Category intros, screenshots, Terms of Use, cusomer log-in, acc’t sign-up

Welcome to the USAGOLD Online Order Desk – a secure, password-protected portal where clients can buy gold and silver anytime day or night. To establish an account, please go to the Account Signup link above and fill out the registration form. Accounts will be activated as soon as possible.

For best results, please login before adding items to your cart.

Historic Fractional Gold Coins

Historic Fractional Gold Coins are an ideal option for those seeking to combine the negotiable/divisible advantages of small-denomination gold coin ownership with added insulation against the risk of a future government intervention into the gold market. Often referred to as ‘Historic Bullion’, their vast mintages and consistent availability make these the least expensive fractional gold coins available in the market. They simultaneously offer buyers the ‘most gold for your money’ option in the pre-1933 genre, track the gold price directly, and typically price below their modern equivalents on a per ounce basis A truly, ‘two birds, one stone’ vehicle for the safe-haven, asset-preservation minded investor.

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Historic U.S. Gold Coins

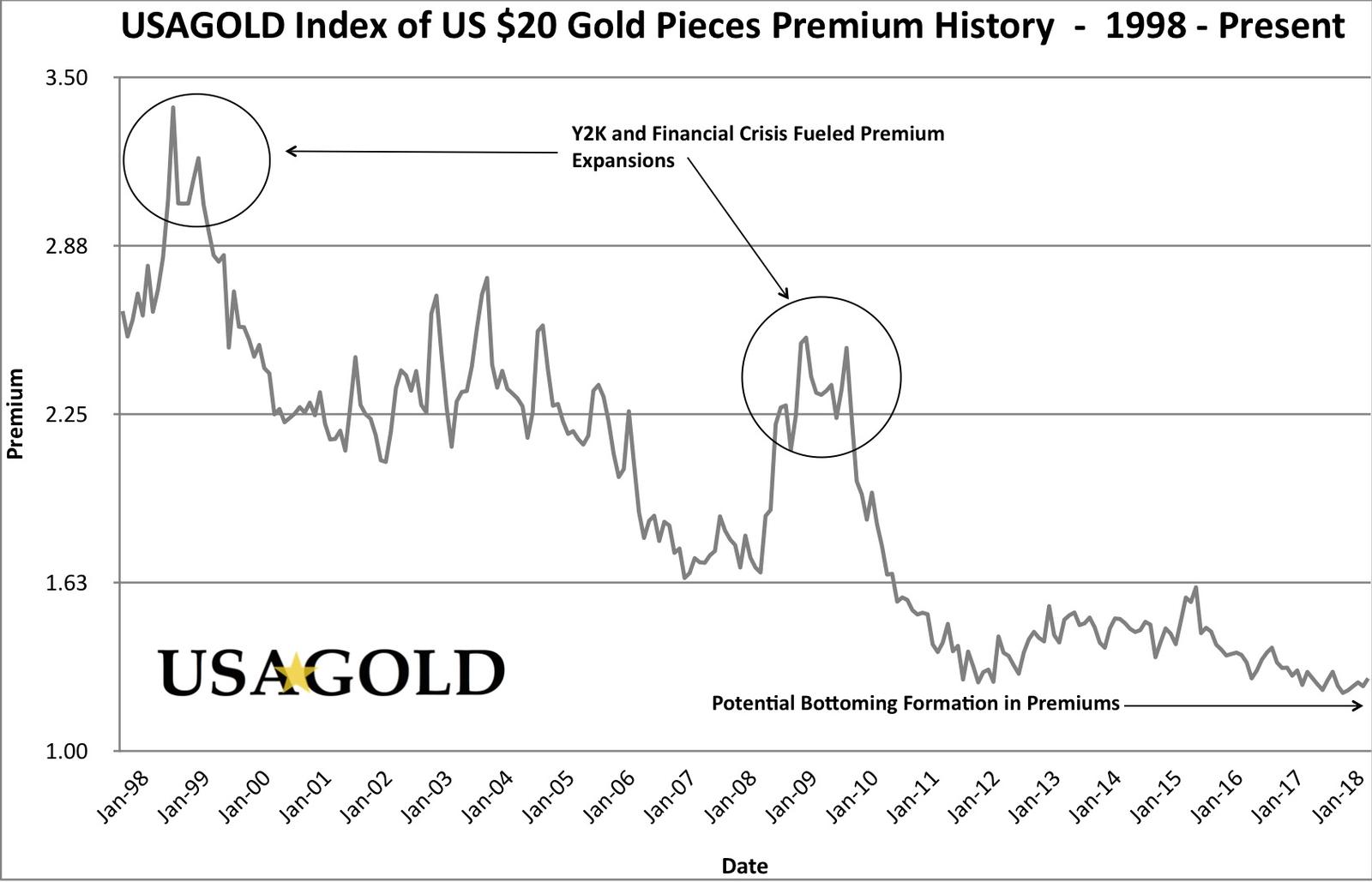

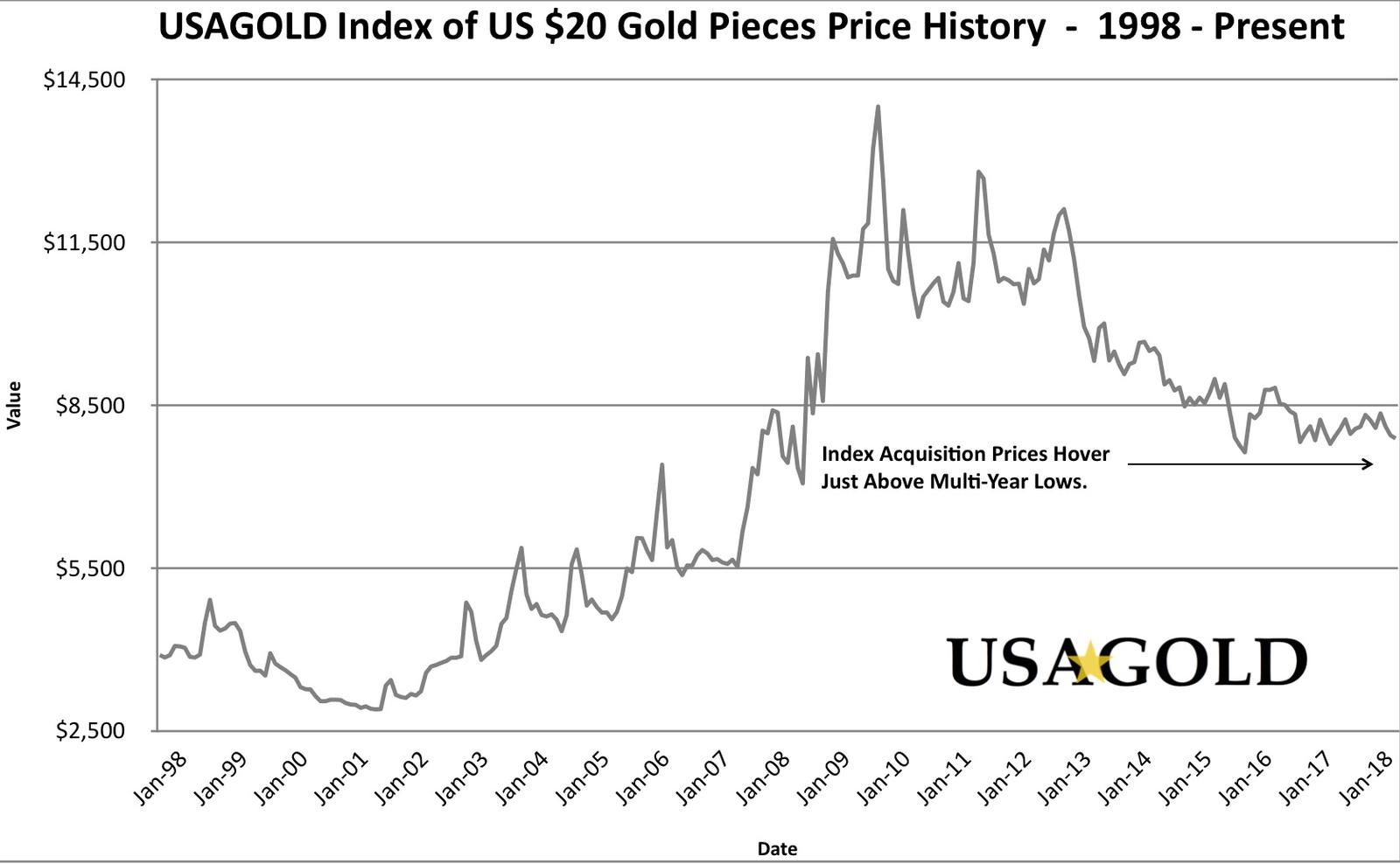

Historic U.S. coins (most notably U.S. $20 gold pieces) as a genre, uniquely combine safety and insulation against the possibility of future government intervention with the opportunity for double-barrel profit potential during periods of premium expansion. The value of historic US coins is driven primarily by the underlying price of gold itself – but due to an inherently limited supply, the ‘premium’ component of their value can also expand during times of increased demand thereby elevating investment returns. Given their current undervalued condition (see historic price graphs and commentary at each invidicual coin page), pre-1933 U.S. coins currently represent one of the most compelling portfolio choices for asset preservation/safety-net oriented gold owners.

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Collectible Coins

USAGOLD is a market leader in type sets, date runs, complete date sets, regional sets, and mint-mark sets of both U.S. and World gold coinage. While we list these sets under ‘Collectible Coins’, many of our sets sell within a reasonable range of the spot gold value of the coins, and are typically offered at a discount to the cost of the coins individually. Items offered here are generally extremely limited in their availability, and represent unique, hard-to-find accumulation opportunities for heirloom-minded investors.

Create An Account

Please create an account by completing the form below. Once completed, you will receive an email verifying the opening of your account, followed by a second email when your account has been activated and approved for use.

If you are an established client of the firm, you automatically qualify for active account status, and your account will be approved/activated within one business day of receipt of this account opening form. If you wish to add your credit card as an optional form of payment, you will need to contact us directly to place your card on file. Please note that all orders paid for by credit card will incur an additional convenience fee.

If you are new to USAGOLD, after completing this form, we will contact you to confirm your information and review the ordering process prior to activating your account. Be advised, for security reasons, all first-time orders must be paid for by either personal check or bank wire.

First-time investor Starter Kit approx $1000

Approximately $1000 Starter Kit Includes:

5 American Silver Eagle

1 oz. – modern dated coinage

5 Brilliant Uncirculated Peace Silver Dollars

.7802 oz. – Minted 1921-1935

1 US Eagle One-Tenth Ounce

.1 oz – modern dated coinage

1 Pre-1933 Brilliant Uncirculated Swiss 20 Franc

.1867 oz – Minted 1898-1930

1 Pre-1933 Brilliant Uncirculated British Sovereign King

.2354 oz – Minted 1902-1932

+ Free Shipping/Handling/Insurance

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Commentary: This combination of gold and silver is an ideal starting point for investors interested in investing roughly $1000 to start. It combines coinage from both the modern era and the historical era and is split roughly 80/20, gold to silver. The total number of ounces of gold in the kit is .5221 and the total number of ounces of silver is 8.901. Shipping is waived on all starter kits.

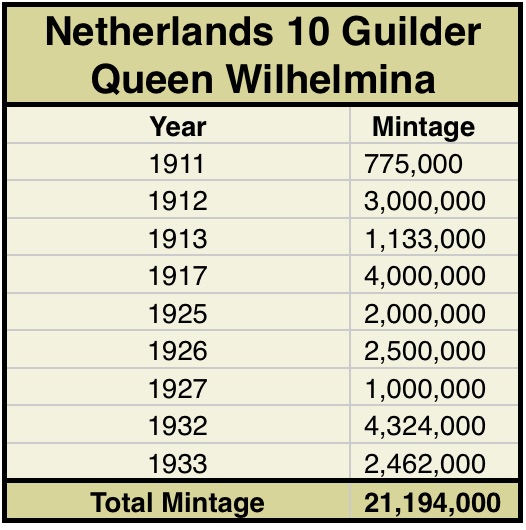

Historic gold Netherlands 10 guilder type set

King Willem III, Queen Wilhelmina (Long Hair, Mature, Elder)

.1947 troy ounce per coin – .7788 troy ounce per set

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

These four coin sets from the Netherlands are offered in Brilliant Uncirculated condition and comprise all 10 Guilder denominated coinage minted from 1875-1933. The ‘Long Hair’ Wilhelmina variety is exceptionally rare, minted for just one year (1897) and a total mintage of just 450,000. The World Gold Coin Catalog suggest a retail value for this coin of $450 by iteself. King Willem 10 Guilders are also hard to come by, especially in uncirculated condition. The later Wilhelmina coins are more common, and perenially act as a foundational position for asset-preservation minded gold owners seeking divisible negotiability and insulation against government intervention risk.

Historical Note Queen Wilhelmina:

Queen Wilhelmina, ‘no-one’s fool’, ascended the throne at a young age after the parliament passed a special law allowing a woman to become monarch. She first displayed an incisive intelligence during a meeting with the powerful Kaiser Wilhelm II of Germany prior to World War I. Wilhelm boasted to the young Wilhelmina that “my guards are seven feel tall and yours are only shoulder high to them.” To this she replied politely: “Quite true, Your Majesty, your guards are seven feet tall, but when we open our dikes, the water is ten feet deep!”

Later, Wilhelmina would display this same acumen in the world of business and finance. She amassed a fortune through various business dealings and investments that surpassed a billion dollars, making her the first female billionaire in history. She moved throughout her life in the highest circles of international finance. Known for her spunk, she called Adolf Hitler “the archenemy of mankind” after being forced to leave Holland for England during the German invasion. In 1953, when the country was devastated by floods, she bicycled the countryside at 73 years of age offering hope and inspiration to the Dutch people. Her rule lasted a remarkable fifty-eight years. This series — both the king and queen varieties — remains a popular addition to accumulations in both the United States and Europe.

Historic gold British sovereign five-coin type set

Queen Victoria Young (AU), Jubilee (AU), Veil (UNC), King Edward (UNC), George (BU)

.2354 troy ounce per coin – 1.177 troy ounce per set

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

These Five Coin Type Sets from Britain contain all five full Sovereigns minted during the rules of Queen Victoria, King Edward VII and King George V, representing almost 100 years of British Rule. The earlier Queen varieites are the hardest to come by, and are usually found in lightly circulated condition. The later Queen Victoria (Veil), as well as the two King types, collectively represent the most well-recognized coinage in the world, used as the global monetary standard, store of value, and means for exchange during the height of the British Empire.

Historical Note on Queen Victoria:

Queen Victoria ruled England for nearly 64 years from 1837-1901, making her one of the longest ruling monarchs in history. She presided over the dramatic expansion of British influence and territorial rule such that during her reign, “The sun never set on the British Empire”. By the time she died, Britain had become the largest empire the world had ever known, and presided over roughly 1/4 of the world’s population. She celebrated her Golden Jubilee (50 years of reign) in 1887 – as signified by the “Jubilee” desing Sovereign – and her Diamond Jubliee (60 years of reign) 10 years later.

Historical Note on King Edward and King George:

The Edwardian era, named for Edward VII (right), differed sharply from the rigid and puritanical Victorian age which preceded it. Edward VII was the eldest son of Queen Victoria, and ruled Britain from 1901-1910. Queen Victoria insisted on an incredibly strict regimen for Edward, while never allowing his involvement in political affairs. As a result, Edward led a rebellious, indulgent lifestyle that many felt would compromise his ability to be an effective monarch. To the chagrin of his critics, Edward ruled peacefully and effectively during his reign, saving Britain from a budgetary crisis and strengthening relationships with European powers. Edward’s reign was a brief and happy time of peace and prosperity for Britain before the shadow of World War I descended upon Europe. He died in 1910 of a heart attack.

His second son, George V (left with wife, Queen Mary) succeeded his rule in 1910. George led Britain through World War I and the negative effects brought on by the Depression of 1929-1931. English Historian Robert Lacey describes George: “. . . as his official biographer felt compelled to admit, King George V was distinguished ‘by no exercise of social gifts, by no personal magnetism, by no intellectual powers. He was neither a wit nor a brilliant raconteur, neither well-read nor well-educated, and he made no great contribution to enlightened social converse. He lacked intellectual curiosity and only late in life acquired some measure of artistic taste.’ He was, in other words, exactly like most of his subjects. He discovered a new job for modern kings and queens to do — representation.” George V and his wife, Queen Mary, made the monarchy a symbol of conservative, middle-class virtue. George relinquished his German titles and adopted the name of Windsor for the British royal house.

US gold Liberty four-coin type set MS 64

$20 Liberty Mint State 64; $10 Liberty MS64;

$5 Liberty MS64; $2.5 Liberty MS64;

All graded by PCGS or NGC

Highly Popular Semi-Numismatic Items

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Featuring the four prominent gold coins in circulation in the late 19th and early 20th centuries, our United States four-coin type sets offer the opportunity to purchase an important piece of American history at cyclically low prices. We offer these sets in the very collectible Mint State 63 and 64 grades – a high state of preservation with pleasing visual appeal. The $10 Indian and $20 St. Gaudens gold coins were designed by famed sculptor Augustus St. Gaudens under the direction of Theodore Roosevelt, who, in 1907, sought to ‘beautify American coinage’. The $5 and $2.5 Indian coins were designed by Bella Pratt, who stepped in after St. Gaudens death in 1907 to complete the series. Christian Gobrecht designed the earlier Liberty type. All our sets are graded by PCGS and/or NGC – the two most widely-accepted independent grading services and include common-date items from the largest mintages or surviving populations.

