Featuring top analysts. Updated regularly.

Looks like there’s a whale snapping up gold bullion below $1800

Bloomberg/Eddie van der Walt/2-2-2022

USAGOLD note: Let the speculation begin as to whom that whale might be …… After a process of elimination, van der Walt says that the buyer is probably a sovereign nation mentioning China as the likely source. We would not be surprised if that turned out to be true, but Russia also comes to mind given the current circumstances. Highly recommended read…….

What will happen to the price of gold in 2022?

MoneyWeek/Dominic Frisby/1-20-2022

USAGOLD note: The conflicted Mr. Frisby writes entertainingly about the metal he hates to love…… His quest to find the real reasons why he owns so much of the metal continues.

Stagflation looming, holding gold more important than ever

Gold Investing News/Charlotte Macleod/1-19-2022

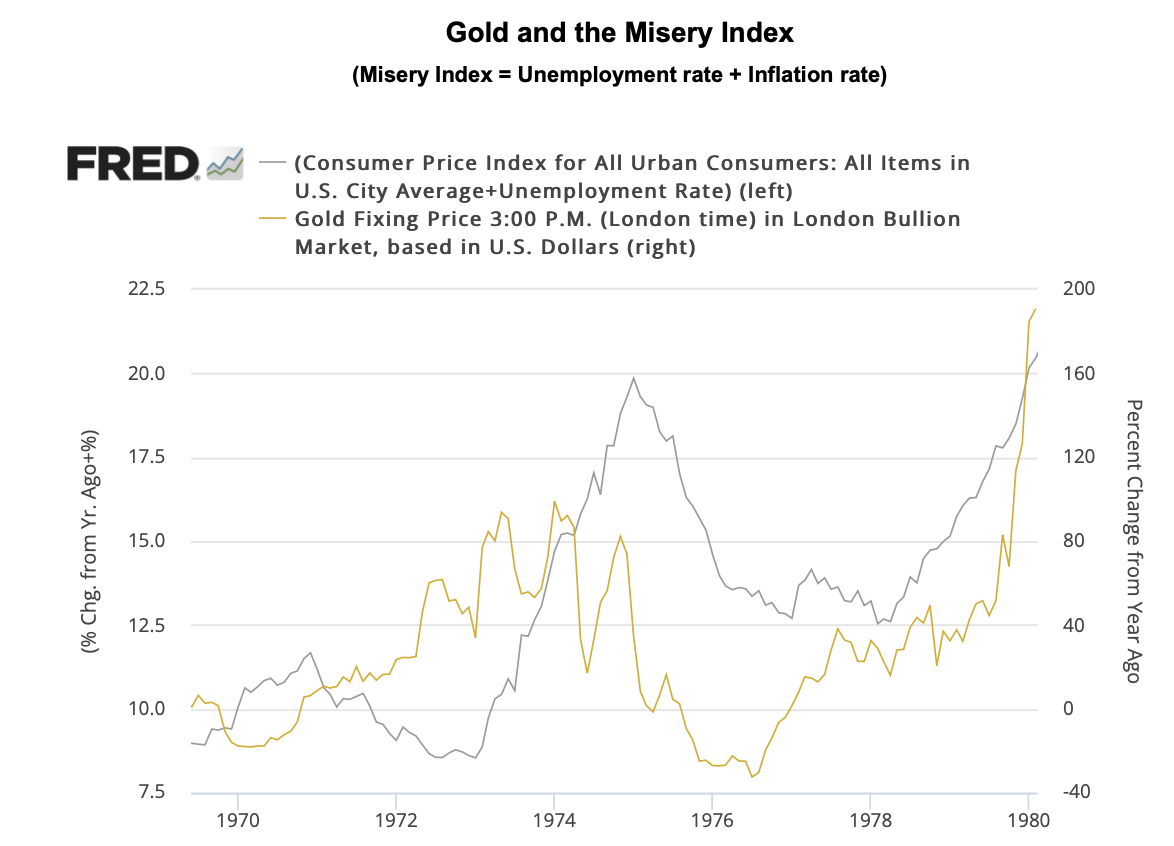

“Speaking to the Investing News Network, [BMG Groups Nick Barisheff] pointed out that if inflation was calculated the way it was in 1980, it would be at 15 percent. He also noted that inflation is happening at a time when gross domestic product is declining. ‘(With) the two of them combined we get stagflation,’ said Barisheff, adding, ‘That’s the worst possible combination.’ In his opinion, that makes it more important than ever to hold gold.”

