Monthly Archives: January 2022

Legendary investor Jeremy Grantham sees an epic market bubble and expects a historic crash. Here are his 12 most dire warnings.

Yahoo!Finance/Theron Mohamed/1-17-2022

“Make no mistake — for the majority of investors today, this could very well be the most important event of your investing lives. Here we are again, waiting for the last dance and, eventually, for the music to stop.”

USAGOLD note: Grantham is among the group of professional investors whose warnings have been routinely ignored.

AFTERNOON UPDATE

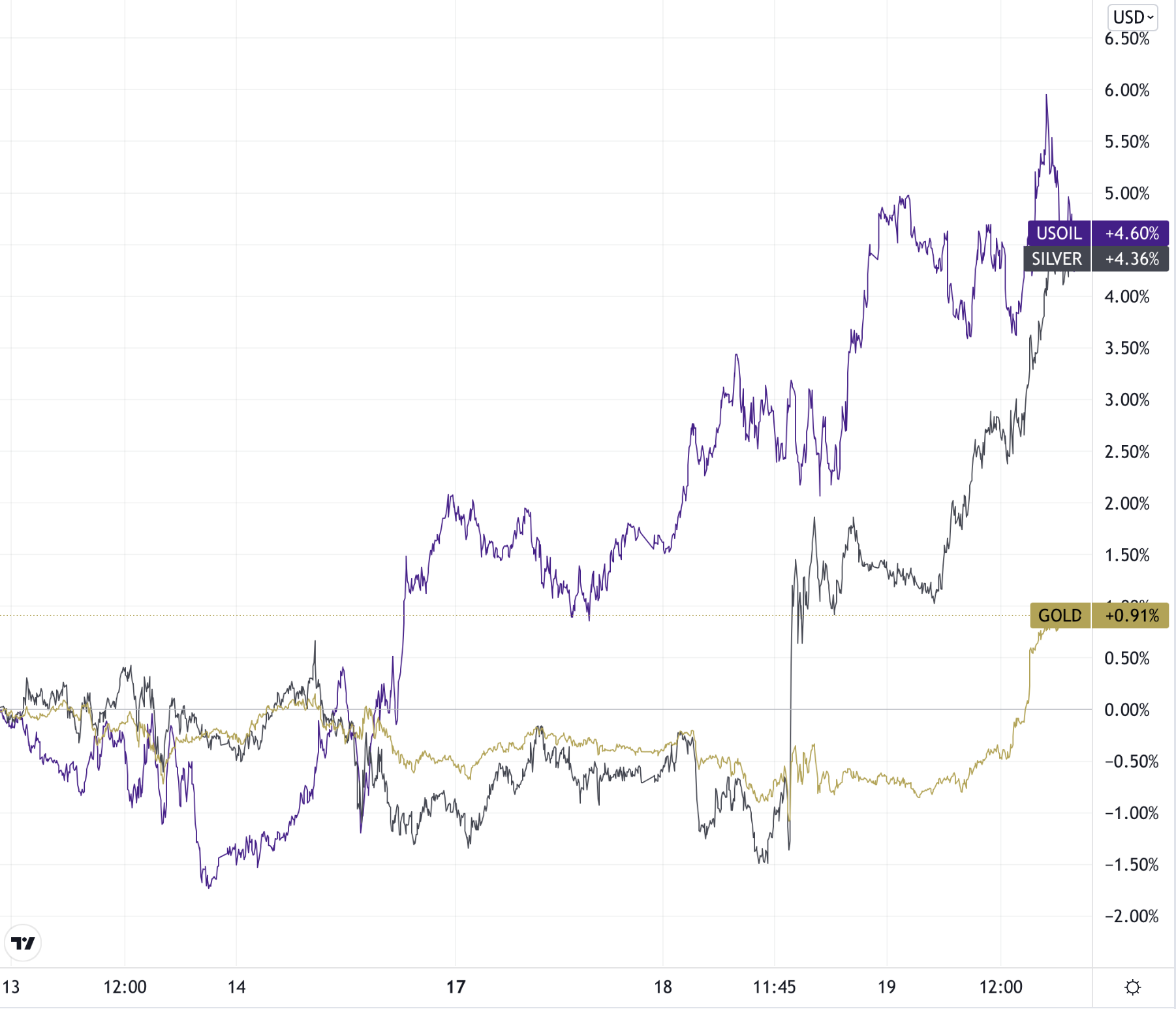

Gold, silver push convincingly higher, part of broad-based commodities rally

‘Silver is the canary in the gold mine and will probably go first.’

