Gold drifts lower ahead of tomorrow’s all-important inflation data

Ukraine war has turned Russia into a nation of gold bugs

(USAGOLD – 2/13/2023) – Gold drifted lower in quiet trading ahead of tomorrow’s all-important inflation data in what looks to be a continuation of the technical selling that began early this month. It is down $8 at $1860. Silver is down 9¢ at $22.00. IG, the UK– based investment firm, believes gold is in a period of consolidation within a broader uptrend.…The narrative continues to be broadly gold supportive,” it says in an advisory released this morning.”

Financial Times reports that the war In Ukraine has turned Russia into a nation of gold bugs. “The demand for gold coins and bars grew faster in Russia than any other country, rising nearly five times the level of the previous year,” it says in an article posted over the weekend. Polymetal’s Vitaly Nesis told FT that “private citizens are looking for a way to save money, and euros and dollars are in short supply, so the popularity of gold has surged. As long as we experience geopolitical instability, the demand for gold may be significant.”

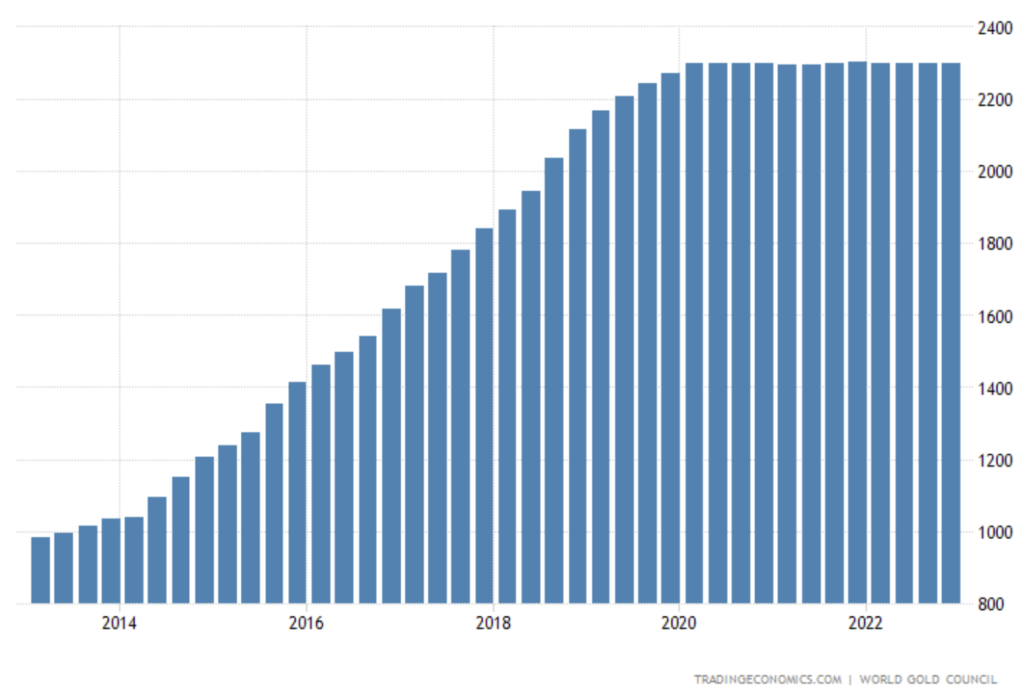

(Editor’s note: FT reports that investor interest in gold jumped following the government’s lifting of the VAT tax on the metal. “The switch to gold,” it notes, “has been strongly encouraged by the Russian government.” Russia itself has more than doubled its gold stockpile over the past decade, as shown below.)

Russia gold reserves

(Metric tonnes)

Chart courtesy of TradingEconomics.com