USAGOLD note: The last time big inflation combined with big unemployment was during the stagflationary 1970s. The Misery Index posted some very big numbers, and gold, as Barisheff points out, tracked it higher throughout the decade.

Sources: St. Louis Federal Reserve, Bureau of Labor Statistics, ICE Benchmark Administration • • • Click to enlarge

Is gold on schedule to catch the inflation train?

Seeking Alpha/Van Eck Funds/1-12-2022

USAGOLD note: Van Eck explains the things that held gold down in 2021 and what might cause it to break out in 2022.

Silver supply-demand trends could catalyze the price

BullionWorldMagazine/Georgia Williams/12-13-2021

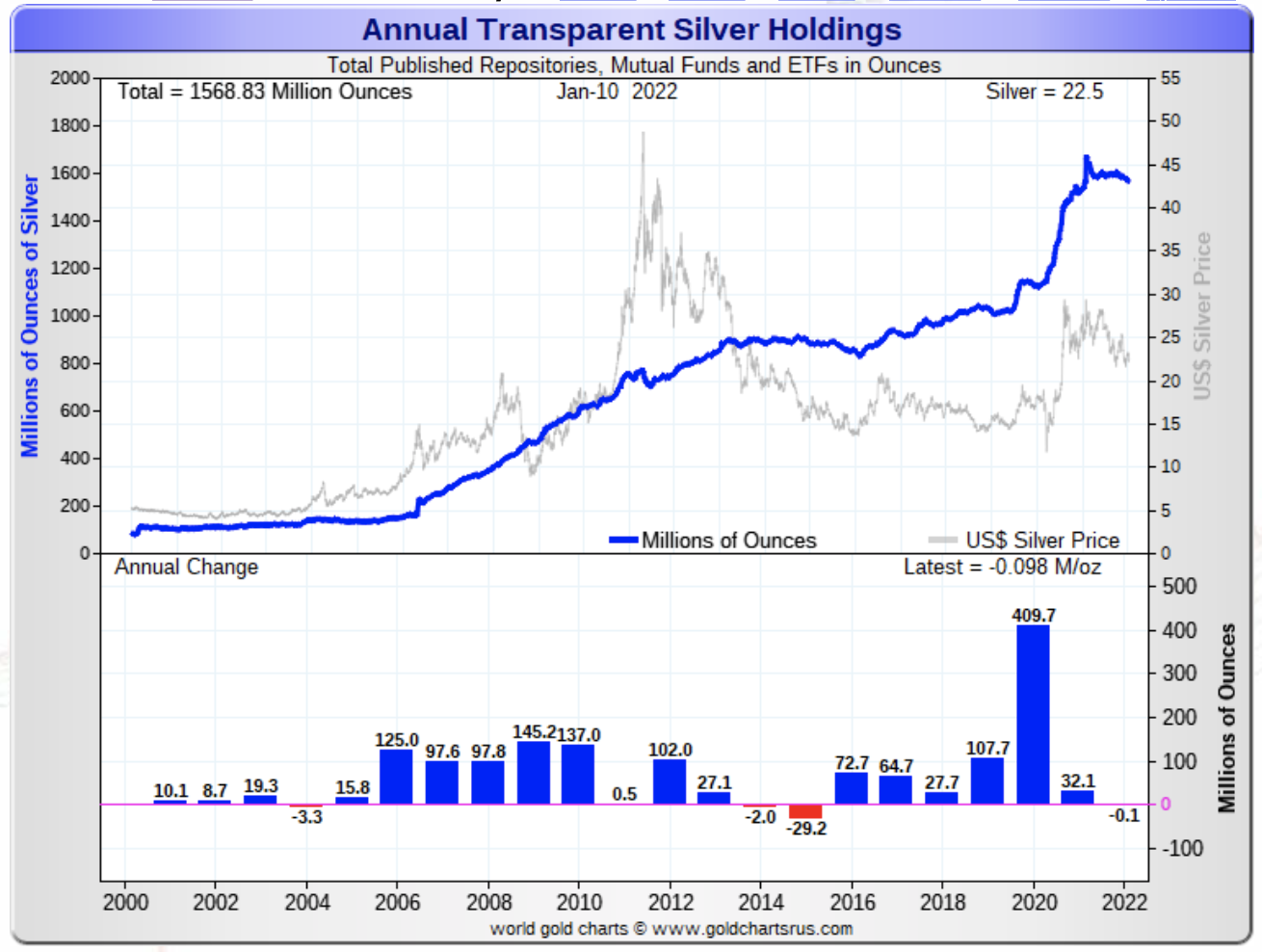

“Silver’s move to US$28.55 wasn’t the only milestone the white metal registered in 2021. Demand for silver exchange-traded products touched an all-time high during Q1, when holdings topped 1.2 billion ounces. Healthy purchases from the investment and industrial segments helped silver demand surpass 1 billion ounces for the first time since 2015.”

USAGOLD note: That buildup at the ETFs – significant as it is – passed without garnering much attention in financial media. Occurring in year one of the pandemic, the very strong 2020 increase in silver ETF stockpiles indicated significant fund and institutional interest in the metal for safe haven purposes.

Chart courtesy of GoldChartsRUs.com

Precious metals prices poised to rise in 2022

Numismatic News/Patrick A. Heller/1-7-2022

USAGOLD note: If you are visiting here today as part of your research program on gold and silver investing, this article offers the essential overview and rationale.

What drives the price of gold? Part 2

The Gold Observer/Jan Nieuwenhuijs/1-14-2022

USAGOLD note: In this second installment on gold pricing mechanics, Nieuwenhuijs dissects the relationship between real yields and the price of gold. Here is the link to the first installment.

Russell Napier forecasts 4% inflation (which implies $7000 gold)

Atlas Plus/Charlie Morris/1-5-2022

USAGOLD note: Based on his own analysis and Napier’s observations, UK’s Charlie Morris says “It is time to be bullish on gold.”

