Monthly Archives: February 2023

Opinion: Gold in your 401(k)? It’s not as crazy as it sounds.

MarketWatch/Brett Arends/1-28-2023

USAGOLD note: We have a considerable number of clients who own gold and silver bullion coins in their self-directed retirement plans. It is not a difficult goal to achieve. Contact us and we will set you up with a solid plan in short order.

Yellow metal is a useful disaster hedge

Bloomberg/John Stepek/1-30-2023

USAGOLD note: Though addressed to UK-based investors, Stepek’s tenets and rationale apply to investors everywhere. “You can think of gold in various ways,” he says, “but the simplest way is to think of it as portfolio insurance. It diversifies your portfolio in a different way to either equities or bonds. It’s the sort of asset that does well when everything else is doing badly.”

What could a US recession mean for gold and gold equities?

Schroders/James Luke/1-24-2023

USAGOLD note: It is still up in the air whether or not the US is going to slide into a recession, but if it does, gold and gold stocks have been clear beneficiaries during past economic slowdowns, according to James Luke, fund manager at London-based Schroders. In five of the last seven recessions, gold outperformed stocks and usually by a wide margin.

Powell’s narrow path would avoid routes taken by Burns, Volcker

Bloomberg/Rich Miller/1-29-2023

“Ex-Fed chief Burns let inflation get out of control in the 1970s by failing to keep monetary policy tight enough for long enough to permanently beat back price pressures. Volcker then conquered double-digit inflation in the 1980s, but the victory came at an enormous expense: A painfully deep economic downturn that pushed unemployment above 10%.”

USAGOLD note: As long as Powell keeps the lending rate below the inflation rate, he’s a Burns.

Gold inches higher ahead of Powell speech later today

Norman sees Goldilocks’ year for gold – ‘not too hot, not too cold’

(USAGOLD – 2/7/2023) – Gold inched higher ahead of a speech later today by Fed Chairman Powell before the Washington Economic Club. It is up $5 at $1873. Silver is down 11¢ at $22.23. The markets will be watching to see if Powell takes the opportunity to address Friday’s explosive jobs number. Ross Norman, who has won the London Bullion Market Association’s annual price forecasting contest a number of times, sees 2023 as a Goldilocks’ year for gold– “not too hot, not too cold.”

“The four key positive factors we see in gold’s favour,” he says in a Linked-In post,” are scope for increased speculative longs as the market trends higher, a shift in the tide in ETF demand from redemptions to creations as institutions re-enter the market looking for diversification, ongoing official purchases in a polarised world and ongoing strength in physical demand from the economically literate.” He sees gold ranging between $1834 and $2070 in 2023 as “headwinds turn into tailwinds.”

Here are 5 rising threats to the dollar’s dominance of global trade.

MarketsInsider/Zahra Tayeb/1-28-2023

USAGOLD note: A summary of the threats mounting against the dollar’s status as the world’s reserve currency. It is doubtful US policymakers will lose sleep over any of these so-called threats. The dollar is likely to remain supreme, but its purchasing power is likely to continue declining as it has since 1971. That, in the end, is the more immediate and important issue for American investors

