Monthly Archives: February 2023

Gold continues selloff on hot wholesale inflation, hawkish Fed rhetoric

‘Investors’ eternal optimism is shaken.’

(USAGOLD –2/17/2023) – Gold continued its selloff in overseas trading as traders reacted to a hotter-than-expected wholesale price report and two prominent Fed officials suggesting that a 0.5% future rate hike would be justified. It is down $8 at $1830. Silver is down 26¢ at $21.40. Both metals have been in steady downtrends since early February after hitting technical resistance at $1960 and $24.50.

In a Bloomberg report this morning, Oanda Europe’s Craig Elam neatly summarized current investor psychology: “It’s taken a lot but it would appear investors’ eternal optimism is being shaken, with the latest PPI figures finally driving the message home that bringing the economy in for a soft landing will be extraordinarily challenging and there’ll likely be plenty of turbulence along the way,” In the meanwhile, inflation is on the march as are Russian forces in Ukraine; the stock market is in a funk, and US Treasuries are suffering a sharp selloff equal to gold’s.

Gold and US Treasuries

(%, February 2023)

Chart courtesy of TradingView.com

There is more inflation complexity ahead

Project Syndicate/Mohaned A. El-Erian/2-9-2023

USAGOLD note: All considered, it seems the Fed chairman is betting that the turnaround in inflation will ultimately bring rates in line with the CPI. What if it doesn’t happen? There is a growing body of evidence that supply-side-driven inflation is building once again in the global economy. Prices, in short, could take off again. ‘[W]hile US inflation has been slowing,” says El-Erian, ” it is dangerous to suggest that the problem is behind us.”

Why a Brics currency is a flawed idea

Financial Times/Paul McNamara/2-10-2023

USAGOLD note 1: The complications implicit in the idea of a currency union could delay a Bric countries common currency for many years. That does not mean, however, that the yuan could not rise on its own to challenge the dollar at some point in the future.

USAGOLD note 2: In the meantime, the dollar remains the lead actor on the currency stage. At the same time, the real challenge for the dollar and those who hold it is the relentless decline in its purchasing power since it was converted to a fiat currency in 1971. That, too, is unlikely to change anytime soon.

US budget deficit widens rapidly, threatening debt-limit timeline

Yahoo!Finance-Bloomberg/Christopher Antsey/2-8-2023

“The federal budget deficit is widening rapidly, according to the latest estimates by the Congressional Budget Office, raising the risk of the Treasury running out of cash earlier than expected amid a debt-ceiling standoff.”

USAGOLD note: A number of money managers have come public with concerns that Congress won’t come to an agreement on the debt ceiling this time around because of the deep animosity between the political parties. The rapidly deteriorating fiscal picture will not help matters.

Bank of America CEO Brian Moynihan warns to prepare for a US debt default and a recession

MarketsInsider/Jennifer Sor/2-7-2023

USAGOLD note: This time around cooler heads might not prevail, though Congress in the past has never been willing to put the US credit rating on the line. The concern is that the animosity between the political parties is so deep that the politicians will throw caution to the wind.

Gold trades marginally to the upside still caught up in technical sell-off

Could central banks’ attitude toward gold more broadly pave the way for investors?

(USAGOLD – 2/16/2023) – Gold is trading marginally to the upside this morning in a market that looks to be still caught up in the technical selling-off that began in early February at the $1960 level. It is up $4 at $1841.50. Silver is down 5¢ at $21.67. Van Eck, the international investment firm, says that “most investors seem uninterested in gold until things get ugly” but believes central banks’ attitude toward the metal might change that way of thinking.

“Could the attitude of central banks towards gold be paving the way for investors more broadly?” it asks in an analysis posted at Seeking Alpha recently. “A track record of 13 years of consecutive net buying demonstrates that as a group these institutions are not trying to ‘time’ the gold market. Their commitment to gold appears to be long-term and based on gold’s key attributes as a safe haven and portfolio diversifier. We, too, believe that gold, rather than being viewed as an asset of last resort, should be considered a core component and enjoy a permanent allocation in any portfolio.”

