Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“For it is, so to speak, a game of Snap, of Old Maid, of Musical Chairs — a pastime in which he is victor who says Snap neither too soon nor too late, who passed the Old Maid to his neighbour before the game is over, who secures a chair for himself when the music stops. These games can be played with zest and enjoyment, though all the players know that it is the Old Maid which is circulating, or that when the music stops some of the players will find themselves unseated.”

John Maynard Keynes

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Strong economic data turns recession fears into recession doubts

Yahoo!Finance/Josh Schafer/6-28-2023

“Consumer attitudes remain resilient,” Jefferies US economist Thomas Simons wrote in a note on Tuesday. He added: “There are storm clouds on the horizon, but the consumer is growing tired of the expectation that a recession is imminent.”

USAGOLD note: It is mind-boggling how quickly economic sentiment can turn……In our view, the best approach to portfolio design is to diversify and hold on for the long run rather than chasing Wall Street’s confused twists and turns. As you might have suspected, we see gold as an integral part of that diversification. “A change of fortune,” says Ben Franklin, “hurts a wise Man no more than a change of the Moon.”

The Federal Reserve thinks catastrophe is coming for US businesses

BusinessInsider/Phil Rosen/6-28-2023

USAGOLD note: Yet the Fed presses on with its tight monetary policies – a Hobson’s choice for the central bank.

