Monthly Archives: February 2023

Can inflation respriral higher? Morgan Stanley’s Caron thinks it can.

Bloomberg/Vildana Hajiric and Micahel P. Regan/2-4-2023

“Aside from all the geopolitical potential risks, the risk that keeps me up at night is that we get this decline in inflation in the first half of the year, which we know is happening, but all of a sudden we realize in the second half of the year that it’s not anchored — it comes down, but then all of a sudden it starts to show signs that it may start to bubble up in 2024 and beyond.”

USAGOLD note: Inflation is a process, not an event.

The new global gold rush

NPR/Stacey Vanek Smith/2-3-2023

“2022 was a rough year for investors: Between inflation, falling stock prices, and the crypto crash, it was hard to find a safe haven. All of that economic turmoil had a lot of investors looking at one of the most ancient places to store wealth: gold. For decades, investing in gold has been seen as a very old school investment, for the maverick, perhaps slightly anti-establishment investor.”

USAGOLD note: Yes. Old school, maverick investors seeking to preserve their wealth over the long run…… The same motivation that has been in place ever since we can remember. The major difference, as NPR points out, is the percentage of the wealthy investors worldwide looking to gold which has increased markedly. It is refresing to see the photo of a 20-year old holding a recently purchased one-ounce gold bar.

Gold drifts lower ahead of tomorrow’s all-important inflation data

Ukraine war has turned Russia into a nation of gold bugs

(USAGOLD – 2/13/2023) – Gold drifted lower in quiet trading ahead of tomorrow’s all-important inflation data in what looks to be a continuation of the technical selling that began early this month. It is down $8 at $1860. Silver is down 9¢ at $22.00. IG, the UK– based investment firm, believes gold is in a period of consolidation within a broader uptrend.…The narrative continues to be broadly gold supportive,” it says in an advisory released this morning.”

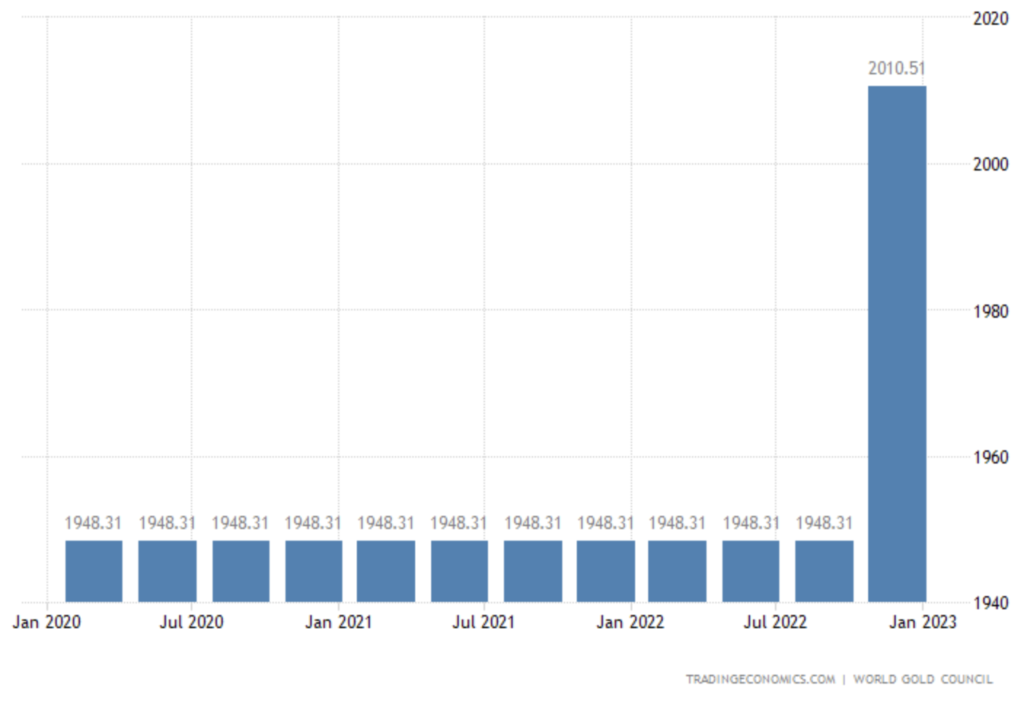

Financial Times reports that the war In Ukraine has turned Russia into a nation of gold bugs. “The demand for gold coins and bars grew faster in Russia than any other country, rising nearly five times the level of the previous year,” it says in an article posted over the weekend. Polymetal’s Vitaly Nesis told FT that “private citizens are looking for a way to save money, and euros and dollars are in short supply, so the popularity of gold has surged. As long as we experience geopolitical instability, the demand for gold may be significant.”

