Author Archives: Opinion

Experts say the stock market is in a bull market. What bull market?

MarketWatch/Brett Arends/6-13-2023

USAGOLD note: Arends says financial economics is better compared to astrology than astronomy. A good read at the link……

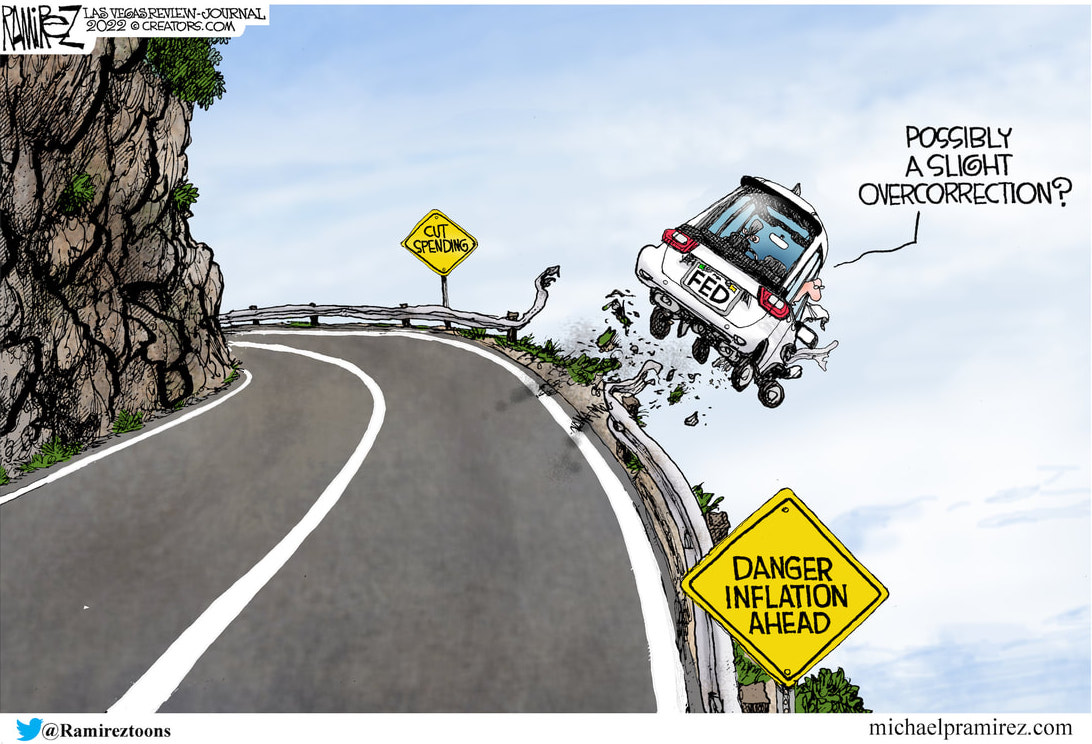

The Fed’s waiting game: Is the US economy finally starting to crack?

Financial Times/Colby Smith/6-11-2023

USAGOLD note: The danger to the economy of the Fed making another major policy mistake hangs like a dark cloud over Wall Street…… Charles Evans, former president of the Chicago Fed, asks, “What kind of policy mistakes are you most comfortable making?”

Credit Bubble Bulletin

Credit Bubble Bulletin/Doug Noland/6-18-2023

Selected quotes:

“Powell: ‘It’s reasonable. It’s common sense to go a little slower… Gives us more information to make decisions. We may try to make better decisions.” I’m all for the Fed trying to make better decisions. But such complex analysis must go much deeper than ‘common sense’. The so-called “hawkish skip” is both messy and problematic. It has left analysts confounded, while a highly speculative stock market couldn’t be happier. Loose conditions as far as the eye can see; latent fragilities safeguarding the ‘Fed put.'”

. . . . . . . . . . . . . . . . . . . . . . . . . . .

“Financial conditions remaining so loose in the face of aggressive Fed rate hikes has been a huge surprise. Importantly, when it comes to modern-day financial conditions and market structure, there’s a thin line between things ‘breaking’ and the intensification of Bubble excess. A major de-risking/deleveraging episode could bring this fragile boom to an abrupt conclusion. But it is this acute fragility that ensures policymakers respond quickly and forcefully against fledgling instability (BOE in September and Fed in March), ensuring that deeply entrenched speculative impulses are sustained. That which does not burst a Bubble only makes it stronger.”

. . . . . . . . . . . . . . . . . . . . . . . . . . .

