Daily Gold Market Report

Gold Market Review 2023:

Surge in Demand, Record Prices, and Central Bank Influence

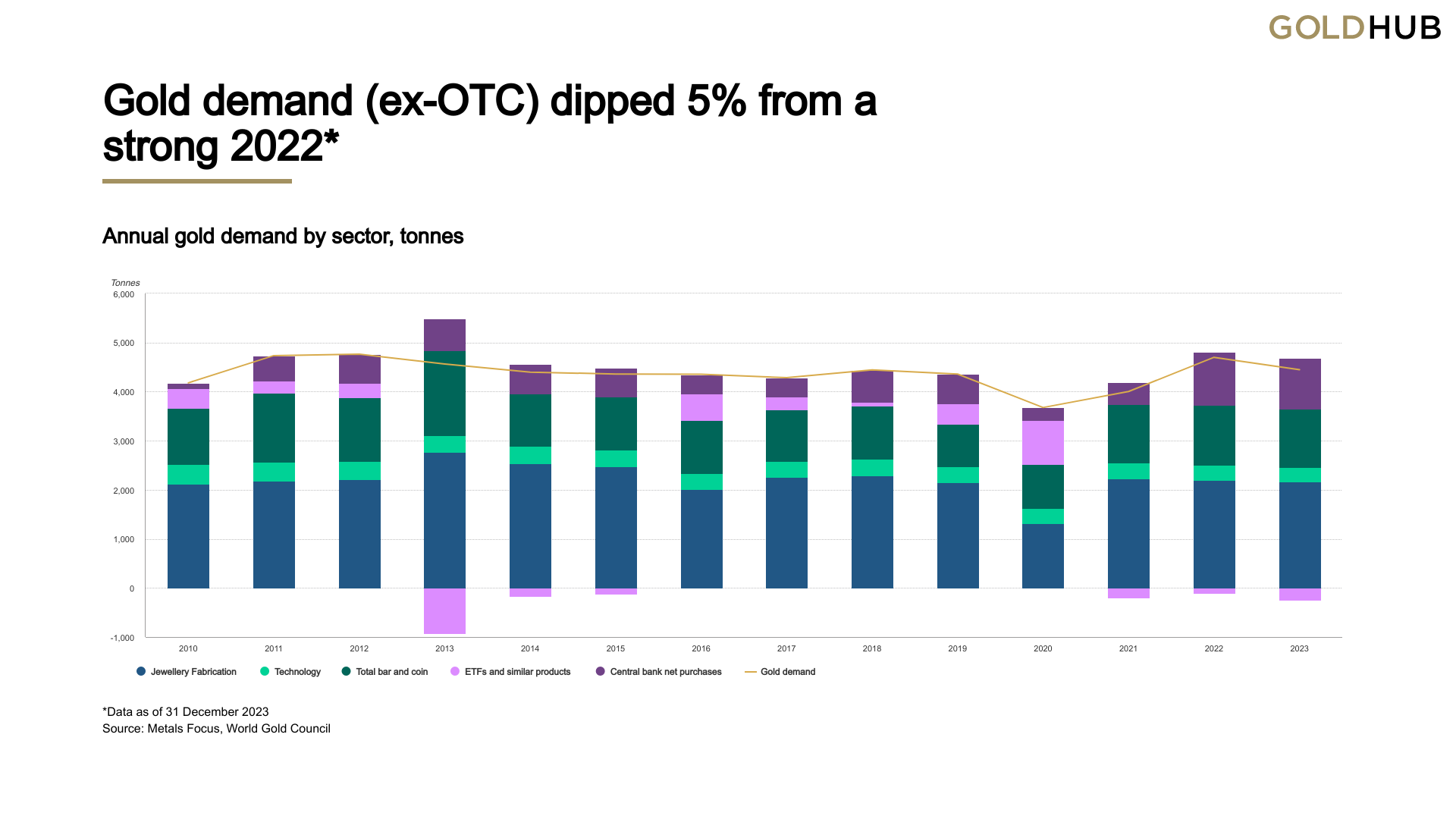

(USAGOLD – 2/02/2024) Gold and silver prices are sharply lower in early trading Friday, after strong U.S. jobs data shows solid gains. Gold is trading at $2031.90, down $23.09. Silver is trading at $22.57, down 61 cents. The World Gold Council reports that in 2023, total gold demand reached a record high of 4,899t, driven by strong central bank buying, steady jewelry consumption, and significant OTC and stock flows, despite a 5% decrease from 2022’s demand and substantial ETF outflows. Central banks nearly matched their 2022 record purchases, with annual net purchases of 1,037t. Global gold ETFs experienced a third year of net outflows, losing 244t, while annual bar and coin investment slightly contracted. Jewelry consumption remained robust at 2,093t, supported by China’s recovery, even amid high gold prices. However, the use of gold in technology fell below 300t for the first time. The LBMA gold price closed 2023 at a record high of US$2,078.4/oz, reflecting a 15% annual return and an 8% increase over the 2022 average price. Q4 gold demand was 8% above the five-year average but 12% lower year-over-year compared to Q4’22. Overall, annual mine production increased slightly, while recycling rose due to high gold prices, leading to a 3% increase in total gold supply.