Author Archives: Daily Market Report

Daily Gold Market Report

No DGMR today. Back Monday.

Below is yesterday’s report.

______________________________________

Gold is cautiously higher following yesterday’s inflation numbers

Gallup finds 26% of Americans view gold as the best long-term investment

(USAGOLD – 5/11/2023) – Gold is cautiously higher this morning as part of the generally muted market reaction to yesterday’s inflation numbers. It is up $6.50 at $2039. Silver is down 34¢ at $25.13. “There’s nothing in the April numbers to make the Federal Reserve feel it has to raise borrowing costs further,” writes Bloomberg’s John Authers in his column this morning. “That helped risk assets, with stocks rising and bond yields falling — but not by enough to jolt any of the major markets out of settled trends.” He reports that the futures and swap markets now rate a pause as a virtual certainty. A recent Gallup poll finds that 26% of Americans view gold as the best investment over the long term – the highest polling since 2012 and a nearly two-fold increase from last year. Gallup found that investors favored gold over stocks and mutual funds for the first time in a decade and by a significant margin – 26% to 18%. [Source: Forbes]

Gold and stocks performance

(%, year to date)

Daily Gold Market Report

Gold breaks tentatively to the upside as inflation rate moderates

Druckenmiller says recession will begin this quarter, owns gold and silver

(USAGOLD – 5/10/2023) – Gold turned tentatively to the upside this morning as the inflation rate came in lower than expected at 4.9% – a reading that raises the prospect of a rate pause. It is up $5 at $2042. Silver is up 18¢ at $25.87. The good news is that Fed tightening looks to be taking effect on inflation; the bad news is that it also raises the prospect of a recession.

Stanley Druckenmiller, the famed hedge fund manager, says the US economy is headed for a hard landing and that it will begin during the current quarter. “I am not predicting something worse than 2008. It’s just naive not to be open-minded to something really, really bad happening,” he told the Sohn Investment Conference yesterday. “Druckenmiller, who recently announced shorting the dollar, added that there are “no fat pitches” when it comes to investment ideas and that his Duquesne Family Office owns gold and silver. [Source: Bloomberg]

Daily Gold Market Report

Gold pushes cautiously higher as Fed warns of ‘broad credit crunch’

Saxo Bank remains bullish longer term but predicts choppy trading in the short run

(USAGOLD – 5/9/2023) – Gold pushed cautiously higher this morning as tomorrow’s inflation report loomed and investors digested a Fed warning of a “broad credit crunch” brought on by the deposit drain and bank losses. It is up $10 at $2034. Silver is down 4¢ at $25.61. Adding to the general angst, Gallup released a poll this morning showing Jerome Powell as garnering the lowest confidence rating for any Fed chairman on record. Saxo Bank’s Ole Hansen has an overall bullish outlook for the investment metals. He thinks, though, that trading will likely remain choppy over the short run, “especially if inflation concerns return to challenge rate cut expectations.”

“Gold continues to trade within a 200-dollar wide upward trending channel that started back in November,” he says in a market update posted recently, “once the triple bottom was confirmed by the move above $1730. Following the strong March to April runup, triggered by a drop in short-term interest rates and yields in response to the banking crisis, gold went through a period of consolidation before the latest runup to a fresh record high. Key support remains in the $2k area ahead of trendline support, currently at $1982, while the next level of major resistance is not until the $2100 area.”

Gold Chart

(w/ trend channel per Saxo Bank above)

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold incrementally higher in quiet trading ahead of inflation data

More than a half-trillion dollars wiped out in banking crisis so far

(USAGOLD – 5/8/2023) – Gold is incrementally higher in quiet trading ahead of Wednesday’s inflation data. It is up $8 at $2027. Silver is down 2¢ at $25.72. Though concerns about the banking system have calmed for the moment, they haven’t gone away. A number of money managers, including Doubleline’s Jeffrey Gundlach, believe we are in only the early stages of the crisis. First Republic Bank, he says, was not the “last chapter in this regional banking problem.” That said, the damage already done has been significant.

