Monthly Archives: January 2022

Here’s what happened the last time the Fed attempted to shrink its balance sheet and hike rates simultaneously

The Reformed Broker/Joshua M. Brown/1-7-2022

USAGOLD note: For some reason unbeknownst to us and most the rest of the investment community, the Fed feels compelled to create the illusion of setting a new course. Meanwhile, economic and financial forces, it knows full well, are unlikely to allow it. So here we go again …… The bond market will be the final arbiter.

Is gold on schedule to catch the inflation train?

Seeking Alpha/Van Eck Funds/1-12-2022

USAGOLD note: Van Eck explains the things that held gold down in 2021 and what might cause it to break out in 2022.

The supply chain is the economy

Daily Reckoning/James Rickards/1-5-2022

USAGOLD note: A rather chilling look from Rickards on what we might expect in the future …… It seems that Rickards might be backing off his prediction of a disinflationary, even deflationary, economy.

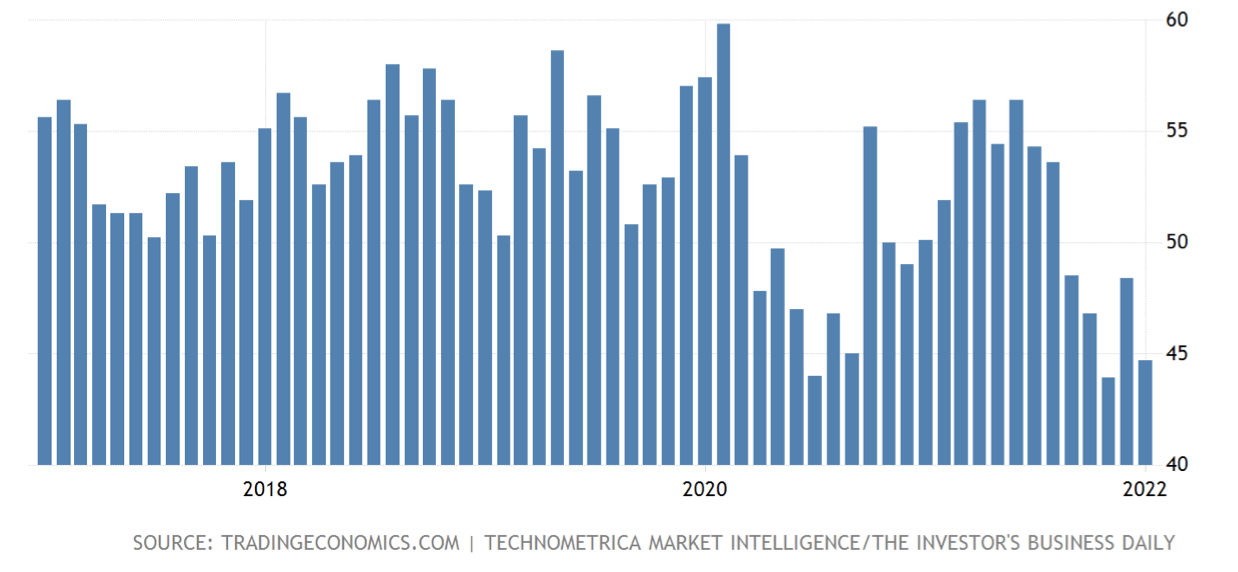

Americans more pessimistic on the economy

Economic Optimism Index

Chart courtesy of TradingEconomics.com

Chart note: “The IBD/TIPP Economic Optimism Index in the US fell sharply to 44.7 in January of 2022 from 48.4 in December, a sign Americans turned more pessimistic as omicron case-levels exploded and inflation continued to hit generational highs. The six-month US economic outlook index slid 4.9 points to 37.9, the lowest level since July 2020. The major shift came among investors, who are suddenly feeling more bearish about the US economic outlook than they’ve been in more than five years. Also, the gauge of support for federal economic policies subindex sank 3.6 points to 43.9. The personal finances subindex fell 2.6 points to 52.3, well off its peak but still reflecting modest optimism.” (Trading Economics – 1/11/2022)

