Speculative mania – Was 2021 the Peak?

Real Investment Advice/Lance Roberts/1-10-2022

“The amount of speculation in the market currently is rampant. There have only been a couple of times in history when we saw similar investors’ actions, and both ended poorly. The three most significant market risks heading into 2022 are a reversal of the things that supported the speculative attitude of investors over the last year: buybacks, liquidity, and earnings growth. Notably, the reversal of liquidity impacts every facet of the economy and markets, and earnings are the ‘bullish support’ for overvaluation.”

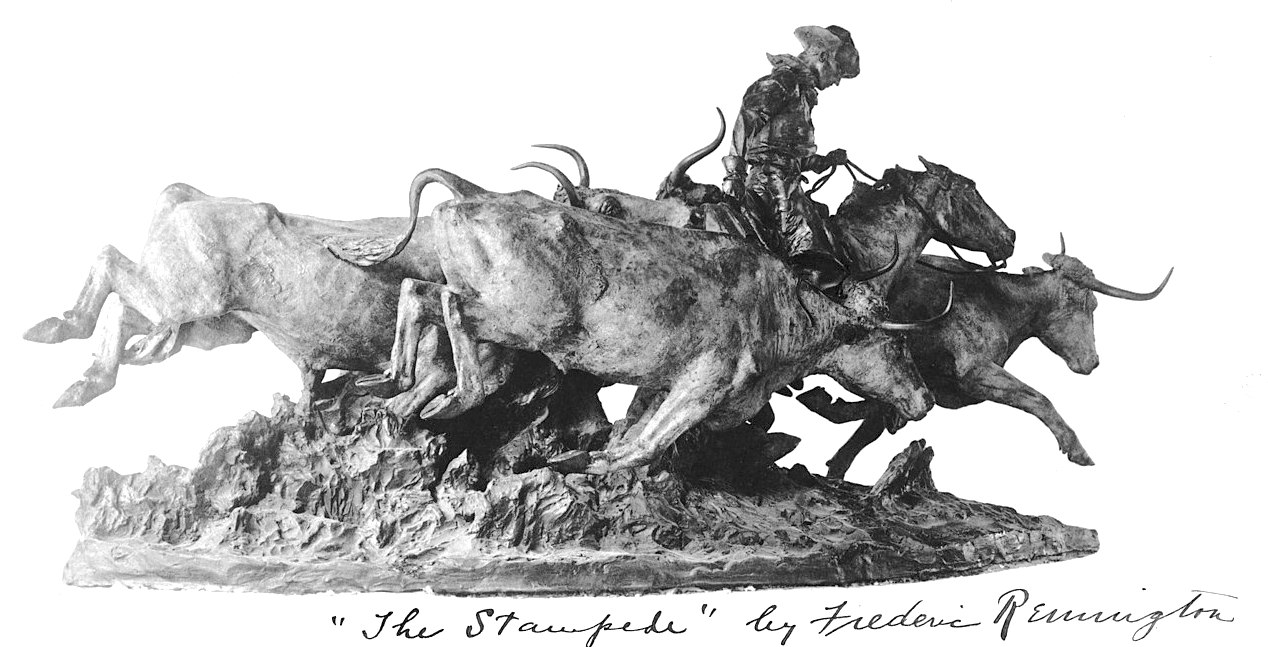

USAGOLD note: The thing about the herd, as any fan of old westerns will tell you, is that it can stampede on the slightest provocation and if you are not agile enough to get out of the way. ……… Well, you get the idea. Roberts ends this well-reasearched perspective with a quote from famed Wall Street speculator Benjamin Grahm: “The investor’s chief problem – and even his worst enemy – is likely to be himself.”