Monthly Archives: April 2023

Lessons from Silicon Valley Bank

Oaktree/Howard Marks/4-17-2023

“My sense is that the significance of the failure of SVB (and Signature Bank) is less that it portends additional bank failures and more that it may amplify preexisting wariness among investors and lenders, leading to further credit tightening and additional pain across a range of industries and sectors.”

USAGOLD note: The latest client memo from Howard Marks recounts a growing concern among top-notch analysts that the bank liquidity crisis will morph into a full-blown credit crunch. He is particularly worried about commercial real estate loans. “Notable defaults on office building mortgages and other CRE loans,” he says, “are highly likely to occur. Some already have.”

Banks take out more loans from Fed in sign of lingering stress on financial system

MarketWatch/Jeffry Bartash/4-20-2023

USAGOLD note: It’s not over until it’s over ……Many banks are sitting on large underwater positions in Treasuries. Bartash says the banks “may not be close to being in the clear.”

Silver market in new era of structural deficits

The Silver Institute/World Silver Survey 2023/4-19-2023

USAGOLD note: The structural deficits are the result of solid global demand and declining mine production. Of special note, TSI reports that the current supply shortfall amounts to “more than half more than half of this year’s forecasted annual mine production, and more than half of the inventories presently held in London vaults offering custodian services.” In general, TSI paints a bullish scenario for the metal going forward.

US banks on alert over falling commercial real estate valuations

Financial Times/Staff/4-22-2023

USAGOLD note: These warnings keep popping up about trouble brewing in commercial real estate. As the old saying goes, where there’s smoke there’s fire. Half of the investors polled in a recent Bank of America survey identify commercial real estate “as the most likely source of a systemic credit event.”

Daily Gold Market Report

Gold drifts marginally lower as attention turns to next week’s Fed meeting

Rosenberg predicts deflationary future, recommends ‘bond-bullion barbell’

(USAGOLD –4/28/2023) – Gold drifted marginally lower in today’s early going as markets turned their attention to next week’s Fed meeting. It is down $4 at $1986. Silver is down 14¢ at $24.90. The $2000 level for gold and the $25 level for silver have proven to be obstacles – at least for the moment. Still, as we close out April, gold is up 1.4% on the month; silver is up 7.5%.

David Rosenberg, the highly regarded Toronto-based investment analyst, says that the current trends point to “a deflationary, not inflationary environment.” He recommends Treasuries, cash, and gold as the best bets for a future that could include significant systemic risk. “The U.S. dollar,” he says In a Marketwatch interview published yesterday, “will come under downward pressure. Gold will be a great hedge against the declining greenback. I’ve been advocating the bond-bullion barbell. “

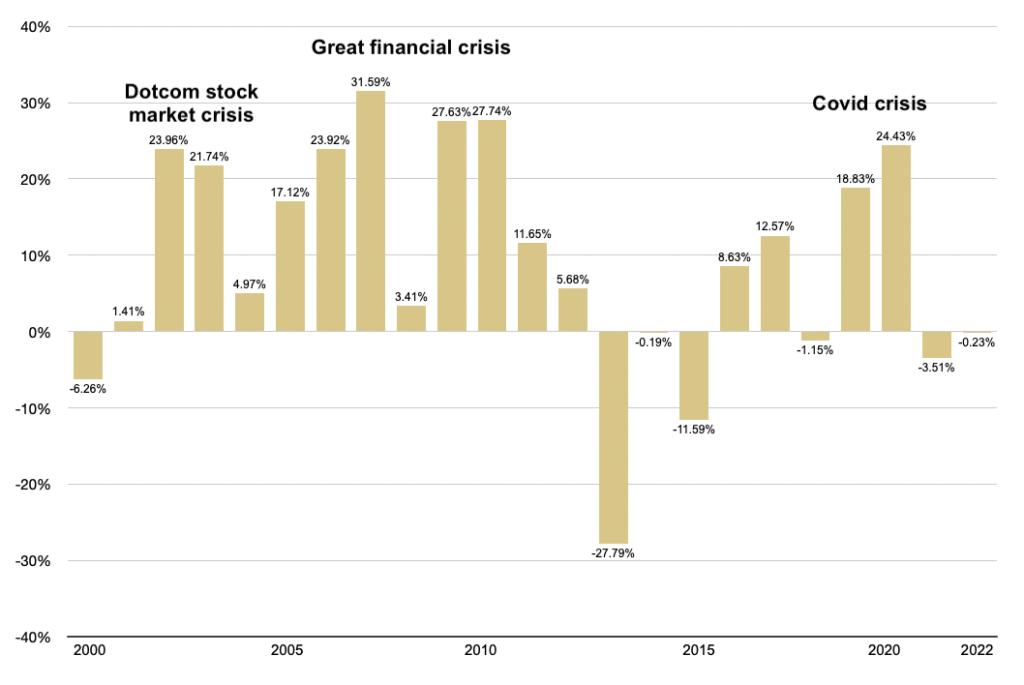

Editor’s note: As shown in the chart below, systemic crisis, not inflation, have generated the most substantial price gains for gold thus far in the 21st century.