AFTERNOON UPDATE

Gold gains ground ahead of Fed

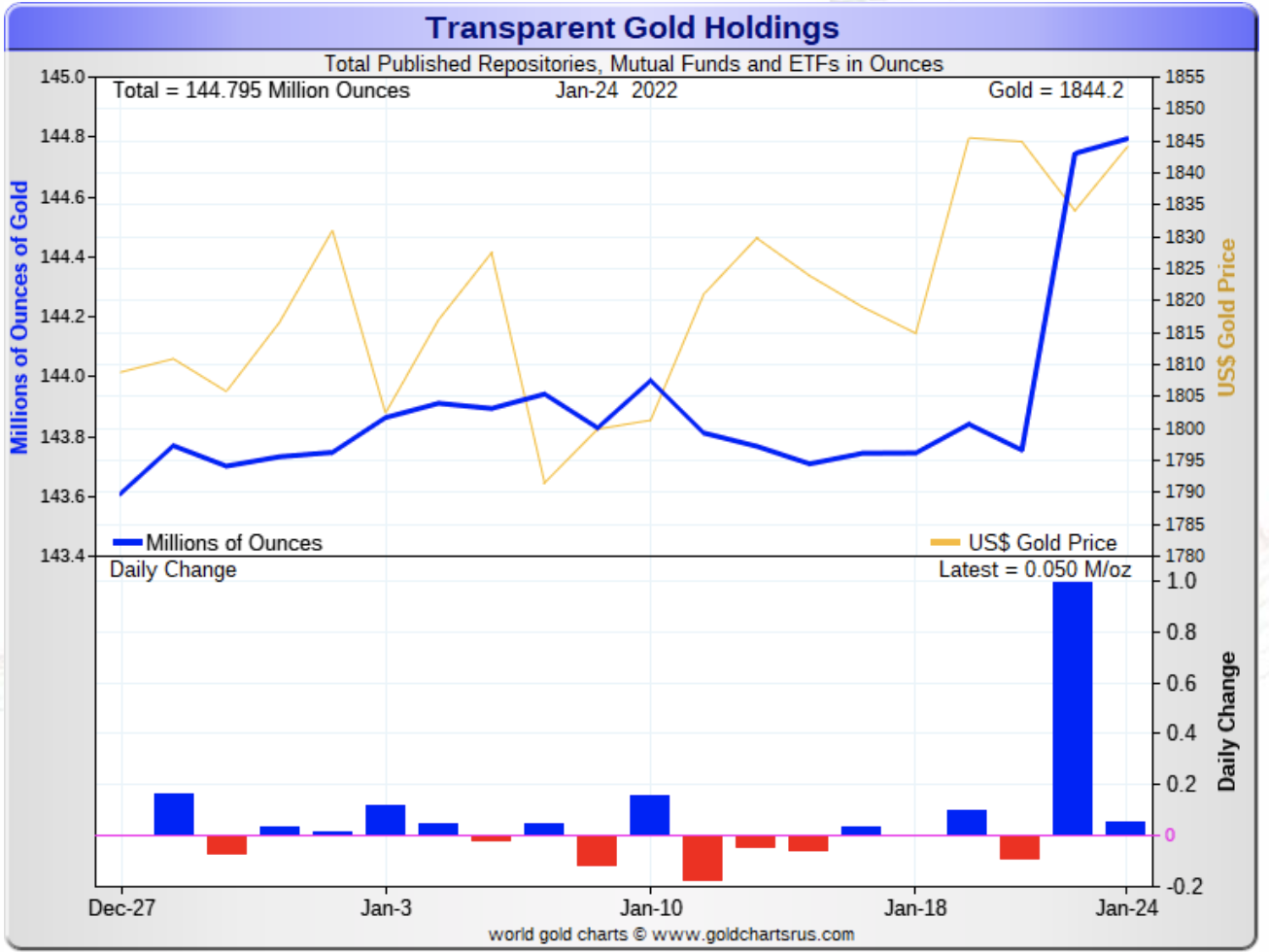

