Author Archives: News

The market is looking for the next ‘domino’ to fall, keeping banks under pressure

“The orderly resolution of First Republic by the nation’s biggest lender was supposed to quell concerns about the state of the American banking system, not reignite them.…[A]mid a lack of new news had banking experts casting about for why this was happening.”

USAGOLD note: A lot of red dominoes out there. We would characterize the problem in the banking system as more like a computer virus than a contagion (domino effect). The same problem present in the banks that have already failed infects at varying degrees any number of banks – an underwater, illiquid bond portfolio that cannot be tapped to meet customer deposit withdrawals without significant losses.…… “People are searching for answers, and no one has a good one,” says KBW’s Christopher McGratty.

Investors warn of First Republic aftershocks at gloomy Milken gathering

Financial Times/Jennifer Hughes and Antoine Gara/5-2-2023

“Top investors have warned against complacency following the rescue of First Republic, arguing the third seizure of a bank by US regulators since March threatens to constrain credit and worsen an economic slowdown.”

USAGOLD note: Prepare for aftershocks. Prepare for the possibility of more failures.

“It’s time for the markets to fully digest how constrained central banks are going to be relative to the last 30, 40 years, when every time there was a tiny murmur of a problem, you could just lower rates [and] print money.” – Karen Karniol-Tambour, Bridgewater Associates

There are 70 major bankruptcies in just four months this year

MishTalk/Mist Shedlock/4-30-2023

USAGOLD note: We see the headlines as one large business after another goes to the ropes. Shedlock offers an aggregate picture that will surprise many of our readers and we are only four months into the year……

US inflation pressures persist, reinforcing case for Fed hike

Bloomberg/Reade Pickert/4-28-2023

USAGOLD note: The consensus opinion is that the Fed will raise rates this week because of inflationary concerns and that it will pause in June acknowledging a possible economic slowdown. It is difficult to understand the thought processes involved. Will conditions have changed to such a degree over a month’s period of time to justify a Fed retreat? Can the Fed fight inflation one month and recession/systemic risks the next?

University of Michigan survey of consumers shows declining confidence in Fed, commercial banks

University of Michigan/Joanne Hsu/4–28-2023

USAGOLD note: This survey reveals a sharp loss of confidence among consumers in financial institutions across the board since 2019 led by the Fed and commercial banks.

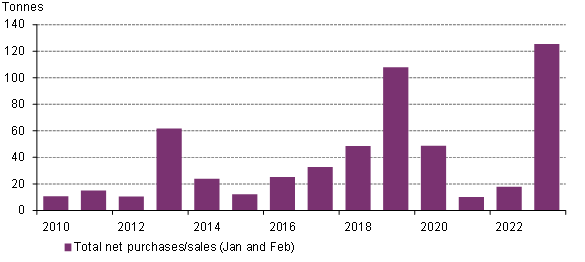

Central banks show little sign of buyer fatigue in February

World Gold Council/Krishan Gopaul/4-4-2023

“Central bank gold buying momentum showed no signs of stalling in February. Reported global gold reserves rose by 52t during the month – the eleventh consecutive month of net purchases – following January’s 74t. This excludes updated data for Russia (more on that below ), but still maintains the upward trend (based on the 12-month moving average) since June 2022.”

USAGOLD note: Much of the publicity of central bank involvement in the gold market has had to do with the record offtake in 2022. Gopaul reports that the record pace has continued into the early months of 2023. Central bank purchases of 125 tonnes in the first two months of 2023 are “the strongest start to a year back to 2010 – when central banks became net buyers on an annual basis.”

Central bank gold demand

(First two months of the year, 2010-2023)

Source: World Gold Council, IMF IFS, respective central banks

Hedge funds place biggest ever short on benchmark Treasuries

Bloomberg/Garfiel Reynolds/4-23-2023

USAGOLD note: About half of Wall Street believes rates will continue to rise. The other half believes that the Fed will be forced to retreat. The standoff has left markets in an eerie equilibrium with major pain likely in one camp or the other. With leveraged bets so large on both sides, the risk of a black swan event – even multiple black swan events – is highly elevated.

The global economy’s slow-motion reset

USAGOLD note: A big picture summary of where we are now economically and a warning where we might be headed over the longer run……

Central banks load up on gold in response to rising geopolitical tensions

Financial Times/Daria Mosolova/4-23-2023

USAGOLD note: Most of the analysis on central bank participation in the gold market centers around acquisitions made over the past few years. This article concentrates on future central bank gold demand based on the attitudes and sentiments of reserves managers and how it will affect future market behavior.

Wild fires and torrential rain in California unleash ‘a flood of gold’ – nuggets worth $2000 each

Daily Mail/Hope Sloop/4-23-2023

USAGOLD note: The barbarous relic strikes back……Gold Fever in California.

About half in US worry about their money’s safety in banks

USAGOLD note: One would think that the more a saver has parked in a bank, the more he or she is going to be worried about it.