“[T]he regional banking crisis is already worse than the global financial crisis—by one metric, anyway,” writes US Global Investors Frank Holmes in an analysis released Friday. “More than half a trillion dollars in assets have been wiped out this year from the failures of Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank. That significantly exceeds the amount that was disrupted in 2008, when 25 U.S. banks went under.”

Total assets lost in bank failures

(2001 to present)

Chart courtesy of the Federal Deposit Insurance Corporation (FDIC) • • • Click to enlarge.

Daily Gold Market Report

Gold gives back some of the week’s strong gains in early trading

JP Morgan touts gold as a recession hedge and ‘long-duration’ trade

UPDATE: Gold’s sudden spike to the downside coincided with the release of today’s jobs report showing notable gains in both employment and hourly wages. Silver is also sharply lower. The unexpectedly strong jobs showing raises concerns that the Fed will be forced to extend its tight monetary policy to keep a lid on inflation. As reported below, profit-taking is also playing a role in this morning’s downside.

(USAGOLD –5/5/2023) – Gold succumbed to profit-taking this morning, giving back some of the solid gains for the week. It is down $13 at $2038.50. Silver is down 22¢ at $25.90. On the week, gold is up 2.5%, and silver is up 3.6%. In a client advisory reviewed at Bloomberg this morning, JPMorgan strategists touted gold as a hedge against a recession – a “long-duration” trade with limited downside if the recession is mild but “plenty of upside” if it is deep.

“The US banking crisis,” says JPM, “has increased the demand for gold as a proxy for lower real rates as well as a hedge against a catastrophic scenario.” Institutional investors, it adds, have flocked into the metal. Similarly, in a separate analysis posted at CME Group, TJM Institutional Services finds that gold has rallied 28% and outperformed the S&P 500 by 37% on average during recessions. Importantly, it adds that gold reacts more to “the Fed and federal government’s response to the recession than the recession itself.”

Gold during recessions

(1971 to present; grey bars = recessions)

Chart courtesy of MacroTrends.net

Daily Gold Market Report

Gold takes breather after briefly trading at an all-time high yesterday

Another bank goes to the ropes, fuels surge in safe-haven gold demand

(USAGOLD – 5/4/2023) – Gold is taking a breather this morning after briefly trading at an all-time high yesterday of $2082. It is up $2 at $2043.50. Silver is down 3¢ at $25.64. No sooner had Fed chairman Powell declared that the banking system is “sound and resilient” at his press conference yesterday that another bank – this time PacWest Bancorp – went to the ropes. The news instantly fueled another surge in safe-haven gold demand that pushed prices past the old high-water mark before settling in the $2040 range.

Reflecting the level of apprehension in the banking business, former Atlanta Fed President, Dennis Lockhart, told Bloomberg yesterday, “It looks like the markets are moving from one bank to the other and vulnerable deer in the herd are being kicked off. But I would like to believe that Jay Powell has information that suggests that the situation is contained or containable.”

