Debt ceiling jitters drive up cost of insuring against US default

Financial Times/Kate Duguid, Lauren Fedor and Colby Smith/4-14-2023

“The cost of buying insurance against a US government default has shot to its highest level in more than a decade, in an early sign of market concerns about the political impasse in Washington over the debt ceiling.”

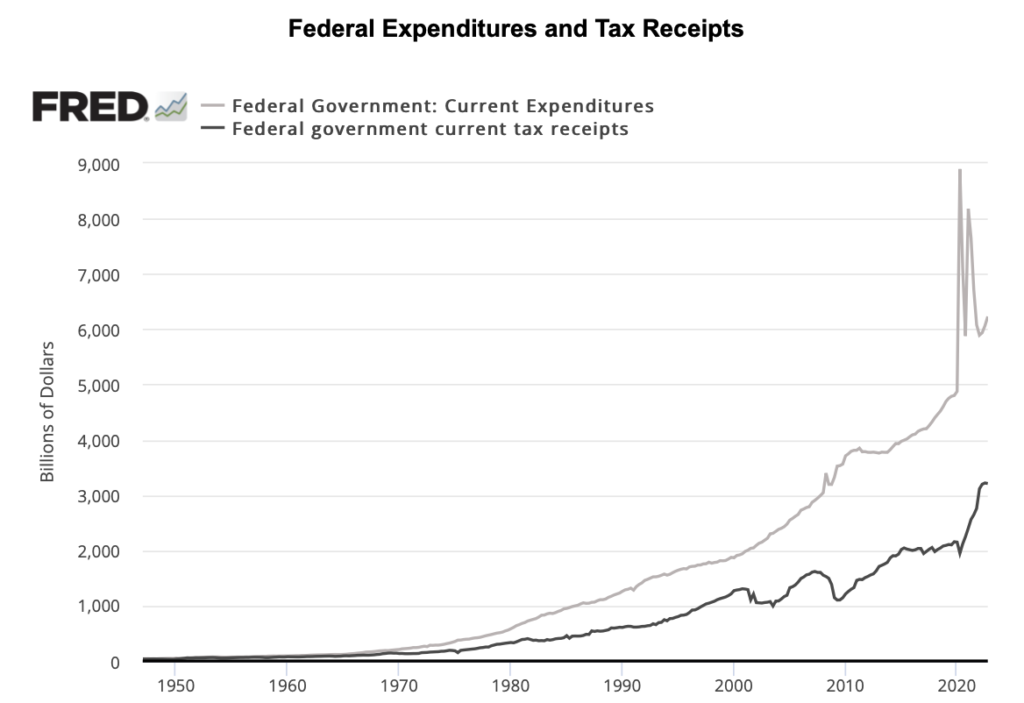

USAGOLD note: Few believe that the politicians will let things get out of hand, yet some would say that the times dictate the unexpected should be expected. The deficits have clearly gotten out of control. By the end of last year, the difference between federal receipts and expenditures was $3.2 trillion.

Sources: St. Louis Federal Reserve {FRED], U.S. Bureau of Economic Analysis