Author Archives: News

Yellen says sanctions may risk US dollar hegemony

USAGOLD note: An unusual admission by a US Treasury Secretary……

Top US banks to reveal $521 billion deposit drop, most in decade

YahooFinance/Bloomberg/4-12-2023

USAGOLD note: The lion’s share of the deposit drain is going into money market funds while a not-so-insignicant amount is flowing into gold and silver. Investors are attempting to protect hard earned savings.

Who is Nouriel Roubini, Wall Street’s ‘Dr. Doom’?

MarketsInsider/Jennifer Sor/4-10-2023

USAGOLD note: His viewpoint receives considerable attention in financial circles and we post his forecasts regularly here at News & Views. This profile provides more background on what makes this controversial economist tick.

____________________________

Photo attribution: Nouriel_Roubini_-_World_Economic_Forum_Annual_Meeting_2012.jpg: World Economic Forumderivative work: Connormah (talk | contribs), CC BY-SA 2.0 <https://creativecommons.org/licenses/by-sa/2.0>, via Wikimedia Commons

China expands gold reserves at central bank for fifth month

“China boosted its gold reserves for a fifth straight month, extending efforts by the world’s central banks to boost their holdings of the precious metal. The People’s Bank of China raised its holdings by about 18 tons in March, according to data on its website on Friday. Total stockpiles now sit at about 2,068 tons, after growing by about 102 tons in the four months before March.”

USAGOLD note: China points the way on central bank gold acquisitions as global official sector demand continues to grow. Some experts believe that central bank demand is at the core of the price rise over the past four years.

BoJ Ueda stands firm on monetary easing and negative rates

“In his first press conference as new Bank of Japan Governor, Kazuo Ueda stated that the central bank will maintain its massive stimulus program, echoing the stance of the previous leadership. Ueda commented, “The BOJ’s current monetary easing is a very powerful one. We need to strive, as we have done so far, to appropriately grasp economic, price, and financial developments to see whether trend inflation will stably and sustainably achieve 2%.”

USAGOLD note: Ueda’s ultra-dovish comments sent the Japanese yen lower and the Dollar Index higher contributing to gold’s downside today.

Dollar-yen exchange rate and gold

(One week, yen inverted)

Chart courtesy of TradingEconomics.com • • • Click to enlarge

US budget deficit widens to $1.1 trillion in fiscal half year

Bloomberg/Christopher Condon/4-12-2023

USAGOLD note: Those increased outlays are not likely to go away anytime soon.