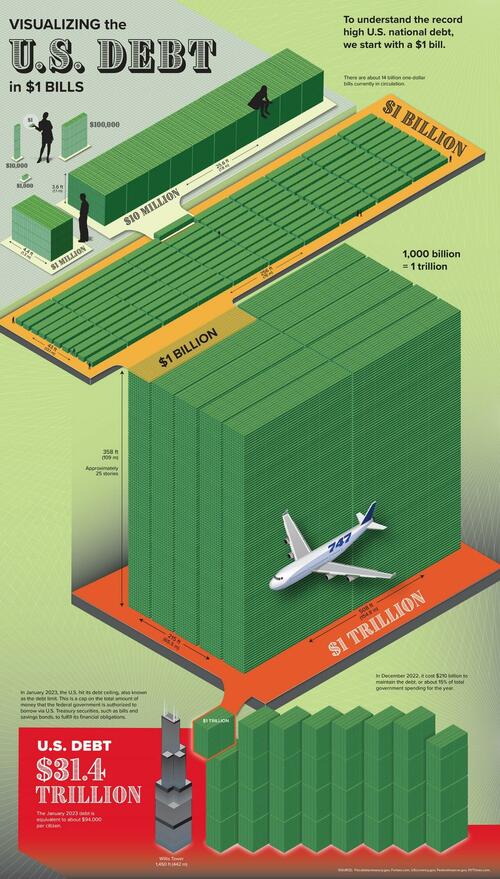

How many $1 bills it would take to stack up to the total U.S. debt of $31.4 trillion?

Visual Capitalist/Julie Peasley/4-20-2023

“Can you picture what $31.4 trillion looks like? The enormity of U.S. government debt is hard for the average person to wrap their head around. For instance, compared to the median U.S. mortgage, the current level of federal debt is 230 million times larger.…U.S. national debt is how much money the federal government owes to creditors. When the government spends more than it earns, it has a budget deficit and must issue debt in the form of Treasury securities. The U.S. has run a deficit for the last 20 years, substantially increasing the national debt. In fact, according to the Department of the Treasury, the current debt is $31.4 trillion. Stacked up in one-dollar bills, the U.S. debt would be equivalent to almost eight of Chicago’s 110-story Willis Tower.”

Washington and Wall Street are worried about ‘de-dollarization’ threat.

MarketWatch/Joseph Adinolfi/4-21-2023

Cartoon courtesy of MichaelPRamirez.com

“Interest in the topic, according to Mark Sobel, a longtime Treasury official and Chair of the Official Monetary and Financial Institutions Forum and others, is being driven by several developments, including the looming U.S. debt-ceiling battle in Congress, a China-brokered deal between Saudi Arabia and Iran as well as Beijing’s ‘no limits’ partnership with Moscow, and growing unease abroad about Washington’s dominance over the global financial system.”

USAGOLD note: There is concrete evidence of de-dollarization. In 2022, the US dollar’s share of global reserves went from 55% to 47% – ten times the average annual pace of erosion, according to Eurizon. That is difficult to ignore. (Please see last Friday’s Daily Gold Market Report for more information.) Exante’s Jens Nordvig says “De-dollarization is one of the biggest things that our institutional clients are looking at.”

Banks take out more loans from Fed in sign of lingering stress on financial system

MarketWatch/Jeffry Bartash/4-20-2023

USAGOLD note: It’s not over until it’s over ……Many banks are sitting on large underwater positions in Treasuries. Bartash says the banks “may not be close to being in the clear.”

Silver market in new era of structural deficits

The Silver Institute/World Silver Survey 2023/4-19-2023

USAGOLD note: The structural deficits are the result of solid global demand and declining mine production. Of special note, TSI reports that the current supply shortfall amounts to “more than half more than half of this year’s forecasted annual mine production, and more than half of the inventories presently held in London vaults offering custodian services.” In general, TSI paints a bullish scenario for the metal going forward.

US banks on alert over falling commercial real estate valuations

Financial Times/Staff/4-22-2023

USAGOLD note: These warnings keep popping up about trouble brewing in commercial real estate. As the old saying goes, where there’s smoke there’s fire. Half of the investors polled in a recent Bank of America survey identify commercial real estate “as the most likely source of a systemic credit event.”

Andy Beal, America’s richest banker, makes a massive bond bet on inflation

MarketWatch/Nathan Vardi/4-19-2023

USAGOLD note: The point that sticks in the mind is that Beal’s bet on inflation is for the long term……”It suggests Beal believes inflation is here to stay for at least several years.”

