Author Archives: Opinion

Waiting for the Godot Recession

Bloomberg/John Authers/6-27-2023

USAGOLD note: Has anyone seen my recession? The economy reminds us that it has a mind of its own.

Financial markets ‘splendidly untroubled by inflation’

ZeroHedge/Simon White-Bloomberg/6-27-2023

“After a brief dalliance with concern around rising price growth in 2021 and the first half of 2022, the market has been happy to gorge on higher-duration stocks as if inflation is yesterday’s problem. But this is woefully misguided. Inflation will return, with a re-acceleration likely late this year or early next year as China’s monetary and fiscal engines slowly shudder back into life.”

USAGOLD note: The markets see inflation to be in regression. White says we are simply experiencing a hiatus. Inflation, as we have stressed in the past, is a process not an event. This article concentrates on sector rotation in the stock market, but the important point made from our perspective is that inflation is not gone and should not be forgotten.

Eight new insights from Nassim ‘Black Swan’ Taleb

MarketsInsider/Matthew Fox/6-23-2023

USAGOLD note: Taleb has not dialed down his warnings about the current state of economic affairs.

Gold can overcome near-term headwinds

UBS Insights/Chief Investment Office/6-8-2023

USAGOLD note: UBS forecasts gold will be $2100 by year-end, and $2250 by mid-2024.

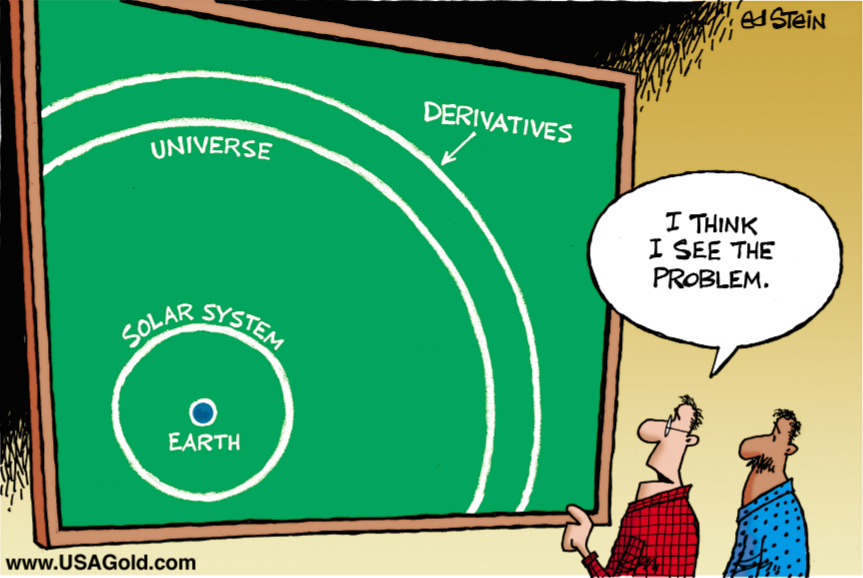

Liquidity risks

Credit Bubble Bulletin/Doug Noland/6-24-2023

Selected quotes:

“The historic scope of policy responses took perceptions of ‘whatever it takes’ market guarantees to a whole new level. While concerns grew that monetary policy tightening could jeopardize the central bank liquidity backstop, those fears were quickly allayed. The BOE in September hastily restarted QE to thwart a bond market crash, and then the Fed in March expanded its balance sheet by almost $400 billion over a few weeks to thwart a systemic run on bank deposits. With banking system stability in the crosshairs, markets understandably assume the ‘Fed put’ is as big and even more reliable than ever.”

. . . . . . . . . . . . . . . . . .

“The upshot is distorted pricing and availability of derivatives risk ‘insurance.’ This has worked to promote risk-taking and speculative leverage, both of which have exacerbated market liquidity excess. In particular, the Fed/FHLB market liquidity bailout came after the risk markets rally had already attained momentum. A speculative Bubble then took hold among the big technology stocks, pushing the ‘A.I.’ Bubble into dangerous manic excess.”

. . . . . . . . . . . . . . . . . .