Gold outlook 2022

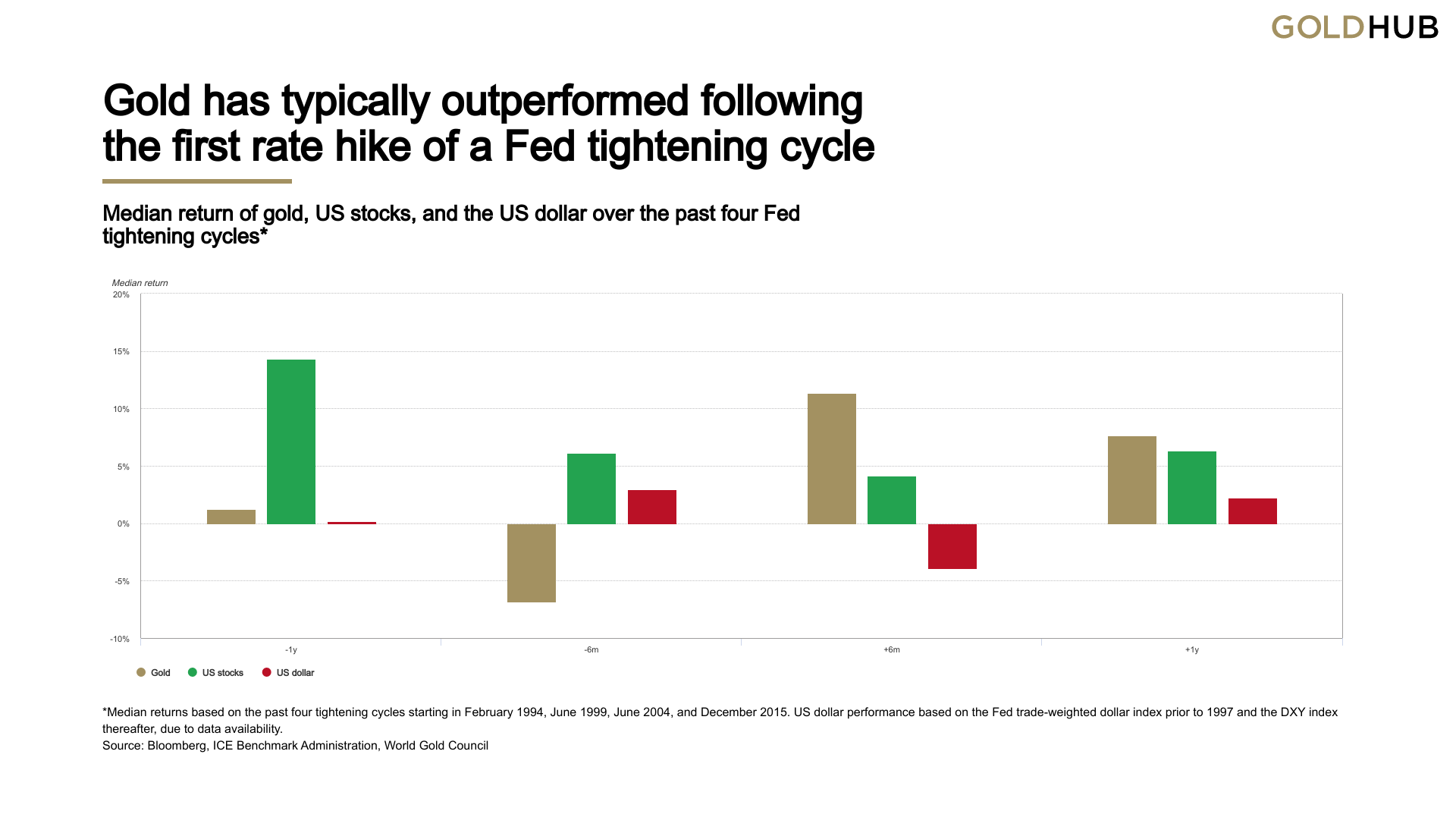

“Dot-plot projections suggest that year-ahead Fed expectations have significantly exceeded actual target rates. More importantly though, financial market expectations of future monetary policy actions – expressed through bond yields – have historically been a key influence on gold price performance. Consequently, gold has historically underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike. (See below) Gold may have partly been aided by the US dollar which exhibited the opposite pattern. Finally, US equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.”

USAGOLD note: The World Gold Council offers a comprehensive review of gold’s prospects for 2022. In essence, it sees rising rates as a headwind for gold, but with limited effect along a six-month to one-year timeline.

Chart courtesy of the World Gold Council • • • Click to enlarge

Reality bites: A forecaast for precious metals in 2022

SprottMoney/Craig Hemke/1-11-2022

“Oh, boy. Here we go again. It’s the start of a new year, and that means it’s time for another adventure in long term price forecasting. Around here we call it a ‘macrocast’ because we figured out long ago that, in a world dominated by computers trading derivatives, if you can get the macroeconomic conditions right, you’ve got a decent shot at forecasting the gold price, too.”