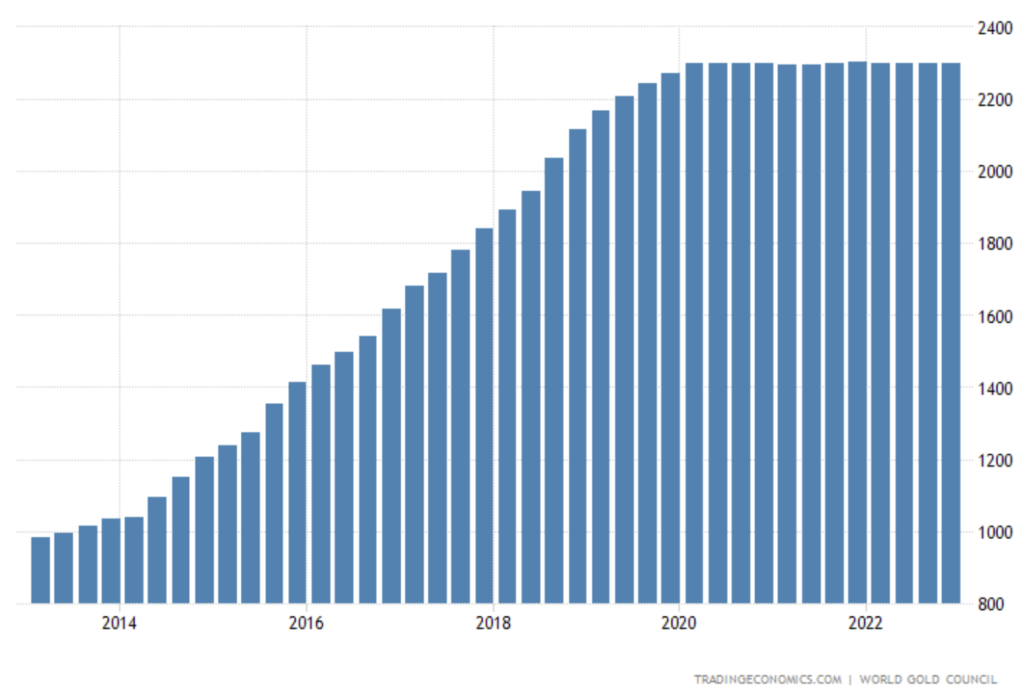

(Editor’s note: FT reports that investor interest in gold jumped following the government’s lifting of the VAT tax on the metal. “The switch to gold,” it notes, “has been strongly encouraged by the Russian government.” Russia itself has more than doubled its gold stockpile over the past decade, as shown below.)

Russia gold reserves

(Metric tonnes)

Chart courtesy of TradingEconomics.com

Markets may be in for an ‘enormous shock’ as the Fed could have to kick up interest rates to a 40-year high to fight inflation, strategist says

MarketsInsider/Carla Mozee/2-14-2023

“Disinflation is a ‘fiction” and US monetary policymakers may need to nearly double borrowing rates from current levels to tamp down hot inflation, a move that would rock markets, according to a strategist at financial research firm Macro Hive.”

USAGOLD note: Out of the blue during his last press conference, the Fed chairman started tossing around the word “disinflation”. Wall Street collectively scratched its head. Macro Hive’s Dominique Dwor-Frecaut says the Fed may have to drive its key lending rate to 8% to tame inflation, and that’s not something she “plucked out of thin air.”

