Gold tracks marginally higher in overseas markets under quiet conditions

Gold bullion desks confirm strong interest from China’s official sector for undisclosed reasons

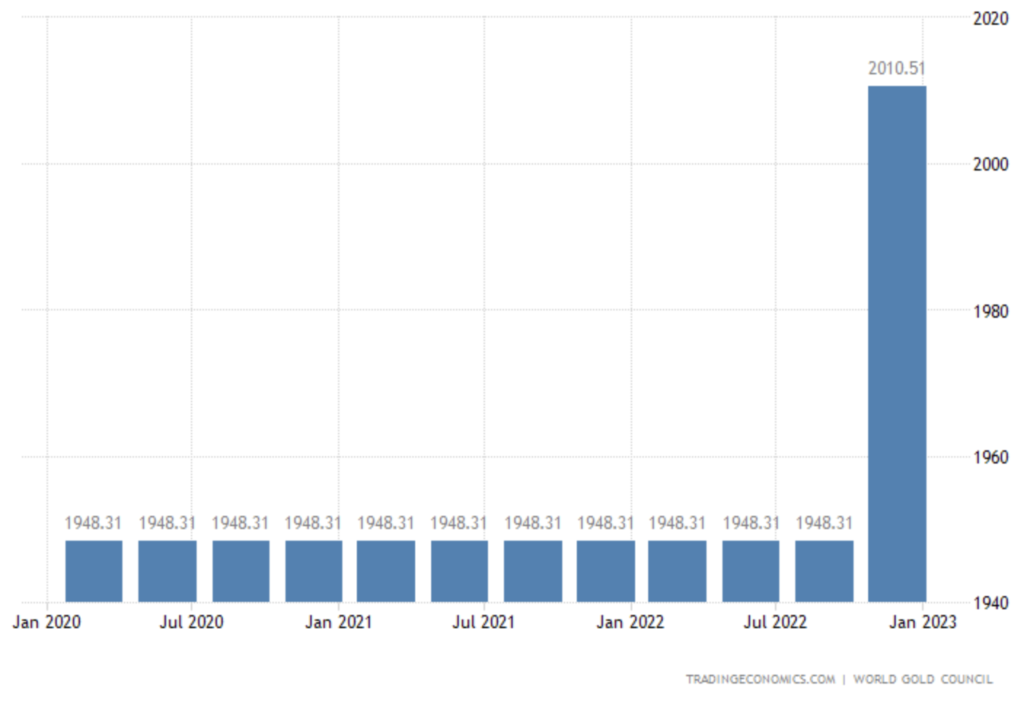

(USAGOLD – 2/9/2023) – Gold tracked marginally higher in overseas markets under generally quiet conditions. It is up $6 at $1884. Silver is up 7¢ at $22.47. Of late, gold has shown signs of life in Asian and European trading, only to run into resistance during the US trading session. China added another almost 15 metric tonnes of gold to its reserves in January, bringing its total holdings to 2025.51 metric tonnes. January is the third straight month it has added to its gold holdings. The acquisitions have coincided with an uptrend in the gold price that began in November of last year.

“Gold bullion trading desks have confirmed this strong interest is a continuation of flow demand from China since early November 2022,” says Sprott analyst Paul Wong in a report posted yesterday, “and the estimated tonnages bought would align with the most significant numbers since 2017. Price action and trading desk anecdotes denote large buying from China’s’ official sector’ (possibly any combination of People’s Bank of China, central bank-related entities or state banks) for undisclosed reasons.”

China gold reserves

(Metric tonnes)

Chart courtesy of TradingEconomics.com