Featuring top analysts. Updated regularly.

China expands gold reserves at central bank for fifth month

“China boosted its gold reserves for a fifth straight month, extending efforts by the world’s central banks to boost their holdings of the precious metal. The People’s Bank of China raised its holdings by about 18 tons in March, according to data on its website on Friday. Total stockpiles now sit at about 2,068 tons, after growing by about 102 tons in the four months before March.”

USAGOLD note: China points the way on central bank gold acquisitions as global official sector demand continues to grow. Some experts believe that central bank demand is at the core of the price rise over the past four years.

Gold’s big breakout – $2000 and beyond

ByteTree/Charlie Morris/4-5-2023

USAGOLD note: The latest from Charlie Morris who says money printing and sovereign risk are in bull markets.

The top three catalysts for higher gold prices in 2023

US Global Investors/Frank Holmes/3-31-2023

“Gold appears to be well-positioned for a strong pump that could carry it to new all-time high prices in 2023—and beyond. As you know, I’ve been following and writing about the precious metal market for a very long time, and I see a number of unique catalysts at the moment that could contribute to higher gold prices. If you’re underexposed or have no exposure, it may be time to consider changing that.”

USAGOLD note: His top three catalysts are rapid dedollarization, the return of QE, and the emergence of two new cold wars. Details at the link……

Gold tailwinds rising as it enters real yield sweet spot

ZeroHedge/ Simon White-Bloomberg Markets/4-12-2023

USAGOLD note: White explores the relationship between real yields and gold price expectations, and comes away with a bullish view on gold.

Why gold?

Notes from the Rabbit Hole/Staff/3-31-2023

USAGOLD note: An offbeat view of gold with a bit of philosophy on how we should view the metal……

OPINION: ‘Most U.S. banks are technically near insolvency, and hundreds are already fully insolvent,’ Roubini says

MarketWatch/Noriel Roubini/3-31-2023

USAGOLD note: Roubini weighs in on the banking crisis with this must read analysis. The banking system is sitting on a powder keg. “The ‘unrealized’ nature of these [unrecognized bond market] losses,'” he says, “is merely an artifact of the current regulatory regime, which allows banks to value securities and loans at their face value rather than at their true market value.”

Four good times to buy gold in 100 years

ByteTree/Charlie Morris/3-23-2023

“Over the past 100 years, there have been four compelling times to buy gold. In 1929 it proved to be a saviour ahead of the great depression. Then in 1969, it preceded the great inflation of the 1970s. In 2000, it cemented itself as the most liquid alternative asset of the 21st century in anticipation of the credit crisis. And just recently, gold is signaling strength ahead of what looks to be an emerging sovereign debt crisis.”

USAGOLD note: Morris says the next few years will be tricky for investors and that gold will have an important role to play. The buying of physica preciousl metals globally since the banking crisis began suggests that a good many investors agree with him.

Gold price

(!834 to present, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge

Is gold a good investment?

NASDAQ/Martha C. White/3-29-2023

“Many people find gold to be a good investment because it can act as a diversifier in a typical portfolio. It can act as a hedge during periods of high inflation and as a safe haven during market volatility. But it also does not earn income and can be subject to fluctuations in value.”

USAGOLD note: A helpful overview for the beginner…… One thing to keep in mind is that safe haven investors usually opt to purchase coins and bullion delivered to their safekeeping. ETs are preferred by funds and institutions because they tend to purchase and sell large amounts of the metal and do not want the logistical problems that accompany large purchases. Also, most gold market experts consider ETFs paper, as opposed to physical, gold. You might want to review this page if you are trying to decide between the two options.

CNBC, Financial Times post bullish articles on gold

Traders pile into bets on gold price rally

Financial Times/Nicholas Megaw/3-27-2023

Gold prices could notch an all-time high soon — and stay there

CNBC/Lee Ying Shan/3-22-2023

‘It’s a crisis built on a crisis we never solved. How can anyone be shocked?’ – Rick Santelli

ZeroHedge/Tyler Durden/3-23-2023

“Listen folks, we all need to take a step back… how many trillions of dollars of negative securities were hovering through Europe… How could anybody be shocked… I was shocked the news wasn’t worse three months ago… and now we are starting to see the realities of it…” – Rick Santelli, CNBC

USAGOLD note: ZH describes Santelli as someone who “channels the unvarnished truth.” When he speaks, people listen. “Oh we ‘solved’ it alright: by printing $20 trillion,” he tweeted. “Guess how much it will cost to ‘solve’ the current crisis…”

Gold prices could notch an all-time high soon — and stay there

‘A sooner Fed pivot on rate hikes will likely cause another gold price surge due to a potential further decline in the U.S. dollar and bond yields,’ said Tina Teng from financial services company CMC Markets. She expects gold will trade between $2,500 to $2,600 an ounce.”