“As they tend to do, the liquidity injection turned self-reinforcing. A powerful short squeeze and unwind of risk hedges stoked FOMO and performance-chasing flows into the risk markets. And with the big tech stocks’ favorite derivatives targets within a marketplace enamored with options trading, the market melt-up added Trillions of market capitalization – along with enormous amounts of speculative leverage. As an analyst of Credit and Bubbles, the first sentence from a December 6, 2022, Reuters article (Marc Jones) is etched in my memory: ‘Pension funds and other ‘non-bank’ financial firms have more than $80 trillion of hidden, off-balance sheet dollar debt in FX swaps, the Bank for International Settlements (BIS) said.’”

For investors, the Russian gun hasn’t fired yet

Must read……

Bloomberg/John Authers/6-25-2023

USAGOLD note: Deep background and analysis from John Authers on recent events in Ukraine-Russia. This feud, in our view, is far from over.

_______________________________

Photo attribution: Government of the Russian Federation, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons

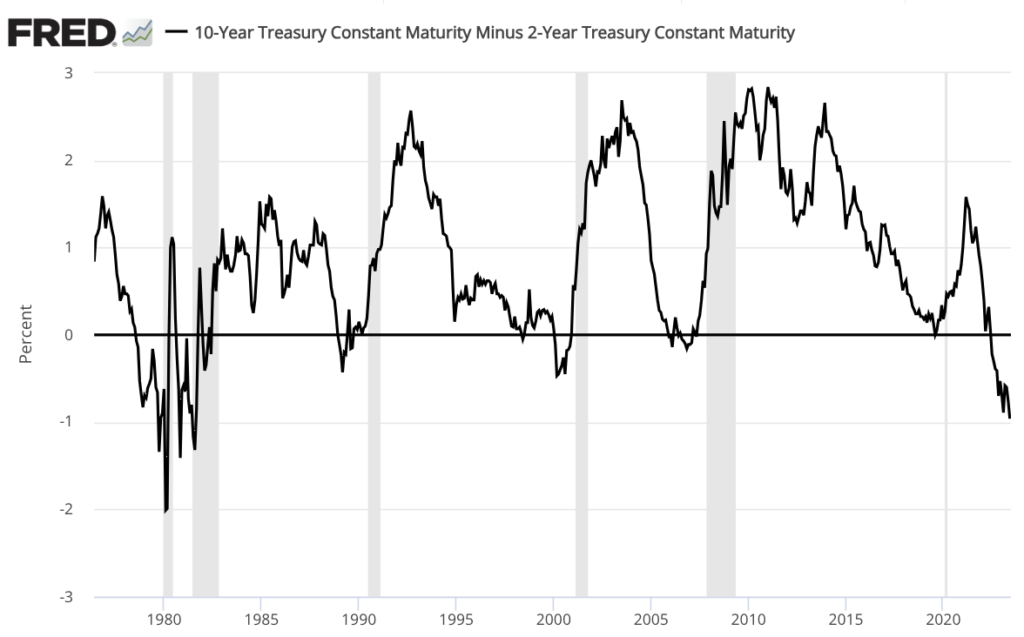

Treasury investors bet on US falling into recession

Financial Times/Kate Duguid/6-21-2023

“This situation, known as an inverted yield curve — most commonly measured as the difference between two- and 10-year Treasury yields — has preceded every recession in the past five decades.”

USAGOLD note: This is another of the warning signs individual investors are ignoring and perhaps the most telling.

JPMorgan’s Kolanovic sees US stocks struggling without Fed cut

Bloomberg/Alexandra Semenova/6-22-2023

“[Kolanovic] cautioned that multiple expansion and eroding pricing power make the risk-reward for US equities unattractive, adding another area of concern is ‘increasing investor complacency’ ahead of a potential recession. ‘In short, the risk of another unknown unknown resurfacing appears high,’ he said.”

USAGOLD note: It is difficult to know with any degree of certainty which side is right in the debate on future stock market values. A judicious hedge lifts the ordinary investor above the fray……… The best approach, in our view, remains to hope for the best but plan for the worst.

Persistent UK inflation should worry everyone

Bloomberg/Mohamed A El-Erian/6-21-2023

“There was nothing but worrisome news in Wednesday’s economic data releases for the UK. And the implications extend beyond Britain in a multifaceted way.”

