Author Archives: Opinion

Fred Hickey: ‘Long term, conditions are perfect for gold to go to record high’

theMarketNZZ/Interview of Fred Hickey by Christoph Gisiger/5-26-2023

USAGOLD note: Hickey says “gold does best when stocks are going down.” He adds that stocks are being held up by “this FOMO move” in tech stocks but it will eventually end.

Elon Musk warns house prices are set to plunge – and says commercial real estate is in meltdown

MarketsInsider/Zahra Tayeb/5-30-2023

USAGOLD note: There will be repercussions…… in the banking sector and the overall economy. Let’s hope they are not major.

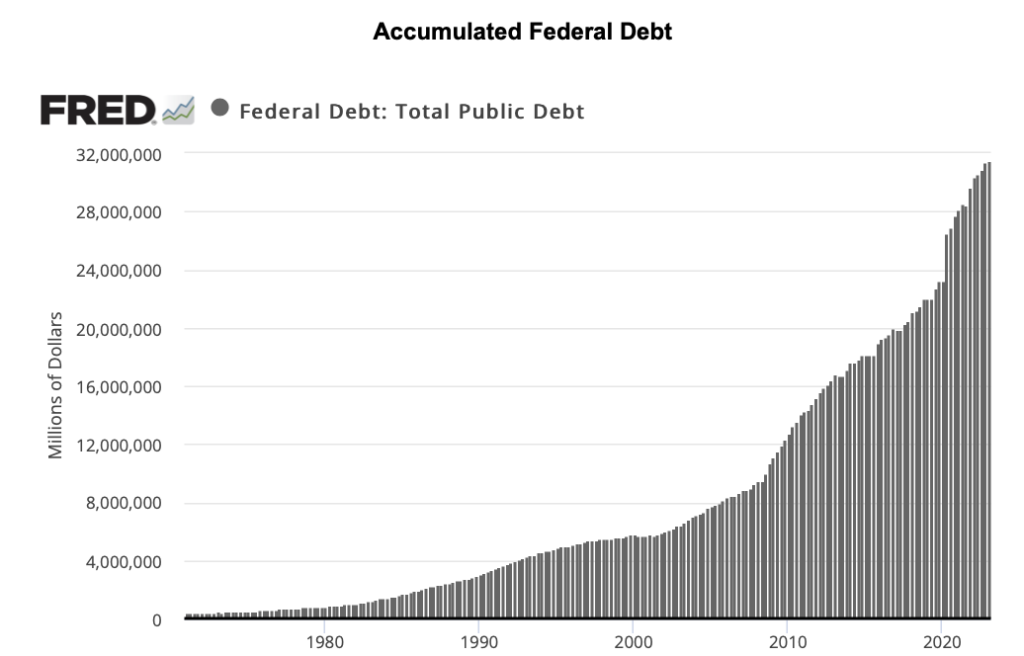

Unruly politicians and unchecked spending risk US debt catastrophe

Financial Times/Michael Strain/5-26-2023

“The nation has arrived at the brink of disaster because of a collision of structural problems in the economy and political system. A deal to increase the debt ceiling and cut certain categories of federal spending would fix the immediate crisis, but would not address these festering problems.”

USAGOLD note: The real debt crisis……The problem of too much debt and its future growth overshadows any debt ceiling arrangement the politicians might stitch together now. Michael Strain is the American Enterprise Institute’s director of economic policy studies.

Sources: St. Louis Federal Reserve [FRED], US Department of the Treasury, Fiscal Service

