Daily Gold Market Report

Gold Market Review 2023:

Surge in Demand, Record Prices, and Central Bank Influence

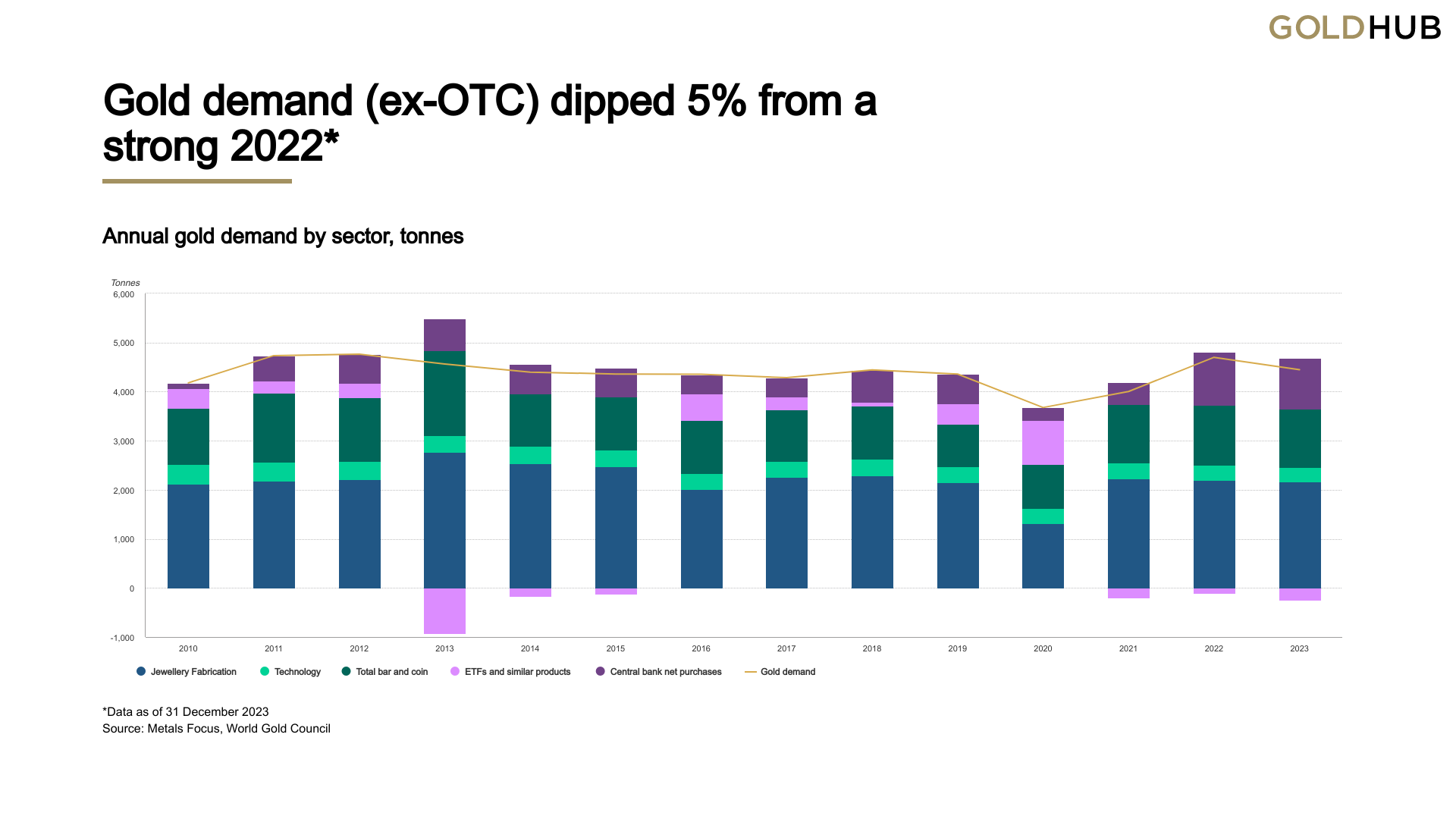

(USAGOLD – 2/02/2024) Gold and silver prices are sharply lower in early trading Friday, after strong U.S. jobs data shows solid gains. Gold is trading at $2031.90, down $23.09. Silver is trading at $22.57, down 61 cents. The World Gold Council reports that in 2023, total gold demand reached a record high of 4,899t, driven by strong central bank buying, steady jewelry consumption, and significant OTC and stock flows, despite a 5% decrease from 2022’s demand and substantial ETF outflows. Central banks nearly matched their 2022 record purchases, with annual net purchases of 1,037t. Global gold ETFs experienced a third year of net outflows, losing 244t, while annual bar and coin investment slightly contracted. Jewelry consumption remained robust at 2,093t, supported by China’s recovery, even amid high gold prices. However, the use of gold in technology fell below 300t for the first time. The LBMA gold price closed 2023 at a record high of US$2,078.4/oz, reflecting a 15% annual return and an 8% increase over the 2022 average price. Q4 gold demand was 8% above the five-year average but 12% lower year-over-year compared to Q4’22. Overall, annual mine production increased slightly, while recycling rose due to high gold prices, leading to a 3% increase in total gold supply.

Daily Gold Market Report

Fed Chair Powell Signals Caution:

No Immediate Rate Cuts Despite Inflation Ease

