Author Archives: USAGOLD

Short and Sweet

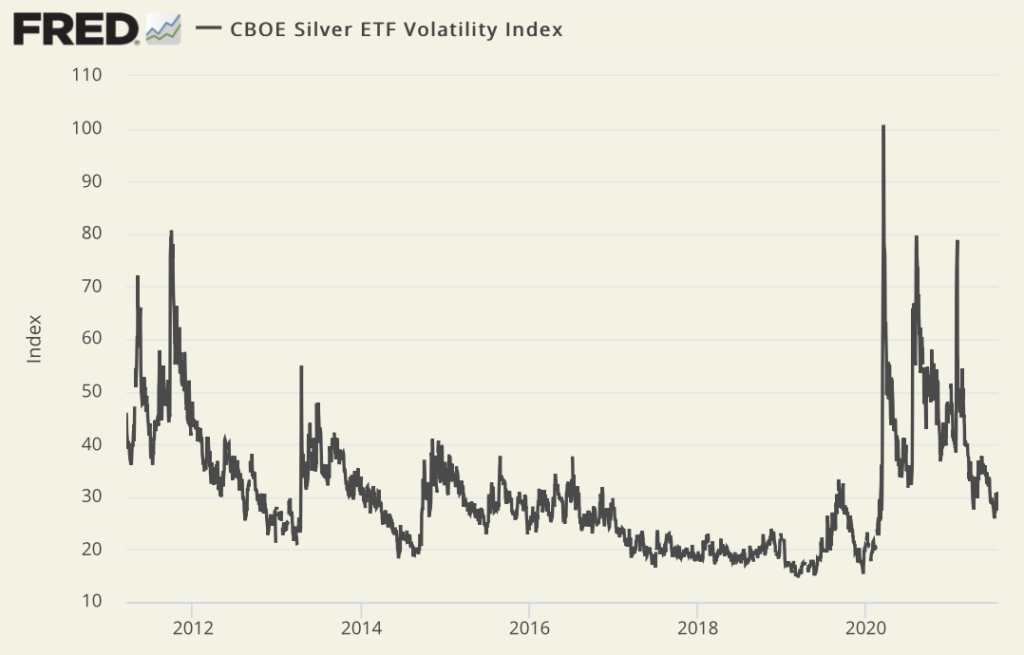

Silver could be setting up for a repeat of 2020’s explosive rally

Silver’s performance over the past month offers a reminder of the metal’s volatility. Commodity analyst Andrew Hecht, whose experience in the silver market stretches back to the 1970s as a trader with Salomon Brothers, is well aware of the metal’s long history of radical ups and downs. “Silver volatility,” he writes in a recent Seeking Alpha article, “can be explosive. Meanwhile, the price action can also be coma-like, lulling market participants into a false sense of security for long periods. Silver’s history is full of false technical breakouts and breakdowns…Silver is a unique metal as it is part industrial, part investment asset. It experiences long periods of coma-like price action. Still, when it moves, as the price did not 2020, few commodities compare to the precious metal when it comes to percentage moves.” Hecht reminds readers of silver’s performance in 2020 when “bearish price action gave way to an explosive rally.” (Silver went from the $12 level in March to $29 by early August.) He goes on to say that “[t]he recent price dynamics could be setting up for a repeat performance given the rising level of inflation across all markets.”

Silver Volatility Index

Sources: St. Louis Federal Reserve [FRED], Chicago Board Options Exchange

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to add a little white metal to your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Short and Sweet

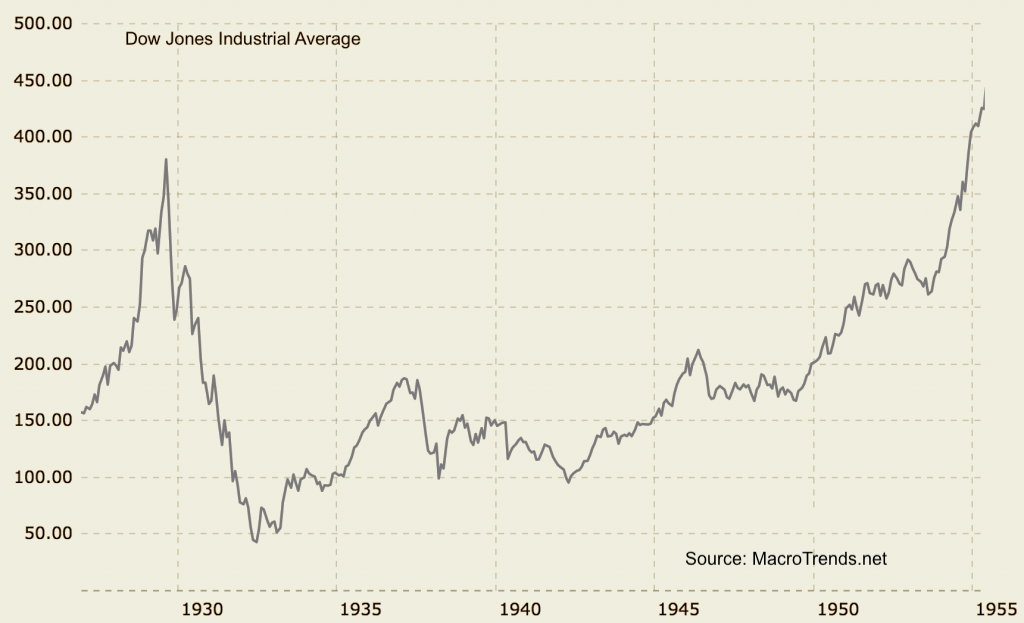

‘I expect a true crash to take a decade of stock market gains.’

“‘If the pandemic doesn’t pop this bubble then, of course, it will be something else that eventually accomplishes this,’ says [Universa Investments’ Mark Spitznagel in a MarketWatch report], “reiterating his long-held belief that easy-money central banks and the bubble they continue to pump will eventually lead to a major global reversal. How bad could it get when it really goes sideways? ‘I expect a true crash to take back a decade [worth of stock-market gains],’ he told The Wall Street Journal last month.'” Spitznagel is a protege of Nicholas Taleb of The Black Swan fame. Some would consider his prediction going overboard. We should keep in mind, though, that from 1929 to 1933 the stock market lost almost 90% of its value. It did not return to its 1929 highs until 1955 – 26 years later. In short, what he is suggesting is not without historical precedent.

