Author Archives: USAGOLD

“Systemic event could rock market . . .”

Andrew Oxlade/The Telegraph/6-20-2015

“Ian Spreadbury, who invests more than £4bn of investors’ money across a handful of bond funds for Fidelity, including the flagship Moneybuilder Income fund, is concerned that a ‘systemic event’ could rock markets, possibly similar in magnitude to the financial crisis of 2008, which began in Britain with a run on Northern Rock.

‘Systemic risk is in the system and as an investor you have to be aware of that,’ he told Telegraph Money.

The best strategy to deal with this, he said, was for investors to spread their money widely into different assets, including gold and silver, as well as cash in savings accounts. But he went further, suggesting it was wise to hold some ‘physical cash’, an unusual suggestion from a mainstream fund manager.”

Carl Icahn: Trump’s right, we’re in a major bubble

“I am knowledgeable concerning markets and believe Donald is completely correct to be concerned that we have ‘a big fat bubble coming up. We have artificially induced low interest rates.’ I personally believe we are sailing in dangerous unchartered waters. I can only hope we get to shore safely. Never in the history of the Federal Reserve have interest rates been artificially held down for so long at the extremely low rates existing today. I applaud Donald for speaking out on this issue – more people should.”

Please see posted below (Fed cracking the whip will no longer work to keep the tiger sitting on its stool). The Fed is the chief architect and project manager of that “major bubble.”

The next great bull market: Gold $25,000

Elliott Wave analyst says coming bull market could last fifty years

OPINION

Originally published at MarketWatch June 5, 2015.

Editor’s note: What caught my eye about this analysis was not just the $25,000 target, but the fifty year timeline. It infers, if Mr. Gilburt is correct, a long-term Kondratieff-like process rather than an event. Of course, such a process will not occur in a vacuum. In fact, it suggests a major, long-term reconfiguration of the monetary system as we know it – an historical trend best hedged by holding the physical metal in the form of coins and bullion as an alternative savings vehicle. Said physical ownership should be established in concert with, or before, exploring any speculative opportunities. MK

by Avi Gilburt

Suppose someone approached you in the year 2000, when the price of gold was around $250 an ounce and suggested that it would be worth almost eight times its current value within the next decade. I am sure most people would have thought that person to be less than credible making such an outrageous market call. Think about it. An asset being expected to multiply by eightfold within a decade? But as we all know now, gold went from $250 an ounce to just over $1,900 an ounce in just that amount of time.

What if I was to tell you that gold could make another such run over the next decade plus? Does it seem that outrageous now? Well, I think the math shows it can and will, with the price of gold futures surpassing $25,000, and more specifically for this column, the price on the Gold Bug Index HUI, -0.85% eclipsing 15,000. But let’s take a look back before we go forward.

It’s the middle of 2011. Gold was rising parabolically — some days even advancing by $50 per day — and heading over $1,900. Breaking the $2000 mark to most was a sure thing.

Think if someone walked up to you then and stated that the price of gold would be cut in half within four years. It would be an outrageous market call. In many ways, it would be no different than the person suggesting that gold would go from $250-$1900 within a little over a decade.

Well, in August 2011, I was that person. In fact, in my first gold column on Seeking Alpha, I warned investors:

“Since we are most probably in the final stages of this parabolic fifth wave ‘blow-off-top,’ I would seriously consider anything approaching the $1,915 level to be a potential target for a top at this time.”

At the time, everyone was so intoxicated with expectations of eclipsing the $2,000 mark that they failed to see the impending top. As we now know, gold topped in September of 2011, at just under $1,921, which was within $6 dollars of my target. We then began this multi-year correction within which we now find ourselves.

Many are probably wondering how I came up with such an accurate target for a top to a market that was rising parabolically. My answer is that the topping target was calculated using a 200-year Elliott Wave and Fibonacci mathematics study. To make this market call even more prescient, before we even topped, I identified the downside targets for gold within the correction I expected. I was looking for gold to drop from the 1900 region, down to a minimum of $1,400 an ounce, but, more likely, the $700-$1000 region.

