Daily Gold Market Report

Gold starts the week on the downside driven by speculators in the paper markets

WGC: Gold prices have increased by a robust 11% annually over the past 50 years

(USAGOLD – 6/5/2023) – Gold is starting the week on the downside as speculators reacted to the prospect of higher rates, entrenched inflation, and an alarmingly (in certain quarters) strong economy. It is down $6 at $1945. Silver is down 13¢ at $23.55. While the Fed and rates have dominated the paper trade over the past year, concerns about the financial system’s stability have driven record safe-haven demand in the physical market, particularly among central banks and private investors. (See interactive chart below.)

Pointing out that gold prices have increased by a robust 11% annually over the past 50 years, the World Gold Council says, “investors want protection in tough times—and historically, this is when gold shines moving higher when equities and other riskier assets are under pressure. Unusually though, gold can also move higher when these assets are in positive territory. This ability to perform in good times and bad is based on gold’s varied demand and makes it a uniquely efficient asset for an investment portfolio.” [Source: World Gold Council/Reuters]

Chart courtesy of the World Bank

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Ironically, the beggar-thy-neighbor implications of competitive devaluations will almost certainly incite a response from countries who may not originally even have needed to resort to currency debasement in the first place, raising the potential for full blown currency war. How should one position for such an endgame? As is probably evident, any nominal instrument will be devalued in real terms, so the solution is to hold an asset that maintains its real value – an asset that cannot be printed.”

Rick Rieder

BlackRock Funds

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short & Sweet

Computer software gone mad

Similarly, in early 2017 Financial Times told the story of the textbook, The Making of a Fly: The Genetics of Animal Design. It started out selling for $113 per copy at Amazon – that is until the governing algorithm misfired between two third-party sellers. The price then skyrocketed to $23 million before someone took note and fixed the problem. We forget that computer software, and this applies to Wall Street’s trading apparatus as readily as it does the Amazon pricing platform, is only as reliable and intelligent as the code by which it is instructed to operate. The practical equivalent to Mr. Spock’s solution in the financial realm is to store sufficient capital in the form of gold and silver coins detached from potentially rebellious electronic circuitry.

Worried about the possibility of computer algorithms running amok in financial markets?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Dr. Moneywise

“In an economy buffeted by the ups and downs of farming and fishing, the people [of India] are used to buying gold after bumper harvests or fishing seasons and selling it after lean ones.” –– Vivek Kaul, Live Mint

Dr. MoneyWise says: “It’s all very simple. Own gold for a rainy day. Use it if and when that day arrives.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to make that rainy-day investment?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Debt ceiling drama will be ‘resolved, but not solved,’ says Jim Grant

USAGOLD note: He goes on to say that these borrowing levels pose a threat to the dollar as global investors worry that the US government could default on future debt payments.

The new gold boom: how long can it last?

Financial Times/Harry Dempsey and Lelie Hook/5-25-2023

USAGOLD note: Financial Times takes a deep dive into what is driving gold demand at present and comes away with conclusions that might come as a surprise to many of our readers……

The most predicted recession ever maybe won’t happen. Get ready for the ‘asset class recession’

Yahoo!Finance-Fortune/Tristan Bove/5-24-2023

USAGOLD note: There is a certain amount of logic in this argument in that much of the inflation over the past several years has ended up in the stock and bond markets. The article goes on to explain that an asset class recession involves a recession for Wall Street while Main Street remains recession-free.

Short and Sweet

Gold Relativity

Do not take your eye off the prize

Gold’s value is relative. It doesn’t really matter how many digits it takes to express the price. Its true value lies in what those digits represent in terms of purchasing power. During the post-World War I hyperinflation in Germany, for example, a 20-mark gold coin in 1918 purchased the equivalent of twenty marks worth of goods and services in the marketplace. By 1924 that same 20-mark gold coin (weighing roughly one-quarter troy ounces) provided the purchasing power of nearly 25 billion paper marks.

By pointing out this example of gold’s constancy, we do not intend to imply that the United States is headed the way of the Weimar Republic. What we do mean to say, though, is that those who track the nominal value of gold by itself without taking into account the current and future value of the currency in which it is measured take their eye off the prize.

What are the intentions of the central bank and federal government, we should ask ourselves, and what will be the likely effect on the purchasing power of the currency?

