Monthly Archives: April 2023

Summers warns US is getting lonely as other powers band together

Bloomberg/Chris Antsey/4-14-2023

USAGOLD note: Summers brings a sense of immediacy to a threat most believed to be on a long timeline……

Head of world’s largest asset manager says this is why Fed will struggle to bring down inflation

USAGOLD note: In other words, prepare for more systemic risk and more safe haven demand for physical gold and silver. – something that has a been consistently strong since the latest banking crisis began through the gamut of investors – individuals, funds, institutions and central banks.

Daily Gold Market Report

Gold loses momentum as traders test the downside

Felder: ‘Gold may be on the cusp of another major bull market.’

(USAGOLD – 4/25/2023) – Gold turned lower this morning as momentum faltered just below the psychologically important $2000 mark and traders tested the downside. It is down $11 at $1980. Silver is down 59¢ at $24.62. Jesse Felder, the veteran market analyst and former hedge fund manager, thinks gold may be on the cusp of another major bull market driven by the federal government’s rapidly deteriorating fiscal situation.

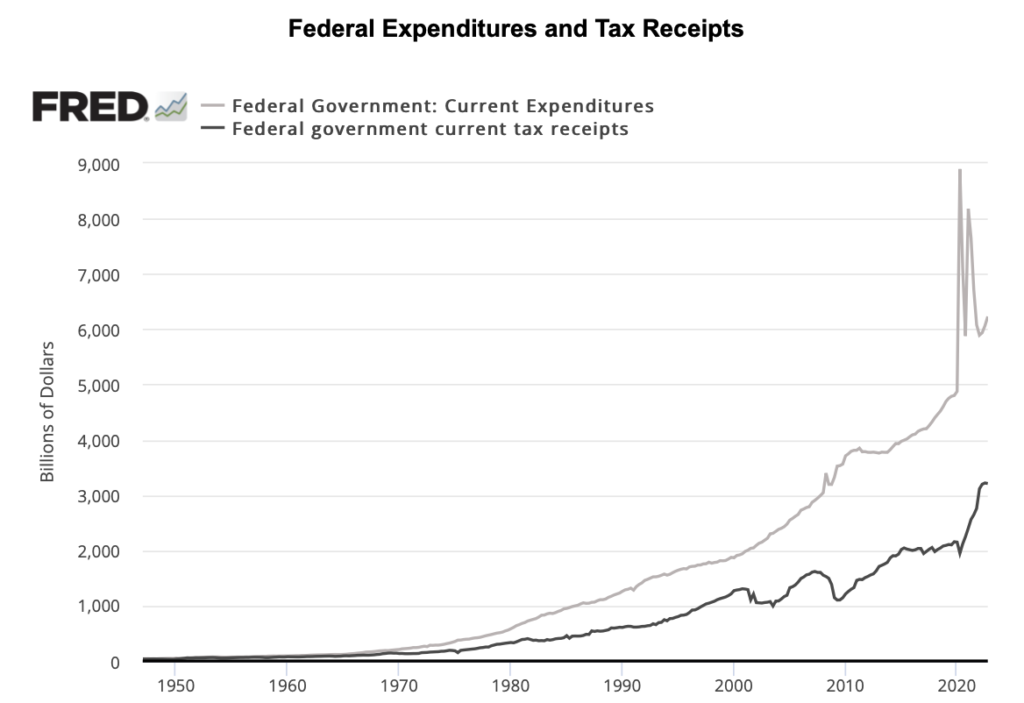

“[I]f history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending) is gold,” he writes in a recently posted analysis. “The last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback that lasted roughly a decade. This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.”

Gold and the US federal debt

(1971 to present)

Chart courtesy of Trading View.com • • • Click to enlarge

Debt ceiling jitters drive up cost of insuring against US default

Financial Times/Kate Duguid, Lauren Fedor and Colby Smith/4-14-2023

“The cost of buying insurance against a US government default has shot to its highest level in more than a decade, in an early sign of market concerns about the political impasse in Washington over the debt ceiling.”