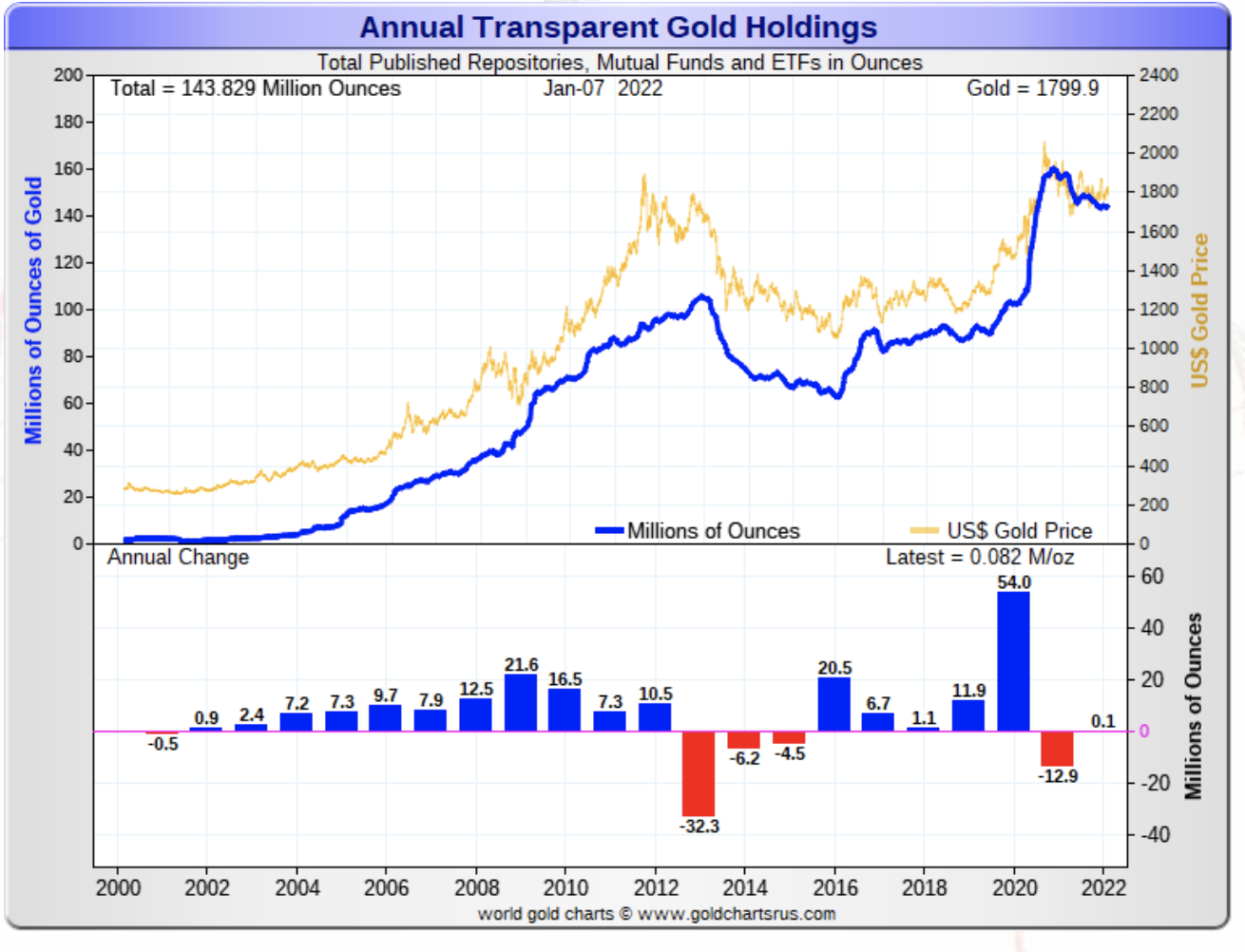

Despite end of ‘easy money era’ gold ETFs post strongest stockpile gains since 2004