Ready to add purchasing power constancy to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

In Gold We Trust 2023

Incrementum/Ronald-Peter Stoferle and Mark J. Valek/May, 2023

“The full year 2022 was clearly positive for gold in all currencies, with the one exception of the US dollar. Gold in US dollars suffered from the marked appreciation of the dollar. On average, the price gain in other currencies was 7.2%. In the (former) safe-haven currency, the Japanese yen, the gold price rose by 13.7%. In euro terms, it was up 6%, for the 5th annual gain in a row, which ruthlessly reveals the glaring weakness of the European single currency. In the current year, 2023, gold is clearly in the plus in all listed currencies, on average by 8.7%.”

Daily Gold Market Report

Gold’s response to this morning’s jobs numbers muted thus far

Fund giant Blackrock makes significant silver investment

(USAGOLD – 6/2/2023) – Gold’s response to this morning’s mixed payroll numbers has been muted thus far. It is down $5 at $1975. Silver is down 9¢ at $23.87. Payrolls exceeded expectations, while the unemployment rate was worse than expected. Bleakley Financial’s Peter Boockvar said that the markets are already pricing in a pause at the June Fed meeting and, as a result, today’s reports “won’t have much of an impact on markets.”

In an article posted earlier this week at FXStreet, The PckAxes’ Jon Forest Little points to the gold-silver ratio, now at 85:1, as an indicator that “something incredibly bullish” is looming in the silver market – something that has attracted the attention of the world’s largest money manager. The historical average is 40:1. “On March 8, 2023,” he writes,” BlackRock Inc., the world’s largest asset manager, disclosed in a regulatory filing that it had purchased 16.1 million shares of the silver exchange-traded fund (ETF) Sprott Physical Silver Trust (PSLV), representing a whopping 10.9% stake in the fund.” Little also cites a Citigroup analysis predicting silver will reach $30 per ounce within the next nine months. [Source: FXStreet]