Only roughly 20,000 coins of each of the $2.5, $5, and $10 Liberty have achieved grade Mint State 64 when combining both PCGS and NGC graded coins. As such, a maximum of just roughly 20,000 four coin sets can even be completed in Mint State 64, though far few likely do exist intact, as numerous coins are owned outside the context of a ‘set’.

US gold Liberty four-coin type set MS63

$20 Liberty Mint State 63; $10 Liberty MS63;

$5 Liberty MS63; $2.5 Liberty MS63;

All graded by PCGS or NGC

Highly Popular Semi-Numismatic Items

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Featuring the four prominent gold coins in circulation in the late 19th and early 20th centuries, our United States four-coin type sets offer the opportunity to purchase an important piece of American history at cyclically low prices. We offer these sets in the very collectible Mint State 63 and 64 grades – a high state of preservation with pleasing visual appeal. The $10 Indian and $20 St. Gaudens gold coins were designed by famed sculptor Augustus St. Gaudens under the direction of Theodore Roosevelt, who, in 1907, sought to ‘beautify American coinage’. The $5 and $2.5 Indian coins were designed by Bella Pratt, who stepped in after St. Gaudens death in 1907 to complete the series. Christian Gobrecht designed the earlier Liberty type. All our sets are graded by PCGS and/or NGC – the two most widely-accepted independent grading services and include common-date items from the largest mintages or surviving populations.

US gold Indian-Saint type set MS 64

$20 St. Gaudens Mint State 64; $10 Indian MS64;

$5 Indian MS64; $2.5 Indian MS64;

All graded by PCGS or NGC

Highly Popular Semi-Numismatic Items

Featuring the four prominent gold coins in circulation in the late 19th and early 20th centuries, our United States four-coin type sets offer the opportunity to purchase an important piece of American history at cyclically low prices. We offer these sets in the very collectible Mint State 63 and 64 grades – a high state of preservation with pleasing visual appeal. The $10 Indian and $20 St. Gaudens gold coins were designed by famed sculptor Augustus St. Gaudens under the direction of Theodore Roosevelt, who, in 1907, sought to ‘beautify American coinage’. The $5 and $2.5 Indian coins were designed by Bella Pratt, who stepped in after St. Gaudens death in 1907 to complete the series. Christian Gobrecht designed the earlier Liberty type. All our sets are graded by PCGS and/or NGC – the two most widely-accepted independent grading services and include common-date items from the largest mintages or surviving populations.

Only roughly 15,000 coins of the $5 Indians have achieved grade Mint State 64 when combining both PCGS and NGC graded coins. As such, a maximum of just roughly 15,000 four coin sets can even be completed in Mint State 64, though far few likely do exist intact, as numerous coins are owned outside the context of a ‘set’.

US gold 4-coin type set MS 63

$20 St. Gaudens Mint State 63; $10 Indian MS63;

$5 Indian MS63; $2.5 Indian MS63;

All graded by PCGS or NGC

Highly Popular Semi-Numismatic Items

Featuring the four prominent gold coins in circulation in the late 19th and early 20th centuries, our United States four-coin type sets offer the opportunity to purchase an important piece of American history at cyclically low prices. We offer these sets in the very collectible Mint State 63 and 64 grades – a high state of preservation with pleasing visual appeal. The $10 Indian and $20 St. Gaudens gold coins were designed by famed sculptor Augustus St. Gaudens under the direction of Theodore Roosevelt, who, in 1907, sought to ‘beautify American coinage’. The $5 and $2.5 Indian coins were designed by Bella Pratt, who stepped in after St. Gaudens death in 1907 to complete the series. Christian Gobrecht designed the earlier Liberty type. All our sets are graded by PCGS and/or NGC – the two most widely-accepted independent grading services and include common-date items from the largest mintages or surviving populations.

US gold $10 Indian MS 64

Graded by PCGS/NGC

Minted 1907 – 1933

Actual Gold Content: .48375 troy ounce

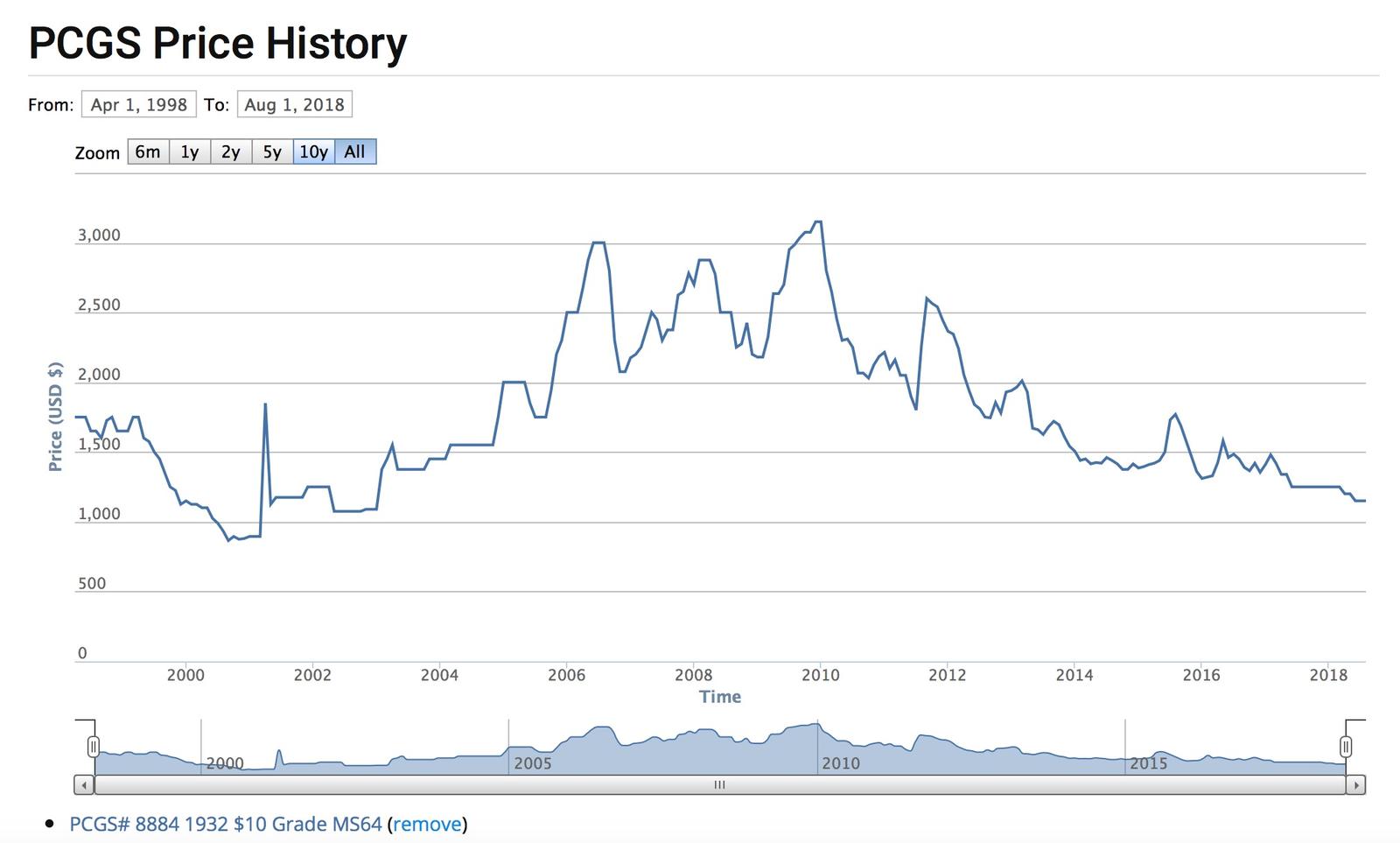

Just 8 years ago, in the wake of the financial crisis, MS64 $10 Indians topped $3000 per coin, making their current price roughly 1/3 of their peak, and last matched in January 2003, when spot gold was only $350! (See graph below)

For our clients who have positions in graded $20 St. Gaudens and $20 Liberties, this is an unprecedented opportunity to diversify and expand your holdings. Just 40,000 $10 Indians have achieved grade Mint State 64 when combining the populations of both PCGS and NGC. For the sake of comparison, roughly 225,000 Mint State 65 $20 St. Gaudens and 140,000 Mint State 64 Liberties, making these Indians 5X and 3.5X as rare respectively, but yet, with this offer, within a reasonable proximity in terms of price per ounce.

Chart courtesy of PCGS.

Historical Note:

The U.S. $10 Indian Gold Coins were minted from 1907 until 1933 and designed by the famous sculptor, Augustus Saint-Gaudens. The $10 “Indian” was surprisingly controversial in its time, though later became accepted and praised as perhaps the most exquisite coin design in US history. When the coin was introduced in 1907, many Americans were taken aback by the obverse of the coin, featuring Lady Liberty adorned in a full Indian war bonnet, and even further disgruntled by Theodore Roosevelt’s decision to exclude the motto “In God We Trust.” Eventually, the public came to appreciate the “Indian” design, and in response to public outcry, the motto was added to the coins in 1908. The outer rim of the coin contained 42 stars, one representing each state in the union, until 1912 when the number was increased to 44 to recognize the addition of Arizona and New Mexico to the Union. A perching eagle is pictured on the reverse.

$10 Indians are scarcer and typically more expensive compared to their $10 Liberty design counterparts. When they can be obtained for similar prices, investors should opt for the $10 Indians.

US gold $20 St Gaudens MS 65

Grade: Mint State 65

Minted: 1907-1932

Actual Gold Content: .9675 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

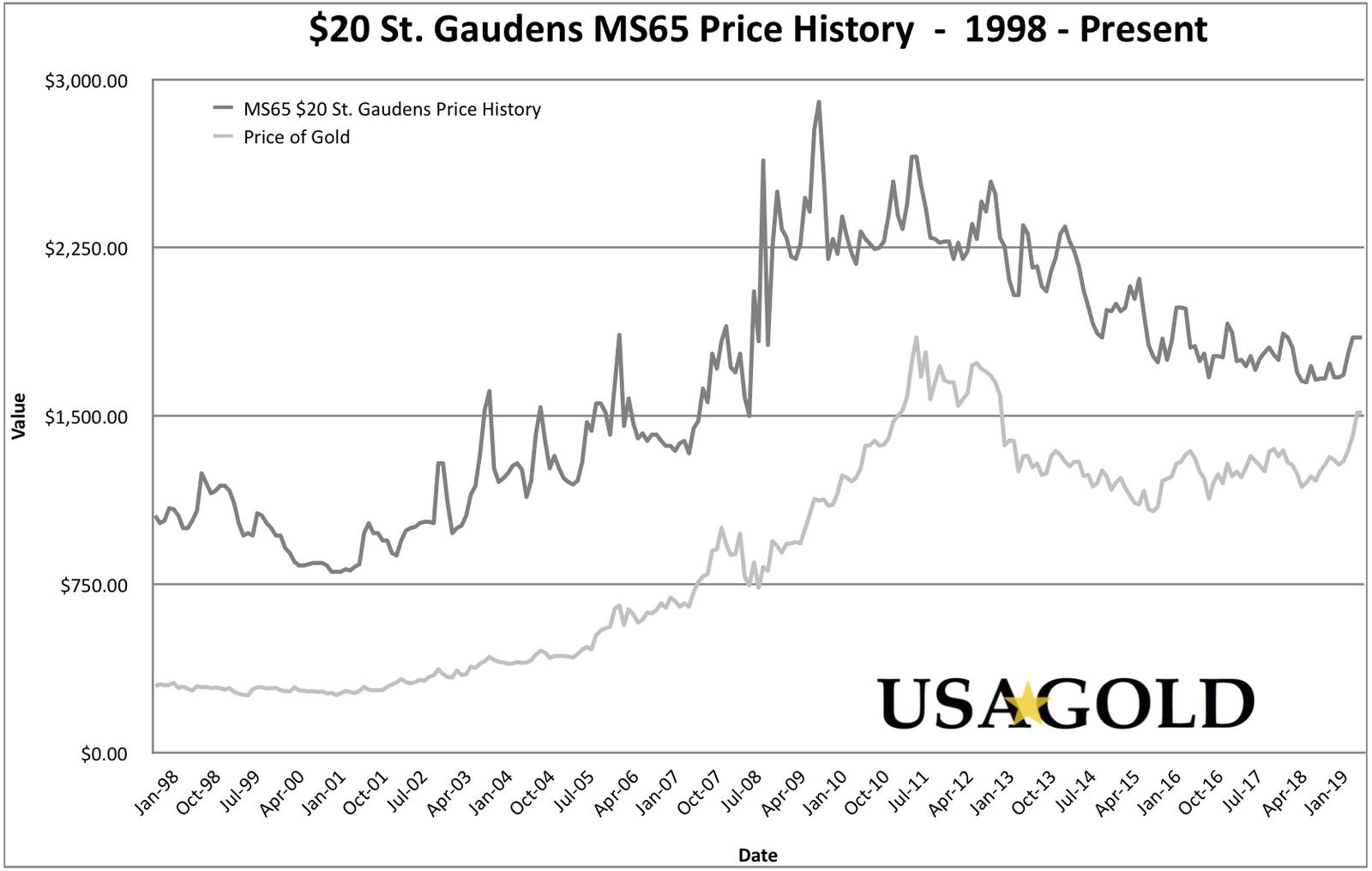

MS65 $20 St. Gaudens are an attractive gold investment for those seeking exposure to both the gold price itself, as well as additional upside potential through the possibility of premium expansion. Price performance for the MS65 $20 St. Gaudens is most closely mirrored by the MS64 $20 Liberty. According to PCGS (Professional Coin Grading Company), MS65 $20 St. Gaudens have a known population of slightly less than 150,000 coins. By comparison, just over 60,000 $20 Liberty gold coins (Type III) exist in MS64.

The following graph displays a twenty year price performance history for the MS65 $20 St. Gaudens gold coins, along with the gold price.

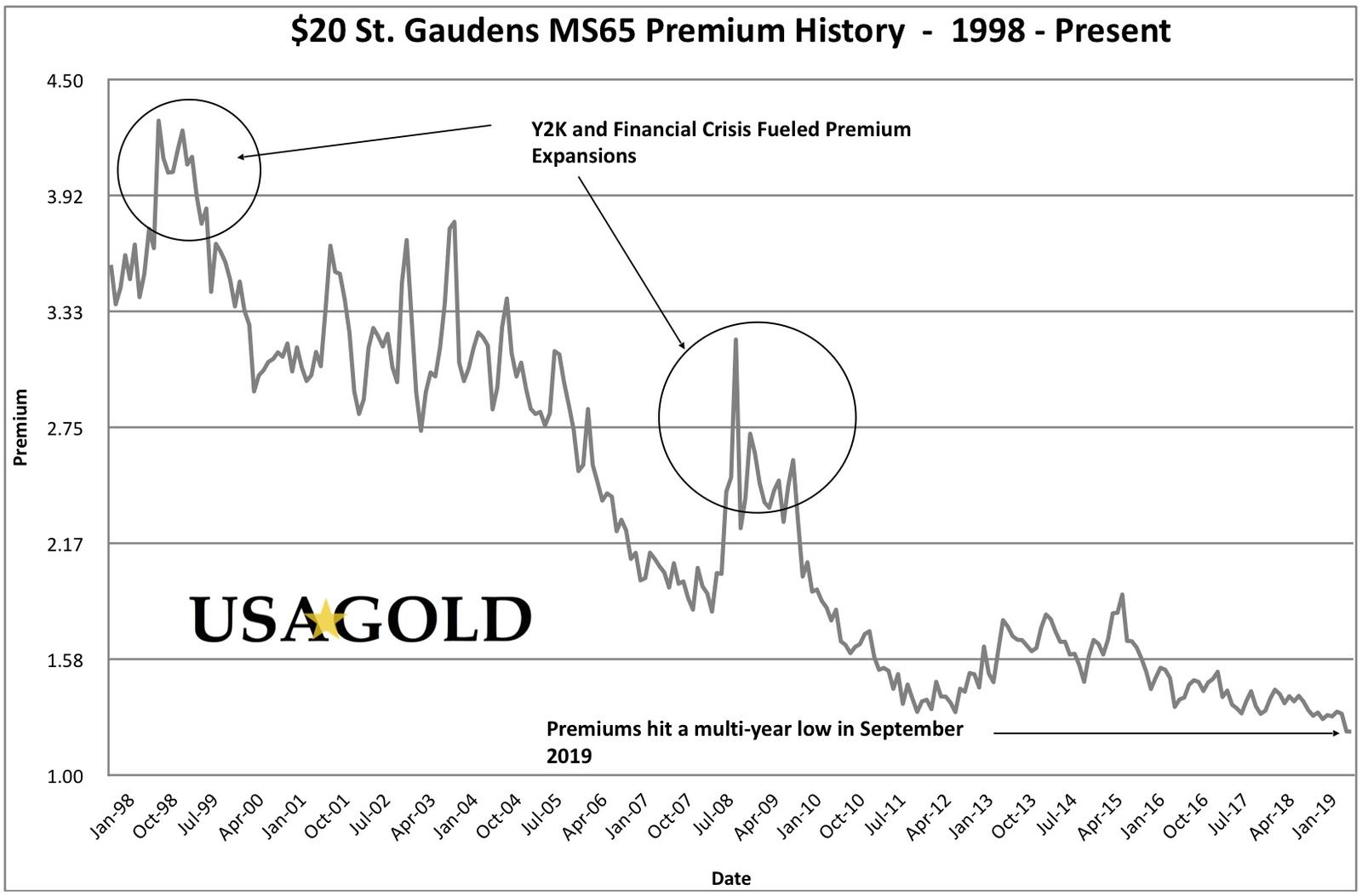

MS65 $20 Saint Gaudens, like their counterparts, are near cycle lows in terms of their premiums to underlying gold value. Their highest rarity levels were achieved in the 1980’s and shouldn’t be necessarily expected to repeat. The graph below shows the twenty-year premium performance for the MS65 $20 St. Gaudens relative to its underlying gold content value. The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2 is equal to double the gold price, and a coin premium of 4 is equal to 4 times the gold price. In recent years, premiums on the MS65 $20 St. Gaudens have begun to form what may be a bottoming pattern, as seen below. Cycle lows have shown premiums as low as 1.40 (40%) over gold, while recent highs in 2009 saw premiums at 2.8x gold.

