Daily Gold Market Report

Gold attempts to gain traction as we close out a less-than-stellar week

Bloomberg strategist: Current inflation lull perfect opportunity to load up on inflation hedges

(USAGOLD – 5/19/2023) – Gold is attempting to gain traction this morning as we close out what’s been a less-than-stellar week. It is up $7 at $1967. Silver is up 9¢ at $23.67. Saxo Bank‘s Ole Hansen sees gold as “consolidating within its well-established uptrend.” The bank maintains its “bullish outlook,” he says, “with the biggest short-term challenge being the risk of long liquidation from momentum-focused hedge funds, a group of speculators that have been strong buyers in recent months.”

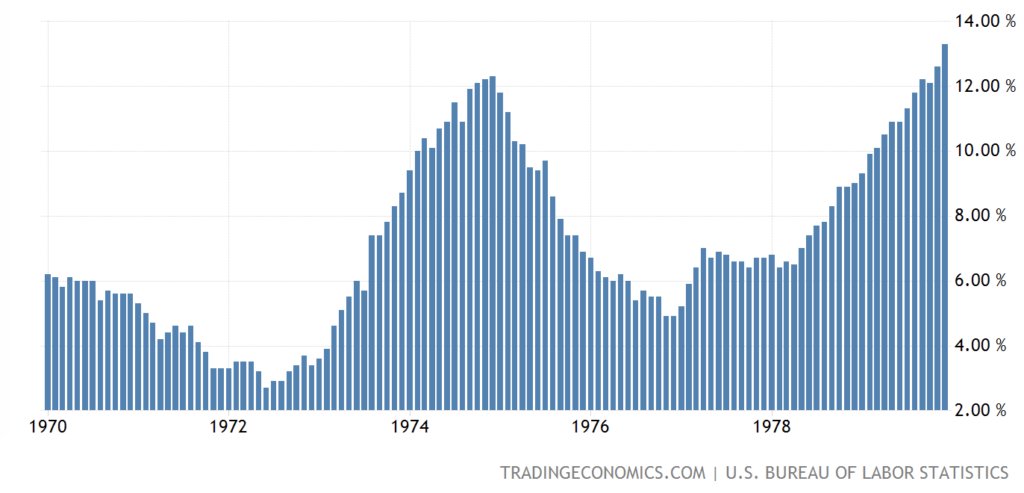

Bloomberg macro strategist Simon White believes “the current lull in inflation offers the perfect opportunity to take advantage of cheap inflation hedges before price growth starts to accelerate again.” He goes on to say that “the stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a ‘one-shot’ problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation. Inflation hedges that look cheap today thus won’t be cheap for very long.” [Source: Zero Hedge]

Headline inflation during the 1970s

Chart courtesy of TradingEconomics.com