Daily Gold Market Report

Gold takes positive turn as Japan signals reversal of dovish monetary policy

‘The desire for gold is the most universal and deeply rooted commercial instinct of the human race.’

Gerald Loeb, Wall Street trader

(USAGOLD – 7/28/2023) – Gold took a positive turn this morning as Japan signaled it might begin reversing its dovish monetary policy – a move that surprised markets and sent the Japanese yen sharply higher in overseas markets. Gold is up $10 at $1959. Silver is up 19¢ at $29.39. “If inflation has indeed returned to Japan, which we believe it has,” says State Street’s Michael Metcalf, “the BoJ will find itself needing to raise rates just as hopes for interest rate cuts rise elsewhere. This should be a medium-term positive for the JPY [Japanese yen], which remains deeply undervalued.”

We came across this passage from a Dominic Frisby essay earlier this week and thought it worth passing along:

“The experience of beauty, whether derived from nature, art, music or even mathematics, correlates with activity in the emotional brain, the medial orbitofrontal cortex. Beauty has long been associated by philosophers with truth and purity – also qualities commonly associated with gold. Our instinct for gold and the emotions it inspires from beauty to desire are basic. There has not been a culture in history that did not appreciate the value of gold. It is a primal instinct. ‘The desire for gold,’ said Wall Street trader Gerald Loeb, ‘is the most universal and deeply rooted commercial instinct of the human race.’” [Source: MoneyWeek]

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We sometimes forget that central banking, as we know it today, is, in fact, largely an invention of the past hundred years or so, even though a few central banks can trace their ancestry back to the early nineteenth century or before. It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. By and large, if the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with ‘free banking.’ The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.” – Paul Volcker, (From Deane and Pringle’s The Central Banks, 1995)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

_______________________________________________________________________________________________________________

The Investment of Kings and the King of Investments

The Investment of Kings and the King of Investments

From the small investor just starting out to the high-net-worth individual hedging a multi-million dollar portfolio, we have helped many thousands add precious metals to their holdings in our nearly 50 years in the gold business – safely, economically and with the investor’s goals in mind.

No matter the size of your investment kingdom, we can help!

_______________________________________________________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

Reliably serving physical gold and silver investors since 1973

Gold should be dead, but somehow it’s still adding value

MarketWatch/Brett Arends/7-15-2023

USAGOLD note: Arends has never been an ardent supporter of gold, but in this article he reluctantly makes concessions.… To make a long story short, a portfolio that includes a 10% gold diversification over the long run does better than one that doesn’t. How would a 20% diversification look?

Goldman chief economist cuts recession probability to 20%, dismisses yield-curve inversion

MarketWatch/Steve Goldstein/7-18-2023

USAGOLD note: Hatzius, in fact, believes the economy is going to grow “albeit below trend pace.”