Gold annual returns and crisis periods during the 2000s

(Year over year gains or loss, 2000 to present)

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration, USAGOLD • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Rome fell because the dictators ruined the Roman economy and the institutions that had made it prosperous. Rome was falling apart before the barbarian invasions. How did the Caesars do that? They were profligate spenders. As emperors with absolute power usually do, they thought big: infrastructure (roads, temples, palaces), a huge bureaucracy, and, as the key to maintaining their power they had a very large, loyal, and well-paid army. As a consequence, massive government spending far outstripped revenue. They had what today we call a deficit problem.”

Jeffrey Harding

Mises Institute

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Nigel Green: Perfect storm will make dollar biggest loser in 2023

NewsmaxFinance/Nigel Green/4-20-2023

“It’s a perfect storm that will lead to the dollar being one of the biggest losers of 2023. There is a transition underway from a bull to a bear cycle for the dollar and this will shift the global investment environment in a profound way.”

USAGOLD note: Green is the founder and CEO of London-based de Vere Group.He says a dollar retreat could jolt portfolios, “especialy if they aren’t properly diversified.”

The dollar is not losing its status anytime soon

Bloomberg/John Authers.4-18-2023

“I think you see where I am going with this. The US dollar is Amazon, and the Chinese yuan is Walmart. Yes, China would like to dethrone the dollar, but it isn’t that simple.” – Brad McMillan, Chief Investment Officer for Commonwealth Financial Network

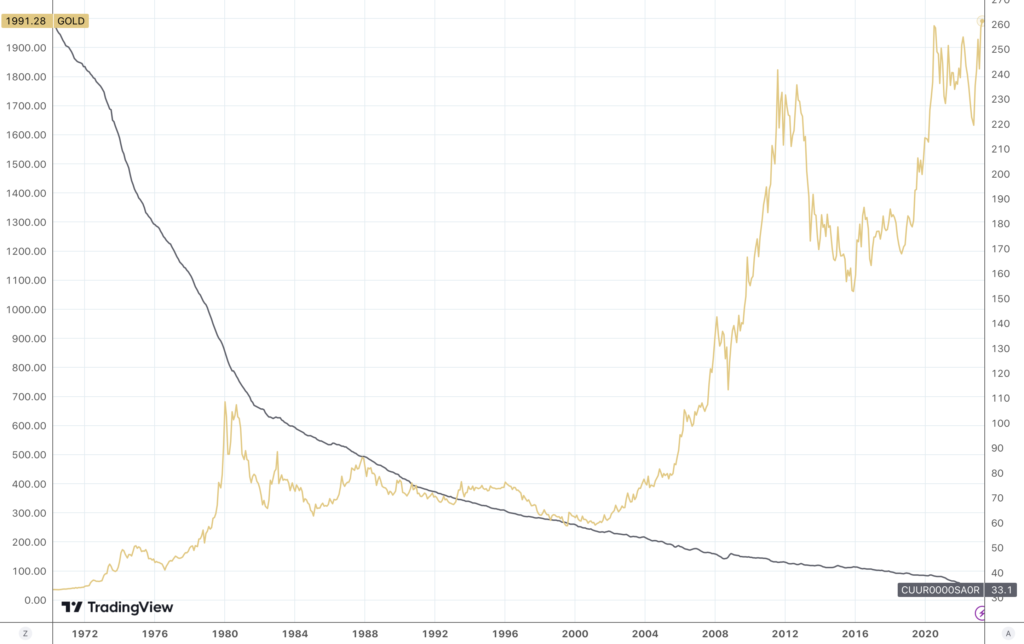

USAGOLD note: While we agree with Authers that the dollar will not lose its status as the dominant currency in international trade anytime soon, it is clearly losing ground as a reserve currency. (Please see this morning’s Daily Gold Market Report further down the page.) Alan Simpson, former Wyoming senator, once referred to the dollar as “the healthiest horse in the glue factory.” All said, gold does not need de-dollarization to continue moving higher. Likewise, the dollar can still decline against other currencies despite its exorbitant privilege (as it has in the past). The more critical factor for savers and investors is the ongoing erosion of the greenback’s purchasing power since 1971 and the attendant increase in the price of gold, as shown in the chart below.