For those who still question how well Elliott Wave can really provide long-term accurate predictions of market direction relative to all other methodologies, allow me to present you with the following prediction made by Ralph Nelson Elliott in August of 1941:

“[1941] should mark the final correction of the 13 year pattern of defeatism. This termination will also mark the beginning of a new Supercylce wave (V), comparable in many respects with the long [advance] from 1857 to 1929. Supercycle (V) is not expected to culminate until about 2012.”

For those of you who do not understand this quote, Elliott was predicting the start of a 70-year bull market in the face of World War II raging around him. Quite an amazing prediction, no?

Let’s come back to the year 2015. Now, someone stands before you and tells you that gold will be worth almost 10 times the current value within a decade. What would you think?

I stand before you today, almost feeling like Elliott did back in 1941. Yes, in 2015, I am seeing this correction finally completing (but at much lower levels) and starting a major bull market phase that can last the next 50 years.

So, while many that have read my analysis over the last three years have viewed me as being the staunchest of bears in the metals world, I will be switching sides and moving strongly into the bull camp, especially after we see the next and final decline which will likely take place over the next half a year.

In fact, if you look at the Gold Bugs Index HUI, -0.85% chart linked at the bottom of this column, you will see that our projections are calling for an almost tenfold increase in this index over the next decade or so, which will likely increase to a fifty-fold increase in the index over the next 20 or so years, and well beyond that in 50 years. Ultimately, we see the HUI over 15,000.

Yes, I know that this is quite a bold prediction. However, please remember that, for me, it is all a matter of mathematics and nothing more.

Now, let’s put this market prediction within the context of Elliott’s back in 1941. At that time, the Dow Jones Industrial Average was around 100. Yes, you heard me right. 100. Seventy years later, we are at a multiple of more than 180 times that baseline. Our base line in the Gold Bugs Index will likely be in the 100-125 region when it finally bottoms. So, based upon this relative perspective, does it seem so unreasonable to foresee this index as high as 15,000 within 50 years?

When the market was setting up to top in 2011, I was going so far as to even be looking for the market to be cut in half. Now, in 2015, I am likely going to begin looking up — especially after we strike the lower lows I still expect. I wonder if I will be standing alone again. But with the upside truly no different than the impending major bull market that Elliott foresaw in 1941, I would hope that some of you will be joining me for this ride. Yes, my friends and fellow investors, we are now on the cusp of the next major bull market in the investing world.

See chart illustrating the wave count on the Amex Gold Bugs Index (HUI).

________________

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

Reprinted with permission.

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Steer clear of ‘Burnished/’Uncirculated’ American Eagles (MS70 First Strike/Early release) and “off market, specialty mint items.”

Back in 2007, we penned a consumer alert posted at our blog site entitled, “Beware MS70, MS69, PF70 “Perfect” + “Certified” Gold & Silver American Eagles & American Buffalos” To this day, it remains the first result google produces when an individual searches MS70 Buffalos or MS70 Eagles – a result we’d like to believe has saved many would be precious metals investors from making an expensive mistake. That said, it hasn’t prevented certain members of the industry from continuing to offer these products, and despite our efforts, their ‘success’ has emboldened them as they have now begun to ‘innovate’ in this field, offering a whole new line of products that provide ambiguity in pricing and allow for higher dealer margins. So, it would appear that the time has come to revisit this article, and to expand to include the latest and ‘not-so’ greatest products we think precious metals buyers should be on guard against.

1. Burnished/’Uncirculated’ American Eagles (MS70 First Strike/Early release)

Where to begin. At the moment of this writing, you can buy these coins direct from the U.S. mint for $1475.00. The first coins with a 2015 date are set to be released in the coming weeks, so you’re going to start hearing about these more and more. So what is a Burnished/’Uncirculated’ American Eagle?

According to the U.S. mint:

“The term “uncirculated” refers to the specialized minting process used to create these coins. Although they are similar in appearance to American Eagle Bullion Coins, uncirculated quality coins are distinguished by the presence of a mint mark, indicating their production facility, and by the use of burnished coin blanks, which are hand-fed into specially adapted coining presses one at a time.

Each American Eagle Uncirculated Coin is carefully inspected before it is encapsulated in plastic. With its pristine finish now protected, each American Eagle Uncirculated Coin is placed in a protective outer box. A Certificate of Authenticity is included with each coin.”