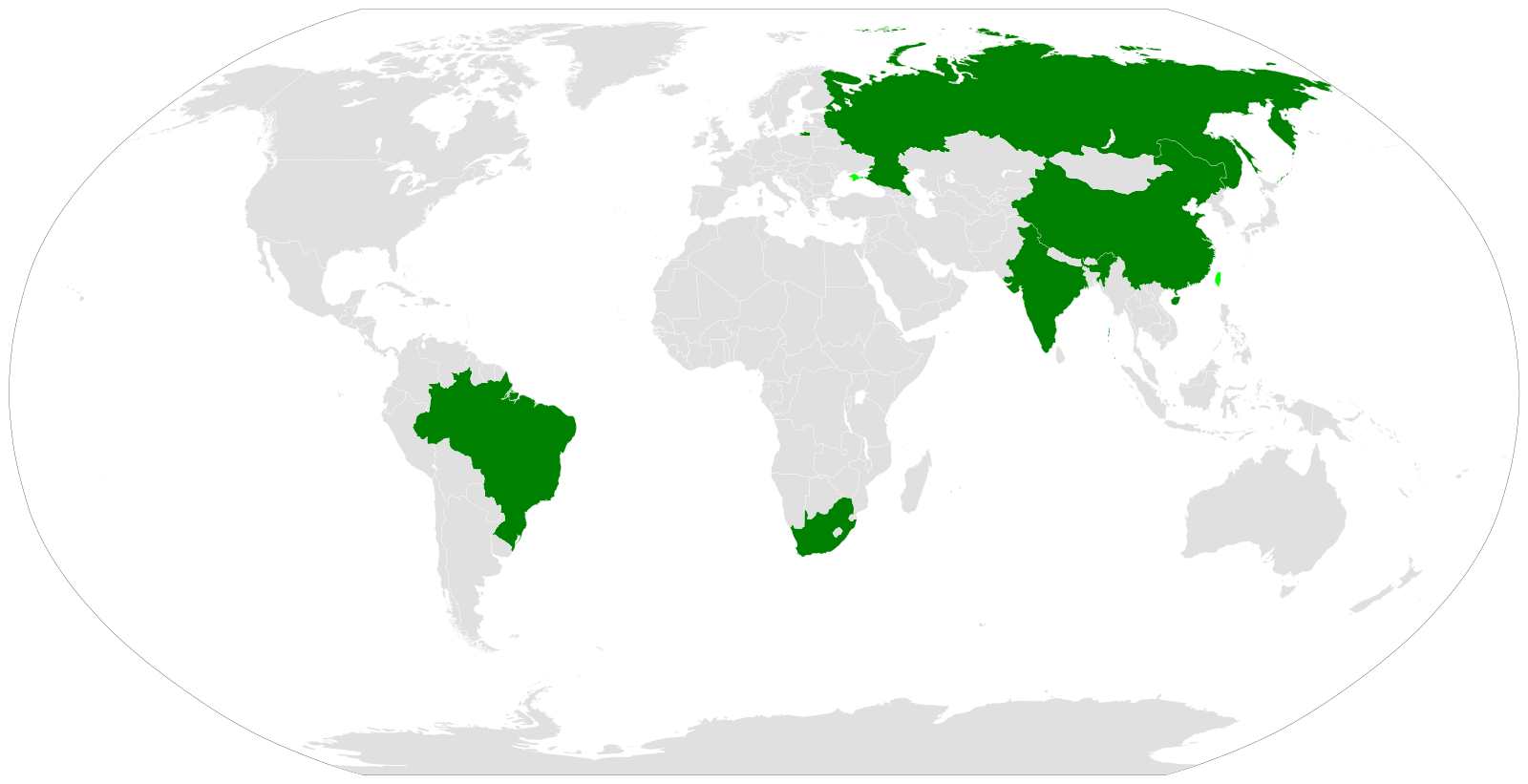

How long will the dollar last as the world’s default currency?

Fortune/Mihaela Papa and The Conversation/6-25-2023

“In August 2023, South Africa will host the leaders of Brazil, Russia, India, China and South Africa – a group of nations known by the acronym BRICS. Among the items on the agenda is the creation of a new joint BRICS currency.”

USAGOLD note: Assuming the BRICS currency is launched, it will be interesting to see how it is priced against other currencies and how many it will take to buy an ounce of gold.

Short and Sweet

Gold, vanadium, europium reveal the existence of a mysterious particle

“Atomo de oro”/Galarza Creador

“To observe the Majorana fermions,” reports Mining.com, “a team of physicists from the Massachusetts Institute of Technology, the Institute of Technology at Delhi, the University of California at Riverside, and the Hong Kong University of Science and Technology, scientists designed and built a material system that consists of nanowires of gold grown atop a superconducting material, vanadium, and dotted with small, ferromagnetic ‘islands’ of europium sulfide, which is a ferromagnetic material that is able to provide the needed internal magnetic fields to create the Majorana fermions. When the researchers applied a tiny voltage and scanned the surface near the islands, they saw signature signal spikes near-zero energy on the very top surface of gold that, according to theory, should only be generated by pairs of Majorana fermions.”

This must have been what Ben Bernanke was talking about years ago when he said he didn’t understand gold. [Smile] Gold’s allure, to be sure, is a mystery to some, but for those who understand the ever-present dangers imposed by the money printing press, the only mystery is why so few own it.

____________________________________

Image attribution: Galarza Creador, Atomo de oro, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to hedge your portfolio against the mysteries of current monetary policy?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

JPMorgan: ‘Boil the frog’ recession will feature of synchronized hard landing

Markets Insider/Jennifer Sor/6-25-2023

USAGOLD note: The calls for recessions have been ongoing for over a year, yet the recession has remained curiously sidelined. JPMorgan rates the ‘Goldilocks soft landing’ a 23% probability.

Daily Gold Market Report

Gold drifts sideways ahead of Wednesday’s inflation report

increased number of countries repatriate gold from London vaults

(USAGOLD – 7/10/2023) – Gold is drifting sideways ahead of Wednesday’s inflation report with a significant drop in the headline number from 4% to 3.1% the consensus expectation. It is down $1 at $1926.50. Silver is down 3¢ at $23.13. An Invesco survey of central banks and sovereign wealth funds finds that an increased number of countries are repatriating gold from London vaults and other storage facilities, according to a Reuters report posted yesterday.

