Daily Gold Market Report

Gold trades marginally lower as financial world awaits debt deadlock outcome

Where will the US find the buyers for the looming debt deluge if/when the deadlock ends?

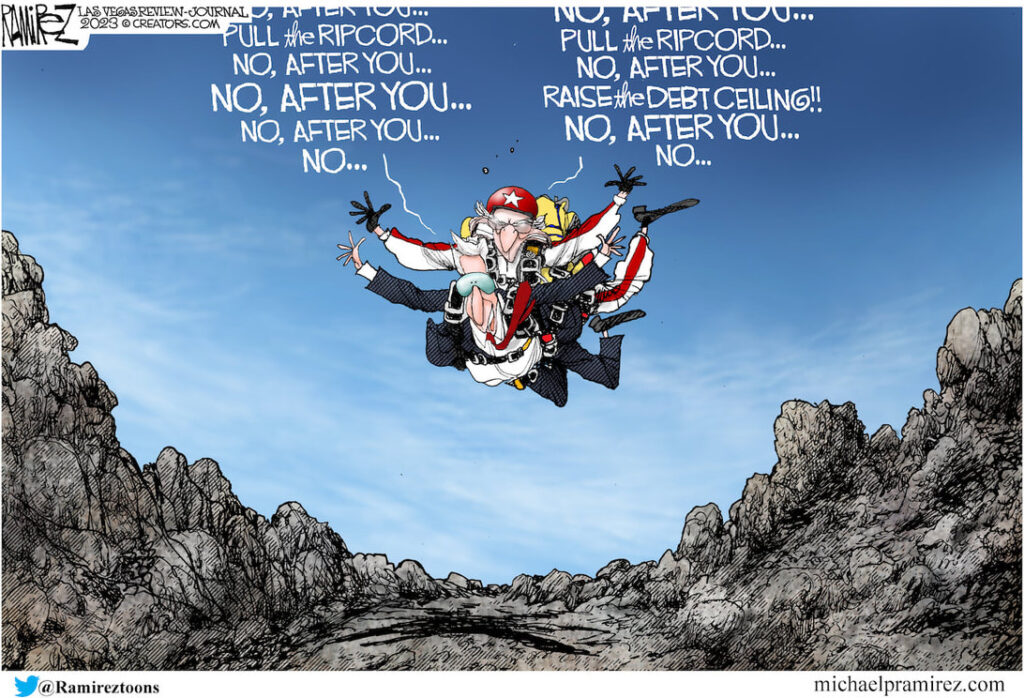

(USAGOLD – 5/25/2023) – Gold is trading marginally lower this morning as the financial world awaits the outcome of the deadlocked Biden-McCarthy negotiations. It is down $10 at $1949.50. Silver is down 12¢ at $23.03. Even as Wall Street frets about a possible federal government default and all it implies, a new worry has surfaced: Where will the United States find the buyers for the deluge of debt likely to follow a settlement? MarketWatch yesterday put that figure at $1 trillion by the end of August – five times the normal issuance over a three-month period.

Granite Shares’ Will Rhind attributes gold’s positive performance thus far in 2023 – up 7.6% – to investor concerns about a potential debt default with the banking crisis, a weaker dollar, and higher inflation also acting as tailwinds for the yellow metal. “The story is all about gold,” he says in a CNBC interview. ”[It’s] the only major metal to remain firmly in the green for this year.…Gold is really serving its purpose at the moment as a way for people to park money in a noncorrelated asset as they worry about what might happen. Certainly, [to] hedge themselves against the probability of something falling out of bed with the debt ceiling.”