Monthly Archives: January 2023

Gold buyers binge on biggest volumes for 55 years

Financial Times/Harry Dempsey/12-30-2022

USAGOLD note: We have likened the current central bank gold-buying spree to a similar event in the late 1960s when European nation-states drained gold from the U.S. Treasury to buttress their reserves against dollar debasement. FT makes the same reference in this article. Ultimately, the United States was forced to devalue the dollar and dismantle the Bretton Woods monetary architecture, giving birth to the fiat money and launching a decade-long bull market in gold. The World Gold Council estimates central banks bought 673 tonnes thus far in 2022 – the largest annual amount in 55 years.

Don’t get too excited over one good inflation report

Bloomberg/John Authers/12-14-2022

“Once sticky prices are rising, however, it’s a sign that inflation psychology is becoming embedded. And sticky price inflation is still very high. On a year-over-year basis it’s at a four-decade high, while inflation over the last three months is running a bit less than at the peak earlier this year — but still at a pace unseen in decades. Once sticky prices come unstuck, will they keep trundling upwards? It’s a crucial question, to which we don’t yet have the answer:”

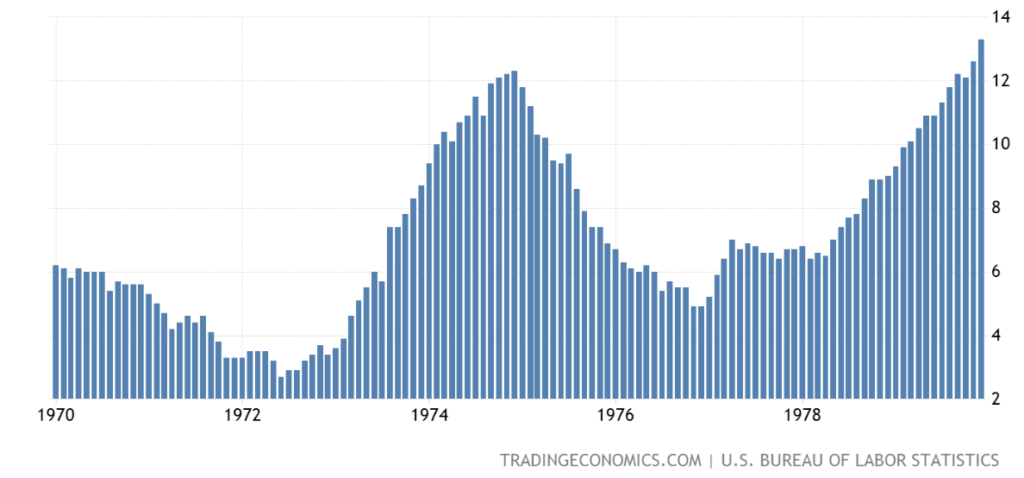

USAGOLD note: During the 1970s big swings up and down in the inflation rate were commonplace (see chart below), but there was no mistaking the overall trend. Stagflation, the real culprit back then and the one feared most now, began slowly, gathered pace, became very sticky, and stayed so through the early 1980s.

US inflation rate 1970-1979

(%, monthly, annualized)

Chart courtesy of TradingEconomics.com

Inflation, uncertainty fuel new gold rush at ancient Austrian Mint

Reuters/Francois Murphy/12-14-2022

USAGOLD note: All the mints at one point or another during the course of the past year have complained about their inability to keep up with demand. The Austrian Mint says it is “unable to keep up with demand [for its gold coins] as people rush to find a safe haven for their money amid surging inflation and economic fears caused by the war in Ukraine,” Gold is up 5% in euro terms year to date. Starsich says that customers for its gold bullion coins are of all ages and from all walks of life.

Sea Change

OakTree/Howard Marks/1-12-2022

“In my 53 years in the investment world, I’ve seen a number of economic cycles, pendulum swings, manias and panics, bubbles and crashes, but I remember only two real sea changes. I think we may be in the midst of a third one today.”