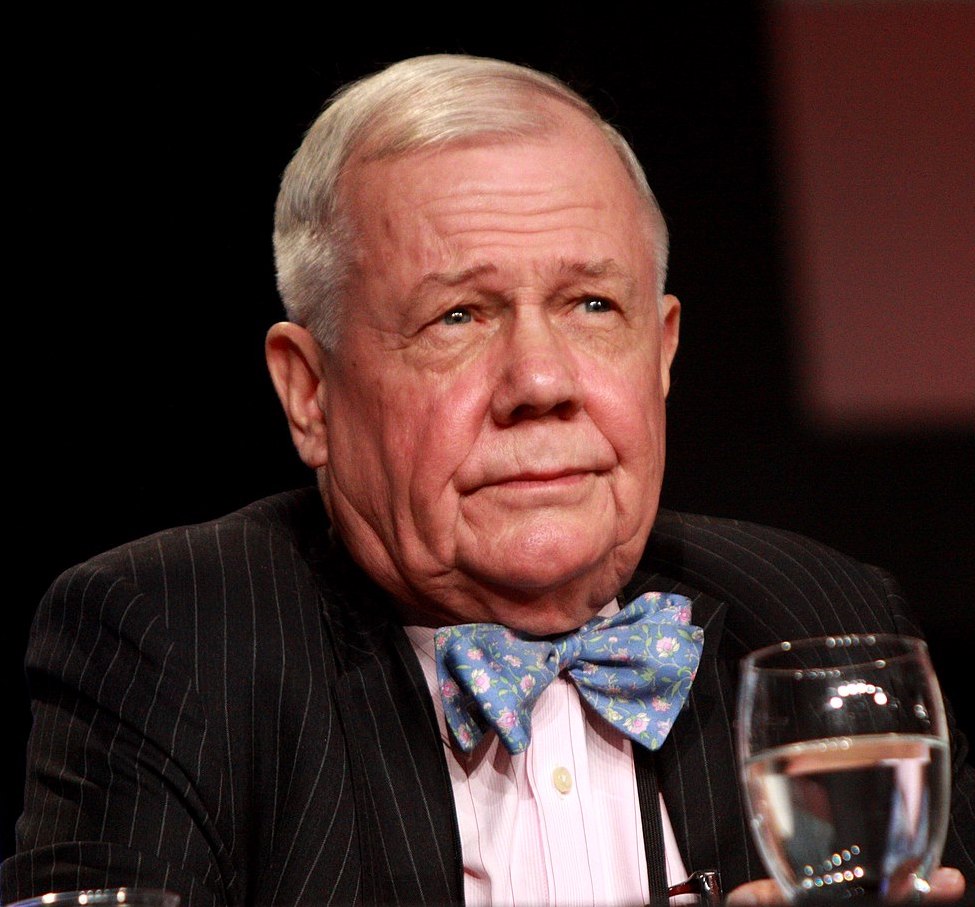

Jim Rogers predicts worst bear market of his life, de-dollarization, and higher interest rates.

MarketsInsider/Theron Mohamed/5-29-2023

USAGOLD note: Rogers says the world has never seen the debt and money printing it has in the last few years. “There will be trouble in all markets,” he adds.

Traders are duped by bear market rally, Morgan Stanley’s Wilson says

Bloomberg/Alexandra Semenova/5-26-2023

USAGOLD note: As Richard Russell (deceased but not forgotten) once put it “bear markets are sneaky beasts and they like to do their damage as secretly and as unobtrusively as possible. I hate to say it but somewhere ahead, the bears going to get it all together and the innocent little stream is going to turn into a waterfall. What can you do about it? Stay out of the market? Protect yourself by remaining in pure wealth, gold.”

The stark ‘de-risking’ choice facing economies

Financial Times/ Mohamed El-Erian/5-26-2023

USAGOLD note: El Erian makes a cutting-edge observation. Economics is no longer alone in determining the structure of national currency reserves. The combined forces of national security, “politics National security, and geopolitics are supplanting economics in shaping national and international interactions. An argument can be made that the level of fragmentation and uncertainty El-Erian elevates gold as the more reliable, long-term option.

Debt ceiling drama will be ‘resolved, but not solved,’ says Jim Grant

USAGOLD note: He goes on to say that these borrowing levels pose a threat to the dollar as global investors worry that the US government could default on future debt payments.

The new gold boom: how long can it last?

Financial Times/Harry Dempsey and Lelie Hook/5-25-2023

USAGOLD note: Financial Times takes a deep dive into what is driving gold demand at present and comes away with conclusions that might come as a surprise to many of our readers……

The most predicted recession ever maybe won’t happen. Get ready for the ‘asset class recession’

Yahoo!Finance-Fortune/Tristan Bove/5-24-2023

USAGOLD note: There is a certain amount of logic in this argument in that much of the inflation over the past several years has ended up in the stock and bond markets. The article goes on to explain that an asset class recession involves a recession for Wall Street while Main Street remains recession-free.