(USAGOLD – 2/01/2024) Gold prices have dipped slightly in Thursday’s early trading session, following outcomes from the recent Federal Reserve’s FOMC meeting, which leaned towards a more hawkish stance on U.S. monetary policy. Gold is trading at $2049.71, up $10.19. Silver is trading at $22.94, down 2 cents. The Federal Reserve decided to maintain the current interest rate range and signaled a cautious approach towards future rate cuts at thier policy meeting yesterday. Jerome Powell emphasized the need for more data to confirm a sustained downward trend in inflation before considering a rate reduction, particularly ruling out a cut in March. Despite a favorable pullback in inflation and a still-solid economy, Powell and the Federal Open Market Committee (FOMC) showed reluctance to quickly lower rates. The FOMC unanimously voted to keep the benchmark rate at a 22-year high of 5.25%-5.5% for the fourth consecutive meeting, removing a previous reference to further policy “firming”. Market expectations for a March rate cut decreased following Powell’s comments, affecting the S&P 500 and Treasury yields. Powell also addressed concerns about premature rate cuts and reiterated the Fed’s commitment to a gradual approach, waiting for clearer signs of inflation moving sustainably toward the 2% target. The article also notes concerns about an upcoming revision to inflation figures and the Fed’s ongoing asset portfolio reduction. Powell indicated that discussions about the balance sheet would begin in March, with decisions expected by mid-year.

USAGOLD Comment: Gold prices briefly shot up to $2050/oz during the meeting but have since faded. Gold is suspected to remain rangebound until the Fed ultimately decides to cut rates.

Daily Gold Market Report

Black Swan’s Taleb Sounds the Alarm:

