Monthly Archives: May 2023

Cut stocks, buy gold, hold your cash, JPMorgan’s Kolanovic says

Boomberg/Alexandra Semenova/5-23-2023

USAGOLD note: At one time, Kolanovic was considered Wall Street’s most vocal bull.

The US Treasury may have to break the law to keep the world’s richest nation from default

Yahoo!Finance/Nate DeiCamillo/ 5-23-2023

USAGOLD note: A bizarre twist to the already bizarre debt ceiling soap opera ……

Three reasons to buy gold now

UBS/Chief Investment Office/5-18-2023

USAGOLD note: UBS sees gold at $2100 by year end and $2200 by March 2024.

Short & Sweet

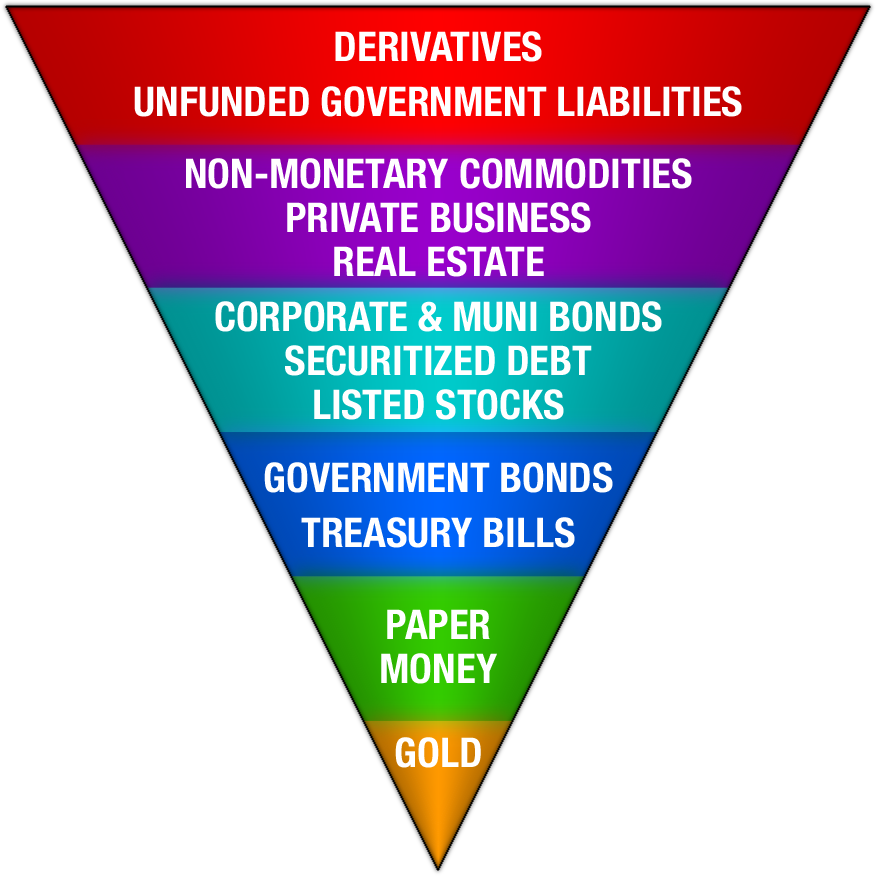

The Exter Inverted Pyramid of Global Liquidity

“[Exter’s Inverted] Pyramid stands upon its apex of gold, which has no counter-party risk nor credit risk and is very liquid. As you work higher into the pyramid, the assets get progressively less creditworthy and less liquid. . .[In a financial crisis] this bloated structure pancakes back down upon itself in a flight to safety. The riskier, upper parts of the inverted pyramid become less liquid (harder to sell), and – if they can be sold at all – change hands at markedly lower prices as the once continuous flow of credit that had levitated those prices dries up.” – Lewis Johnson, Capital Wealth Advisor’s Lewis Johnson

____________________________________________________________________________________________

Gold: Older than the solar system itself

Deutsche Goldmesse/Dominic Frisby/5-6-2023

“Gold was present in the dust which formed the solar system billions and billions of years ago and gradually that dust accreted to form the planets.”

