Monthly Archives: January 2022

The case for ‘digital gold’ unravels as bitcoin’s plunge deepens

Bloomberg/Akayla Gardner/1-21-2022

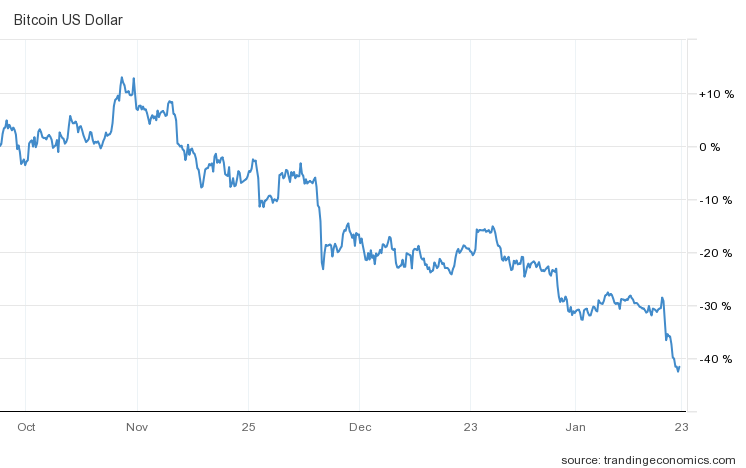

“As the world’s largest cryptocurrency slips to $38,000, the lowest price since August, its decline in tandem with risk assets such as tech stocks is casting a shadow on a long-touted similarity to gold.”

USAGOLD note: Imagine yourself as private citizen Elon Musk and that three months ago you sold your 3-year old Tesla. In payment, you accepted bitcoin and decided to hold onto the remittance because it looked to have a very bright future. At first, your decision looked to be a very shrewd maneuver as the cryptocurrency rose 10%. But then things began to go in the other direction. By the end of last week, the value of your holding dropped 40%! Not so shrewd after all. You just sold your Tesla for about 60% of its value. To the rest of the world, your plight illustrates why bitcoin can never be mistaken for gold. Had you taken gold in payment, instead, the value of your holding would have risen by about 2%. The truly shrewd investor will note, at the same time, bitcoin’s trading in sympathy with tech stocks, particularly those priced on shaky foundations.

Chart courtesy of TradingEconomics.com

The real revoluition is underway but no one recognizes it

Of Two Minds/Charles Hugh Smith/1-12-2022

USAGOLD note: Smith offers a provocative look at a reality many of us have experienced in our daily lives. Most would like to believe it is temporary – that things will get back to normal. The truth of the matter is that it is gaining momentum instead. Much food for thought at the link above……

Why did almost nobody see inflation coming?