US gold $20 St Gaudens MS 64

Grade: Mint State 64

Minted: 1907-1932

Actual Gold Content: .9675 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

MS64 $20 St. Gaudens are an ideal gold investment for those seeking exposure to both the gold price itself, as well as additional upside potential through the possibility of premium expansion. Given that the Saint Gaudens gold cons were minted after Liberties, and are therefore newer and experienced less use and circulation, specimens from each conditional grade are a fair bit more common, and therefore more affordable, than a Liberty counterpart. MS 64 St. Gaudens are a common option for investors looking to step up slightly from raw uncirculated coinage but not pay significant added premiums. According to PCGS (Professional Coin Grading Company), slightly less than 300,000 $20 Saint Gaudens gold coins exist in MS64, about the same number as MS63 $20 St. Gaudens.

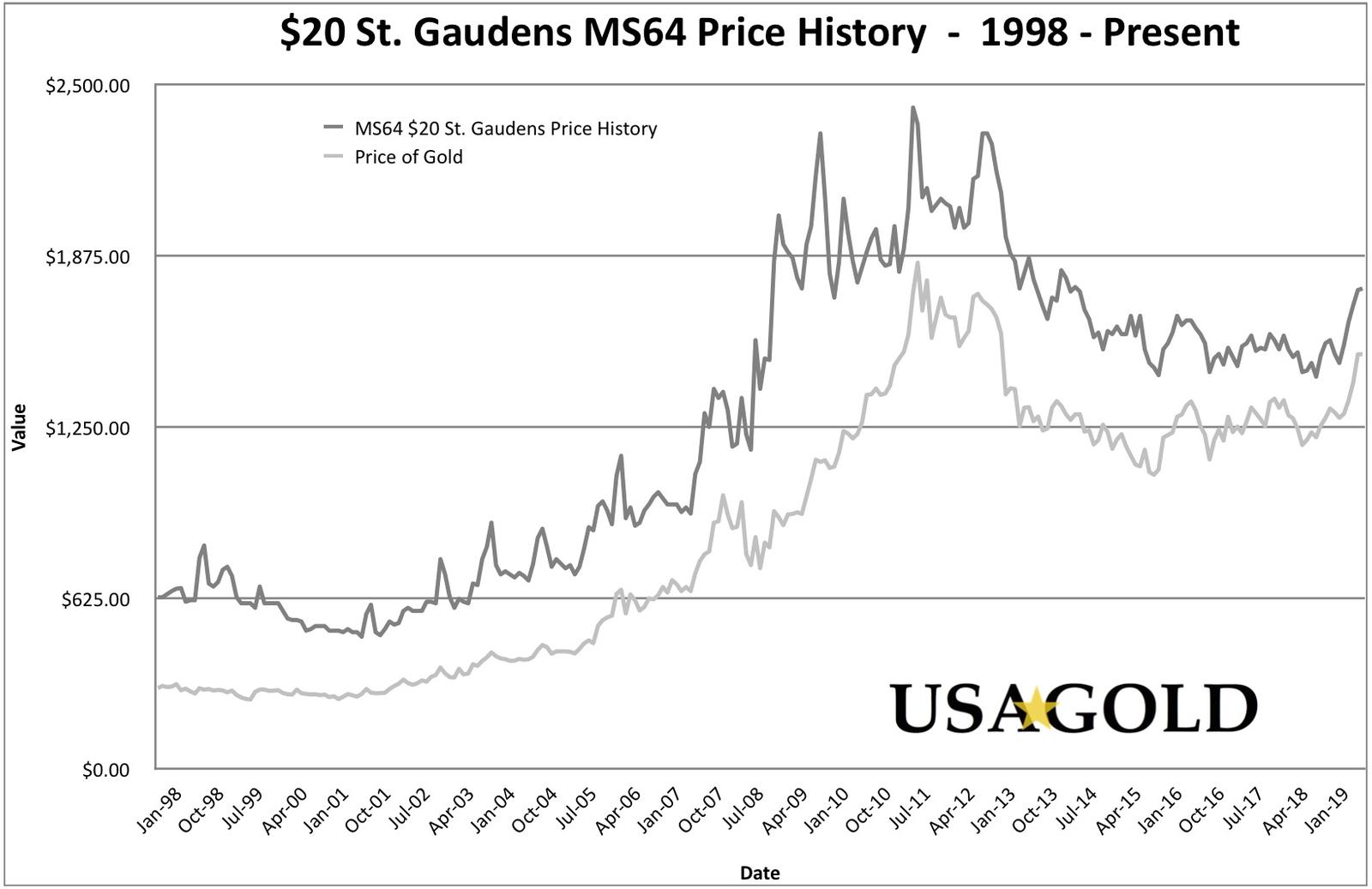

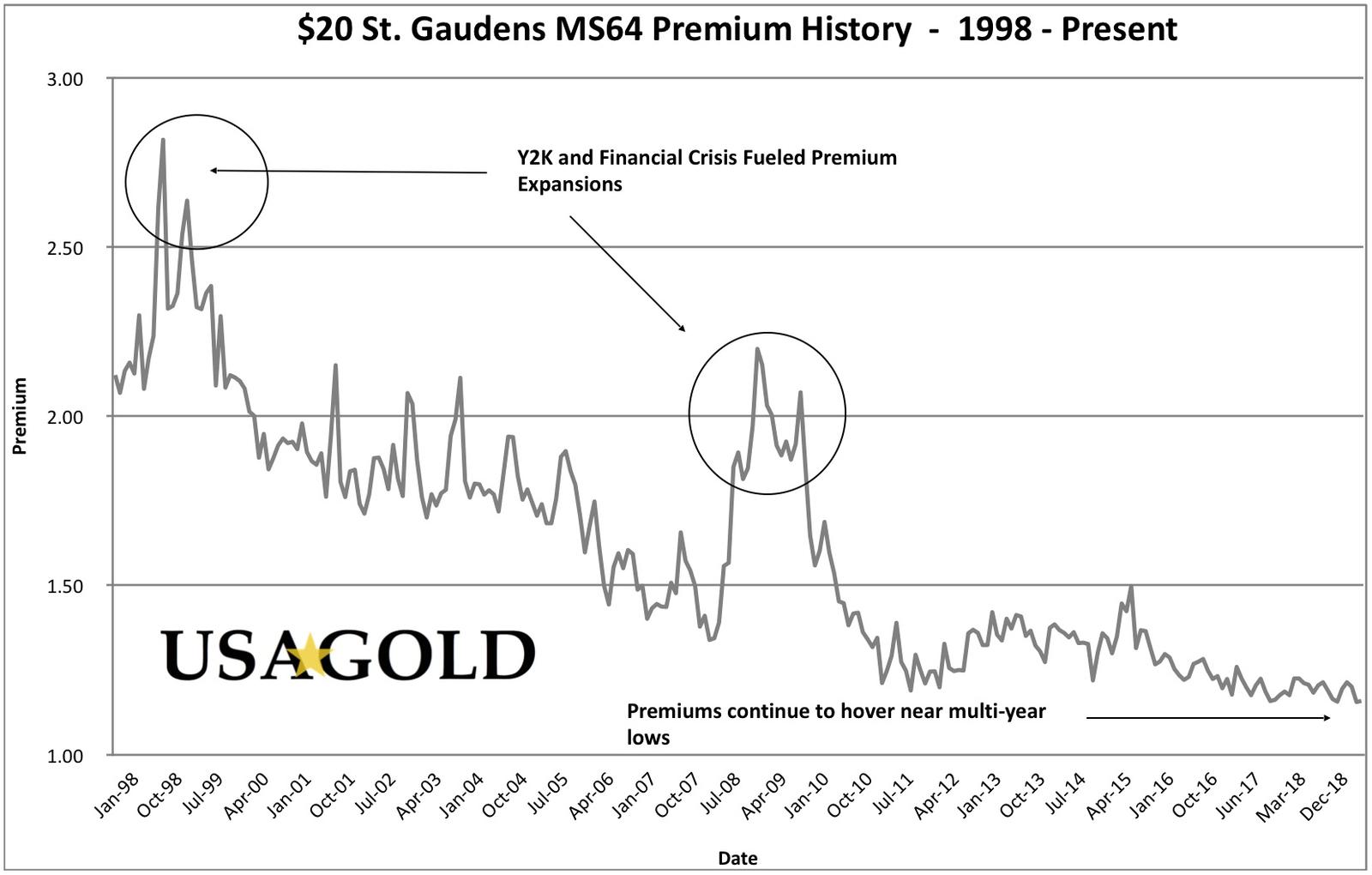

The following graph displays a twenty year price performance history for the MS64 $20 St. Gaudens, along with the gold price.

With such a similar populations, 63 and 64 grade Saint Gaudens are usually paired closely in price. MS63 $20 Saint Gaudens, like their counterparts, are near cycle lows in terms of their premiums to underlying gold value. Their highest rarity levels were achieved in the 1980’s and shouldn’t be necessarily expected to repeat. The graph below shows the twenty-year premium performance for the MS64 $20 St. Gaudens relative to its underlying gold content value. The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2 is equal to double the gold price, and a coin premium of 4 is equal to 4 times the gold price. Cycle lows have shown premiums on the MS64 $20 St. Gaudens as low as 1.19 (19%) over gold, although just recently (April 2019) premiums dipped to just 15% over gold (the lowest premium ever recorded), while recent highs in 2009 saw premiums at 2.2x gold.

US gold $20 St. Gaudens MS 63

United States $20 St. Gaudens

Grade: Mint State 63

Minted: 1907-1932

Actual Gold Content: .9675 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

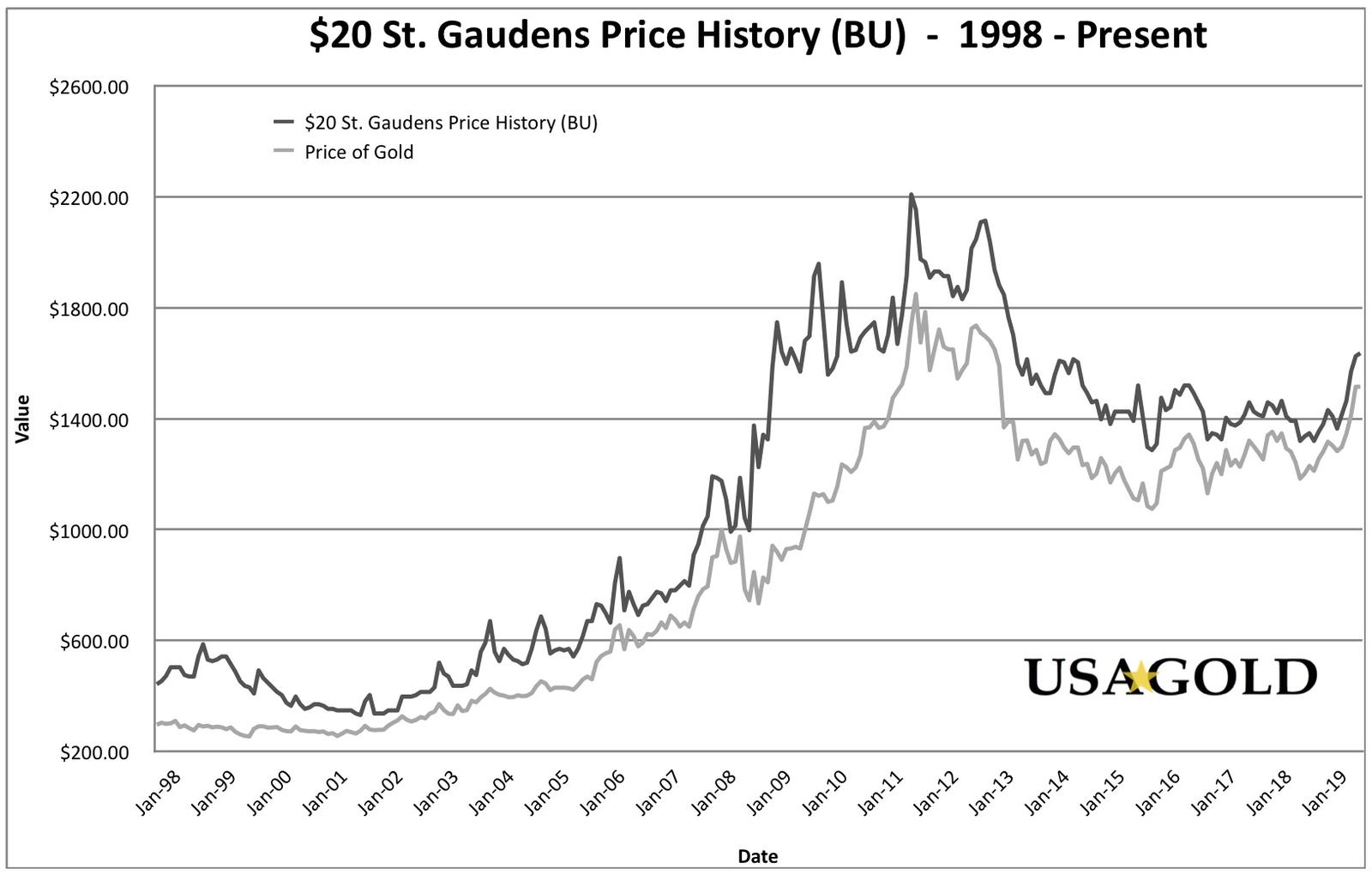

MS63 $20 St. Gaudens are an ideal gold investment for those seeking exposure to both the gold price itself, as well as additional upside potential through the possibility of premium expansion. Given that the Saint Gaudens gold cons were minted after Liberties, and are therefore newer and experienced less use and circulation, specimens from each conditional grade are a fair bit more common, and therefore more affordable, than a Liberty counterpart. MS 63 St. Gaudens are a common option for investors looking to step up slightly from raw uncirculated coinage but not pay significant added premiums. According to PCGS (Professional Coin Grading Company), slightly less than 300,000 $20 Saint Gaudens gold coins exist in MS63.

