Gold in the Attic

Every once in a while, we rummage around USAGOLD’s creaky old attic and dust off a golden vignette from our storied past. Here is a longer piece that first appeared in our monthly client letter in December 2015. It considers how the celebrated British economist John Maynard Keynes might have reacted to the current economic predicament in which we find ourselves – particularly in light of the money-printing response to the coronavirus-related breakdown. Some have criticized me for lending credence to the work of Keynes, but I try to look past the politics to the man and his philosophy, and from there, make my own judgment as to the value of his work. This particular piece garnered a very large audience when it was first published, and it still resonates with readers six years later.

Keynes on the menace of printing money

How the celebrated economist might have structured his portfolio today

“I find myself more and more relying for a solution of our problems on the invisible hand which I tried to eject from economic thinking twenty years ago.” – John Maynard Keynes, 1946

Originally published December 2015

One wonders what Keynes might have thought of that declaration. What we came to call Keynesian economics in the years that followed had little to do with the economic picture the most celebrated economist of the 20th century had painted. The free-wheeling post-Bretton Woods system reached its zenith in the aftermath of the 2008 crisis under the baton of Fed chairman Ben Bernanke who directly monetized government debt to the tune of trillions of dollars, bailed out an incorrigible financial sector, and made saving at the bank a virtue of the past. When Keynes decried the debauching of the currency, this was exactly what he was talking about. Subsequently, central bankers the world over would follow Bernanke’s example.

Far from the laissez-faire economics Keynes endorsed at the end of his life, we have ended up with the exact opposite: A command economy directed by the state and fueled by the beneficent paper money machine of the world’s central banks. Today the world economy floats on a sea of paper money backed by nothing but the promises of the governments that issued it and with little in the way of policy options except to do more of the same. Debasing the currency is no longer something to hide in the back corners of central bank policy but to be trotted out in full view of everyone, including the financial markets. Countries, in fact, compete with each other to see who can devalue their currency fastest. As Richard Russell, the recently deceased critic of central bank policies, put it: “Inflate or die!”

Keynes would be buying gold hand over fist

How might Keynes, as famous for his investing prowess as he was for his advice to politicians, have reacted to these circumstances in his own investment portfolio? Writing in the Wall Street Journal, Richard Hurowitz, publisher of the Octavian Report, offers some interesting conjecture on that score:

“Keynes understood that sound money and stable exchange rates were necessary conditions for world prosperity and peace. Contrary to popular belief, he believed that currency devaluations were counterproductive in most cases, their benefits often outweighed by increased domestic costs and the undermining of sovereign credit. ‘There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency,’ Keynes observed in 1919. He consistently argued that a sound currency was critical to a functioning free economy. He understood that such a currency would ultimately create much greater wealth than the endless and vicious cycle of improvisational debasement we see playing out globally today.

Were Keynes alive today, he would likely be arguing along with German Chancellor Angela Merkel for more monetary discipline and a return to a more balanced international system. No doubt, however, his neo-Keynesian acolytes would be dismissing his concerns as hopelessly outdated and reactionary.

Keynes was an economic theorist, but he was also a clear-eyed market analyst and a passionate and committed speculator for his own account and for Cambridge University. If he took in today’s economic vista of near-zero interest rates and quantitative easing, it is clear that he would be buying gold hand over fist—regardless of what his disciples might think.”

The economic consequences of inflationism

Those of you who read this newsletter regularly will recognize the quote from Keynes about the dangers of currency debasement. It occupies a place of prominence at the top of the page (see upper left column). Keynes first penned those words as a young man in The Economic Consequences of Peace (1919) – a treatise published in the aftermath of World War I. It argued leniency for defeated Germany and its allies, but it also warned of what he called the “menace of inflationism” in the defeated central European countries.

Here, for the record, is that quote in its entirety:

“By a continuing process of inflation governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.

Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

It will not escape the notice of the reader that Keynes’ description of the inflationary process eerily fits the set of social and economic circumstances in which we find ourselves today. Whether or not the advanced economies will proceed from asset inflation to rapid price inflation – remains to be seen, but we should not overlook the fact that the ground has been prepared and the seed sown. In 1919, when Keynes wrote those words, money printing in Germany, its point of reference, had yet to produce price inflation. In fact, the German economy experienced deflation in the period 1920-1921. In the end, though, Keynes was right. By 1922 the hidden forces of economic law were unleashed. Hyperinflation gripped the German economy suddenly and with a vengeance.

I believe Hurowitz is right about Keynes and gold. He would have understood the wolf hammering on the door and adjusted accordingly – both in his personal finances and as an advisor to governments. I keep coming back to former Fed chairman Alan Greenspan’s comment last October that “Gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments.”

__________________________________________________________

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.