Gold marginally higher ahead of jobs report

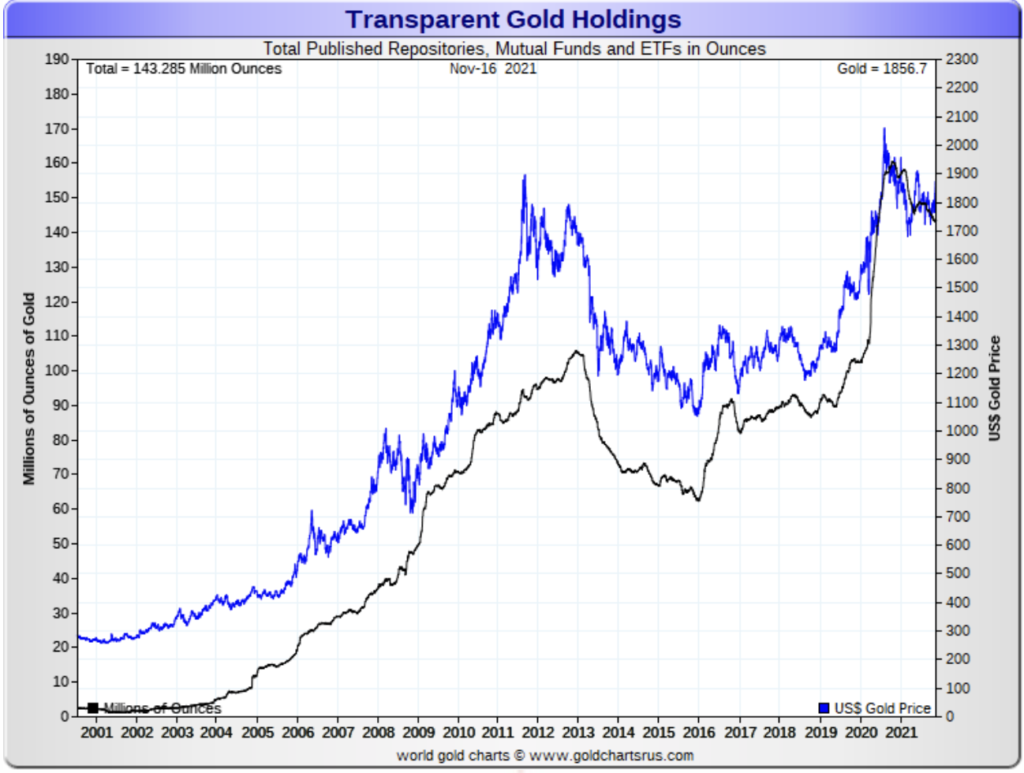

Saxo Bank foresees strong gold demand from central banks and ETFs in ‘price friendly’ 2023

(USAGOLD – 1/6/2023) – Gold moved marginally higher as financial markets traded cautiously ahead of this morning’s jobs number. It is up $4 at $1849.50. Silver is up 19¢ at $23.52. The World Gold Council reports central banks added another 50 tonnes of gold to their collective holdings in November. Saxo Bank’s Ole Hansen sees 2023 as “price friendly” for investment metals as central banks continue buying and ETF demand turns to the plus side.

“This de-dollarization and general appetite for gold,” he says in a client update posted this morning, “should ensure another strong year of official sector gold buying. Adding to this we expect the friendlier investment environment for gold to reverse last year’s 120 tons reduction via ETF’s to a potential increase of at least 200 tons. Hedge funds meanwhile turned net buyers from early November when a triple bottom signaled a change away from the then prevailing strategy of selling gold on any signs of strength. As a result, the net position during this time flipped from a 38k contract net short to a 67k contract net long on December 27.”

Peak inflation? The new dilemma for central banks

Financial Times/Chris Giles, Colby Smith and Martin Arnold/12-17-2022

“Headline inflation has almost certainly peaked and will fall next year, but officials are far from certain that the underlying inflationary pressures will also disappear. Their worry is that inflation will take too long to fall back to their hoped-for 2 percent targets and might stick at a rate considerably higher.”