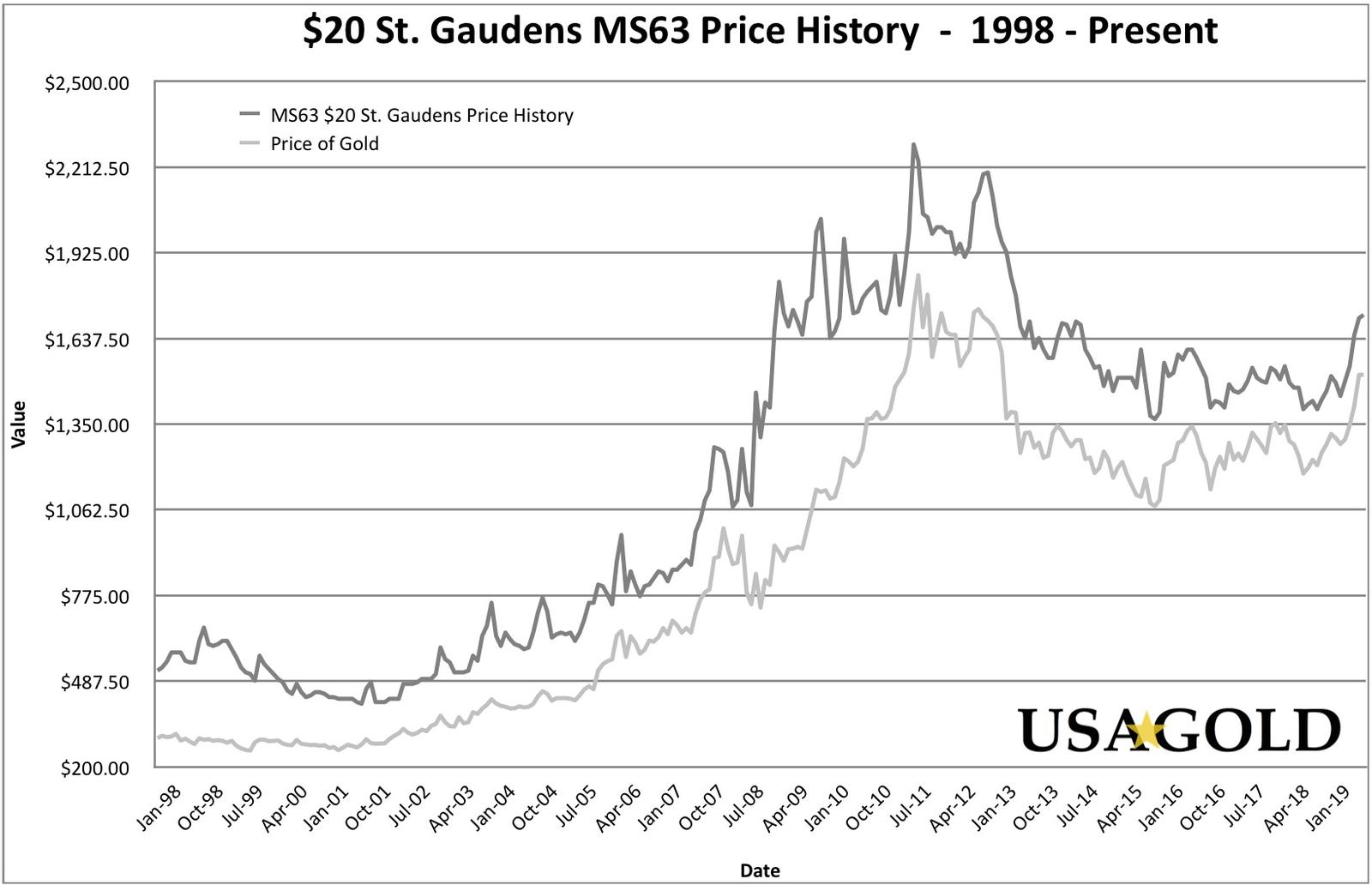

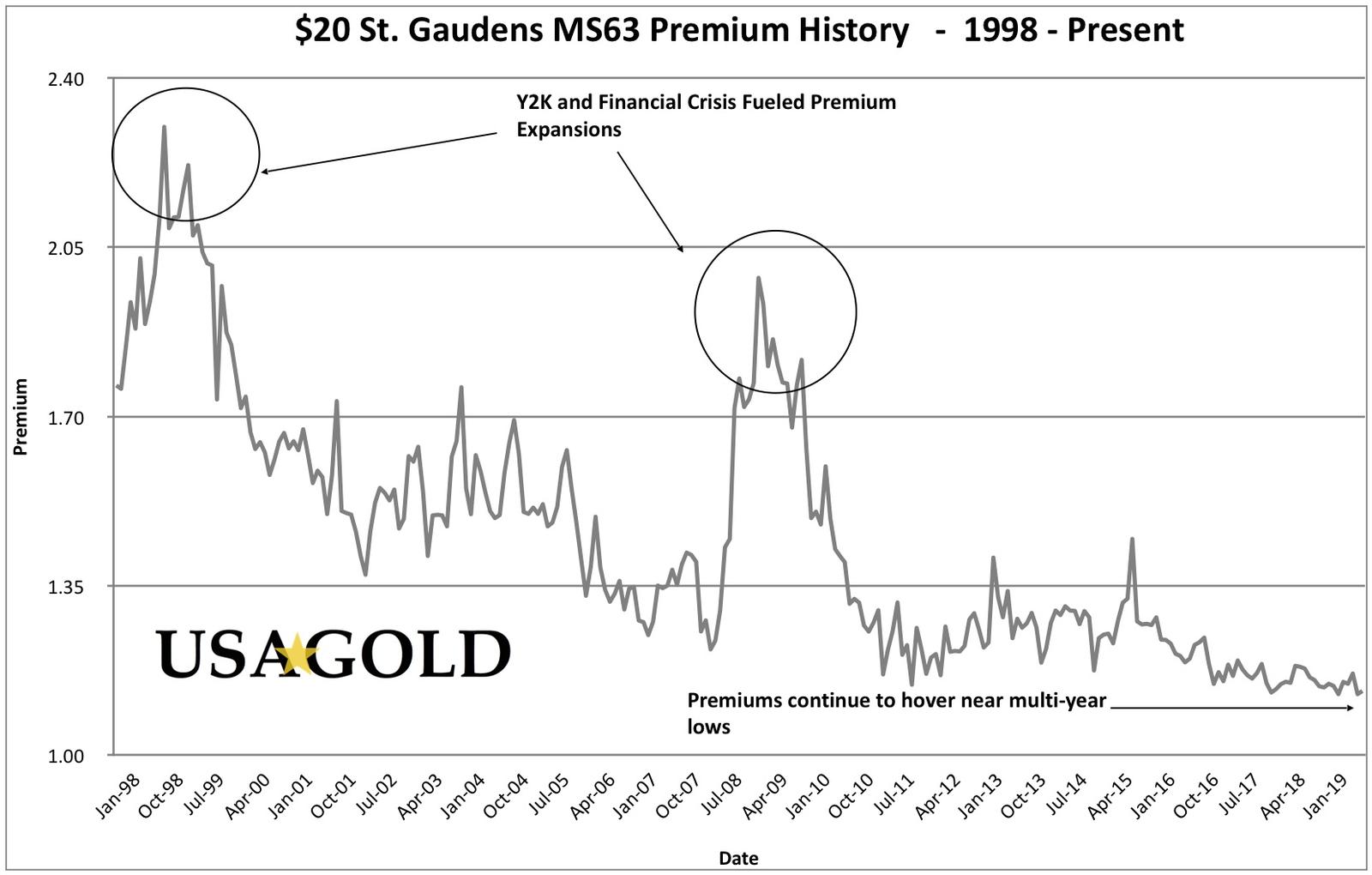

The following graph displays a twenty year price performance history for the MS63 $20 St. Gaudens gold coins, along with the gold price.

MS63 $20 Saint Gaudens, like their counterparts, are near cycle lows in terms of their premiums to underlying gold value. Their highest rarity levels were achieved in the 1980’s and shouldn’t be necessarily expected to repeat. The graph below shows the twenty-year premium performance for the MS63 $20 St. Gaudens relative to its underlying gold content value. The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2 is equal to double the gold price, and a coin premium of 4 is equal to 4 times the gold price. Cycle lows have shown premiums on the MS63 $20 St. Gaudens as low as 1.15 (15%) over gold, while recent highs in 2009 saw premiums at 2x gold. In recent months, premiums on the MS63 $20 St. Gaudens have begun to form what may be a bottoming pattern, as seen below.

US gold $20 Liberty MS 64

United States $20 Liberty

Grade: Mint State 64

Minted: 1850-1907

Actual Gold Content: .9675 troy ounc

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

MS64 $20 Liberty gold coins are an ideal gold investment for those seeking exposure to both the gold price itself, as well as additional upside potential through the possibility of premium expansion. Given that the Liberty gold cons were minted prior to St. Gaudens, and are therefore older and experienced broader use and circulation, specimens from each conditional grade are a fair bit scarcer than a St. Gaudens counterpart. To the point, price performance in the MS64 $20 Liberty is most closely mirrored by the MS65 $20 St. Gaudens, though it is traditionally valued slightly higher due to a lower population. According to PCGS (Professional Coin Grading Company), about 60,000 $20 Liberty gold coins exist in Mint State 64. By comparison, MS65 $20 St. Gaudens have a known population of slightly less than 160,000 coins.

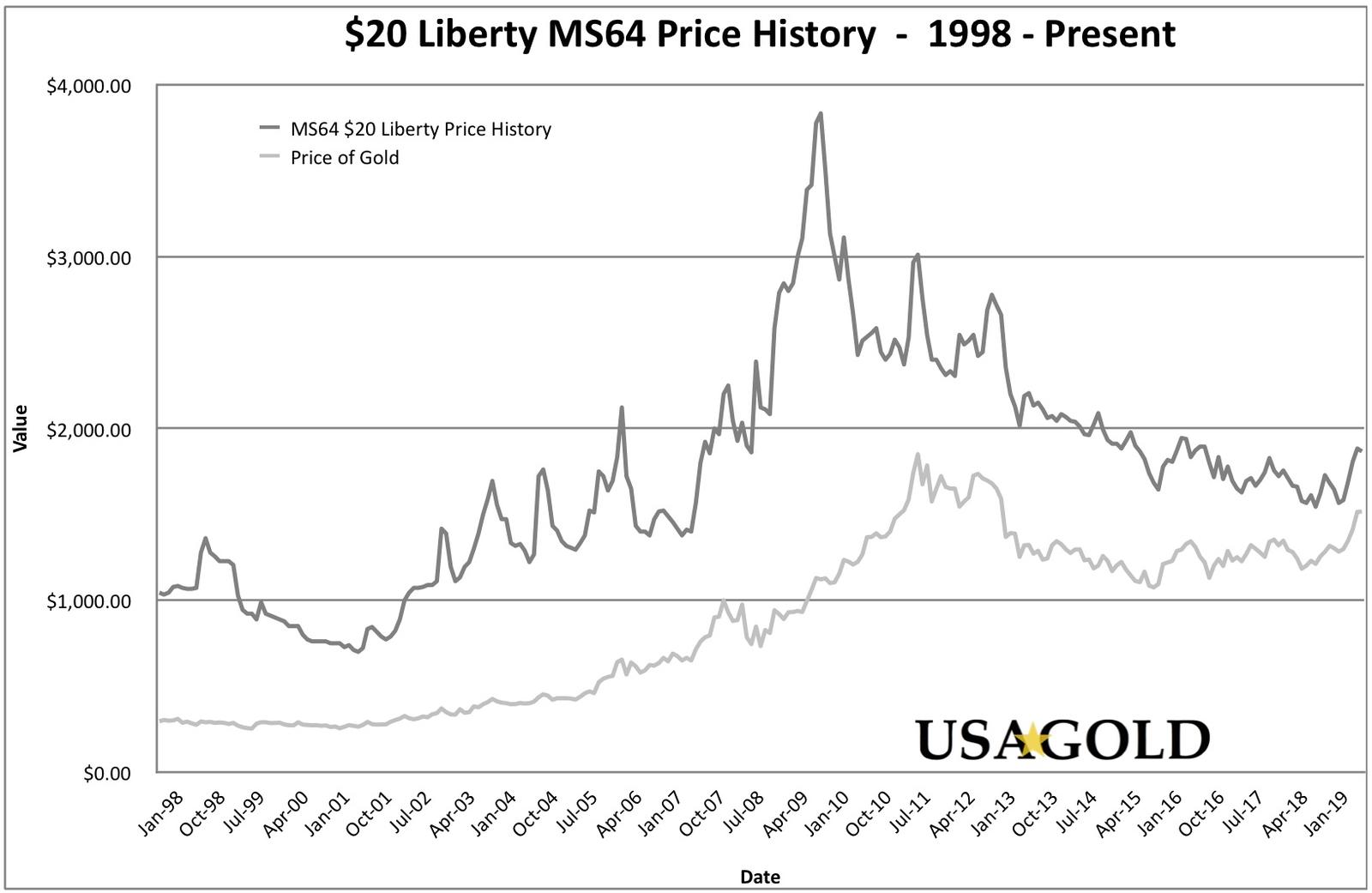

The following graph displays a twenty year price performance history for the MS64 $20 Liberty gold coins, along with the gold price.

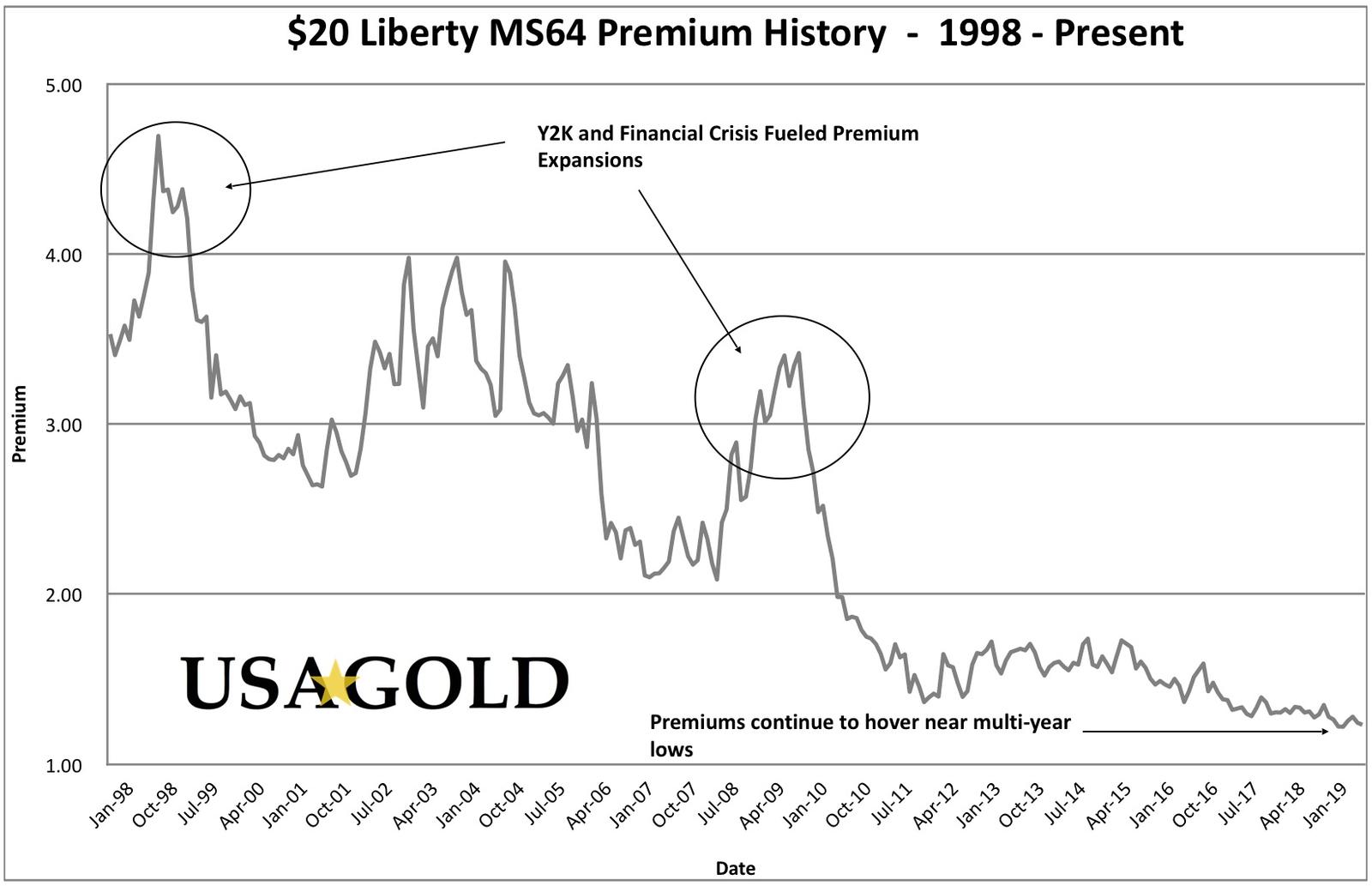

MS64 $20 Liberties, like their counterparts, are near cycle lows in terms of their premiums to underlying gold value. Their highest rarity levels were achieved in the 1980’s and shouldn’t be necessarily expected to repeat. The graph below shows the twenty-year premium performance for the MS64 $20 Liberty relative to its underlying gold content value The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2 is equal to double the gold price, and a coin premium of 4 is equal to 4 times the gold price. Cycle lows have shown premiums as low as 1.30 (30%) over gold, while recent highs in 2009 saw premiums at nearly 3.5x gold.