Gold Classics Library

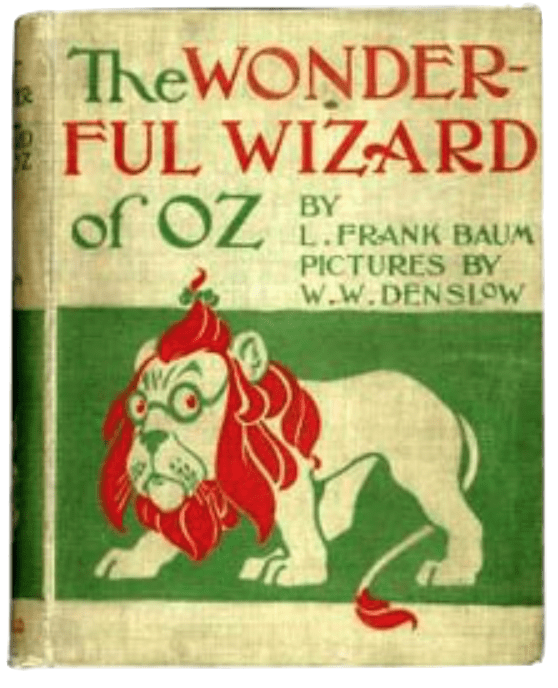

A Gold Classics Library Selection

Money and politics in the land of Oz

The extraordinary story behind the extraordinary story of

The Wonderful Wizard of Oz

by Professor Quentin Taylor, Rogers State University

Year in, year out, Money and politics in the land of Oz is among our most highly-visited Gold Classics Library selections. Here is the extraordinary story behind the extraordinary story of ‘The Wonderful Wizard of Oz’. Most have seen the movie version of this allegorical tale published in 1900, an election year, but few are aware of what the various characters, places and things represented in the mind of Frank Baum, the tale’s author. Though ‘The Wonderful Wizard of Oz’ was written 120 years ago, the themes will be recognizable to those with an interest in golden matters today. While many today consider gold an instrument of financial and personal freedom, in Baum’s tale, it is painted as a villain — the tool of oppression. So, as you are about to see, we have come full circle, and gold has traveled a yellow brick road of its own.

Ready to travel the yellow brick road?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Legendary ‘Big Short’ investor Michael Burry issues an ominous warning after the latest stock market rally: ‘Sell.’

Yahoo!Finance-Fortune/Will Daniel/2-1-2023

USAGOLD note: The latest from Burry comes down to a single, ominous word…… Fortune, however, documents more detail on Burry’s thinking at the link.

Summers sees risk of ‘sudden stop’ in economy after jobs surge

Bloomberg/Chris Antsey/2-3-2023

USAGOLD note: Even Summers was caught off guard by the Friday jobs numbers. He says the danger is that the reduction in inflation will be transitory. “I think that risk is greater than I think the Fed thinks it is,” he says.

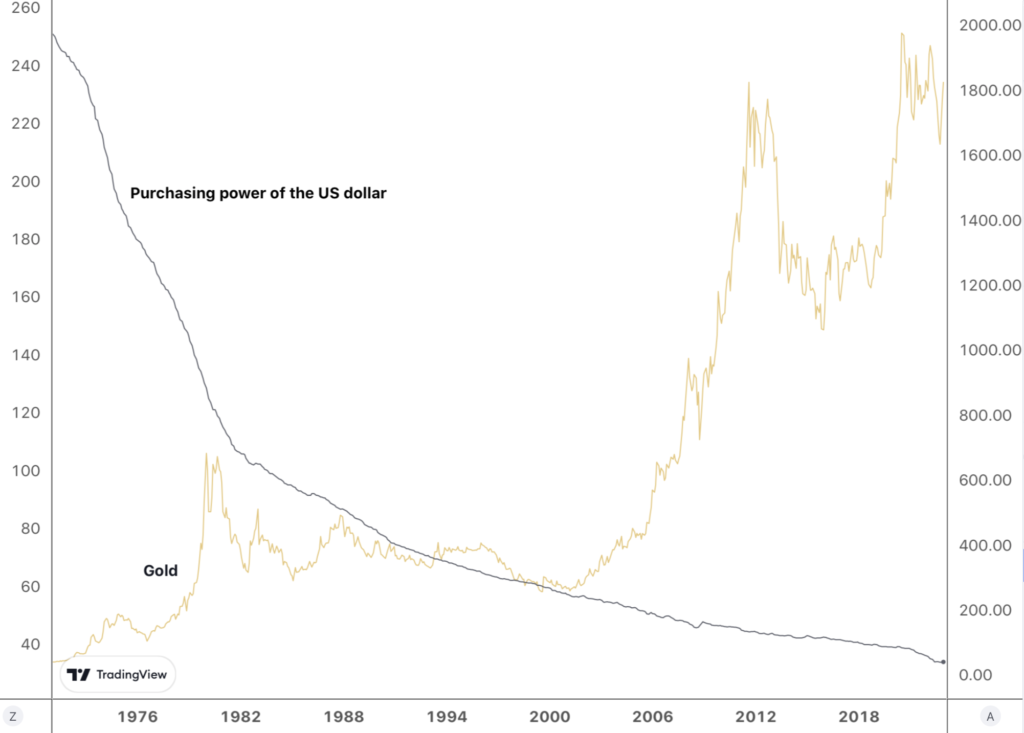

Why every investor should consider some gold in their portfolio

FidelityInternational/Tom Stevenson/2-3-2023

USAGOLD note: Don’t get hung up on the short-term bumps and bruises or, for that matter, the occasional out-of-the-box explosions to the upside……We have always recommended gold as a long-term store of value rather than a short-term speculation. And, when viewed as such, it is a very rewarding item to own as borne out by the long-term charts.