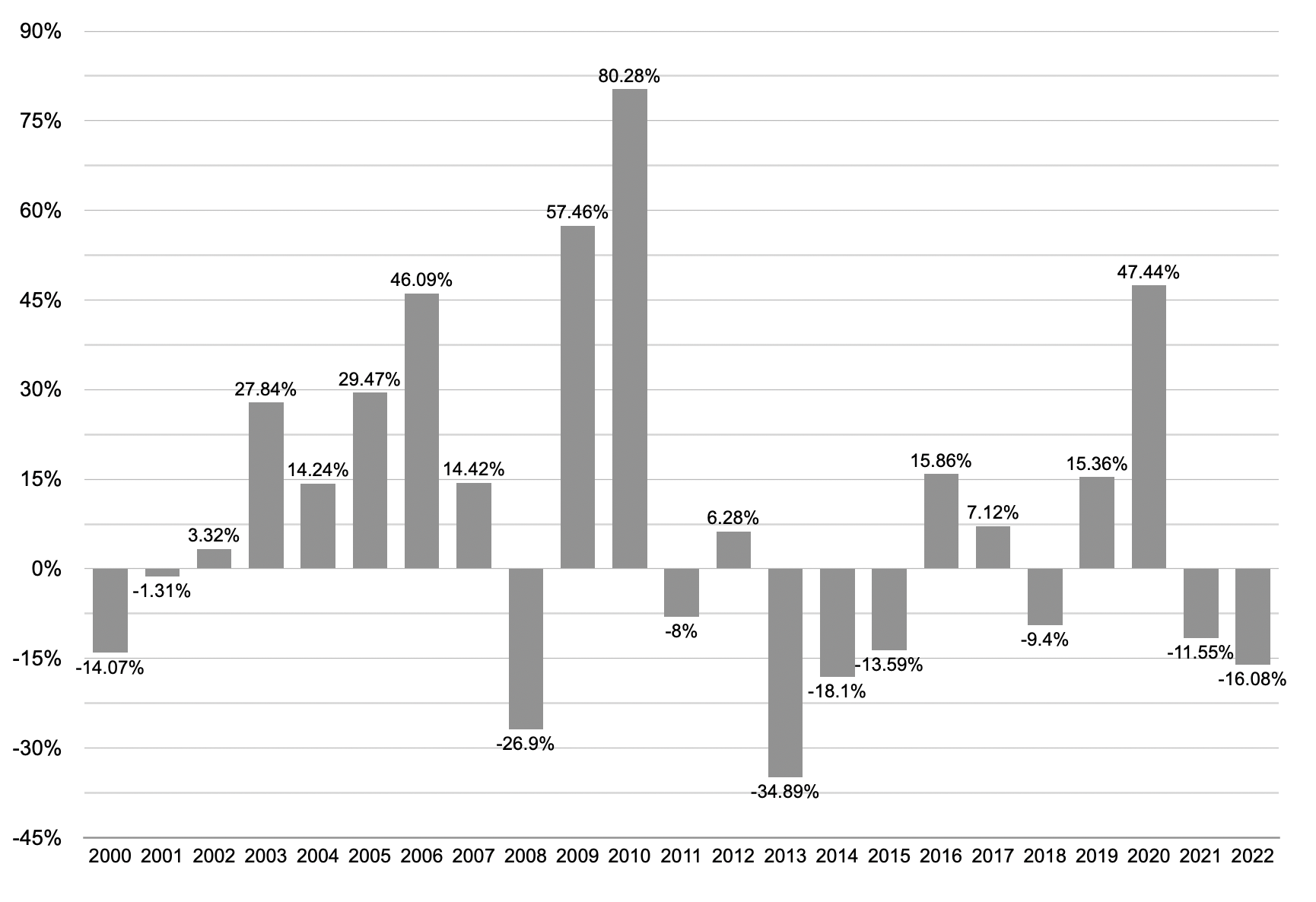

Silver Annual Returns

(%, 2000 to present)

Chart by USAGOLD [All rights reserved, Data source: MacroTrends.net

A debt-ceiling deal will spark a new worry: Who will buy the deluge of Treasury bills?

MarketWatch/Joy Wiltermuth/5-24-2023

USAGOLD note: If it’s not one thing, it’s another. This situation could seriously impact rates if sufficient demand doesn’t materialize. Then again, there is always the printing press if things get out of hand.

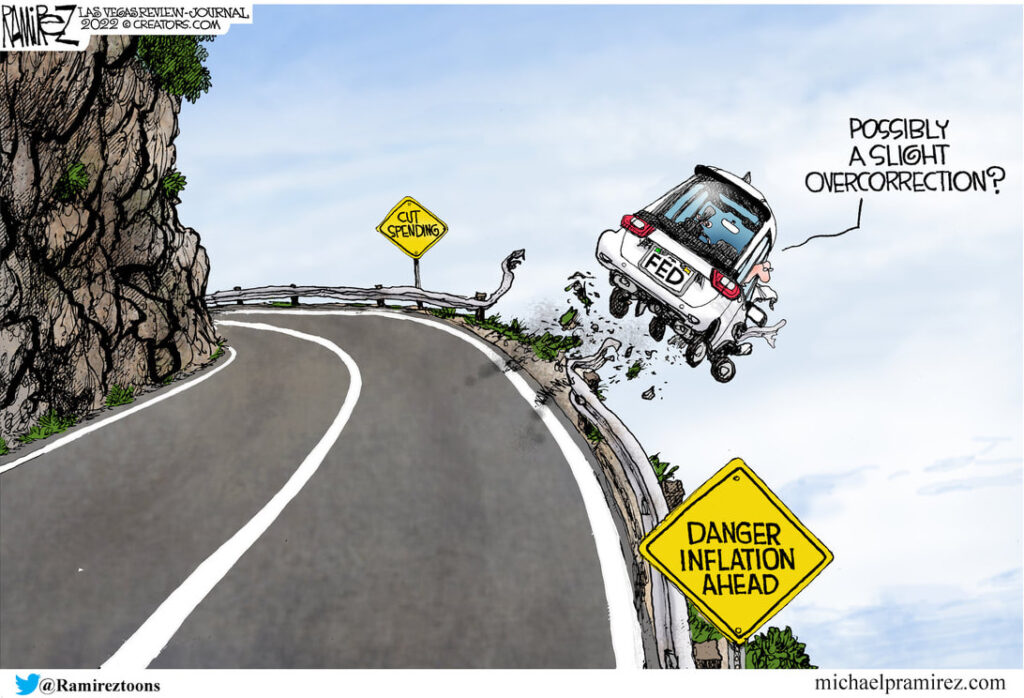

Do we need to destroy the economy to save it?

