Daily Gold Market Report

Rising Debt Delinquency

Millennials and Gen Z Struggle with Debt Payments Across Major U.S. Cities

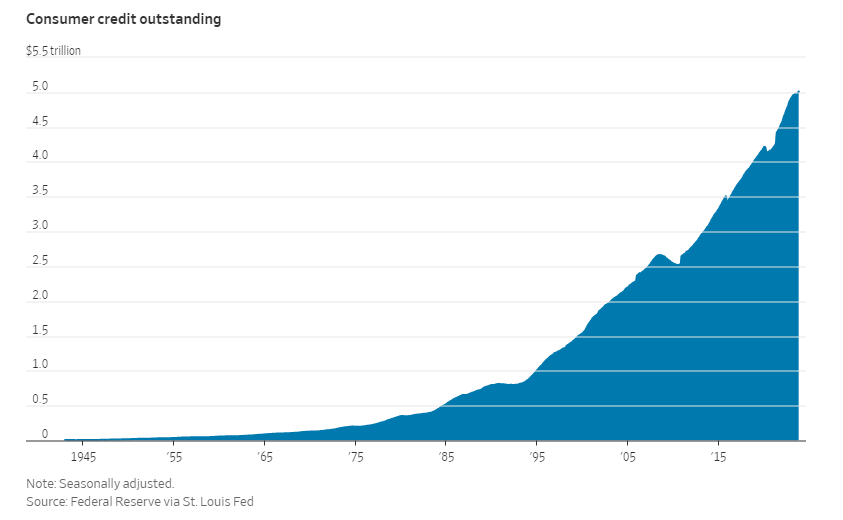

(USAGOLD – 1/11/2024) Gold and silver prices strengthened in early trading on Thursday, but retreated from their daily peaks after a U.S. inflation report was released, which was slightly higher than anticipated. Gold is trading at $2029.33, up $4.92. Silver is trading at $22.91, up 7 cents. LendingTree researchers analyzed the anonymized credit reports of about 310,000 users on the LendingTree platform from July 1 to Sept. 30, 2023, and found that nearly 30% of Americans in the 100 largest metropolitan areas were behind on their debt payments as of late 2023. This includes various debts, such as credit cards, auto loans, personal loans, mortgages, and student loans. Debt delinquency is notably higher in Southern cities, with McAllen, Texas; El Paso, Texas; and Baton Rouge, Louisiana, having the highest rates of late payments. Additionally, the study reveals that millennials and Gen Zers are significantly more likely to be behind on debt payments compared to older generations. Moreover, MarketWatch reports that total consumer credit exceeded $5 trillion for the first time ever.