USAGOLD note: Even that is an assumption fraught with peril. It’s that part about getting the macroeconomic conditions right that raises an eyebrow. Just when you think you have it nailed something like a pandemic or credit crisis comes along to blow it apart. Viewing gold as a defensive portfolio asset – one without contingent liabilities – is still the best course of action. Better a successful armchair investor, from our perspective, than a thoroughly disenchanted speculator. That said, Hemke stays conservative and ends up with $2050 gold and $29 silver by year end.

Spot gold at $2,100? Commodities analyst says gold could test new highs this year

“We do think across the course of 2022, we will see the gold price testing at the all-time record highs, but we can’t see it traveling much beyond that once it gets there.” – David Lennox, Fat Prophets

USAGOLD note: Lennox says that the Russia-Ukraine confrontation could turn “disastrous” and if it does the $2100 target would come “sooner rather than later.”

The commodity that soars when inflation is rising

Rogue Economics/Laurynas Vegys/12-31-2021

“So silver is relatively cheap right now. In fact, the metal is currently trading well below its July 2020 price of roughly $27 – before the Fed’s printing press really went into overdrive. In other words, it’s trading as if no money-printing has happened. … The next few years could be huge for silver. Now is the time to add some exposure to this unloved metal to your portfolio.”

USAGOLD note: Given the strong volumes for silver coins and bullion over the course of last year and going into 2022, it appears investors agree with Vegys’ assessment.