Gold and the purchasing power of the US dollar

(1971 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

When parsing the banking crisis, don’t forget easy money

Bloomberg/Bill Dudley/4-19-2023

“Quantitative easing also played a role. When the Fed purchased trillions of dollars in Treasury and mortgage-backed securities to push down longer-term interest rates, it flooded the banking system with deposits, which banks often invested in the same longer-term securities at extremely low yields. This all but ensured that when the Fed later tightened, causing yields to rise and prices to fall, it would generate large mark-to-market losses at the banks.”

USAGOLD note: An usually strong indictment of the Fed’s easy money policies from the former head of the Federal Reserve Bank of New York – the traditional linchpin of Fed policy implementation. Can the Fed ever step off the QE treadmill? That is a question every investor must address in his or her long-term investment planning. To ignore it, is to ignore the central economic issue of the times.

Short and Sweet

Blowing up the “Everything Bubble”

“What the average person fails to understand,” writes Lance Roberts in an analysis posted at the Real Investment Advice website, “is that the next ‘financial crisis’ will not just be a stock market crash, a housing bust, or a collapse in bond prices. It could be the simultaneous implosion of all three. Whatever causes that change in sentiment is unknown to me or anyone else. I am not saying with certainty it will happen, as I hope sanity prevails and actions are taken to mitigate the consequences. Unfortunately, history suggests such is unlikely to be the case.” And, we might add, it is not likely the damage will be restricted to the United States In fact, an implosion in one location could cause corresponding meltdowns in multiple locations. Easy money and heavy leverage have greatly influenced price levels in all markets heightening rollover risks. And then there’s the derivative problem with notional exposure estimated at more than $1 quadrillion, according to Investopedia.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you ready for the ultimate derivatives moment?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Andy Beal, America’s richest banker, makes a massive bond bet on inflation

MarketWatch/Nathan Vardi/4-19-2023

USAGOLD note: The point that sticks in the mind is that Beal’s bet on inflation is for the long term……”It suggests Beal believes inflation is here to stay for at least several years.”

Daily Gold Market Report

Gold turns to the upside on banking system worries, general economic uncertainty

Aden Forecast says ‘once gold takes off, it will skyrocket’

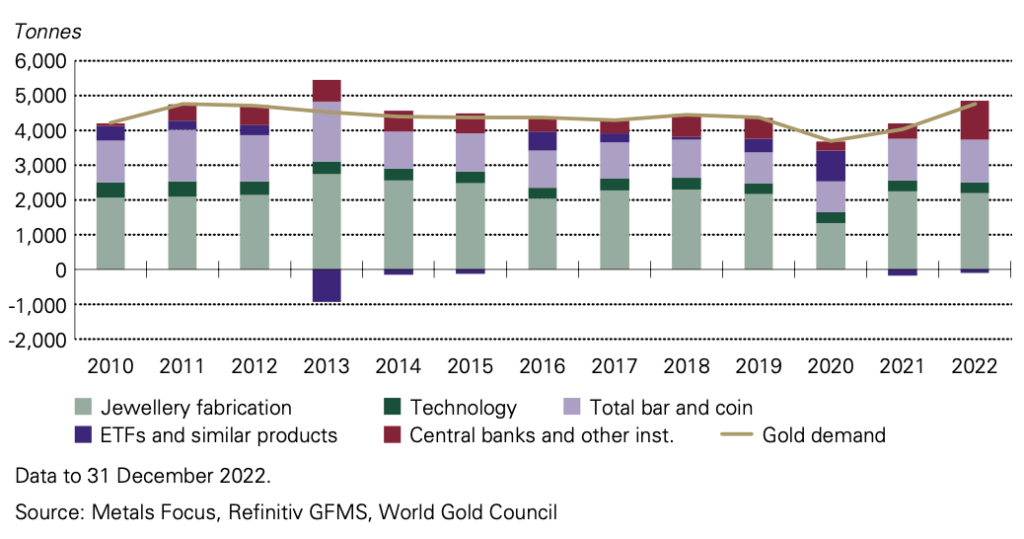

(USAGOLD – 4/27/2023) – Gold turned to the upside this morning as worry about the banking system and general economic uncertainty pushed back to the forefront. It is up $8.50 at $2000. Silver is up 16¢ at $25.07. The Aden sisters (Aden Forecast) have been a mainstay in financial circles for decades. Known for their straightforward market analysis, they now believe that a “big financial shift” is in the cards and that central banks and private investors are stockpiling gold to prepare for it.