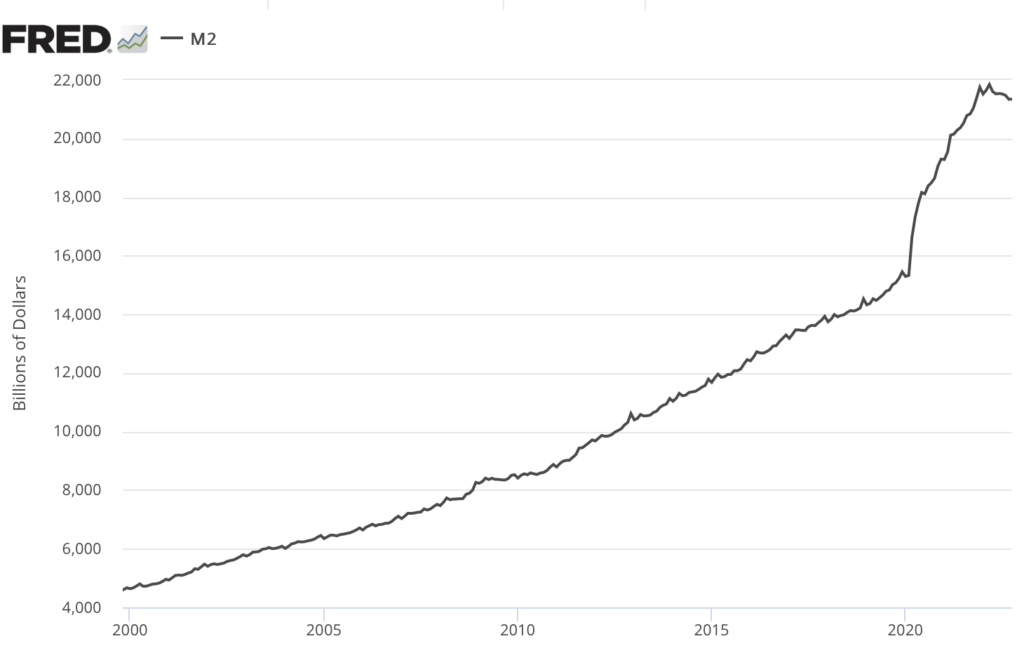

USAGOLD note: Given the fact that the financial press was caught completely off-guard when inflation rocketed higher last year, one wonders if it is being hasty by declaring it has already peaked. Goldman Sachs is calling for a 43% gain in commodity prices next year – much of it centered around energy and industrial metals. If the reality is anywhere near the prediction, it is likely to drive retail inflation much higher. Only the timing is in question. Peak anything in an inflationary environment is a pipe dream – including inflation itself. We should keep in mind that the current inflation is the product of the largest money-printing binge in history, and most, if not all, the global central banks participated. You can’t just wish that away.

United States Money Supply

(M2)

Sources: St. Louis Federal Reserve, Board of Governors of the Federal Reserve System

Goldman says commodities will gain 43% in 2023 as supply shortages bite

Bloomberg/Paul Wallace/12-15-2022

“Commodities will be the best-performing asset class once again in 2023, handing investors returns of more than 40%, according to Goldman Sachs Group Inc. The Wall Street bank said that while the first quarter may be “bumpy” due to economic weakness in the US and China, scarcities of raw materials from oil to natural gas and metals will boost prices after that.”

USAGOLD note: If Goldman is right that commodity prices are about to reignite, it will blow a hole in the peak inflation narrative now making the rounds. It predicts oil will go to $105/barrel from the current $82, and that copper will go from its current price of $8400 per tonne to $10,050. Gold and silver are not mentioned in this article.

Chart courtesy of TradingEconomics.com

New York Fed’s Williams says interest rates need to top inflation rate to get prices under control