(USAGOLD – 1/19/2022) – Following silver’s lead yesterday, gold pushed convincingly through resistance levels around $1830 today as part of a broad-based commodities rally. Silver is up another 3% (+70¢) at $24.23. Gold is up $28 at $1843. Some analysts, as reported yesterday, believe that a recovery in Chinese industrial production is pushing the rally in commodity prices. Precious metals, some feel, have lagged the inflation building in the economy and are now beginning to play catch up. A weaker dollar and falling bond yields contributed to precious metals’ upside. Equity Management Academy takes a somewhat different tack on the commodities rally, saying that it is driven by oil and that oil, in turn, is driven by the prospect of war in Ukraine.

“A combination of factors is shaking the foundation of supplies across the board,” it concludes in a report released his morning. “Gold and silver could explode. Silver is the canary in the gold mine and will probably go first. Silver is the most undervalued asset in the world. It’s clear that the Fed is not in control of inflation, and it’s still unclear if this inflation is going to be temporary or long term. Once you raise prices it is very difficult to lower them later. There’s a lot of uncertainty in a lot of areas. … Gold and silver are both poised for a major move up. If Gold takes out $1874, then the next high would be the $1920 area. If Gold goes beyond that, it would test $2062.”

Gold, silver and oil prices

(% gains, 5-days)

Chart courtesy of TradingView.com • • • Click to enlarge

We will be posting occasional afternoon updates only for the next few weeks.

Please stay tuned.

Is it time to fight the Fed? This veteran strategist says the central bank won’t risk a 20% drop in house prices and a 30% slide in stocks.

MarketWatch/Steve Goldstein/1-7-2022

“David Rosenberg, chief economist and strategist at Rosenberg Research and the former chief North American economist at Merrill Lynch, isn’t buying the tough talk from the Fed. ‘One should be skeptical of the Fed’s forecasts, given the poor track record, even though investors treat them (and the dot plots and FOMC minutes) as gospel,’ he says.”

USAGOLD note: We agree with what Rosenberg is saying. The Fed can’t jump on the brake without causing a fiery rollover. Rosenberg is among the group of market savants that does not take Elmer Fedd seriously.

Image attribution: Elmer Fudd and Bugs Bunny, Warner Bros. Cartoons, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>, via Wikimedia Commons

Precious metals prices poised to rise in 2022

Numismatic News/Patrick A. Heller/1-7-2022

USAGOLD note: If you are visiting here today as part of your research program on gold and silver investing, this article offers the essential overview and rationale.

With no Plan B, the global economy must brace itself for another ‘black swan’ event

South China Morning Post/David Brown/1-3-2022

USAGOLD note: Potentially lethal for global growth and personal investment portfolios, we will add …… And central banks, says Brown, a London-based economist and former investment banker, have little room to maneuver. In our view, that puts the ball in the private investor’s court when it comes to building protections into one’s portfolio.

The great gold love trade is alive and well, as India buys a record amount

U.S. Global Investors/Frank Holmes/1-5-2022

USAGOLD note: For the gold market, Indian and Chinese demand are foundational and, at this juncture, that foundation is strong.

What drives the price of gold? Part 2

The Gold Observer/Jan Nieuwenhuijs/1-14-2022

USAGOLD note: In this second installment on gold pricing mechanics, Nieuwenhuijs dissects the relationship between real yields and the price of gold. Here is the link to the first installment.

The Federal Reserve is scaring markets with the triple threat of policy tightening

USAGOLD note: And in our view, we are only in the early stages of that market reaction.……

Why we go for gold

The Spectator/James Fox/1-8-2022

USAGOLD note: Gold’s origins, scarcity and allure ……

Russell Napier forecasts 4% inflation (which implies $7000 gold)

Atlas Plus/Charlie Morris/1-5-2022

USAGOLD note: Based on his own analysis and Napier’s observations, UK’s Charlie Morris says “It is time to be bullish on gold.”

Frisby’s forecasts – What does 2022 have in store for investors?

Money Week/Dominic Frisby/1-5-2022

USAGOLD note: UK’s Frisby entertains as well as prognosticates on a wide range of assets in this quick read. He has a section on gold and says it will go above $2000 per ounce.