USAGOLD note: Few believe that the politicians will let things get out of hand, yet some would say that the times dictate the unexpected should be expected. The deficits have clearly gotten out of control. By the end of last year, the difference between federal receipts and expenditures was $3.2 trillion.

Sources: St. Louis Federal Reserve {FRED], U.S. Bureau of Economic Analysis

New interview: Eight best quotes from Howard Marks

Markets Insider/Theron Mohamed/4-15-2023

USAGOLD note: Howard Marks offers insights on a range of topics…… Humility was the thirteenth (and last) virtue Ben Franklin lived by.

Yellen says sanctions may risk US dollar hegemony

USAGOLD note: An unusual admission by a US Treasury Secretary……

El-Erian terrified of central banks losing autonomy over errors

Bloomberg/Philip Aldrick and Sam Kim/4-14-2023

USAGOLD note: Some see central banks as god-like. Other see them as a source of instability. it cannot be overlooked that confidence in central banks is waning – especially the Federal Reserve which finds itself at the epicenter of a crisis largely of its own making.

If King Dollar is wobbling, silver is your best investment, says Citi

MarketWatch/Barbara Kollmeyer/4-18-2023

‘That brings us to our call of the day from a team of analysts at Citigroup, led by Maximilian J Layton, who see more dollar weakness ahead, which is good news for a shiny asset less often in the spotlight. ‘Silver has already rallied 20% in a short period of time, but we think it has another >10% move in the tank over the coming months to $30/ounce, with our bull case of $34/ounce still a distinct possibility over the next 6 -12 months,’ Layton and the team told clients in a note.”

USAGOLD note: Citigroup jumps aboard the silver bandwagon…“Precious metals and especially silver has near perfect conditions for the ongoing bull market,” it says.

Daily Gold Market Report

Gold off to slow start this morning in featureless trading

Sharma: ‘Gold is now a vehicle of central bank revolt against the dollar.’

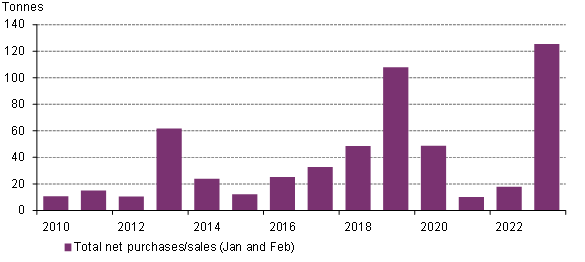

(USAGOLD – 4/24/2023) – Gold is off to a slow start this morning in featureless trading. It is up $1 at $1986.50. Silver is level at $25.16. In a Financial Times opinion piece over the weekend, Rockefeller International’s Ruchir Sharma says that there is “something new” in the gold market – “heavy” central bank gold buying driven by weaponization of the US dollar. He points out that central banks now account for a record 33% of monthly gold demand.

“[T]he oldest and most traditional of assets, gold,” he writes, “is now a vehicle of central bank revolt against the dollar. Often in the past, both the dollar and gold have been seen as havens, but now gold is seen as much safer.” Separately, the World Gold Council reports central banks picking up in the first two months of 2023 where they left off in 2022 – a record year for central bank offtake. Early-year demand was at a pace not seen since at least 2010, says WGC.

Central bank gold demand

(First two months of the year, 2010-2023)

Source: World Gold Council, IMF IFS, respective central banks

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The cities were still there, the houses not yet bombed and in ruins, but the victims were millions of people. They had lost their fortunes, their savings; they were dazed and inflation-shocked and did not understand how it had happened to them and who the foe was who had defeated them. Yet they had lost their self-assurance, their feeling that they themselves could be the masters of their own lives if only they worked hard enough; and lost, too, were the old values of morals, of ethics, of decency.”

