Daily Gold Market Report

Mandatory Fed Borrowing for Banks:

A Strategy for Stability or a Step Towards Financial Control?

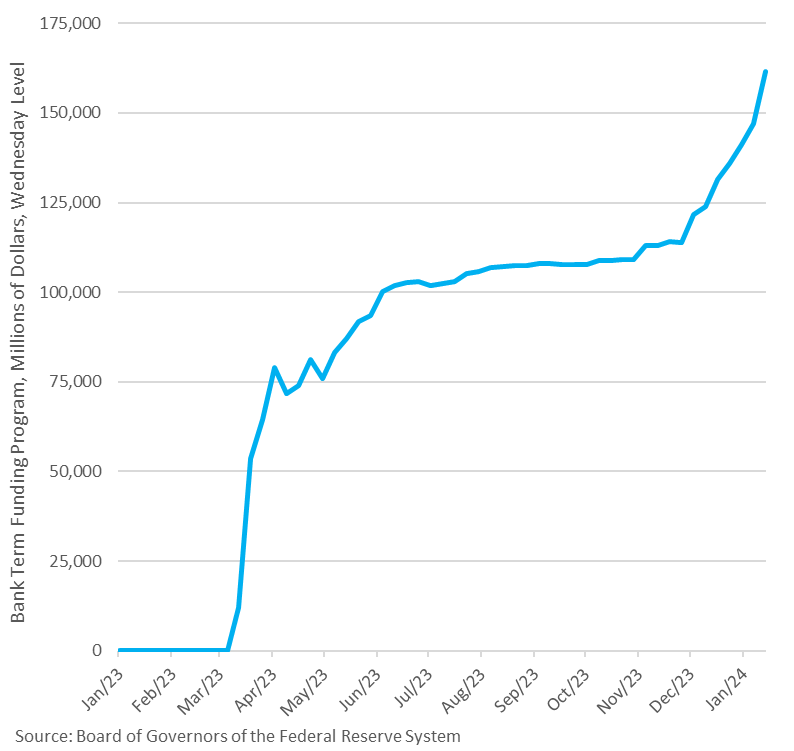

(USAGOLD – 1/23/2024) Gold and silver prices have marginally increased in early trading on Tuesday, due to modest rebounding after recent downward trends. Gold is trading at $2023.38, up $1.68. Silver is trading at $22.34, up 25 cents. Bloomberg reports that U.S. regulators, including the Office of the Comptroller of the Currency, the Federal Reserve, and the FDIC, are preparing a plan to require banks to use the Federal Reserve’s discount window at least once a year. This move aims to remove the stigma associated with borrowing from this facility and ensure banks are operationally ready to access funds during times of financial stress. The proposal is in response to the failure of several midsize banks last year and is part of a broader effort to strengthen the banking system’s resilience to crises. The plan may also include making the discount window more attractive by potentially lowering borrowing costs and adjusting balance sheet treatments for certain assets.