New York Fed’s Williams says interest rates need to top inflation rate to get prices under control

MarketWatch/Jeffrey Bartash/12-16-2022

“In market parlance, a real interest rate is one that is above inflation. The rate of inflation right now, using the Fed’s preferred personal-consumption-expenditures, or PCE, price gauge, is 6%. That’s markedly higher than the current 4.25% to 4.5% fed-funds rate”

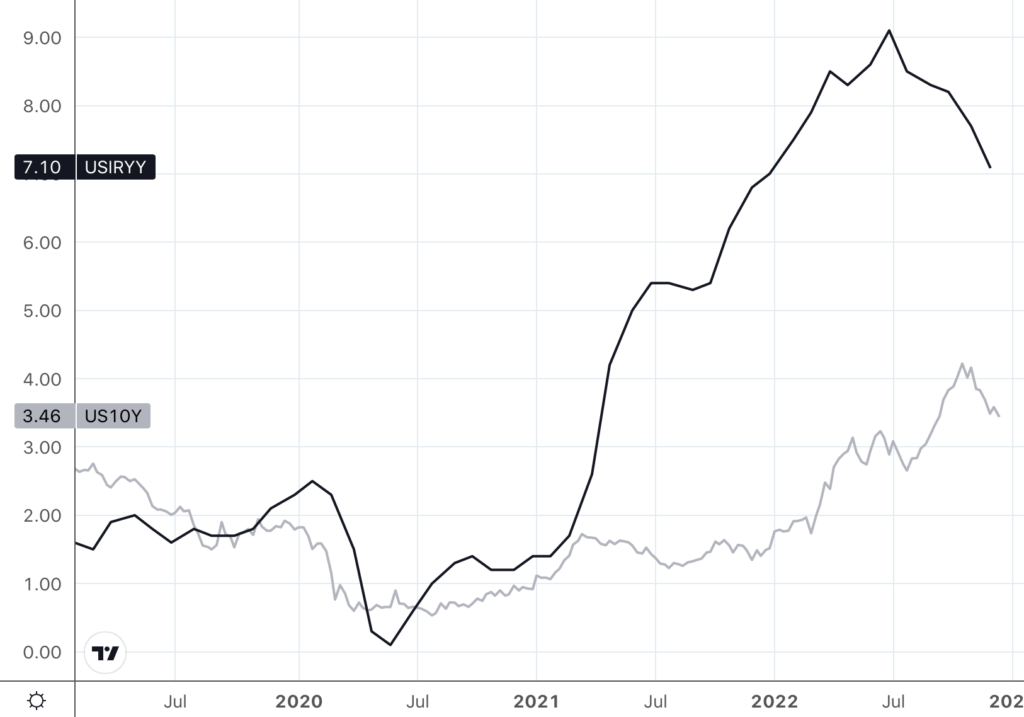

USAGOLD note: If you are a regular reader of this page, this argument will sound familiar. We are a very long way from achieving the positive real rate milestone. Too, the PCE price index, though preferred by the Fed, excludes food and energy prices, so how realistic is it as a real measure of inflation? The inflation rate, as measured by the more worldly Consumer Price Index is 7.1%. Shadow Government Statistics, which tracks the inflation rate using the Labor Department methodology of the 1980s, puts the inflation rate at 15%. By either measure, the ten-year Treasury yield at roughly 3.5% leaves a substantial gap that needs to be breached for investors to achieve a real rate of return.

10-year US Treasury yield vs the inflation rate

Chart courtesy of TradingView.com