A little Ramirez humor to start your day……

Cartoon courtesy of MichaelPRamirez.com

Daily Gold Market Report

Gold drifts sideways in quiet pre-Fed decision trading

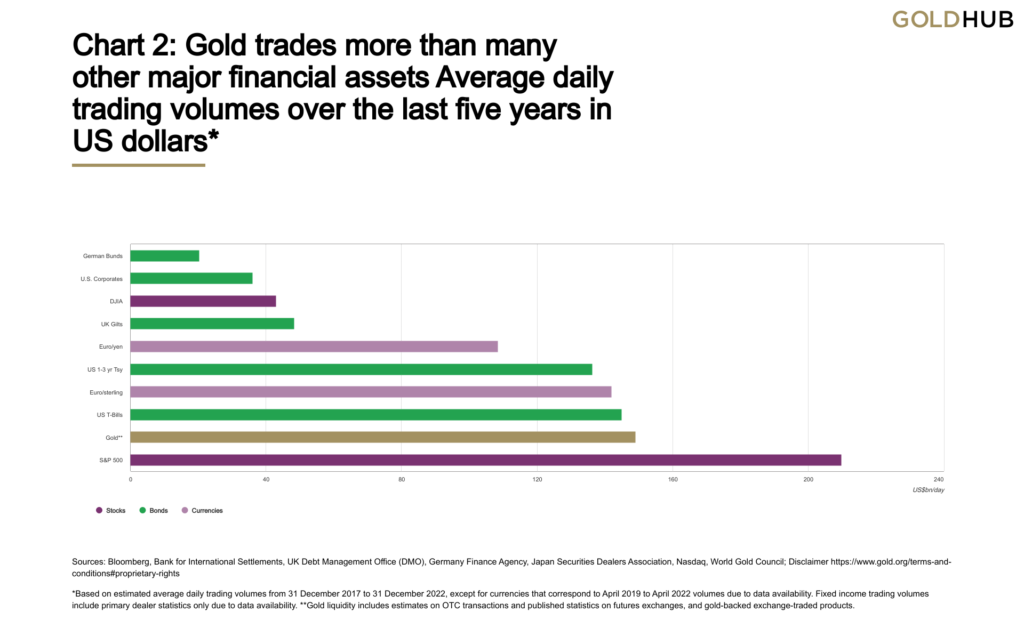

Global trading volumes for gold average $149 billion per day, second only to stocks

(USAGOLD – 5/3/2023) – Gold is drifting sideways in quiet pre-Fed decision trading. It is level at $2019. Silver is down 13¢ at $25.32. The relative calm follows sharp gains yesterday driven by growing instability in the US banking system. “It’s spooky. Thousands of banks are underwater,” Professor Amit Seru, a banking expert at Stanford University, told The Telegraph yesterday. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.” Such is the unsettling backdrop for the Fed’s rate decision, statement, and press conference later today.

Market liquidity is a crucial factor in judging any investment’s portfolio worthiness, especially when large amounts of money are at stake. Gold, says the World Gold Council in a recently released in-depth statistical profile, is “more liquid than many other major assets. Gold trading volumes averaged approximately US$149bn per day over the past five years, more than the Dow Jones Industrial Average and comparable to those of US 1–3-year treasuries and US T-Bills among primary dealers. The size of the market allows it to absorb large purchases and sales from both institutional investors and central banks without resulting in price distortions. And in stark contrast to many financial markets, gold’s liquidity has not dried up, even during times of financial stress, making it a much less volatile asset.”

Chart courtesy of the World Gold Council • • • Click to enlarge

DGMR UPDATE

Gold’s sudden, sharp move to the upside this morning is not the sort of thing that occurs often during a Fed rate meeting. It looks like the catalyst is a collapse of several regional banking stocks, as the aftershocks from the First Republic failure rumble through the banking system – a signal that more banks might be headed for rough water. In turn, the tumult could present a problem for FOMC members intent on raising rates another one-quarter point. Although it would be difficult to imagine a turnaround on rates at this juncture, the Fed might choose to soften its tone in tomorrow’s statement and follow-up press conference. Many analysts have pointed to higher rates and falling bond prices as the problem at the heart of the current banking crisis.

Daily Gold Market Report

Gold up marginally as Fed meets amidst besieged US economy

Druckenmiller shorts the dollar, his only ‘high-conviction trade.’

(USAGOLD –5/2/2023) – Gold is up marginally this morning as the Fed begins its conclave amidst a range of stubborn problems besieging the US economy. It is up $6 at $1991. Silver is down 22¢ at $24.82. Stanley Druckenmiller, the highly regarded former hedge fund manager, recently called the current market environment the most uncertain he has seen in his 45-year career. “The Fed has shown some mettle over the last year,” he recently told Financial Times, “but historically I would not say [Federal Reserve chair] Jay Powell is a profile in courage.” Druckenmiller is betting against the US dollar calling it his only “high conviction trade.” He also said that “big asset classes like equities were likely to show little if any positive direction over the next 10 years.”

US Dollar Index

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold bolts higher as bank failure realities sink in

Bank of America strategist sees $2500 as a possibility before year-end

(USAGOLD – 5/1/2023) – Gold bolted higher in early trading as the realities of another significant bank failure and FDIC rescue began to sink in among investors. It is up $13.50 at $2006. Silver is up 69¢ at $25.83. Strong performances in gold and silver in the first half of April instigated by problems in the banking system gave way to profit-taking and choppy market action in the second half. Nevertheless, silver ended the month 4.43% higher. Gold was up 1.31%.