Chart courtesy of MacroTrends.net

Are you looking to solidify your hard-earned wealth for the long run?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Short and Sweet

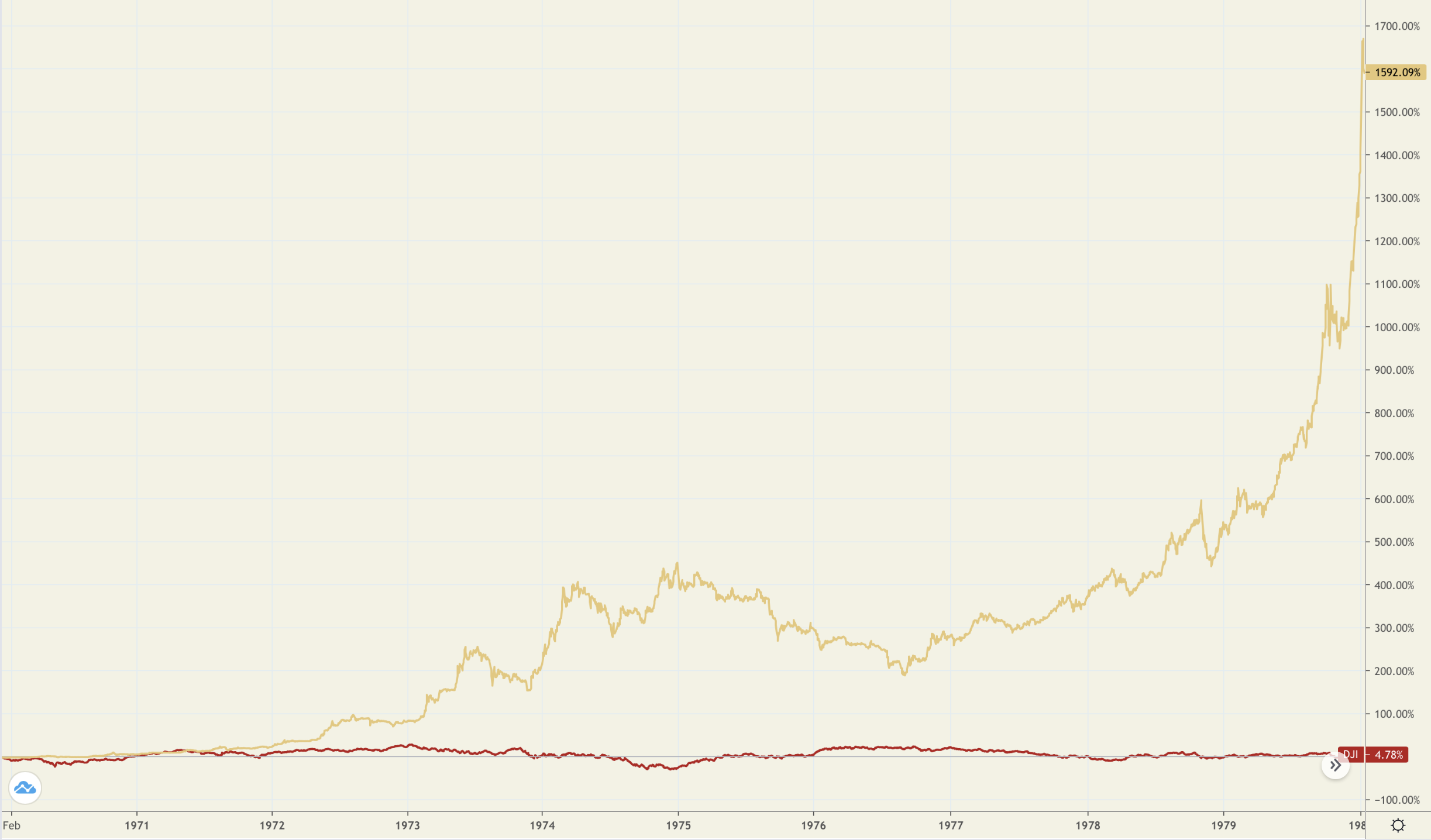

Beware the new mantra that stocks are a good inflation hedge

“So, to be clear, this April really was cruel,” writes John Authers in his regular Bloomberg column, “In terms of the basic economic numbers that affect us most, it was the cruelest month for the U.S. in many decades. It was only one month. It is way too soon to proclaim the beginning or end of a major economic trend, on the base of the data we have so far. But April’s data were not only very, very bad, but also very, very surprising. They need to be confronted and understood.” Authers is surprised at the markets’ muted reaction to “a bad unemployment number followed by a bad inflation number.” He warns that if inflation does take root, stocks have plenty of room to fall further.