US gold $20 Liberty MS 63

Grade: Mint State 63

Minted: 1850-1907

Actual Gold Content: .9675 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

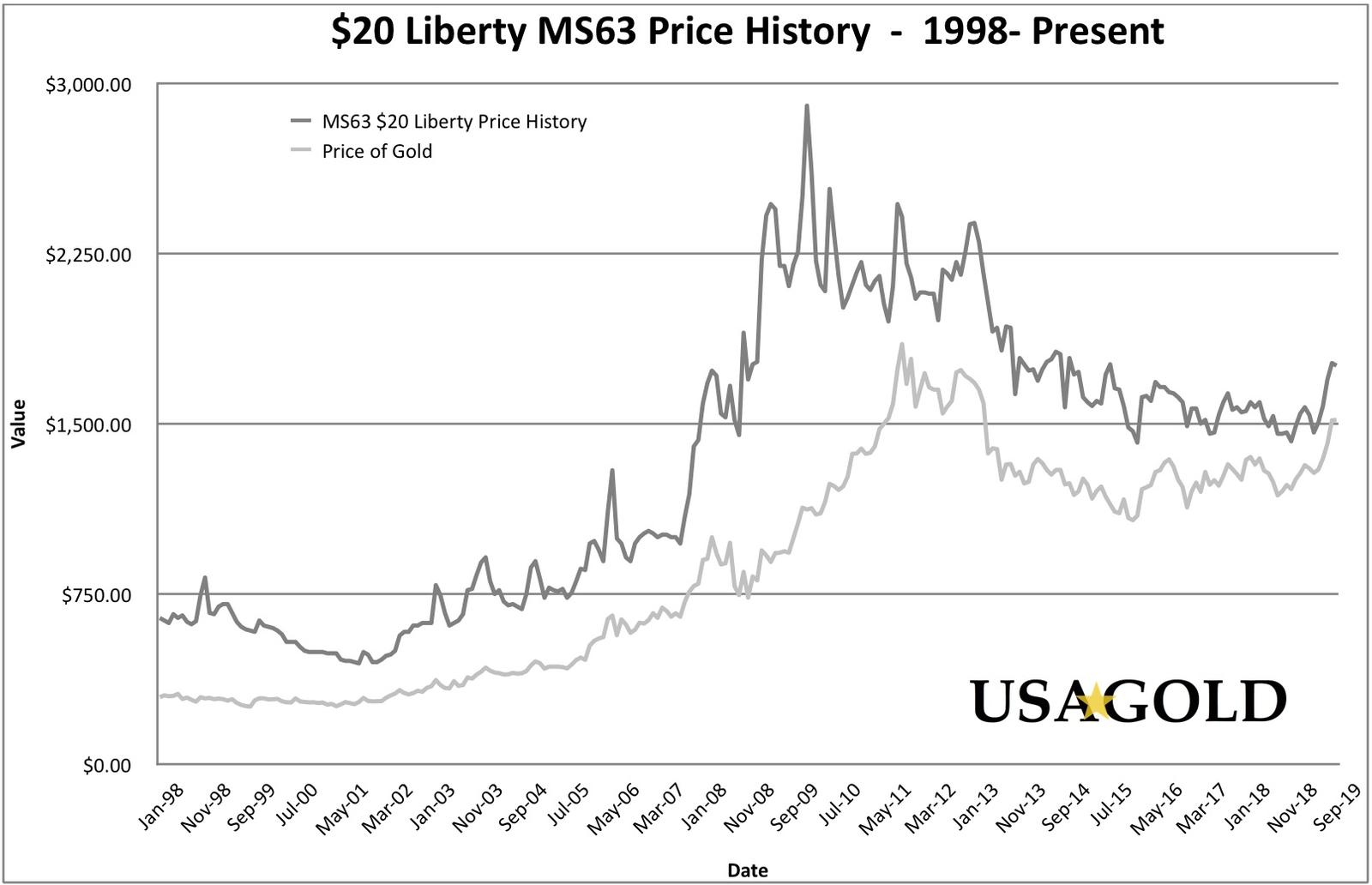

MS63 $20 Liberty Gold Coins are an ideal gold investment for those seeking exposure to both the gold price itself, as well as additional upside potential through the possibility of premium expansion. Given that the Liberty gold cons were minted prior to St. Gaudens, and are therefore older and experienced broader use and circulation, specimens from each conditional grade are a fair bit scarcer than a St. Gaudens counterpart. To the point, price performance in the MS 63 Liberty is most closely mirrored by the MS 64 St. Gaudens, though it is traditionally valued slightly higher due to a lower population. According to PCGS (Professional Coin Grading Company), about 130,000 $20 Liberty gold coins exist in MS63. By comparison, MS64 $20 St. Gaudens have a known population of 245,136 coins. The following graph displays a twenty year price performance history for the MS63 $20 Liberty gold coins, along with the gold price.

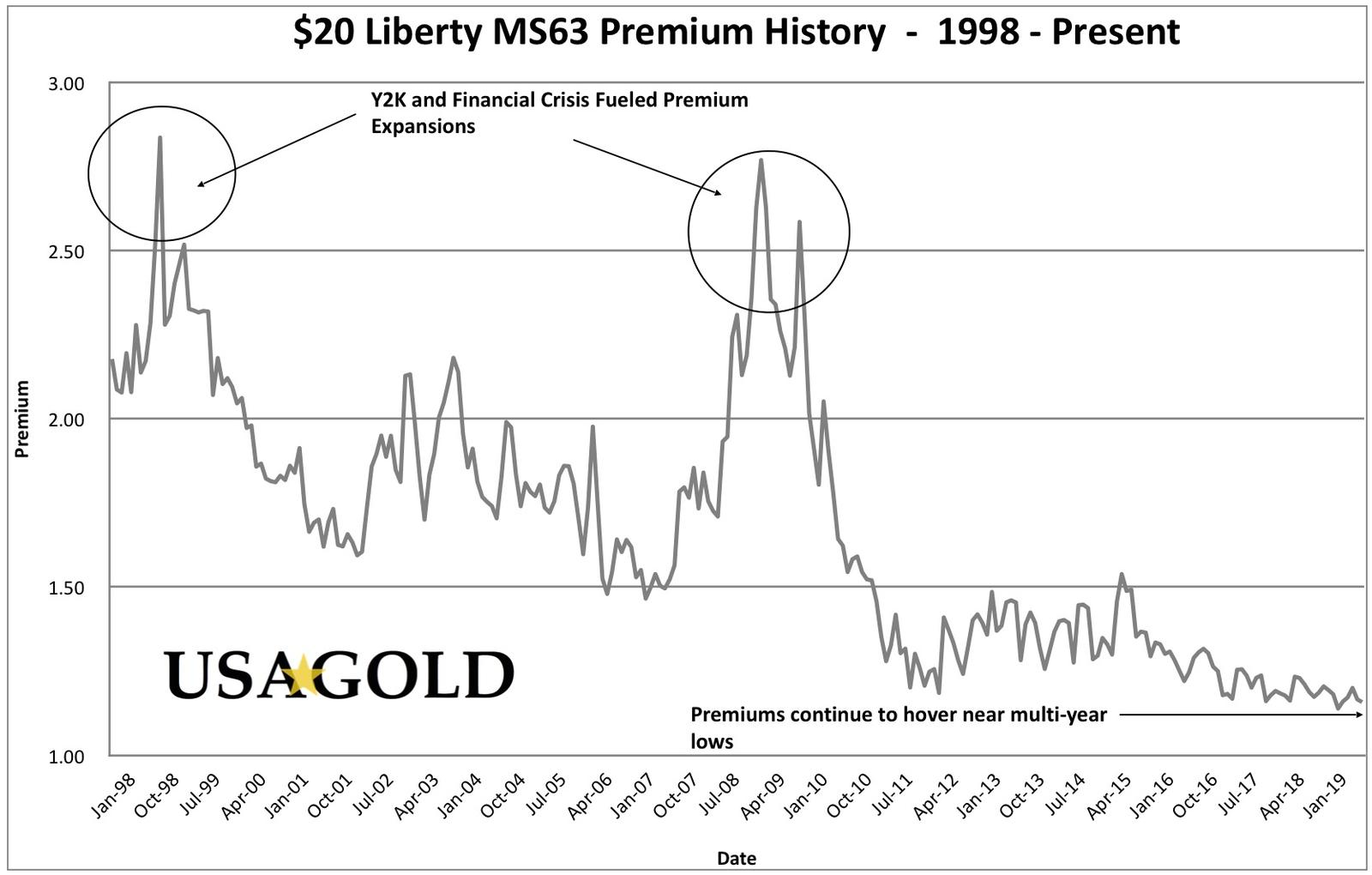

MS63 $20 Liberties, like their counterparts, are near cycle lows in terms of their premiums to underlying gold value. Their highest rarity levels were achieved in the 1980’s and shouldn’t be necessarily expected to repeat. The graph below shows the twenty-year premium performance for the MS63 $20 Liberty relative to its underlying gold content value. The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2 is equal to double the gold price, and a coin premium of 4 is equal to 4 times the gold price. Cycle lows have shown premiums as low as 1.25 (25%) over gold, while recent highs in 2009 saw premiums at 2.75x gold.

US gold five-piece index set – St. Gaudens

Includes: $20 Liberty Mint State 63 & 64;

$20 St. Gaudens Mint State 63, 64 & 65

(One each)

All graded by PCGS or NGC

Semi-numismatic items

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

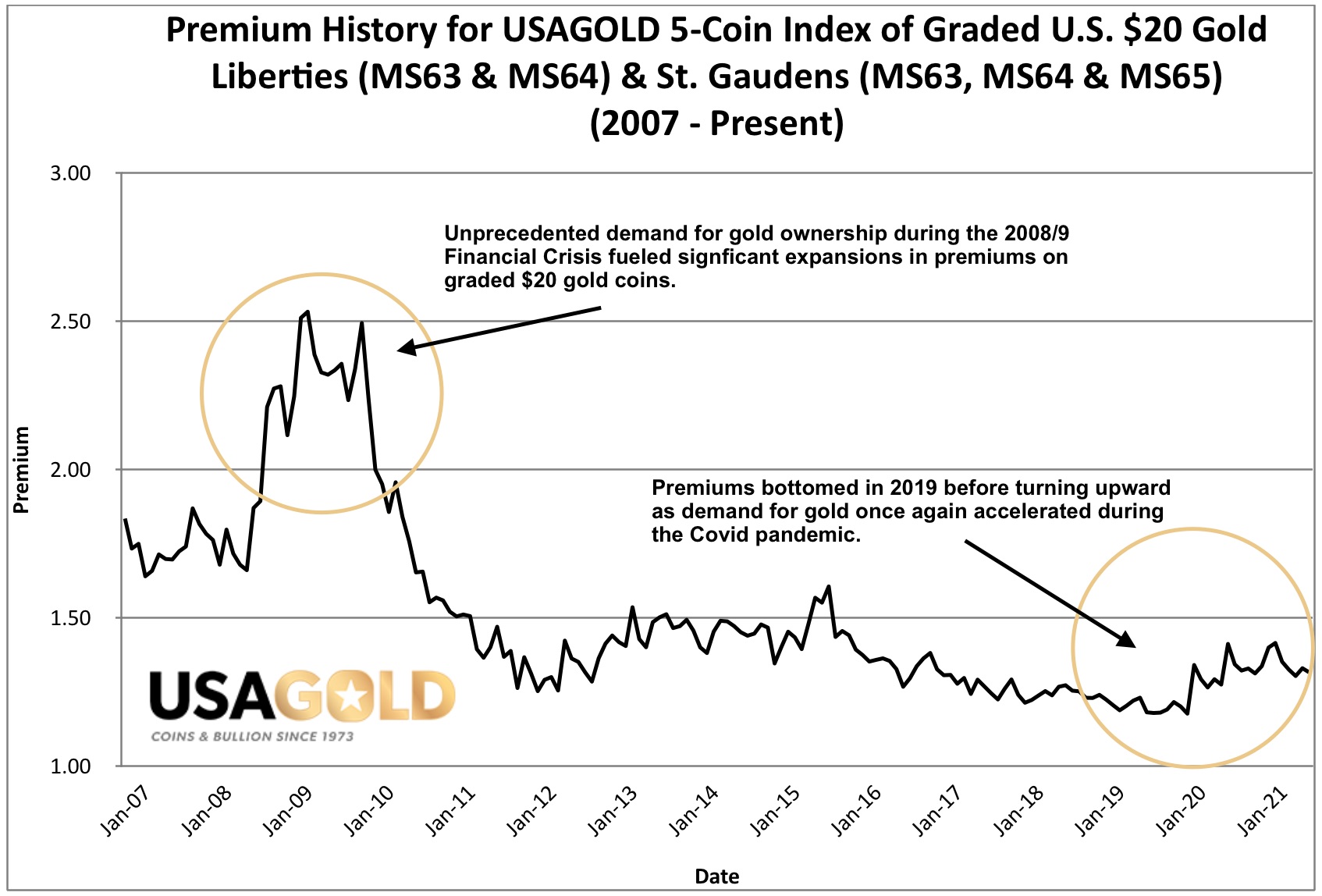

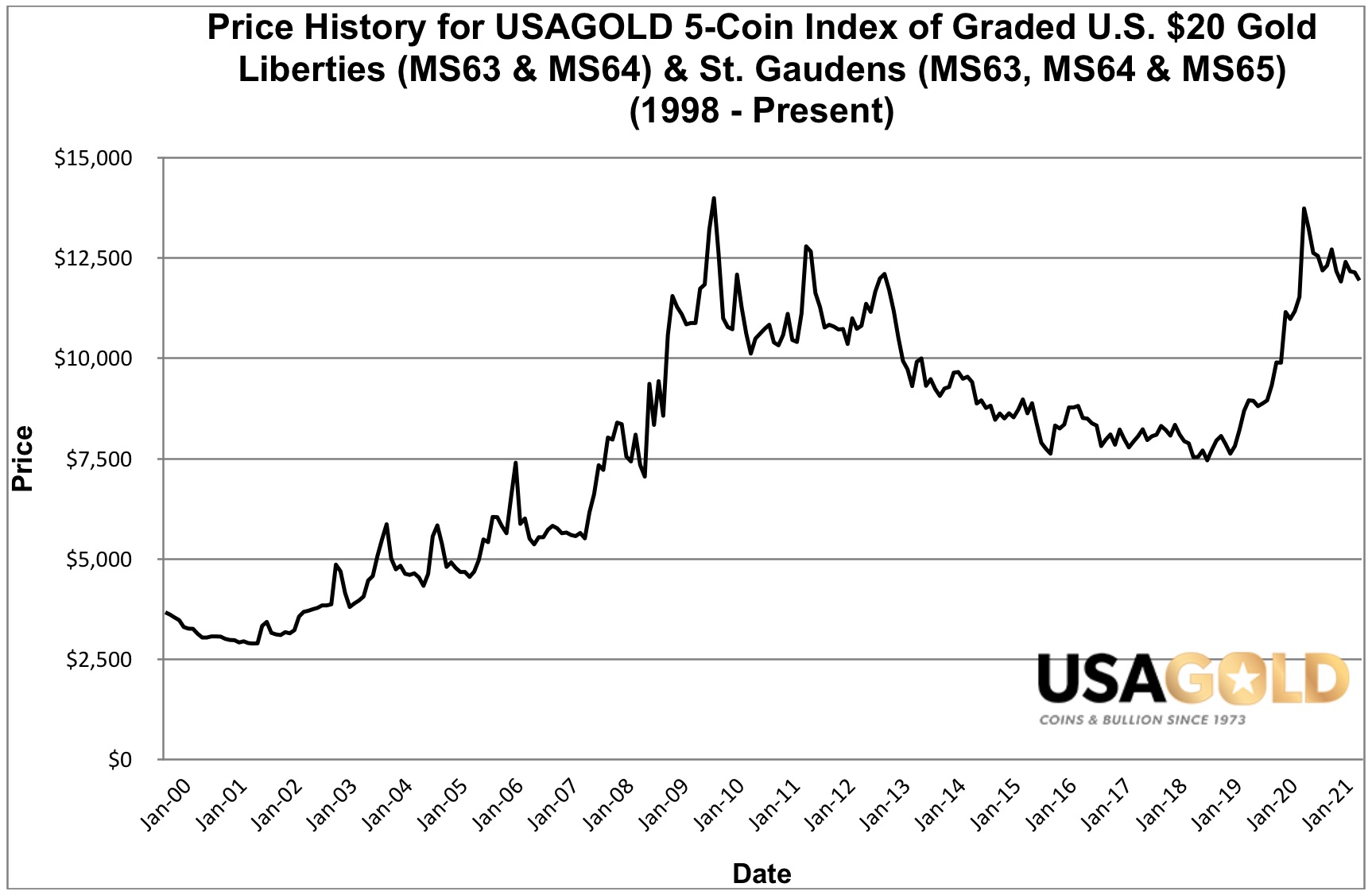

This research report details the price and premium history of the Mint State (MS)63 and MS64 United States $20 Liberty and the MS63, MS64, and MS65 $20 St. Gaudens gold coins. Pictured above is a brief explanation of the Mint State grading scale for semi-numismatic gold coins. As you move to the right across the scale, the condition of the coins improves and their scarcity increases (total availability decreases). The value of that scarcity is represented through the premium, or value of the coin above and beyond the value of its underlying gold content. The premium a coin carries is directly correlated to its rarity, and the more value a coin carries in its rarity, the more volatile its price changes will be. As such, moving right along the scale naturally increases risk/reward opportunities.

Below you will find both price history and premium history graphs for the five coin index set. The two charts can be used in conjunction to evaluate the current market conditions for these gold coins. Buying when the premium cycles are at or near all time lows has proven to be an ideal investment strategy.

Downside risk in these coins is divided into two categories: Premium risk, and the risk associated with the price of gold. By purchasing at a level where the premium is at or near an all time low, exposure to loss of value through declining premiums is mitigated. In other words, by buying ‘right’ investors can enjoy all the increased upside potential inherent in these coins without adding substantially more risk to their position than that of gold itself. Conversely, if one buys when premiums are too high, he stands to see compounded losses if both gold and premiums should decline together, or risks abbreviated gains should gold move higher, but premiums move lower.