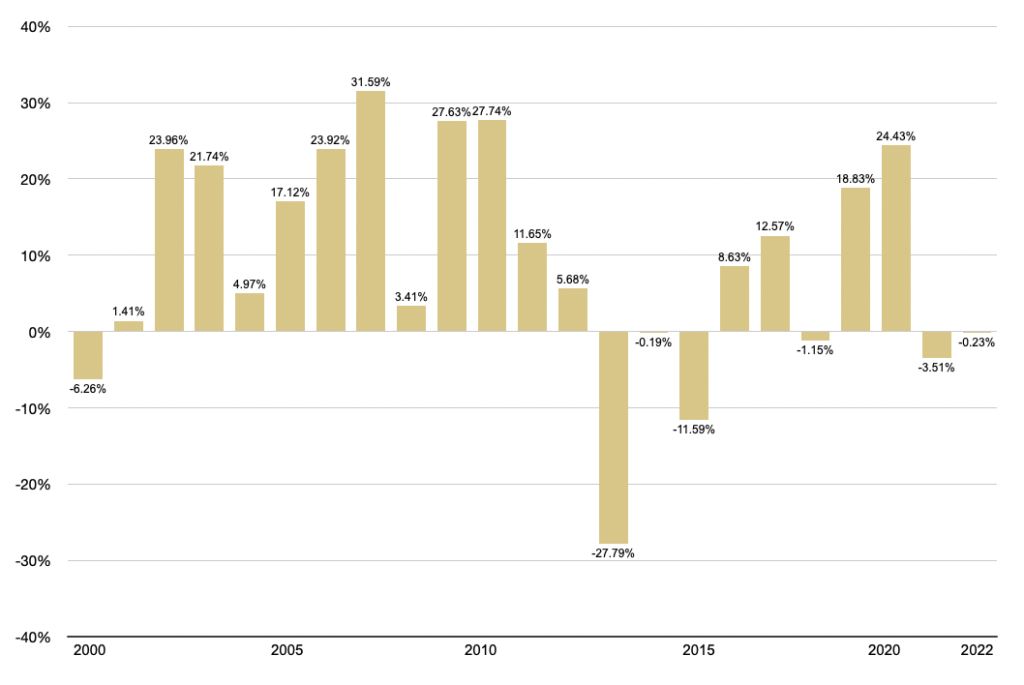

Editor’s note: Some are surprised to learn that since the United States went off the gold standard in 1971, gold has outperformed stocks by a wide margin. Gold is up 4696% over the 52 years. Stocks are up 3829.5% (as of this morning).

Gold and the Dow Jones Industrial Average

(1971 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

The Fed’s monetary whiplash

National Review/Steve Hanke and Caleb Hofman/1-31-2023

USAGOLD note: Hanke and Hofman argue that the Fed ignores the quantity theory of money and has “no clear sense of direction.” First, it hits the accelerator; then it slams on the brakes. Next stop: Recession.

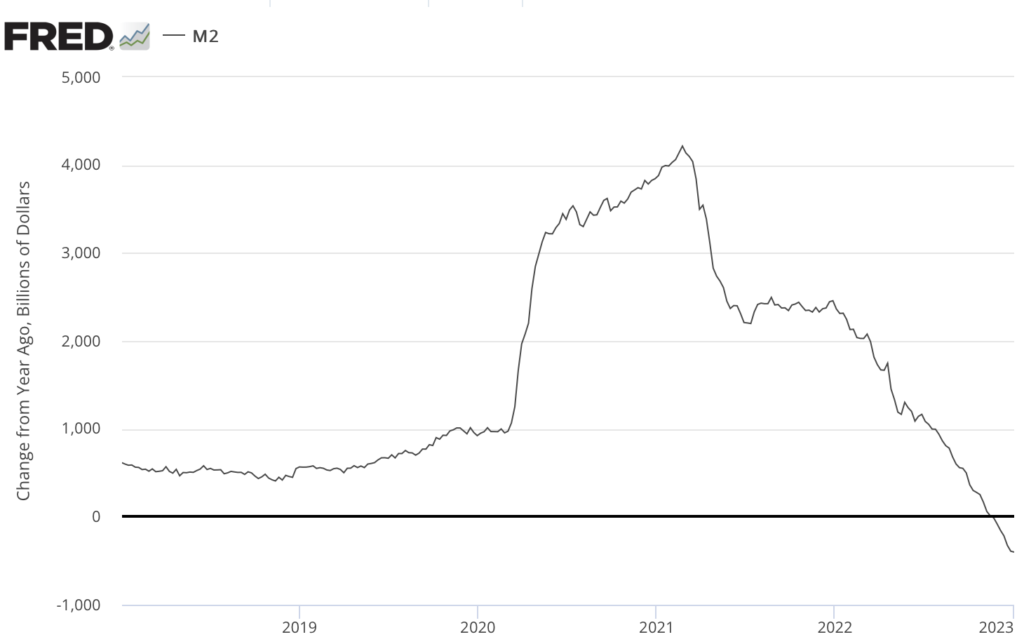

Money supply [M2]

