Monthly Archives: January 2023

Stock market acting like it did before the recession of 1969, JPMorgan strategist finds

MarketWatch/Steve Goldstein/1-5-2023

USAGOLD note: At about that same time, gold demand began to stir among investors, and European nation-states began converting their dollar holdings to gold at the U.S. Treasury’s gold window. Gold’s price history, thereafter, is well known.

The central bank horror story

Financial Times/John Plender/1-2-2023

“For the moment, a standard market view is that the central banks’ ‘tighter for longer’ mantra will keep bond yields rising and equities falling. But the big question is whether, in the event of a funding crisis, central banks will feel obliged once again to return to asset buying to prop up markets and financial institutions, thereby weakening their anti-inflationary stance.”

USAGOLD note: Some refreshingly clear thinking from Mr. Plender…… We have suggested for months that a change of course at the Fed is more likely to come the result of another credit crisis than a slowing economy.

Why are the central banks secretly buying gold

The New York Sun/Editorial staff/1-2-2023

USAGOLD note: Much food for thought in this New York Sun editorial……Of special note, the prospect of sovereign wealth funds in the Middle East buying gold sub rosa with oil revenues, and the Sun ending with the observation that in the context of a breakdown in the current monetary system it is “easy to understand the logic of buying gold.”

All is not quiet on the Eastern front

Bloomberg/Niall Ferguson/12-31-2022

Gold pushes toward $1900 mark in advance of CPI data

‘Once you get into the 1900s, it becomes a gravitational pull toward $2000.’

(USAGOLD – 1/12/2023) – Gold pushed toward the $1900 level in advance of today’s inflation data. It is up $10 at $1888. Silver is up 37¢ at $23.85. The consensus view is that the CPI will come in at 6.5% – a significant drop from the 7.1% reading in November that might inspire a more dovish Fed. Financial Times attributes gold’s 15% rise since early November to expectations that the Federal Reserve “will slow the pace of its increases in borrowing costs as inflation eases off its highs.” It quotes Blue Line’s Phillip Streible as saying gold could break through $1900 if today’s inflation reading comes in weaker than expected. “Once you get in the 1900s,” he says, “it becomes a gravitational pull towards $2,000.”

Roubini says more war means more inflation

Project Syndicate/Nouriel Roubini/12-30-2022

USAGOLD note: Roubini argues the opposite of Wall Street’s favored inflation scenario – not peak, not transitory, but in the ascendancy. He adds a new layer to his analysis in this essay – the disruptive effect of “globotics.” As more and more workers – white and blue collar – lose their jobs to globalization and automation, governments will be pressured “to help those left behind, whether through basic-income schemes, massive fiscal transfers, or vastly expanded public services.” He ends with a warning that “a great stagflationary debt crisis is upon us.” Though not always an advocate of gold ownership, Roubini has become one in recent years.

Fed wants a recession, Bank of America says

MarketsInsider/Jennifer Sor/1-5-2023

USAGOLD note: What happened to “Don’t fight the Fed?” The markets, it appears, are in full defiance. The Powell Fed has become the Rodney Dangerfield Fed – looking for a little respect.

The one true secret to successful investing

Bloomberg/Alison Schrager/1-5-2023

USAGOLD note: We pass this along simply because it includes the principles of sound money management that too many have forgotten or pushed aside over the last several years. The free money era is over. Everthing’s changed. Increasingly analysts are recommending investing in the old world economy of which gold is a charter member.

Go for gold, and a few other investing tips for surviving years of financial repression

Toronto Star/Russell Napier/1-2-2023

USAGOLD note: A must-read from Russell Napier – a market analyst widely followed by other market analysts.…… Napier believes gold will glitter in an atmosphere in which central banks keep interest rates below the inflation rate. The rise in inflation, he says, will not be matched by a rise in interest rates. He describes the process as “financial repression” and predicts it will be in place for at least a decade.