AFTERNOON UPDATE

Silver turns decisively to the upside

Improved economic picture for China cited as the reason for the price jump

(USAGOLD – 1/18/2022) – Though gold stayed stubbornly within a tight range just above the $1800 mark in today’s trading, silver decisively turned to the upside. It is up 48¢ on the day at $23.53. Gold is down $4 at $1816. Silver’s advance looks to be part of a general rally in commodities led by oil. Gold, at the same time, has been held in check by a firming U.S. dollar. The big story in financial markets continues to be the sell-off in the bond market with yields on the 10-year Treasury now approaching two-year highs.

Investing Cube’s Faith Maina attributes silver’s rise to positive economic numbers coming out of China. “The Middle Kingdom is the largest consumer of silver and other industrial metals. To begin with, the country’s GDP rose by 1.6% in Q4’21 compared to the predicted 1.1% and prior quarter’s 0.2%. Besides, industrial production rose by 4.3% in December YoY, which is higher than the previous 3.8% and expected 3.6%.” In keeping with that analysis, platinum and palladium are also higher this morning.

Chart courtesy of TradingView.com

We will be posting occasional afternoon updates only for the next few weeks.

Please stay tuned.

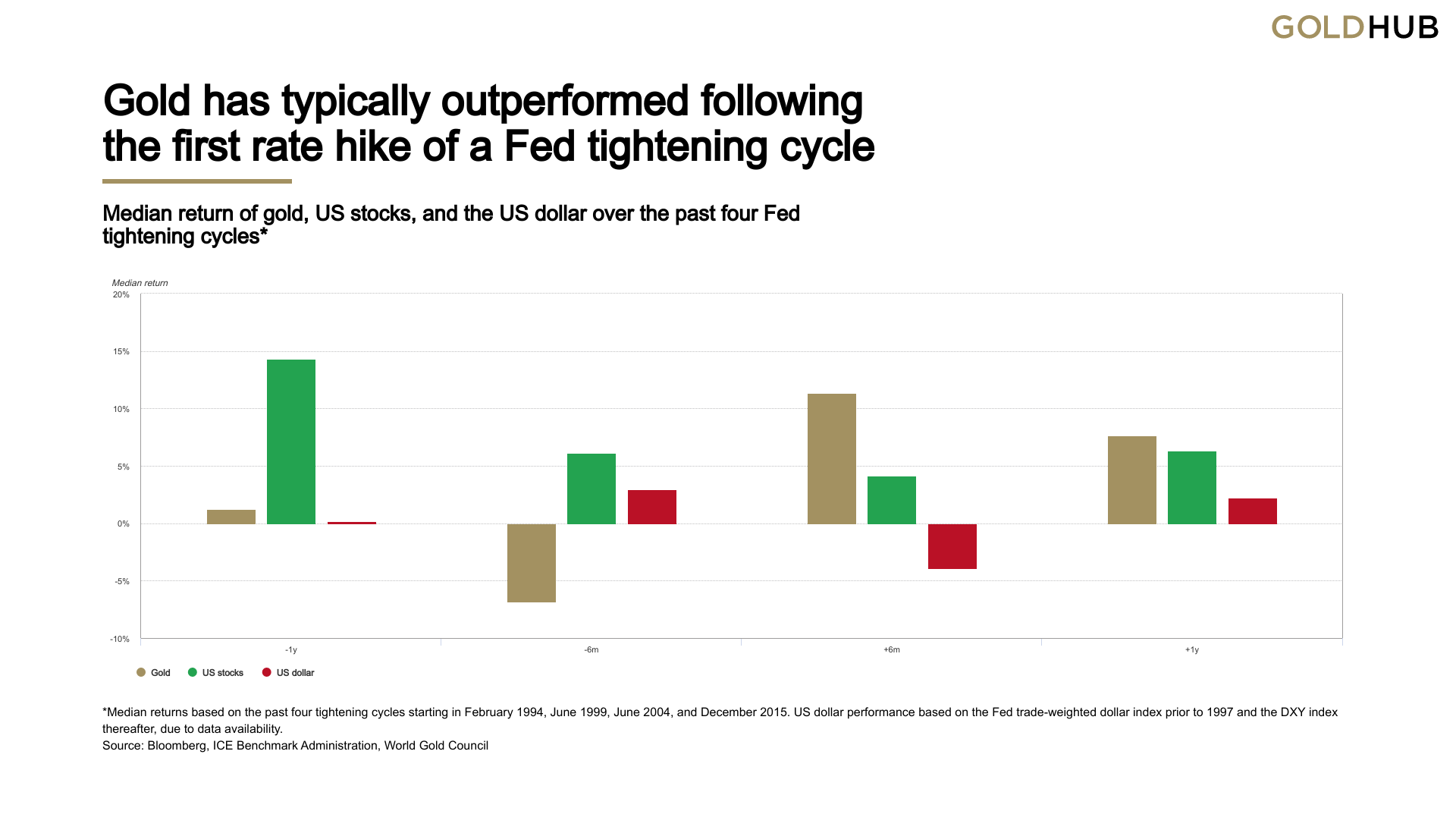

Gold outlook 2022

“Dot-plot projections suggest that year-ahead Fed expectations have significantly exceeded actual target rates. More importantly though, financial market expectations of future monetary policy actions – expressed through bond yields – have historically been a key influence on gold price performance. Consequently, gold has historically underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike. (See below) Gold may have partly been aided by the US dollar which exhibited the opposite pattern. Finally, US equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.”

USAGOLD note: The World Gold Council offers a comprehensive review of gold’s prospects for 2022. In essence, it sees rising rates as a headwind for gold, but with limited effect along a six-month to one-year timeline.

Chart courtesy of the World Gold Council • • • Click to enlarge

Do you trust the Fed?

On the Money/Dennis Miller/1-13-2022

USAGOLD note: A number of analysts who concentrate on the fundamentals say the greatest fundamental of all is whether or not the investing public trusts the Fed. If it does gold tends to remain subdued. If it doesn’t, the lack of trust can fuel strong demand and future price increases. The 14% inflation rate comes from Shadow Government Statistics which calculates inflation using Bureau of Labor Standards methodology from the early 1980s.