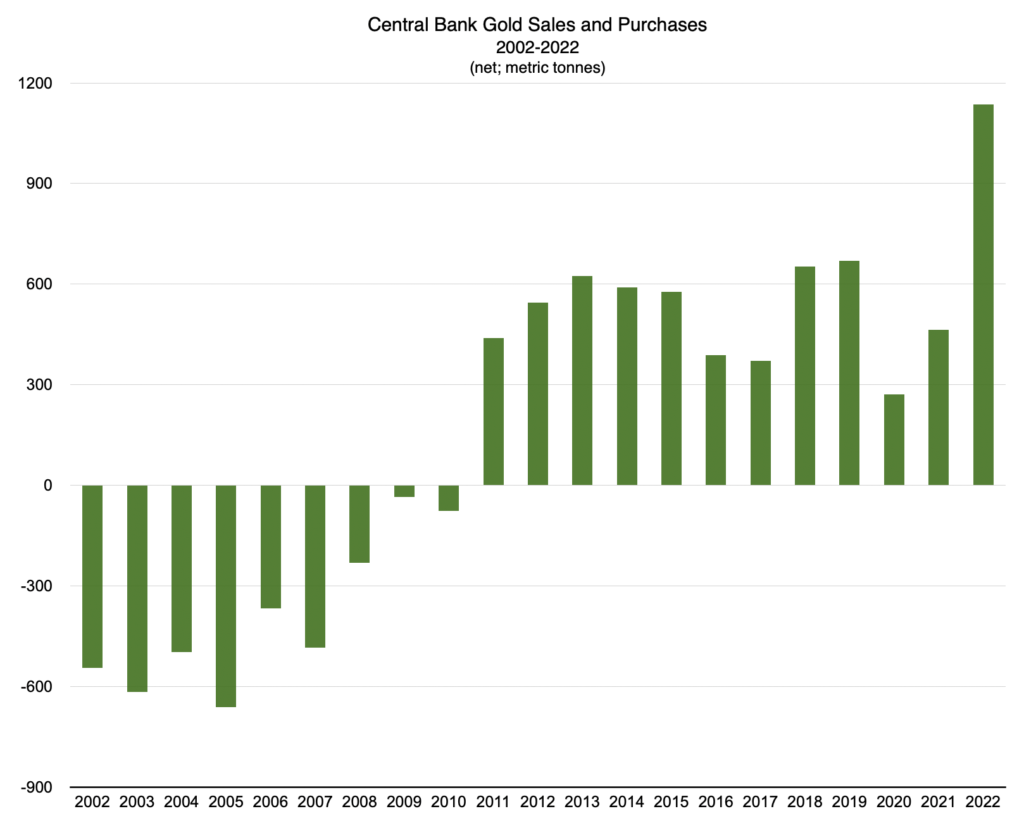

‘Colossal’ central bank buying drives gold demand to decade high

Financial Times/Harry Dempsey/1-31-2023

“Demand for gold surged to its highest in more than a decade in 2022, fuelled by ‘colossal’ central bank purchases that underscored the safe haven asset’s appeal during times of geopolitical upheaval. Annual gold demand increased 18 percent last year to 4,741 tonnes, the largest amount since 2011, driven by a 55-year high in central bank purchases, according to the World Gold Council, an industry-backed group.”

USAGOLD note: Some will think it odd that demand, led by central banks, surges to levels last seen in 2011 (when gold hit an interim peak) while the price remains restrained……

Chart by USAGOLD [All rights reserved] • • • Data source: World Gold Council

The world is not ready for the long grind to come

Financial Times/Ruchir Sharma/1-29-2023

“Over the past half century, as governments and central banks teamed up ever more closely to manage economic growth, recessions became fewer and farther between. Often they were shorter and shallower than they might have been. After so much mildness, most people cannot imagine a painfully lasting business cycle. But the global economy is heading into a period unlike any we have seen in decades.”

USAGOLD note: Wall Street expects a soft landing, but Rockefeller International’s Sharma worries about a prolonged, grinding downturn. Inflation will remain a problem, and that will hamper the Fed’s ability to cushion the blow.

US dollar hits reverse gear as Fed cedes rate-rise ‘driver’s seat’

Financial Times/Kate Duguid/1-27-2023

“The US dollar has wilted against its peers in the opening month of 2023 as the Federal Reserve fades as the key driver in currency markets and investors focus on the policies of other major central banks.”

USAGOLD note: This article offers a solid background summary and review of the dollar’s current status along with the relative positioning of the top central banks. Its timing is good for those playing catch-up as we head into this week’s Fed meeting.