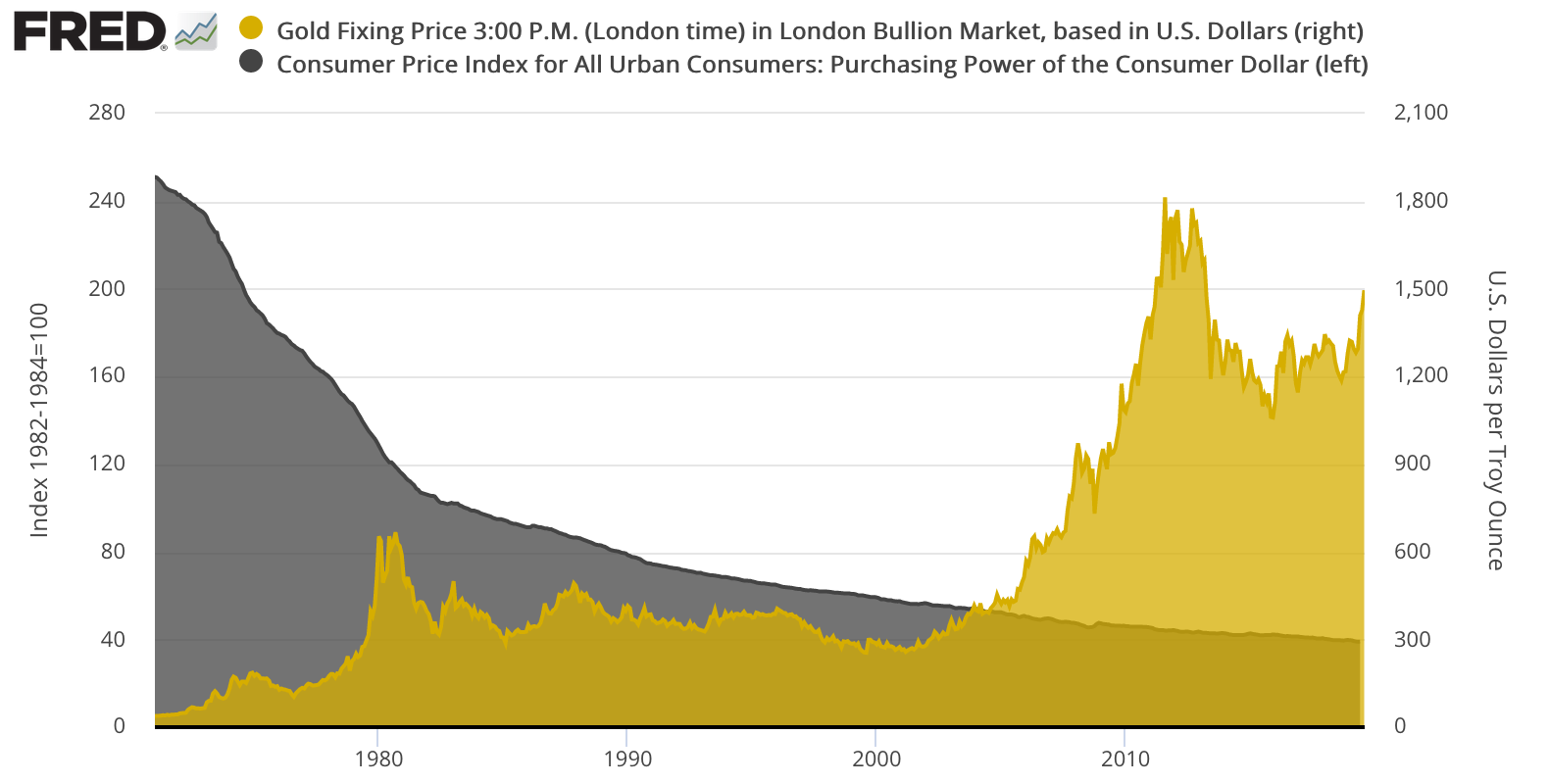

The chart below shows what happened in the 1970s once investors realized that inflation was not “transitory” but entrenched instead. Stocks drifted sideways for most of the decade, managing only a 4.78% gain. Gold, on the other hand, gained 1592%. We sometimes overlook the fact that stocks peaked in the late 1960s, just before the inflation began. Nearly twenty years of sideways to down action followed. Stocks started and ended the 1970s at 1000 while runaway inflation raged.

Gold and Stocks

(In percent, 1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

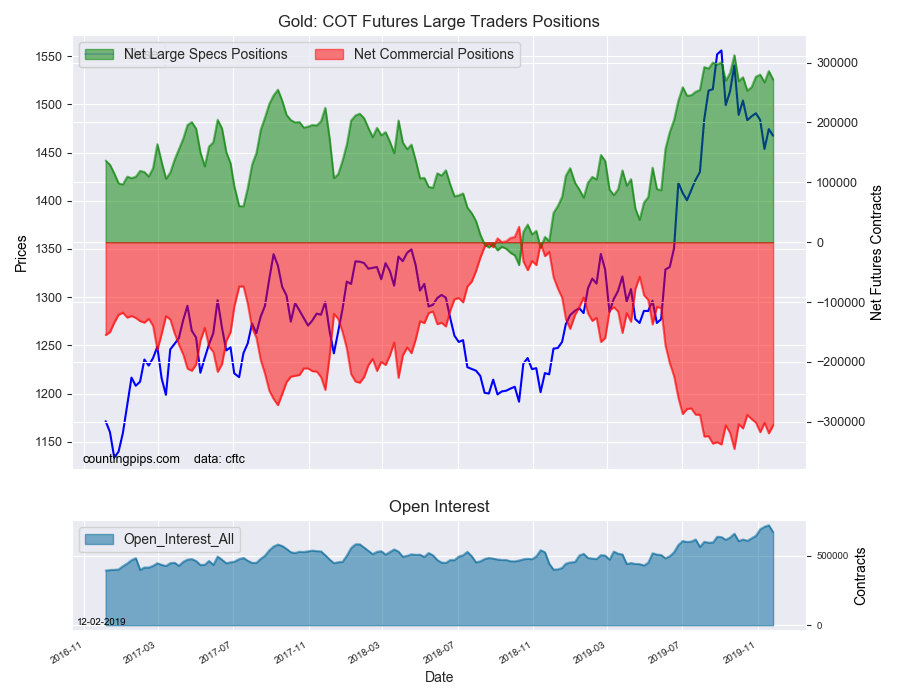

Gold specs cut back bullish bets

Through Tuesday, November 26, 2019

Charts and commentary courtesy of CountingPips.com

Tables courtesy of GoldSeek

Note: Commitment of Traders reports are published Friday with data from the previous Tuesday.

Gold Non-Commercial Speculator Positions:

Large precious metals speculators lowered their bullish net positions in the Gold futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday (delayed due to Thanksgiving holiday).

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 271,634 contracts in the data reported through Tuesday November 26th. This was a weekly change of -14,225 net contracts from the previous week which had a total of 285,859 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -12,010 contracts (to a weekly total of 325,286 contracts) while the gross bearish position (shorts) rose by 2,215 contracts for the week (to a total of 53,652 contracts).

