth Carson/5-17-2023

USAGOLD note: Confused? Don’t feel like the Lone Ranger. JPMorgan is completely at odds with the poll of top economists cited below.

Poll: Fed to keep rates untouched, default risk high

NewsMaxFinance/Staff/5-17-2023

USAGOLD note: Market players, we are told consistently, believe just the opposite, i.e., that the Fed will be forced to cut rates in 2023.

Investors most pessimistic so far this year, BofA survey shows

Bloomberg/Ksenia Galouchko/5-16-2023

“The mood among global fund managers soured further in May, with investors flocking to cash amid concerns that a recession and credit crunch are looming, according to Bank of America Corp.’s latest survey.”

USAGOLD note: Given the run of today’s posts, the pessimism is justified. The demand for gold worldwide is a further indication of the concern reflected in the BofA survey.

Big firms are filing for bankruptcy left and right — and it’s just the beginning

BusinessInsider/Joe Ciolli/5-16-2023

“Vice – saddled with liabilities of up to $1 billion – has filed for bankruptcy. It’s far from alone. Six other large companies threw in the towel within a recent 48-hour span, the most active such period for bankruptcies since 2008, according to Bloomberg data looking at companies with at least $50 million in liabilities.”

USAGOLD note: These are the sorts of things that happen when a real recession takes hold……

Notable Quotable

––––––––––––––––––––––––––––––––––––––––––––––––––––

“Today, there is a spreading awareness that our monetary situation is rather rotten. Leaving things up to central bankers, who are obviously making it up as they go along, has not worked out very well. Most recently, these central bankers got very aggressive in response to Covid in 2020; and the “inflation” that has followed has not been very surprising. People generally find monetary affairs to be extremely confusing. But, in the end it really amounts to a choice of two alternatives: The Gold Standard, and the PhD Standard.” – Nathan Lewis, Forbes

––––––––––––––––––––––––––––––––––––––––––––––––––––

Powell’s legacy tested by inflation, bank crisis, new Fed dynamics

NASDAQ-Reuters/Howard Schneider/5-16-2023

USAGOLD note: The Fed has only itself to blame, though Powell inherited much of the problem from Bernanke and Yellen.

What are older office towers worth? San Francisco provides an example.

Wolf Street/Wolf Richter/5-9-2023

USAGOLD note: Richter says that Union Bank building was first listed for $250 million in 2020. It pulled the listing in 2022 and then relisted at $120 billion in early 2023. It recently sold for between $60-$67 million – 75% below the original offer price. The sale, says Richter, “is sending cold shivers down the spines of Commercial Mortgage-Backed Securities.”

Boom and bust: How commodity super cycles influence gold and silver prices

LBMA-The Alchemist/Tom Brady and Chantelle Schieven/May 2023

“It is interesting to note that silver and gold prices appear to have increasingly trended in similar patterns to those of the industrial metals, particularly since President Nixon eliminated the backing of the US dollar with gold in 1971. Closing the gold window thus removed a very large non-industrial buyer of gold. Under the gold standard system, government could be counted upon to purchase mine production en masse at set prices, regardless of industrial growth or decline in any particular moment. Silver, with its broadening industrial demand, has been ~75% correlated with the Industrial Metals Index.”

USAGOLD note: Brady and Schieven believe we are headed for the boom phase of a new commodity supercycle that could last 10 to 20 years. Gold and silver, they show, have tracked supercycle booms in the past [Please see chart], and, as a result, they are “very bullish” on both metals over the long run.

Gold, silver, and producer price index industrial metals

(1925 to present, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge

‘Genuinely worried’ Asian investors flock to safe haven gold amid US dollar woes

South China Morning Post/Biman Mukherji/5-15-2023

USAGOLD note: One retailer in Hong Kong reports 40% increase for April over March and 110% year to date. Most of the buying has to do with investor concern about the eroding value of their savings.

Daily Gold Market Report

Gold pushes lower as investors remain on the defensive

Dimon, Pozsar warn of further problems in the banking system

(USAGOLD – 5/23/2023) – Gold pushed lower this morning as uncertainty prevailed over the debt ceiling, bond yields rose, and investors remained on the defensive over further problems in the banking system. It is down $14 at $1960. Silver is down 44¢ at $23.24. With bond yields rising, JP Morgan’s Jamie Dimon worries about further problems in the banking industry centered around commercial real estate loans. “I think everyone should be prepared for rates going higher from here,” he said yesterday at the bank’s investor conference. Dimon went on to say that “lenders should be prepared for benchmark lending rates to climb as high as 7%,” according to a report posted at Markets Insider.