Gold drifts sideways ahead of tomorrow’s inflation data

Credit Suisse foresees the possibility of $2300 gold and ‘likely beyond’

(USAGOLD – 1/11/2023) – Gold drifted sideways in early trading as investors awaited tomorrow’s Labor Department inflation data. It is up $1.50 at $1881. Silver is up 20¢ at $23.89. Trading Economics forecasts a 6.7% inflation reading for December – a sharp drop from November’s 7.1% and a number the markets would likely interpret as a dovish influence on the Fed. Technical analysts at Credit Suisse foresee the possibility of gold trading at $2300 in 2023.

“We look for further tactical gains to test the 61.8% retracement of the 2022 fall and June 2022 high at $1,876/96, which ideally caps for now,” says the bank In a report posted this morning at FXStreet. “Should strength directly extend though we see resistance next at the 78.6% retracement and April 2022 high at $1,973/1,998. Whilst on a big picture basis this strength is seen as a rally within a broader long-term sideways range, should the rally ever extend above the record highs from 2020 and 2022 at $2,070/2,075, this would be seen to mark a significant and long-term break higher, opening up we think $2,300 and likely beyond.”

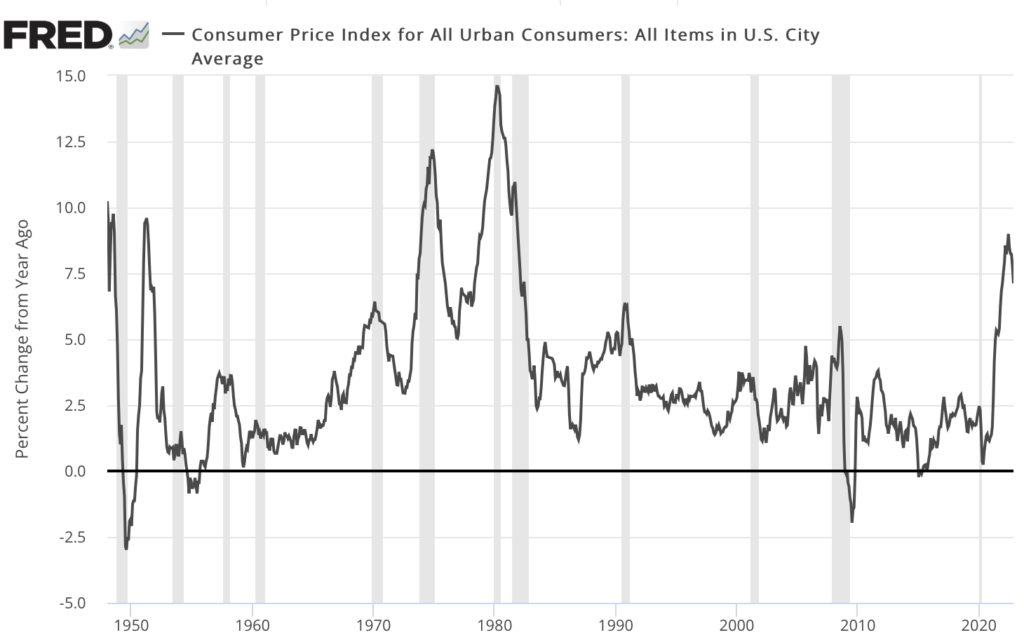

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics

Commodities trading boom raises fear of big losses among retail investors

Financial Times/Madison Darbyshire and Nicholas Megaw/1-2-2023

USAGOLD note: Commodities investors on the futures exchanges own leveraged positions, and as one analyst pointed out, “these are very sophisticated markets where you can lose . . . whatever you put up with your [broker] in a matter of minutes.” By owning physical gold and silver outright, you can participate in any future commodities rally without exposing yourself to the dangers of leverage. In fact, you can ride out any downside and live to potentially profit another day. The commodities’ futures markets are not for everyone – a lesson too many learn the hard way.