MarketWatch/Jeffrey Bartash/12-16-2022

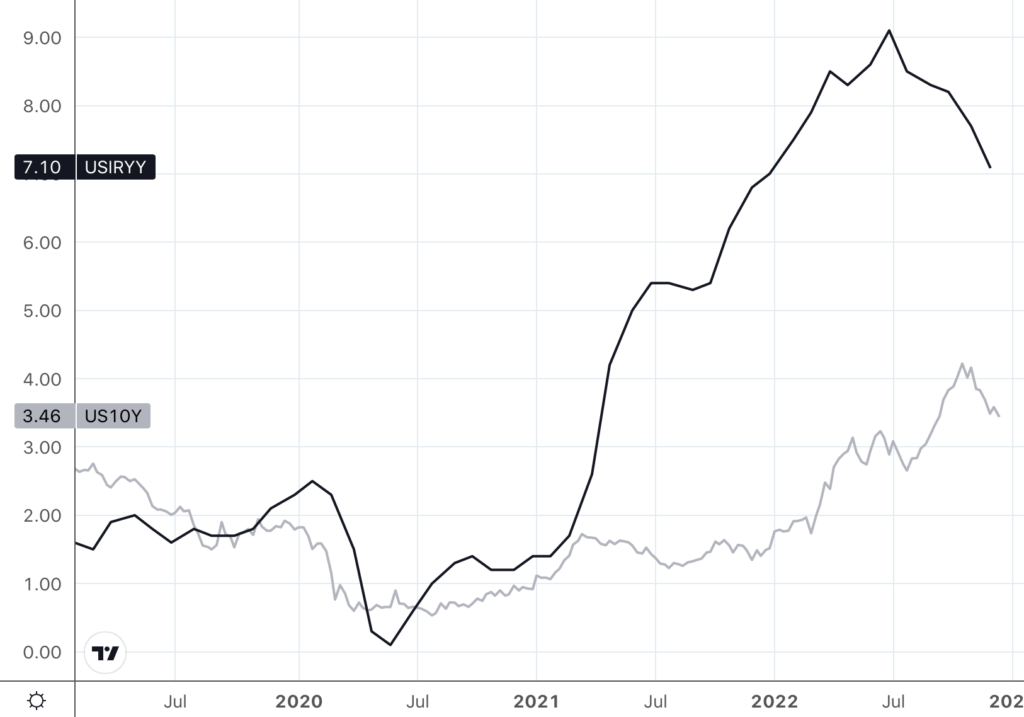

“In market parlance, a real interest rate is one that is above inflation. The rate of inflation right now, using the Fed’s preferred personal-consumption-expenditures, or PCE, price gauge, is 6%. That’s markedly higher than the current 4.25% to 4.5% fed-funds rate”

USAGOLD note: If you are a regular reader of this page, this argument will sound familiar. We are a very long way from achieving the positive real rate milestone. Too, the PCE price index, though preferred by the Fed, excludes food and energy prices, so how realistic is it as a real measure of inflation? The inflation rate, as measured by the more worldly Consumer Price Index is 7.1%. Shadow Government Statistics, which tracks the inflation rate using the Labor Department methodology of the 1980s, puts the inflation rate at 15%. By either measure, the ten-year Treasury yield at roughly 3.5% leaves a substantial gap that needs to be breached for investors to achieve a real rate of return.

10-year US Treasury yield vs the inflation rate

Chart courtesy of TradingView.com

Economists like Nouriel Roubini are starting to fret about a US debt crisis as interest rates rise – here’s why it’s the latest issue rattling markets

MarketsInsider/George Glover/12-11-2022

USAGOLD note: This article does not mention the most dangerous aspect of the developing debt crisis – interest payments on the US federal debt. That expenditure now stands at $475 billion in fiscal year 2022 and is destined to go higher as interest rates rise. By way of perspective, the expenditure on national defense is $767 billion.

Gold gives back some of its early-year gains

The lack of dovish indicators in Fed minutes plays on market sentiment

(USAGOLD – 1/5/20230) – Gold drifted to the downside this morning, giving back some of the gains since the start of the year. It is down $7 at $1849.50. Silver is down 32¢ at $23.52. Pressing on market sentiment was the lack of any dovish indicators on rates in December’s FOMC meeting minutes released yesterday. In fact, the FOMC reported that “no participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023.” Yet, traders, for their part, cling to the notion that a weakening economy will force the Fed to step back.

“Gold is having a great start to the New Year,” writes senior market analyst Ed Moya at the Oanda website. “Wall Street continues to pile into gold as global bond yields continue to slide and recessionary risks remain elevated. Many traders are growing confident that the end of the Fed’s tightening cycle is nearing and that rate cuts could happen at the end of the year. Gold is eyeing the $1900 level, but for that to happen we’ll need to see the bond market rally remain in place a while longer.”

The precious metals sector may have started a sustainable bull cycle

Investment Research Dynamics/Dave Kranzler/12-12-2022

USAGOLD note: Kranzler delves into some of the behind-the-scenes developments lending themselves to an improved technical picture for the yellow metal.