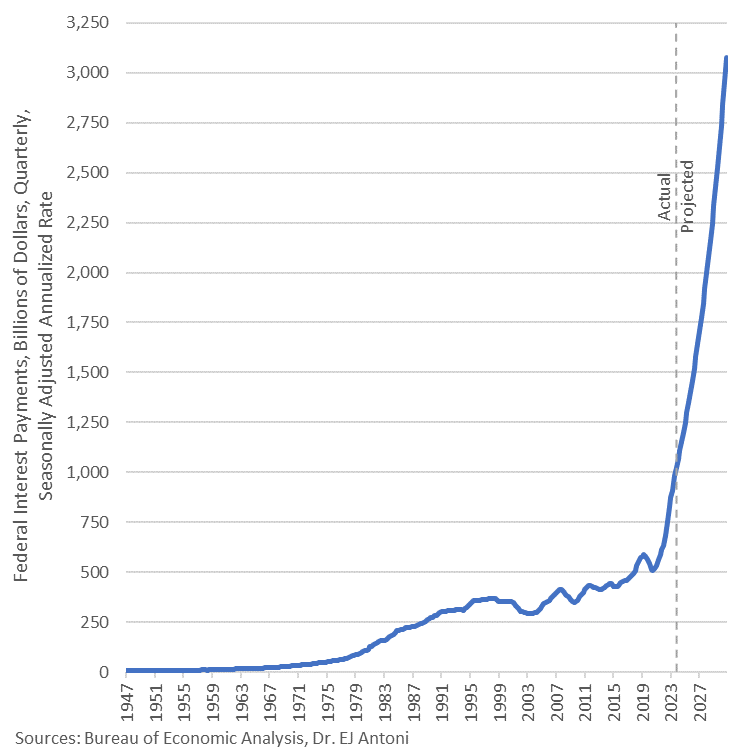

U.S. ‘Death Spiral’ Due to Mounting Debt Crisis

(USAGOLD – 1/31/2024) Gold prices are up in early trading Wednesday, ahead of the conclusion of the U.S. central bank monetary policy meeting. Gold is trading at $2048.10, up $11.09. Silver is trading at $23.22, up 5 cents. Nassim Nicholas Taleb, author of “Black Swan,” warned that the U.S. is facing a critical situation with its escalating national debt, which he describes as a “white swan” event – highly probable and potentially disastrous. Speaking at a Universa Investments event reported by Bloomberg, Taleb criticized the U.S. political system, particularly Congress, for continually extending the debt limit without addressing the underlying issue. He suggested that the increasing interconnectivity of the global economy makes the situation more precarious. This concern is echoed by other financial experts like former Treasury Secretary Robert Rubin and BlackRock Inc.’s Vice Chairman Philipp Hildebrand. Universa Investments, where Taleb advises, is known for its strategy of profiting from market downturns. Taleb expressed a gloomy view of the Western political system, indicating that a significant external intervention or an unlikely miracle might be necessary to reverse the debt spiral.

Daily Gold Market Report

Jamie Dimon’s Stark Warning:

U.S. Debt Nears ‘Cliff’ with Global Fallout Imminent

(USAGOLD – 1/30/2024) Gold prices are higher in early trading Tuesday, as the world anxiously awaits the U.S. military’s response. Gold is trading at $2045.90, up $12.67. Silver is trading at $23.26, up 6 cents. JPMorgan Chase CEO Jamie Dimon warns of a potential global market crisis due to the escalating U.S. government debt. He expressed these concerns at a Bipartisan Policy Center event, alongside former Speaker Paul Ryan. Dimon compares the current economic situation to the 1980s, highlighting the significantly higher debt-to-GDP ratio now, which is around 100% compared to 35% back then. He predicts that by 2035, this ratio could reach 130%. Dimon also emphasized the global impact of the U.S. debt, noting that countries like Japan, China, and the U.K. hold substantial portions of it. He stressed the importance of a stronger America and military for global security, and advocated for closer collaboration between the public and private sectors.

Daily Gold Market Report

Gold Prices Decoupled from Real Interest Rates:

The New Economic Driver

(USAGOLD – 1/29/2024) Gold prices are higher in early trading Monday , driven by a surge in safe-haven investments following a terrorist attack in Jordan that resulted in the death of three U.S. soldiers. Gold is trading at $2035.39, up $16.87. Silver is trading at $22.99, up 19 cents. Frank Holmes, of U.S. Global Investors, recently wrote an article discussing how the traditional correlation between gold prices and real interest rates, a key economic indicator, has weakened according to BMO Capital Markets. Despite a strong U.S. economy, indicated by a higher-than-expected GDP growth and positive consumer and business sentiments, gold remains a recommended investment. This shift is attributed to several factors. Analysts believe gold will benefit from rate cuts and increased investment demand. Notably, emerging economies, especially China, are diversifying away from the U.S. dollar and increasing their gold holdings, making this the new primary driver of gold prices. Central banks, particularly the People’s Bank of China, have been buying significant amounts of gold, impacting the market. The article also mentions that Chinese households, facing a declining stock market, are turning towards gold, further supporting its demand. Despite potential risks from a possible equity market rally in China, BMO and analyst Colin Hamilton foresee continued central bank buying and household investment in gold as a multi-year trend, positioning gold as not just a safe haven but also a strategic asset in a diversifying global economy.

Daily Gold Market Report

Overstepping Boundaries:

Court Finds FBI Violated Constitution in 2021 Vault Raid

(USAGOLD – 1/26/2024) Gold prices remain unchanged in early Friday trading, following a significant monthly U.S. inflation report that confirmed a decrease in inflation levels. Gold is trading at $2020.49, down 35 cents. Silver is trading at $22.81, down 10 cents. In 2021, the FBI’s seizure of contents from safe deposit boxes during a raid on a Beverly Hills vault was deemed unconstitutional by a federal appeals court reports The Epoch Times. The operation targeted U.S. Private Vaults, a business offering anonymous box rentals, on suspicions of criminal use. The warrant allowed opening boxes for inventory and owner identification, but the FBI’s actions exceeded this scope. Initial district court rulings favored the government, citing an inventory exception to the Fourth Amendment. However, the appeals court found this inapplicable, highlighting the FBI’s use of custom instructions and lack of probable cause for all boxes. The case was remanded for further action, including the destruction of records collected on the box renters involved in the class-action lawsuit. This ruling is significant in reinforcing constitutional limits on government searches.