Project Syndicate/Jason Furman/1-17-2022

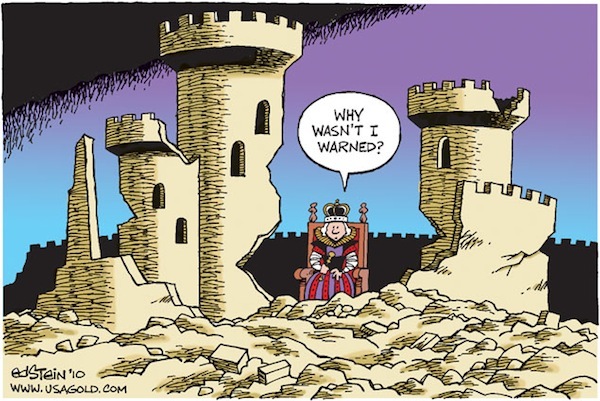

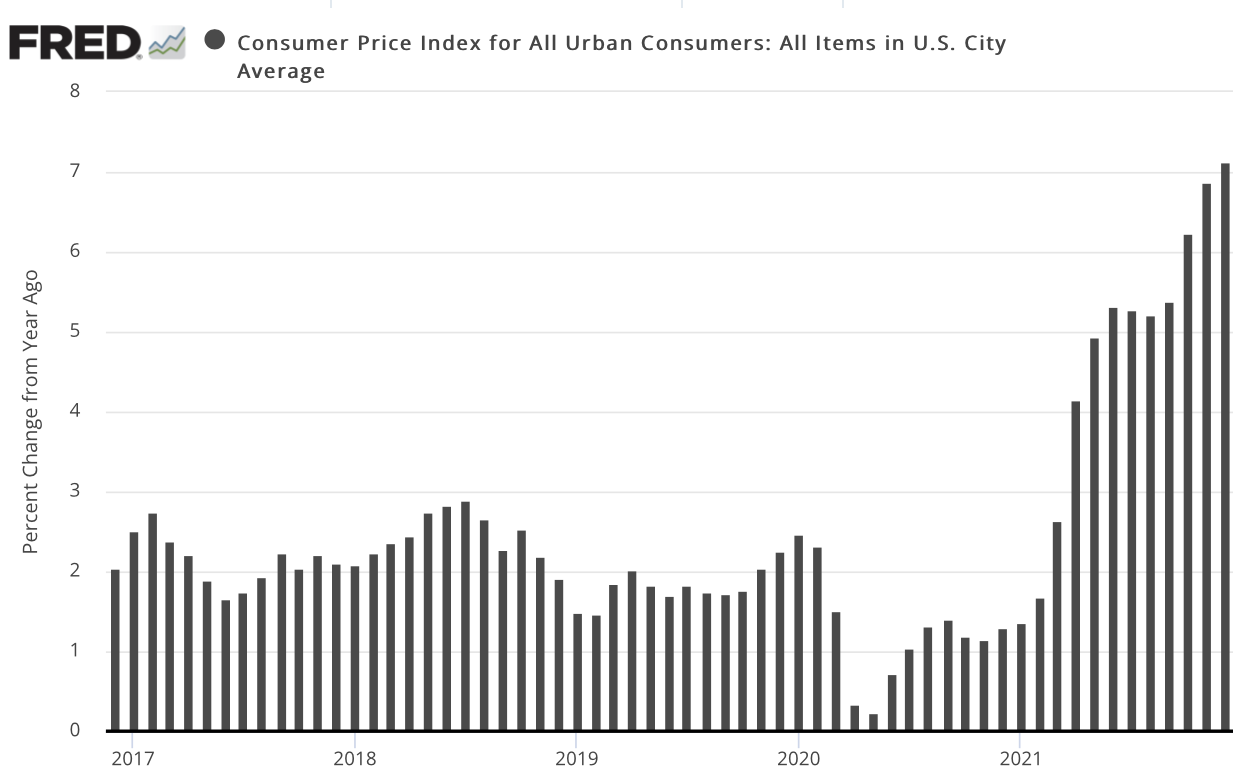

“In 2008, as the global financial crisis was ravaging economies everywhere, Queen Elizabeth II, visiting the London School of Economics, famously asked, ‘Why did nobody see it coming?’ The high inflation of 2021 – especially in the United States, where the year-on-year increase in consumer prices reached a four-decade high of 7% in December – should prompt the same question.”

USAGOLD note: How much, we will venture to ask, is not simply willful blindness? An unwillingness to read the signs, no matter how apparent the outcome. The truth of the matter is that a good many saw it coming and we published their warnings here.

Short and Sweet

The core problem is the debasement of the currency

“The strategies, in which portfolios hold 60% stocks and 40% bonds, have produced just two down years since 2007,” writes Bloomberg’s Michael Mackenzie and Liz McCormick. “… But it posted losses in September and November and is down 0.4% so far in December, just as the Federal Reserve started signaling a hawkish shift.” The bottom line is that both sectors – stocks and bonds – are overvalued, as we are constantly warned in financial reports these days. One analyst said: “In this environment, we think 60/40 is pretty dangerous.” Inflation undermines the value of the very currency in which those assets are denominated. So the problem at its core is the debasement of the currency.

Switzerland-based analyst Claudio Grass, who receives considerable attention among market watchers for his insights on monetary policy, holds what many would consider a controversial view on the Fed’s tapering program. He believes that “most investors can see through the political narrative and the ‘packaging’ of the central bank’s decisions. They realize they can depend on continued support and that there’s no reason to fear that the monetary expansionism of the last decade will be reversed anytime soon. And they are justified in their assumptions.”

“Of course,” he concludes in a short analysis posted at the Gavekal website, “as might have been expected from the track record of central planners this ‘strategy’ is extremely short-sighted. Keeping the money faucets open and persisting in maintaining an environment of extremely low rates is only postponing the inevitable. As conservative, rational investors and precious metals owners clearly understand and have seen coming for a very long time, this myopic approach might put off a recession over the next weeks or months, but it is has created much larger, deeper, systemic risks, ranging all the way from an inflationary crisis to the potential for actual currency collapse.”