Gold Outlook 2023: The global economy at a crossroads

World Gold Council/Staff/12-8-2022

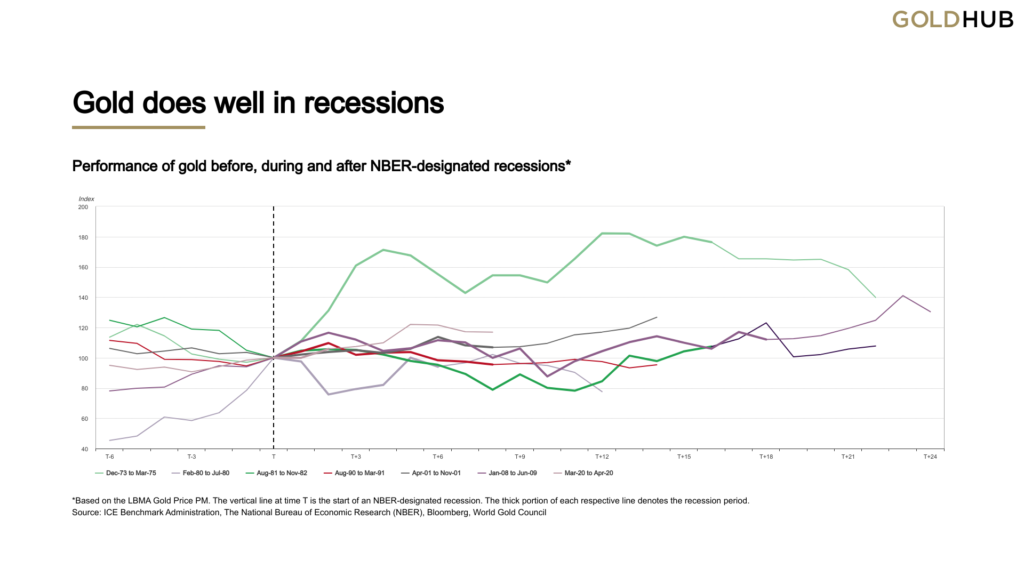

“[Gold] could provide protection as it typically fares well during recessions, delivering positive returns in five out of the last seven recessions (See chart below). But a recession is not a prerequisite for gold to perform. A sharp retrenchment in growth is sufficient for gold to do well, particularly if inflation is also high or rising.”

USAGOLD note: WGC goes on to say that the economy might not follow a “well-telegraphed path” in 2023 warning that “hypervigilant central banks” might overtighten resulting in “more severe economic fallout and stagflationary conditions.” That would be “a considerably tough scenario,” it says, “for equities with earnings hit hard and greater safe-haven demand for gold and the dollar.” It goes to say that the “interplay between inflation and central-bank intervention” will be a key determinant in gold’s performance. It sees challenges ahead for global central banks “as the prospect of slower growth collides with elevated, albeit declining inflation” – in short, the early stages of stagflation.

Chart courtesy of the World Gold Council • • • Click to enlarge

Jerome Powell’s Volcker deficit

Project Syndicate/Stephen Roach/5-25-2022

“Poor Jerome Powell. With US inflation close to a 40-year high, the Federal Reserve chair knows what he needs to do. He has professed great admiration for Paul Volcker, his 1980s-era predecessor, as a role model. But, to paraphrase US Senator Lloyd Bentsen’s famous 1988 quip about his vice-presidential rival, Senator Dan Quayle, I knew Paul Volcker very well, and Powell is no Paul Volcker.”

USAGOLD note: A scathing review of Jerome Powell’s tenure as Fed chairman including his remarks suggesting a replication of the Paul Volcker approach to taming inflation……As any number of prominent analysts have already pointed out, by keeping the interest rate under the inflation rate, Powell’s policies resemble more closely those of Arthur Burns than Paul Volcker, and as long as that is the case stagflation will remain a major concern among investors. Though somewhat dated, Roach’s assessment is well worth a second look. Llittle has changed since its original publication in May.

Yahoo Finance BofA survey shows ‘pessimism stable’ as China steadies economic outlook

Yahoo!Finance/Alexandra Semenova/12-13-2022

USAGOLD note: Well, it’s pessimism, but at least it’s not runaway pessimism, according to the survey…… At the same time,, Yahoo reports that bearishness is stable at record levels.