Daily Gold Market Report

Federal Reserve to End Bank Term Funding Program Amid Exploitation Concerns:

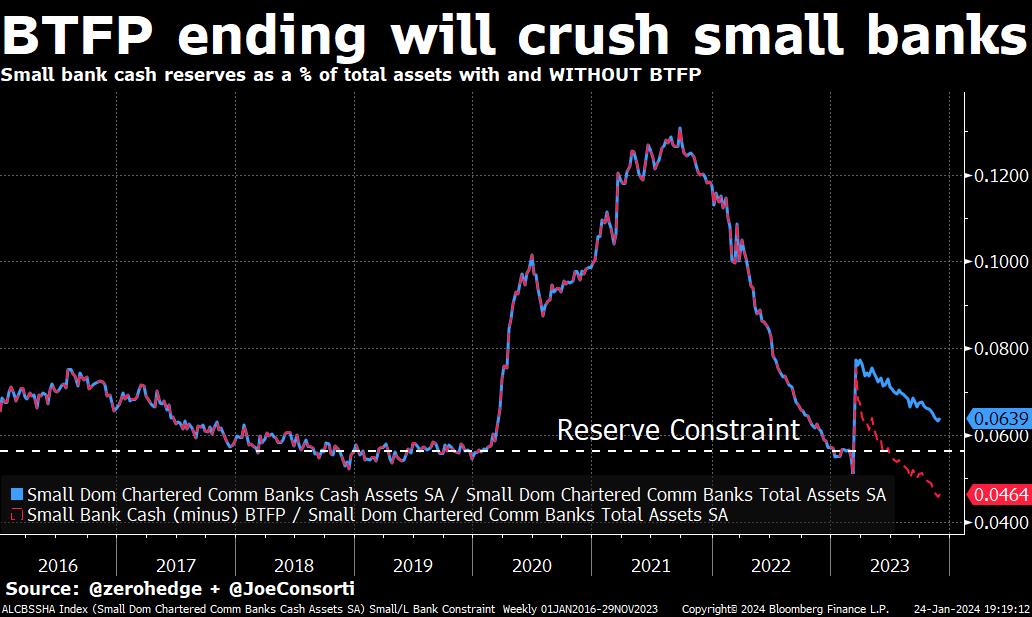

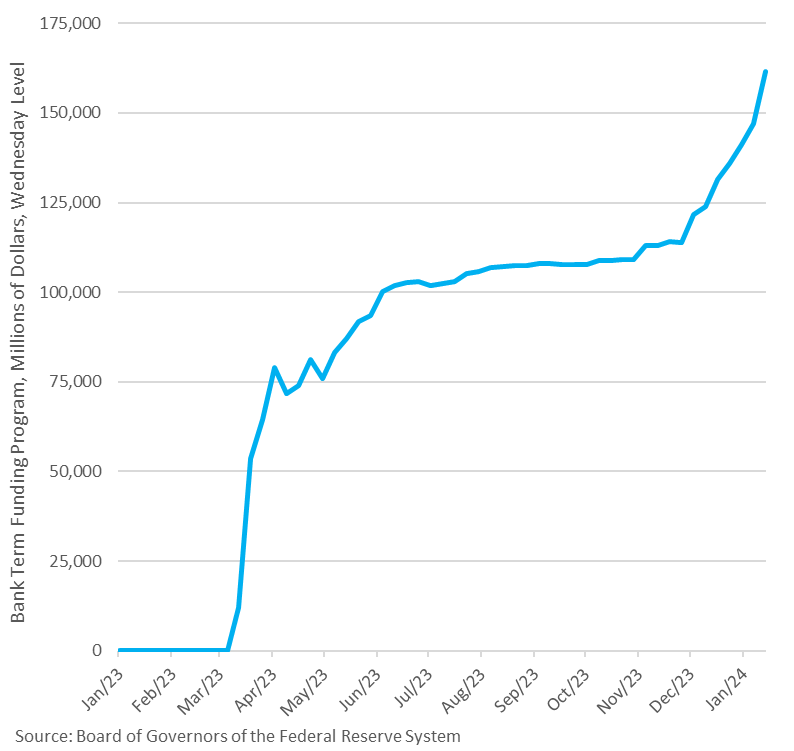

Shifts Focus to Discount Window

(USAGOLD – 1/25/2024) Gold prices are trading higher following the release of recent data indicating that the U.S. economy’s growth surpassed expectations, alongside inflation rates that were lower than anticipated. Gold is trading at $2022.21, up $8.32. Silver is trading at $22.88, up 22 cents. The Federal Reserve Board announced the termination of the Bank Term Funding Program (BTFP) on March 11, following reports of banks exploiting the program for profit. This decision comes amid concerns over the program’s optics and its role in providing banks with essentially free money ($47 billion) over the last two months. The Fed now plans to address future liquidity needs through the discount window as we reported on Tuesday, the same mechanism involved in the 2008 financial crisis. This is shaping up to an interesting end to Q1 of 2024 for the banking system.