Thinking that the 60/40 portfolio has seen better days?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

A Gold Classics Library Selection

Pompous Prognosticators

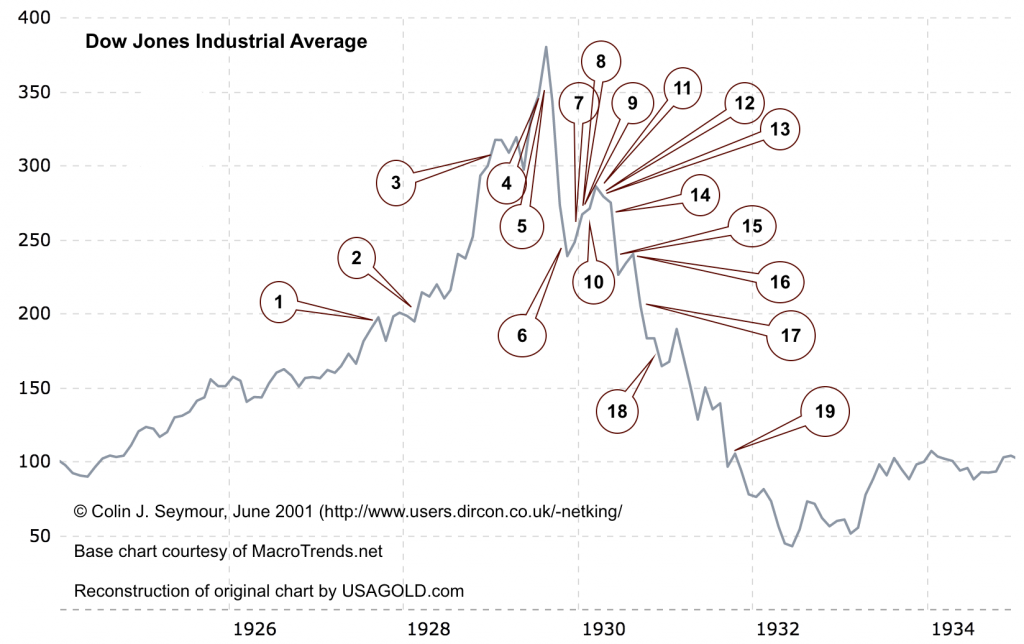

Optimism abounds as stock market crashes – 1928 to 1932

by Colin J. Seymour

May 2001 (Rev. August 29, 2001)

This classic study posted on the USAGOLD website in 2001 has received thousands of visits over the years. Seymour captures the essence of a period in stock market history not unlike our own through quotes from major market players, economists, and analysts from John Maynard Keynes to Bernard Baruch, Irving Fisher, and many other notables.

Worried about bubbling sentiment in today’s stock market?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

Hawkish central banks lead investors’ biggest fears list

BNN Bloomberg/Nikos Chrysoloras/1-18-2022

USAGOLD note: Only 9% see asset bubbles as the greatest risk while 21% see inflation as the biggest risk. A full 44% see hawkish central banks as the biggest risk which goes a long way in explaining financial markets’ behavior over the last several weeks.

Rand Paul on inflation: ‘It’s only going to get worse’

NewsMax/Jeffrey Rodack/1-18-2022

USAGOLD note: Rand Paul reviews the fundamentals of spend and print economics in this report. Congress is unlikely to heed his warning. He ends with Milton Friedman’s words of wisdom: “There is no such thing as a free lunch.”

Why interest rates aren’t really the right tool to control inflation

MaketWatch Opinion/Rex Nutting/1-15-2022

USAGOLD note: If Rex Nutting is right, what happens if and when financial markets discover that the Fed is confronting a disease it cannot magically cure?

Tensions between Russia and Ukraine aren’t fully priced into commodities

MarketWatch/Myra Saefong/1-14-2022

“A potential conflict could raise the possibility of disruptions to commodity flows, says Warren Patterson, head of commodities strategy at ING. The U.S. and European Union may also react in the event of a conflict, leading to sanctions against Russia that could have an ‘impact on the supply of a number of commodities to world markets,’ he says — and none of these factors are priced into the market.”