Gold speculators had increased their bullish positions in four out of the previous five weeks before last week’s decline. The overall bullish position remains strong and above the +250,000 net contract level for a nineteenth straight week.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -305,467 contracts on the week. This was a weekly rise of 13,628 contracts from the total net of -319,095 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1467.40 which was a decrease of $-6.90 from the previous close of $1474.30, according to unofficial market data.

Sorry. No silver report this week.

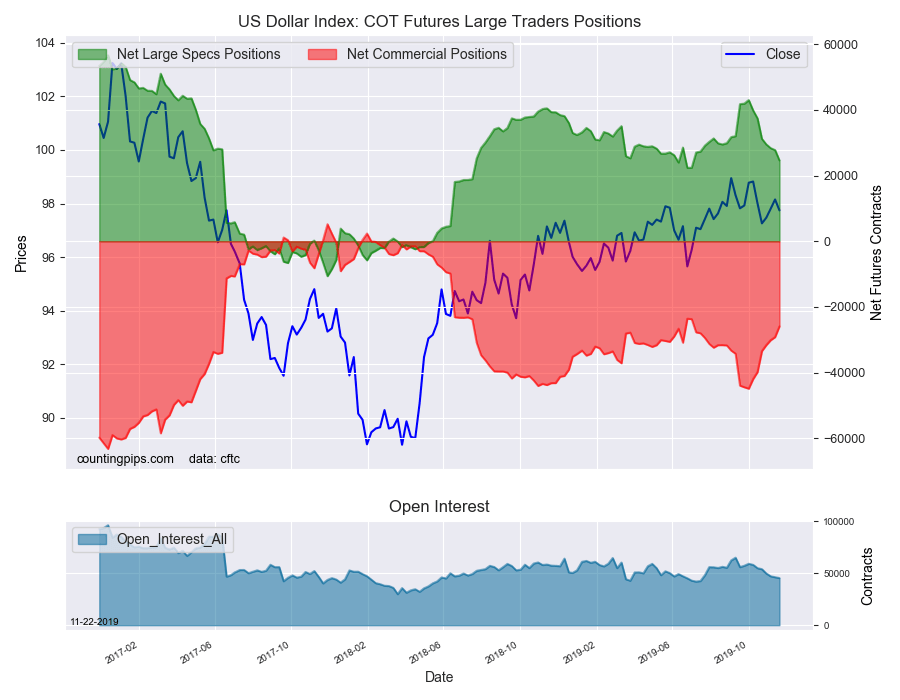

US Dollar Index speculators cut bullish bets 7th straight week

US Dollar Index Speculator Positions

Large currency speculators once again decreased their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 24,625 contracts in the data reported through Tuesday November 19th. This was a weekly fall of -3,159 contracts from the previous week which had a total of 27,784 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -2,408 contracts (to a weekly total of 31,509 contracts) compared to the gross bearish position (shorts) which saw a gain by 751 contracts on the week (to a total of 6,884 contracts).

US Dollar Index speculators cut back on their bullish bets for a seventh straight week and have now trimmed the net position by a total of -18,403 contracts over the past seven weeks. These recent declines have brought the overall net position to the lowest bullish level in twenty-three weeks.

Gold in the Attic

Every once in a while we rummage around USAGOLD’s creaky old attic and dust-off a golden vignette that still has relevance in the here and now – particularly as investors assess the potential consequences of the massive money-printing response to the coronavirus breakdown. This piece appeared originally on this page in November 2015. It tells the interesting tale of a scrupulous saver from some 1700 years ago attempting to shelter his or her wealth against the process of inflation.

How 4,000 Roman coins found buried in a

Swiss orchard reinforce gold ownership today

“The coins’ excellent condition indicated that the owner systematically stashed them away shortly after they were made, the archaeologists said. For some reason that person had buried them shortly after 294 and never retrieved them. Some of the coins, made mainly of bronze but with a 5% silver content were buried in small leather pouches. The archaeologists said it was impossible to determine the original value of the money due to rampant inflation at the time, but said they would have been worth at least a year or two of wages.” – The Guardian/11-19-2015

by Michael J. Kosares

I was initially at a loss to explain why anyone would go to so much trouble to hoard so many coins with such a low silver content – about 5%. The only rational explanation is that the hoarder had decided that even worse debasement was on its way. And, a quick review of Roman history tells us that this indeed was the case.

In the next generation of the denarius, issued by Emperor Diocletian, bronze coins were simply dipped in silver and passed into circulation. By 294AD, the latest date in the hoard, Diocletian abandoned silver coinage entirely and began issuing bronze coins instead. Prior to that, prices had risen over a roughly twenty-year period by 1000%. Value-conscious barbarian troops hired by the emperors demanded to be paid in gold aureus and for good reason as you will discover below. By the end of the third century, the currency was crumbling and along with it the empire.

For a fascinating short course on the connection between the fall of the Empire and inflation, I would recommend this lecture by professor Joseph Peden in 2009, titled “Inflation and the Fall of the Roman Empire” and published at the Mises Institute. Peden quotes a 5th-century account of the Roman inflation by a Christian priest named Salvian. Says Peden,

“Salvian tells us, and I don’t think he’s exaggerating, that one of the reasons why the Roman state collapsed in the 5th century was that the Roman people, the mass of the population, had but one wish after being captured by the barbarians: to never again fall under the rule of the Roman bureaucracy. In other words, the Roman state was the enemy; the barbarians were the liberators. And this undoubtedly was due to the inflation of the 3rd century.”

It is instructive to note that for Rome, as has been the case in a myriad of episodes through history, inflation was not an event but a process. The ancient Roman version unfolded over a more than a 200 year period. “By the time of Trajan in 117 AD,” says Peden, “the denarius was only about 85 percent silver, down from Augustus’s 95 percent. By the age of Marcus Aurelius, in 180, it was down to about 75 percent silver. In Septimius’ time it had dropped to 60 percent, and Caracalla evened it off at 50/50.”