The great disruption has only just begun

Financial Times/Gillian Tett/12/15/2022

USAGOLD note: Tett explores shifting sentiment at a time when the old economic structures are crumbling, and the new do not feel all that sturdy.

Gavekal touts emerging markets and gold for 2023

the market NZZ/Mark Dittli interview of Louis-Vincent Gavekal/12-23-2022

USAGOLD note: Gavekal is the widely followed founder of Hong Kong-based research group bearing his name. “I think we have seen peak hawkishness,” he says,” but we haven’t seen peak inflation. We don’t have a lot of modern examples of inflation in the industrialised world, and nobody who is still active in markets really remembers the Seventies”

Burry says US is in recession ‘by any definition’

Bloomberg/Michael Sin/1-1-2023

USAGOLD note: Burry obviously is not buying into Wall Street’s favored notion that the Fed has gotten the genie back in the bottle.

Gold drifts sideways ahead of inflation data, Powell speech

Saxo Bank says gold has been the “star performer” during the first week of commodities trading

(USAGOLD – 1/10/2023) – Gold drifted sideways ahead of tomorrow’s all-important inflation report and Jerome Powell’s speech later today. It is level at $1874.50. Silver is down 19¢ at $23.56. Saxo Bank’s Ole Hansen offers a solid assessment of the developing demand for gold among futures traders in an analysis posted this morning. To sustain the momentum, though, he thinks gold will need further support from central bank and ETF investors. “Both of which are playing out,” he adds, “after China’s PBoC added 62 tons during November and December while ETFs last week saw its first back to back week of buying since last April.”

“Demand for gold,” he says, “which started to recover after the yellow metal made a triple bottom around $1620 back in November (See chart), extended into the new year with funds raising their net long by 8% to 7.8k lots, a seven-month high. Supported by momentum and the outlook for a friendlier 2023 for investment metals gold has been the star performer during the first week of trading. While many wise traders over the years have refrained from getting involved during the first few weeks of a new year, the continued rally has increasingly forced technical focused traders to get involved.”

Gold Price

(One Year)

Chart courtesy of TradingView.com

Nouriel Roubini: ‘I hope I didn’t depress you too much’

Financial Times/Henry Mance interview of Nouriel Roubini/12-28-2022

USAGOLD note: Under these circumstances, says Roubini, “you go to short-term Treasuries, you go to inflation-indexed bonds, you go to gold.” The financial press likes to call him Dr. Doom but he sees himself as “Dr. Realist.”

Long-time gold bear JC Parets turns bullish; $5,000 possible

Forbes/Simon Constable/12-27-2022

USAGOLD note: It’s always heartening to hear that a long-time bear has gone bullish. In Paret’s case, he does it in a big way.

Stock and bond markets shed more than $30tn in ‘brutal’ 2022

Financial Times/Tommy Stubbington, Adam Samson, and Kate Duguid/12-31-2022

“Global stocks and bonds lost more than $30tn for 2022 after inflation, interest rate rises and the war in Ukraine triggered the heaviest losses in asset markets since the global financial crisis.…[S]aid Luca Paolini, chief strategist at Pictet Asset Management. ‘The lesson of this year is that at some point there’s a day of reckoning, and when it comes it’s brutal.’”