USAGOLD note: In this video, Frisby makes an engaging presentation on the yellow metal saying “We have a primal instinct for gold.”

Daily Gold Market Report

Gold level ahead of Friday’s jobs numbers, today’s debt package vote

Saxo Bank’s Hansen says gold downside fueled by long reduction, not short selling

(USAGOLD – 6/1/2023) – Gold is level this morning ahead of Friday’s jobs numbers and a vote in the House of Representatives later today on the debt package. It is down $1 at $1960. Silver is up 8¢ at $23.34. “Hedge funds were net sellers of gold for a second week,” reports Saxo Bank’s Ole Hansen in a recent client advisory, “but interestingly the reduction was driven by long liquidation with no appetite for short selling despite the recent technical breakdown. Equally in silver the selling appetite was also muted while the copper net short was reduced by 27%, the first reduction following five weeks of constant selling that saw the net drop from a 20k net long to a 22.6k net short.”

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“If you look at the history of currency, gold has a unique role and I don’t think it’s accidental. Some people say that if gold hadn’t been selected as a currency thousands of years ago, it would not have a role today. I don’t agree. Gold has a lot of useful properties and unique features so I don’t think its status is in any way accidental. It’s a monetary asset and I think if you replayed history another way, you would come out with gold again.”

Ken Rogoff

Harvard University

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Buffett: Debt standoff an idiotic waste of time……

Markets Insider/Theron Mohammed/5-27-2023

USAGOLD note: Hard to disagree with Buffett’s assessment. Putting Wall Street and the rest of the country through this periodic ritual comes off as a childish desire to get attention – political gamesmanship at its worse.

The gold cases resurface

The New York Sun/Editorial Staff/5-22-2023

USAGOLD note: We note with interest that President Ulysses S. Grant (photo insert) declared at the time that the US should pay its debts in gold as a matter of national honor. If that were to occur today, it would wipe out the US gold reserve of 8133 metric tonnes. The Sun delves into what the Fourteenth Amendment is really all about.

Fed rate path hinges on trade off between stable banks or prices

Bloomberg/Craig Torres/5-23-2023

“Federal Reserve policymakers are increasingly grappling with a critical question: How much should they weigh the adverse impact of their interest-rate hikes on banks against the goal of containing the fastest price increases in decades?”

USAGOLD note: Stark choice…… And, in our view, it’s not just the banks that the Fed needs to be worried about.

A US debt default is the wake-up call the world needs

Yahoo!Finance-The Telegraph/Matthew Lynn/5-21-2023

USAGOLD note: An unusual, and some would say dangerous, take on the prospect of a US debt default, but not one without merit. The global tower of debt was $210 trillion in 2010. It is $300 trillion now and projected to be $400 trillion by the end of the decade.

The financial system is slipping into state control

YahooFinance/The Economist/5-18-2023

USAGOLD note: Banks are becoming wards of the state, says The Economist. The publication puts special emphasis on the fact that the Fed will buy bank-held securities at par even though the market value has been heavily discounted. “The bigger the backstop,” it says, “the more reason government has to dictate what risks banks may take” – a notion antithetical to tenets of capitalism.

Daily Gold Market Report

Gold gains ground as debt drama moves to the halls of Congress

Bridgewater sees subtle shift as central banks, investors turn to gold as a store of value

(USAGOLD – 5/30/2023) – Gold gained ground this morning as the still unresolved debt drama moved to the halls of Congress. It is up $16 at $1962. Silver is up 7¢ at $25.32. After all is said and done, Bloomberg points out in its morning advisory, the deal barely dents the $20 trillion in combined budget deficits projected over the next decade.