Newsweek/Zain Jaffer/5-23-2023

“It is one thing for natural events to conspire to wreck an economy. It is another to intentionally slow one down.”

USAGOLD note: Jaffer ends with a few investment suggestions and a caution about more centralized planning which he says is reminiscent of Soviet Russia. “There should be a better way,” he says, “to adjust for economic conditions than what we are doing now.”

Short & Sweet

Super-rich doomsday preppers ahead of the times

And the not-so-super-rich are following in their footsteps

“Survivalism,” Evan Osnos once wrote in an article for The New Yorker, “the practice of preparing for a crackup of civilization, tends to evoke a certain picture: the woodsman in the tinfoil hat, the hysteric with the hoard of beans, the religious doomsayer. But in recent years, survivalism has expanded to more affluent quarters, taking root in Silicon Valley and New York City, among technology executives, hedge-fund managers, and others in their economic cohort.”

We have always taken exception to the mainstream media’s portrayal of the ordinary gold owner as “the woodsman in the tinfoil hat”. . . etc. Many among the media are utterly amazed to learn that people like Steve Huffman (Reddit, CEO), Peter Thiel (PayPal founder), and the long roster of other luminaries mentioned in this New Yorker article are identified as “preppers” in one capacity or another. They would probably be even more amazed to learn that many of this same group are likely to be gold and silver owners. We say “likely” because precious metals owners by and large are a group reluctant to advertise their ownership.