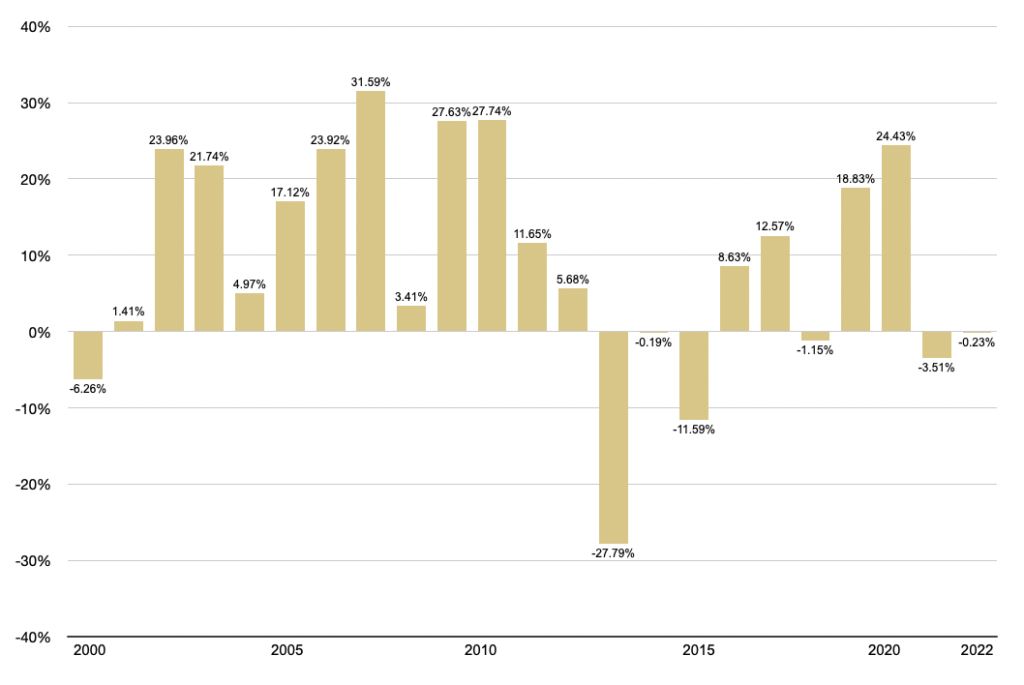

USAGOLD note: We posted this chart regularly in 2022 and here’s the final tally.

Stocks… down 19.95%

Treasuries… down 31.00%

Crypto… down 64.25%

Gold… up 1.19%

Silver… up 4.61%

Performances key asset groups 2022

(Stocks, bonds, crypto, gold and silver)

Chart courtesy of TradingView.com • • • Click to enlarge

For the Fed, a red card from the 1970s

Bloomberg/Niall Ferguson/12-18-2022

“Jay Powell may find, as Arthur Burns did, that tackling inflation is not a beautiful game.”

USAGOLD note: Ferguson walks us through the possibilities. He says the wrong call by the Fed – and it could be a matter of 25 basis points on interest rates – “can make the difference between a nasty recession and an inflationary spiral.” That might be cutting the margin of error a bit close. The real problem, in our view, is whether or not the Fed lucks out on the inflation rate and it continues to decline, or it bottoms and starts back up again. In Burns’ case it started back up again – repeatedly.

Gold extends new year rally

China announced adding another 30 tonnes to its reserves in December

(USAGOLD –1/9/2023) – Gold extended its new year rally this morning as investors prepped for Thursday’s inflation data release, and commodities, led by oil, turned to the upside on the prospect of economic recovery in China. It is up $9 at $1877.50. Silver is up 10¢ at $24.02. Adding to the momentum, China announced the acquisition of another 30 tonnes of the yellow metal in December – the second month in a row it added to its coffers. Credit Bubble Bulletin‘s Doug Noland sees bubbles everywhere, each in its own unique stage of inflation or deflation. The one non-bubble in his scenario is gold at a time of “acute currency market uncertainty and instability.”

“[Will 2023] be the year of precious metals?” he asks. “Precious metals were generally out of the blocks quickly to begin the new year. Metals performed relatively well last year in the face of dollar strength and rising rates. A year of currency market uncertainty, persistent inflation, and ongoing expansion of non-productive Credit would seem to support the precious metals. After a 2022 inflection point, I would expect 2023 to provide more New Cycle momentum. There will be ebbs and flows, but the cycle of hard asset outperformance versus financial assets is in its infancy.”

Gold annual returns

(%, 2000-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: MacroTrends.net • • • Click to enlarge