Gold extends new year rally into second day

Napier says rate increases will not keep up with inflation; gold will benefit

(USAGOLD – 1/4/2023) – Gold took its new year rally into its second day on rising hopes that inflation is on the fade and the Fed will begin dialing down interest rate increases. It is up $16 at $1858. Silver is up 20¢ at $24.27. Russell Napier, the highly regarded markets analyst, is at odds with the building sentiment on inflation and rates. He says inflation will not be matched by rate increases – a process he calls “financial repression” that will remain in place for at least a decade. Gold, he believes, will be among the beneficiaries.

“Gold has long seemed a better bet in an environment when inflation would be rising faster than interest rates,” he writes in an analysis published Monday in the Toronto Star. “Going forward, the more investors focus on governments’ need to ensure that interest rates remain below the rate of inflation, the more the price of gold is likely to rise. This will be particularly true when central bankers begin to reduce interest rates. Should a financial repression require capital controls to coral investors into local currency government bonds, the rise in the gold price will accelerate.”

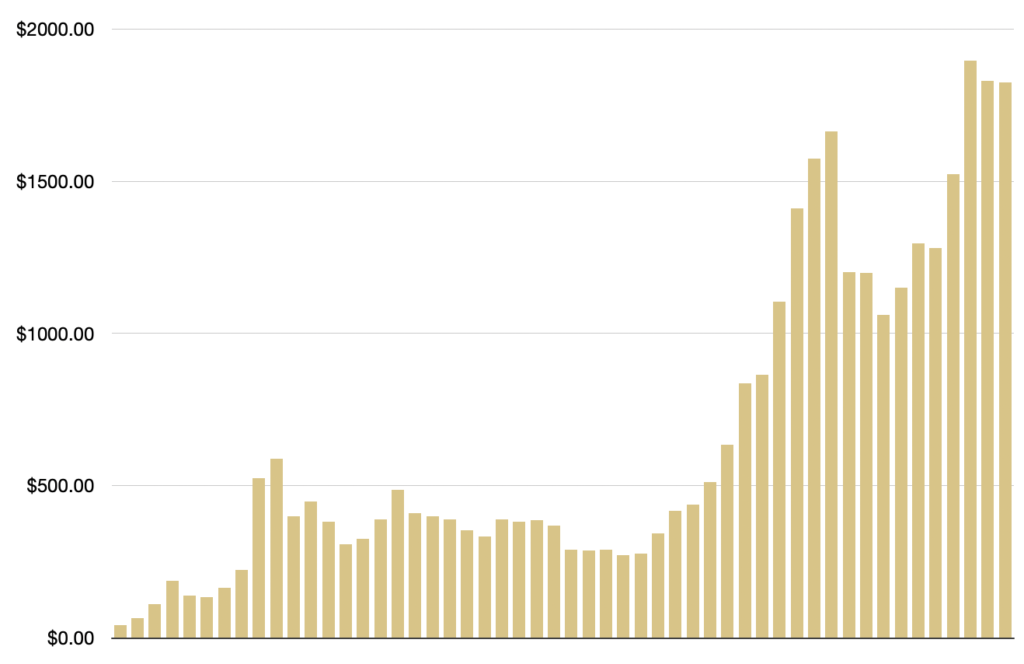

Gold average annual price

(1971-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: MacroTrends.net

The markets are full of idiots

Blain’s Morning Porridge/Bill Blain/12-30-2022

USAGOLD note: Blain features a photo composite that includes Musk, Bezos, Zuckerberg, and Gates, then advises: “It’s a false assumption to think people in positions of power know what they are doing or understand what they are saying. 2022 has been an extraordinary year for seeing our idols exposed as mere craven images.”

Federal Reserve must tighten to 9% to break core inflation’s back

PoundSterlingLive/Gary Howes/12-9-2022

“It adds to a growing body of economist research that suggests the Fed will simply be unable to achieve its aim of bringing inflation back to target for fear of breaking the economy.,This opens up the potential for a new monetary policy regime that risks wrecking central bank credibility, a second successive rate hiking cycle and a period of protracted stagflation: scenarios these leading economists don’t think markets are prepared for.”

USAGOLD note: The foregoing is the opinion of Societe General economist Solomon Tardese. Albert Edwards, another Societe General analyst who happens to have a large following, agrees with him. “I must share his shocking findings with you. He and I are on the same page. We both believe there is no way that the Fed can break the back of core CPI inflation in this economic cycle,” says Edwards.