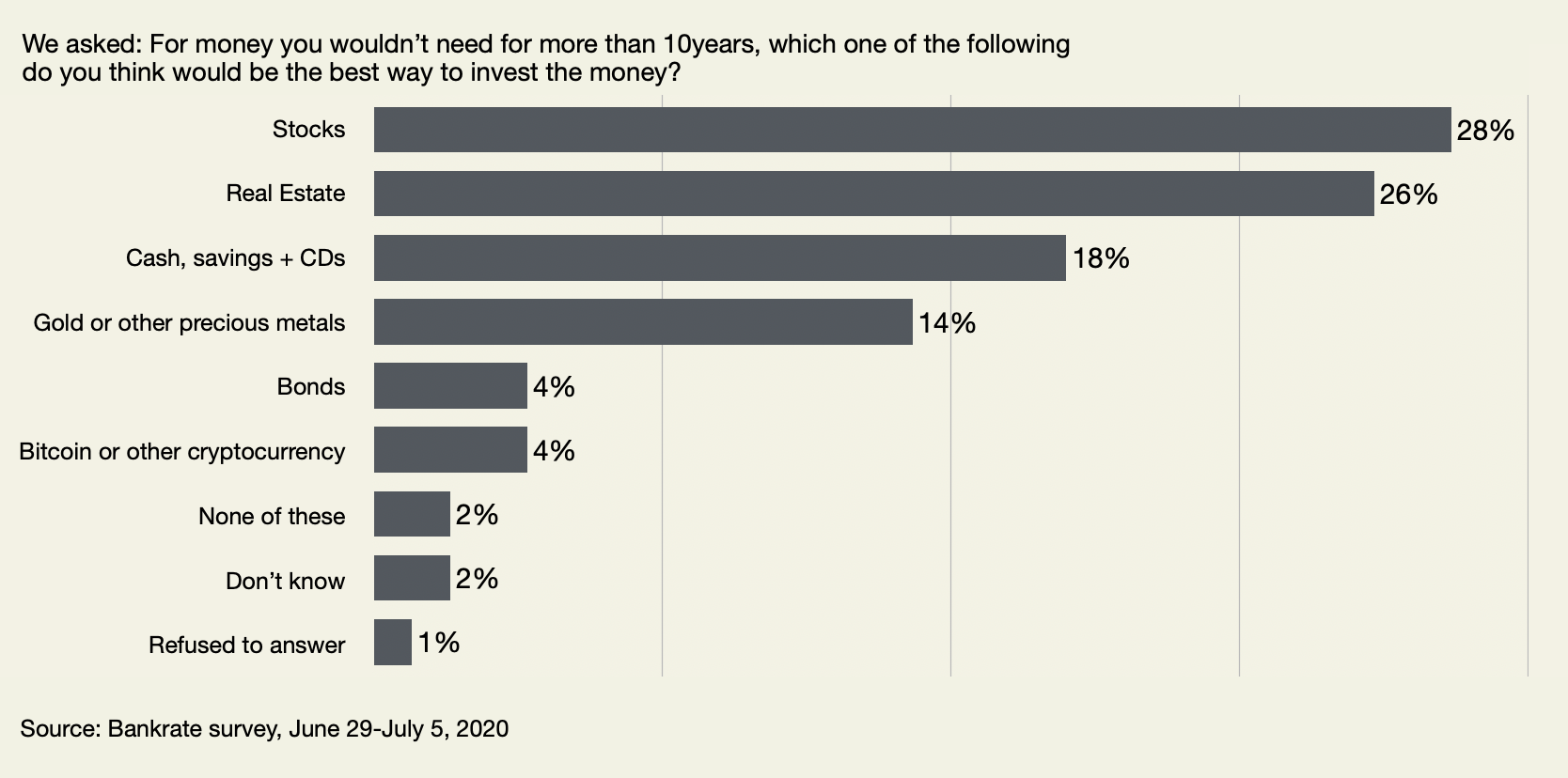

As it is, they take a place alongside a wide range of Americans who own precious metals – physicians and dentists, nurses and teachers, plumbers, carpenters, and building contractors, business owners, attorneys, engineers, and university professors (to name a few.) We know because that is the description of our clientele here at USAGOLD. Gold ownership, in short, is pretty much a Main Street endeavor. In a 2020 Bankrate survey, one in seven investors (14%) chose gold or other precious metals as the best place to park money they wouldn’t need for more than ten years – making it the fourth most popular category. Similarly, a 2020 Gallup poll found that 17% of American investors rated gold the best investment “regardless of gender, age, income or party ID. . .” One might assume that if Bankrate or Gallup took a similar poll today, even more investors would give the precious metals a thumbs up given what has occurred over the past year.

Those well-to-do preppers, as it turns out, were uncannily ahead of the times. Over the years, large numbers of the not-so-super-rich followed in their footsteps – setting up “bugout” retreats in the countryside and small-town America (though for reasons unforeseen in the article) while a good many fled the big cities permanently for safer environs. That mindset – the general flight to safety – has echoed loudly in the precious metals markets. The World Gold Council reports global retail gold investment demand running at record levels in 2022. As for silver, the Silver Institute, a research organization not given to hyperbole, recently reported an eye-catching 36% increase in physical silver investment for 2021.

Bankrate Survey of Investors

Chart courtesy of BankRate.com • • • Click to enlarge

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

NEWS & VIEWS

Forecast, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 49th year in the gold business

We invite your interest in our popular monthly newsletter.

Prospective clients welcome.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

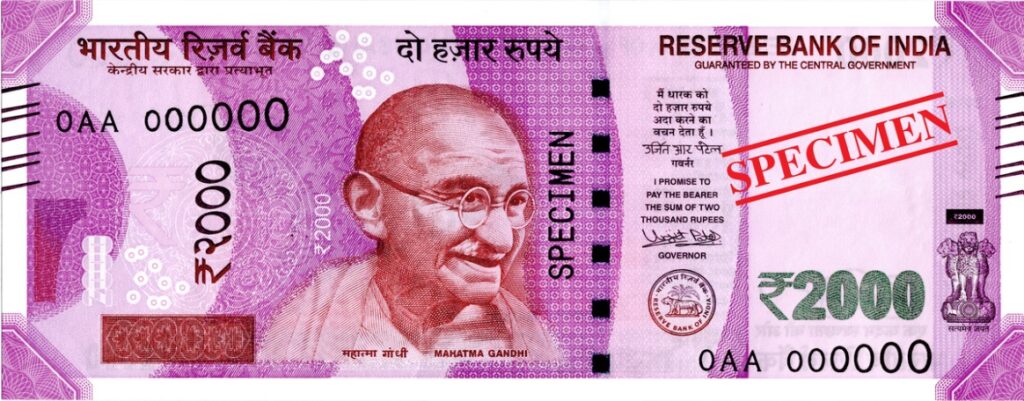

2000 rupee note withdrawal spurs purchase of gold and silver

HIndustanTimes/Staff/5-22-2023

USAGOLD note: In a separate article, Bloomberg mentioned that the 2000 rupee note withdrawal was “reminiscent of a shock demonetization exercise in 2016.”