“Everyone knows that gold is real money,” they say. “It has stood the test of time. It has a 5000-year track record and it’s essentially the only global currency in the world. It’s also the world’s favorite safe haven and that’s why central banks worldwide have been stocking up on gold and easing out of dollars. They see what’s happening on the economic and geopolitical fronts and they want to play it safe by accumulating real money. Private investors are starting to do the same. And once gold takes off, we believe it’s going to skyrocket.” [Source: Yahoo Finance]

2022 gold demand led by private investors and central banks matched the 2011 record

Source: World Gold Council

Public pessimism on the economy hits a new high, CNBC survey shows

USAGOLD note: Helps to explain the consistently strong demand for gold and silver among American investors.

Ruffer Investment Review offers unique perspective, practical advice

Ruffer Investment Review/Jonathan Ruffer/April 2023

USAGOLD note: Ruffer believes that investors need to keep their powder dry in order to take advantage of the next bottom in financial markets. As a result, he recommends a strong cash position even though inflation erodes its value. Though he does not mention gold in this essay (except in a historical context), his firm has recommended holding it in the past. [Please see: Gold Matters, September 2020.]

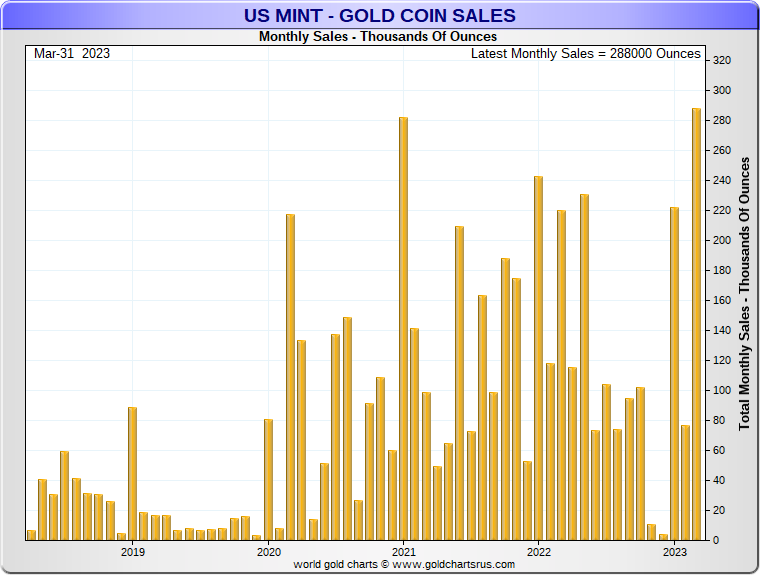

US Mint gold bullion coins see explosive sales in March

“Sales of American Eagle and Buffalo gold bullion coins from the U.S. Mint experienced an incredible rally in March, rocketing from the prior month, and far beyond last year’s sales figures from the same month.”

USAGOLD note: Demand for gold and silver bullion coins is running strong, driven by safe-haven investors looking for an alternative to bank savings. The US Mint reports a 277% gain in sales of the American Eagle gold bullion coin over last month and a 38% gain over the same month last year, according to CoinNews. Demand for the American Eagle silver bullion coin in March was at par with last month, but ultra-high premiums have channeled strong global demand to lower premium alternatives like the Canadian Maple Leaf and the Austrian Philharmonics. Combined sales of American Gold Eagle and Buffalo gold bullion coins posted their best month in five years at just over 280,000 ounces.

Chart courtesy of GoldChartsRUs

Investors bet US dollar has further to fall

Financial Times/Jenniger Luges, Mary McDougll and Kate Duguid/4-18-2023

USAGOLD note: A very dovish BoJ rate policy has kept the dollar from declining even further, faster over the short run……But that damper might wear off over the next few weeks. Professional traders have doubled their short positions in the greenback, reports FT.

Daily Gold Market Report

Gold up marginally this morning in muted reaction to run on First Republic Bank

Lombard Odier makes an important observation on changing gold market psychology

(USAGOLD – 4/27/2023) – Gold is up marginally this morning as the market reaction to the run on California’s First Republic Bank remains muted. It is up $2 at $2002. Silver is level at $25.11. In an analysis released yesterday, Lombard Odier’s Stephane Mornier makes an important observation about changing gold market psychology we thought worth passing along.