By the end of the third century, as demonstrated by the Swiss find, the denarius had gone to 5% silver, then, as mentioned above, a thin coating of silver, then no silver at all, only bronze. In short, a chart could have been constructed at the time showing an ounce of silver in a steady upward progression in terms of denarii from 117 AD through 300 AD. One wonders if the pundits at the time would have deemed it to have been in a bubble.

About 1200 years later, Thomas Gresham would draft “Gresham’s Law” stated simply as ‘bad money drives out good.’ Had Gresham the opportunity to visit the British Museum and study ancient Roman coinage, he would have found a ready example of his law in action. One expert told The Guardian newspaper that the original owners hoarded the Roman coins found in Switzerland because “the silver contained in them guaranteed a certain value retention in a time of economic uncertainty.”

In ‘The Story of Money for Understanding Economics” researcher Vincent Lannoye tells us that during the Roman inflation, “The less debased gold coins had been stashed under the mattress for decades, maybe centuries. These precious and valuable coins hardly circulated, as it can be deduced from their high concentrations in hoards discovered by archaeologists.” Peden puts a finer point on the role of gold during the Roman inflationary period:

“Now one interesting thing with all this inflation should be a great comfort to us: historians of prices in the Roman Empire have come to the conclusion that despite all of this inflation — or perhaps we should say, because of all of this inflation — the price of gold, in terms of its purchasing power, remained stable from the first through the fourth century. In other words, gold remained, in terms of its purchasing power, a stable value whereas all this other coinage just became increasingly worthless.”

In 1700 years, as you can see in the chart above, not much has changed. Since 1971, when the United States detached the dollar from gold and ushered in the era of fiat money, the dollar has lost 84% of its purchasing power. The 1971 dollar is now worth 16¢. Gold in the meanwhile has risen from $35/oz. then to roughly the $1480 level today (with a stop at $1900/oz in 2011.) Over the long run, gold in the modern era has maintained its purchasing power as it did in Roman times, while the dollar, like the denarius, has been steadily debased. So it is by the circuitous route just taken, you now know why 4000 Roman coins recently found buried in a Swiss orchard reinforce gold ownership today.

(Editor’s note June 2020 – Gold is now priced at over $1700 per ounce.)

Final Note 1: We should not become desensitized to the prospects of future inflation as a result of the lull we have encountered in recent years. Even though price inflation is relatively subdued of late, monetary inflation continues unabated with consequences yet to be determined. In the inflationary process, it should be remembered that the line between cause and effect is not always a straight one. History teaches us that when inflation does arrive, it comes suddenly without notice and with a vengeance.

Final note 2: I should add that at any point along the way in the Roman inflationary period, the hoarder who had stashed away earlier silver coinage would have effectively hedged the event, as this article illustrates. In the modern era, though more volatile than gold, silver has functioned effectively as a safe-haven asset in the portfolio. A chart like the one above could be drawn with silver as the overlay instead of gold.

Image by The Portable Antiquities Scheme/ The Trustees of the British Museum [CC BY-SA 2.0 (https://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons [Edited]

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.

Better Business Bureau Five Star Review

––––––––––––––––––––––––––––––––––––––––––––––––––

Recent Better Business Bureau Client Review

Scorecard: 31 five star reviews. Zero complaints.

A+ rating. Accredited since 1991.

“We were first time gold investors. In search for information we came across their web site, which is excellent. When we contacted them, Jonathan Kosares lead us through the process. He provided information, suggested gold coins, but did not direct how we invested. He is always available to answer questions. The service has been excellent. Their business practices have been outstanding. We have absolute faith the company. They are the best investment company we have ever dealt with.”

John G.

[Link]

USAGOLD Recommendation: The precious metals industry is unique in the financial industry in that it is not subject to oversight or regulation by third-party government entities like the SEC or CFTC. As such, marketplace forums and feedback sites often serve as a replacement for investors attempting due diligence. While several options can be found, by far the most impartial and least susceptible to vested influence is the Better Business Bureau. When looking at a company’s BBB profile, don’t focus solely on the rating. To be honest, pretty much everybody has an ‘A’ or ‘A+’ rating. What is far more important to assess is the number and nature of complaints, number and caliber of positive and negative reviews, longevity with the BBB, as well as the number of ‘stars’ given a company through the actual customer review system.

––––––––––––––––––––––––––––––––––––––––––––––––––

Short and Sweet

––––––––––––––––––––––––––––––––––––––––––––––––

Is Buffett wrong about gold?

“While I very often agree with Warren Buffett’s views regarding, for example, the level of cash in portfolio or migration from growth to value stocks,” says Independent Trader for ETF Trends, “I absolutely can not agree with what he wrote in the letter to shareholders about gold, once again showing how badly it performs in comparison to the US shares.” The article goes on from there to do a good job of debunking Buffett’s latest attack on gold – one of many he has conducted over the years – while drawing on cyclical analysis to lay out a solid longer-term future for the metal. It concludes with the opinion that Buffett’s stance on gold is “part of a deal with the establishment of the United States.”

That could be true, but it could also be little more than an old professional bias on Buffett’s part going back decades combined with a classic talking of one’s book. We counter with a single chart that refutes his arguments at a glance. It tells the story of gold and stocks in the times in which we live – the historically distinct fiat money era that began in 1971 – not some other timeline that carries little relationship to the present. To make a very long story short, gold has appreciated 3,399% since January 1971. Stocks have appreciated 2,884%. What’s more stocks are bumping against all time highs while gold looks like it might be in the early stages of a new bull market run.

Repost from 2/20/2020

______________________________________________

The Great Silver Rush of 2016

Global investors snapped up a record 89.6 million one ounce silver coins in 2015, according to USAGOLD’s annual survey of global bullion coin sales, and the strong demand has continued at a comparable pace in 2016. The U.S. Mint reports sales of just over 30 million one-ounce silver American Eagles thus far this year with another big demand pick-up in October. American Eagle sales are just one component of our four coin annual grouping and a bellwether for the rest of the global market. We suspect that once we compile the statistics from the four top mints for 2016, the chart will show volumes approaching the record performance of last year.