Daily Gold Market Report

Golden Warning:

Skyrocketing Gold/Silver Ratio Suggests Stormy Economic Seas Ahead

(USAGOLD – 1/24/2024) Gold prices were up earlier this morning but have since reversed. Investors are exercising caution as they await crucial US economic data, including the Q4 GDP announcement on Thursday and the Core PCE Price Index release on Friday, which will provide more clarity on market direction. Gold is trading at $2025.57, down $3.71. Silver is trading at $22.67, up 23 cents. The gold/silver ratio is a financial metric that compares the relative value of gold to silver, indicating how many ounces of silver it takes to purchase one ounce of gold. Historically, this ratio has fluctuated, reflecting various economic and market conditions. The average gold/silver ratio since the year 2000 is approximately 65:1. When the gold/silver ratio exceeds 90:1, it often signals turbulent times ahead. In recent years, the ratio was above 90:1 during the COVID crash of 2020 and the March Bank Failures of 2023. This high ratio typically indicates that investors are favoring gold over silver, which is often seen as a less stable investment. Gold is traditionally viewed as a safe-haven asset during times of economic uncertainty, political tensions, or financial instability. Therefore, a significantly high gold/silver ratio can be interpreted as a lack of investor confidence in the economy, suggesting that investors are bracing for potentially challenging economic conditions.

Daily Gold Market Report

Mandatory Fed Borrowing for Banks:

A Strategy for Stability or a Step Towards Financial Control?

(USAGOLD – 1/23/2024) Gold and silver prices have marginally increased in early trading on Tuesday, due to modest rebounding after recent downward trends. Gold is trading at $2023.38, up $1.68. Silver is trading at $22.34, up 25 cents. Bloomberg reports that U.S. regulators, including the Office of the Comptroller of the Currency, the Federal Reserve, and the FDIC, are preparing a plan to require banks to use the Federal Reserve’s discount window at least once a year. This move aims to remove the stigma associated with borrowing from this facility and ensure banks are operationally ready to access funds during times of financial stress. The proposal is in response to the failure of several midsize banks last year and is part of a broader effort to strengthen the banking system’s resilience to crises. The plan may also include making the discount window more attractive by potentially lowering borrowing costs and adjusting balance sheet treatments for certain assets.

Daily Gold Market Report

The Return of Inflation:

Analyzing Worldwide Economic Trends and Central Bank Challenges

(USAGOLD – 1/22/2024) Gold prices are slightly down this morning as the positive U.S. economic data has restrained the enthusiasm of precious metals bulls, leading to reduced market expectations for early U.S. interest rate cuts by the Federal Reserve. Gold is trading at $2020.93, down $8.56. Silver is trading at $22.00, down 66 cents. Peter St Onge recently wrote an article that discusses the resurgence of inflation worldwide, contrasting the optimism of economists like Paul Krugman with recent data indicating a rise in inflation rates. The Bureau of Labor Statistics reported a significant increase in the Consumer Price Index (CPI), including both the overall CPI and the “core” CPI that excludes food and energy. “Finally, so-called “SuperCore” inflation — not a joke. Which the Fed pulled out of its hat to strip out housing costs. That one’s doing even worse, hitting almost 5% annualized. That feeling when your fake statistics don’t work out,’ St Onge emphasizes. Despite the Federal Reserve’s efforts to control inflation through tight monetary policy, inflation persists due to continued government spending and financial dynamics on Wall Street. St Onge concludes with, “Central banks across the West — really across the world — have painted themselves into the mother of corners, potentially facing durable global stagflation for the first time in 50 years, this time paired with a financial crisis that would make it a combination not seen since the 1930’s.”