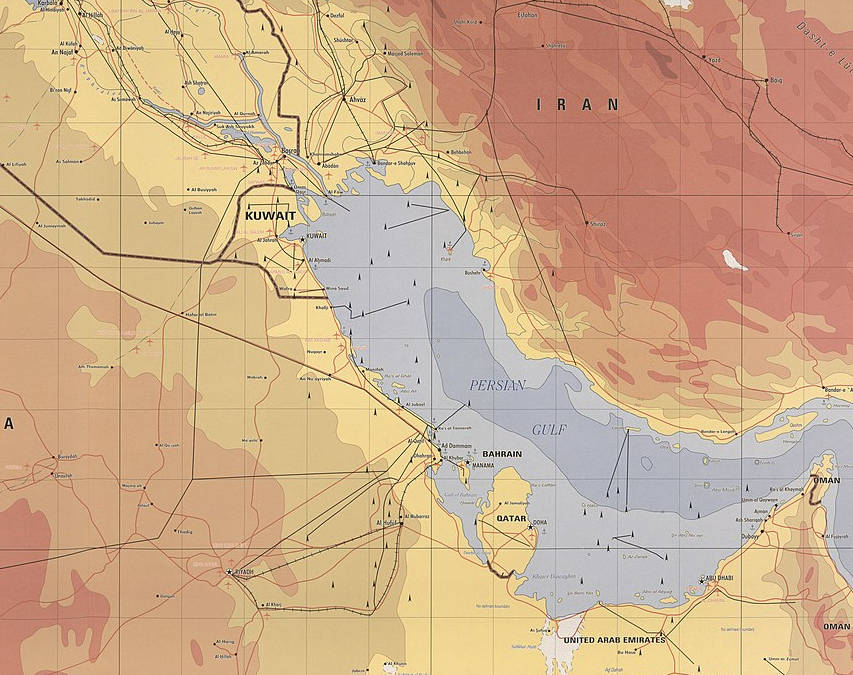

Saudi Arabia emboldened on world stage underpins OPEC decision

Bloomberg/Fiona MacDonald and Sam Dagher/4-3-2023

“Mere months after rebuffing President Joe Biden’s pleas to pump more crude, an increasingly confident Riyadh is using its regional clout to carve out its own path. Whether in the fields of energy or diplomacy, through forging ties with former foe Iran and moving toward embracing Syria’s pariah leader, it’s evidence of a determination to pursue Saudi priorities even if they run against Washington’s interests.”

USAGOLD note: The surprise production cut of one million barrels per day was important in terms of the effect on the price of oil. There might be an even more important geopolitical component with longer-term economic implications that needs to be understood. The warming of ties between Iran and Saudi Arabia may have given rise to an OPEC with clout rivaling its heyday in the 1970s.

Piles of commercial-real-estate loans at banks may be worth just 77 cents on the dollar — if that

MarketWatch/Joy Wiltermuth/3-30-2023

USAGOLD note: A number of top-drawer analysts have identified commercial real estate as the next source of problems for the financial system. The problem is similar to the one presented by bank bond holdings. “What everybody has been operating under,” says CapStack’s David Blatt, “is this hold-to-maturity veneer. There’s just no way these things get resolved at par:…”

Flood of cash into US money market funds could add to banking strains

Financial Times/Kate Duguid, Harriet Clarfelt and Colby Smith/4-1-2023

USAGOLD note: Some of that cash is making its way to the precious metals market as savers attempt to circumvent the financial system’s problems in their entirety.

One risk was missing from strategists 2023 view: banking crisis

Bloomberg/Sagarika Jaisinghani/4-2-2023

USAGOLD note: It is precisely because it is difficult, if not impossible, to guess where the next financial crisis will originate, or when, that prudent investors hedge their portfolios with precious metals – assets (unlike bank deposits, for example) not subject to default or counterparty risk.

How rising interest rates are exposing bank weaknesses

Financial Times/Laura Noonan and Brooke Masters/3-30-2023

USAGOLD note: The section under the subhead, “Losses on bond portfolios,” is particularly illuminating. It explains the acute dangers presented by accounting standards that have allowed the banks to build massive underwater bond positions.

Barclays sees a ‘second wave’ of deposit outflows coming for banks

Bloomberg/Joe Weisenthal/3-29-2023

USAGOLD note: Depositors are also awakening to the precarious position in which the banks find themselves and the risk of an extended systemic breakdown. Banks forced to meet a second wave of deposit outflows will be tempted to tap the Fed’s new rescue facility adding to its already bloated balance sheet. Bloomberg points out that there has already been a “substantial jump” in money market funds, but that the “cycle may be just warming up.”

A $3 trillion threat to global financial markets looms in Japan

Bloomberg/Ruth Carson, Masake Kondo and Michael Mackenzie/3-29-2023

“Bank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.”

USAGOLD note: The high level of Japanese ownership of foreign bonds will shock many investors. Beyond the $1.1 trillion it owns in U.S. Treasures, itself a formidable figure, it owns 10% of the Dutch and Australian sovereign bond issue, 8% of New Zealand’s outstanding debt, and 7% of Brazil’s. Now with the BOJ seemingly poised to raise rates and normalize monetary conditions bond market experts expect much of that position to be sold off and the capital returned to Japan. With China already selling off US treasuries and the Fed reducing its holdings through its quantitative tightening program, as well as natural market attrition as rates continue to climb, one wonders if the bond market can withstand Japan becoming a seller. A monetary Pearl Harbor may be ahead of us.