In other words, put simply, they are all perfect. To be sure, I don’t fault the mint for making a product that is a more attractive strike than the traditional bullion coin. In fact, we even think purchasing these coins for aesthetic/owner enjoyment purposes is reasonable. As we often say to our clients, if you want to buy a coin or two to own for your own personal enjoyment, go for it.

Where we do find fault is if someone is trying to sell you one of these as an ‘early release’ or ‘first strike’, or perfect ‘MS70’ for a considerable premium to what the mint is charging that day. You can be sure that whatever that difference is, its going straight to the pocket of whoever is selling it to you.

To see what the mint is charging for these on any given day, visit here: http://catalog.usmint.gov/coin-programs/american-eagle-coins/?_ga=1.20401534.732613573.1408386463

Which leads us to our second, ‘Buyer Beware’ product:

2. Off market, specialty mint items. More and more, mints have begun cooperative efforts with dealers to develop unique and exclusive product offerings – what essentially amounts to modern commemoratives. The advantage to dealers in these products is that a would-be buyer has no basis of comparison. A dealer can deliver a sales pitch along these lines: “We have cooperated with mint x to develop a superior quality specialty product. Only 3000 coins were struck, so they are of inherent rarity.” They may even throw in some real motivators like, “These are selling out fast, and we already have commitments for 2000 coins, so if you don’t act now, they will all be gone.” Or, “With this kind of rarity, these are going to increase in value faster than the gold price, and your returns will be exponential.” We could go on, but you get the point. Our advice would be very simple here: If someone is offering you a product you cannot locate elsewhere, a product that you cannot make a cost comparison to ensure a competitive price, don’t walk the other direction, RUN.

The Gods of the Copybook Headings

by Rudyard Kipling

AS I PASS through my incarnations in every age and race,

I make my proper prostrations to the Gods of the Market Place.

Peering through reverent fingers I watch them flourish and fall,

And the Gods of the Copybook Headings, I notice, outlast them all.

We were living in trees when they met us. They showed us each in turn

That Water would certainly wet us, as Fire would certainly burn:

But we found them lacking in Uplift, Vision and Breadth of Mind,

So we left them to teach the Gorillas while we followed the March of Mankind.

We moved as the Spirit listed. They never altered their pace,

Being neither cloud nor wind-borne like the Gods of the Market Place,

But they always caught up with our progress, and presently word would come

That a tribe had been wiped off its icefield, or the lights had gone out in Rome.

With the Hopes that our World is built on they were utterly out of touch,

They denied that the Moon was Stilton; they denied she was even Dutch;

They denied that Wishes were Horses; they denied that a Pig had Wings;

So we worshipped the Gods of the Market Who promised these beautiful things.

When the Cambrian measures were forming, They promised perpetual peace.

They swore, if we gave them our weapons, that the wars of the tribes would cease.

But when we disarmed They sold us and delivered us bound to our foe,

And the Gods of the Copybook Headings said: “Stick to the Devil you know.”

On the first Feminian Sandstones we were promised the Fuller Life

(Which started by loving our neighbour and ended by loving his wife)

Till our women had no more children and the men lost reason and faith,

And the Gods of the Copybook Headings said: “The Wages of Sin is Death.”

In the Carboniferous Epoch we were promised abundance for all,

By robbing selected Peter to pay for collective Paul;

But, though we had plenty of money, there was nothing our money could buy,

And the Gods of the Copybook Headings said: “If you don’t work you die.”

Then the Gods of the Market tumbled, and their smooth-tongued wizards withdrew

And the hearts of the meanest were humbled and began to believe it was true

That All is not Gold that Glitters, and Two and Two make Four

And the Gods of the Copybook Headings limped up to explain it once more.

As it will be in the future, it was at the birth of Man

There are only four things certain since Social Progress began.

That the Dog returns to his Vomit and the Sow returns to her Mire,

And the burnt Fool’s bandaged finger goes wabbling back to the Fire;

And that after this is accomplished, and the brave new world begins

When all men are paid for existing and no man must pay for his sins,

As surely as Water will wet us, as surely as Fire will burn,

The Gods of the Copybook Headings with terror and slaughter return!