Daily Gold Market Report

Inflation Proof Investments:

How Gold Outperforms Ski Pass Costs

(USAGOLD – 1/19/2024) Gold prices are posting modest gains even as there was no major, markets-moving news overnight, which has allowed some better risk appetite in the marketplace to end the trading week.. Gold is trading at $2029.63, up $6.29. Silver is trading at $22.63, down 11 cents. Incrementum AG just released the “The Gold/Ski Pass Ratio 2024” report which discusses the impact of inflation on ski ticket prices in Austria and the value of gold as an investment. “With an increase of 10.2%, ski ticket prices have risen even more sharply this winter season than in the 2022/23 winter season. Since the 1990/91 winter season, ski ticket prices have risen by an average of 3.5% annually,” Incrementum reports. The comparison between ski ticket prices and gold prices reveals that gold investors have been relatively insulated from these increases. The purchasing power of gold in terms of ski passes has remained high, indicating that gold is a stable investment that can protect against inflation and maintain or even increase purchasing power over time.

Daily Gold Market Report

Bank of America’s Earnings Take a Massive Hit:

Profits Plummet by Over Half Amidst Market Turbulence and Hefty Charges

(USAGOLD – 1/18/2024) Gold prices are trading slightly higher after the number of American workers applying for first-time unemployment benefits last week came in well below expectations. Gold is trading at $2012.07, up $5.82. Silver is trading at $22.51, down 4 cents. Bank of America reported a significant drop in its fourth-quarter earnings late last week, with profits falling 56% to $3.14 billion, impacted by one-time charges. The decline was primarily due to a $1.6 billion charge related to the transition from the London Interbank Offered Rate and a $2.1 billion Federal Deposit Insurance Corp. fee following the failures of Silicon Valley Bank and Signature Bank. Revenue decreased by 10% to $21.99 billion, against a forecast of $23.7 billion. Despite a challenging quarter, the bank saw increases in trading revenue and investment banking fees, with trading revenue up 3% to $3.62 billion and investment banking fees rising 8% to $1.18 billion. The bank also released $88 million from its reserves for potential loan losses. The bank giant also shed over 4,000 (2%) employees in turbulent year. However, it faced challenges with an extensive portfolio of low-rate securities and increasing loan charge-offs, though a late-year bond rally helped reduce unrealized losses.

Daily Gold Market Report

Turning Crisis into Opportunity:

Banks Exploit Fed’s Rate Cuts for Profit

(USAGOLD – 1/16/2024) Gold and silver prices are down in early trading Tuesday, coming out of the holiday weekend. Gold is trading at $2038.78, down $17.77. Silver is trading at $22.92, down 30 cents. The Wall Street Journal recently reported on how banks are exploiting the Federal Reserve’s Bank Term Funding Program (BTFP), initially created during the 2023 banking crisis. While intended for emergency lending, banks are now using it for profit, borrowing at low rates and earning higher returns on overnight deposits. This situation arose due to market predictions of Federal rate cuts, which lowered the BTFP’s borrowing costs. The program’s usage increased significantly, not due to new financial stresses but due to this favorable rate differential. The Fed’s vice chairman suggests the program, which is set to expire soon, might not be extended. This situation illustrates banks’ ability to utilize monetary policy changes for financial gain.

Daily Gold Market Report

Navigating Investment Waters:

Gold’s Enduring Legacy in the Era of Bitcoin ETFs

(USAGOLD – 1/12/2024) Gold and silver prices are sharply up in early trading Friday, on safe-haven buying following news of U.S.-British air strikes against Houthi rebels in Yemen. Gold is trading at $2062.01, up $33.10. Silver is trading at $23.45, up 70 cents. The SEC approved 11 Bitcoin spot ETFs that began trading today with a record $4.6 billon exchanging hands. Charlie Morris of ByteTree highlights how gold ETFs transformed the gold market, the rise of Bitcoin ETFs, and the comparative flows between gold and Bitcoin. The question of gold versus bitcoin is set to become more prominent, and in light of this important occasion, examining Graham Tuckwell’s responses to this query, as outlined in his article in the Alchemist, is merited:

Are gold and bitcoin similar?Yes, in some ways. They have a near fixed supply, earn no return, are cheap to hold and are not fiat currencies.Will gold go more electronic and bitcoin more mainstream?Yes. They are coming from opposite ends of the spectrum and there will be some convergence and overlapping.Will bitcoin replace gold as a safe-haven investment?No. Institutional investors have always wanted allocated gold in their ETFs as it is more secure, and they want to be able to see it is there in the vault. It cannot just be wiped out on a computer screen.Will both gold and bitcoin be sought after?Yes, whilst yields remain low to negative and, better still, if interest rates rise and bond prices fall. Maybe a bet on both gold and Bitcoin will work, but for security, a gold ETF for me please.