Bridgewater Associates, the world’s largest hedge fund, writes Financial Times’ Gillion Tett, believes that “the past 15 years of quantitative easing and recent high inflation have left central banks and retail investors alike reaching for gold as a store of value.” Moreover, investors have subtly shifted from “evaluating gold as an alternative to other dollar-denominated savings to increasingly evaluating gold as an alternative to the dollar.” She concludes that “gold is now a good barometer not just of global instability, but of US dysfunction too” and that America’s economic problems will not end with a debt ceiling deal. [Source: Financial Times]

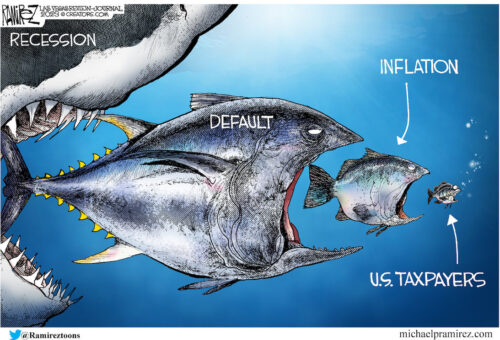

Cartoon courtesy of MichaelPRamireiz.com

Notable Quotable

__________________________________________________________________

“Perhaps what gives us the highest conviction on commodities as an asset class is not the similarities to historical bull markets but the differences. In particular we continue to believe that the global focus on climate mitigation strategies and decarbonisation is limiting the supply response to higher prices to an extent that is unprecedented. That breakage of the link between higher prices and a supply response is likely to significantly extend the commodities bull market. When we combine these factors to our belief that we are entering a fundamentally more inflationary age, the case for an enlarged commodities allocation remains compelling.” – Schroders, client advisory

__________________________________________________________________

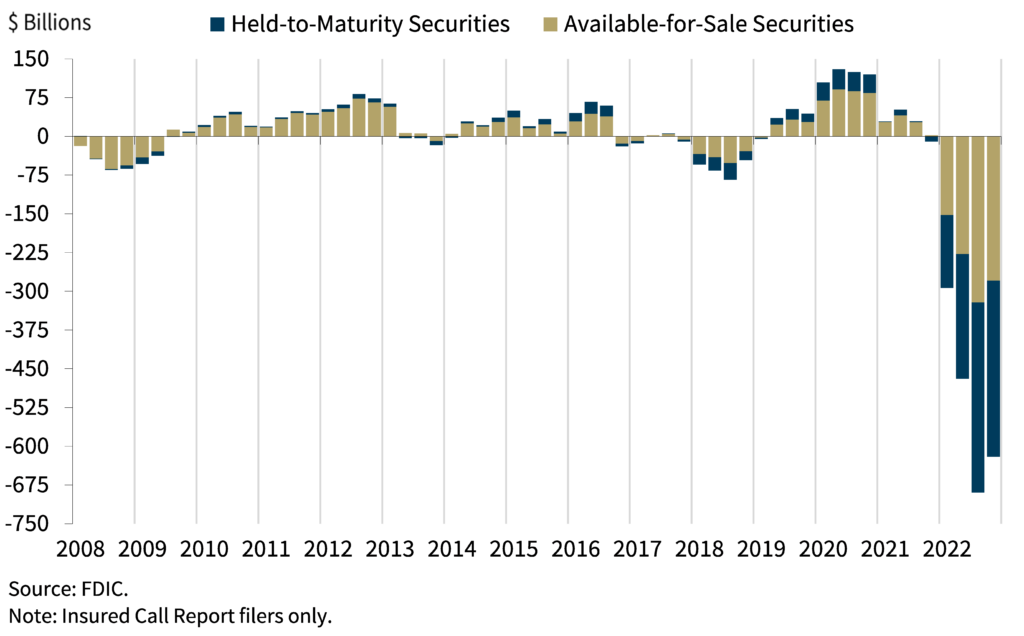

‘We should be on the alert for more problems’

themarketNZZ/Chistopher Gisiger interview of Raghuram Rajan/5-15-2023

“The recent events highlighted mid-sized banks with volatile deposits and asset problems. I think the asset problems haven’t gone away. There are still lots of losses to be absorbed on bank balance sheets, and the problem with volatile deposits hasn’t gone away either.… As a result, there will be an issue of longer-term health of the banking system, especially regarding mid-sized banks exposed to areas like commercial real estate.” – Raghuram Rajan, Professor of Finance at the University of Chicago and former Governor of the Reserve Bank of India

USAGOLD note: Above is Rajan’s reasoning on why the banking system still needs watching. The chart below from the FDIC speaks a thousand words………

Total unrealized gains or losses on investment securities held by FDIC-insured banks

Chart courtesy of the FDIC • • • Click to enlarge

Wall Street fears $1 trillion aftershock from debt deal

Bloomberg/Liz McCormick and Alex Harris/5-18-2023

USAGOLD note: Be careful what you wish for …… Penso Advisors’ Ari Bergmann sees a confluence factors swamping the bond market all at the same time.