US core inflation is still unacceptably high for the Fed – and that means more pain for the economy, strategist Jim Bianco says

MarketsInsider/Zahra Tayeb/6-20-2023

“US core inflation is still too high for the Federal Reserve’s comfort – and that means more pain ahead for the economy as the central bank pushes ahead with monetary tightening to cool price pressures, according to Wall Street analyst Jim Bianco.”

USAGOLD note: Along with, should it unfold as Bianca is suggesting, the risk of shakier financial institutions, bankruptcies, and accompanying systemic risks.……

Murky world of global food trading is too important to ignore

Financial Times/Helen Thomas/6-20-2023

USAGOLD note: The “merchants of grain” move to become an even more dominant presence in the global economy……”Perhaps it was the ancient nightmare of the middleman-merchant that made them all so aloof and secretive.”

Stock market rally reminiscent of what led up to 2008 crisis

Yahoo!Finance/Zinya Salfiti/6-12-2023

USAGOLD note; If we ever do actually confront a new 2008-style crisis, the Fed’s most likely response would be to introduce some new version of quantitative easing – a scenario under which the price of gold almost tripled. The bulk of stock market investors are ignoring warnings like the one detailed at the link above.

Powell wake-up call means more corporate defaults: Credit Weekly

Bloomberg/Michael Tobin/6-17-2023

USAGOLD note: The banking sector warns Fed chairman Powell – a case of being careful what one wishes for.……

America still leads the world, but its allies are uneasy

Bloomberg/Nial Ferguson/6-17-2023

USAGOLD note: We’ve become accustomed to the mention of geopolitical tensions as a potential future driver of the gold price, but what that might mean remains distant and vague. In this deep dive, Ferguson assesses the current geopolitical framework. He worries about the fallout from the Rimland cracking and a developing global order of “separate silos”………

DoubleLine’s Gundlach warns stocks are ‘exhibiting signs of a mania’

MarketWatch/Joy Wiltermuth/6-14-2023

“The stock market, frankly, is exhibiting signs of a mania, where you have a very concentrated part of the market’s that driving the entire train.” – Jeffrey Gundlach, DoubleLine Capital

__________________________

“Have you ever seen in some wood, on a sunny quiet day, a cloud of flying midges — thousands of them — hovering, apparently motionless, in a sunbeam? …Yes? …Well, did you ever see the whole flight — each mite apparently preserving its distance from all others — suddenly move, say three feet, to one side or the other? Well, what made them do that? A breeze? I said a quiet day. But try to recall — did you ever see them move directly back again in the same unison? Well, what made them do that? Great human mass movements are slower of inception but much more effective.” – Bernard Baruch

Larry Summers dubs Fed’s latest narrative ‘disturbing’

MarketsInsider/Zinya Salfiti/6-16-2023

USAGOLD note: A number of prominent economists found the Fed’s latest stance disturbing. If Summers is right that internal politics played a role in the Fed narrative, it will only further undermine the central bank’s already flagging credibility.

Is the stock market rally for real?

MarketWatch/William Watts/6-16-2023

USAGOLD note: The Financial Times pointed out recently that this rally is essentially concentrated in seven high-tech stocks. Hartnett sees it as fragile but could stay elevated until Fed “reintroduces fear.”

Gold stays gold, forever

HedgeNordic/Eugene Guzun/6-13-2023

USAGOLD note: Guzun adds that gold has returned 7.7% annually since 1971, the year the United States went off the gold standard.

Waller says bank failures may influence Fed on how much to raise interest rates

MarketWatch/Jeffry Bartash/6-16-2023

USAGOLD note: A solid indicator that problems still lurk in the banking system from an influential Fed governor.

Forget a shooting match, economic warfare is enough to impoverish most of us

South China Morning Post/Alex Lo/6-13-2023

USAGOLD note: Lo goes on to say that the Center for Economic Policy Research the weaponization of the dollar and the introduction of a digital yuan “constitute the sharpest shock to the status quo since the collapse of the Brettonn Woods system 50 years ago.” What we present here is only a small portion of the analysis at the link.