The most important question is whether we’re going to have stagflation

themarketNZZ/Christoph Gisiger interview of Howard Marks/1-30-2023

USAGOLD note: The latest from Howard Marks – much offered here in the way of practical advice for the private investor. Is the old-fashioned armchair investor making a comeback? All things considered, it seems to be the approach Marks is recommending, i.e., the opposite of the day trader mentality that has dominated markets the last several years.

Gold up marginally as attention turns to Tuesday’s inflation report

Holmes undaunted by recent gold selloff, sees strong year ahead

(USAGOLD – 2/10/2023) – Gold is up marginally this morning as financial markets turned their attention to Tuesday’s consumer inflation report. It is up $3 at $1866. Silver is up 13¢ at $22.18. Trading Economics forecasts a 6.3% annualized inflation rate for January as compared to December’s 6.5% reading. Global Investor’s Franks Holmes is undaunted by gold’s reversal from the $1960 mark over the past ten days.

“I don’t believe that this takes away from the fact that gold posted its best start to the year since 2015,” he says in an update posted this morning at Bullion Vault. The yellow metal rose 5.72% in January, compared to 8.39% in the same month eight years ago.…Gold was one of the very few bright spots in a dismal 2022, ending the year essentially flat, and I expect its performance to remain strong in the year ahead.”

Gold and the purchasing power of the US dollar

(1971-2022)

Chart courtesy of TradingView.com • • • Click to enlarge

Talking softly without carrying a big enough hawk

Bloomberg/John Authers/2-1-2023

USAGOLD note: Auther’s day-after-the-meeting observations…… “So, no, Powell didn’t succeed in sounding very hawkish,” he writes. “Investors didn’t take his professions of tightening intent at all seriously.”

Cash is no longer trash, says Dalio, who calls it more attractive than stocks and bonds

MarketWatch/Joseph Adinolfi/2-2-2023

USAGOLD note: Investor cash holdings are approaching record highs, according to the Investment Company Institute……Cash, though, remains vulnerable to inflation. Even at a 4.5% yield, the investor is still losing money if the inflation rate stays at 6.5% or goes higher.

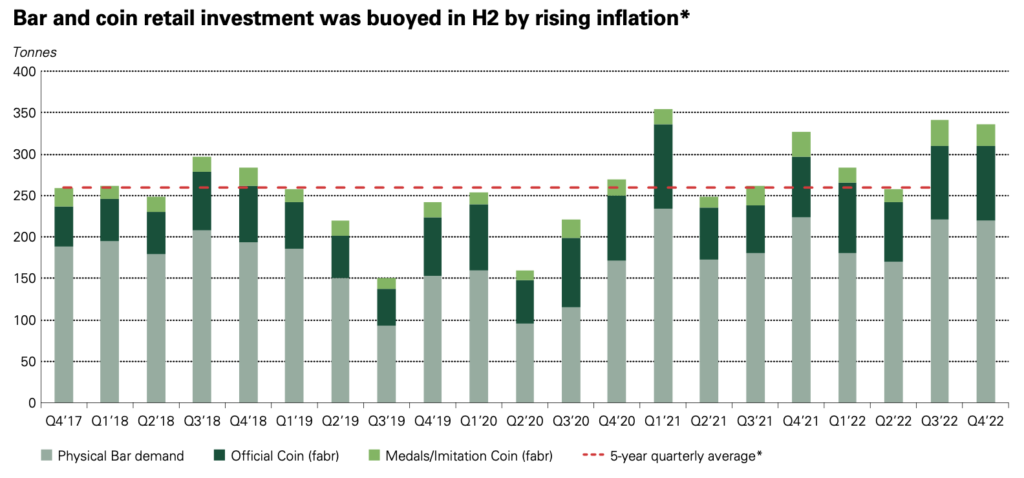

Gold demand trends full year 2022

World Gold Council/Staff/1-31-2023

“Colossal central bank purchases, aided by vigorous retail investor buying and slower ETF outflows, lifted annual demand to an 11-year high Annual gold demand (excluding OTC) jumped 18% to 4,741t, almost on a par with 2011 – a time of exceptional investment demand. The strong full-year total was aided by record Q4 demand of 1,337t.”