Gold is in a strong rebound position in 2022

NewsMaxFinance/Lee Barney/1-3-2021

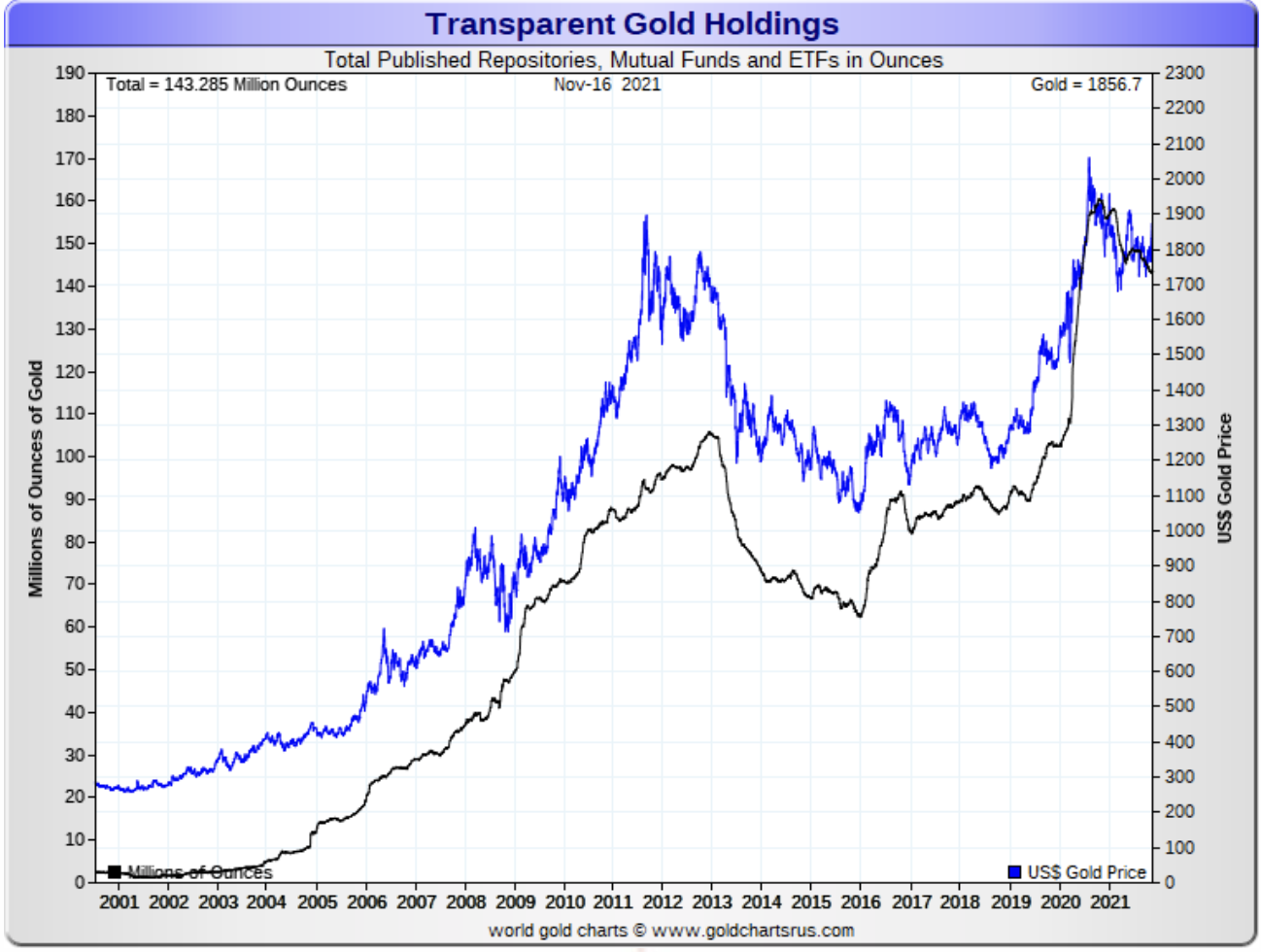

“Gold’s lackluster year may pave the way for renewed interest in exchange-traded funds in 2022 from investors seeking a hedge against growing global uncertainties.”

USAGOLD note: As we have posted here previously and as the chart below shows, there has been a direct correlation in the past between growth in ETF stockpiles and rising prices.