Gold in the Attic

Every once in a while we rummage around USAGOLD’s creaky old attic and dust-off a golden vignette that still has relevance in the here and now – particularly as investors assess the potential consequences of the massive money-printing response to the coronavirus breakdown. This piece appeared originally on this page in November 2015. It tells the interesting tale of a scrupulous saver from some 1700 years ago attempting to shelter his or her wealth against the process of inflation.

How 4,000 Roman coins found buried in a

Swiss orchard reinforce gold ownership today

“The coins’ excellent condition indicated that the owner systematically stashed them away shortly after they were made, the archaeologists said. For some reason that person had buried them shortly after 294 and never retrieved them. Some of the coins, made mainly of bronze but with a 5% silver content were buried in small leather pouches. The archaeologists said it was impossible to determine the original value of the money due to rampant inflation at the time, but said they would have been worth at least a year or two of wages.” – The Guardian/11-19-2015

by Michael J. Kosares

I was initially at a loss to explain why anyone would go to so much trouble to hoard so many coins with such a low silver content – about 5%. The only rational explanation is that the hoarder had decided that even worse debasement was on its way. And, a quick review of Roman history tells us that this indeed was the case.

In the next generation of the denarius, issued by Emperor Diocletian, bronze coins were simply dipped in silver and passed into circulation. By 294AD, the latest date in the hoard, Diocletian abandoned silver coinage entirely and began issuing bronze coins instead. Prior to that, prices had risen over a roughly twenty-year period by 1000%. Value-conscious barbarian troops hired by the emperors demanded to be paid in gold aureus and for good reason as you will discover below. By the end of the third century, the currency was crumbling and along with it the empire.

For a fascinating short course on the connection between the fall of the Empire and inflation, I would recommend this lecture by professor Joseph Peden in 2009, titled “Inflation and the Fall of the Roman Empire” and published at the Mises Institute. Peden quotes a 5th-century account of the Roman inflation by a Christian priest named Salvian. Says Peden,

“Salvian tells us, and I don’t think he’s exaggerating, that one of the reasons why the Roman state collapsed in the 5th century was that the Roman people, the mass of the population, had but one wish after being captured by the barbarians: to never again fall under the rule of the Roman bureaucracy. In other words, the Roman state was the enemy; the barbarians were the liberators. And this undoubtedly was due to the inflation of the 3rd century.”

It is instructive to note that for Rome, as has been the case in a myriad of episodes through history, inflation was not an event but a process. The ancient Roman version unfolded over a more than a 200 year period. “By the time of Trajan in 117 AD,” says Peden, “the denarius was only about 85 percent silver, down from Augustus’s 95 percent. By the age of Marcus Aurelius, in 180, it was down to about 75 percent silver. In Septimius’ time it had dropped to 60 percent, and Caracalla evened it off at 50/50.”

By the end of the third century, as demonstrated by the Swiss find, the denarius had gone to 5% silver, then, as mentioned above, a thin coating of silver, then no silver at all, only bronze. In short, a chart could have been constructed at the time showing an ounce of silver in a steady upward progression in terms of denarii from 117 AD through 300 AD. One wonders if the pundits at the time would have deemed it to have been in a bubble.

About 1200 years later, Thomas Gresham would draft “Gresham’s Law” stated simply as ‘bad money drives out good.’ Had Gresham the opportunity to visit the British Museum and study ancient Roman coinage, he would have found a ready example of his law in action. One expert told The Guardian newspaper that the original owners hoarded the Roman coins found in Switzerland because “the silver contained in them guaranteed a certain value retention in a time of economic uncertainty.”

In ‘The Story of Money for Understanding Economics” researcher Vincent Lannoye tells us that during the Roman inflation, “The less debased gold coins had been stashed under the mattress for decades, maybe centuries. These precious and valuable coins hardly circulated, as it can be deduced from their high concentrations in hoards discovered by archaeologists.” Peden puts a finer point on the role of gold during the Roman inflationary period:

“Now one interesting thing with all this inflation should be a great comfort to us: historians of prices in the Roman Empire have come to the conclusion that despite all of this inflation — or perhaps we should say, because of all of this inflation — the price of gold, in terms of its purchasing power, remained stable from the first through the fourth century. In other words, gold remained, in terms of its purchasing power, a stable value whereas all this other coinage just became increasingly worthless.”