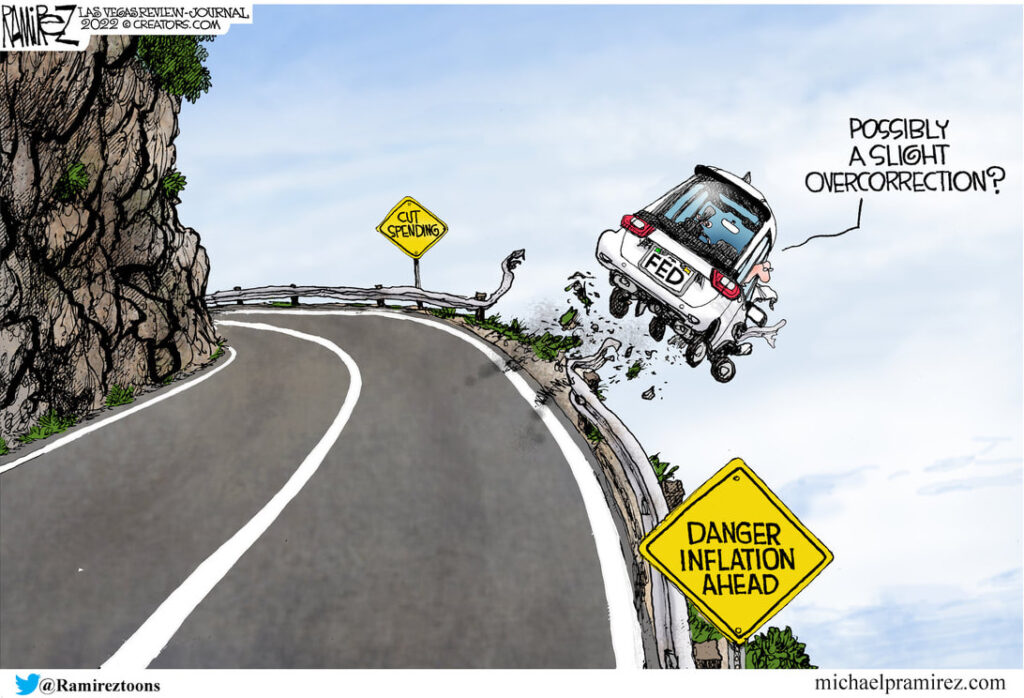

Do we need to destroy the economy to save it?

Newsweek/Zain Jaffer/5-23-2023

“It is one thing for natural events to conspire to wreck an economy. It is another to intentionally slow one down.”

USAGOLD note: Jaffer ends with a few investment suggestions and a caution about more centralized planning which he says is reminiscent of Soviet Russia. “There should be a better way,” he says, “to adjust for economic conditions than what we are doing now.”

Cut stocks, buy gold, hold your cash, JPMorgan’s Kolanovic says

Boomberg/Alexandra Semenova/5-23-2023

USAGOLD note: At one time, Kolanovic was considered Wall Street’s most vocal bull.

Three reasons to buy gold now

UBS/Chief Investment Office/5-18-2023

USAGOLD note: UBS sees gold at $2100 by year end and $2200 by March 2024.