Similarly, former Credit Suisse managing director Zoltan Pozsar described the turmoil at US banks as “basically lessons in not being able to run interest rate risk, not knowing how to make a loan that will be weathering a rising interest rate storm.” He cryptically added that the Fed is only addressing “half the problem” and likened its current rescue regime to “foaming the runway for any large banks that might be having problems.” [Source: Bitcoin Magazine]

Chart courtesy of TradingEconomics.com

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“I’ve been saying for years that central banks can never step away from this. They can threaten to. And they can bluff, and they can do some probing bets like they did last year, and the market may fall for that, or call that bluff in the short term. But yes I think we’re in a position now where central banks can never back away, which sort of begs the question how can this ever end. Can asset markets get inflated forever?”

Mark Spitznagel

Universa

Bloomberg interview

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

CLIENT ALERT

Beware MS70, MS69, PF70 ‘Perfect’ + ‘Certified’ + ‘First-Strike’ + ‘First-Release’ Gold and Silver American Eagles and American Buffalos

In 2006, the US Mint produced its first-ever .9999 fine gold coin in the form of the popular American Buffalo. The goal was to offer investors an American-made alternative to popular pure gold products like Canadian Maple Leafs, Austrian Philharmonics, and gold bars. While numerous dealers (USAGOLD was one) offered Buffalos as an alternative bullion coin at a competitive rate, the novelty of the coins coupled with feverish demand helped spawn a whole new spinoff in the gold business – the independently graded contemporary bullion coin.

On the surface, there is nothing wrong with having one’s contemporary bullion coins graded and housed permanently in hard plastic containers. It is when these items are then promoted as exceptionally rare and desirable and priced at very high, and often unsustainable, premiums over their gold content that it becomes a problem. In reality, as you will read below, the graded item, in most cases, is not substantially different (except for the container) from the typical bullion coin purchased daily by thousands of investors around the world.

After Buffalo hype wore off, our feeling was that this promotion, like many others that came before it, would fade away with waning interest. Yet here we stand many years later, rather than fading away, it has expanded and proliferated to include American Gold Eagles, American Silver Eagles, and US Mint Commemoratives. One need only search MS70 or PF70 “Perfect” American Eagles to see just how many companies offer these fictional “numismatics.” (MS is an abbreviation for mint state and PF for proof)

At USAGOLD, we could not be more emphatic in our warning against paying significant premiums above the metal content for these products. This includes common contemporary items sold as “first-strike,” “early issue,” “first release,” Mint State 69, Mint State 70, Proof 69, and Proof 70, as graded by the independent grading services, including the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC). Below we have published the U.S. Mint’s official statement regarding “First Strike”/”First Release” designations and production quality controls.

|

Coin dealers and grading services may use these terms in varying ways. Some base their use on the dates appearing on United States Mint product packaging or packing slips, or on the dates of product releases or ceremonial coin strike events. Consumers should carefully review the following information along with each dealer’s or grading service’s definition of “first strike” or “first release” when considering purchasing coins with these designations. The United States Mint has not designated any coins or products as “first strikes” or “first releases,” nor do we track the order in which we mint coins during their production. The United States Mint strives to produce coins of consistently high quality throughout the course of production. Our strict quality controls assure that coins of this caliber are produced from each die set throughout its useful life. Our manufacturing facilities use a die set as long as the quality of resulting coins meets United States Mint standards and then replace the dies, continually changing sets throughout the production process. This means that coins may be minted from new die sets at any point and at multiple times while production of a coin is ongoing, not just the first day or at the beginning of production. United States Mint products are not individually numbered and we do not keep track of the order or date of minting of individual coins. Any dates on shipping boxes are strictly for quality control and accounting purposes at the United States Mint. The date on the box represents the date that the box was packed, verified and sealed, and the date of packaging does not necessarily correlate with the date of manufacture. The date on shipping labels and packing slips for coins that are sent directly to United States Mint customers from our fulfillment center is the date the item was packed and shipped by the fulfillment center. The other numbers on the shipping label and packing slip are used for tracking the order and for quality control. |

The statement of ‘consistently high quality throughout the course of production’ is critical. For example, at one of the top grading services, 100% of the one-ounce gold 2021 American Eagle (Type 2) business strikes submitted for review graded either Mint State 69 or Mint State 70 – the two highest grades at the services. Almost 95% of submissions received a Mint State 70 grade, the ultimate rating. As for the 2021 silver American Eagle one-ounce coins (Type 2), 99.9% of submissions made the top grades of Mint State 69 and Mint State 70, and a similar percentage of proof silver Eagles made the top grades of Proof 69 and Proof 70.

With the mint continually producing new coins at the same high quality that they always have, year after year, there is literally an ENDLESS supply of product. To be clear, you do not have to avoid buying these coins altogether. You just have to avoid paying an egregious dealer premium to do so. In fact, if you were so inclined as to desire ownership of graded bullion coins for future numismatic potential, we’d recommend simply purchasing bullion coins from us at our competitive premiums and submitting them to be graded (certified) on your own.

Content last updated on 11-12-2021

_______________________________________________________________________________________________________________

Looking to include gold and silver in your retirement plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Need more information? Try –

What you need to know before you launch your gold and silver IRA