(USAGOLD – 1/25/2022) – Gold gained ground ahead of Fed results scheduled for tomorrow – an unusual departure from the typical pre-Fed price action. A number of influences coalesced around the price, with Putin’s thumping the war drum, extreme stock market volatility, and general economic weakness topping the list. The yellow metal is up another $6 this morning at $1850 – an important psychological barrier for the metal. Silver is down 15¢ at $23.87.

Bloomberg reports that funds and institutions are holding on to their gold despite “the end of the easy money era.” One Frankfurt-based fund manager is quoted as saying that he does not expect his gold position (8% of his fund) to change, adding somewhat cryptically, “We don’t see a dramatic change in the interest-rate environment.” We suspect that he is making a veiled reference to the deeply negative real rate of return on yield investments. Along these lines, Bloomberg also reports gold’s largest ETF logging the strongest stockpile growth since 2004. “Gold,” it says, “just got a very bullish sign from investors who are returning to the precious metal in a big way.”

We will be posting occasional afternoon updates only for the next few weeks.

Please stay tuned.

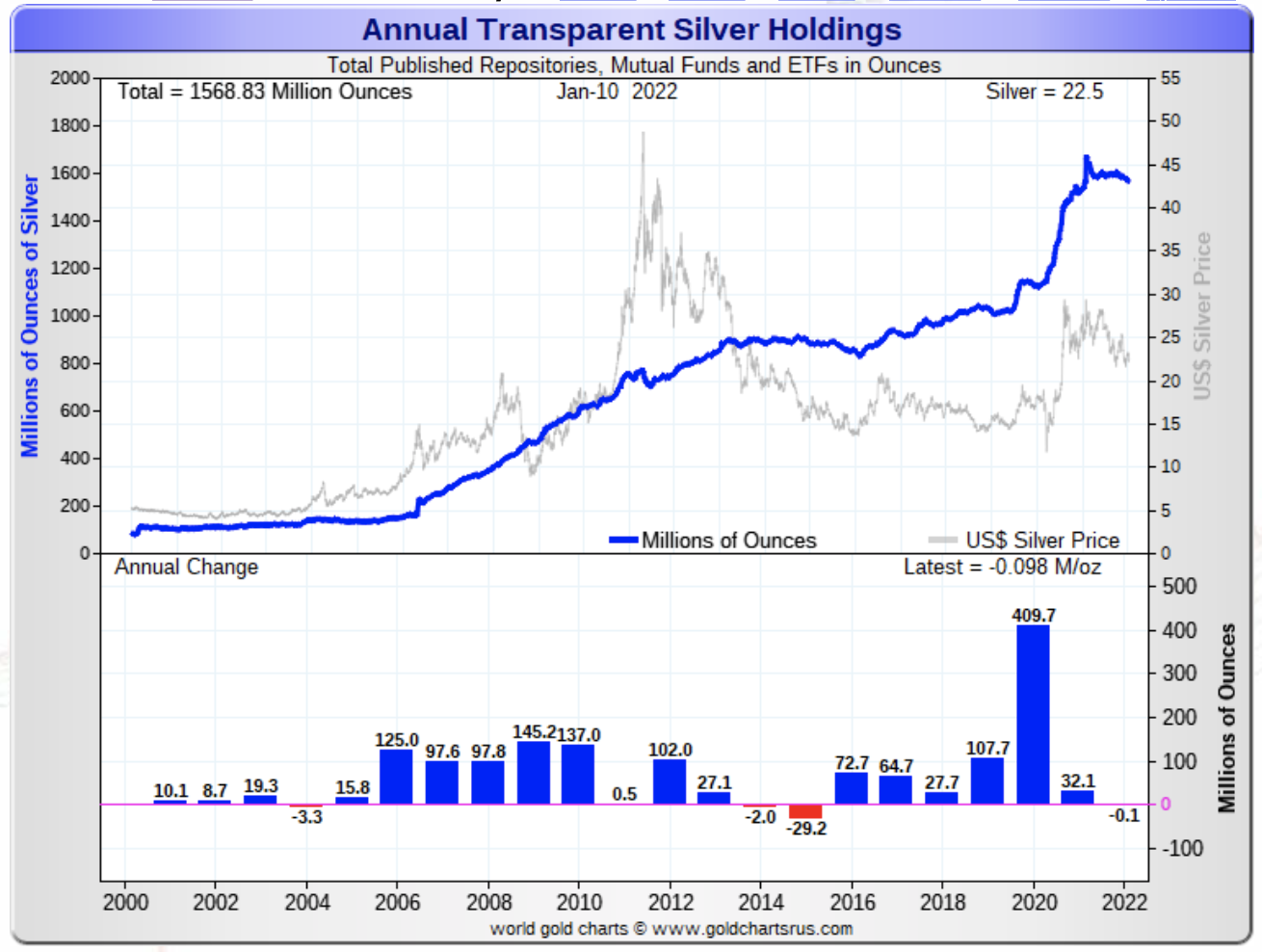

Silver supply-demand trends could catalyze the price

BullionWorldMagazine/Georgia Williams/12-13-2021

“Silver’s move to US$28.55 wasn’t the only milestone the white metal registered in 2021. Demand for silver exchange-traded products touched an all-time high during Q1, when holdings topped 1.2 billion ounces. Healthy purchases from the investment and industrial segments helped silver demand surpass 1 billion ounces for the first time since 2015.”

USAGOLD note: That buildup at the ETFs – significant as it is – passed without garnering much attention in financial media. Occurring in year one of the pandemic, the very strong 2020 increase in silver ETF stockpiles indicated significant fund and institutional interest in the metal for safe haven purposes.