USAGOLD note: CNBC’s Shan interviews gold experts on the metal’s future prospects in light of the ongoing bank crisis. The consensus is bullish. Strong demand is developing among investors looking for a way to preserve capital during uncertain times.

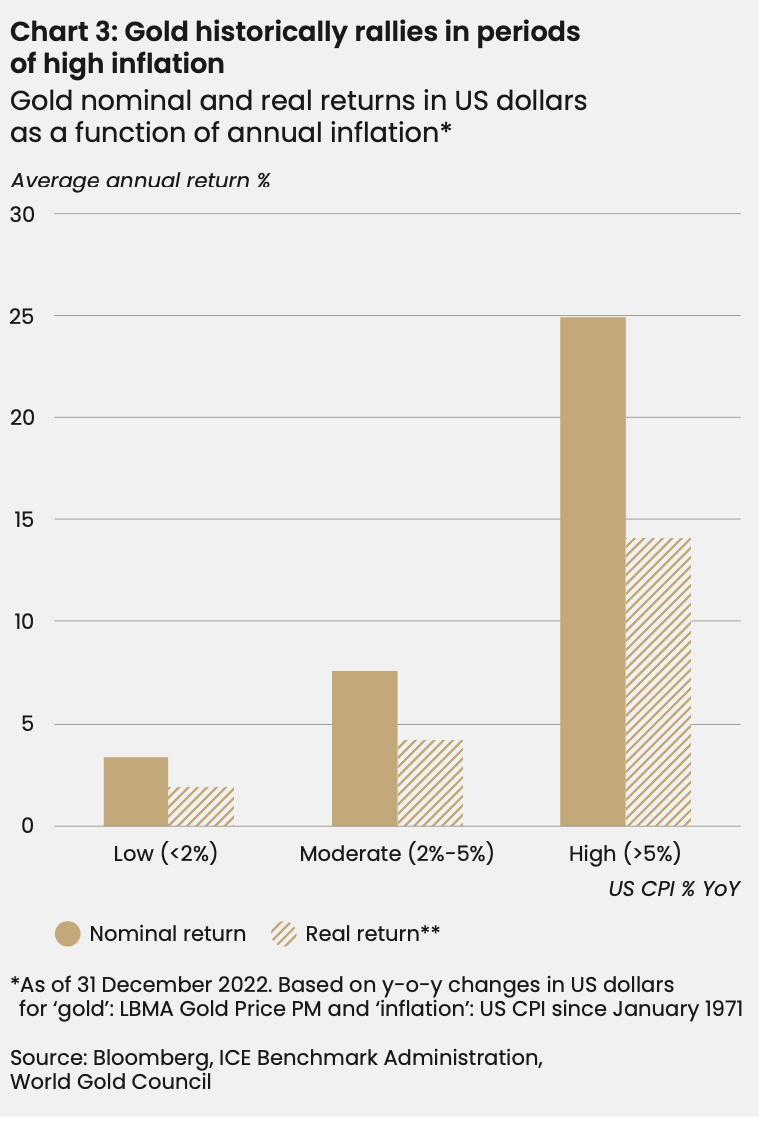

The case for a strategic allocation to gold

“Gold has a key role as a strategic long term investment and as a mainstay allocation in a well-diversified portfolio. Investors have been able to recognise much of gold’s value over time by maintaining a long-term allocation and taking advantage of its safe-haven status during periods of economic uncertainty.”

USAGAOLD note: The World Gold Council makes the baseline case for gold as a vehicle for long-term asset preservation.

‘Commodities are the only attractively valued asset class’ – Jim Rogers

themarketNZZ/Sadra Rosa interview of Jim Rogers/3-21-2023

“That is certainly one possible approach. I own silver and I expect to buy more silver and more hard assets in general, because historically, if you have inflation or chaos, the way to protect yourself is with real assets.”