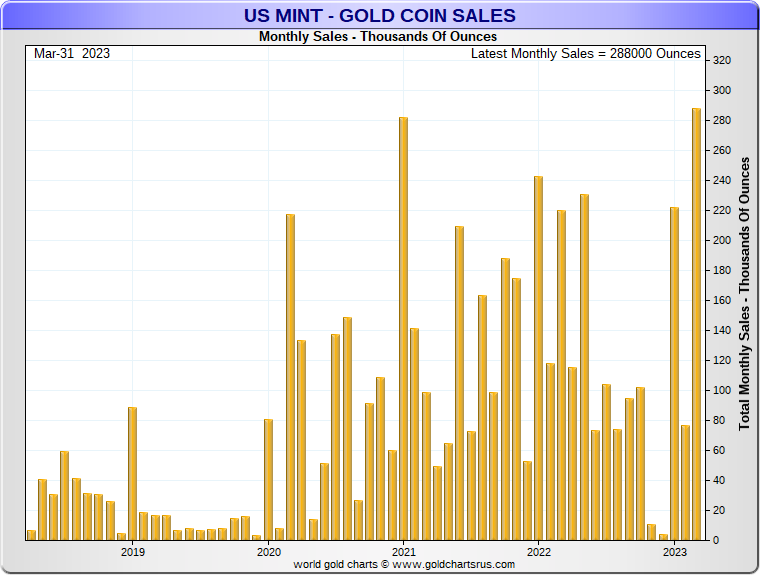

US Mint gold bullion coins see explosive sales in March

“Sales of American Eagle and Buffalo gold bullion coins from the U.S. Mint experienced an incredible rally in March, rocketing from the prior month, and far beyond last year’s sales figures from the same month.”

USAGOLD note: Demand for gold and silver bullion coins is running strong, driven by safe-haven investors looking for an alternative to bank savings. The US Mint reports a 277% gain in sales of the American Eagle gold bullion coin over last month and a 38% gain over the same month last year, according to CoinNews. Demand for the American Eagle silver bullion coin in March was at par with last month, but ultra-high premiums have channeled strong global demand to lower premium alternatives like the Canadian Maple Leaf and the Austrian Philharmonics. Combined sales of American Gold Eagle and Buffalo gold bullion coins posted their best month in five years at just over 280,000 ounces.

Chart courtesy of GoldChartsRUs

Investors bet US dollar has further to fall

Financial Times/Jenniger Luges, Mary McDougll and Kate Duguid/4-18-2023

USAGOLD note: A very dovish BoJ rate policy has kept the dollar from declining even further, faster over the short run……But that damper might wear off over the next few weeks. Professional traders have doubled their short positions in the greenback, reports FT.

Debt ceiling jitters drive up cost of insuring against US default

Financial Times/Kate Duguid, Lauren Fedor and Colby Smith/4-14-2023

“The cost of buying insurance against a US government default has shot to its highest level in more than a decade, in an early sign of market concerns about the political impasse in Washington over the debt ceiling.”

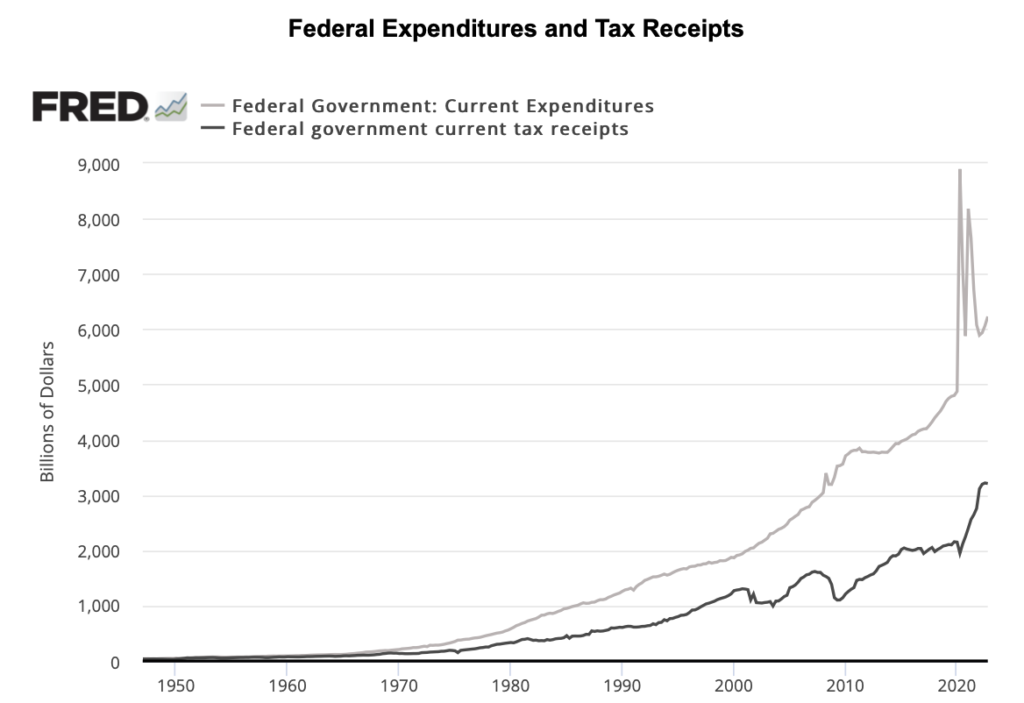

USAGOLD note: Few believe that the politicians will let things get out of hand, yet some would say that the times dictate the unexpected should be expected. The deficits have clearly gotten out of control. By the end of last year, the difference between federal receipts and expenditures was $3.2 trillion.

Sources: St. Louis Federal Reserve {FRED], U.S. Bureau of Economic Analysis