_____________

USAGOLD note: William A. Levinson’s interpretation of Kipling’s poem from American Thinker magazine:

“All of our economic woes, more or less, have come from defiance of what Rudyard Kipling called the Gods of the Copybook Headings. These are the nonpartisan, scientific, and implacable laws of economics and human behavior on which Henry Ford elaborated as follows:

Most of the wisdom of the world was in the copy books. The lines we used to write over and over again, the homely old maxims on which we practiced to obtain legibility of our p’s and q’s, were the essence of human wisdom. (Ford Ideals, 1922)

The implacable laws in question include the basic economic concept that no system can deliver more value to its stakeholders than it produces. Ford’s mastery of these principles, along with what we now call lean manufacturing or the Toyota production system, built a multibillion-dollar enterprise and made the United States the wealthiest and most powerful nation on earth. Ford prospered by acting in accordance with the Gods of the Copybook Headings, while Kipling described what happened to those who went against them. . . .

The ‘Gods of the Market Place’ refers to temporary fads like Dutch tulip bulbs, dot-com stocks, mortgage-backed securities, and, if the Obama administration has its way, carbon credits. These lesser gods of Kipling’s pantheon are temporary, ephemeral, and mortal, while those of the Copybook Headings are eternal and immutable.”

2001 – A Gold Odyssey

by Michael J. Kosares

“Adjusted for the 1980 inflation measure the gold price is approaching its bear market low of 2001. In fact, gold is now below the 1975 price when it became legal to own it again! . . . . . . . .Don’t worry about the current rangebound price. Buying now represents tremendous value and tremendous protection against the next economic crisis.” – Jeff Clark/Casey Research

A healthy skepticism.

Insight.

Belief.

Courage.

Those were the four characteristics almost all gold investors had in common in 2001. I can tell you that from personal experience as we helped a good many become gold owners in those times and listened carefully to what they had to say. Gold was stuck under $300 per ounce. Anti-gold rhetoric was all the rage in the mainstream financial media. The general public was high on stocks and apathetic about gold ownership. Stocks would rise forever, they thought, and gold would never rise again. The prevailing psychology in those years, though, was fertile ground for the contrarians and true-believers who took advantage of it by accumulating gold at what turned out to be bargain basement prices – many in large quantities.

They understood that the economy and financial markets were not all they were cracked up to be. (A healthy skepticism) They understood the inviolable law that markets cycle. (Insight) They understood gold’s role in the long-term portfolio. (Belief) They acted on that belief despite much opposition and criticism. (Courage)

Years later, when the financial markets reversed and finally went into the tank, none in this group were heard to mumble excuses, like “We didn’t see it coming” or complained that “they were not warned.” They saw it coming. They acted. When it was all over, few acknowledged this group’s vision. In turn, it stayed quiet, kept its own counsel. A good many invested enough to preserve their wealth while some some invested enough to, in fact, become very wealthy – even though their intentions for the most part were merely to preserve what they already had.

It seems we have come back to the place where we began. There are really only two kinds of people in the world when it comes to facing the potential for economic calamity, and I think most of us are aware of these psychological opposites. There are those who believe that the authorities are in full control of the situation and that all will end well, and then there are those, the more cautious among us, who hedge the opposite outcome. The first group will always hold the second with disdain, and the second will always see the first as lacking in common sense.

_____________

Benjamin Franklin once said that ‘Experience keeps a dear school, but fools will learn in no other, and scarce in that. . .’ A wise man, Mr. Franklin. . . .Kipling penned his own warning along these lines: “[T]he Dog returns to his Vomit and the Sow returns to her Mire, [a]nd the burnt Fool’s bandaged finger goes wabbling back to the Fire.”*

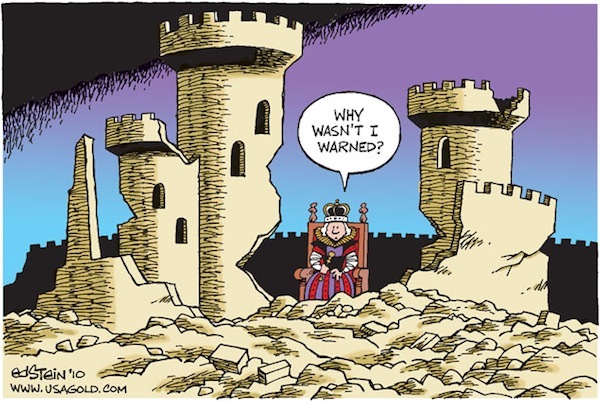

Speaking of “the Fire”, let me conclude with an Ed Stein cartoon published here at USAGOLD just after the 2008 debacle. If nothing else, it serves as a gentle reminder. Queen Elizabeth at the time had asked a group of economists at the London School of Economics “Why did nobody see it coming?” As mentioned earlier, some did see it coming.