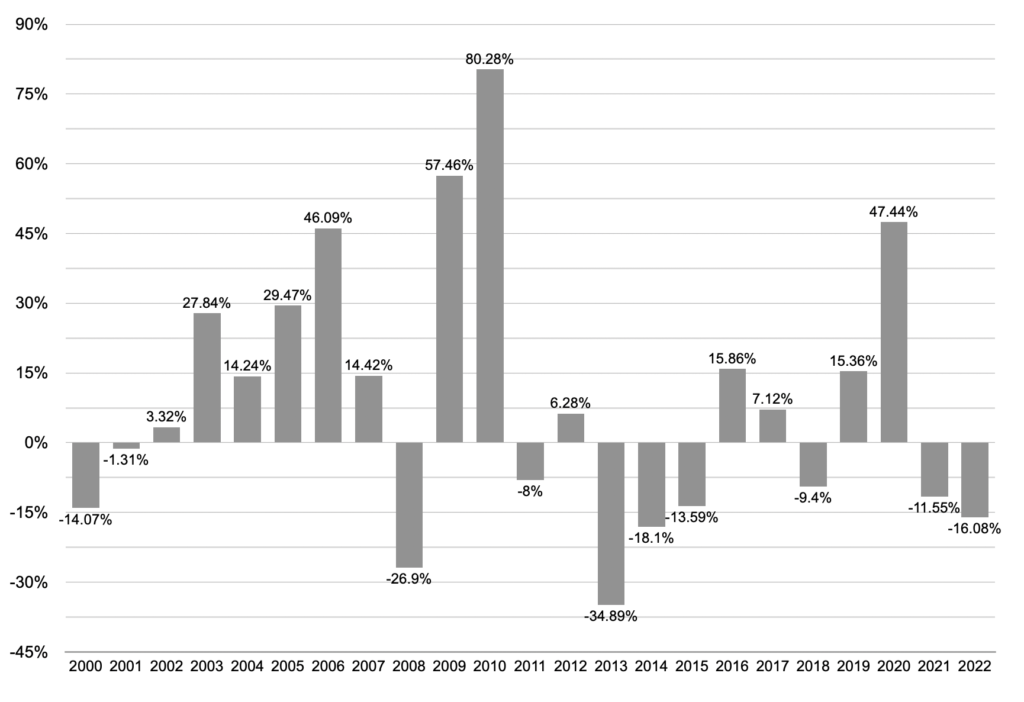

USAGOLD note: Rogers updates his thinking and outlook in the wake of bank failures and the Fed’s rescue plan. As you can tell from the chart below, when silver goes up, it can go up in a major way.

Silver: Average Annual Return

(%, 2000-2022)

Chart by USAGOLD • • • Data source: Macrotrends.net • • • Click to enlarge

‘The Fed is broke – Gundlach likes gold, fears ‘expanding wars’ most

Zero Hedge/Tyler Durden/3-18-2023

USAGOLD note: This article will bring you up to date on Gundlach’s thinking…… “I think gold is a good long-term hold,” he concluded in the same CNBC interview. “Gold and other real assets with true value, such as land and collectibles.”

Greatest hedge fund manager of all time says to gift your kids gold to get them started investing

Yahoo!Finance/Henry Slater/3-14-2023

USAGOLD note: A good many of our clients have been doing this for years…… Dalio gives gold coins to his grandchildren every birthday and holiday.

US capitalism is ‘breaking down before our eyes’, says Ken Griffin

Financial Times/Harriet Agnew, Laurence Fletcher and Patrick Jenkins/3-14-2023

USAGOLD note: For well-known reasons, creative destruction and the fear of losses are essential to the market process. Banks are in the unique position of capitalizing on their profits and socializing their losses. Bad things happen when Humpty has nothing to worry about.

‘Time to buy gold’: Tucker Carlson reacts to ‘second biggest’ bank failure in American history

Daily Caller/Harold Hutchinson/3-11-2023

“Fox News host Tucker Carlson said Friday that the collapse of Silicon Valley Bank was similar to a ‘bank run’ from 1929 and the collapse of the cryptocurrency exchange FTX.…’What it means is it could be time to buy gold and stockpile food.'”

USAGOLD note: The blunt, widely followed Mr. Carlson makes his views known…… He points out that the biggest banks lost $50 billion in market value after SVB’s collapse on Friday – a blow to those who hope further damage might be confined to smaller, regional banks.

The guessing game: Ben Bernanke’s 21st century monetary policy

RealClearMarkets/CJ Maloney/2-24-2023

USAGOLD note: Bernanke’s legacy lives on at the Federal Reserve today – for better or worse. History will be the judge – particularly on his most enduring and far-reaching contribution, quantitative easing. Maloney takes a deep dive into the Bernanke Fed – and the impact it had then and now. Commenting on the Bernanke Fed, Jerome Powell said, “We crossed a lot of red lines that had not been crossed before.”