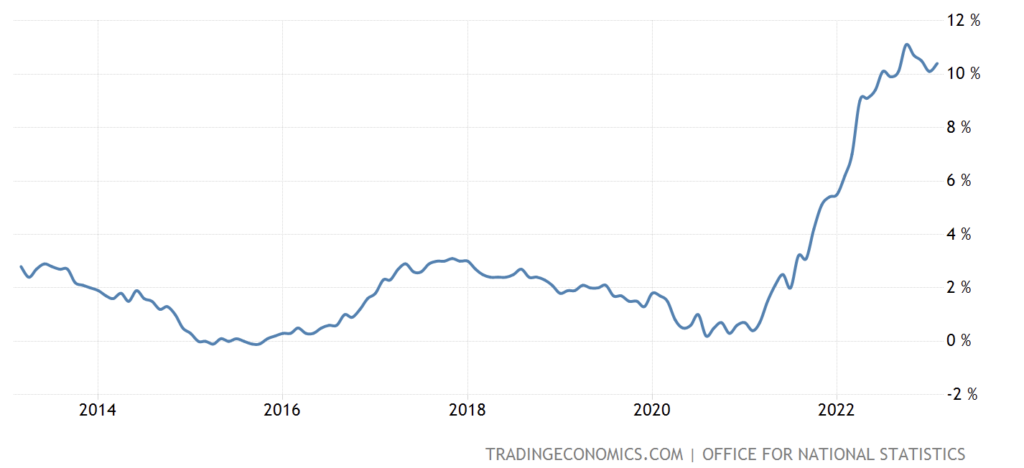

Bank of England calls for urgent action on funds that nearly toppled UK financial system

CNN Business/Julia Horowitz/3-29-2023

“This would allow them to withstand ‘severe but plausible stresses’ in the UK government bond market and meet any calls to post collateral in an orderly fashion.”

USAGOLD note: The Bank of England has already shown it is ready and waiting with more quantitative easing at the next sign of trouble. The financial sector comes out a winner; the citizenry will likely feel the pinch of more inflation.The inflation rate in UK is already in double digits at 10.4%.

United Kingdom Inflation rate

Chart courtesy of Trading Economics.com

Is gold a good investment?

NASDAQ/Martha C. White/3-29-2023

“Many people find gold to be a good investment because it can act as a diversifier in a typical portfolio. It can act as a hedge during periods of high inflation and as a safe haven during market volatility. But it also does not earn income and can be subject to fluctuations in value.”

USAGOLD note: A helpful overview for the beginner…… One thing to keep in mind is that safe haven investors usually opt to purchase coins and bullion delivered to their safekeeping. ETs are preferred by funds and institutions because they tend to purchase and sell large amounts of the metal and do not want the logistical problems that accompany large purchases. Also, most gold market experts consider ETFs paper, as opposed to physical, gold. You might want to review this page if you are trying to decide between the two options.

SVB’s collapse shows the world’s favorite safe asset isn’t risk free

Bloomberg/Liz McCormick, Ben Holland and Edward Harrison/3-28-2023

USAGOLD note: Now that the cat’s out of the bag on the position of a good many commercial banks i.e., deposits supported by eroding bond holdings, investors will have to make a decision on gold as a savings instrument within their personal asset structure. It brings to mind gold’s most important attribute. It is an asset that is not simultaneously someone else’s liability.

CNBC, Financial Times post bullish articles on gold

Traders pile into bets on gold price rally

Financial Times/Nicholas Megaw/3-27-2023

Gold prices could notch an all-time high soon — and stay there

CNBC/Lee Ying Shan/3-22-2023

More U.S. banks potentially insolvent: Columbia University study

USAGOLD note: A troubling update on the upside-down reality in the banking system – 190 “precarious” banks and $2.2 trillion in potential losses.

Moody’s sees risk that U.S. banking ‘turmoil’ can’t be contained

MarketWatch/Vivien Lou Chen/3-23-2023

“Despite quick action by regulators and policymakers, there’s a rising risk that banking-system stress will spill over into other sectors and the U.S. economy, ‘unleashing greater financial and economic damage than we anticipated,’ said Moody’s Investors Service, one of the Big Three credit-ratings firms.”

USAGOLD note: With reports that the Treasury Department and Fed are scrambling to develop solutions, the ordinary investor needs to take precautions. There have been times in economic history when things couldn’t be contained, leading to the worst outcome – either an inflationary or deflationary breakdown. Thus far, we have avoided the worst, but perhaps, as Moody’s suggests, we’ve been pressing our luck.

Yellen says Treasury is ready to take ‘additional actions if warranted’ to stabilize banks

CNBC/Christina White/3-23-2023

USAGOLD note: That offer of support seems to leave a lot of wiggle room on the deposit limits debate. With the Fed’s unlimited, open-to-all credit facility in place, does it really matter?