* See The Gods of the Copybook Headings, Rudyard Kipling, Kipling Society, UK introduced to me by Chris Powell what seems too many years ago. (And also posted in full here with an interesting interpretation.)

______________________________________________________________

–– To register, go here. And thank you for your interest.

A little USAGOLD history. . . . Pictured are News & Views hard copies from 1999 just before gold began its secular bull market. News & Views was Review & Outlook’s popular predecessor at a time when gold-based publications were few and far between. The “Big Breakout” headlined in the November, 1999 issue refers to a price jump from $260 to $330 per ounce. Your editor sees a good many similarities between that period and now.

Strike gold on your smartphone!

With USAGOLD’s new mobile gold and silver market monitor

Included –

• Live spot prices for gold, silver, oil and the euro

• Live gold bullion coin prices

• Live silver bullion coin prices

• Daily, live gold chart

• Daily, live silver chart

• Live, running gold news and opinion from our London-based wire service

• Running gold-centric news and commentary via our Daily Blog

• Introductory gold and silver purchase information

We invite you to explore smartphone friendly USAGOLD Mobile. Don’t forget to bookmark.

And please remember: It is your purchase of gold and silver from USAGOLD that makes services like this possible.

One of the drivers. . .

. . .for gold’s uptick today might be this report:

India’s gold imports hit 125 tonnes in March / Reuters – Economic Times/4-10-2015

– 900 tonnes imported fiscal year ending 3/31/15

USAGOLD Note: When you take into account China’s imports, these become important numbers. With all the emphasis on China, India has been overlooked as a strong source of continuous demand. This article emphasizes the Hindu Akshay Tritiya festival, but the 36% (yoy) jump in imports could just as well indicate pent-up demand resulting from past import restrictions. If this pace continues – and it well could – India’s gold imports could nudge the 1500 tonne per year level – about 56% of annual mine production.

Review & Outlook – April, 2015

Reflections in a Golden Eye

Rejection, repatriation and redemption in the gold market

Caveat venditor

Let the seller beware! The German citizen/investor who put away a few rolls of 20 mark gold coins (.2304 tr ozs. shown below) in 1918 would have done so at 119 marks per ounce. By early 1920 the previous rapid inflation had suddenly given way to deflation. Had that gold owner decided to cash in on gold’s significant gains thinking runaway inflation was over, a 100,000 mark investment would have made him or her a millionaire. The glow, however, would have quickly worn off. By late 1921 the runaway inflation had resurfaced but now with a vengeance. Gold shot to 4,000 marks per ounce. By mid-1922 gold reached 10,000 marks per ounce and the wholesale price index went from 13 to 70. By late 1922, the roof caved in. Gold traded at 134,000 marks per ounce. In January, 1923, it cracked 1,000,000 marks per ounce. By midyear, it broke the 100 million marks per ounce barrier and at the peak of the hyperinflationary breakdown, it sold for over 100 billion marks per ounce. The individual who thought he or she had the cat by the tail and cashed-in his or her golden chips during the 1920’s deflation became a millionaire. In short order though, that millionaire became a pauper as wave after wave of hyperinflation washed over the German economy. One moral from this somewhat frightening tale is that becoming a millionaire or even a billionaire on one’s gold holdings was inconsequential. Another is not to give up one’s hedge until there is ample evidence that it is no longer needed. Momentary nominal profits can be illusory.

Caveat venditor!

Also:

New Fix same as the old Fix

Federal budget myths and reality

How gold benefits from the yuan’s challenge to the dollar

The potential effects of the gold repatriations on the rest of the market

Review & Outlook April Special Report. We welcome your visit.

Sign-up here for an e-mail alert when we publish the next issue of Review & Outlook