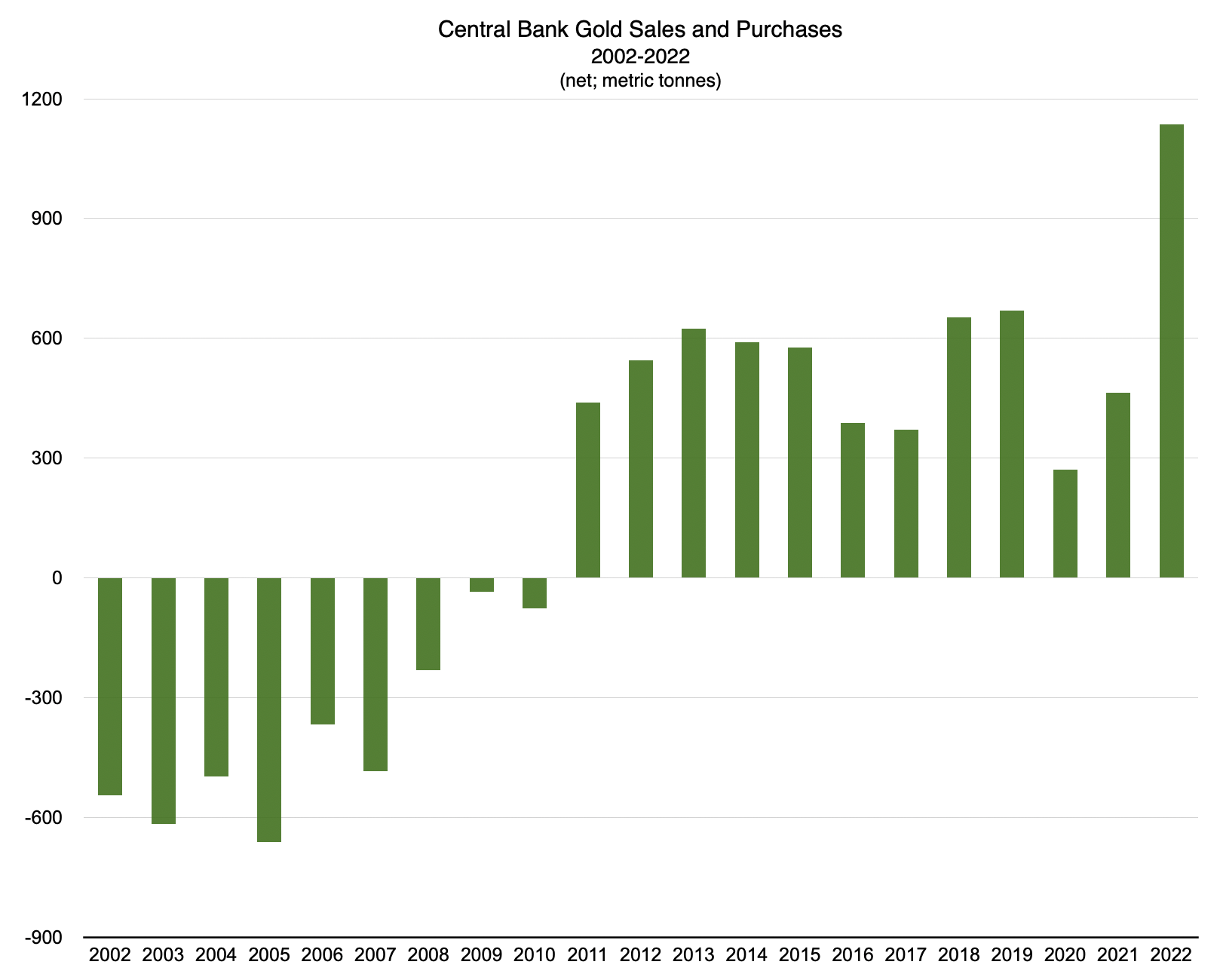

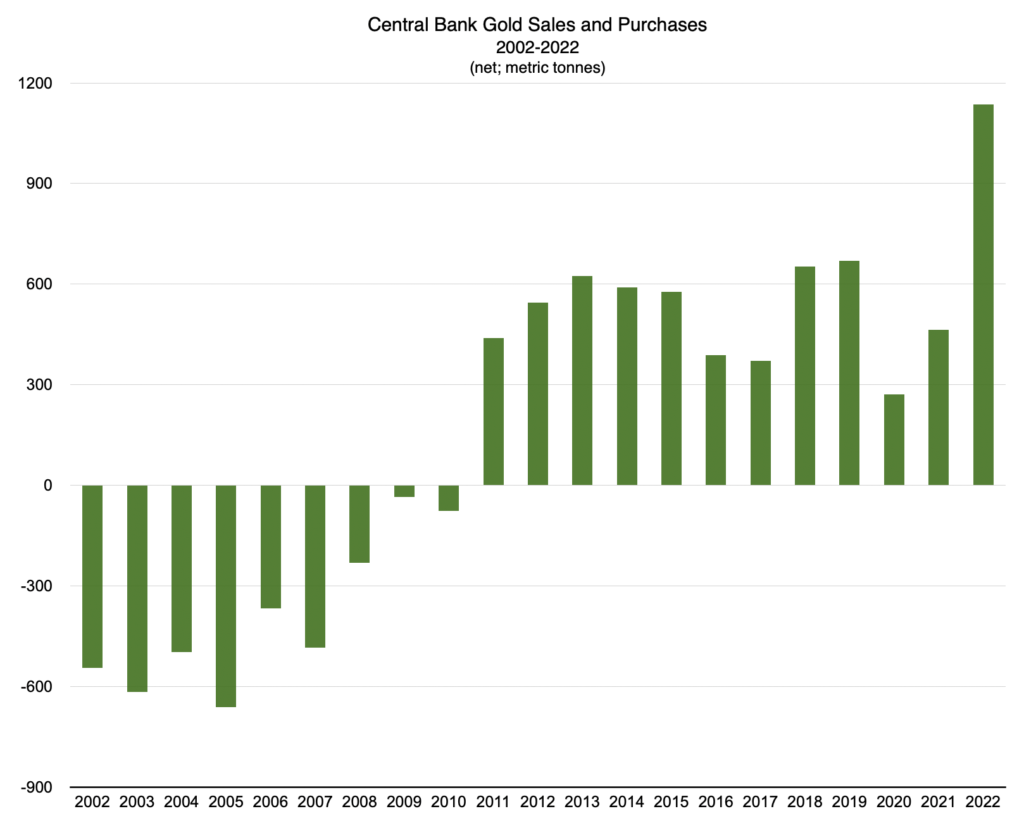

The great gold rush: Central banks in frenzy

Eurasia Review/Alex Gloy-Fair Observer/2-18-2023

USAGOLD note: Eurasia Review returns to a World Gold Council survey of central banks from last June – a revealing look at what is driving official sector interest in gold. It delivers insights especially interesting in light of developments since then. This article will appeal to readers who would like to dig a little deeper into the forces now at work in the gold market. Gloy’s credentials include stints at Deutsche Bank and Credit Suisse over a 35-year career with a focus on macroeconomic research.

Will investors follow central banks into gold

Seeking Alpha/Van Eck/2-15-2023

“During our most recent quarterly webinar, we said that it feels as if investors need to be ‘scared into’ owning gold. What we meant is that most investors seem uninterested in gold until things get ugly. Well, things got really ugly last year, and central banks took note, so you may say that they, too, got scared into owning gold, accelerating their purchases to record levels. Could the attitude of central banks towards gold be paving the way for investors more broadly?”

USAGOLD note: The time to buy gold is when things are quiet, not when they get ugly. That is precisely what the central banks have been doing over the past couple of years, and are doing now.

Chart by USAGOLD [All rights reserved] • • • Data Source: World Gold Council

The barbarous relic

Comerica Wealth Management/John Lynch/2-13-2023

“While the fundamental strategies driving the move higher in gold can be disputed between its use as an inflation hedge or a safe-haven asset, the technicals are indisputable – momentum is strong, and flows are mild – suggesting further gains ahead.”

USAGOLD note: Lynch starts with John Maynard Keynes’ famous description of told as the “barbarous relic” which he says questioned its usefulness as an investment. However, Keynes’ wasn’t talking about gold as an investment in that context, but as a national asset backing the value of the currency. That said, Lynch goes on to paint of picture of gold that shows it as anything but a barbarous relic. He focuses on the longer-term trends.

The latest from John Paulson on gold, fed policy, currencies, stocks and more

Alain Eldann Interviews/Interview of John Paulson/2-12-2023

USAGOLD note: Paulson offered this answer in response to why nation states are switching from holding dollars in their reserves to physcial gold. Of course, the appreciation Paulson states is not confined to nation-states, but applies to anyone who owns gold. He believes that we are at the beginning of a long term gold uptrend. He advises, “you’d be better off keeping your investment reserves in gold at this point.”