USAGOLD note: Geopolitical concerns, of late, have taken a back seat to the more pressing build-up of inflation, but inflation’s cause would be well-served by a military confrontation in Ukraine, according to MarketWatch’s Myra Saefong. In particular, a conflict between Russia and Ukraine would impact natural gas, wheat, and corn, she writes. As it is commodity prices, as reflected in the CRB Index, are up 40% over the past twelve months.

Chart courtesy of TradingEconomics.com

Henry Kaufman, 1970s Wall Street Dr. Doom, blasts Powell on inflation

Bloomberg/Erik Schatzker/1-13-2022

USAGOLD note: Kaufman, in short, thinks the Fed will let inflation run, i.e., that we are in for a repeat of the 1970s. “I don’t think this Federal Reserve and this leadership has the stamina to act decisively. They’ll act incrementally,” he says. Like former Treasury Secretary Larry Summers, he believes a Volcker-style shock is necessary to bring the current surge in inflation under control.

The mother of all supply shocks lurks in China’s covid crackdowns

Bloomberg/Enda Curran/1-12-2022

USAGOLD note: As we have suggested in the past, the Fed might find it very difficult to control an inflation rate with drivers beyond its control, like curtailment in the manufacturing and export of goods from China.

The broad inflation problem. Can it be controlled?

Bloomberg/John Authers/1-14-2022

“Many reasons were offered in mid-year, sincerely and honestly, to show that higher inflation numbers were merely a facet of transitory effects of the pandemic. None of them holds water any longer.”

USAGOLD note: Authers breaks down the inflation numbers in this piece and comes away with the conclusion that inflation is here to stay. Now the Bureau of Labor Statistics not only proposes to exclude food and energy from its baseline number it would like to also exclude used cars. Authers calls the new index “inflation excluding everything you would like to exclude.”

Chart courtesy of TradingEconomics.com

AFTERNOON UPDATE

Gold breaks sharply to the downside as market confusion abounds

Goldman Sachs remains undaunted, touts $2150/oz target over next 12 months

(USAGOLD – 1/27/2022) – Gold broke sharply to the downside in early U.S. trading as markets attempted to sort out the results of this week’s Fed meeting and yesterday’s press conference. A sharply higher dollar and an unexpectedly strong GDP report accelerated the decline. Gold is down $25 at $1796. Silver is down 92¢ at $22.58. If we were to tag the market reaction thus far with a word, it would be “confused.” It doesn’t seem like there is a clear perception in financial markets where we are headed – on burgeoning inflation, an impending recession, and what precisely the Fed is likely to do next. If anything stands on firm ground in all of this, it is market volatility. Now stronger than it has been in quite some time, it testifies to the confusion already mentioned.

Goldman Sachs remains undaunted: “Get long gold on weaker U.S. growth and resilient E.M.s,” it says in a report issued yesterday. “In our view, this combination of slower growth and higher inflation should generate investment demand for gold, which we consider to be a defensive inflation hedge. In addition, we expect continued growth in E.M. dollar-wealth and a rebound in consumer and central bank demand for gold. As such, we are raising our 12-month gold target to $2150/toz from $2000/toz and are launching a long Gold (Comex Dec 22) trading recommendation.”

We will be posting occasional afternoon updates only for the next few weeks.

Please stay tuned.

Sell dollar for everything else is echoing across trading rooms

Bloomberg/Ruth Carson and Joanne Ossinger/1-12-2022

USAGOLD note: If this is the call echoing across institutional trading rooms, it could end being a good year for precious metals after all. Watch the precious metals ETFs for signs of a rotational groundswell.

Fed response to trading scandal risks more damage to reputation

Financial Times/Colby Smith/1-12-2022

USAGOLD note: The Fed comes under fire for the trading practices of top brass, including its chairman and vice-chairman, in a way few anticipated. “This makes it harder for people to stick up for the Fed and insist on the Fed retaining its independence,” says MIT professor Simon Johnson. Should the Fed’s critics succeed in undermining its independence, little stands in the way of a politically influenced monetary policy. In turn, we see little real resistance in either political party at this juncture to running significant budget deficits and printing money to cover them. Though now pretty much in the background, should the movement to undermine Fed independence gain traction, it will have major long-term implications for the dollar and gold.