A Bank of America commodities analyst believes that with the strong influences already at work in the gold market, it will not take a significant influx of new buyers to push gold to the $2500 level this year. “Influenced by the recent banking turmoil,” said the strategist in a client note reviewed at Kitco News, “markets are pricing imminent rate cuts. At the same time, core inflation has been sticky and elevated price pressures, for example in shelter, highlight the risk of second-round effects. This confirms our long-held view: central banks have no silver bullet for fighting inflation and this should ultimately bring investors back to the market. The end of the hiking cycle will be critical for the yellow metal.”

Gold and silver price performance

(% price change April 2023)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold drifts marginally lower as attention turns to next week’s Fed meeting

Rosenberg predicts deflationary future, recommends ‘bond-bullion barbell’

(USAGOLD –4/28/2023) – Gold drifted marginally lower in today’s early going as markets turned their attention to next week’s Fed meeting. It is down $4 at $1986. Silver is down 14¢ at $24.90. The $2000 level for gold and the $25 level for silver have proven to be obstacles – at least for the moment. Still, as we close out April, gold is up 1.4% on the month; silver is up 7.5%.

David Rosenberg, the highly regarded Toronto-based investment analyst, says that the current trends point to “a deflationary, not inflationary environment.” He recommends Treasuries, cash, and gold as the best bets for a future that could include significant systemic risk. “The U.S. dollar,” he says In a Marketwatch interview published yesterday, “will come under downward pressure. Gold will be a great hedge against the declining greenback. I’ve been advocating the bond-bullion barbell. “

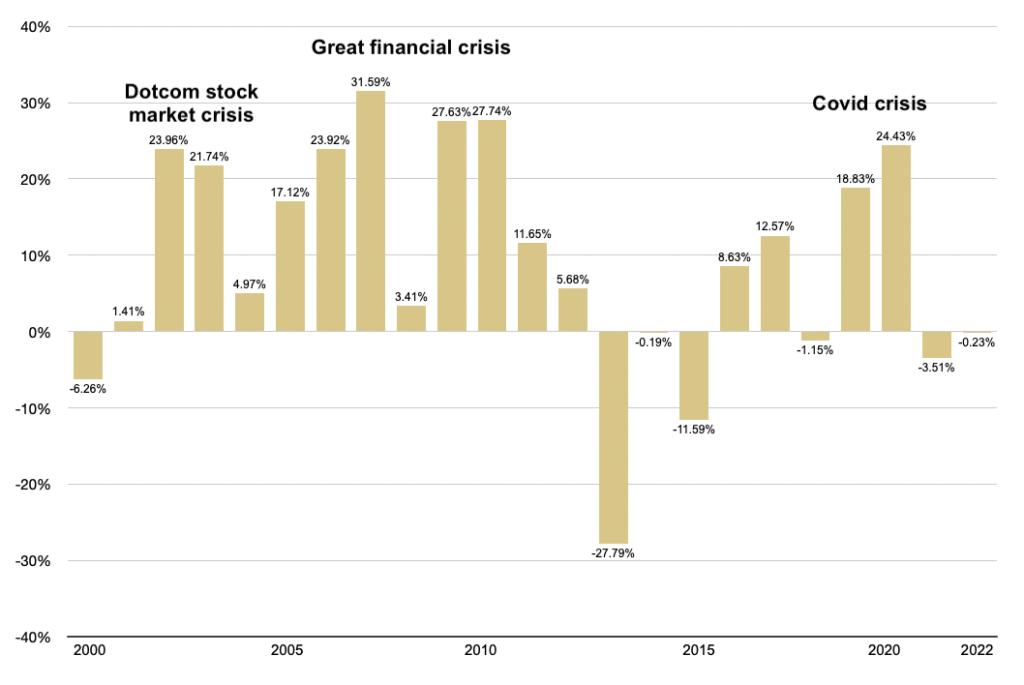

Editor’s note: As shown in the chart below, systemic crisis, not inflation, have generated the most substantial price gains for gold thus far in the 21st century.