Charted here is the USAGOLD Index of Graded $20 Gold Pieces – Premium (above) & Price (below). The Index of Graded $20 Gold Pieces contains one each Mint State (MS) 63 and MS 64 United States $20 Liberty and one each MS63, MS64, and MS65 $20 St. Gaudens gold coins and combines them into a five-coin market index. This index removes the volatility possible when tracking individual coins to provide a more accurate general market snapshot for graded $20 gold pieces. Take some time to study these charts closely. The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2 is equal to double the gold price, and a coin premium of 3 is equal to 3 times the gold price.

In short, the graded $20 gold piece market works well for those looking to increase the risk/reward factor in their gold holdings. If approached carefully and prudently, investors can enjoy great success in this market. Due simply to the fact that these coins trend with the gold price rather than track it directly (as seen in the price graph above), our advice is not to utilize these coins as the sole position in one’s gold holdings, but instead as a component in a balanced portfolio. We recommend a three to five year minimum holding period for these items.

US gold $5 Liberty

Grade: Almost Uncirculated

Minted: 1839-1908

Actual Gold Content: .241875 troy ounce

- Fractional/Divisible/Negotiable historic American coinage

- Less per coins than the modern equivalent (1/4 oz. American Eagle)

- Added liquidity advantages and premium potential associated with pre-1933 gold coin ownership

- All coins in vistually attractive, strong AU/AU+ condition

- Nice mix of dates ranging from 1880-1907

Commentary: It’s worth noting, that as a general rule, the smaller you go in historic US coinage, the rarer and more expensive it typically becomes. Even though a great many were stuck, given the prevalence of smaller coinage in circulation at the time of Roosevelt’s recall in 1933, large swaths were easily confiscated and relegated to the melting pot. As such, it has typically been the case over the years that smaller US coinage carries significant premiums to both their larger $20 gold piece contemporaries and even moreso to modern equivalents, especially during periods of significant demand. To the point, thoughout 2009, during the height of the financial crisis, $5 Liberties in AU condition carried an average premium of 50% over spot gold (which would equate to a price today of roughly $580/coin).

US gold $10 liberty

Grade: Brilliant Uncirculated

Minted 1866 – 1907

Actual Gold Content: .48375 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Referred to as the Liberty Eagle, the US $10 Liberty Gold Coin depicts the crowned image of Lady Liberty on the obverse, surrounded by 13 stars representing the original 13 colonies. On the reverse is the traditional bald eagle image, with a shield on its breast, clasping three arrows in its left talon (sinister) and an olive branch in its right (dexter), symbolizing the power of Congress to bring both war and peace, respectively. The eagle’s head is turned to the right, signaling its preference for peace. On an interesting side note, the seal for the President of the United States was virtually the same, except the eagle faced the talon holding the arrows. In 1945, Harry S Truman changed it so that the seals were the same. Christian Gobrecht, most famous for the “seated liberty” design seen on dimes, quarters, and half dollars during this era, designed the Liberty series presented here.

$10 Liberties survived at lower rates than the larger $20 varieties following the gold recall of 1933 and are a good deal scarcer as a result. When two $10’s can be obtained for close to the same price of a $20, investors would be wise to accumulate.

US gold $10 Indian

Grade: Brilliant Uncirculated

Minted 1907 – 1933

Actual Gold Content: .48375 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

The U.S. $10 Indian Gold Coins were minted from 1907 until 1933 and designed by the famous sculptor, Augustus Saint-Gaudens. The $10 “Indian” was surprisingly controversial in its time, though later became accepted and praised as perhaps the most exquisite coin design in US history. When the coin was introduced in 1907, many Americans were taken aback by the obverse of the coin, featuring Lady Liberty adorned in a full Indian war bonnet, and even further disgruntled by Theodore Roosevelt’s decision to exclude the motto “In God We Trust.” Eventually, the public came to appreciate the “Indian” design, and in response to public outcry, the motto was added to the coins in 1908. The outer rim of the coin contained 42 stars, one representing each state in the union, until 1912 when the number was increased to 44 to recognize the addition of Arizona and New Mexico to the Union. A perching eagle is pictured on the reverse.

$10 Indians are scarcer and typically more expensive compared to their $10 Liberty design counterparts. When they can be obtained for similar prices, investors should opt for the $10 Indians.

US gold $20 St Gaudens

Grade: Brilliant Uncirculated

Minted: 1907 – 1932

Actual Gold Content: .9675 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

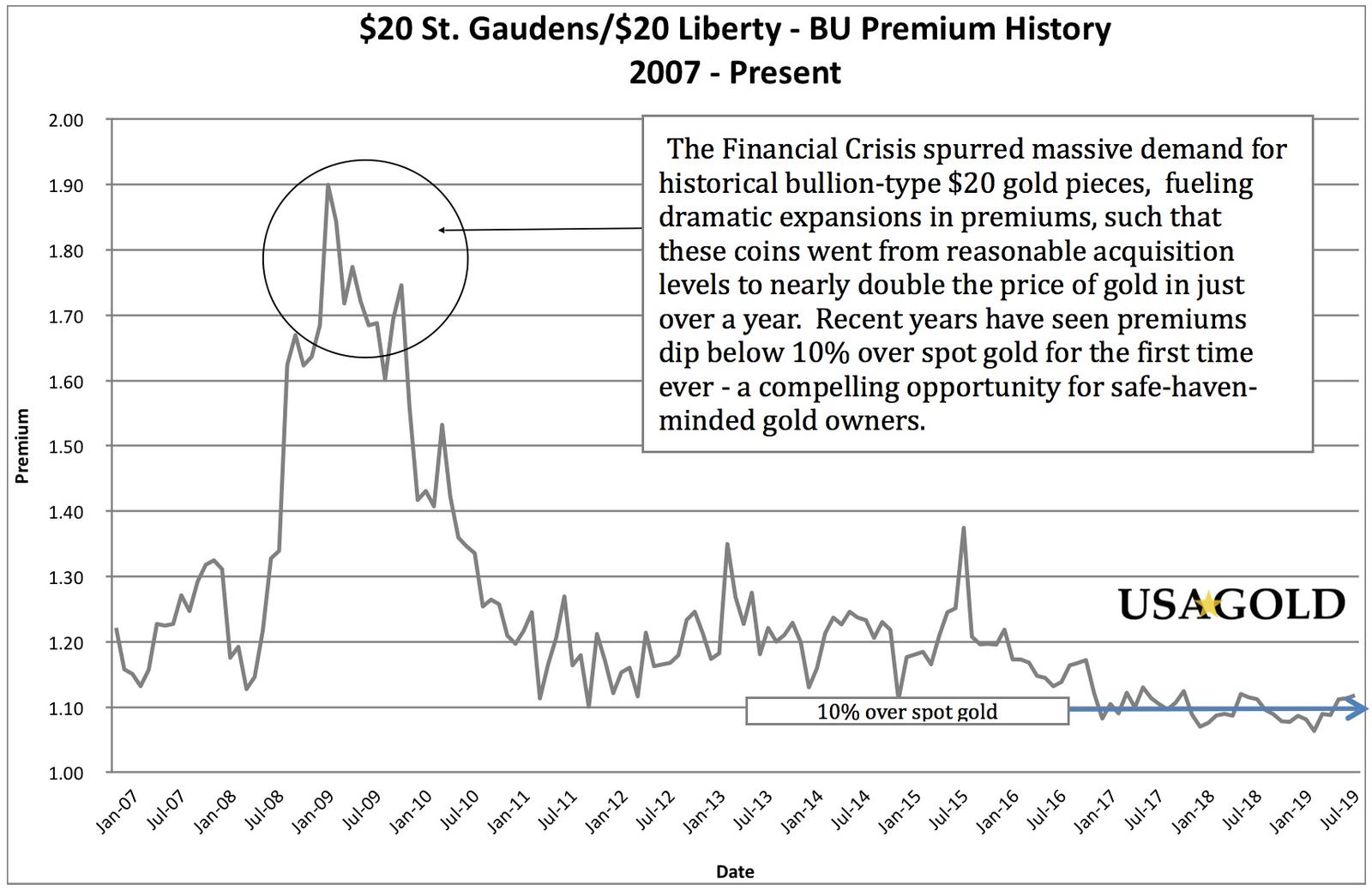

One could argue that US. $20 St. Gaudens Gold Coins are one of the best portfolio choices for asset preservation/safety-net oriented owners. Owners seeking portfolio protection will appreciate the fact the these coins, while trending directly with the spot price of gold over time, also participate in the periods of premium expansion seen during ‘flight to safety episodes’ – the most recent of which occurred during 2008/09 financial crisis (see graphs below). Such ‘double-barrel’ profit potential is only accentuated by the $20 St. Gaudens’ historic (pre-1933) designation and the associated insulation against the possibility of future government intervention.

Explaining further, $20 gold pieces are a unique combination of one of the safest and most liquid forms of gold ownership, but also potentially one of the most lucrative – specifically in situations that safe-haven investors describe as the scenarios in which they are most likely to rely on their gold positions. For example, individuals who purchased BU $20 St. Gaudens in May of 2008 would have enjoyed a doubling of their investment by December 2009, during which the gold price itself had only appreciated $250/oz.

Ironically, the current low in $20 gold piece premiums, measured against an arguably undervalued gold price, in the midst of a destabilized macroeconomic backdrop, are all reminiscent of early 2008 – an environment that proved to be literally the single best ‘buying opportunity’ in $20 gold pieces in the last decade.

US gold $20 Liberty

Grade: Brilliant Uncirculated

Minted: 1850-1907

Actual Gold Content: .9675 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

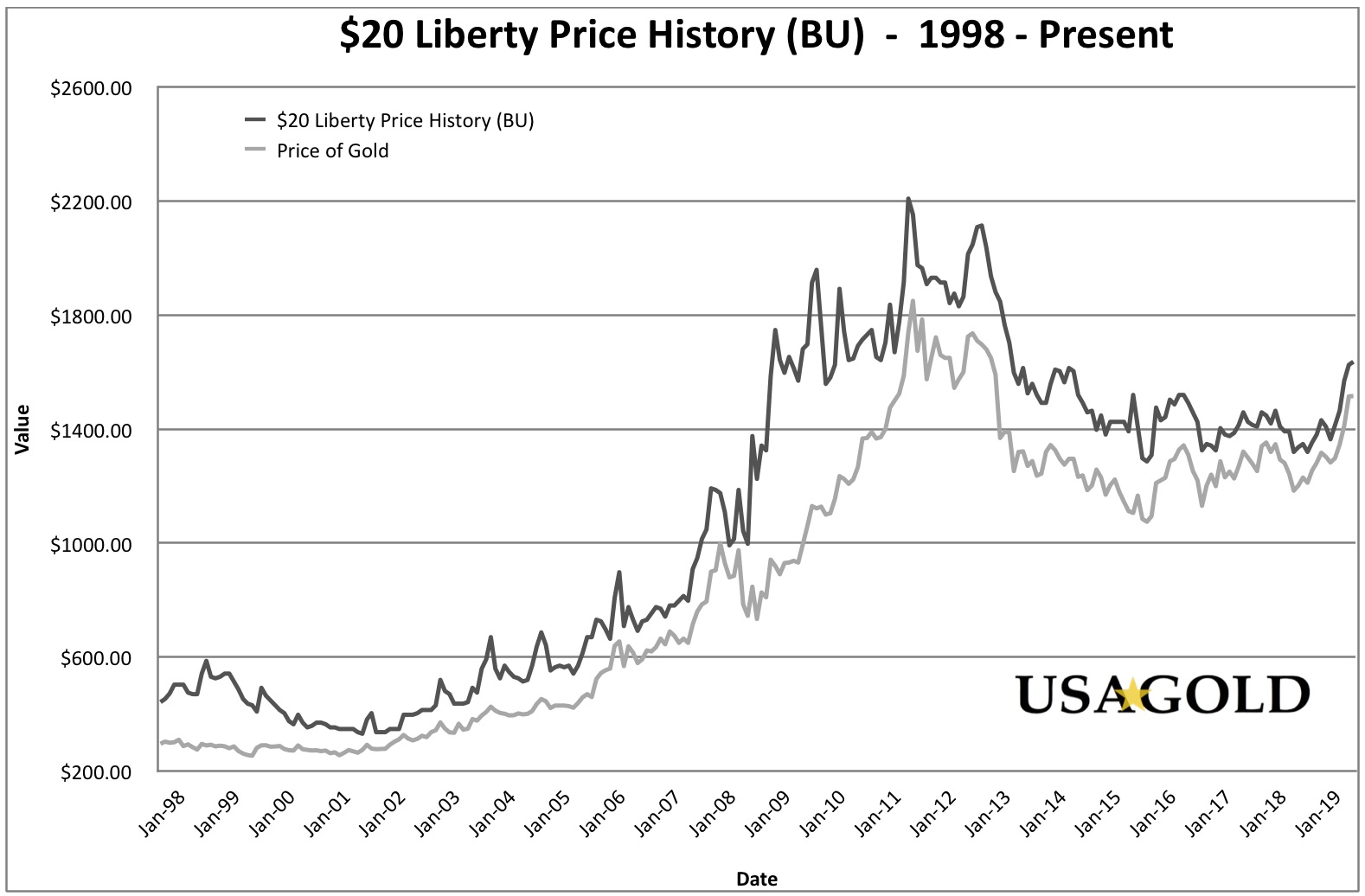

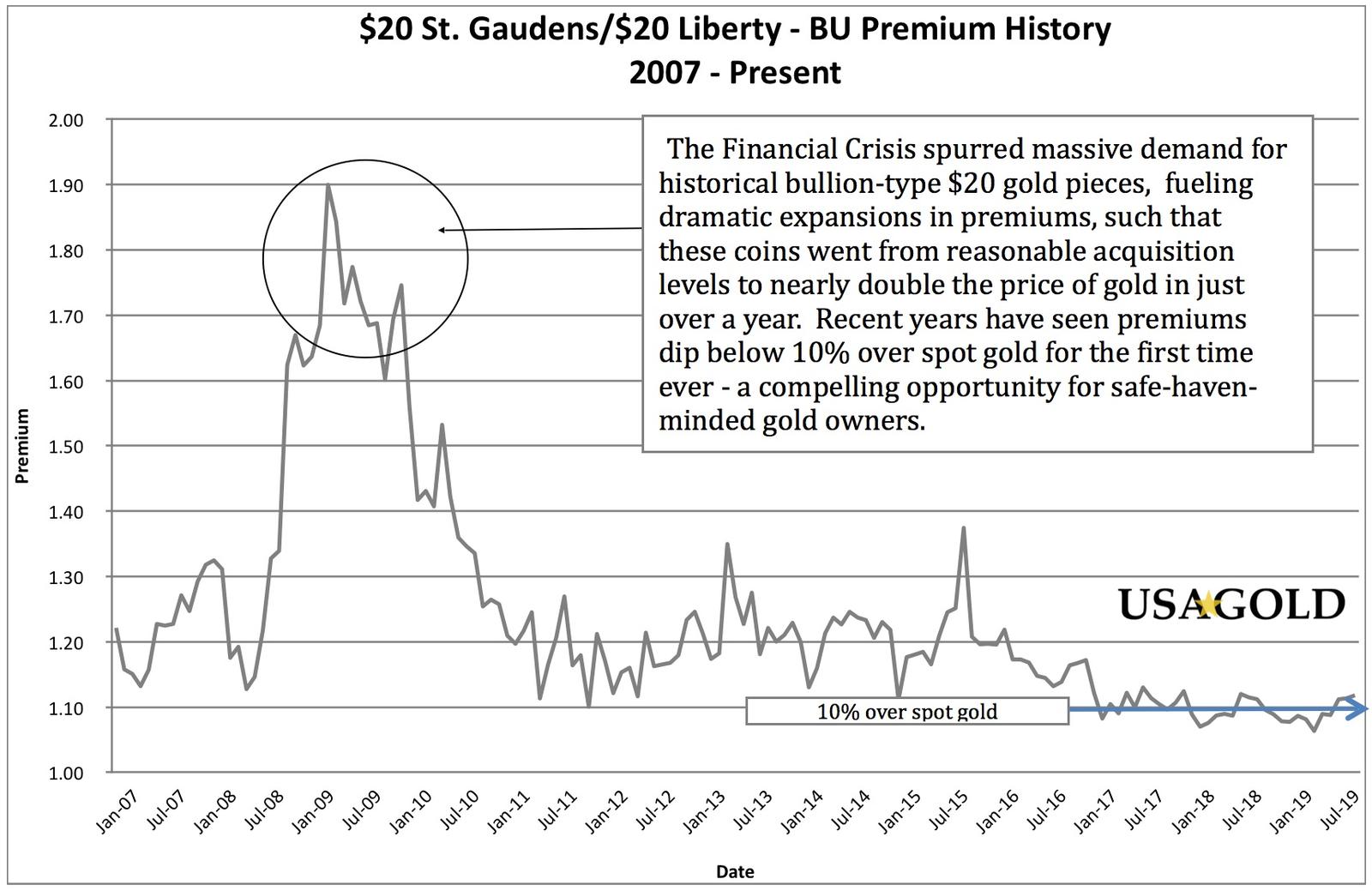

One could argue that US. $20 Liberty Gold Coins are one of the best portfolio choices for asset preservation/safety-net oriented owners. Owners seeking portfolio protection will appreciate the fact the these coins, while trending directly with the spot price of gold over time, also participate in the periods of premium expansion seen during ‘flight to safety episodes’ – the most recent of which occurred during 2008/09 financial crisis (see graphs below). Such ‘double-barrel’ profit potential is only accentuated by the $20 Liberty’s historic (pre-1933) designation and the associated insulation against the possibility of future government intervention.