As you can see from the chart, demand for silver bullion coins grew significantly after the 2008 financial crisis and never returned to pre-crisis levels. The persistent demand over the period indicates lingering concerns among investors about the economy and continuing worry about the potential for a similar crisis at some future date.

Coin demand is only one segment of the burgeoning market for silver. Demand through silver ETFs is also running at record levels with a total of 938 million ounces now in aggregate holdings. ETFs are a favorite among major investment funds and institutions.

Chart courtesy of goldchartsrus.com/Nick Laird

As you can see by the chart immediately below, China has put its foot on the accelerator with respect to its silver purchases – a development widely neglected by the financial media. Take a look at the ramp-up of physical demand in China over the past two years (bottom bar chart). China’s quiet, nascent interest gives credence to silver’s graduation from commodity status to a monetary metal utilized by many investors as an asset of last resort, i.e., the other metal, besides gold, that separates itself from the pack as an asset that is not someone else’s liability. China, the largest single source of silver demand in Asia, is buying silver as a means to augmenting its attention-grabbing gold acquisition program.

Chart courtesy of goldchartsrus.com/Nick Laird

Past supply disruptions for silver Eagle coins signal more of same for future

The U.S. Mint reports sales for the silver Eagle would have been much higher in 2015 if it could have secured more coin planchets. Planchet manufacturers have consistently been unable to supply enough blanks to meet the extraordinary demand over the past several years. The mint suspended silver Eagle sales this past July when a sharp price decline generated huge demand among investors. It did not begin delivering wholesaler orders again until mid-August.

The U.S. Mint has suspended wholesale allocations for one or both metals in 2009, 2011, 2013, 2014 and 2015. Since the 2008 crisis, there have been numerous stoppages at other national mints in the face of strong, unprecedented investor demand for both gold and silver bullion coins that depleted stocks. As a result, worries about potential supply disruptions consistently haunt the bullion coin market.

Bill Bonner, the long-time market analyst who founded the Agora publishing empire, recently warned investors about the potential for further disruptions. Bonner focuses on gold but his warning could just as easily apply to silver:

“[T]here will be one important difference between the new super spike and what happened in 1980. Back then, you could buy gold at $100, $200, or $500 per ounce and enjoy the ride. In the new super spike, you may not be able to get any gold at all. You’ll be watching the price go up on TV but unable to buy any for yourself. Gold will be in such short supply that only the central banks, giant hedge funds, and billionaires will be able to get their hands on any. The mint and your local dealer will be sold out. That physical scarcity will make the price super spike even more extreme than in 1980. The time to buy gold is now, before the price spikes and before supplies dry up.”

If you are planning to buy silver – particularly if you are buying for a longer-term retirement plan – it might make sense to secure the metal now, while it can still be purchased at favorable prices and the market is functioning normally. If we do encounter another shortage, in all likelihood buyers will faced with three problems – rising prices, increased premiums and lack of availability.

There is an old truism about the precious metals market that applies to the current environment:

The time to buy gold and silver is when the markets are quiet. Apparently, as seen in these charts, a good many silver investors around the world (including some major hedge funds and financial institutions) have already taken that advice to heart.

This final chart shows the performance of silver relative to other investments thus far this year. It ranks fourth as of this posting and it has been as high as second. As you can see, silver has quietly gone about its business of providing a strong return while its more widely-publicized competitors, like stocks and bonds, have languished. (Note also gold’s strong performance.)

China meltdown: “Its impact could be the worst the world has ever seen.”

China meltdown scenario: World economy sent into a tailspin

OPINION/Daiwa Securities

“We have already stressed that the scenario discussed in the previous section is the optimum or bestcase scenario. What is just as likely or possibly more likely to occur is the following. If the expected growth rate declines and the progress of the capital stock adjustment causes the bad debt problem to become even more serious, the economy could spiral out of control, lapsing further into a meltdown situation. Of all the possible risk scenarios the meltdown scenario is, realistically speaking, the most likely to occur. It is actually a more realistic outcome than the capital stock adjustment scenario.

The point at which the capital stock adjustment is expected to hit bottom is at a much lower point than in the previously discussed capital stock adjustment scenario. . . [T]he actual economic growth rate will continue to register considerably negative performance. If China’s economy, the second largest in the world, twice the size of Japan’s, were to lapse into a meltdown situation such as this one, the effect would more than likely send the world economy into a tailspin. Its impact could be the worst the world has ever seen.“

From a report issued by Daiwa Securities, Japan’s second largest stock brokerage, titled “What Will Happen if China’s Economic Bubble Bursts?” (PDF link dated 9/10/15)

Latest News & Views now available

Reflections in a golden eye

Confluence of events drives renewed investor interest

The gold and silver markets are experiencing very strong investor interest and demand. For the gold investment industry, this past summer has been one of the busiest on record. This issue concentrates on the factors driving this interest and speculates on what the future might hold as we move into precious metals’ traditional September through January busy season.

News & Views is available free of charge and you can sign-up here to receive the latest issue.

GoldCorp CEO sees strong prospects for gold

Bloomberg/Video/8-17-2015

Chuck Jeannes agrees with our assessment that the imploding Chinese stock market is good for gold and for the same reasons.

USAGOLD once again rated one of top ten best gold blogs

We are a little late in getting this posted, but once again CommodityHQ rates this page one of the top ten best gold blogs. At number nine overall, we find ourselves in good company and among colleagues and friends. We would like to thank CommodityHQ for rating us so highly.

In an era of purchased ratings and bogus rating services (often created clandestinely by the website ranking itself at the top), it is gratifying to rank highly in one where the results are arrived at independently, and where the websites ranked had no influence on the outcome, except by the strength of what they have to offer.

We invite you to bookmark the USAGOLD Daily Blog for quick, easy access. Pete Grant, our resident economist, begins updating this page in the early hours of the morning. We give special attention to getting news and opinion posted quickly (including our own views on the matter at hand) whenever something important happens in the gold market.

From CHQ (6-24-2015):

These blogs are among the most active, both on this list and in the industry.

1. King World News: The gold section of this broad-based website will keep you up to date on all of the news surrounding the yellow commodity.