Daily Gold Market Report

Rising Debt Delinquency

Millennials and Gen Z Struggle with Debt Payments Across Major U.S. Cities

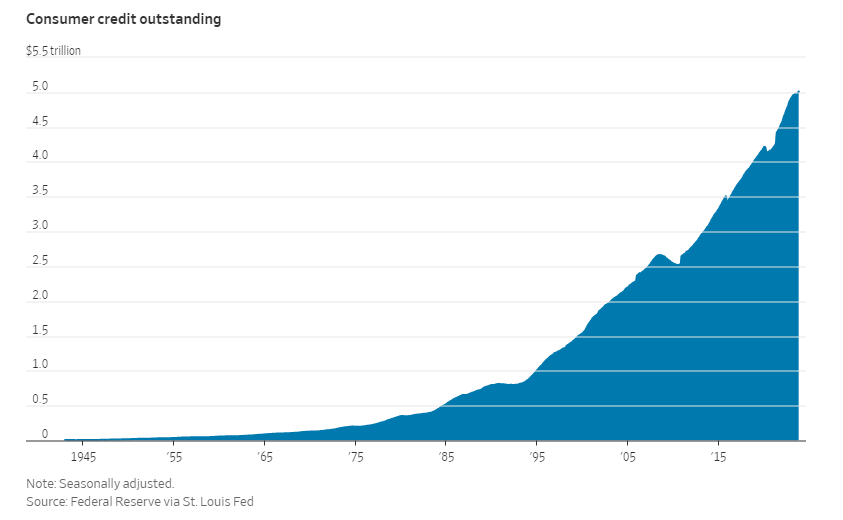

(USAGOLD – 1/11/2024) Gold and silver prices strengthened in early trading on Thursday, but retreated from their daily peaks after a U.S. inflation report was released, which was slightly higher than anticipated. Gold is trading at $2029.33, up $4.92. Silver is trading at $22.91, up 7 cents. LendingTree researchers analyzed the anonymized credit reports of about 310,000 users on the LendingTree platform from July 1 to Sept. 30, 2023, and found that nearly 30% of Americans in the 100 largest metropolitan areas were behind on their debt payments as of late 2023. This includes various debts, such as credit cards, auto loans, personal loans, mortgages, and student loans. Debt delinquency is notably higher in Southern cities, with McAllen, Texas; El Paso, Texas; and Baton Rouge, Louisiana, having the highest rates of late payments. Additionally, the study reveals that millennials and Gen Zers are significantly more likely to be behind on debt payments compared to older generations. Moreover, MarketWatch reports that total consumer credit exceeded $5 trillion for the first time ever.

Daily Gold Market Report

Projecting Silver’s Future

Industrial and Jewelry Sectors Lead Global Demand Growth by 2033

(USAGOLD – 1/10/2024) Gold and silver prices are steady in early trading Wednesday as investors await the December consumer price index report on Thursday and the December producer price index report on Friday. Gold is trading at $2029.32, down 32 cents. Silver is trading at $22.86, down 13 cents. The Oxford Economics report, “Fabrication Demand Drivers for Silver“, predicts significant growth in silver demand across industrial, jewelry, and silverware sectors by 2033. Industrial silver, particularly in electrical and electronics, is expected to grow by 46%, with major consumption in China. Jewelry sector output is forecasted to increase by 34%, with a market shift towards China from India. The silverware sector is projected to grow by 30%, mainly in India, though its global market share may decline.

The report emphasizes the importance of long-term demand forecasting for better-informed supply and resource allocation decisions in the silver industry. It also acknowledges challenges in forecasting, such as the possibility of technological changes in manufacturing processes that could alter silver usage. The overall analysis provides valuable insights for stakeholders in the silver industry, highlighting where and how demand for silver as an intermediate input is likely to evolve over the next decade.

Daily Gold Market Report

Election Year Surge

How Political Changes Could Boost Gold Prices

(USAGOLD – 1/9/2024) Gold prices are moderately higher and silver near steady in early trading Tuesday. Gold is trading at $2036.40, up $8.33. Silver is trading at $23.09, down 2 cents. Heraeus’ recent Precious Appraisal discusses the potential positive impact of global elections on gold prices, particularly focusing on the US and India. The US faces a potential recession, and the Federal Reserve might cut rates in response, possibly weakening the dollar and boosting gold prices. Over 50% of the world’s population will participate in elections in 76 countries this year, significantly influencing gold demand. The US, undergoing a presidential election, and India, with its price-sensitive gold market, are key players.