Chart courtesy of TradingEcononics.com

Gold struggles to stay positive after last week’s steep sell-off

Markets unsure how to read Friday’s explosive jobs number

(USAGOLD – 2/6/2023) – Gold struggled to stay positive this morning in the wake of last week’s steep selloff. It is up $7 at $1875. Silver is up 7¢ at $22.50. Judging from the reaction, the markets are not sure how to read Friday’s explosive jobs number. An anomaly? A return of the phantom workforce that disappeared during the pandemic? A repudiation of the recession scenario? Outright inflation? Of course, the most important reading will be the Fed’s, and it is likely to remain cautious.

Gold Newsletter‘s Brien Lundin offered the following summation of Friday’s events in the gold market: “Gold is being hit this morning because the positive surprise on the jobs number is a strong indication that the Fed has more than a single rate hike left in it. Unfortunately for the bulls, it’s being hit harder than equities because it’s been outperforming stocks over the last few months. Profits are being taken by those who have enjoyed that ride.”

Editor’s note: As we pointed out in late January, with hedge funds back in the gold market, we should expect more volatility and technical trading at key chart numbers.This break actually began on Thursday with selling at the $1960 mark. Friday’s jobs number accelerated the downtrend.)

Gold Price

(1/30/2023 through 2/3/2023)

Chart courtesy of TradingView.com • • • Click to enlarge

Top US air force general predicts China conflict in 2025

Financial Times/Demetri Sevastopulo/1-28-2023

USAGOLD note: Let’s hope he’s wrong. A war, in our view, benefits neither side. The status quo is a better option – a thought, in retrospect, Russia may now be entertaining with respect to its Ukraine incursion. Minihan is concerned that circumstances have embloldened China’s Xi.

‘The Fed-fueled fantasy bubble has popped.’ Stock investors are detached from reality — but they’re about to get a big dose.

MarketWatch/Michael Sincere/1-23-2023

USAGOLD note: Bierman sees a 20% drop in the S&P to 3200 as in the cards…… “You can’t be 100% in stocks,” he says.