2. Gold Investing News: Hands down one of the best gold resources on the internet, featuring daily analysis on the metal.

3. Gold Review: A news based source that features multiple updates per day and breaking news in the gold industry.

4. 321 Gold: An extremely active website that focuses on gold news.

5. 24 Hour Gold: Another go-to source for all things gold, including pricing, news, and analysis.

6. ZeroHedge: One of the most popular websites, ZeroHedge often writes about gold and the surrounding industry.

7. GoldSeek: Dedicated to bringing you the most up-to-date gold news.

8. TF Metals Report: A site focused on both gold news and analysis.

9. USAGOLD: One of the best places to get updates on your favorite precious metal.

10. JLN Metals: Though not specifically catered to gold, a fair amount of posts are dedicated to the world’s most popular precious metal.

11. Mineweb: A well-known financial resource that includes multiple daily posts concerning gold. \

12. Resource Investor: One of the best places to keep up with the overall financial world, including gold.

13. Silver Gold Market News: A great resource that aims to be the best at bringing readers developing news in the precious metals world.

14. CommodityOnline: A great site that brings you all aspects of the commodity world.

15. The Daily Crux: A website that is jam-packed with gold news and analysis on a daily basis along with other popular financial instruments.

16. TradingFloor.com: A massive trading website with a strong gold section.

17. Economy Collapse Blog: An excellent resource for controversial posts covering gloomy economic forecasts as well as dollar and gold manipulation.

18. Hard Assets Investor: Another one of the most prominent commodity sites on the web with a heavy focus on gold.

August News & Views just released

The gold investment demand juggernaut

Public buys dips, saves gold for rainy day

What stands out to you in this chart? Read this month’s issue of our newsletter to find out what we found interesting about it. We also cover gold mining’s existential crisis and what it means to gold coin and bullion owners and publish an interesting Q&A exchange with a prospective client.

FT’s Sanderson headlines trader suspicion of gold market drop

Traders suspicious of bear raid in gold amid low liquidity

“Traders and analysts said, however, that the nature and timing of the selling suggested there was more at play than investors responding to a slight strengthening in the US dollar or lower central bank purchases. ‘There is to my mind no coincidence that this happened in the quietest, thinnest period of the week,’ said David Govett, head of precious metals at Marex Spectron in London. ‘Anyone who trades gold knows not to put any volume into the market at this time, unless they deliberately want to move it in a big way.'”

The Shanghai stock crash and China gold demand

What it means for the future of the gold market

A NEW IN-DEPTH SPECIAL REPORT

by Michael J. Kosares

Founder, USAGOLD

Author, The ABCs of Gold Investing: How To Protect and Build Your Wealth With Gold

“This emphasis on physical pricing in Shanghai, particularly when the new Shanghai Fix comes into play later this year, could signal the birth of a whole new gold market unlike anything we have experienced since the United States detached the dollar from gold in 1971.”

Chart courtesy of Market Realist, Shanghai Gold Exchange Withdrawals

Mint suspends American Silver Eagle sales

ALERT!

We have received word through an industry source that the U.S. Mint temporarily suspended sales of American Silver Eagles due to strong investor demand. It intends to resume sales in two weeks. The Mint sent out an announcement to this effect earlier today.

USAGOLD has experienced strong demand for both gold and silver coin and bullion items over the past two weeks. Today’s price drop has encouraged another wave of interest. At the moment, the production shutdown has NOT extended to American Gold Eagles.

Typically, these production shutdowns translate to higher premiums for contemporary bullion products. At this time, we have limited availability of American Silver Eagles, priced right and our normal quick delivery times are still in place. Please call if you have an interest in reserving items from the remaining inventory.

News & Views Reprint Series – Important in-depth study now available

Open Access / Full Version

In Gold We Trust 2015

by Ronald-Peter Stoferle and Mark J. Valek, Incrementum AG, Lichtenstein

Editor’s note: Annually Incrementum, the Lichtenstein investment house, publishes the most comprehensive gold study available. In Gold We Trust 2015 comprises 140-pages of top-drawer analysis for those wondering whether or not gold should continue (or begin) to play a significant role in their financial plans. That study is published in the clear at the link to the left. We highly recommend at least paging through this important work, if not fully digesting it.

The following is an important excerpt from the study’s conclusions:

“We are strongly convinced that we are now close to a fork in the road. Over the coming three years, a paradigm change is likely to become evident in the markets, quite possibly including rising inflationary trends. We believe the following scenarios to have the highest probability:

Scenario I: The current economic cycle nears its end and the fairy tale of a self-sustaining recovery is increasingly questioned by market participants. This leads to a significant devaluation of the US dollar relative to commodities, since the Fed – as it has stressed time and again – will once again employ quantitative easing or similar interventions if occasion demands it. In this case gold would benefit significantly from wide-ranging repricing in financial markets. A stagflation-type environment would become a realistic alternative in this scenario, something that is currently on almost no-one’s radar screen.

Scenario II: Rising yields lead to an increase in credit creation and an increase in money velocity (= decline in the demand for money). Economic activity picks up, is however accompanied by accelerating price inflation. In this scenario, both financial assets (with the exception of bonds) and real assets (such as gold) would benefit in nominal terms.

Scenario III: The system hasn’t become any healthier since 2008, but has in fact become more fragile in many respects. Due to further concentration in the banking sector, the balance sheets of the largest banks have grown enormously. The volume of outstanding derivatives has continued to grow, with many off-balance sheet positions. In addition, the geopolitical situation hasn’t been this tense since the end of the cold war. The probability of a “black swan” event striking is therefore in our opinion higher than it has been in a long time. In this type of scenario, gold would likely emerge as a beneficiary as well.

Conclusion: All in all we are convinced that gold remains in a secular bull market, which is likely close to a renaissance. Should this assessment be correct, we would expect to see a trend acceleration in the coming phase. As discussed above, a variety of scenarios is possible which would mostly have positive effects on the gold price. We believe that this is a good time to provide a concrete time horizon for our long ago formulated price target. In light of the perspective discussed above, we have decided to set a time horizon of three years for our long term gold price target of USD 2,300.

