Daily Gold Market Report

Gold’s response to this morning’s jobs numbers muted thus far

Fund giant Blackrock makes significant silver investment

(USAGOLD – 6/2/2023) – Gold’s response to this morning’s mixed payroll numbers has been muted thus far. It is down $5 at $1975. Silver is down 9¢ at $23.87. Payrolls exceeded expectations, while the unemployment rate was worse than expected. Bleakley Financial’s Peter Boockvar said that the markets are already pricing in a pause at the June Fed meeting and, as a result, today’s reports “won’t have much of an impact on markets.”

In an article posted earlier this week at FXStreet, The PckAxes’ Jon Forest Little points to the gold-silver ratio, now at 85:1, as an indicator that “something incredibly bullish” is looming in the silver market – something that has attracted the attention of the world’s largest money manager. The historical average is 40:1. “On March 8, 2023,” he writes,” BlackRock Inc., the world’s largest asset manager, disclosed in a regulatory filing that it had purchased 16.1 million shares of the silver exchange-traded fund (ETF) Sprott Physical Silver Trust (PSLV), representing a whopping 10.9% stake in the fund.” Little also cites a Citigroup analysis predicting silver will reach $30 per ounce within the next nine months. [Source: FXStreet]

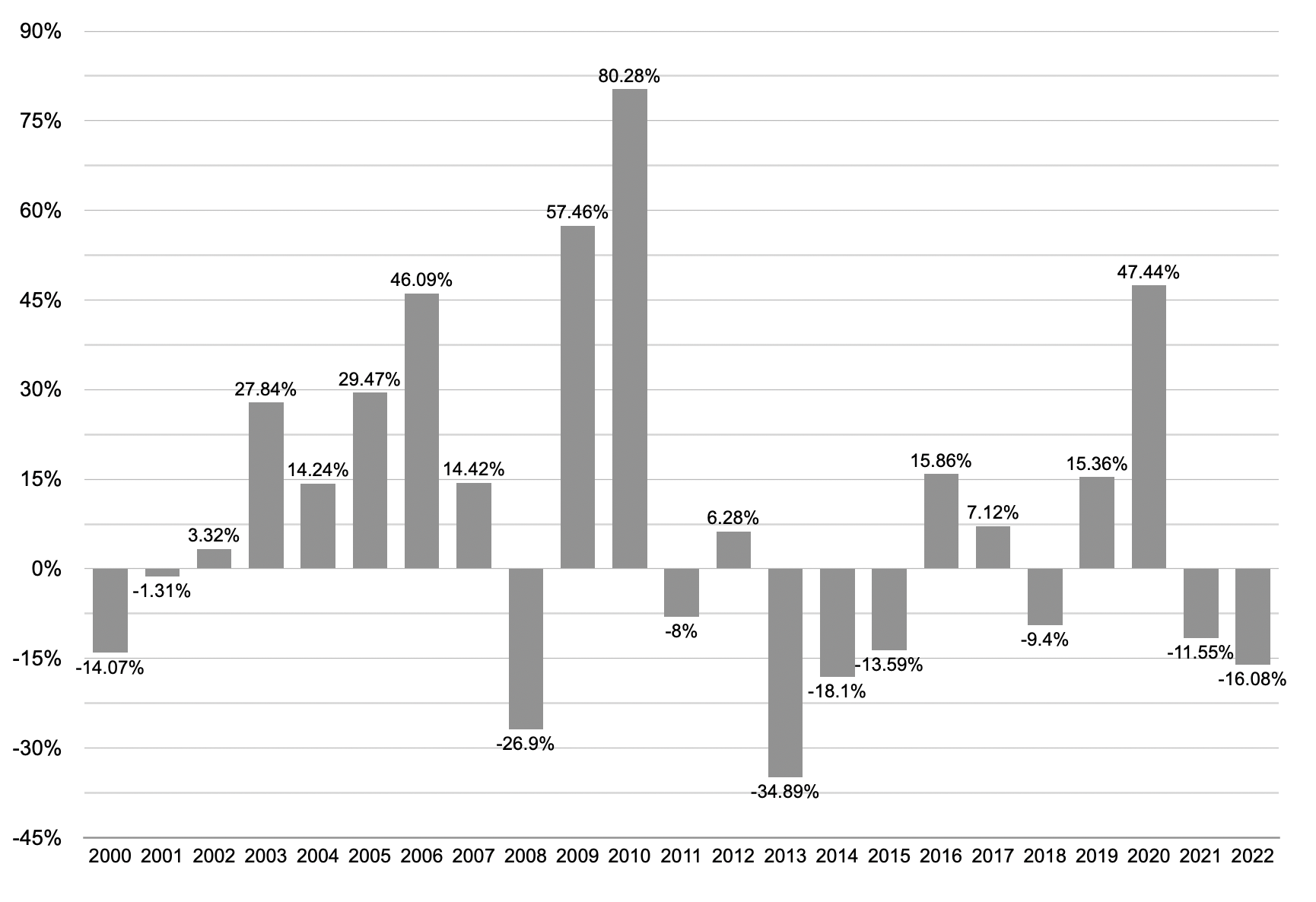

Silver Annual Returns

(%, 2000 to present)

Chart by USAGOLD [All rights reserved, Data source: MacroTrends.net