__________________________________

Image attribution: Reserve Bank of India, GODL-India <https://data.gov.in/sites/default/files/Gazette_Notification_OGDL.pdf>, via Wikimedia Commons

Daily Gold Market Report

Gold pushes marginally this morning as debt ceiling concerns fade

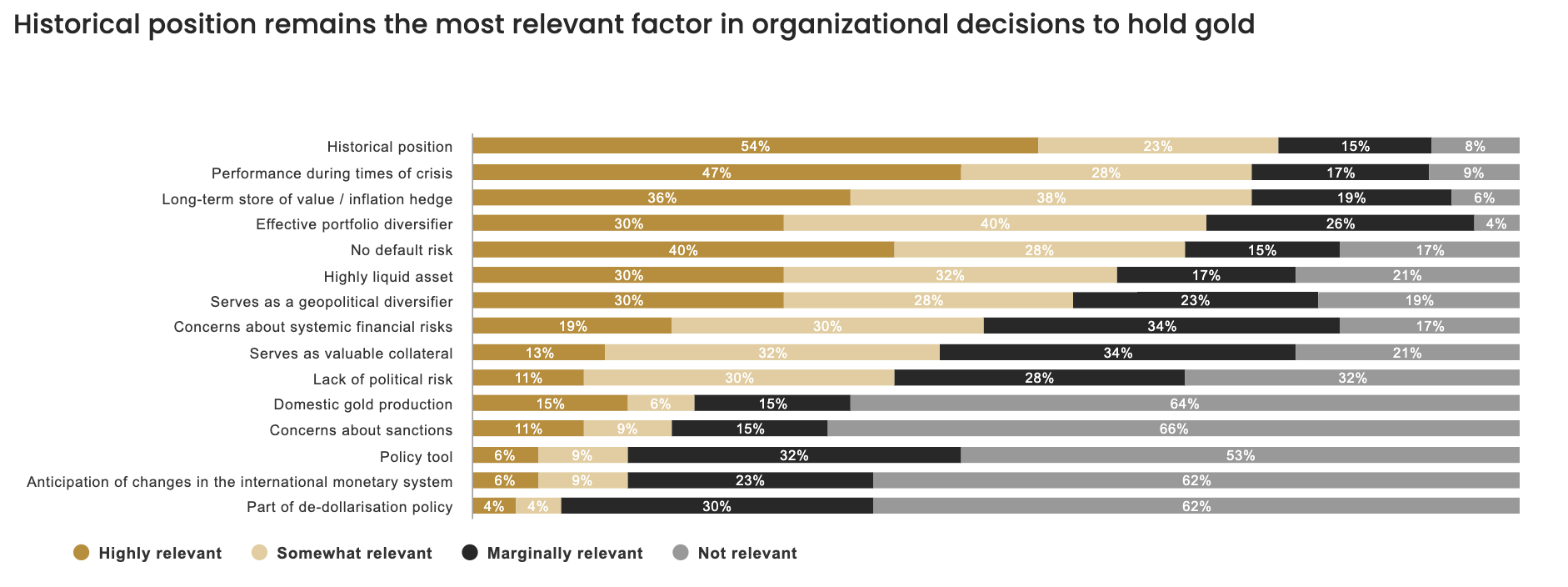

WGC survey of central bankers reveals healthy future interest in gold as a reserve asset

(USAGOLD – 6/1/2023) – Gold pushed marginally higher this morning as debt ceiling concerns faded and investors took to the sidelines ahead of Friday’s jobs numbers. It is up $5 at $1970. Silver is up 1¢ at $23.58. The World Gold Council released its annual survey of central bankers earlier this week, providing insights on the sector’s future interest in the metal as a reserve asset.

As most of you already know, demand from that quarter has been running at record levels, and according to the survey, that interest is likely to continue. Most notably, 62% say that gold will garner a greater share of reserves in the future up from 46% last year, while 24% expressed their intention to increase gold reserves over the next 12 months. In addition, says WGC, “central banks’ views towards the future role of the US dollar were more pessimistic than in previous surveys.”