Chart courtesy of GoldChartsRUs

Byron Wien’s 10 surprises for 2022

Zero Hedge/Tyler Durden-Byron Wien/1-3-2021

USAGOLD note: Among Wein’s surprises for 2022, he says persistent inflation will become the dominant theme, the 10-year Treasury note will yield 2.75% (it’s 1.72% now) and gold will gain 20% increase as it “reclaims its title as safe haven for newly minted billionaires.”

The perfect storm for gold

Gold-Eagle/Nick Barisheff/12-27-2021

“In December 1997, The Financial Times ran an article entitled ‘The Death of Gold.’ Since then, the gold price in US dollars has increased 519I% from $288 to $1,780. Today, after many political events and crises we have evidence of the continuous and in many ways spectacular growth of the gold price. This confluence of many current events is creating a perfect storm for gold to increase dramatically more than we imagined.”

USAGOLD note: This article by Nick Barisheff caught our attention because financial press gold naysayers are out in full force once again proclaiming the death of gold, even as storm clouds gather on the horizon. Given the record demand for gold coins and bullion over the past 12-months, we suspect that the reports of its death are greatly exaggerated.

Image attribution: MichaelKirsh, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>, via Wikimedia Commons

Gold’s turn to shine

Seeking Alpha/Adam Hamilton/1-1-2022

“Gold’s turn to shine again is nearing, with major bullish drivers aligning heading into this new year. The Fed’s vast deluge of new money remains intact despite QE tapering, continuing to fuel raging inflation. A new rate-hike cycle to fight that is looming, but gold has thrived during past cycles. This Fed tightening will weigh heavily on QE-levitated bubble-valued stock markets. As they fall, gold investment demand will surge. Gold mostly spent 2021 grinding sideways-to-lower in a high consolidation. That lack of upside progress left this leading alternative asset increasingly out of favor with speculators and investors alike as the year marched on. Heading into year-end midweek, gold was down 4.9% year-to-date. While psychologically-grating, maybe big gains needed to be digested after gold surged 18.4% in 2019 then another 25.1% in 2020.”

USAGOLD note: We often read about investor rotation from one asset class to another, and sometimes those rotations begin as a trickle that ultimately turns to a flood. The World Gold Council reports record coin and bullion investment demand in 2021. The trickle before the flood? Much will depend on what 2022 brings to the table, but the strong on-going worldwide demand for precious metals implies an uneasiness among investors not likely to be easily placated.

Gold: Good riddance 2021’s hangover and ‘inflation fail’

Bullion Vault/Adrian Ash/12-29-2021

USAGOLD note: When quantifying the long-term prospects for gold, it is sensible to keep things in perspective, as Adrian Ash does in this entertaining year-end review and outlook. In the end, gold is really portfolio insurance more than it is a speculative investment. On that score, its long-term value as a hedge against depreciating currencies is a matter of record.

Use price corrections to build your gold allocation

Financial Express/Chirag Mehta/12-25-2021

“As the world learns to live with Covid-19, gold prices in 2022 will be influenced by how inflation shapes up and central banks’ reaction to it. The persistence of higher inflation may boost the demand for the yellow metal, but it also increases the odds of a more hawkish Fed, hurting prices.”

USAGOLD note: Quantum Mutual Fund’s Mehta lays out a positive scenario for gold in 2022 saying it “will have the last laugh.”

Why commodities could absolutely soar in the next decade

Daily Wealth/Dan Ferris/12-20-2021

“It’s important to compare commodities to stocks and see where we stand in the cycle…You see, learning to read commodity market cycles can be a very lucrative proposition – and it can offer excellent diversification during times of poor equity returns.”

USAGOLD note: Ferris points to two distinct eras in commodity values (See chart below) and says we are now approaching a “turning point” in the current cycle – one that will usher in a decade of higher commodity prices. Of course, gold and silver are two key players in the commodities complex that also enjoy a high degree of investor interest as long-term stores of value.

Chart courtesy of TradingView.com

Larry Summers predicts the future and it doesn’t look good

Bloomberg/Stephanie Flanders and Michael Sasso/12-23-2021

USAGOLD note: In this video interview, former Treasury Secretary Summers, the leading apostle of secular stagnation, warns that “we are already reaching a point where it will be challenging to reduce inflation without giving rise to recession.” And, we might add, it will be a challenge for the Fed to reduce the risk of recession without fueling inflation.

