China’s easing monetary policy paints a positive picture for 2022’s retail gold investment demand

World Gold Council/Ray Jia/12-22-2021

“As 2021 comes to an end and 2022 approaches, we are actively searching for clues of possible changes in next year’s global and regional gold markets. Unlike other key markets, China is entering into a different economic cycle and stepping up its easing monetary policy. We believe this could be supportive for local retail and institutional investors’ interest in gold.”

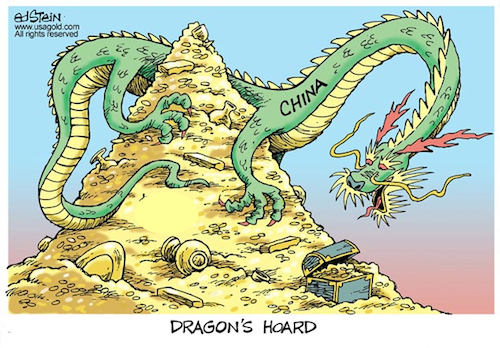

USAGOLD note: China’s physical gold demand is foundational to the overall market structure, and ramped-up monetary stimulus from the Peoples Bank of China is likely, as Jia suggests, to further stimulate the Chinese people’s already strong interest in the metal.

This entry was posted in Gold-silver price predictions, Today's top gold news and opinion. Bookmark the permalink.