Chart courtesy of GoldChartsRUs.com

Bitcoin could tumble below $30,000 this year as the crypto bubble pops, Invesco says

MarketsInsider/Harry Robertson/1-17-2022

USAGOLD note: Such a move to the downside would put bitcoin at less than half its nearly 68,000 peak at the end of 2020. Such volatility undermines the safe haven claims made by its promoters.…… This article also cites UBS suggesting that the crypto space might be headed for “crypto winter.”

Return-free risk

Hussman Funds/John P. Hussman/1-14-2022

USAGOLD note: Hussman’s latest delves into the return of your capital in a market so distorted none of the old verities matter any longer. In our view, it is not that modern-day investors do not see what is going on, it is that they choose to ignore it. He features a quote from Albert Einstein: “The difference between genius and stupidity is that genius has its limits.” “By relentlessly depriving investors of risk-free return,” he says, “the Federal Reserve has spawned an all-asset speculative bubble that we estimate will provide investors little but return-free risk.” That situation is made all the worse, and more compelling, by inflation and the plummeting real rate of return. The wise lemming will bring along a golden parachute.

Summers says U.S. risks recession by blaming inflation on greed

Bloomberg/Chris Anstey/1-14-2022

USAGOLD note: Throughout the 1970s, we recall, the federal government blamed inflation on everyone but itself: businesses, oil exporters, even farmers. The 1970s Nixon administration went so far as to introduce price controls – a policy that only made things worse and had to be abandoned. The real source of inflation now is the same as it has always been – running large federal deficits and financing them with printing press money. The White House, from our perspective, is doing its best to ignore the continuing pleas of the former Treasury Secretary. Summers says we are moving toward “higher entrenched inflation.”