Invesco found that two developments over the past year triggered the shift – sanctions on Russia’s gold and currency reserves and a belief that “inflation in the coming decade will be higher than in the last.” Of the 85 sovereign wealth funds and 57 central banks surveyed, 68% said they were keeping their reserves at home compared to 50% in 2020.” Gold repatriation removes bullion from the leasing pool, which has acted as a drag on the gold price in the past. “We did have it held in London,” said one central banker, “but now we’ve transferred it back to [our] own country to hold as a safe haven asset and to keep it safe.”

Notable Quotable

Favorite web pages

Gold and silver price predictions and analysis from prominent players

Curious about gold and silver’s future? This page catalogs price predictions and new analysis from top pundits and prognosticators – a casting of the runes updated regularly throughout the year as new additions surface.

We encourage your bookmark. We invite your return visits.

A Gold Classics Library Selection

Uses and Abuses of Gresham’s Law in the History of Money

by Robert Mundell, Nobel Prize for Economics, 1999

Now deceased, Dr. Robert Mundell, the highly influential Columbia University economist, was well-known for his advocacy of a gold component in monetary systems, including circulating gold coinage. But he also has written voluminously on a wide range of other topics. As early as 1961, Mundell proposed reducing tax rates and improving monetary discipline as the best means to achieve greater and more stable economic growth. His theories on this subject led to the Kennedy tax cuts, which propelled the U.S. economy of the 1960s and later became the supply-side basis for much of Reaganomics. Mundell also wrote early on of the constant realignment problems which would attend a world monetary system of free-floating currencies. His prescient work on the desirability of regional currencies was, in fact, fundamental to the creation of the euro. When Mundell was awarded the 1999 Nobel Prize for economics, Princeton University economist Peter Kenen said, “Bob was modeling the world of the 1990s through the work he did in the 1960s.” Our thanks go to Dr. Mundell for his kind permission to reprint Uses and Abuses of Gresham’s Law in the History of Money in its entirety.

A mild global contraction is coming

Project Syndicate/Nouriel Roubini/6-27-2023

USAGOLD note: Even Dr. Doom feels a need to adjust his analysis…… Hard or soft landing, he still believes stocks will be subject to “significant declines.”

The return of quantitative easing

Financial Times/Michael Howell/6-27-2023

USAGOLD note: Quantitative easing as a permanent fixture in the economic mix…… Gold has responded quickly and vertically whenever the Fed revs up QE.

Waiting for the Godot Recession

Bloomberg/John Authers/6-27-2023

USAGOLD note: Has anyone seen my recession? The economy reminds us that it has a mind of its own.

Short and Sweet

‘Everyone knows they need a safe haven’

“Last March and April (2020),” writes the Systemic Risk Council’s Paul Tucker in a piece published recently at Financial Times, “the fabric of our financial system was stretched almost beyond endurance. Only intervention from the north Atlantic central banks seems to have averted some kind of disaster triggered by markets grasping the pandemic was serious.”

The most important lesson from that brush with disaster is that the financial authorities did not even bother to disclose to the public (and the investment community) just how dangerous the situation had become until months after the fact. It was labeled, you might recall, a “liquidity problem” that the Fed was addressing – no need to worry. Such circumstances argue strongly for having a hedge in place at all times just in case the wheels actually do come off.

MoneyWeek’s Merryn Somerset Webb posted a reminder of gold’s baseline portfolio role during times of market uncertainty in a separate Financial Times’ opinion piece in early January. “Think of the reasons to hold gold,” she wrote. “If inflation is coming (and it probably is) you want to hold a real asset that can hedge against it — one that can’t be inflated away by relentless money creation and currency debasement.…[E]veryone knows they need a safe haven, but everyone also knows the traditional ones (government bonds) no longer offer that safe haven. That turns us to gold, the one asset that has a 3,000-year record of protecting purchasing power. No wonder the gold price is up around 40 percent since 2018. I hold a lot of gold for all these reasons.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking for a long-term safe haven?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Chaos Kings — the traders who make fortunes from disaster

Financial Times/Katie Martin/6-27-2023

USAGOLD note: This review of Scott Patterson’s book Chaos Kings is an entertaining read we think you will enjoy.