Explaining further, $20 gold pieces are a unique combination of one of the safest and most liquid forms of gold ownership, but also potentially one of the most lucrative – specifically in situations that safe-haven investors describe as the scenarios in which they are most likely to rely on their gold positions. For example, individuals who purchased BU $20 Liberties in May of 2008 would have enjoyed a doubling of their investment by December 2009, during which the gold price itself had only appreciated $250/oz.

Ironically, the current low in $20 gold piece premiums, measured against an arguably undervalued gold price, in the midst of a destabilized macroeconomic backdrop, are all reminiscent of early 2008 – an environment that proved to be literally the single best ‘buying opportunity’ in $20 gold pieces in the last decade.

Historic gold German 20 marks, Wilhelm II

German 20 Marks

(Wihelm II)

Grade: Uncirculated

Minted 1888 – 1913

Actual Gold Content: .2304 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

German 20 Mark gold coins are some of the most popular with investors. As the last gold coin minted prior to the disastrous inflation that befell Germany in the 1920s, they proved to be life-savers for those who had the foresight to put some away before economic disaster struck. At the height of the 1920’s Nightmare German Inflation, a family’s life savings could not purchase a cup of coffee. A purse of Wilhelm 20 Mark gold coins on the other hand stubbornly held its value, a lesson that has not been lost on the modern saver, particularly those of German descent. Even today, it is said the nightmare inflationary experience of the 1920s affects central bank and federal government economic policy.

Wilhelm II ascended the throne of Germany in June of 1888. Fairly or not, he is generally recorded in history as one of its dark players — highly intelligent, but also tactless, vain, ambitious and adventurous. Historians believe his policies in the early 20th century, particularly toward Britain and France, drove Europe to the brink of war. His personal blunders also strained Germany’s diplomatic relations with other countries.

The most well known instance of this may be the “Daily Telegraph Affair” of 1908. When Wilhelm was offered an interview with the newspaper, he saw it as an opportunity to promote his views and ideas on Anglo-German friendship. Instead, due to his emotional volatility and subsequent outbursts during the course of the interview, Wilhelm ended up further alienating not only the British people, but also the French, Russians, and Japanese all in one fell swoop. He effectively implied that the Germans cared nothing for the British; that the French and Russians had attempted to instigate Germany to intervene in the Second Boer War (a war between the British and republics within South Africa, resulting in their addition to the British Empire); and that the German naval buildup during that time period was targeted against the Japanese, not Britain.

Historic gold Netherlands 10 guilder, queen

Netherlands 10 Guilder

(Queen Wilhelmina)

Grade range: Uncirculated/Brilliant Uncirculated

Minted 1892 – 1933

Actual Gold Content: .1947 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Holland is most famous in financial history for its Tulipmania in 1637 — the prototype financial bubble against which all other bubbles will forever be measured. The price of one special, rare type of tulip bulb called Semper Augustus was 1000 guilders in 1623, 1200 guilders in 1624, 2000 guilders in 1625, and 5500 guilders in 1637. Shortly thereafter, the bottom fell out on the market and prices plummeted to 1/200 of their peak price.

Though tulip bulbs have spent the last 366 years in happy financial dormancy, the more contemporary mania involving stocks and irredeemable paper money continue to crop around the globe with disturbing regularity. A Dutch newspaper reported in 2002 that there now exists a tulip appropriately named Dow Jones, and advised that stock market investors might consider cashing in their holdings and investing the proceeds in (you guessed it) . . . tulip bulbs. It seems they are once again on the upswing. History teaches us that gold coins, like the Dutch 10 Guilder, protect one’s portfolio against such mania.

Queen Wilhelmina, no-one’s fool, ascended the throne at a young age after the parliament passed a special law allowing a woman to become monarch. She first displayed an incisive intelligence during a meeting with the powerful Kaiser Wilhelm II of Germany prior to World War I. Wilhelm boasted to the young Wilhelmina that “my guards are seven feel tall and yours are only shoulder high to them.” To this she replied politely: “Quite true, Your Majesty, your guards are seven feet tall, but when we open our dikes, the water is ten feet deep!”

Later, Wilhelmina would display this same acumen in the world of business and finance. She amassed a fortune through various business dealings and investments that surpassed a billion dollars, making her the first female billionaire in history. She moved throughout her life in the highest circles of international finance. Known for her spunk, she called Adolf Hitler “the archenemy of mankind” after being forced to leave Holland for England during the German invasion. In 1953, when the country was devastated by floods, she bicycled the countryside at 73 years of age offering hope and inspiration to the Dutch people. Her rule lasted a remarkable fifty-eight years. This series — both the king and queen varieties — remains a popular addition to accumulations in both the United States and Europe.

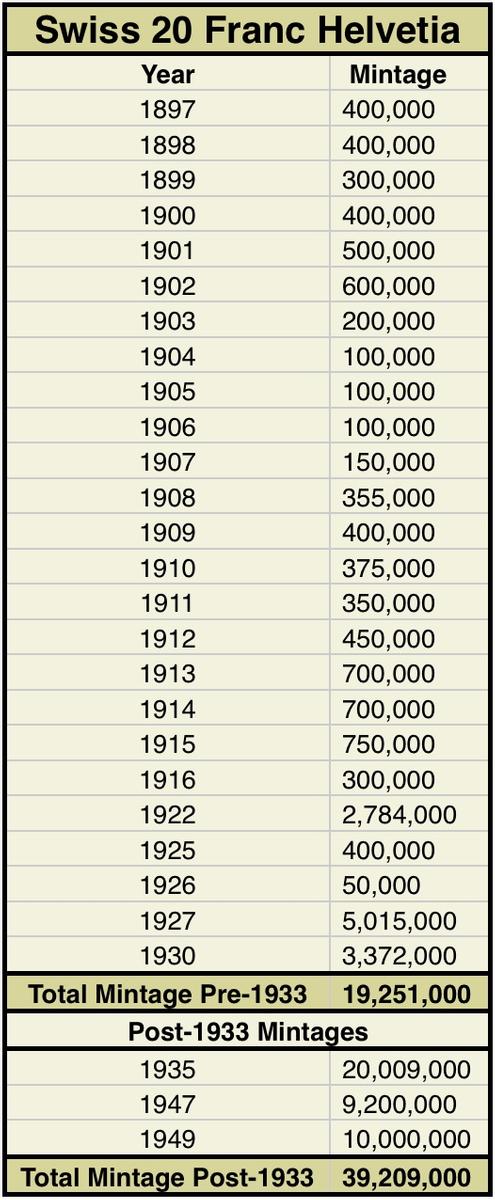

Historic gold Swiss 20 franc Helvetia

Swiss 20 Franc

(Helvetia or Vreneli)

Grade range: Uncirculated/Brilliant Uncirculated

Minted 1897 – 1935

Actual Gold Content: .1867 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

The Swiss 20 Franc ‘Helvetia’ is one of the most popular and highly sought-after pre-1933 European gold coins. At roughly one fifith of an ounce, it trades for comparable premiums to modern bullion coins of the same size, is highly recognized and liquid in international markets, and moves in direct concert with the gold price.

The Swiss 20 Franc Helvetia is referred to informally as the “Vreneli” derived from “Verena” which is Switzerland’s equivalent to the United States Lady Liberty. Modeled by Francoise Engli, this female visage appears on the obverse of the gold coin with the word “Helvetia” written above her head. When the Roman Empire extended northward into Gaul during the second century B.C., the Helvetii were the dominant tribe in the area, and thus Switzerland became known to the Romans as Helvetia. On the reverse is a picture of the Swiss Cross surrounded by a shield, lying on an oak branch.

Owing to its central geographic location among the great powers of Europe, Switzerland has been a commercial and banking center for centuries. It is famous for its role in the gold market where “the gnomes of Zurich” are said to hold much sway. The “gnomes” made their first splash in the gold market when they convinced South Africa that Swiss bankers would be a better market for its gold than the London variety. Russian gold business quickly followed the South African lead. Noted gold authority Timothy Green once said that, “Gold is as much a part of Switzerland as the Alps and skiing.”

Many individuals in Europe and elsewhere who do not trust their own governments and financial systems trust the Swiss to handle their money. As a result, much of the world’s privately held gold is stored secretly in Swiss vaults. For centuries, Swiss bankers and money men have recommended gold coins and bullion as standard portfolio inclusion.

Investor Note: Some firms offer the far more common 1935, 1947, and 1949 mintages at a lower comparative price to the earlier coinage. If your interest is to acquire items dated before 1933, be certain that you are not inadvertently buying a post-1933 item.

Historic gold British sovereign king

British Sovereign Kings

(King Edward VII, George V)

Grade range: Uncirculated/Brilliant Uncirculated

Minted 1902 – 1925

Actual Gold Content: .2354 troy ounces

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

British Sovereign gold coins minted during the reigns of Edward VII (left image) and George V (right image) are probably the most widely owned and recognized gold coins in the world — so much so that the U.S. Army included them as part of its special forces survival pack for a number of years. Over 600 million of the St. George design Sovereigns were minted from 1816 to 1932, and other types come in a high state of preservation. Still today, an original bag of one thousand occasionally shows up in the marketplace.

The Edwardian era, named for Edward VII (left), differed sharply from the rigid and puritanical Victorian age which preceded it. Edward VII was the eldest son of Queen Victoria, and ruled Britain from 1901-1910. Queen Victoria insisted on an incredibly strict regimen for Edward, while never allowing his involvement in political affairs. As a result, Edward led a rebellious, indulgent lifestyle that many felt would compromise his ability to be an effective monarch. To the chagrin of his critics, Edward ruled peacefully and effectively during his reign, saving Britain from a budgetary crisis and strengthening relationships with European powers. Edward’s reign was a brief and happy time of peace and prosperity for Britain before the shadow of World War I descended upon Europe. He died in 1910 of a heart attack.

His second son, George V (right with wife, Queen Mary) succeeded his rule in 1910. George led Britain through World War I and the negative effects brought on by the Depression of 1929-1931. English Historian Robert Lacey describes George: “. . . as his official biographer felt compelled to admit, King George V was distinguished ‘by no exercise of social gifts, by no personal magnetism, by no intellectual powers. He was neither a wit nor a brilliant raconteur, neither well-read nor well-educated, and he made no great contribution to enlightened social converse. He lacked intellectual curiosity and only late in life acquired some measure of artistic taste.’ He was, in other words, exactly like most of his subjects. He discovered a new job for modern kings and queens to do — representation.” George V and his wife, Queen Mary, made the monarchy a symbol of conservative, middle-class virtue. George relinquished his German titles and adopted the name of Windsor for the British royal house.

The first British Sovereign Gold Coin was minted under Tudor King Henry VII in 1489 (not shown). It gets its name from that first mintage which depicts the monarch seated majestically on the throne facing outward. The current design type with St. George slaying a dragon on the reverse and the monarch on the front was introduced nearly 200 years ago in 1816 under George III.

The Sovereign was minted almost continuously from that date until 1932, when Britain went off the gold standard. Minting was resumed in 1957, as a bullion coin, with Queen Elizabeth on the obverse. As such, it holds the distinction of being the only pre-1933 coin to carry over to the modern era.

Historic gold Victoria young head British sovereign

British Sovereign Queen Victoria

(Young Head Variety)

Grade range: Extra Fine/Almost Uncirculated+

Minted 1871-1885

Actual Gold Content: .2354 troy ounces

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

The Queen Victoria sovereign gold coins invoke a special nostalgia for a time when the British Navy ruled the seas, and the sun never set on the Empire. London flourished as the trading and financial capital of the world; Britain became the center of rapid technological innovation; and, India glittered as the Crown Jewel of the Empire. The gold Sovereign came to symbolize British financial solidity and to this day enjoys a strong international market, wide-spread recognition and strong liquidity.

The “Young Head” is offered for sale in quantity very infrequently, and holds rank as the oldest and rarest of the Sovereigns that can still be obtained at reasonable premiums?. NCG places a per coin suggested retail anywhere from $450-$600 for coins in similar condition to those offered here.

Historic gold Belgian 20 franc

(Leopold II)

Grade: Brilliant Uncirculated

Minted 1867 – 1882

Actual Gold Content: .1867 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

If one takes the time to contrast the computerized replication of modern currencies at little or no cost with the old world elegance, solidity and beauty of these Belgian 20 Franc gold coins, the argument for gold ownership makes itself. The “Leopold” invokes a simpler time when the long-term purchasing power of the national money was not an issue and the great nations of the world forthrightly made their money from gold. The saver knew that 20 francs deposited would translate to the same 20 francs in value when withdrawn.

The Belgian 20 Franc gold coins were minted to the Latin Monetary Union standard of .1867 ounces per coin, to facilitate cross border trade with the 20 Franc issues of other countries at that time (France, Switzerland, Italy, etc.). The obverse shows Leopold II facing right. On the reverse is the Belgian coat of arms, and the inscription, “L’ Union Fait La Force” or “The Union Makes Strength”. Belgian 20 Francs are slightly harder to come by than the more common French issues of the era, but still trade at very favorable premiums given their age and state of preservation.

Historic gold Argentina 5 peso

Argentina 5 peso

(Argentino)

Grade: Uncirculated

Minted 1881 – 1896

Actual Gold Content: .2334 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Around the early 1900’s, the phrase “rich as an Argentine” was used popularly to describe an individual of substantial wealth. In 1914, only Great Britain was more urbanized, and by 1929 only Great Britain had more cars per capita. Argentina was considered to be one of the ten wealthiest nations in the world in terms of per capita income.

Not more than 20 years later, a series of poorly executed policies begun primarily under the administration of Juan Peron — the nationalization of industries, expansion of state services and substantial overseas borrowing, as well as a period of bad leadership — began to undermine the economic prosperity of the country.

Unable to finance its spending, the government opted to inflate its way out of debt. This caused an astronomical wage and price inflation factor of 2.1 billion times original prices between 1976 and 1991. To give an example, a single one of the 5 Pesos Argentino gold coins pictured above now holds a modern purchasing-power equivalent to beyond 500 trillion the original, five peso coin denomination. Once an example of prosperity, Argentina’s currency failure set the stage for one of the most dramatic economic breakdowns of the late 20th and early 21st centuries.

Reminiscent of early United States coinage, the popular Argentino is a beautifully designed coin with a representation of Liberty on the obverse, and Argentina’s coat of arms on the reverse. This coin is difficult to obtain in uncirculated condition.

Historic gold Mexican 50 peso

Grade range: Uncirculated/Brilliant Uncirculated

Minted: 1921 to 1931

(Pre-1933 mintages only; no restrikes)

Actual Gold Content: 1.2057 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Less than 1/10 as many Mexico 50 pesos were struck as US $20 St. Gaudens during the 1920s alone. If you include the total mintage of $20 gold pieces across their 80 year production, the total population of Mexico 50 pesos is a mere 3% that of the $20 gold pieces. With premiums on uncirculated $20 gold pieces at times topping 50%, the opportunity for long-term premium growth in the Mexican 50 Pesos coins is notable. From 1921 to 1931, over 4.9 million 50 pesos were struck compared to nearly 50 million $20 St. Gaudens.*

Historical Note:

The 20th century is rife with examples of financial breakdown and Mexico’s rendezvous with economic disaster in 1994 is among the most instructive. The crisis began, as happens so often in these affairs, with a surprise announcement by Mexico’s government that the currency had been devalued. As soon as it was made public, depositors lined up at the banks to retrieve their money and inundated brokerages with sell orders. A general panic gripped the nation almost immediately. The inflation rate went to 50% overnight, and interest rates soared to 70%.

Only a proper diversification into gold well before the crisis emerged properly insulated savers from the devaluation’s pervasive reach into every area of the financial system. In many cases, those who managed to diversify did so in the physical gold former-coinage of the country. Immediately after the devaluation, the price of gold went from 1200 pesos per ounce to 2500 pesos, and from there it exceeded 3000 pesos in 1995, living up to its reputation as a safe-haven for investors.

In 1910 Mexico celebrated the Centennial of the beginning of its War of Independence with Spain. To commemorate the event, a giant column was erected in the middle of Mexico City with a statue of El Angel de la Independencia (The Angel of Independence), sitting atop. This 6.7-meter statue, constructed of Bronze and Gold, represents the “Winged Victory,” a Greek symbol for the goddess Nike (Victory). In her right hand the Angel holds a laurel crown, symbolizing Victory, while in her left she holds a broken chain, symbolizing Freedom.