“Historic monetary inflation has altered structures. Millions over the long bull market have become impassioned speculators – stocks, ETFs, options and derivatives, crypto – with the financial resources to stay in the game. Households have been granted Trillions of additional liquid assets and tens of Trillions of additional perceived wealth, while the Fed did exactly what it needed to avoid: its words and deeds further solidified the perception that the Fed is backstopping the markets.”

Dalio says US at beginning of ‘late, big-cycle debt crisis’

Yahoo!Finance-Bloomberg/Katherine Burton/6-7-2023

USAGOLD note: Dalio’s diagnosis amounts something akin to stagflation – a scenario that has been favorable for gold and silver in the past, and not so favorable for stocks and bonds.

China: A gold bullion investor’s best friend?

Barchart/Levi Donohue/6-2-2023

USAGOLD note: Donohue uncovers a little-known Chinese initiative through its banking system that could bring millions of new investors into the market. We consider China’s latest gold-friendly policy a very important development. “Western bullion investors,” says Donohue, “should brace for a demand shock in the market which will see premiums on gold bullion bars and coins rise and decouple from the paper gold price. China is betting the prospects of its own citizens on gold and as of yet very few people in the west have noticed.”

Druckenmiller warns there are ‘more shoes to drop’

Yahoo!Finance-Bloomberg/Will Daniel/6-7-2023

“There’s a lot of stuff under the hood when you go from this kind of environment, the biggest broadest asset bubble ever, and then you jack interest rates up 500 basis points in a year, I think the probability is that Silicon Valley Bank, Bed Bath & Beyond, they’re probably the tip of the iceberg.” – Stanley Druckenmiller, Duquesne Family Office

USAGOLD note: Druckenmiller sees a credit crunch and recession ahead.……

Forget inflation – deflation is the real danger

MSN-The Telegraph/Ambrose Evans-Pritchard/6-8-20-23

USAGOLD note: China is already showing signs of deflation, says Evans-Pritchard – a deflation it is exporting. He says that the pace is quickening in the United States as the Treasury Department borrows heavily in turn pressuring bank reserves and regional lenders.

Rosenberg says the US economy is a ‘dead man walking’

MarketsInsider/Zahra Tayeb/6-2-2023

USAGOLD note: Rosenberg is sticking with the hard landing scenario. He says if the Fed continues to raise rates “they’ll crush the economy.”

Analysis – Dollar bears bide their time as U.S. economic strength persists

Yahoo!Finance-Reuters/Saqib Iqbal Ahmed/6-4-2023

“The dollar is ‘in a very messy transition from bull market to a bear market,’ said Aaron Hurd, senior portfolio manager, currency, at State Street Global Advisors. ‘That transition period is going to be fairly frustrating.'”

USAGOLD note: Hurd expects the dollar to hold up over the short term but decline steadily over the longer run. Gold has done well during extended bear markets for the dollar.

Gold and the US Dollar Index (DXY)

( Dollar index inverted)

Billionaire Perot warns of real recession as loans dry up

Bloomberg/Shelly Hagan and Matthew Miller/5-31-2023

“Ross Perot Jr., whose family is one of the largest independent property developers in the country, warned of a looming real estate recession if banks don’t start lending again.”

USAGOLD note: As noted this morning, despite warnings from the likes of Ross Perot Jr., a number of banks have already declared commercial real estate risky and are trimming their portfolios accordingly.

Why America’s economic policy muddle matters

Financial Times/Adam Tooze/6-2-2023

“There is none of [Dutch economist Jan ] Tinbergen’s unified technocratic intelligence here. Nor should one dignify this mess by reference to the wisdom of the 18th-century founders and the principle of the division of powers. The kaleidoscope is driven by the twisted logic of a profoundly divided society and a polarised political class.

USAGOLD note: The invisible hand that played such a large role in building the modern economy is slowly but surely being paralyzed by Washington bureaucrats. Highly recommended reading……

Gold to shine again

Singapore Bullion Market Association/Chen Guangzi/June 2023

USAGOLD note: A practical overview new investors will find informative. Guangzhi is head of research at KGI Securities Singapore. His analysis includes an enlightening table of gold’s performance during recessions.

Signs of de-dollarisation emerging, Wall Street giant JPMorgan says

Yahoo!Finance-Reuters/Marc Jones/6-5-2023

USAGOLD note: These mainstream press articles on de-dollarization inevitably include the caveat that the dollar’s global dominance is not going to happen anytime soon. What they overlook is the damage that can be done on the long road to getting there.