Reality bites: A forecaast for precious metals in 2022

SprottMoney/Craig Hemke/1-11-2022

“Oh, boy. Here we go again. It’s the start of a new year, and that means it’s time for another adventure in long term price forecasting. Around here we call it a ‘macrocast’ because we figured out long ago that, in a world dominated by computers trading derivatives, if you can get the macroeconomic conditions right, you’ve got a decent shot at forecasting the gold price, too.”

USAGOLD note: Even that is an assumption fraught with peril. It’s that part about getting the macroeconomic conditions right that raises an eyebrow. Just when you think you have it nailed something like a pandemic or credit crisis comes along to blow it apart. Viewing gold as a defensive portfolio asset – one without contingent liabilities – is still the best course of action. Better a successful armchair investor, from our perspective, than a thoroughly disenchanted speculator. That said, Hemke stays conservative and ends up with $2050 gold and $29 silver by year end.

Spot gold at $2,100? Commodities analyst says gold could test new highs this year

“We do think across the course of 2022, we will see the gold price testing at the all-time record highs, but we can’t see it traveling much beyond that once it gets there.” – David Lennox, Fat Prophets

USAGOLD note: Lennox says that the Russia-Ukraine confrontation could turn “disastrous” and if it does the $2100 target would come “sooner rather than later.”

The commodity that soars when inflation is rising

Rogue Economics/Laurynas Vegys/12-31-2021

“So silver is relatively cheap right now. In fact, the metal is currently trading well below its July 2020 price of roughly $27 – before the Fed’s printing press really went into overdrive. In other words, it’s trading as if no money-printing has happened. … The next few years could be huge for silver. Now is the time to add some exposure to this unloved metal to your portfolio.”

USAGOLD note: Given the strong volumes for silver coins and bullion over the course of last year and going into 2022, it appears investors agree with Vegys’ assessment.

The Fed minutes that shook the world

BloombergOpinion/John Authers/1-6-2022

USAGOLD note: In the aftermath of the Fed’s minute release, CNBC reported the balance sheet reduction as being in the majority. Authers quotes the minutes directly as reading “Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate.” Authers’ rendition seems the more plausible of the two.

Gold is in a strong rebound position in 2022

NewsMaxFinance/Lee Barney/1-3-2021

“Gold’s lackluster year may pave the way for renewed interest in exchange-traded funds in 2022 from investors seeking a hedge against growing global uncertainties.”