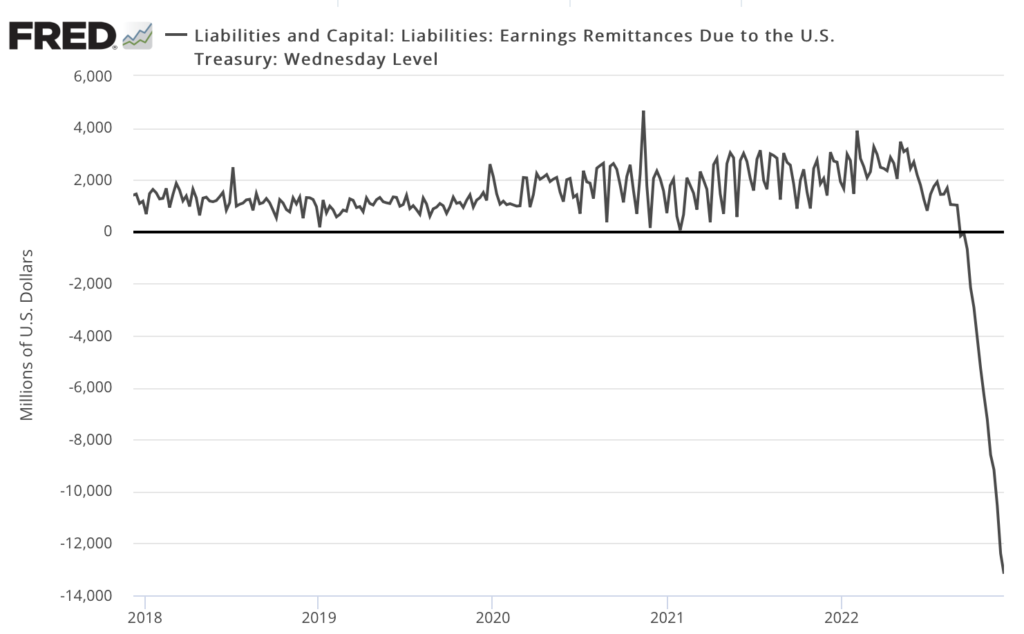

How big are the Fed’s losses and where can we go see them

Wolf Street/Wolf Richter/12-9-2022

“A collapse-chart has been making the rounds in the social media, financial blogs, and the like. It’s being handed around without context, as if self-explanatory, sort of like, look, the world is collapsing. It’s from the St. Louis Fed’s data depository. The title of the chart says, among other things, ominously, ‘Liabilities: Remittances Due to the U.S. Treasury.’ Whatever this is, it’s violating the WOLF STREET dictum, ‘Nothing Goes to Heck in a Straight Line.'”

USAGOLD note: The Fed’s losses resulting from its bloated balance sheet have been a subject of interest in recent weeks. Remittances, as shown in the chart, have turned into a drain. Richter explains what it all means and how the Fed and Treasury Department account for it. “The net loss for the Fed could be north of $260 billion in 2023,” he says. For those with an interest, this article provides essential background.

Sources: St. Louis Federal Reserve [FRED], Board of Governors of the Federal Reserve System (US)

Central banks around the world have now given the markets a clear message — tighter policy is here to stay

USAGOLD note: We shall see how this plays out in the gold market. If Friday’s markets are an indicator, we could be at a turning point. Rising rates, stagnation and stubborn inflation, in our view,point to a stagflationary trend. During the 1970s – the last time stagflation was the prime concern – gold and silver glittered. On Friday, as the news on where central banks were headed settled in, stocks slipped in the United States while gold and silver rose – a departure from recent trends. One day does not make a trend, but under the circumstances, we thought it worth noting.

Forget what you’ve learned about investing in the last 20 years

Bloomberg/Merryn Somerset Webb/12-8-2022

“Then there are those who find this terrifyingly naïve, who believe that this year does not represent a blip, nor anything close to an ordinary business cycle. For them, the volatility in the stock markets is telling us the story of a huge structural change — one that is taking us back to a different kind of normal, one that might mean you need to forget everything you have learned about investing over the last 20 years.”

USAGOLD note: Another top-drawer analyst throws in the towel on traditional approaches to portfolio design. Webb is a long time advocate of including gold in one’s finances. She first recommended it at $320/oz in 2002.