Short & Sweet

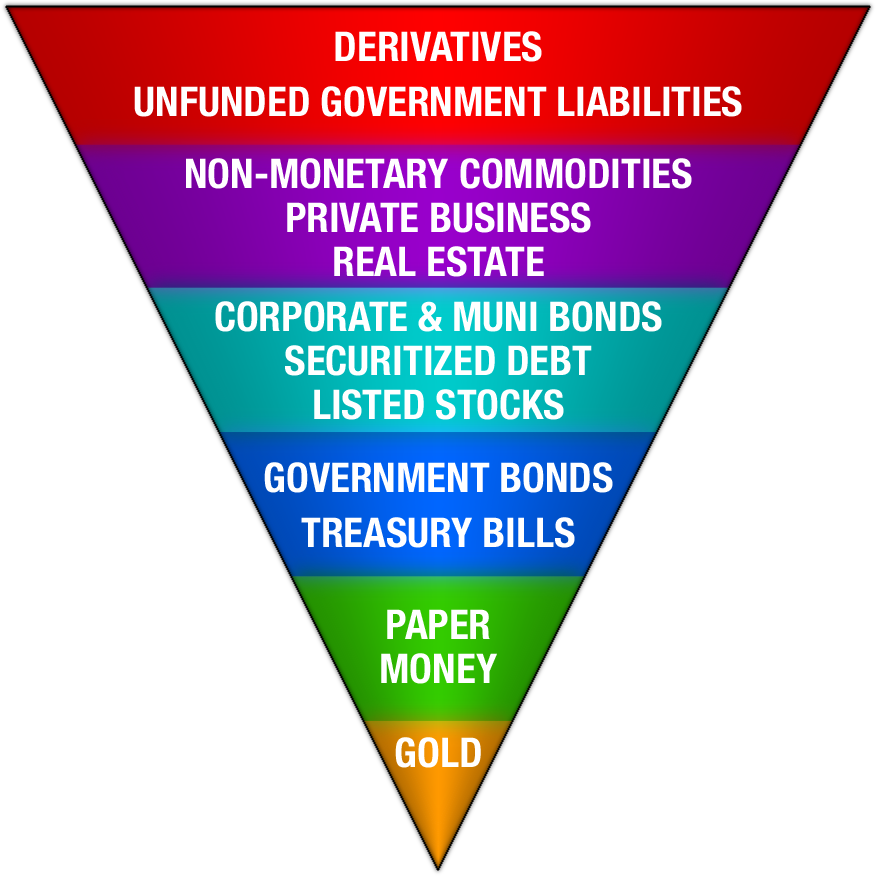

The Exter Inverted Pyramid of Global Liquidity

“[Exter’s Inverted] Pyramid stands upon its apex of gold, which has no counter-party risk nor credit risk and is very liquid. As you work higher into the pyramid, the assets get progressively less creditworthy and less liquid. . .[In a financial crisis] this bloated structure pancakes back down upon itself in a flight to safety. The riskier, upper parts of the inverted pyramid become less liquid (harder to sell), and – if they can be sold at all – change hands at markedly lower prices as the once continuous flow of credit that had levitated those prices dries up.” – Lewis Johnson, Capital Wealth Advisor’s Lewis Johnson

____________________________________________________________________________________________

Gold: Older than the solar system itself

Deutsche Goldmesse/Dominic Frisby/5-6-2023

“Gold was present in the dust which formed the solar system billions and billions of years ago and gradually that dust accreted to form the planets.”

USAGOLD note: In this video, Frisby makes an engaging presentation on the yellow metal saying “We have a primal instinct for gold.”

Buffett: Debt standoff an idiotic waste of time……

Markets Insider/Theron Mohammed/5-27-2023

USAGOLD note: Hard to disagree with Buffett’s assessment. Putting Wall Street and the rest of the country through this periodic ritual comes off as a childish desire to get attention – political gamesmanship at its worse.

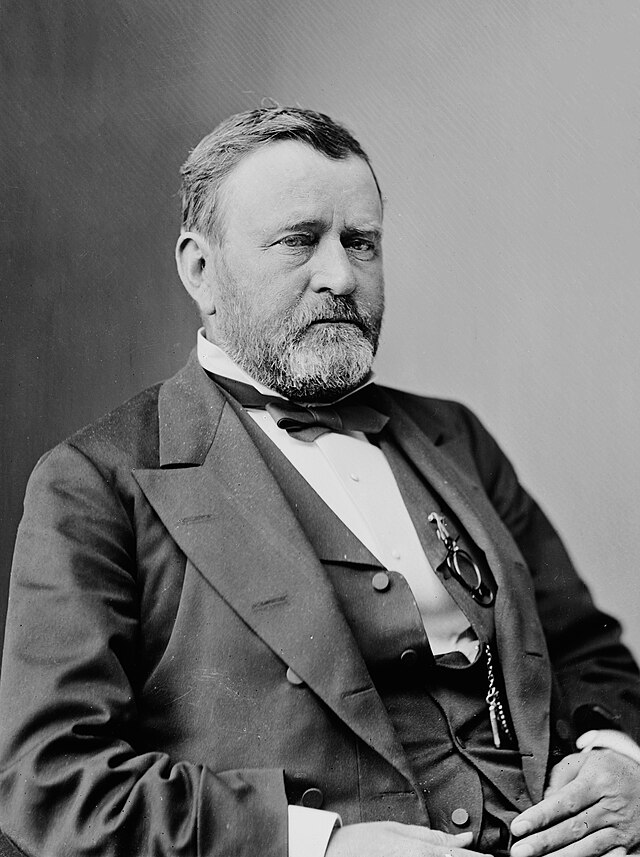

The gold cases resurface

The New York Sun/Editorial Staff/5-22-2023

USAGOLD note: We note with interest that President Ulysses S. Grant (photo insert) declared at the time that the US should pay its debts in gold as a matter of national honor. If that were to occur today, it would wipe out the US gold reserve of 8133 metric tonnes. The Sun delves into what the Fourteenth Amendment is really all about.