China’s easing monetary policy paints a positive picture for 2022’s retail gold investment demand

World Gold Council/Ray Jia/12-22-2021

“As 2021 comes to an end and 2022 approaches, we are actively searching for clues of possible changes in next year’s global and regional gold markets. Unlike other key markets, China is entering into a different economic cycle and stepping up its easing monetary policy. We believe this could be supportive for local retail and institutional investors’ interest in gold.”

USAGOLD note: China’s physical gold demand is foundational to the overall market structure, and ramped-up monetary stimulus from the Peoples Bank of China is likely, as Jia suggests, to further stimulate the Chinese people’s already strong interest in the metal.

The great reconciliation of asset prices

Pento Portfolio Strategies/Michael Pento/12-20-2021

USAGOLD note: That great reconciliation can be either nominal, i.e., a direct deflation of asset values, or it can occur through an inflation that diminishes the purchasing power of those assets. Pento offers much food for thought in this solid overview of where financial markets might be headed in 2022.

Gold outlook 2022: Consolidation a launching pad for price rise

InvestingNewsNetwork/Georgia Williams/12-14-2021

USAGOLD note: After a realistic assessment of 2021, this article offers a generally optimistic view of gold for 2022 with several analysts quoted including the World Gold Council’s Adam Perlaky, asset manager Adrian Day, Digest Publishing’s Gerardo Del Real, Metals Focus’ Adam Webb and Junior Stock Review’s Bran Leni.

List of things to worry about in 2022

Blain’s Morning Porridge/Bill Blain/12-14-2021

“Let me present a list of things to worry about next year. Inflation, US and China growth, Stagflation, Central Banks, Stocks, Climate and Equality, etc, etc.…But the big risks will be the consequences of US Politics and a Liquidity Meltdown in the Credit Markets.”

USAGOLD note: In this all-inclusive sneak peak, Blain clues us in on what we need to be worried about for 2022.

CPM Group: Silver price could reach $50 again

InvestingNewsNetwork/Georgia Williams

Repost from 5-21-2021

USAGOLD note: Christian’s bullish views on silver came in conjunction with CPM Group’s release of its 2021 Silver Yearbook. He sees silver rising sharply in concert with the next financial or economic crisis. The next black swan, he says, may be closer than we think.

BlackRock says ‘out of favour’ gold may see fortune turn in 2022

TheEdgeMarkets/Ranjeetha Pakiam – Bloomberg/12-16-2021

Gold to $1,900? MKM Partners says one major tailwind could give a big boost

USAGOLD note: The Fed has said it will keep rates near zero to “at least 2022” [CNBC – 6/10/20]. If that be the case, gold has a long way to go with the wind in its sails.

Repost from 7-5-2020

Gold has ‘growing potential’ to break $1,800 an ounce, says UBS

USAGOLD note: And now over the past few days, geopolitical tension has begun to bubble once again to the surface – particularly between the United States and China ……

Gold bull will extend beyond coronavirus

USAGOLD note: Droke considers gold’s post-virus prospects . . . It had entered into a bull market, he says, long before COVID-19 made its appearance on the global stage.

Repost from 3-3-2020

New note: The Financial Times reports this morning that, according to an expert with China’s disease control panel, coronavirus cases in Wuhan “could drop to zero by the end of the month.” He adds, “I estimate that by the end of April except for Hubei, the rest of the country can basically take off their face masks and resume normal life.” The markets will wait for further evidence that this particular expert got it right, but this is certainly a turn for the better if true.

Goldman maintains bullish target for gold

USAGOLD note: This article also discusses Goldman’s outlook for the commodity index, oil and industrial metals – all bullish.

Repost from 11-26-2019

Ongoing consolidation in gold is healthy – UBS

USAGOLD note: UBS is on the $1600 gold bandwagon. In fact, the Swiss banking concern thinks it could happen over the next three months.

Repost from 11-26-2019

Looking for more than an e-commerce platform?

DISCOVER THE USAGOLD DIFFERENCE

"Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

3:40 am Sun. May 19, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115