Fed has to be ‘far more aggressive … than the Street thinks,’ says Wharton’s Siegel: ‘This is too much money chasing too few goods’

MarketWatch/Mark DeCambre/1-12-2022

“Meanwhile, Siegel said that so-called TINA, or ‘there is no alternative’ (to stocks), trading will help buttress the equity markets as bonds get hit. Stocks are real assets, you just can’t hold paper assets, which are bonds,” Siegel said. The 10-year Treasury note yields 1.73% on Wednesday, hovering around its highest levels since March 2021.”

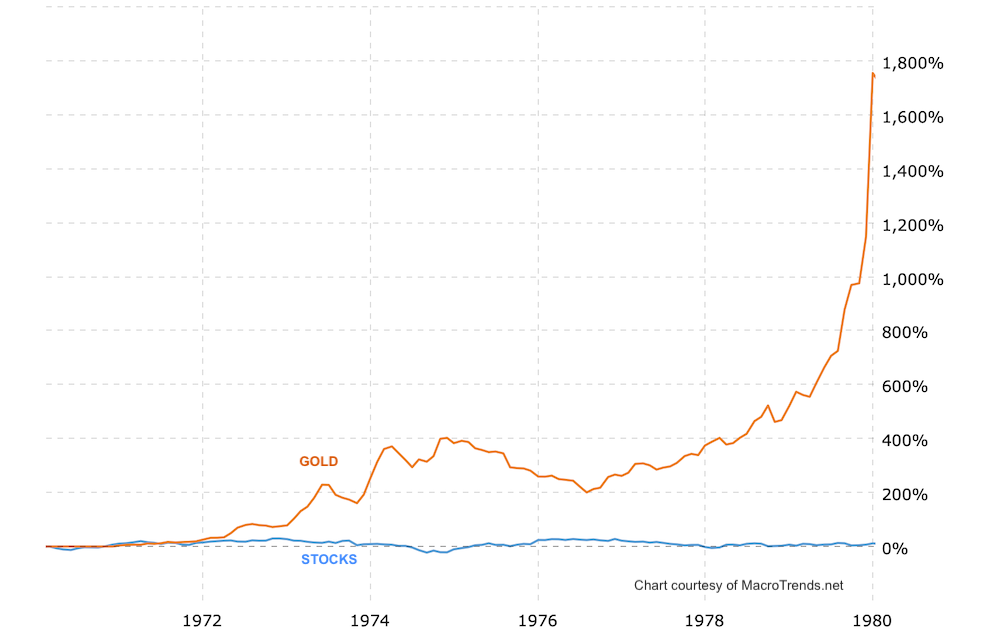

USAGOLD note: Siegel is right about the Fed’s timidity, but can it muster the will to become significantly more aggressive? A good many economists would take issue with Siegel’s long-held view that stocks are a hedge against inflation. During the 1970s, an inflationary period often cited as similar to the present, stocks were poor performers while gold and silver soared. In short, there is an alternative to stocks.

Gold and stocks price performance

(%, 1970-1980)

Chart courtesy of MacroTrends.net

‘This country is getting angry when they go to the supermarket’

CNBC/Matthew J. Belvedere/1-14-2022

“Discontent over skyrocketing inflation is the most important issue for voters heading into this year’s midterm election, and Democrats are going to pay the price, according to Frank Luntz, a longtime GOP pollster and strategist.”

USAGOLD note: The tentacles of a failed monetary policy run deep and grocery prices are only one manifestation of the problem. How long until economists begin talking about an inflation trap, i.e., a Fed that wants to raise rates but can’t do so aggressively without trashing the stock, bond, and real estate markets?

‘There’s no way the stock market goes up this year — it probably goes down pretty aggressively.” – Kyle Bass

MarketWatch/Mark DeCambre/1-13-2022

USAGOLD note: Bass goes on to say that the Fed will be forced to back off its hawkish stance when stocks begin to decline “aggressively.”

Has the NASDAQ finally caught up with reality?

Bloomberg/John Authers and Lisa Abramowicz/1-21-2022

USAGOLD note: This interview of Bloomberg columnist John Authers folds nicely into the Richards piece featured below on supply chain issues.

Gold investors don’t care about the stock market’s taper tantrum

Bloomberg/Eddie Spence, Ranjeetha Pakiam and Yvonne Yue Li/1-24-2022

USAGOLD note: It’s all about the real rate of return, in our view. Better to hold that hedge during times times like these, then dump it and have little or no balance in the portfolio – even for the more aggressive fund managers. It would not be prudent to invest as if everything were hunky-dory when all the signs are pointing to a period of elevated insecurity.