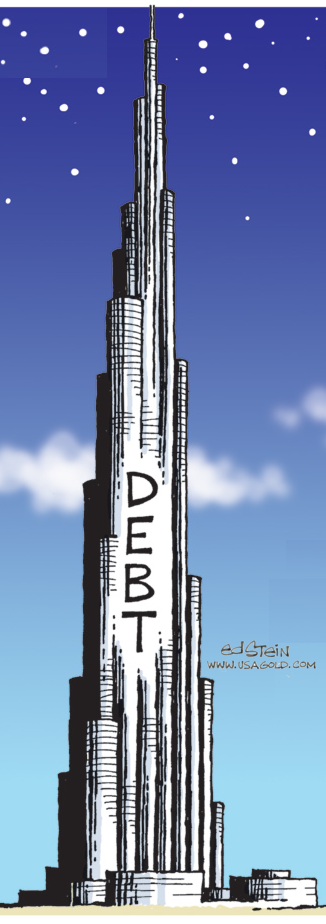

A US debt default is the wake-up call the world needs

Yahoo!Finance-The Telegraph/Matthew Lynn/5-21-2023

USAGOLD note: An unusual, and some would say dangerous, take on the prospect of a US debt default, but not one without merit. The global tower of debt was $210 trillion in 2010. It is $300 trillion now and projected to be $400 trillion by the end of the decade.

The financial system is slipping into state control

YahooFinance/The Economist/5-18-2023

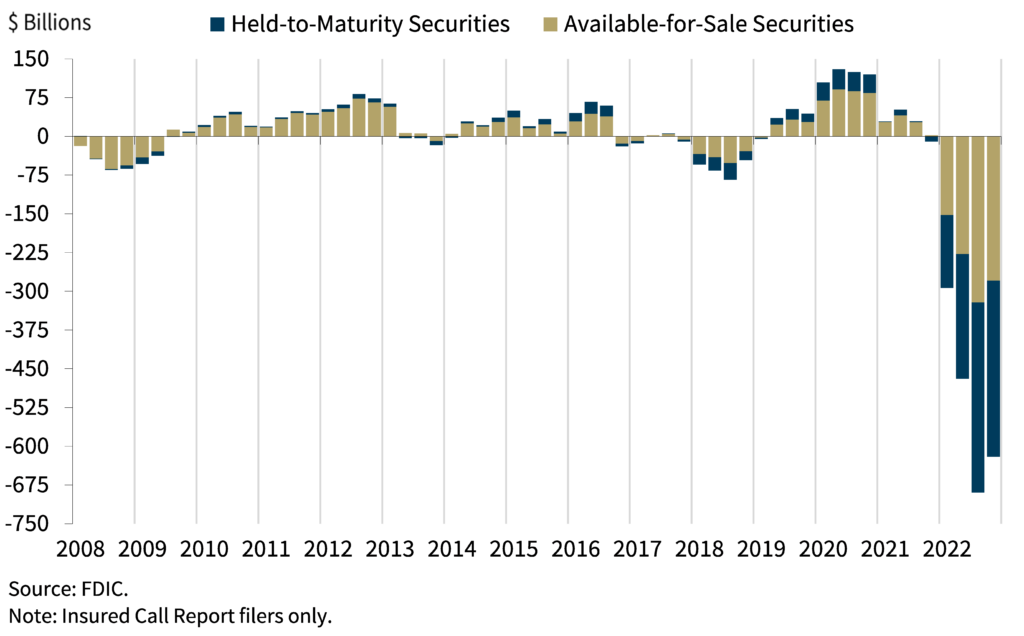

USAGOLD note: Banks are becoming wards of the state, says The Economist. The publication puts special emphasis on the fact that the Fed will buy bank-held securities at par even though the market value has been heavily discounted. “The bigger the backstop,” it says, “the more reason government has to dictate what risks banks may take” – a notion antithetical to tenets of capitalism.

‘We should be on the alert for more problems’

themarketNZZ/Chistopher Gisiger interview of Raghuram Rajan/5-15-2023

“The recent events highlighted mid-sized banks with volatile deposits and asset problems. I think the asset problems haven’t gone away. There are still lots of losses to be absorbed on bank balance sheets, and the problem with volatile deposits hasn’t gone away either.… As a result, there will be an issue of longer-term health of the banking system, especially regarding mid-sized banks exposed to areas like commercial real estate.” – Raghuram Rajan, Professor of Finance at the University of Chicago and former Governor of the Reserve Bank of India

USAGOLD note: Above is Rajan’s reasoning on why the banking system still needs watching. The chart below from the FDIC speaks a thousand words………

Total unrealized gains or losses on investment securities held by FDIC-insured banks

Chart courtesy of the FDIC • • • Click to enlarge

Wall Street fears $1 trillion aftershock from debt deal

Bloomberg/Liz McCormick and Alex Harris/5-18-2023

USAGOLD note: Be careful what you wish for …… Penso Advisors’ Ari Bergmann sees a confluence factors swamping the bond market all at the same time.