The bubble is bursting and gold is strong

Myrmikan Research/Daniel Oliver/1-18-2022

USAGOLD note: Oliver inquires into gold’s rangebound behavior under these extraordinary circumstances and concludes “what propels gold into the multi-thousands of dollars per ounce—is sharply rising rates that destroy the value of the Fed’s assets and make further federal deficit spending impossible. Without a political reason to buy the dollar, it will seek out its economic value.” It’s all in the math ……

Favorite web pages

Gold Trends and Indicators

Live charts that make it easy to monitor gold market history and correlations

Our Gold Trends and Indicators page was first constructed many years ago to serve a specific need. At the time, there was no single place a client, or prospective client, could go to monitor statistical categories and correlations relevant to gold ownership. This page filled that need with interactive, automatically updating charts that featured gold’s annual returns; one-year, ten-year, and long-term price charts; correlations like gold and the purchasing power of the dollar, gold and the S&P 500 and gold and the volatility index (to name a few); and, real rates of return over the long term on gold and the dollar. It remains a favorite reference among serious investors and students of the gold market to this day. We believe it to be particularly useful to the prospective gold buyer who wants to understand the history of gold under various circumstances as part of the due diligence process.

Gold Trends and Indicators is another of the quiet pages at USAGOLD that garners significant global interest particularly when the market is moving or breaking news warrants more than average interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion, and analysis as it happens.

We have recently added to new correlation charts:

• The Misery Index and Gold

• The Fed’s Balance Sheet and Gold

__________________________________________________________________________________

We invite you to also check out our other chart page:

Monetary Trends and Indicators

Charts offered in conjunction with the St. Louis Federal Reserve and the ICE Benchmark Administration

Goldman Sachs says bitcoin will compete with gold as ‘store of value’

Reuters/Elizabeth Howcroft/1-5-2022

“Bitcoin will take market share away from gold in 2022 as digital assets become more widely adopted, Goldman Sachs analyst Zach Pandl said in a research note to clients.”

USAGOLD note: Bitcoin trades more like a new issue tech stock than a safe haven – more like a pure speculation than store of value. Down almost 14% on the year thus far and almost 35% from its high three months ago – and pretty much being dragged down in the wake of the tech wreck – it passes the duck test with flying colors. At the end of this article, Reuters points out that Goldman Sachs restarted its crypto trading desk in 2021.

Bitcoin/U.S. dollar

(3 months)

Chart courtesy of TradingView.com • • • Click to enlarge

Summers says Fed, markets too sanguine on anti-inflation steps

Bloomberg/Chris Anstey/1-7-2022

“My own view is that the Fed and the markets are still not recognizing what’s likely to be necessary. The market judgment and Fed’s judgment is that you can somehow contain this inflation without rates ever rising above 2.5% in terms of the fed funds rate.” – Larry Summers, former Secretary of the Treasury

USAGOLD note: Summers continues to channel Paul Volcker on stemming the inflationary tide, but, as he points out, the Fed is not all that interested in an aggressive policy stance at this juncture. Keeping a lid on rates amounts to keeping the real rate of return deeply in the negative – a circumstance likely to keep gold demand running at a high level. What the press touts as a hawkish policy, Summers sees as not very hawkish at all.

The changing world order: The new paradigm

“For reasons explained in this report, I believe the current paradigm is a classic one that is characterized by the leading empire (the US) 1) spending a lot more money than it is earning and printing and taxing a lot, 2) having large wealth, values, and political gaps that are leading to significant internal conflict, ad 3) being in decline relative to an emerging great power (China). The last time we saw this confluence of events was in the 1930-45 period, though the 1970-80 period was also analogous financially. In this piece, I will explain my reasoning and show charts that display these things happening.”