Short & Sweet

The true nature of inflation

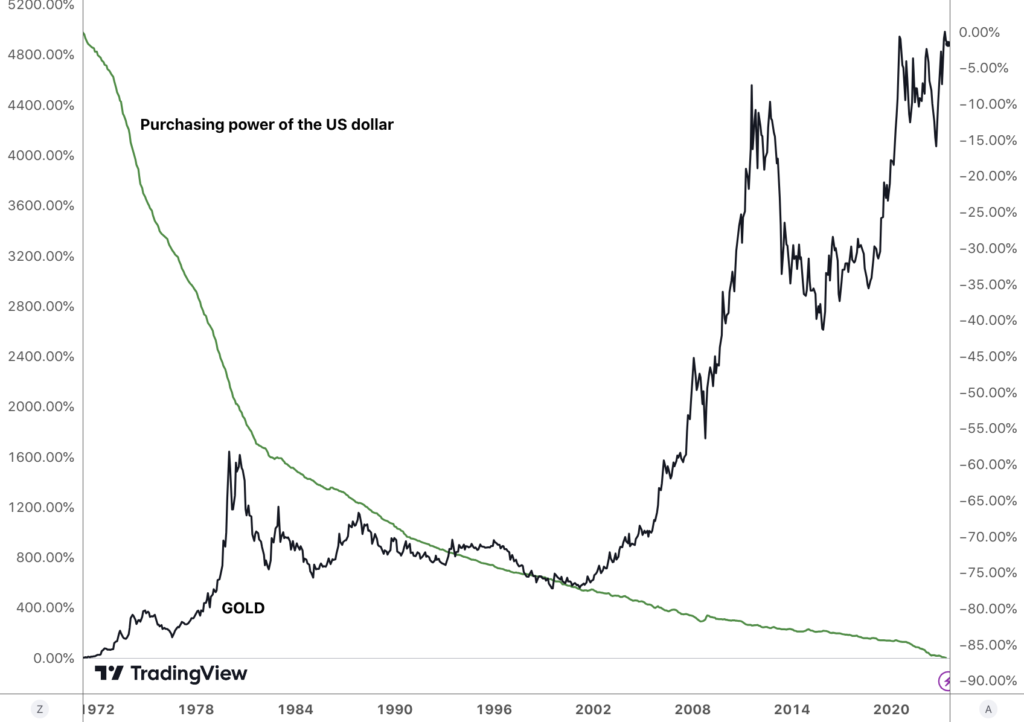

“The nature of inflation is widely misunderstood and misinterpreted,” writes analyst Dave Kranzler in an Investing.com overview, “‘Inflation’ and ‘currency devaluation’ are tautological—they are two phrases that mean the same thing. … Dollar devaluation has been occurring since the early 1970’s. The value of the dollar relative to gold (real money) has declined 98%. In 1971, $40,000 would buy a 4,000 square foot home in a good suburb. Now it takes $700,000 on average to buy that same home. Price inflation is the evidence of currency devaluation. The CPI is not a real measure of price inflation. The CPI is methodically massaged – starting with the Arthur Burns Federal Reserve (it was his idea) to hide the real degree of currency devaluation from all of the money that has been printed since 1971.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Worried about what currency devaluation is doing to the value of your savings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

The decline and fall of the U.S. dollar

The Heritage Foundation/EJ Antoni/7-13-2023

“The U.S. dollar’s reserve currency status is one of America’s greatest strengths, but President Joe Biden seems hellbent on toppling the dollar from its throne through both his domestic and foreign policy agenda. Americans need to pay attention because we’ve seen this movie before, and it doesn’t end well.”

USAGOLD note: The Biden Administration is only one of the players undermining the dollar. Congress is equally culpable as is the Federal Reserve which is quick to turn to money printing at the first signs of a crisis.

Daily Gold Market Report

Gold pushes higher in Fed aftermath

JPMorgan sees gold hitting ‘fresh records in 2024’

(USAGOLD – 7/27/2023) – Gold pushed higher in the aftermath of yesterday’s Fed hike and press conference. It is up $5 at $1978.50. Silver is up 13¢ at $25.12. The market reaction to yesterday’s events was generally subdued as Chairman Powell emphasized future decisions would be data-driven leaving market sentiment pretty much where it was prior to the meeting – up in the air and open to interpretation.

JP Morgan sees the Fed turning dovish by the second quarter of next year – a shift it believes will push gold to new record levels during 2024. “We’re in a very prime place,” says Greg Shearer, the firm’s director of commodities research, “where we think gold ownership and long allocation to gold and silver is something that acts as both a late cycle diversifier and something that will perform as we look to the next sort of 12, 18 months.… There is an eagerness here to really buy in and diversify allocation away from currencies.” [Source: Yahoo!Finance-Bloomberg]

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“I’m a fan of gold. I think gold’s valuable in a crisis. If the world turns to hell, the war expands and gets worse, God forbid a nuclear weapon is used, I think people are going to say: ‘How do I know what anything’s worth anymore? I’m going to make sure I have some gold because I don’t want to not have money at a time of desperation.’ It may never come to that, but I think it’s prudent to have a little bit of your portfolio in gold.” – Seth Klarman, Baupost Capital, Harvard University interview at Yahoo

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Pozsar on the ‘monetary divorce’ from the dollar

Zero Hedge/Tyler Durden/7-17-2023

“Gold is definitely something that’s coming back as a theme… we are seeing this more and more in the data that especially the countries that are not geopolitically aligned to the US are shunning Treasuries and shunning the dollar and they are buying gold instead.”