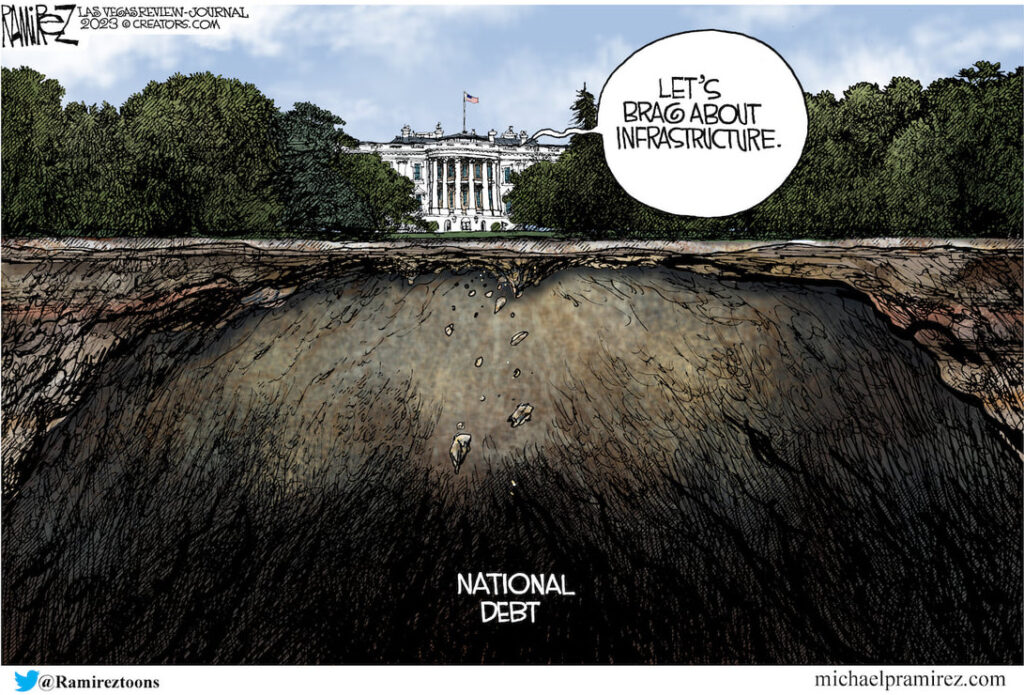

How Jerome Powell’s ego could trigger a recession

MarketsInsider/William Edwards/1-30-2023

USAGOLD note: The popular Wall Street view is that Fed would like to engineer a soft landing, but that goal and controlling inflation might not be compatible. This less-than-sympathetic article does a good job of presenting the dilemma facing the Fed chairman with opinion from a number of heavyweight market analysts.

Crash test this week for market versus real world

Bloomberg/John Authers/1-30-2023

“The Fed, [former Treasury Secretary Lawrence Summers] says, is ‘driving the vehicle on a very, very foggy night, when the economy could yet go either way.’ The market is rallying, meanwhile, as though it’s a clear day with a long straight road ahead and not a car in sight. And in doing so, it comes up against the paradox that has dogged every attempt at a rally over the last year. Central bankers want to slow down the economy, and hope to use tighter financial conditions to achieve it.”

USAGOLD note: Authers worries that the rosier conditions and the recent stock market rally will induce surprise hawkish outcome to this week’s Fed deliberations. He quotes Academy Securities’ Peter Tchir: “If the demons are getting to the Fed, the financial conditions give them a real world metric to support them being more hawkish than markets have priced in. At this point I believe that markets have priced in what the Fed ‘should’ do and not what the Fed ‘will’ do.”

Silver ETFs likely to record huge upside in 2023

Yahoo!Finance/Sanghamitra/1-26-2023

USAGOLD note: A big pick-up in ETF demand could serve as adrenaline for the silver price. It would indicate the renewal of institutional interest. It is interesting to note that silver’s strong run-up since last November has occurred in the absence of ETF buying.

Gas prices jump to $3.50 a gallon in January, pose threat to Fed’s inflation fight

MarketWatch/Joy Wiltermuth/1-26-2023

USAGOLD note: A January, pre-meeting surprise the Fed is unlikely to appreciate.

Switzerland sent 524 tonnes of gold to China last year, the most since 2018

NASDAQ/Peter Hobson//1=24-2023

“Swiss exports of gold to countries including China, Turkey, Singapore and Thailand surged to multi-year highs last year, Swiss customs data showed on Tuesday, as low prices boosted demand from consumers in Asia and the Middle East.”