The key to 2022 will be how inflation is brought down

Financial Times/Mohamed El Erian/1-3-2021

USAGOLD note: This piece offers another rendition of the damned if you do, damned if you don’t dilemma in which the Fed finds itself on inflation and rates. You come away with the impression after reading this piece that 2022 is shaping up as The Year of Uncertainty – not just for financial markets and the economy, but for the Fed itself. The result could be a form of policy paralysis in reality, no matter what is said – a time when it essentially pulls up anchor on the global economy and leaves the markets to fend for themselves. Then, indeed, we will be back in the1970s as Dalio warns. (Please see above.)

Thoughts on todays J-shaped precious metals repricings

MKS PAMP/Nicky Shiels/1-20-2022

USAGOLD note; Insights from Nicky Shiels on important changes in the way professional money managers now view precious metals including possible short covering in the silver market ……

Flaws are evident in Fed’s approach to inflation

Financial Times/Fred Mishkin/1-11-2021

USAGOLD note: Mishkin is a former governor of the Federal Reserve so he has some experience with its internal workings. It is interesting to note that he sees the recent big change from anticipating inflation to waiting for it to become evident as counter-productive. Such a policy, it we are reading his critique correctly, will always put the Fed behind the curve. The markets have not accepted, as this note is written, that reality. Mishkin goes on to say that the Fed needs to return to a pre-emptive approach to inflation and that if it doesn’t the outcome will be “persistent inflation well above the 2 percent objective …”

Speculative mania – Was 2021 the Peak?

Real Investment Advice/Lance Roberts/1-10-2022

“The amount of speculation in the market currently is rampant. There have only been a couple of times in history when we saw similar investors’ actions, and both ended poorly. The three most significant market risks heading into 2022 are a reversal of the things that supported the speculative attitude of investors over the last year: buybacks, liquidity, and earnings growth. Notably, the reversal of liquidity impacts every facet of the economy and markets, and earnings are the ‘bullish support’ for overvaluation.”

USAGOLD note: The thing about the herd, as any fan of old westerns will tell you, is that it can stampede on the slightest provocation and if you are not agile enough to get out of the way. ……… Well, you get the idea. Roberts ends this well-reasearched perspective with a quote from famed Wall Street speculator Benjamin Grahm: “The investor’s chief problem – and even his worst enemy – is likely to be himself.”

Gold struggles to attract investors as interest rates rise (?)

Financial Times/Chris Flood/1-8-2022

“Gold exchange traded funds were hit by net outflows of $9bn last year in a retreat that could herald a significant decline in investor appetite for the precious metal in 2022.”

USAGOLD note: This article tells only part of the story on gold ETFs and leaves out a few very important details. For one, withdrawals amounting to 9 billion from a nearly $260 billion pool is not particularly “heavy,” as indicated in Financial Times’ subhead. Secondly, the outflows come after one of the biggest years on record in 2020 for inflows – right at $54 billion – and, as such, probably justified. Third, the hedge funds and other institutions – the group that dominates gold ETF trading – are on the sidelines. They have not been aggressive buyers over the last 12 months but they haven’t been aggressive sellers either. Some would read that as a positive indicator given gold’s sideways to down year in 2021.