Gold annual returns and crisis periods during the 2000s

(Year over year gains or loss, 2000 to present)

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration, USAGOLD • • • Click to enlarge

Daily Gold Market Report

Gold turns to the upside on banking system worries, general economic uncertainty

Aden Forecast says ‘once gold takes off, it will skyrocket’

(USAGOLD – 4/27/2023) – Gold turned to the upside this morning as worry about the banking system and general economic uncertainty pushed back to the forefront. It is up $8.50 at $2000. Silver is up 16¢ at $25.07. The Aden sisters (Aden Forecast) have been a mainstay in financial circles for decades. Known for their straightforward market analysis, they now believe that a “big financial shift” is in the cards and that central banks and private investors are stockpiling gold to prepare for it.

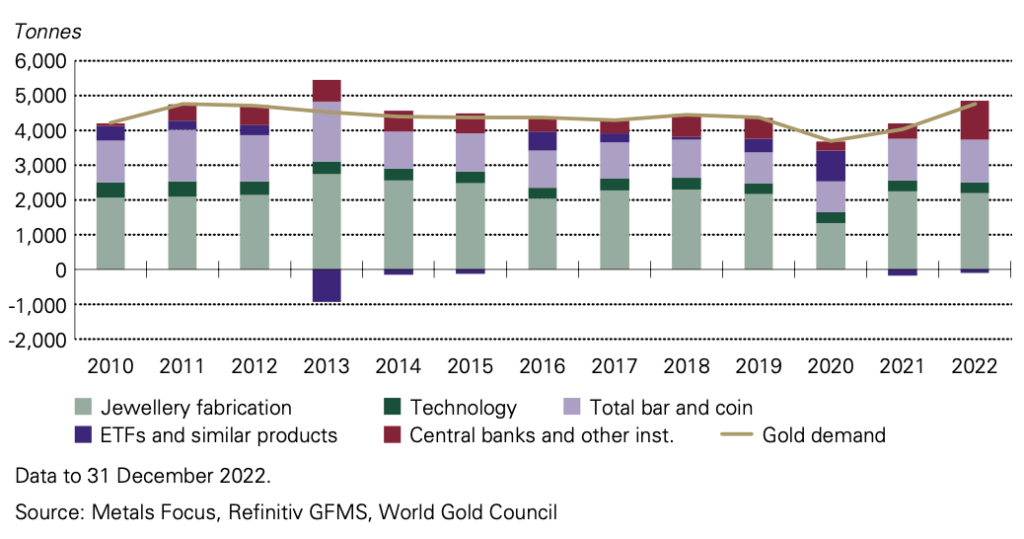

“Everyone knows that gold is real money,” they say. “It has stood the test of time. It has a 5000-year track record and it’s essentially the only global currency in the world. It’s also the world’s favorite safe haven and that’s why central banks worldwide have been stocking up on gold and easing out of dollars. They see what’s happening on the economic and geopolitical fronts and they want to play it safe by accumulating real money. Private investors are starting to do the same. And once gold takes off, we believe it’s going to skyrocket.” [Source: Yahoo Finance]

2022 gold demand led by private investors and central banks matched the 2011 record

Source: World Gold Council

Daily Gold Market Report

Gold up marginally this morning in muted reaction to run on First Republic Bank

Lombard Odier makes an important observation on changing gold market psychology

(USAGOLD – 4/27/2023) – Gold is up marginally this morning as the market reaction to the run on California’s First Republic Bank remains muted. It is up $2 at $2002. Silver is level at $25.11. In an analysis released yesterday, Lombard Odier’s Stephane Mornier makes an important observation about changing gold market psychology we thought worth passing along.

“What do the Singaporean, Turkish, and Chinese central banks have in common with jittery investors?” he asks. “Answer, they’ve been buying gold as a haven and diversifier from fears of a recession, a crisis of confidence in banking, and a weakening US dollar. We see this as an indication that economic factors are taking over from financial speculation as the main driver of demand for gold.” Real demand, it says, is pushing gold towards a new standard. The bank has raised its target price to $2100 by the end of the year.