Pearl S. Buck

Novelist who was in Germany during the hyperinflation in 1923

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Jamie Dimon issues warning on rates: ‘It will undress problems in the economy’

USAGOLD note: Dimon pressures the Fed to come around on rates or prepare for more systemic risk……

The gold bull market is just getting started

Seeking Alpha/Christopher Yates/4-13-2023

USAGOLD note: A well-constructed argument calling for a bull market in gold based on an erosion in the real rate of return……

Grantham doubles down on bearish stock market call

MarketsInsider/Theron Mohamed/4-14-2023

USAGOLD note: There is a reason Grantham gets considerable attention in the mainstream financial media. His bearish calls have proven to be on the money over the past two years. He is now saying that the S&P 500 will fall another 27% to around the 3000 level, and to the 2000 level in a worst-case scenario – a 50% drop overall.

Hank Paulson: ‘We can never abolish financial crises. They will always happen.’

Financial Times/Interview of Hank Paulson/4-15-2023

USAGOLD note: The quote above is Paulson’s response to the question – Are you “happy with the fact that the US government is now essentially guaranteeing every deposit in the land. Isn’t that getting close to having a socialist banking system?” He goes on to say that “We can never abolish financial crises. They will always happen.”

Daily Gold Market Report

Gold tracks lower in cautious end of week trading

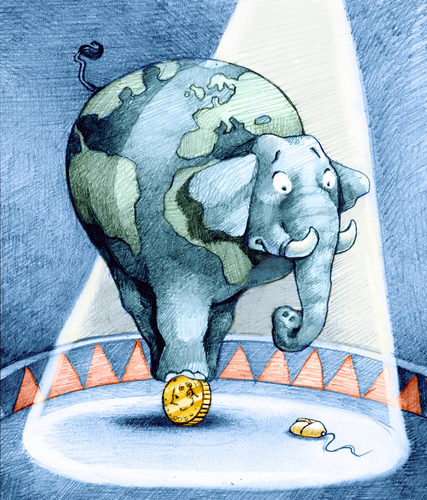

Eurizon reports sharp decline in global dollar reserves, gold a beneficiary

(USAGOLD –4/21/2023) – Gold tracked lower this morning as uncertainty over the rate picture lingered, worry about the banking system cooled, and cautious end of week trading prevailed. It is down $17.50 at $1990. Silver is down 15¢ at $25.22. A recently released study by Eurizon SLJ Asset Management finds that the dollar’s share of total global reserves declined sharply in 2022 while its status as the dominant currency in international trade remained “unchallenged” – a differentiation we have not seen referenced by other analysts.

“In a Monday note, strategists Joana Freire and Stephen Jen calculated that the greenback accounted for about two-thirds of total global reserves in 2003, then 55% by 2021, and 47% last year. ‘This 8% decline in one year is exceptional, equivalent to 10 times the average annual pace of erosion in the USD’s market share in the prior years,’ the authors said.” [Source: Markets Insider, 4/17/2023)

Editor’s note: Gold has been one of the primary beneficiaries of that 8% shift in global reserves. The World Gold Council reports record central bank purchases of 1136 metric tonnes in 2022. “There has been a concerted shift away from over-reliance on the US dollar as a reserve currency in an environment of non-existent real yields on sovereign debt,” writes the Council’s Louise Street in a recent market review.

Cartoon courtesy of MichaelPRamirez.com

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“[T]he object of speculation may vary widely from one mania or bubble to the next. It may involve primary products, especially those imported from afar (where the exact conditions of supply and demand are not known in detail), or goods manufactured for export to distant markets, domestic and foreign securities of various kinds, contracts to buy or sell goods or securities, land in the country or city, houses, office buildings, shopping centers, condominiums, foreign exchange. At a late stage, speculation tends to detach itself from really valuable objects and turn to delusive ones. A larger and larger group of people seeks to become rich without a real understanding of the processes involved. Not surprisingly, swindlers and catchpenny schemes flourish.”

Robert Z. Aliber and Charles P. Kindleberger

Manias, Panics and Crashes – Anatomy of a Typical Financial Crisis (2001)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Bank of America’s Hartnett sees 20% dollar selloff, turns bullish on gold

Markets Insider/Benzinga/4-14-2023

“According to the most recent ‘The Flow Show’ from Hartnett, markets are entering a new period of conflict, geopolitical isolationism, populism, fiscal excess, state intervention, regulation and redistribution. These factors will result in a world with 3%-4% inflation and 3%-4% interest rates.”