USAGOLD note: The mobilization of gold west to east continues……

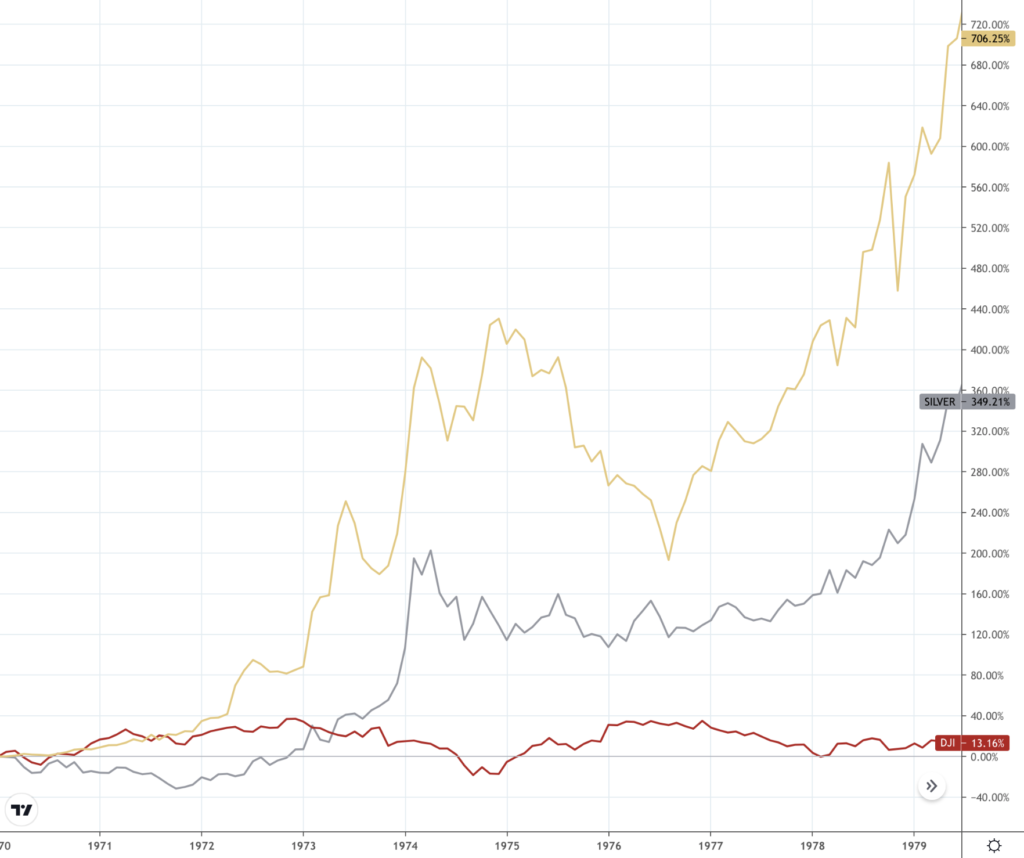

Stagflation is the dreaded word no one dare speak at Davos

Bloomberg/Lisa Abramowicz/1-23-2023

“Yes, there was talk of catastrophic tail risks, but there was relatively little said about the most obvious threat to global well-being: stagflation. But the positive developments lightening everyone’s mood are making stagflation—slowing growth combined with rising prices—look increasingly likely.”

USAGOLD note: Like inflation (a component of the stagflation scenario along with economic stagnation), stagflation is a process, not an event. At times, it might be front and center. It can also fade in the face of other concerns. All the while, it is doing subtle damage in the financial markets (and private investment portfollios). Gold and silver were two top-performing during the stagflation of the 1970s.

Gold, silver, and the Dow Jones Industrial Average

(1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

Notable Quotable

______________________________________________________________________

“I’ve been involved in markets since I got with E.F. Hutton in 1975. So, you know, a long time. I’ve never seen such a confluence of events of upside and downside potentials that are so strong that will impact each other like icebergs crashing into one another. Fiat currencies, we think, are at the doorstep of collapse. We will now see events unfold in a chaotic manner. It’s not going to take five years for this to happen. It’s going to happen in the next year or so. ……” – Michael Oliver, King World News

______________________________________________________________________

Charles Mackay: What the poet, playboy and prophet of bubbles can still teach us

Financial Times/Tim Hartford/1-26-2023

“Is gold a frivolous investment or a necessity of the age? Gold produces no stream of income. It has some industrial and ornamental uses, but it is chiefly valued because people expect that they will be able to find someone to take it off their hands, quite likely at a profit. That is almost a textbook definition of a bubble, but if gold is in a bubble it has been in a bubble for several thousand years.”

USAGOLD note 1: Human frailty and financial bubbles go hand in hand. Even Charles Mackay, who wrote the still widely read Extraordinary Popular Delusions and the Madness of Crowds, was drawn into the British railway stocks mania of the 1830s and 1840s, saying that the bubbles’ critics had “somewhat exaggerated the danger.” Shortly thereafter, railroad shares plummeted from their peak by two-thirds.

USAGOLD note 2: Hartford offers a fascinating look at bubbles past and present and has a somewhat forgiving attitude about the people who get caught up in them. He says Mackay was wrong when he said that you don’t need hindsight to see a bubble, that they are obvious if you keep your head about you. We come down on Mackay’s side.

USAGOLD note 3: As for gold being in a several thousand-year bubble, looking around at what cheap money has wrought, we think it still has a ways to go.