Chart courtesy of World Gold Council • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Ask anyone in Germany what they associate with gold and, more often than not, they will say that it is synonymous with enduring value and economic prosperity. Ask us at the Bundesbank what our gold holdings mean for us and we will tell you that, first and foremost, they make up a very large share of Germany’s reserve assets … [and they] are a major anchor underpinning confidence in the intrinsic value of the Bundesbank’s balance sheet. The Bundesbank produced this publication to give a detailed account, the first of its kind, of how gold has grown in importance over the course of history, first as medium of payment, later as the bedrock of stability for the international monetary system.”

Jens Wiedmann

Former President, Bundesbank

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Cut stocks, buy gold, hold your cash, JPMorgan’s Kolanovic says

Boomberg/Alexandra Semenova/5-23-2023

USAGOLD note: At one time, Kolanovic was considered Wall Street’s most vocal bull.

The US Treasury may have to break the law to keep the world’s richest nation from default

Yahoo!Finance/Nate DeiCamillo/ 5-23-2023

USAGOLD note: A bizarre twist to the already bizarre debt ceiling soap opera ……

Three reasons to buy gold now

UBS/Chief Investment Office/5-18-2023

USAGOLD note: UBS sees gold at $2100 by year end and $2200 by March 2024.

Short & Sweet

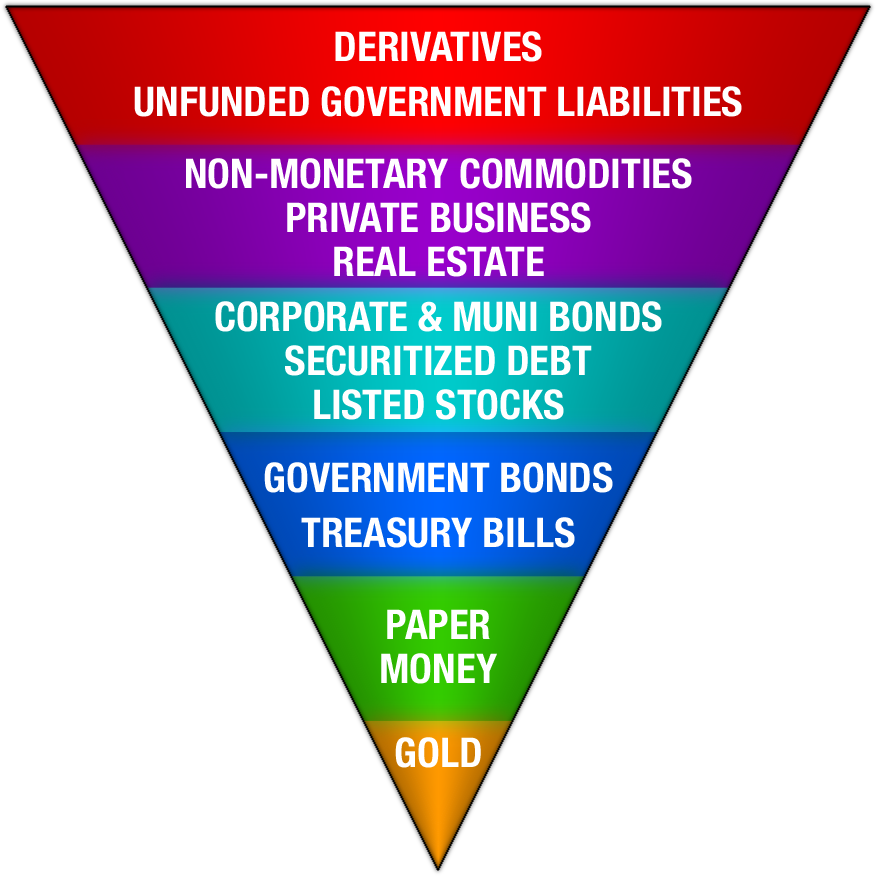

The Exter Inverted Pyramid of Global Liquidity

“[Exter’s Inverted] Pyramid stands upon its apex of gold, which has no counter-party risk nor credit risk and is very liquid. As you work higher into the pyramid, the assets get progressively less creditworthy and less liquid. . .[In a financial crisis] this bloated structure pancakes back down upon itself in a flight to safety. The riskier, upper parts of the inverted pyramid become less liquid (harder to sell), and – if they can be sold at all – change hands at markedly lower prices as the once continuous flow of credit that had levitated those prices dries up.” – Lewis Johnson, Capital Wealth Advisor’s Lewis Johnson

____________________________________________________________________________________________