Daily Gold Market Report

Gold loses momentum as traders test the downside

Felder: ‘Gold may be on the cusp of another major bull market.’

(USAGOLD – 4/25/2023) – Gold turned lower this morning as momentum faltered just below the psychologically important $2000 mark and traders tested the downside. It is down $11 at $1980. Silver is down 59¢ at $24.62. Jesse Felder, the veteran market analyst and former hedge fund manager, thinks gold may be on the cusp of another major bull market driven by the federal government’s rapidly deteriorating fiscal situation.

“[I]f history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending) is gold,” he writes in a recently posted analysis. “The last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback that lasted roughly a decade. This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.”

Gold and the US federal debt

(1971 to present)

Chart courtesy of Trading View.com • • • Click to enlarge

Daily Gold Market Report

Gold off to slow start this morning in featureless trading

Sharma: ‘Gold is now a vehicle of central bank revolt against the dollar.’

(USAGOLD – 4/24/2023) – Gold is off to a slow start this morning in featureless trading. It is up $1 at $1986.50. Silver is level at $25.16. In a Financial Times opinion piece over the weekend, Rockefeller International’s Ruchir Sharma says that there is “something new” in the gold market – “heavy” central bank gold buying driven by weaponization of the US dollar. He points out that central banks now account for a record 33% of monthly gold demand.

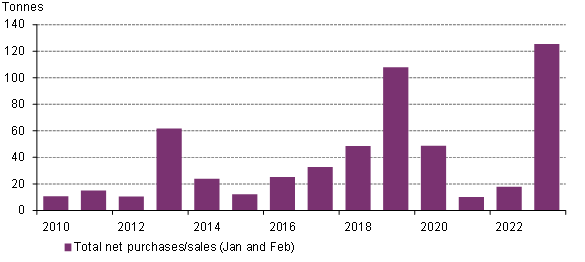

“[T]he oldest and most traditional of assets, gold,” he writes, “is now a vehicle of central bank revolt against the dollar. Often in the past, both the dollar and gold have been seen as havens, but now gold is seen as much safer.” Separately, the World Gold Council reports central banks picking up in the first two months of 2023 where they left off in 2022 – a record year for central bank offtake. Early-year demand was at a pace not seen since at least 2010, says WGC.

Central bank gold demand

(First two months of the year, 2010-2023)

Source: World Gold Council, IMF IFS, respective central banks

Daily Gold Market Report

Gold tracks lower in cautious end of week trading

Eurizon reports sharp decline in global dollar reserves, gold a beneficiary

(USAGOLD –4/21/2023) – Gold tracked lower this morning as uncertainty over the rate picture lingered, worry about the banking system cooled, and cautious end of week trading prevailed. It is down $17.50 at $1990. Silver is down 15¢ at $25.22. A recently released study by Eurizon SLJ Asset Management finds that the dollar’s share of total global reserves declined sharply in 2022 while its status as the dominant currency in international trade remained “unchallenged” – a differentiation we have not seen referenced by other analysts.

“In a Monday note, strategists Joana Freire and Stephen Jen calculated that the greenback accounted for about two-thirds of total global reserves in 2003, then 55% by 2021, and 47% last year. ‘This 8% decline in one year is exceptional, equivalent to 10 times the average annual pace of erosion in the USD’s market share in the prior years,’ the authors said.” [Source: Markets Insider, 4/17/2023)

Editor’s note: Gold has been one of the primary beneficiaries of that 8% shift in global reserves. The World Gold Council reports record central bank purchases of 1136 metric tonnes in 2022. “There has been a concerted shift away from over-reliance on the US dollar as a reserve currency in an environment of non-existent real yields on sovereign debt,” writes the Council’s Louise Street in a recent market review.

Cartoon courtesy of MichaelPRamirez.com

Daily Gold Market Report

Gold pushes back over the $2000 level in early trading

The Silver Institute says silver market is in a new era of structural deficits

(USAGOLD – 4/20/2023) – Gold pushed over the $2000 level this morning in an attempt to regain momentum lost in the sell-off of the past couple of days. It is up $13 at $2009.50. Silver is up 7¢ at $25.44. The Silver Institute says that the silver market is in a new era of structural deficits as demand reached a record 1.242 billion ounces in 2022. It forecasts a continuation of both trends in 2023.