(Change from a year ago in billions of dollars)

Sources: St. Louis Federal Reserve [FRED], Board of Governors of the Federal Reserve System

Traders are starting to put big money on the Fed going to 6%

“A shift in sentiment on Federal Reserve policy is emerging in interest-rate options, where several big wagers on the central bank’s benchmark rate reaching 6% — nearly a percentage point higher than the current consensus — have popped up this week.”

USAGOLD note: Whoodathunk? Not more than a week ago, traders were betting on a pivot. The Wall Street casino is alive, well, and thriving.

Norman foresees Goldilocks year for gold – ‘not too hot, not too cold’

Linked In/Ross Norman/2-6-2023

USAGOLD note: Norman has a history of getting it right on his annual forecasts, so we give his forecasts special attention. He sees the possibility of a return to record levels at $2070 per ounce in 2023. The forecast also includes his price targets for silver, platinum, and palladium.

Gold has proven its mettle for long-term investing

FTAdvisor/Darius McDermott/2-6-2023

USAGOLD note: This Financial Times advisory goes on to offer very strong arguments for adding gold to your portfolio in 2023. Of special note: “Corporate earnings downgrades in many sectors may also drive volatility and push investors towards gold as a safe haven.”

No DMR today (2-15-2023). Below is yesterday’s report.

________________________________________________

Gold moves higher in tentative trading ahead of CPI release

Paulson says gold will appreciate this year and on a three, five, and ten year basis

(USAGOLD – 2/14/2023) – Gold moved higher in tentative trading ahead of today’s CPI release. It is up $7 at $1863. Silver is down 21¢ at $21.88. Trading Economics puts the consensus CPI number at 6.2% annualized, which would be a notable decline from December’s 6.5% reading. John Paulson, the New York-based hedge fund impresario, believes “inflation will be more persistent than the markets currently perceive, and that the Fed will raise rates another 50 to 100 basis points, “then hold it there until we get a severe economic shock.”

“We’re at the beginning of trends that are going to increase the demand for gold,” he says in a recent interview with Alain Elkann, “and inflation and geopolitical tensions will determine the rate at which gold increases. This year gold will appreciate versus the dollar, and also over a three, five and ten year basis.” He points out that central banks around the world are “looking for an alternative reserve currency” and that gold is on the rise again: “[I] t’s been the reserve currency of the world for thousands of years, a legitimate alternative to holding the dollar or other paper currencies.”

Gold annual returns

(2000-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net • • • Click to enlarge

Fed’s Powell delivered ‘most counterproductive press conference’ in memory: Larry Lindsey

MarketWatch/Isabel Wang/2-7-2023

USAGOLD note: Chairman Powell referred to ‘disinflation’ a number of times in that press conference which raised more than a few eyebrows. A few days later, the jobs report was released, and it was anything but disinflationary. In fact, many worried it reflected high inflation coursing through the economy.

Oil market faces production issue in 2024, Goldman’s Currie says

Bloomberg/Anthony DiPaoloa/2-5-2023

USAGOLD note: Oil priced above $100 would do some damage to the low-inflation scenario since it is a component in pricing just about everything. Too, the China scenario Currie envisions could pressure other commodities higher adding to the problem.

A bipolar currency regime will replace the dollar’s exorbitant privilege

Financial Times/Nouriel Roubini/2-6-2023

USAGOLD note: Roubini argues that the dollar’s exorbitant privilege is nearing an end as the world moves toward a bipolar regime – one centered on China’s renminbi and the other on the US dollar.

Hedge funds caught in bigger squeeze than 2021 meme stock frenzy – Goldman Sachs note

Reuters/Nell Mackenzie and Carolina Mandl/2-6-2023

USAGOLD note: There is no way to know for certain, but perhaps the recent sell-off in gold was the result of hedge funds taking profits to cover losses in their short stock positions. Just a thought……….