Ex-Treasury chief Larry Summers says the Fed should consider a big bump in interest rates

MarketsInsider/Zahra Tayeb/6-6-2023

USAGOLD note: Appears Mr. Summers, still echoing Paul Volcker, sees inflation as much more resilient than either the Fed or Wall Street.

Why the Fed is hard to predict

Project Syndicate/Mohamed A. El-Erian/5-30-2023

USAGOLD note: El Erian says that no one knows what is going to happen at it June meeting – not even the Fed itself. It lacks, he says, “a solid strategic foundation.” Our interpretation? It bends with the wind and has become vulnerable to political pressure, it is unpredictable and not the kind of Fed Wall Street is likely to find reassuring.

Fed poised for another big policy mistake?

Credit Bubble Bulletin/Doug Noland/6-2-2023

Selected quotes from Friday’s report:

“It’s not a close call. If the Fed “Skips” policy tightening at the June 14th FOMC meeting, it will be yet another big policy mistake. The long string of errors has greatly damaged the Federal Reserve’s inflation-fighting credibility. It has also promoted dangerously dysfunctional market structure. At this point, the Fed should err on the side of demonstrating resolve in reining in inflationary excesses.”

. . . . . . . . . . . . . .

“Financial markets are also poised to sustain inflationary pressures. Resurgent Bubble Dynamics have fueled a major loosening of financial conditions. Surveys and anecdotes point to a degree of bank lending tightening. But this has been more than offset by risk embracement, leveraged speculation, and liquidity excess throughout the financial markets.”

. . . . . . . . . . . . . .

“Basically, the Fed/GSE liquidity backstop was integral to the pricing and liquidity dynamics that made derivatives so appealing for both hedging and speculating. And the bigger this complex became – and the more critical to the markets and economy – the more the Fed was compelled to quickly intervene to stabilize markets. Last year’s heightened concerns that the unfolding tightening cycle created ambiguity with respect to the Fed’s liquidity backstop were allayed by the Bank of England’s September and the Federal Reserve’s March interventions.”