“This year is expected to be another of solid silver demand,” it says in its World Silver Survey released yesterday. “Industrial fabrication should reach an all-time high, boosted by continued gains in the P.V. market and healthy offtake from other industrial segments. Although bar & coin demand and jewelry fabrication are expected to fall short of last year’s exceptional levels, both are forecast to remain historically high.…Adding up the supply shortfalls of 2021-2023, global silver inventories by the end of this year will have fallen by 430.9 Moz from their end-2020 peak. To put this into perspective, it is equivalent to more than half of this year’s forecasted annual mine production, and more than half of the inventories presently held in London vaults offering custodian services.”

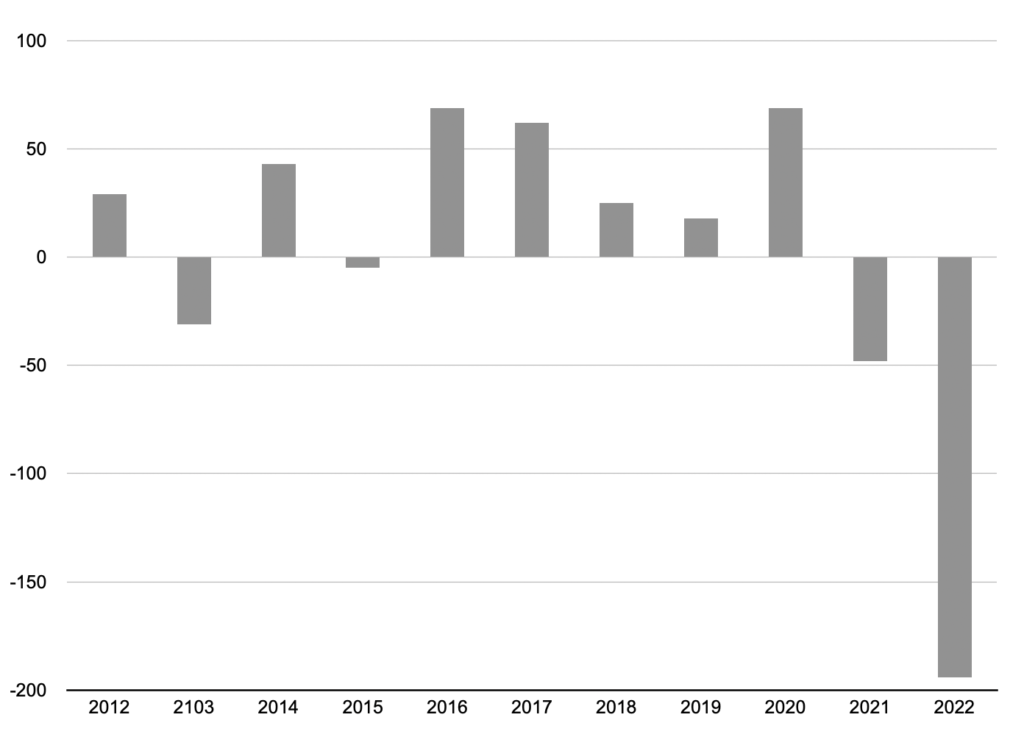

Silver supply surpluses and deficits

(2012-2022)

Chart by USAGOLD [All rights reserved], Data source: Macrotrends.net

Daily Gold Market Report

Gold takes a sharp turn to the south on wavering rate sentiment

Saxo Bank’s Ole Hansen thinks a short-term consolidation might be in the works

(USAGOLD – 4/19/2024) – Gold took a sharp turn to the south this morning in what looks to be a general commodities sell-off driven by wavering sentiment on inflation and rates. It is down $34 at $1973. Silver is down 52¢ at $24.77. Persistently high inflation readings globally, this morning’s UK inflation report being the latest example, are fueling a perception that central banks will be forced to keep rates high for some time to come.