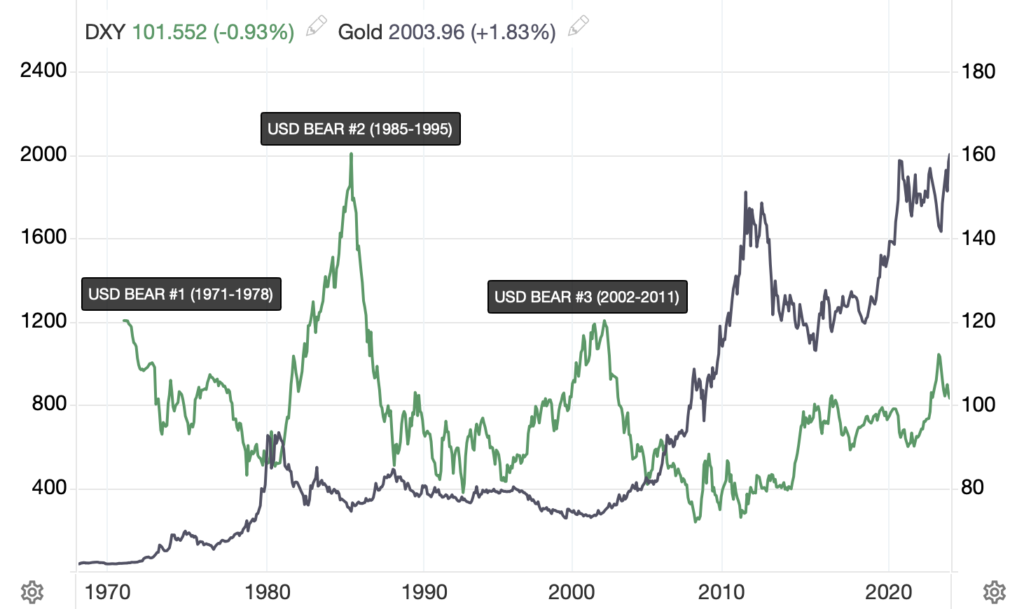

USAGOLD note: Hartnett is highly respected on Wall Street, so this forecast will not be taken lightly……He sees the dollar entering its fourth bear market in the last 50 years. The chart below shows the relationship between the US Dollar Index (DXY) and gold. A 20% decline would take the DXY back to the 80 level, implying the potential for an upside move in the gold price.

US Dollar Index and Gold

(1970 to present)

Chart courtesy of TradingEconomics.com • • • Click to enlarge

What I learnt from three banking crises

Financial Times/Gillian Tett/4-8-2023

USAGOLD note: As a reporter and columnist at the Financial Times, Gillian Tett has had a ringside seat, as FT puts it, for “a quarter century of financial crashes.” In this detailed analysis, she walks us through “five key lessons to ponder” she learned from covering those events. We reference the first above. We add that the same erosion of bond values that caused the collapse of SVB also brought down Credit Suisse a short time later and remains a cause for concern in the international banking system.

Top US banks to reveal $521 billion deposit drop, most in decade

YahooFinance/Bloomberg/4-12-2023

USAGOLD note: The lion’s share of the deposit drain is going into money market funds while a not-so-insignicant amount is flowing into gold and silver. Investors are attempting to protect hard earned savings.

Why bitcoin will never eclipse gold

MoneyWeek/Merryn Somerset Webb/4-11-2023

“Imagine, says [Orbis’ Alec] Cutler, that a divine ruler had written a white paper for gold, just as the inventor of bitcoin apparently did for his new currency. Humanity will, he might have thought, need ‘a convenient and reliable vehicle for the preservation of wealth and universally trusted medium of exchange, for both government-issued and peer-to- peer transactions’, one that ‘will maintain its value for all eternity.'”