USAGOLD note: Pozsar elaborates on the evolving monetary system and the dollar and gold’s role in it.

High-yield bond exodus gathers pace as 10% drains from funds

Yahoo!Finance-Bloomberg/Olivia Rainmonde/7-14-2023

“Investors have pulled more money out of US junk-bond funds than from any other asset class so far this year, according to a report by Bank of America.”

USAGOLD note: It’s not just the return on your money, but the return of your money that’s important.

Short and Sweet

Structuring your portfolio for the rest of the 2020s

“Precious metals are and always have been the ultimate insurance,” says Pro Aurum’s Robert Hartman in an interview with Claudio Grass. “They provide protection both against state failures and against mistakes in the monetary policy of the central banks. Every investor who looks into the history books sees that both have happened over and over again in the past centuries. From that perspective, investing in physical gold and silver is a common-sense precaution and a necessary part of any wealth preservation plan. Investors and ordinary savers ignore this at their peril and the failure to include precious metals in one’s portfolio is pure negligence.”

There are essentially two broad schools of thought alive and well in the gold market. The first holds that crisis is around the corner and, as a result, precious metals should be owned to profit from the event. The second holds that crisis is a permanent fixture in the market dynamic and that the portfolio should always include precious metals as the ultimate safe haven. The first buyer sees precious metals as investment products, i.e., buy now and sell later when the time is right. The second considers gold and silver, like Hartmann, as insurance products to be held for the long run. Some combine the two, allocating one part of their precious metals portfolio for trading purposes and another as a permanent, or semi-permanent, store of value. The novice precious metals owner must decide where he or she stands in this regard because it determines, in turn, which products to include in the portfolio and to what degree.

Investors often ask about the percentage commitment one should make to precious metals in a well-balanced investment portfolio. Analyst Michael Fitzsimmons offered an interesting take on that subject in a Seeking Alpha editorial last fall, “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.” As it has for many years, USAGOLD recommends a diversification of between 10% and 30% depending on your view of the risks at large in the economy and financial markets.

Looking to structure your portfolio for the rest of the 2020s?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Markets are propelled by what hasn’t happened

Bloomberg/Mohamed A. El-Erian/7-1 7-2023

USAGOLD note: It’s been a year of surprises and unexpected serenity…… El-Erian offers food for thought in this Bloomberg piece.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The truth, yet unspoken from on high is that radical monetary policy begets more radical monetary policy.”

James Grant, Grant’s Interest Rate Observer

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

New to precious metals?

We put this page together just for you.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Dollar’s busted bull run has doomsayers calling end of era

Bloomberg/Alice Atkins and Carter Johnson/7-16-2023

“The greenback’s worst slump since November has a bevy of strategists and investors saying a turning point is finally at hand for the world’s primary reserve currency. If they’re right, there will be far-reaching consequences for global economies and financial markets.”

USAGOLD note: Whatever it does against other currencies in the short term, the dollar’s history over the long run has been one of steady debasement and loss of purchasing power, and that era, in our view, is far from over.

The purchasing power of the US dollar and gold

(%, 1971-present)

Chart courtesy of TradingView.com • • • Click to enlarge

India ties up with UAE to settle trades in rupees

Reuters/Arpan Chaturvedi/7-15-2023

USAGOLD note: Is cutting transactional costs the real reason for this new arrangement?

Short and Sweet

New smart money queues up in the gold market

First institutions and funds came over to gold’s corner, then central banks. Now, a whole new grouping of professional investors – pension funds, private wealth management, insurance companies, and sovereign wealth funds. “It’s a bit like what happened to big tech,” says highly respected economist Mohammed El-Erian. “People like [gold] because it’s defensive. People like it because it’s a reflation trade. People like it because it’s inflation protection. What we are starting to see with the narrative about gold is starting to be like the narrative about big tech. It gives you everything.” These groups bring considerable purchasing power and market savvy to the table. One immediate result might be more buying interest on price dips. Another might be a better blend of investment psychology and objectives that could have a settling effect on the market overall.

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973