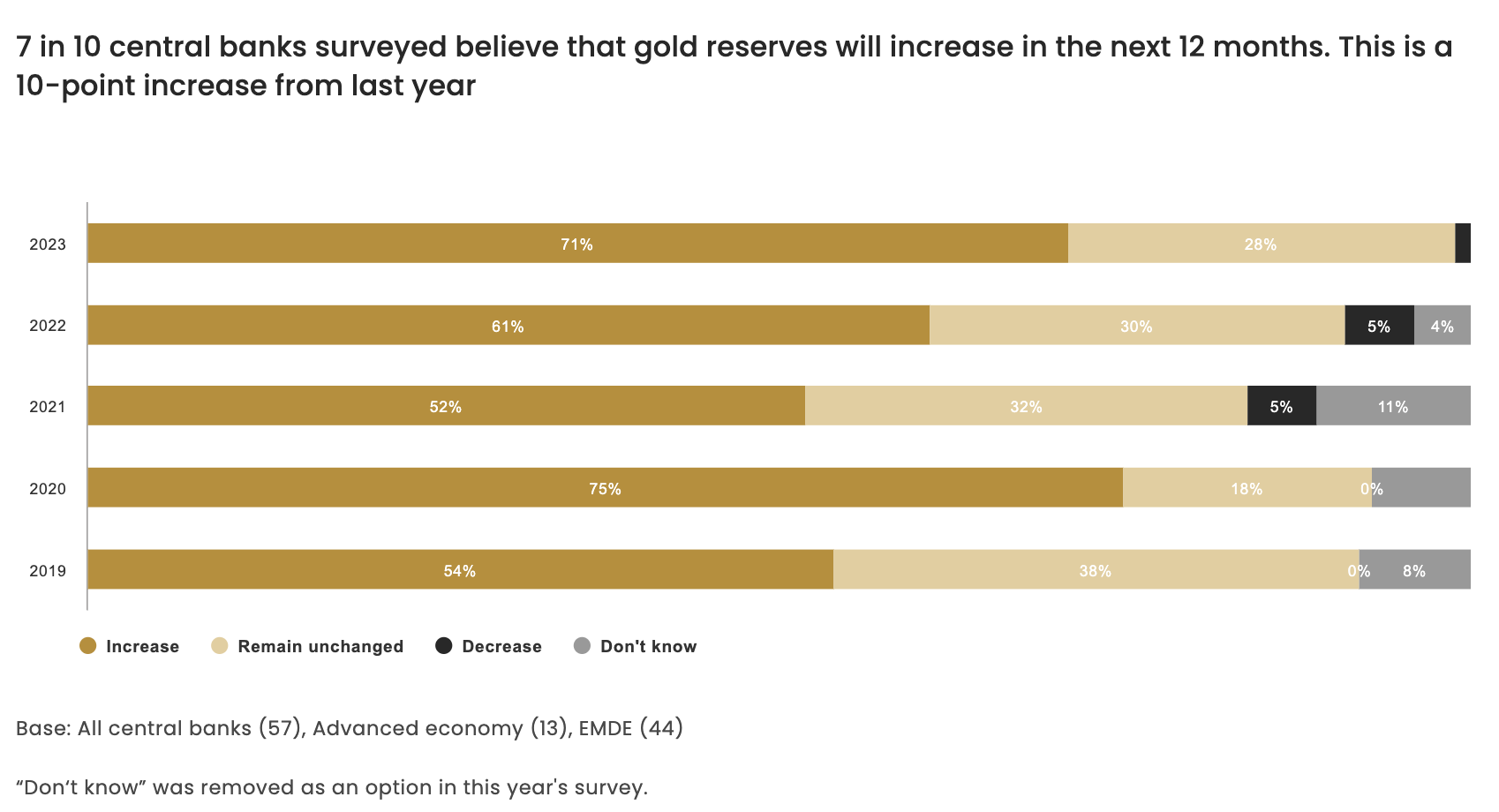

2023 central bank gold reserves survey

World Gold Council/Gold Hub/5-30-2023

“Following a historical high level of central bank gold buying, gold continues to be viewed favourably by central banks. Our 2023 survey revealed that 24% of central banks intend to increase their holding reserves in the next 12 months. Furthermore, central banks’ views towards the future role of the US dollar were more pessimistic than in previous surveys. By contrast, their views towards gold’s future role grew more optimistic, with 62% saying that gold will have a greater share of total reserves compared to 46% last year.”

USAGOLD note: Many believe that central bank purchases are the chief reason for gold’s rise over the past year to central banks purchases. That being the case, World Gold Council’s finding in the survey bode well for the future.

How chasing the sugar rush of monetary infusions gave us high inflation

South China Morning Post/Richard Harris/6-1-2023

USAGOLD note: Some solid background on how we got where we are now from an expert on Asian markets who formerly held senior positions at JP Morgan, Citi and BNY Mellon. He ends with an interesting comment: “Across London, the fact that the Bank of England, well endowed with economics PhDs, still has ‘very big lessons to learn’ about inflation indicates that the future of economic mismanagement is secure.”

The ‘impenetrable armor of the dollar’ is at risk, says BlackRock’s Rieder

Semafopr/Liz Hoffman/5-23-2023

USAGOLD note: In times like these, the dollar would be dominant in the flight to quality, says Rieder, “but after sanctions and the dynamic around deglobalization [post-pandemic], international investors are inclined to diversify.” We would add fears of US government default to that list even if things change for the better. Gold has been one of the key beneficiaries of the diversification Rieder mentions.

Melt-up vs. Deleveraging

Credit Bubble Bulletin/Doug Noland/5-26-2003

Observations from Credit Bubble Bulletin’s Doug Noland:

Here at home, the banking system remains highly levered and vulnerable. There are scores of big securities portfolios that become immediately problematic in the event of a yield spike. And it wouldn’t take much to restart the deposit exodus from vulnerable institutions. The mortgage marketplace is vulnerable to self-reinforcing deleveraging and interest-rate hedging-related selling. And, generally, leverage permeating the entire system creates vulnerability to a surge in market yields.

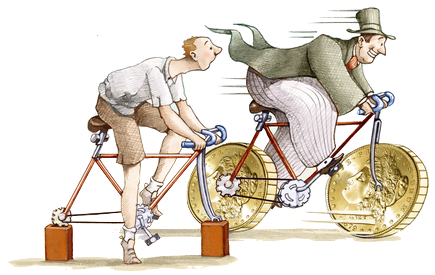

The Fed is in a bad place. The resurgent stock market speculative Bubble is a major force for loosening financial conditions and stoking inflationary pressures, while risking a melt-up and crash scenario. But additional Fed tightening measures are problematic for the bond market and banking system.

We’re back to the Fed hikes until something breaks. At this point, financial conditions must tighten significantly to keep inflation from becoming only more deeply ingrained. And especially after this speculative stock market run, tighter conditions pierce Bubbles. For now, such loose conditions set the stage for the nightmare scenario – a surprising jump in inflation, a spike in market yields, and a repricing for tens of Trillions of fixed-income securities. Stocks can relish the fun and games. But look over your shoulder, and you might see inklings of de-risking/deleveraging.”