Bank of America CEO Brian Moynihan warns to prepare for a US debt default and a recession

MarketsInsider/Jennifer Sor/2-7-2023

USAGOLD note: This time around cooler heads might not prevail, though Congress in the past has never been willing to put the US credit rating on the line. The concern is that the animosity between the political parties is so deep that the politicians will throw caution to the wind.

Norman foresees Goldilocks year for gold – ‘not too hot, not too cold’

Linked In/Ross Norman/2-6-2023

USAGOLD note: Norman has a history of getting it right on his annual forecasts, so we give his forecasts special attention. He sees the possibility of a return to record levels at $2070 per ounce in 2023. The forecast also includes his price targets for silver, platinum, and palladium.

Gold has proven its mettle for long-term investing

FTAdvisor/Darius McDermott/2-6-2023

USAGOLD note: This Financial Times advisory goes on to offer very strong arguments for adding gold to your portfolio in 2023. Of special note: “Corporate earnings downgrades in many sectors may also drive volatility and push investors towards gold as a safe haven.”

The new global gold rush

NPR/Stacey Vanek Smith/2-3-2023

“2022 was a rough year for investors: Between inflation, falling stock prices, and the crypto crash, it was hard to find a safe haven. All of that economic turmoil had a lot of investors looking at one of the most ancient places to store wealth: gold. For decades, investing in gold has been seen as a very old school investment, for the maverick, perhaps slightly anti-establishment investor.”

USAGOLD note: Yes. Old school, maverick investors seeking to preserve their wealth over the long run…… The same motivation that has been in place ever since we can remember. The major difference, as NPR points out, is the percentage of the wealthy investors worldwide looking to gold which has increased markedly. It is refresing to see the photo of a 20-year old holding a recently purchased one-ounce gold bar.

Why every investor should consider some gold in their portfolio

FidelityInternational/Tom Stevenson/2-3-2023

USAGOLD note: Don’t get hung up on the short-term bumps and bruises or, for that matter, the occasional out-of-the-box explosions to the upside……We have always recommended gold as a long-term store of value rather than a short-term speculation. And, when viewed as such, it is a very rewarding item to own as borne out by the long-term charts.

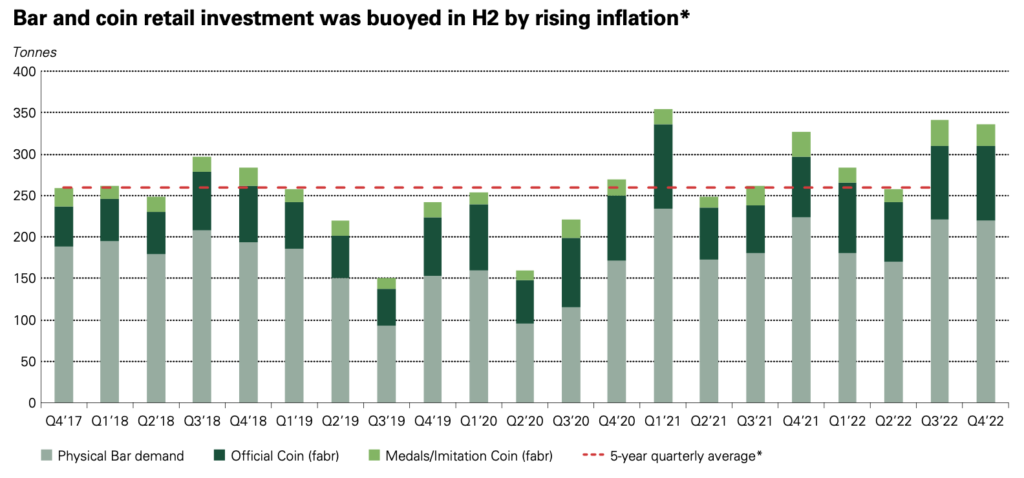

Gold demand trends full year 2022

World Gold Council/Staff/1-31-2023

“Colossal central bank purchases, aided by vigorous retail investor buying and slower ETF outflows, lifted annual demand to an 11-year high Annual gold demand (excluding OTC) jumped 18% to 4,741t, almost on a par with 2011 – a time of exceptional investment demand. The strong full-year total was aided by record Q4 demand of 1,337t.”

USAGOLD note: Some very positive numbers from the World Gold Council to launch the new year…… This report garnered considerable attention in the global financial media. We offer the link above for those who like to dig into the numbers.

