Gold specs cut back bullish bets

Through Tuesday, November 26, 2019

Charts and commentary courtesy of CountingPips.com

Tables courtesy of GoldSeek

Note: Commitment of Traders reports are published Friday with data from the previous Tuesday.

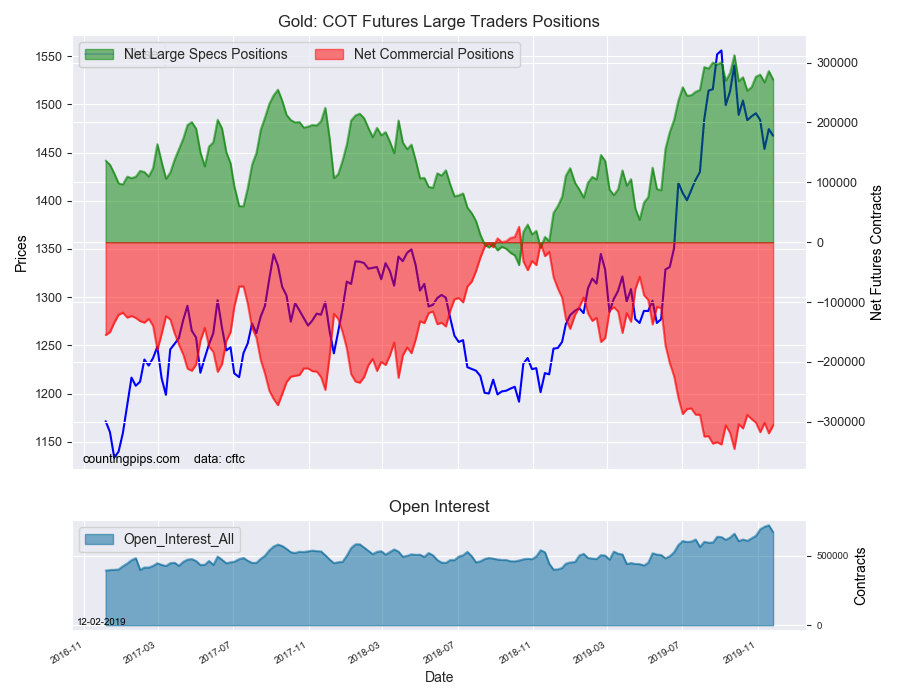

Gold Non-Commercial Speculator Positions:

Large precious metals speculators lowered their bullish net positions in the Gold futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday (delayed due to Thanksgiving holiday).

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 271,634 contracts in the data reported through Tuesday November 26th. This was a weekly change of -14,225 net contracts from the previous week which had a total of 285,859 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -12,010 contracts (to a weekly total of 325,286 contracts) while the gross bearish position (shorts) rose by 2,215 contracts for the week (to a total of 53,652 contracts).

Gold speculators had increased their bullish positions in four out of the previous five weeks before last week’s decline. The overall bullish position remains strong and above the +250,000 net contract level for a nineteenth straight week.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -305,467 contracts on the week. This was a weekly rise of 13,628 contracts from the total net of -319,095 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1467.40 which was a decrease of $-6.90 from the previous close of $1474.30, according to unofficial market data.

Sorry. No silver report this week.

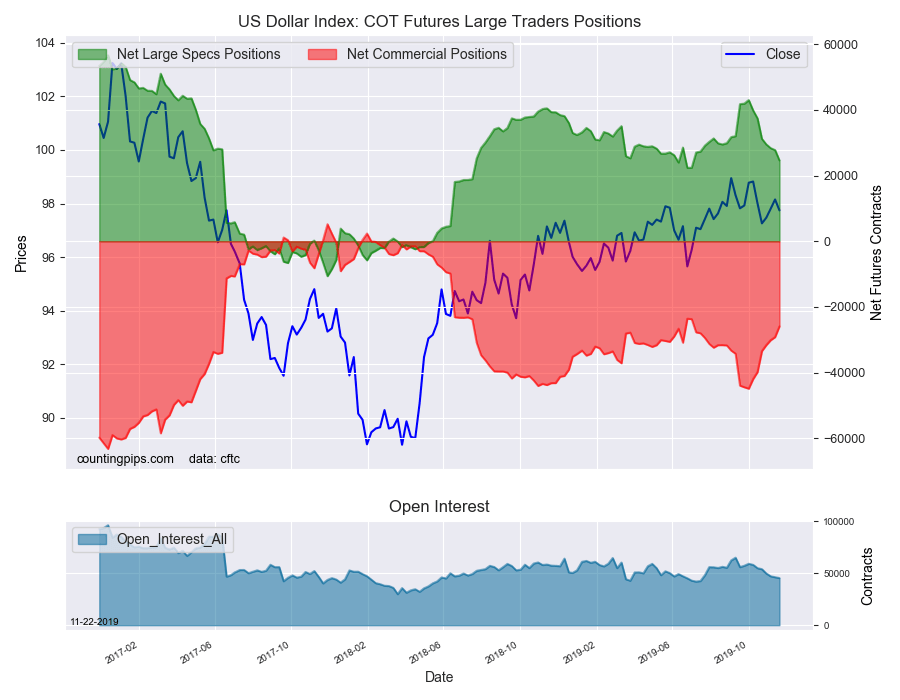

US Dollar Index speculators cut bullish bets 7th straight week

US Dollar Index Speculator Positions

Large currency speculators once again decreased their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 24,625 contracts in the data reported through Tuesday November 19th. This was a weekly fall of -3,159 contracts from the previous week which had a total of 27,784 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -2,408 contracts (to a weekly total of 31,509 contracts) compared to the gross bearish position (shorts) which saw a gain by 751 contracts on the week (to a total of 6,884 contracts).

US Dollar Index speculators cut back on their bullish bets for a seventh straight week and have now trimmed the net position by a total of -18,403 contracts over the past seven weeks. These recent declines have brought the overall net position to the lowest bullish level in twenty-three weeks.

Looking for more than an e-commerce platform?

DISCOVER THE USAGOLD DIFFERENCE

"Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

4:50 pm Sat. April 27, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115