*As a final note of clarification, the information above does not include re-strike versions of both the 50 pesos and 20 pesos. Both coins were heavily re-struck from 1944-1975, typically carrying the date 1947 in the case of the 50 pesos, and 1959 in the case of the 20 pesos. These re-strike coins are bullion items that carry lttle to no premium potential.

Historic gold French Ceres gold coin

French 20 Franc Ceres

Grade range: Extra Fine/Almost Uncirculated

Minted 1849-1851

Actual Gold Content: .1867 troy ounces

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Due to their extremely short-lived mintage – just 3 years from 1849-1851 – the French Ceres is one of the hardest pre-1900 European coins to locate in quantity. It consistently holds distinction as the least expensive pre-civil war antiquity on a per ounce basis – an unmatched opportunity for the gold investor seeking to combine historical intrigue and rarity with pure gold accumulation.

Rather, the coin’s obverse is the allegorical figure symbolizing the French Republic, referred to as “Marianne”. Her image is meant to resemble that of Ceres, the Roman goddess of agriculture, grain, and the love a mother bears for her child – hence the coin’s name. Ceres was beloved for her service to mankind in giving them the gift of the harvest, the reward for cultivation of the soil.

The Second Republic ultimately lasted just three years. When it became evident the French Parliament would block President Louis-Napoleon Bonaparte’s re-election bid in 1852, he promptly organized a coup in December 1851, seized power, re-wrote the constitution and declared himself emperor of France. Just like that, the Second Republic of France had ended, as did the mintage of the French Ceres gold coins.

In an interesting historical side note, Emperor Napoleon III claimed the throne of the Second Empire of France on December 2nd 1852, 48 years to the day after his Uncle, Napoleon I was crowned.

Historic gold Uruguay 5 peso gold coin

Uruguay 5 Peso

Grade range: Uncirculated/Brilliant Uncirculated

Minted: 1930

Actual Gold Content: .2501 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Listed in The Standard Catalogue of World Gold Coins as the only coin of its design type and minted in 1930 only, the catalogue notes: “Only 14,415 were released. Remainder withheld.” A hoard of roughly 80,000 coins (which comprised most of the remaining mintage) was released, rumor has it, by the Argentina Central Bank in 1998, and most of those coins were placed with private investors and collectors. Add it up and you’ll quickly note that less than 100,000 total Uruguay 5 Pesos are known to exist, making them one of the most affordable true rarities in the gold market. These coins rarely surface, and only in very small quantities, usually made available when early owners of the Argentine hoard pare down their holdings. NGC places a sugested retail value of similar conditioned coins at $475 a piece.

In 1930, the Uruguayan peso was of slightly greater value than the U.S. dollar. (Twenty U.S. dollars were “pegged” to the 0.9675 troy ounces of gold contained in the $20 double-eagle gold piece, whereas twenty Uruguayan pesos were “pegged” to the 1.0004 troy ounces of gold contained in four of these 5-peso face value coins.) As inflation took its toll, the New Peso was introduced in 1975 to replace the old peso at a rate of 1 NP for 1,000 old pesos. But alas, the New Peso also fell victim to these same inflationary trends, and was itself supplanted in turn at a rate of 1-for-1000 NP in March 1993 by the “newer” peso which circulates today (as of April 2010) at 19 pesos per U.S. dollar (a net plunge, effectively, from near parity to 19 million old pesos per dollar!)

Examination of this coin reveals the words Republica Oriental Del Uruguay (Oriental Republic of Uruguay). The designation “Oriental” in the official name of Uruguay refers to the country’s location upon the eastern bank of the Uruguay River, which separates it from Argentina to the west. Comprised of a population exceeding 3.25 million largely derived from Spanish and Italian descent and occupying a landmass about the size of Oklahoma between Brazil and Argentina, Uruguayans, in fact, sometimes call themselves “Orientals.”

Historic gold Italy 20 lira – VE

Italy 20 Lira

(Victor Emanuele II)

Grade range: Almost Uncirculated/Uncirculated

Minted: 1861 – 1874

Actual Gold Content: .1867 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Italy 20 Lira Vittorio Emanuele Gold Coins are considerably scarcer than Umberto varieites, and generally only surface in small lots. Though just over 10,000,000 were minted total during their 13 year production, only a fraction have survived into the modern era in collectible condition. Such reality is evidenced by NGC’s suggested retail price of $700-$800 per coin in similar condition as those offered here. The 20 Lira gold coins were minted to the Latin Monetary Union standard of .1867 ounces per coin, to facilitate cross border trade with the 20 Franc issues of other countries at that time (France, Switzerland, Belgium, etc.).

Victor Emanuele’s place in history is inextricably connected to that of Giuseppe Garibaldi, the Italian revolutionary leader with whom he collaborated to unite Italy under a single kingdom in the mid-19th century. Prior to that, Italy was a loose confederation of states. Known among the Italian people as ‘the honest king,’ Victor Emmanuel became the symbol and central figure of the ‘Risorgimento,’ and spent the rest of his monarchy consolidating the new kingdom.

Historic gold German 20 mark – Wilhelm I

(Wilhelm I)

Grade range: Extra Fine/Almost Uncirculated+

Minted 1871 – 1888

Actual Gold Content: .2304 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Wilhelm Friedrich Ludwig (1797-1888) ascended to the Prussian throne in 1861. Showing little political interest, his primary goal upon gaining power was to reorganize and strengthen the Prussian army. He was met with opposition from the Prussian legislature, and his desire to remain politically neutral led to his appointment of Otto von Bismark as his prime minister in 1862. Bismark proved to be far more historically significant than Wilhelm I, engaging Prussia in a number of conflicts aimed at attaining the goal of a unified German Empire. Perhaps the most notable of these conflicts was the Franco-Prussian War of 1870-71. Upon the defeat and surrender of Napoleon III at Sedan, Wilhelm I was proclaimed the first emperor of Germany (Kaiser) in 1871. These events, and the conflicts that ensued between Germany and France, eventually escalated into World War I.

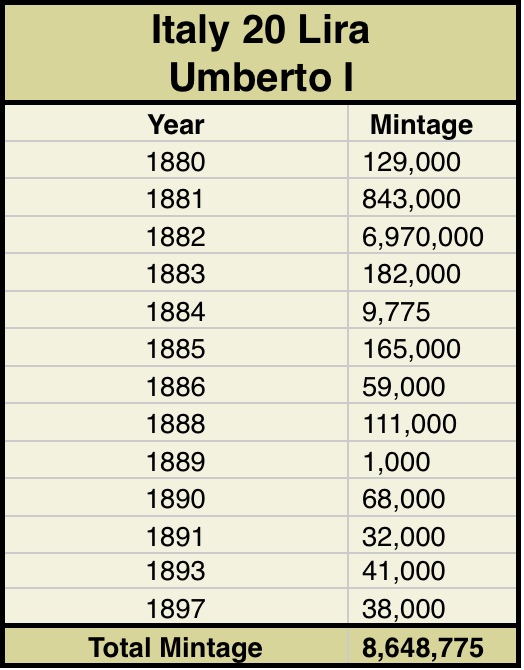

Historic gold Italian 20 lira

Italian 20 Lira

Grade range: Uncirculated/Brilliant Uncirculated

Minted: 1880 – 1897

Actual Gold Content: .1867 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

Umberto I, also known as Humbert I, was King of Italy from 1878 until his death in 1900. He was son to Victor Emmanuel II, who united Italy under a single kingdom during the ‘Risorgimento’ movement of the 19th century. Umberto I was the only modern King of Italy to die by assassination, killed by the Italo-American anarchist Gaetano Bresci. In history, Umberto I was referred to as “The Good” although he was wildly unpopular throughout his rule with left-wing circles. His assassination was said to be retribution for his praise of General Fiorenzo Bava-Beccaris’ restoration of order during an uprising in the city of Milan. In this uprising, Bava-Beccaris used a cannon against demonstrators protesting the rising cost of bread. Two assassination attempts on Umberto I immediately followed, with the third attempt ultimately claiming the King’s life in 1900.

Historic gold French angel

French 20 Franc

(Angel)

Grade: Uncirculated

Minted 1878 – 1913

Actual Gold Content: .1867 troy ounce

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

The French Angel 20 Francs were minted in vast numbers over a great many years (see mintage study to right), beginning with a brief mintage prior to the Second French Republic (1849/50), followed by a reintroduction in 1871, that precipitated a more or less continous production over the ensuing 35 years. Though one of the more common European coins by total mintage, they remain some of the most highly sought after and widely held historic world gold coins in existence. As such, they are difficult to locate in quantity and even harder to find in a high state of preservation, making the Brilliant Uncirculated coins offered here truly exceptional.

The French Angel characterizes the ideals of the French Revolution. Symbolically, the angel depicted on the obverse represents the Spirit of France and he is shown on the coin writing the French Constitution. A rooster symbolizing vigilance appears next to the angel. Behind the angel stands the fasces or bundle of rods – a symbol of power previously carried by Roman magistrates. On top of the fasces is the Cap of Liberty, which also appears on U.S. coinage with the same meaning. The slogan; Liberte, Egalite, Fraternite appears on the reverse along with the date. The French Angel gold coins were minted to the Latin Monetary Union standard of .1867 ounces per coin, to facilitate cross border trade with the 20 Franc issues of other countries at that time (Switzerland, Belgium, Italy, etc.).

There are literally thousands of stories about the powers of the ‘French Angel.’ There are stories of people who claim their lives were saved during some tragic event to those who extol its healing powers from terminal cancer and other diseases. I have even found websites where many have told their stories. Never have I seen so much mysticism surrounding a numismatic coin. This is a coin that any collector can enjoy for its beauty, but the stories behind this coin really make it a collectors’ must have piece.

— Raymond Hanisco, Coin Collecting Editor, Bella Online.

Silver peace dollars

Silver Peace Dollars

Grade: Uncirculated

Fineness: .900 pure silver

Net fine weight: .77343 troy ounces

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

The U.S. Peace silver dollars were minted beginning just after the end of World War I — “the war to end all wars” — and was thus came to be known as the “Peace dollar.” It was minted from 1921 through 1935 to the same specifications as its predecessor, the Morgan silver dollar, and too, traces its ancestry to the legendary Spanish 8 reales that circulated in the American colonies prior to and during the Revolutionary War. The coins were minted at the Philadelphia, Denver, and San Francisco mints and over its lifetime roughly 190 million of the coin were produced. Of that number, experts believe that almost 80% were melted. In one notable instance, the government ordered the melting of 50 million silver dollars to provide electric conductors for the Manhattan Project in 1942. Many of the coins melted were believed to have been Peace dollars.

The official silver to gold ratio during the period of the coin’s production was sixteen to one meaning that the federal government officially sanctioned a monetary value of sixteen ounces of silver to one ounce of gold. The coins routinely trade individually, in rolls of twenty coins and bags of 1000 coins. The coin was designed by sculptor Anthony de Francisci. The obverse bears a representation of Lady Liberty similar to the Statue of Liberty and the reverse depicts an eagle perched on rock carrying an olive branch.

A Quick Note on Silver Prices:

The current ratio of gold to silver of roughly 85:1 is within throwing distance of most undervalued condition in the market’s history. Even a return to the historic average of 62:1 would have remarkable implications for the silver price. In fact, widely read technical analyst Clive Maund called the current silver market ‘The most bullish set up for silver that I have ever seen.” For a more detailed review of silver ownership, we invite you to read our special report linked immediately below.

Silver Morgan Dollars

Grade: Brilliant Uncirculated

Fineness: .900 pure silver

Silver content: .77343 troy ounces

Face value: One dolla

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

The U.S. Morgan silver dollar is among the most famous, collected and accumulated silver coins ever minted. Produced by the United States Mint from 1878 to 1904 and again in 1921, the Morgan dollar bears a representation of Lady Liberty on its obverse and the American eagle on its reverse. Its monetary predecessor was the legendary Spanish 8 reales (or piece of eight) which circulated in the colonies before the establishment of the United States as a free republic in 1776. The coins were minted at the Philadelphia, Carson City, Denver, New Orleans and San Francisco mints and over the 27 years of its production nearly 650 million Morgan silver dollars were produced. Of that amount, experts estimate that roughly 17% have survived to present. The official silver to gold ratio during the period of the coin’s production was sixteen to one meaning that the federal government officially sanctioned a monetary value of sixteen ounces of silver to one ounce of gold. The coins routinely trade individually, in rolls of twenty coins and bags of 1000 coins. It is referred to as the Morgan silver dollar after its designer, George T. Morgan.

A Quick Note on Silver Prices:

The current ratio of gold to silver of roughly 85:1 is within throwing distance of most undervalued condition in the market’s history. Even a return to the historic average of 62:1 would have remarkable implications for the silver price. In fact, widely read technical analyst Clive Maund called the current silver market ‘The most bullish set up for silver that I have ever seen.” For a more detailed review of silver ownership, we invite you to read our special report linked immediately below.

Silver bullion bars

Fineness: .999 pure

Weight: 100 troy ounces

Minted by various private refiners including Johnson Matthey,

Engelhard, Royal Canadian Mint and others

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

One-hundred ounce silver bars are the most commonly traded silver bullion item. As with any precious metals bar, it is important to purchase exchange-approved brands as they enjoy the broadest liquidity. In fact, only exchange-approved bars are eligible for retirement plans including Individual Retirement Accounts. One hundred ounce bars are also manufactured by non-Comex approved refiners, but these are recommended only under special circumstances. Most investors avoid owning the one thousand ounce bars due to liquidity, shipping and storage problems. Ten ounce bars are not manufactured regularly by exchange-approved refiners and are usually not as popular as the one-ounce coins for those interested in smaller sized units.

Before buying silver bars, we advise speaking with one of our representatives to learn more about this tricky area of the market. Generally speaking, we recommend the purchase of silver bars only when the bars are stored at a depository and never leave the storage account, as is the case with most retirement plan purchases. We do not gaurantee repurchase when a client takes delivery of the bars and then wishes to ship and liquidate.

A Quick Note on Silver Prices:

The current ratio of gold to silver of roughly 85:1 is within throwing distance of most undervalued condition in the market’s history. Even a return to the historic average of 62:1 would have remarkable implications for the silver price. In fact, widely read technical analyst Clive Maund called the current silver market ‘The most bullish set up for silver that I have ever seen.” For a more detailed review of silver ownership, we invite you to read our special report linked immediately below.

Silver coin bag – United States pre-1965

United States Pre-1965 Silver Coin Bag

($1000 face value)

Net silver content: 715 troy ounces

Fineness: .900

Dimes, quarter, half-dollars minted for circulation

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

U.S. pre-1965 silver coins, also referred to as “junk bags,” are a popular diversification among silver owners. Generally, silver in this form is sold in $1000 face value bags weighing 715 fine troy ounces. Items included in this category are U.S. minted silver coins in dime, quarter and half-dollar denominations. $1000 face value bags of half-dollars are usually priced at slight premiums over the dime and quarter bags. Generally speaking, $1000 face value bags track the silver spot price and trade at reasonable premiums over their melt value. Though difficult to store and transport, this item remains a standard inclusion in many precious metals portfoliios.

A Quick Note on Silver Prices:

The current ratio of gold to silver of roughly 85:1 is within throwing distance of most undervalued condition in the market’s history. Even a return to the historic average of 62:1 would have remarkable implications for the silver price. In fact, widely read technical analyst Clive Maund called the current silver market ‘The most bullish set up for silver that I have ever seen.” For a more detailed review of silver ownership, we invite you to read our special report linked immediately below.

Silver South African Krugerrand

Fineness: .999 pure silver

Weight: 1.0 troy ounce

Face value: 1 Rand

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

In August 2018, for the first time in it’s 50+ year history, the South African mint released a Silver Krugerrand. A one ounce coin minted to a purity of .999, the Silver Krugerrand mirrors it’s gold counterpart, with the reverse featuring the springbok and the obverse the bust of Paul Kruger, who played a significant role in South Africa gaining independence from Britain in the late 1800’s. Offered at a slightly lower premium to the popular American Silver Eagle, the Silver Krugerrand is an attractice option for those looking to procure silver through one ounce government minted coins, at a slight lower cost per ounce. Add in the intrigue of ‘first year of issue’, and these are a great option for building a position in silver, especially at current prices.

A Quick Note on Silver Prices:

The current ratio of gold to silver of roughly 85:1 is within throwing distance of most undervalued condition in the market’s history. Even a return to the historic average of 62:1 would have remarkable implications for the silver price. In fact, widely read technical analyst Clive Maund called the current silver market ‘The most bullish set up for silver that I have ever seen.” For a more detailed review of silver ownership, we invite you to read our special report linked immediately below.

Silver Austrian Philharmonic

(Silver)

Fineness: .999 pure silver

Weight: 1.0 troy ounce

(31.10 grams)

Face value: 1.50 Euro

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

The Austrian (also Vienna) Philharmonic produced by the Austrian Mint (pictured left) is among the most artistically appealing of the bullion silver coins minted for the investment market. Struck in pure silver, investors have purchased many millions making it one of the most popular silver bullion coins currently available, and thebiggest seller in Europe. Its first year of issue was 2008.