Saxo Bank’s Ole Hansen maintains a bullish outlook for gold and silver but thinks a short-term consolidation might be in the works. “Gold,” he says in an analysis released this morning, “reached a fresh cycle high last week at $2048/oz, coming within just 22 dollars of the 2022 record peak. Silver experiencing a 31% rally since early March, reached a one-year high above $26/oz before encountering profit-taking. After such strong gains, both metals are in need of consolidating their gains, especially after relative strength indicators began flashing overbought in both metals.”

Daily Gold Market Report

Gold turns to the upside after once again finding support just below $2000

London-based fund manager Ruffer offers investors a few words of wisdom

(USAGOLD – 4/18/2023) – Gold turned to the upside this morning after once again finding support just below the $2000 level. It is up $9 at $2006. Silver is up 5¢ at $25.18. Also helping gold along in today’s early going is a strong first-quarter GDP report out of China (+4.5%) led by domestic consumer demand. We came across the following bit of wisdom from London-based fund manager Jonathan Ruffer over the last weekend and thought it worth passing along, particularly in the context of declining bond markets. (The full essay is a gem and highly recommended.):

“The mischief will be centred on investment portfolios. To survive, one will have to be careful in the sorts of assets one owns. There is usually a sharp changing of the guard in markets after an event which involves illiquidity – when the refreshing waters return, it is not always to the old favourites. In the emergency, though, the jewels and the paste are all jettisoned together, and real money can be made by having the firepower to buy assets from distressed investors. This requires a strong ammunition cart of cash, or cash-equivalent: the latter has to be regularly checked to confirm that there is a genuine equivalence. I am a bit queasy writing this, in case the crisis happens… and we find ourselves locked into our ‘safe’ investments.”

Editor’s note: Though Ruffer does not mention gold in this essay (except in a historical context), his firm has recommended holding it in the past. [Please see: Gold Matters, September 2020.]

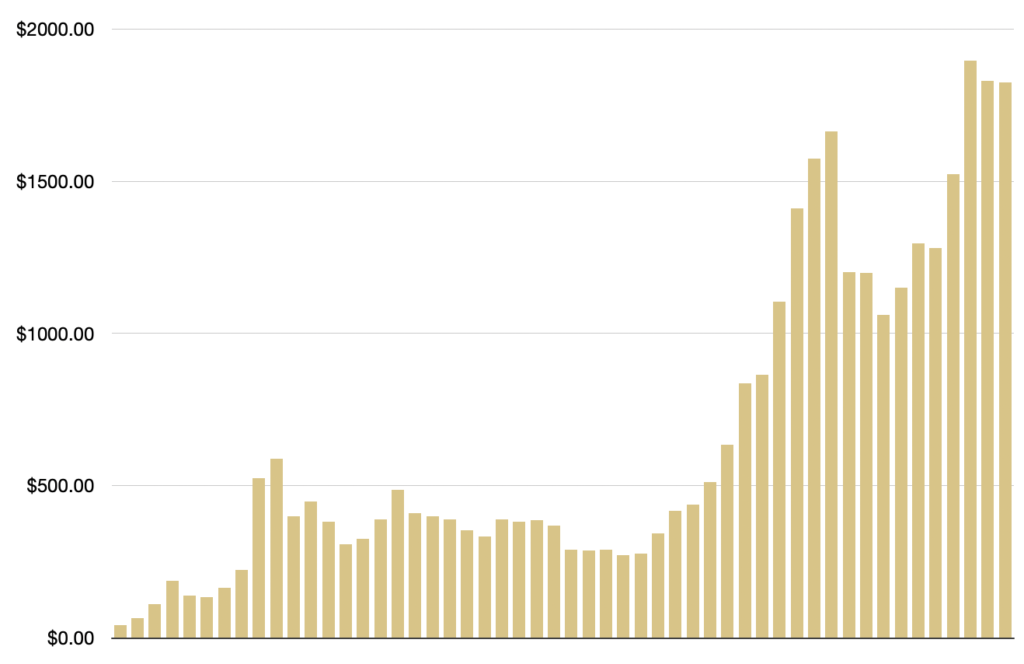

Gold Average Annual Prices

Chart by USAGOLD [All rights reserved], Data source: Macrotrends.net