“What do the Singaporean, Turkish, and Chinese central banks have in common with jittery investors?” he asks. “Answer, they’ve been buying gold as a haven and diversifier from fears of a recession, a crisis of confidence in banking, and a weakening US dollar. We see this as an indication that economic factors are taking over from financial speculation as the main driver of demand for gold.” Real demand, it says, is pushing gold towards a new standard. The bank has raised its target price to $2100 by the end of the year.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“My studies of the 17 major financial crises since the founding of the Republic reveal that over-optimism is an important driver of the bubbles that eventually become busts. As the legendary investor, Sir John Templeton, once said, ‘The four most dangerous words in investing are ‘This time is different.’ Such was the mind-set that real estate prices could only rise (2008), dot-com companies would forever grow and be profitable (2001), or that the Russian government would never default (1998). “

Robert F. Bruner

The Hill

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

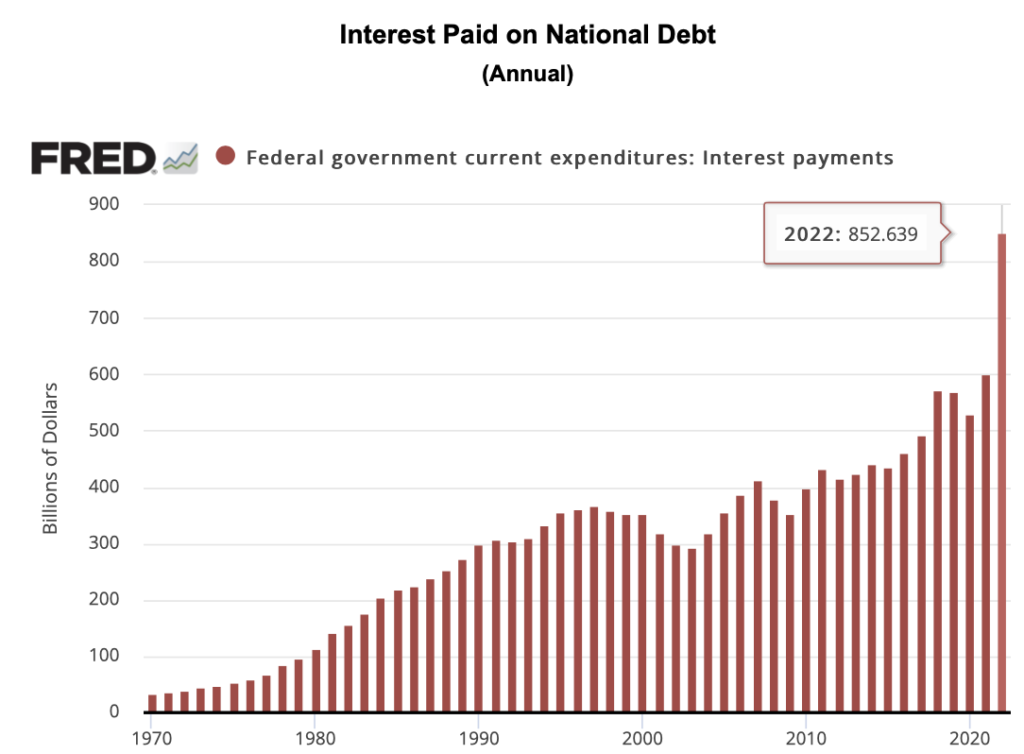

US annualized debt costs exceed $800 billion

ZeroHedge/Mark Cudmore/4-17-2023

“US yields have risen more than 20bps all the way out the curve. The costs are still rising almost parabolically, so expect headline excitement when the $1t figure is likely reached later this year.”

USAGOLD note: Though the interest paid on the national debt is a problem widely ignored by mainstream economists, we can be assured that both the Fed and the Treasury Department are acutely aware of it. The problem can be worsened in two ways. First, the federal government continues to pile up the debt. Second, interest rates could continue to rise. To add a little perspective, federal government tax receipts as of the end of 2022 stood at $3.2 trillion. Thus, interest payments were 26% of taxes collected. Mark Cudmore is a Bloomberg macro strategist.

Banking crises are preventable, but human nature gets in the way

Bloomberg/Max Abelson/4-15-2023

USGAOLD note: Nettlesome human nature always seems to get in the way……In more ways than one. As human beings, we are tasked with operating within systems designed, built, and managed by human beings. But worry not, artificial intelligence is moving quickly in the direction of rremedying the human condition.