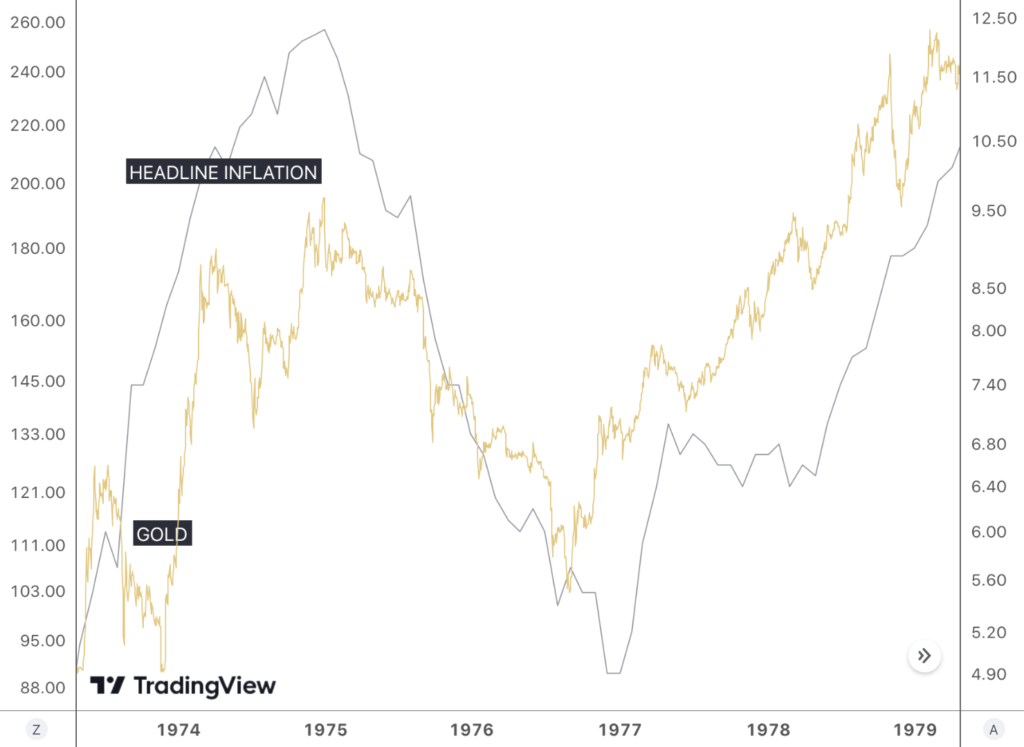

Now’s the time to get ahead of inflation’s resurgence

Zero Hedge/Simon White/5-18-2023

“[T]he current lull in inflation offers the perfect opportunity to take advantage of cheap inflation hedges before price growth starts to accelerate again.” He goes on to say that “the stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a ‘one-shot’ problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation. Inflation hedges that look cheap today thus won’t be cheap for very long.”

USAGOLD note: Simon White is a Bloomberg macro strategist. He likens the current inflation situation to the 1970s in which we had periods of decelerating inflation that were calms before the inflationary storms to come. Inflation, as we have said many times, is a process rather than an event.

Gold and headline inflation

(1970-1979, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge

Why are central bank forecasts so wrong?

Financial Times/Chris Giles/5-18-2023

“The Bank of England is holding a ‘Festival of Mistakes’ this week, celebrating lessons learnt from financial disasters of the distant past. Some would argue that they, and their counterparts at other central banks, should focus on more recent errors.”

USAGOLD note: If their forecasts are wrong, can policy be far behind? James Grant recently called the Fed problem #1 in American finance, and Elon Musk slammed the Fed for being slow to raise rates and thinks it will now be too slow to lower them.

