Daily Gold Market Report

Gold drifts lower as debt ceiling concerns dissipate

Grant calls Fed ‘the No. 1 problem in American finance.’

(USAGOLD – 5/18/2023) – Gold drifted lower this morning as debt ceiling concerns dissipated and rate uncertainty continued to hang like a dark cloud over financial markets. It is down $6 at $1977. Silver is down 22¢ at $23.60. James Grant, the editor of Grant’s Interest Rate Observer, believes the Fed is “problem No. 1 in American finance.” He says that the “past 10 or 12 years in respect to Fed policy and the general suppression of the rate of interest has sowed the seeds for the regional-banking problems, the debt drama, the debt ceiling.”

“I think that the basic idea of buying up bonds,” he told MarketWatch in an interview last week, “and thereby suppressing longer-dated interest rates in the hopes of generating rising asset prices and thereby stimulating the economy by dint of people spending the proceeds of their capital gains, this idea that the Bernanke Fed surfaced in 2010-11 I think it is a very, very dicey proposition longer term. I don’t think it work.” Grant says he has been identifying more things to sell than own in the present environment, but he remains bullish on gold.

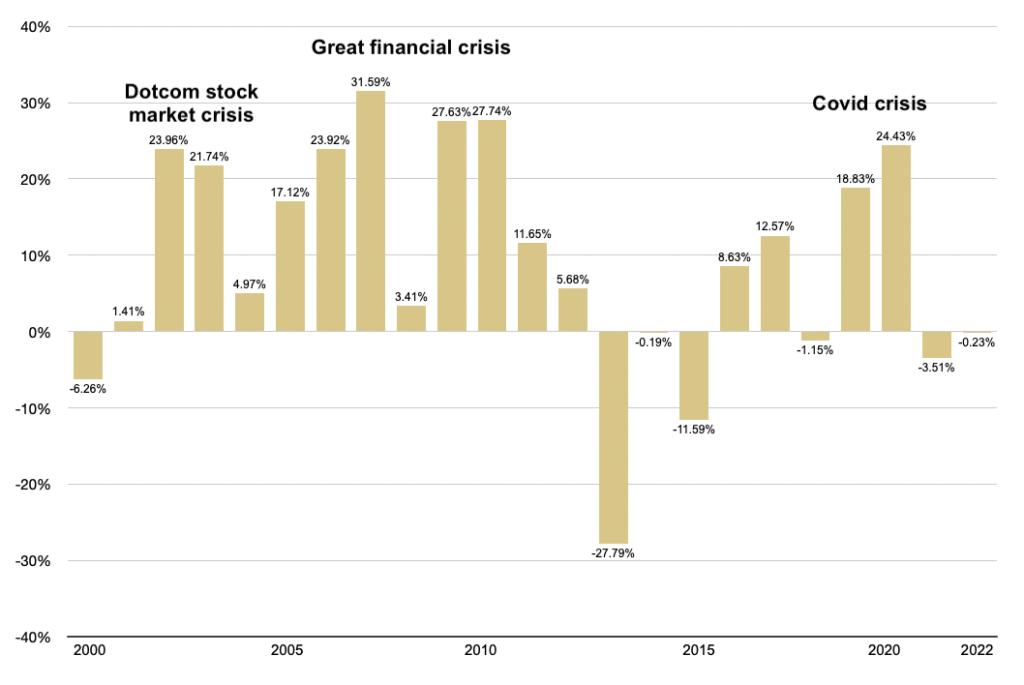

Gold returns and financial crises

(2000-present)

Chart by USAGOLD [All Rights Reserved] • • • Data source: MacroTrends.net • • • Click to enlarge