Chart courtesy of World Gold Council • • • Click to enlarge

A barbarous relic no more?

USAGOLD note: Three internationally recognized economists dissect what’s behind the move back to gold among emerging central banks. Arslanalp is a macroeconomist at the International Monetary Fund. Eichengreen is a well-known economic historian at the University of California, Berkley. Chima Simpson-Bell is also an economist with the International Monetary Fund.

Opinion: Gold in your 401(k)? It’s not as crazy as it sounds.

MarketWatch/Brett Arends/1-28-2023

USAGOLD note: We have a considerable number of clients who own gold and silver bullion coins in their self-directed retirement plans. It is not a difficult goal to achieve. Contact us and we will set you up with a solid plan in short order.

Yellow metal is a useful disaster hedge

Bloomberg/John Stepek/1-30-2023

USAGOLD note: Though addressed to UK-based investors, Stepek’s tenets and rationale apply to investors everywhere. “You can think of gold in various ways,” he says, “but the simplest way is to think of it as portfolio insurance. It diversifies your portfolio in a different way to either equities or bonds. It’s the sort of asset that does well when everything else is doing badly.”

What could a US recession mean for gold and gold equities?

Schroders/James Luke/1-24-2023

USAGOLD note: It is still up in the air whether or not the US is going to slide into a recession, but if it does, gold and gold stocks have been clear beneficiaries during past economic slowdowns, according to James Luke, fund manager at London-based Schroders. In five of the last seven recessions, gold outperformed stocks and usually by a wide margin.

‘Colossal’ central bank buying drives gold demand to decade high

Financial Times/Harry Dempsey/1-31-2023

“Demand for gold surged to its highest in more than a decade in 2022, fuelled by ‘colossal’ central bank purchases that underscored the safe haven asset’s appeal during times of geopolitical upheaval. Annual gold demand increased 18 percent last year to 4,741 tonnes, the largest amount since 2011, driven by a 55-year high in central bank purchases, according to the World Gold Council, an industry-backed group.”

USAGOLD note: Some will think it odd that demand, led by central banks, surges to levels last seen in 2011 (when gold hit an interim peak) while the price remains restrained……

Chart by USAGOLD [All rights reserved] • • • Data source: World Gold Council

Silver ETFs likely to record huge upside in 2023

Yahoo!Finance/Sanghamitra/1-26-2023

USAGOLD note: A big pick-up in ETF demand could serve as adrenaline for the silver price. It would indicate the renewal of institutional interest. It is interesting to note that silver’s strong run-up since last November has occurred in the absence of ETF buying.

Charles Mackay: What the poet, playboy and prophet of bubbles can still teach us

Financial Times/Tim Hartford/1-26-2023

“Is gold a frivolous investment or a necessity of the age? Gold produces no stream of income. It has some industrial and ornamental uses, but it is chiefly valued because people expect that they will be able to find someone to take it off their hands, quite likely at a profit. That is almost a textbook definition of a bubble, but if gold is in a bubble it has been in a bubble for several thousand years.”

USAGOLD note 1: Human frailty and financial bubbles go hand in hand. Even Charles Mackay, who wrote the still widely read Extraordinary Popular Delusions and the Madness of Crowds, was drawn into the British railway stocks mania of the 1830s and 1840s, saying that the bubbles’ critics had “somewhat exaggerated the danger.” Shortly thereafter, railroad shares plummeted from their peak by two-thirds.

USAGOLD note 2: Hartford offers a fascinating look at bubbles past and present and has a somewhat forgiving attitude about the people who get caught up in them. He says Mackay was wrong when he said that you don’t need hindsight to see a bubble, that they are obvious if you keep your head about you. We come down on Mackay’s side.

USAGOLD note 3: As for gold being in a several thousand-year bubble, looking around at what cheap money has wrought, we think it still has a ways to go.

Gold’s breakout: It’s not the inflation

Daily Reckoning/James Rickards/1-23-2023

USAGOLD note: Rickards offers his take on what has happened in the gold market over the past three months…… He essentially sees gold demand being driven by major fundamental forces seeking a true safe haven.