Daily Gold Market Report

No DGMR today. Below is Wednesday’s report.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gold trades higher reflecting the high degree of uncertainty in investment markets

This morning’s Financial Times features ‘The New Gold Boom: How Long Will It Last?’

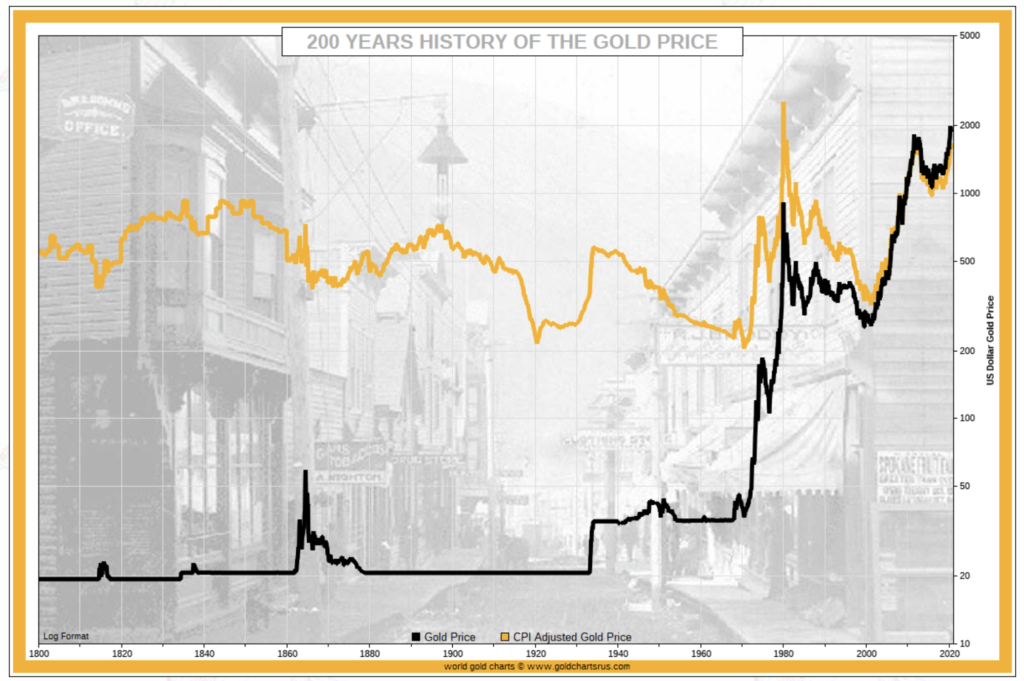

(USAGOLD –5/24/2023) – Gold is trading higher in the early going as markets continued to reflect a high degree of uncertainty about the debt ceiling and the general direction of the economy and investment markets. It is up $7 at $1984.50. Silver is up 1¢ at $23.49. It was a pleasant surprise to come across a feature article in this morning’s Financial Times under the provocative headline – “The New Gold Boom: How Long Will It Last?” Ashok Sewnarian, who manages a bulging private vaulting facility in London, sets the stage by saying clients “have a growing alertness to the new world order.… We have mistrust in the banks, huge inflation, and a global divide on reserve currencies.”

Citing “a rush to gold by the global elite,” FT goes on to say that “the revival in gold’s fortunes has central bank officials, fund managers and retail investors wondering whether the world is on the precipice of a new gilded period. Some forecasters reckon gold could escalate towards its real record high of nearly $3,300 per troy ounce in today’s dollars, set in 1980 when oil-driven inflation and turmoil in the Middle East capped a nine-year bull run unleashed by US president Richard Nixon cutting off the dollar from bullion.” The full article is highly recommended.

Inflation-adjusted price of gold

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“I grew up in a purely urban family. We had no relatives in the country. I’m born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins. Without gold, I would have starved. She always told me that. Therefore, this generation already has a certain gold affinity. In extreme times of crisis, this is one of the few things left to be accepted. Gold was the only thing left to the people of the city at that time. Before the silver cutlery was also traded at the farmer.”

Ewald Nowotny

Former European Central Bank governor

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––