Daily Gold Market Report

Central Banks’ Appetite for Gold

44 Tonnes Added in November

(USAGOLD – 1/8/2024) With no significant new fundamental developments to begin the trading week, gold prices have fallen in early Monday trading, reaching a three-week low. Gold is trading at $2019.75, down $25.70. Silver is trading at $22.96, down 23 cents. In November 2023, central banks globally increased their gold reserves by a net 44 tonnes, with gross purchases of 60 tonnes significantly surpassing gross sales of 15 tonnes, the World Gold Council reports. This trend reflects the sustained momentum in central bank demand for gold. Major buyers were predominantly from emerging markets, with the Central Bank of Turkey leading the acquisitions by adding 25 tonnes, followed by the National Bank of Poland and the People’s Bank of China. Throughout 2023, the People’s Bank of China was the largest gold purchaser, with emerging market banks being the primary drivers of both purchases and sales. Interestingly, the Monetary Authority of Singapore was the only developed market bank adding gold to its reserves, aside from the ECB’s addition due to Croatia joining the eurozone.

Daily Gold Market Report

Decade of Stability

Gold’s Consistent 4% Q1 Performance Over 10 Years

(USAGOLD – 1/5/2024) The gold market is flat as the U.S. labor market remains robust, generating a higher number of jobs than anticipated in December. Gold is trading at $2042.06, down $1.59. Silver is trading at $23.04, up 2 cents. Over the past decade, gold has demonstrated a consistent yet moderate performance, yielding an average return of approximately 4% in the first quarter of each year. This steady increase reflects its enduring status as a safe-haven asset, particularly in times of economic uncertainty. Despite fluctuations in the market and changes in global economic conditions, gold’s 10-year performance in Q1 underscores its appeal to investors seeking a reliable store of value and a hedge against inflation and currency devaluation. Its behavior during this period reinforces its role in diversifying investment portfolios and preserving wealth over the long term.

Daily Gold Market Report

Bracing for Impact

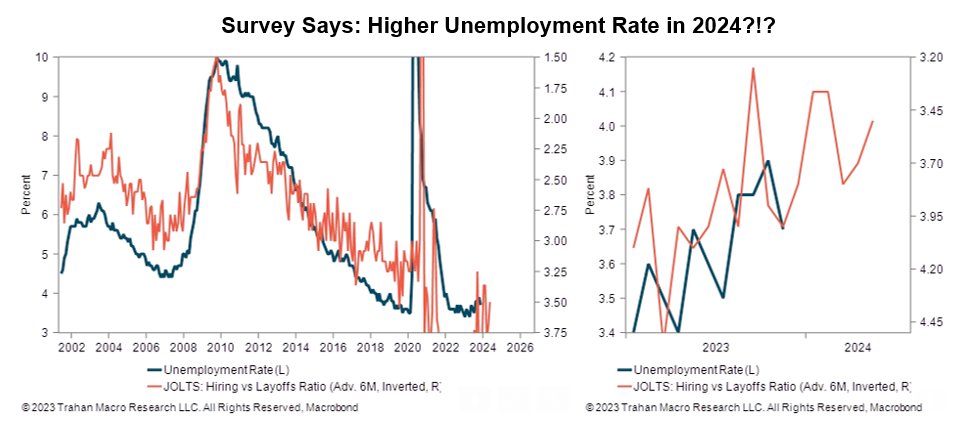

Navigating Layoffs, AI Disruption, and the Unsteady Job Market

(USAGOLD – 1/4/2024) Gold prices dropped lower this morning as the count of U.S. workers filing for initial unemployment benefits significantly decreased in the final week of 2023. Gold is trading at $2039.98, down $1.51. Silver is trading at $22.76, down 23 cents. As the stock market fails to stage a “Santa Claus rally” in a rough start to 2024, reality is starting to set in. The Resume Builder survey forecasts mass layoffs in 2024, with nearly half of companies affected, primarily due to anticipated recessions and the rise of AI. “In the survey, nearly four in 10 companies said they are likely to have layoffs in 2024, prompting increased fears of a recession around the corner. More than half of companies also said they plan to implement a hiring freeze in 2024,” Suzanne Blake of Newsweek reports.

Looking for more than an e-commerce platform?

DISCOVER THE USAGOLD DIFFERENCE

"Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

6:26 am Fri. April 26, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115