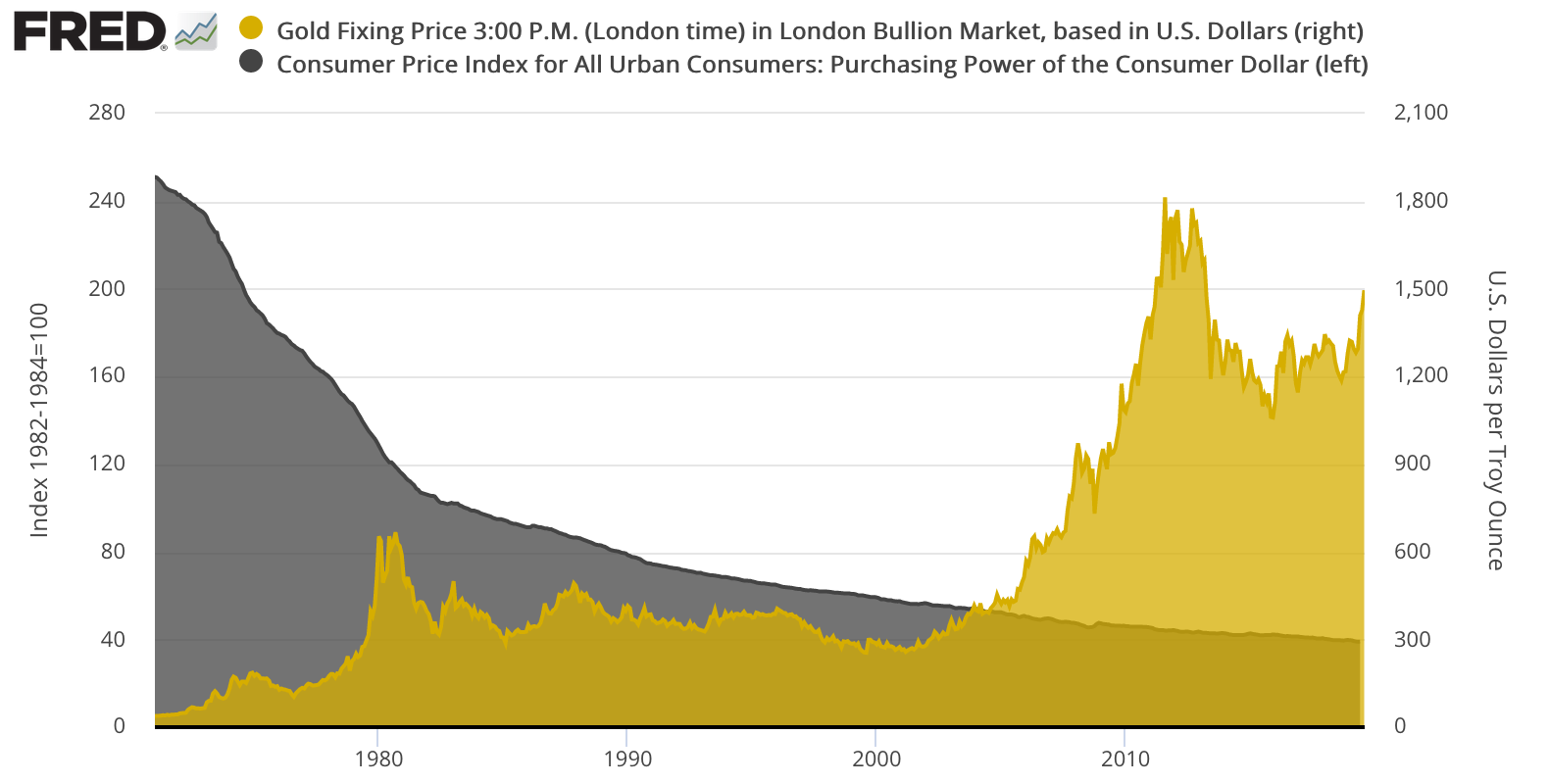

In 1700 years, as you can see in the chart above, not much has changed. Since 1971, when the United States detached the dollar from gold and ushered in the era of fiat money, the dollar has lost 84% of its purchasing power. The 1971 dollar is now worth 16¢. Gold in the meanwhile has risen from $35/oz. then to roughly the $1480 level today (with a stop at $1900/oz in 2011.) Over the long run, gold in the modern era has maintained its purchasing power as it did in Roman times, while the dollar, like the denarius, has been steadily debased. So it is by the circuitous route just taken, you now know why 4000 Roman coins recently found buried in a Swiss orchard reinforce gold ownership today.

(Editor’s note June 2020 – Gold is now priced at over $1700 per ounce.)

Final Note 1: We should not become desensitized to the prospects of future inflation as a result of the lull we have encountered in recent years. Even though price inflation is relatively subdued of late, monetary inflation continues unabated with consequences yet to be determined. In the inflationary process, it should be remembered that the line between cause and effect is not always a straight one. History teaches us that when inflation does arrive, it comes suddenly without notice and with a vengeance.

Final note 2: I should add that at any point along the way in the Roman inflationary period, the hoarder who had stashed away earlier silver coinage would have effectively hedged the event, as this article illustrates. In the modern era, though more volatile than gold, silver has functioned effectively as a safe-haven asset in the portfolio. A chart like the one above could be drawn with silver as the overlay instead of gold.

Image by The Portable Antiquities Scheme/ The Trustees of the British Museum [CC BY-SA 2.0 (https://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons [Edited]

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

5:29 am Thu. April 18, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115