USAGOLD note: Some very positive numbers from the World Gold Council to launch the new year…… This report garnered considerable attention in the global financial media. We offer the link above for those who like to dig into the numbers.

Chart courtesy of World Gold Council • • • Click to enlarge

There are signs of a ‘second chapter in the pandemic price surge

Bloomberg/Joe Weisenthal/1-30-2023

USAGOLD note: There are signs of price acceleration within the United States as well – gasoline price being one example. Too, we do not know what the net effect will be on inflation once China gears up production……

Gold tracks marginally higher in overseas markets under quiet conditions

Gold bullion desks confirm strong interest from China’s official sector for undisclosed reasons

(USAGOLD – 2/9/2023) – Gold tracked marginally higher in overseas markets under generally quiet conditions. It is up $6 at $1884. Silver is up 7¢ at $22.47. Of late, gold has shown signs of life in Asian and European trading, only to run into resistance during the US trading session. China added another almost 15 metric tonnes of gold to its reserves in January, bringing its total holdings to 2025.51 metric tonnes. January is the third straight month it has added to its gold holdings. The acquisitions have coincided with an uptrend in the gold price that began in November of last year.

“Gold bullion trading desks have confirmed this strong interest is a continuation of flow demand from China since early November 2022,” says Sprott analyst Paul Wong in a report posted yesterday, “and the estimated tonnages bought would align with the most significant numbers since 2017. Price action and trading desk anecdotes denote large buying from China’s’ official sector’ (possibly any combination of People’s Bank of China, central bank-related entities or state banks) for undisclosed reasons.”

China gold reserves

(Metric tonnes)

Chart courtesy of TradingEconomics.com

Opinion: The Fed expects a ‘soft landing’ and no recession for the economy. We could get stagflation instead.

MarketWatch/Robert Brusca/1-31-2023

USAGOLD note: Something that needed to be said…… Policy reduced to a coin flip.

US consumers may have to live with high prices for longer — and a falling dollar could be to blame

MarketsInsider/Ryan Hogg/1-28-2023

“The greenback is extending losses in January, after sliding almost 8% last quarter in the worst three-month slump in over 12 years. A weaker dollar raises the cost of imported goods, which would eventually feed into consumer prices in the US.”

USAGOLD note: Contrary to the consensus opinion on Wall Street, the subdued prices of the last few months look to be on shaky ground. This report is one among many on the cracks developing in the low-inflation scenario.

Black Swan author Taleb: Stock market ‘way too overvalued’ relative to current interest rates

MarketWatch/William Watts/1-31-2023

USAGOLD note: Some straightforward logic from Mr. Taleb……

A barbarous relic no more?

USAGOLD note: Three internationally recognized economists dissect what’s behind the move back to gold among emerging central banks. Arslanalp is a macroeconomist at the International Monetary Fund. Eichengreen is a well-known economic historian at the University of California, Berkley. Chima Simpson-Bell is also an economist with the International Monetary Fund.

Gold turns quietly to the upside on less-than-aggressive Powell policy stance

Better Markets says the US is now dealing with ‘historically high persistent inflation’

(USAGOLD – 2/8/2023) – Gold turned quietly to the upside in early trading following the Fed chair’s less-than-aggressive positioning before the Washington Economic Club yesterday. It is up $2 at $1877. Silver is up 21¢ at $22.43. Many suspected Powell would come out guns blazing following last Friday’s big jobs numbers. Instead, we got a promise of more of the same – more restrained rate increases only over a more extended period. The markets, according to press reports, are reading the speech as dovish.

Stating that the US is now dealing with “historically high persistent inflation,” Better Markets’ Dennis Kelleher and Phillip Basel see the Fed and financial markets as living with a banquet of consequences the result of Fed policies past and present – “an unprecedented array of multiple, simultaneous, and consequential economic, financial, and geopolitical shocks that are causing significant volatility and stress in financial markets while straining consumers and businesses in the real economy. In this environment, the margin for error is vanishingly small.” [For the full report, please see “Federal Reserve Policies and Systemic Instability: Decoupling Asset Pricing from Underlying Risks,” Kelleher and Basel, January 17, 2023.]