Daily Gold Market Report

Gold inches higher ahead of today’s all-important unemployment, payrolls numbers

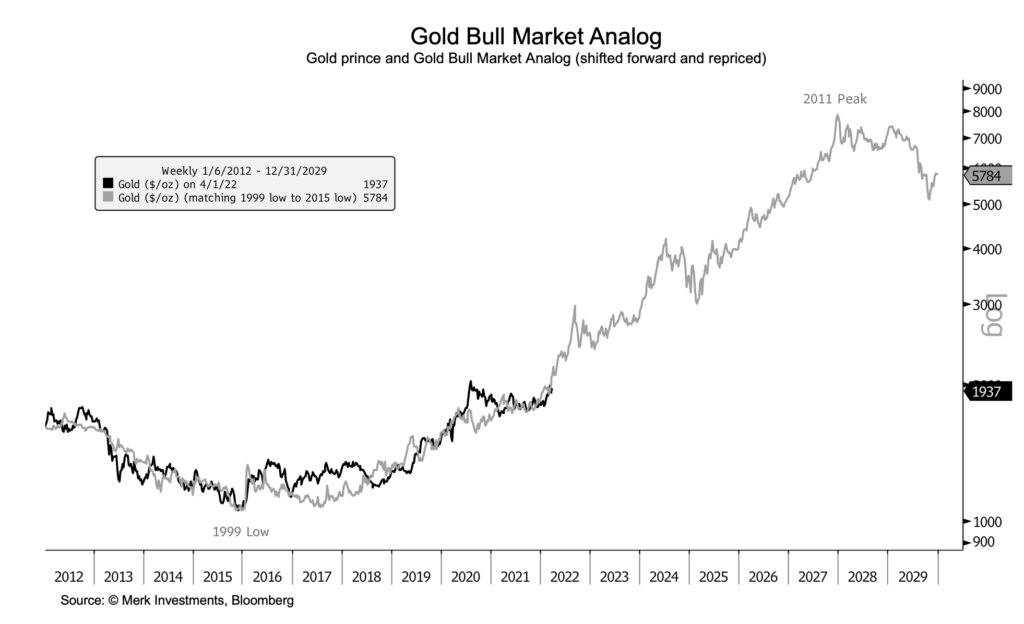

Goehring & Rozencwajg sets long-term price target for gold at $12,000 to $15,000 (!!)

(USAGOLD – 7/7/2023) – Gold inched higher in early trading ahead of today’s all-important unemployment and payrolls numbers. It is up $6 at $1919.50. Silver is up 4¢ at $22.79. The bond market continued its plunge, with yields surpassing critical upside levels – 4% on the 10-year and 5% on the two-year. Goehring & Rozencwajg, the natural resource investment firm, caught our attention recently with a long-term gold price target of $12,000 to $15,000 an ounce. It’s been out of the gold market over the last two years, it says, but now it is getting back in.

“We think that gold has entered into a new phase of this bull market,” says Adam Rozencwajg in a recent interview. “It probably started in the third and fourth quarter of last year, and it really revolves around central banks’ behavior as much as anything else. I think it’s going to propel gold much much higher in this leg of the bull market.” As for the ultra-high price target, Rozencwajg says, “That’s always been our long-term price forecast on gold.”

Chart courtesy of Merk Investments • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“I never met Arthur Burns — Volcker’s predecessor, but one, as Federal Reserve chairman — who preferred puffing on a pipe to cigars. But I think I’ve read enough about Burns to suggest plausibly that the current Fed chair, Jay Powell, has more in common with him than with Volcker. This is unfortunate and potentially disastrous for the US economy.” – Niall Ferguson, Stanford historian, in a Bloomberg opinion piece.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