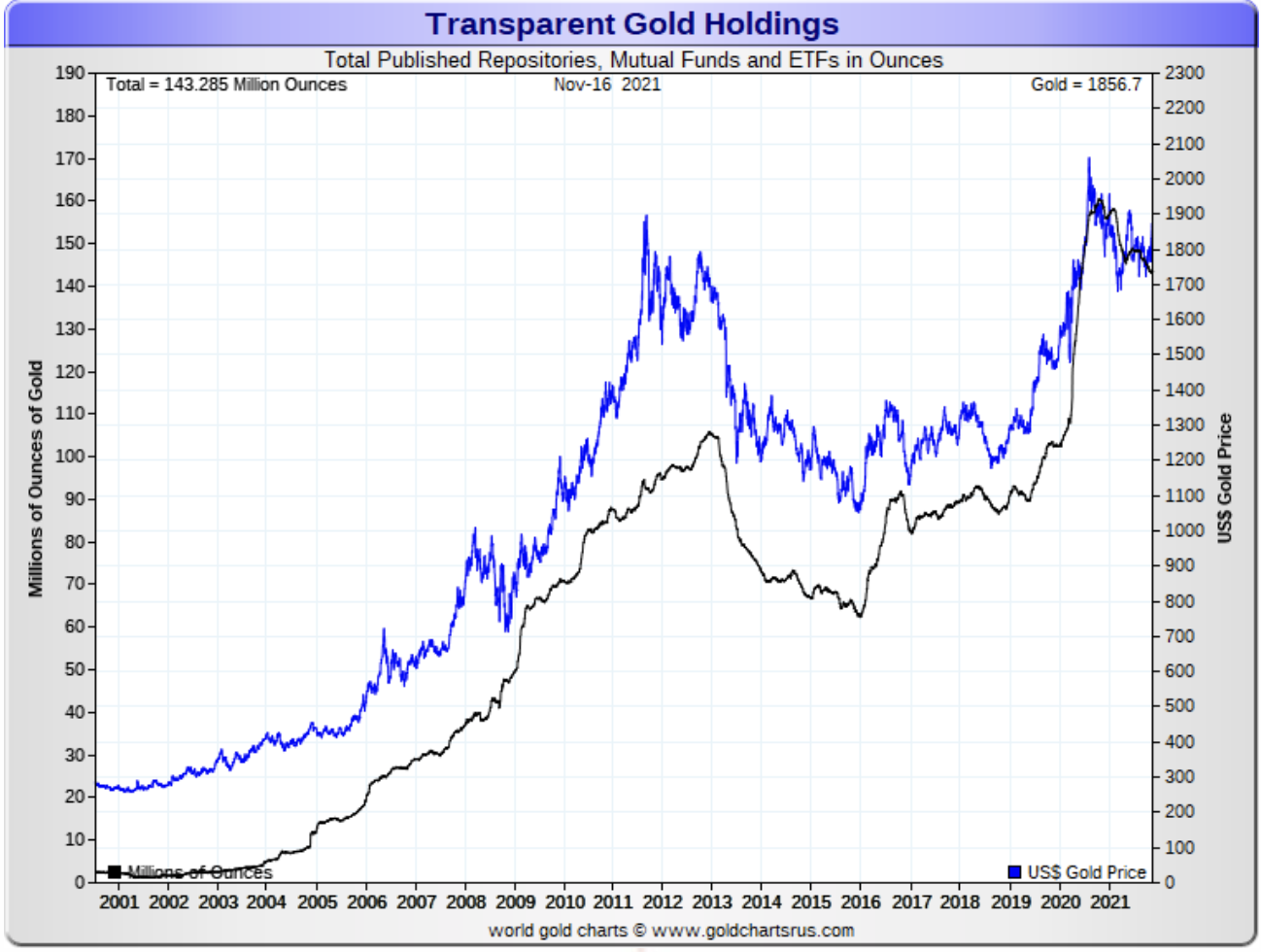

USAGOLD note: As we have posted here previously and as the chart below shows, there has been a direct correlation in the past between growth in ETF stockpiles and rising prices.

Chart courtesy of GoldChartsRUs

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We believe 2020 marked the secular low point for inflation and interest rates. The 40-year bull market in bonds is over.’”

Michael Hartnett

Bank of America

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––