Sentiment speaks: $2428 target for gold

Seeking Alpha/Avi Gilbert/1-17-2023

USAGOLD note: Elliot Wave analyst Gilbert reprises a long history of successful gold calls to give extra credibility to his bullish $2428 target ……

Silver prices could touch a 9-year high in 2023 — with a bigger upside than gold

USAGOLD note: Big rallies in the silver price often come out of the blue without warning, rhyme or reason. The best approach to owning silver is to accumulate it in physical form sans leverage and wait for the potential price spike. At $30, silver would provide a hefty return for most USAGOLD clientele who own the metal. Even as it is, silver is up 34.5% from September 2022’s bottom at $17.75 per ounce – a more than respectable gain that has not gotten a lot of play in the financial press.

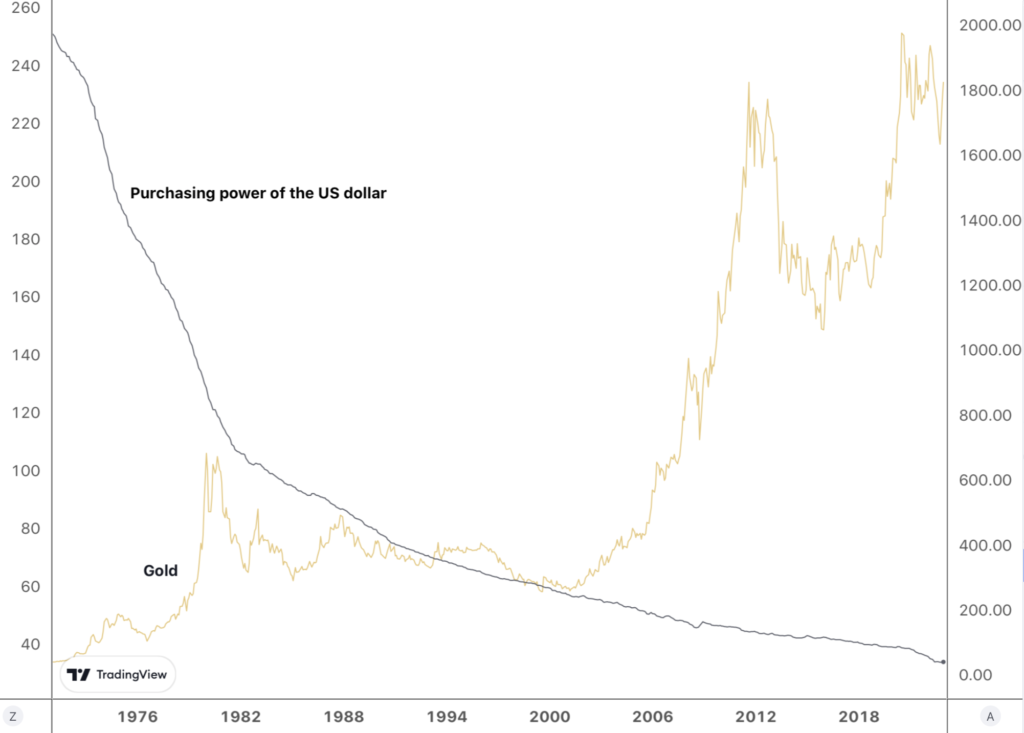

James Grant: ‘I’m somewhat of a broken record on gold’

themarketNZZ/Christopher Gisiger interview of James Grant/1-17-2023

USAGOLD note: If you’ve never exposed yourself to James Grant’s unique brand of deep thinking on the economy and financial markets, you might find opportunity in this interview with Christopher Gisiger. Grant has always been an advocate of gold ownership, and nothing has changed on that score. “Allow me to suggest that I’m somewhat of a broken record on gold,” he confesses. “I’m going to continue with this broken record and observe that people have not yet come to terms with the essential inherent weaknesses of the monetary system that has been in place since 1971.” A point well taken as illustrated by the chart below.

Grant’s Interest Rate Observer

Gold and the purchasing power of the US dollar

(USD as measured by the consumer price index)

Chart courtesy of TradingView.com

Precious Metals Outlook 2023

MKS Pamp Group/Staff/January 2023

“Our macro view is to play for a slower Fed and rising stagflation & recession risks which will ensure both peak US$ and peak real US yields. Inflation will fall, but not to target and the recoveries will be uneven and will ultimately disappoint. That setup has already ensured Gold pivoted from trading defensively for most of 2022, to trading offensively where dips are actively capitalized on, establishing a new technical bull trend after the Fed ended its 75bp hiking regime in November 2022.”

USAGOLD note: A detailed review of the prospects for precious metals in 2023 from Swiss refiner MKS Pamp Group – includes gold, silver, platinum, and palladium base case, bullish case and bearish case scenarios.

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

6:56 am Fri. April 26, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115