Emphasis added. Reprinted with permission

• • • Also added to USAGOLD’s Gilded Opinion Library – a repository of timeless classics on matters of importance to gold owners.

Gold ownership as a lifestyle decision

‘It shone with the placid certainty of received tradition’

by Michael J. Kosares

“It is related of the illustrious Sandy McHoots that when, on the occasion of winning the British Open Championship, he was interviewed by reporters from the leading daily papers as to his views on Tariff Reform, Bimetallism, the Trial by Jury System, and the Modern Crave for Dancing, all they could extract from him was the word ‘Mphm!” Having uttered which he shouldered his bag and went home to tea. A great man. I wish there were more like him.” – P.G. Wodehouse

Then there’s the issue of summertime and whether or not the world can be put on hold while thoughts turn to the configuration of one’s golf swing, landing the fly in precisely the right location on the stream, or simply counting waves at the seaside. To a large degree we side with the McHoots school on the issue of summertime, but we also know that summertime can produce its unpleasant market surprises – dark thunderstorms that travel across the investment landscape wreaking havoc far and wide.

Bank of America Merrill Lynch was thinking just that when it warned its clients of a “grim summer” ahead and that they should consider moving money out of stocks and bonds and into gold and cash. A good many others have issued similar warnings. “Open your computer or smartphone these days,” says MarketWatch’s Mitch Tuchman, “and the stock market warnings fly by in giant type — ‘Summer Crash Imminent’ and ‘Sharp Correction Ahead'” blink at the top of nearly every investing website.

Though the temptation might be great to retreat unphased into the comforts of summertime, this might not be the year to do it. Of course, the best course of action is to diversify one’s holdings in such a way that summer’s pursuits need not suffer fully the consequences of that late afternoon window rattler. Stock market practitioners generally agree with that apporach, but almost universally fail to mention the one item that truly gets the job done for its owners – a tidy cache of gold and silver coins.

A telephone call from an old client and friend

Along these lines, I had the happy occasion recently of receiving a telephone call from an old client and friend – a physician safely retired near the sea and alongside one of the South’s oldest golf clubs. It was good to hear from this student of the markets – one of life’s steady and thoughtful practitioners. McHoots probably would have counted Doc, as I will call him, a friend, since he thinks much like the character so skillfully described by Mr. Wodehouse. Back at the turn of the century, Doc foresaw much of what would happen economically in the United States and purchased what he considered enough gold to see him through it.

Vanity Fair’s Matthew Hart offers this masterfully written overview of those early years of the 21st century:

“An ounce of gold cost $271 in 2001. Ten years later it reached $1,896 – an increase of almost 700 percent. On the way, it passed through some of the stormiest periods of recent history, when banks collapsed and currencies shivered. The gold price fed on these calamities. In a way, it came to stand for them: it was the re-discovered idol at a time when other gods were falling in a heap of subprime mortgages and credit default swaps and derivative products too complicated to even understand. Against these, gold shone with the placid certainty of received tradition. Honored through the ages, the standard of wealth, the original money, the safe haven. The value of gold was axiomatic. This view depends on a concept of gold as unchanging and unchanged—nature’s hard asset.”

“I still have all the gold I purchased from you,” he said simply. “Every ounce of it. It’s now worth well-over $2,000,000. I want to thank you again for your book and your advice. It made a great difference to me as you may have gathered.”

(Ed note: At the interim top – the $1896 Matthew Hart mentions above – Doc’s holdings reached a value well over $3,000,000!)

“That,” I said, “is the kind of story we enjoy hearing around here, Doc. I’m happy for you. Happy gold could help you like it did.”

“We had some very interesting conversations back in the day,” he said with a chuckle, “and gold did for me what we thought it would, what you said it would.”

I mentioned to him that the book to which he referred, “The ABCs of Gold Investing – How to Protect and Build Your Wealth with Gold,” was now in its third edition and still introducing people to the advantages of owning the metal and advising readers how to go about it. The conversation then drifted to other of life’s pursuits for both of us and ultimately to the purpose of his telephone call – a fresh gold transaction. We completed our business and I left the conversation with a strong sense of satisfaction. We get a steady stream of phone calls like Doc’s, but it is always good to hear real-life tales about gold’s role in preserving our clients’ assets.

The fact of the matter, though rarely discussed, is that gold ownership has as much to do with personal philosophy as it does finance and economics — though by that I do not mean to diminish the importance of financial markets, or politics for that matter, in our everyday lives. Things, though, do need to be kept in perspective and gold helps toward that goal — once one understands its true nature. In many ways, gold ownership, as Doc would likely attest, is a rational portfolio decision that suits the times, but it is also a life-style decision. As Richard Russell, the venerable purveyor of Dow Theory Letters puts it, “I still sleep better at night knowing that I hold some gold. If or when everything else falls apart, gold will still be unquestioned wealth.” And one that helps you spend a quiet summer enjoying family and friends no matter what happens on Wall Street or in Washington D.C.

If you appreciate the kind of gold-based analysis you just read, you would probably enjoy and gain from our e-mail newsletter service which sends you the link whenever a new issue is published. It comes free of charge and you can opt out of the service at anytime. Last, we will not deluge you with emails.

The rest of the July issue offers much to ponder . . . .

–– To receive it and register for future editions, go here. ––

A little USAGOLD history. . . . Pictured are News & Views hard copies from 1999 just before gold began its secular bull market. News & Views first made its appearance at a time when gold-based publications were few and far between. The “Big Breakout” headlined in the November, 1999 issue refers to a price jump from $260 to $330 per ounce. Your editor sees a good many similarities between that period and now.

Bank holiday in Greece Monday

Where there’s smoke. . . . .there’s (ahem) smoke. (We haven’t gotten to the fire stage yet.)

“Greek leaders planned to shutter their banks on Monday amid last-ditch discussions about their nation’s economic future, as panicked citizens tried to pull their money from their accounts while they still were able.”

Gold up $10.50 . . . .at $1186 late Sunday.

P.S. They are also closing the stock exchange Monday.