The key to 2022 will be how inflation is brought down

Financial Times/Mohamed El Erian/1-3-2021

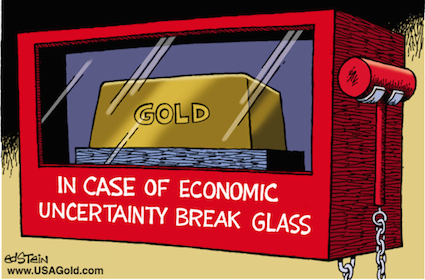

USAGOLD note: This piece offers another rendition of the damned if you do, damned if you don’t dilemma in which the Fed finds itself on inflation and rates. You come away with the impression after reading this piece that 2022 is shaping up as The Year of Uncertainty – not just for financial markets and the economy, but for the Fed itself. The result could be a form of policy paralysis in reality, no matter what is said – a time when it essentially pulls up anchor on the global economy and leaves the markets to fend for themselves. Then, indeed, we will be back in the1970s as Dalio warns. (Please see above.)