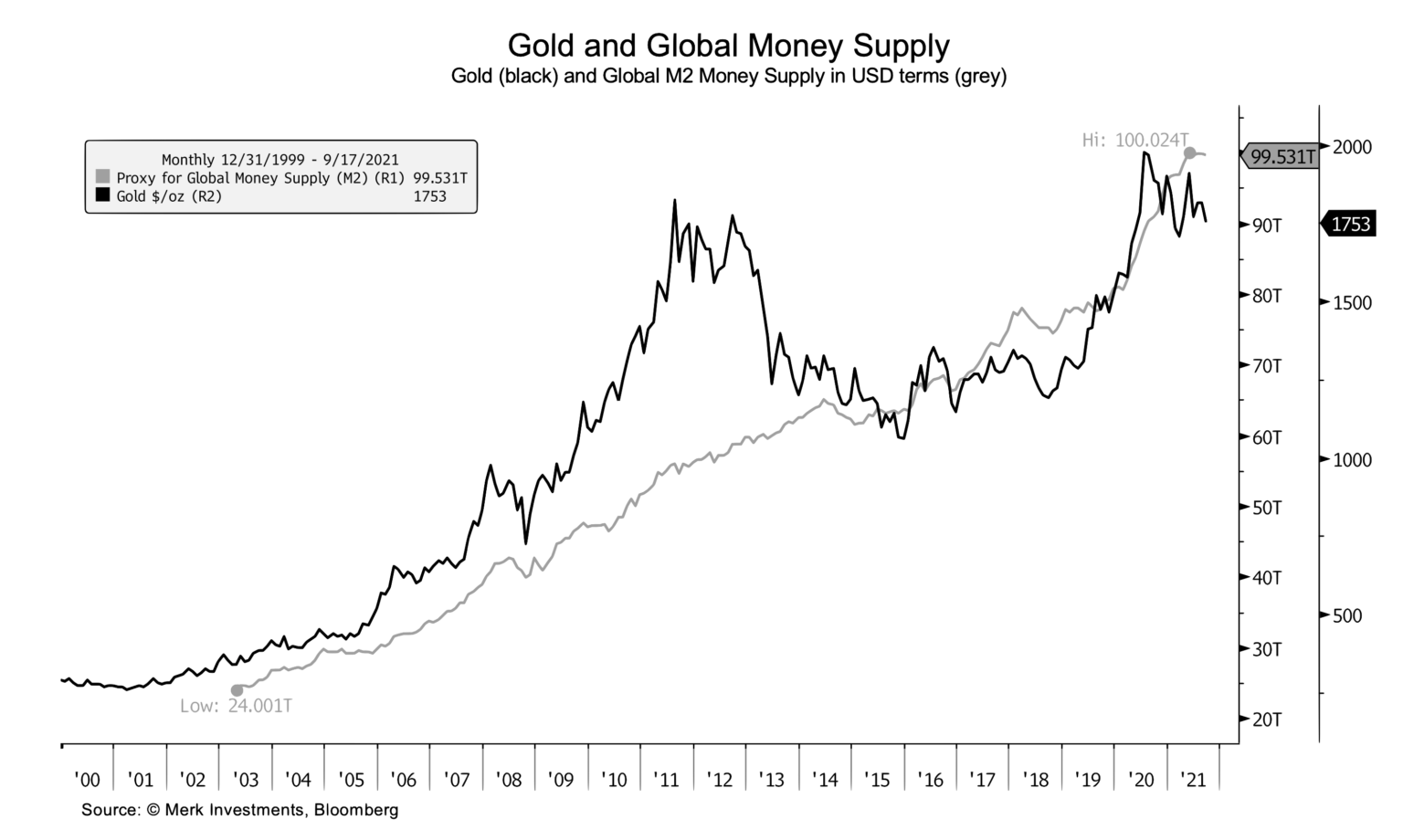

Money supply and rising interest rates

Seeking Alpha/Alasdair Macleod/1-6-2022

• “This article explains why interest rates are set to rise substantially in this new year. It draws on evidence from the inflation crisis of the 1970s, points out the similarities and the fact that currency debasement today is far greater and more global than fifty years ago. In the UK, half the current rate of monetary inflation for half the time — just for one year — led to gilt coupons of over 15%. And today we have Fed watchers who can only envisage a Fed funds rate climbing to 2% at most.”

• “A key factor will be the discrediting of this Keynesian hopium, likely to be replaced by a belated conversion to the monetarism that propelled Milton Friedman into the public eye when the same thing happened in the mid-seventies. The realisation that inflation is always and everywhere a monetary phenomenon will come too late for policy makers to stop it.”

USAGOLD note: How and why the 2020s are shaping up much like the stagflationary 1970s……

Chart courtesy of Merk Investments • • • Click to enlarge