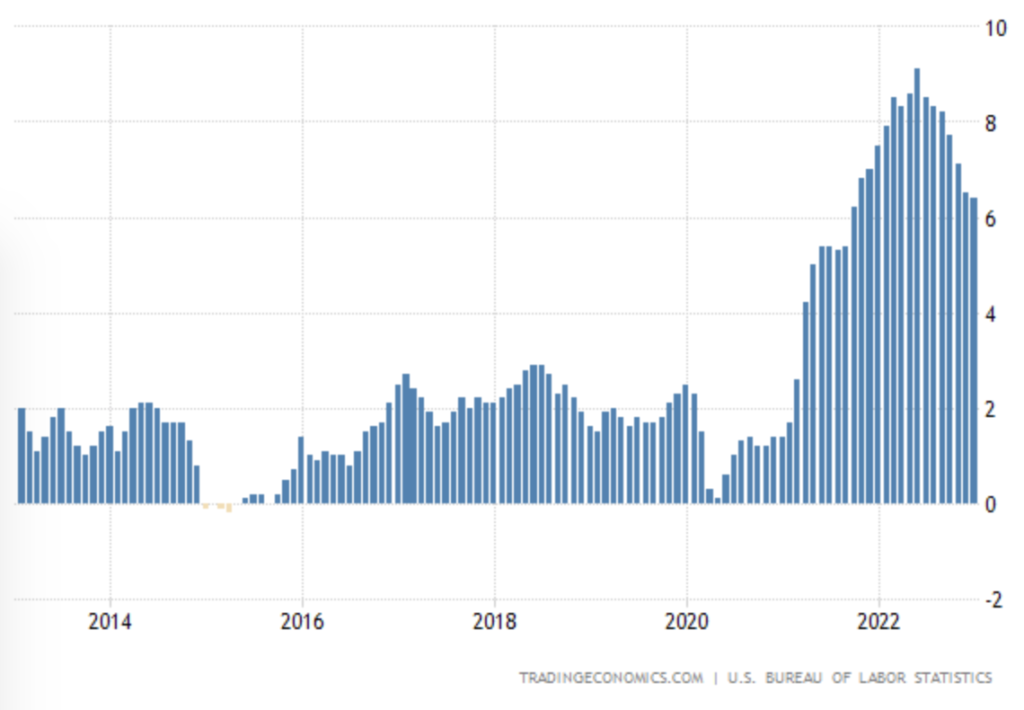

CPI comes in higher than expected at 6.4%

TradingEconomics/Staff/2-14-2023

“The annual inflation rate in the US slowed only slightly to 6.4% in January of 2023 from 6.5% in December, less than market forecasts of 6.2%. Still, it is the lowest reading since October of 2021. A slowdown was seen in food prices (10.1% vs 10.4%) while cost of used cars and trucks continued to decline (-11.6% vs -8.8%). In contrast, the cost of shelter increased faster (7.9% vs 7.5%) as well as energy (8.7% vs 7.3%), with gasoline prices rising 1.5%, reversing from a 1.5% decline in December. On the other hand, both fuel oil (27.7% vs 41.5%) and electricity prices slowed (11.9% vs 14.3%). Although inflation has shown signs of peaking at 9.1% in June last year, it remains more than three times above the Fed’s 2% target and continues to point to a broad-based advance on the general price level, particularly services and housing. Compared to December, the CPI rose 0.5%, the most in three months, mostly due to the higher cost of shelter, food, gasoline, and natural gas.”

United States Consumer Price Index

(%, annual)

Chart courtesy of Tradingeconomics.com

Strong US jobs report confounds economists

MoningStar/Lauren Solberg/2-6-2023

“Caldwell says that either jobs growth is being overestimated, economic growth is being underestimated, businesses are hiring aggressively into an imminent economic slowdown, or a mix of all three. ‘And if businesses really are hiring aggressively ahead of an economic slowdown, then business profits are about to take a nosedive, which will likely lead eventually to reduced hiring and layoffs,’ he says.”

USAGOLD note: Some offbeat analysis of the jobs report from Morningstar’s chief economist Preston Caldwell. It’s not so much what the numbers say, but what they portend.

Whatever Keynes said, let’s follow his advice

Bloomberg/John Authers/2-6-2023

USAGOLD note: Authers digs deep into last Friday’s blow-out jobs report and thinks Wall Street might be due for a reassessment. “The case for a pivot,” he says, “just got weaker.”

Summers sees turbulence ahead with market complacent about inflation

Bloomberg/Chris Antsey/2-10-2023

USAGOLD note: Seems to be the theme of the day …… Summers joins an expanding group of economists worried about inflation quietly building in the background. He says we are “headed into what is likely to be a turbulent period.”