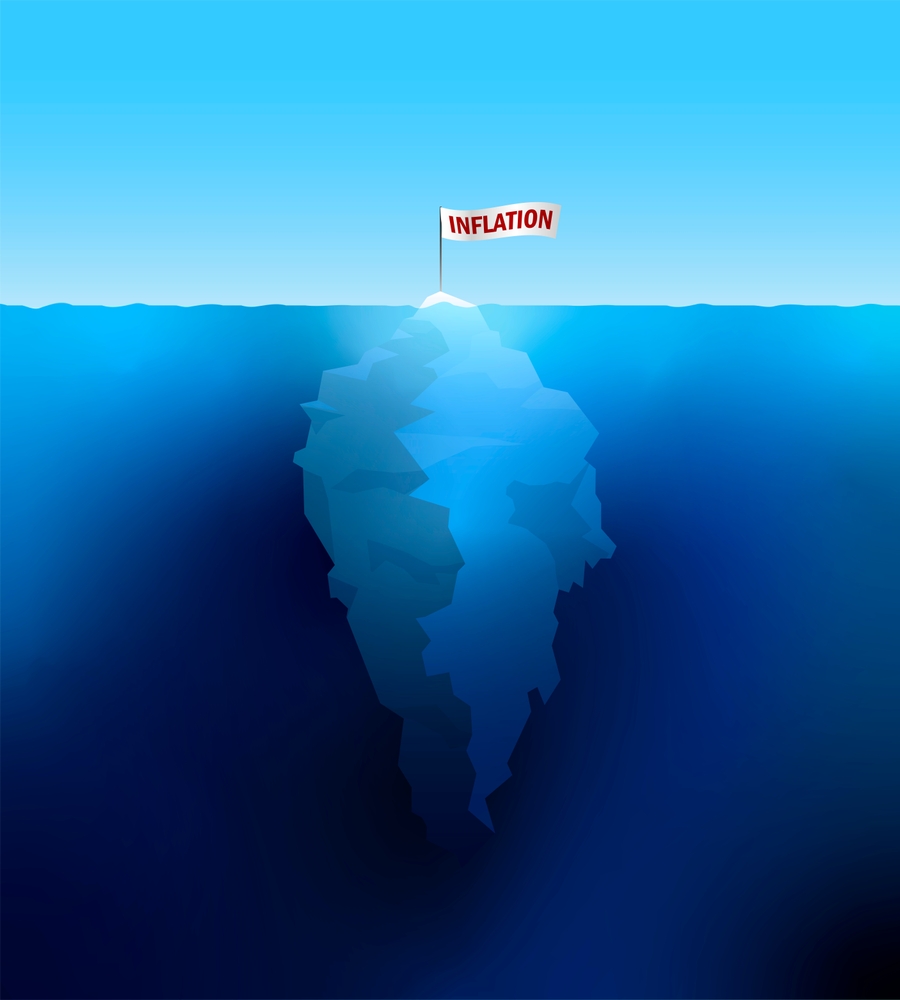

Financial markets ‘splendidly untroubled by inflation’

ZeroHedge/Simon White-Bloomberg/6-27-2023

“After a brief dalliance with concern around rising price growth in 2021 and the first half of 2022, the market has been happy to gorge on higher-duration stocks as if inflation is yesterday’s problem. But this is woefully misguided. Inflation will return, with a re-acceleration likely late this year or early next year as China’s monetary and fiscal engines slowly shudder back into life.”

USAGOLD note: The markets see inflation to be in regression. White says we are simply experiencing a hiatus. Inflation, as we have stressed in the past, is a process not an event. This article concentrates on sector rotation in the stock market, but the important point made from our perspective is that inflation is not gone and should not be forgotten.

Eight new insights from Nassim ‘Black Swan’ Taleb

MarketsInsider/Matthew Fox/6-23-2023

USAGOLD note: Taleb has not dialed down his warnings about the current state of economic affairs.

Gold can overcome near-term headwinds

UBS Insights/Chief Investment Office/6-8-2023

USAGOLD note: UBS forecasts gold will be $2100 by year-end, and $2250 by mid-2024.