Includes: $20 Liberty Mint State 63 & 64;

$20 St. Gaudens Mint State 63, 64 & 65

(One each)

All graded by PCGS or NGC

Semi-numismatic items

Questions? Give us a call or send us an email. Market insight, analysis & guidance from real experts with real experience. 46 years in business. A+ BBB. Zero complaints.

This research report details the price and premium history of the Mint State (MS)63 and MS64 United States $20 Liberty and the MS63, MS64, and MS65 $20 St. Gaudens gold coins. Pictured above is a brief explanation of the Mint State grading scale for semi-numismatic gold coins. As you move to the right across the scale, the condition of the coins improves and their scarcity increases (total availability decreases). The value of that scarcity is represented through the premium, or value of the coin above and beyond the value of its underlying gold content. The premium a coin carries is directly correlated to its rarity, and the more value a coin carries in its rarity, the more volatile its price changes will be. As such, moving right along the scale naturally increases risk/reward opportunities.

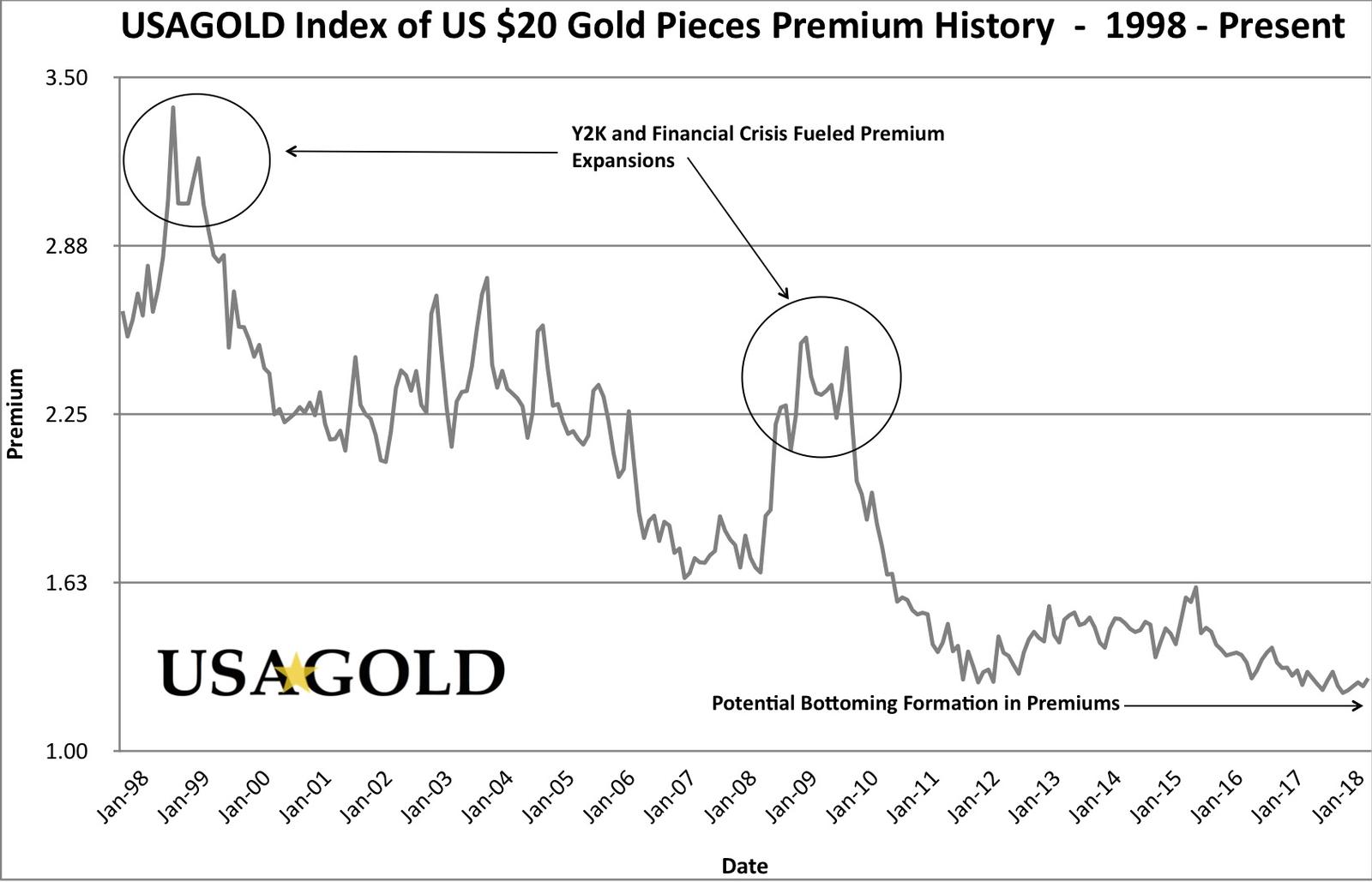

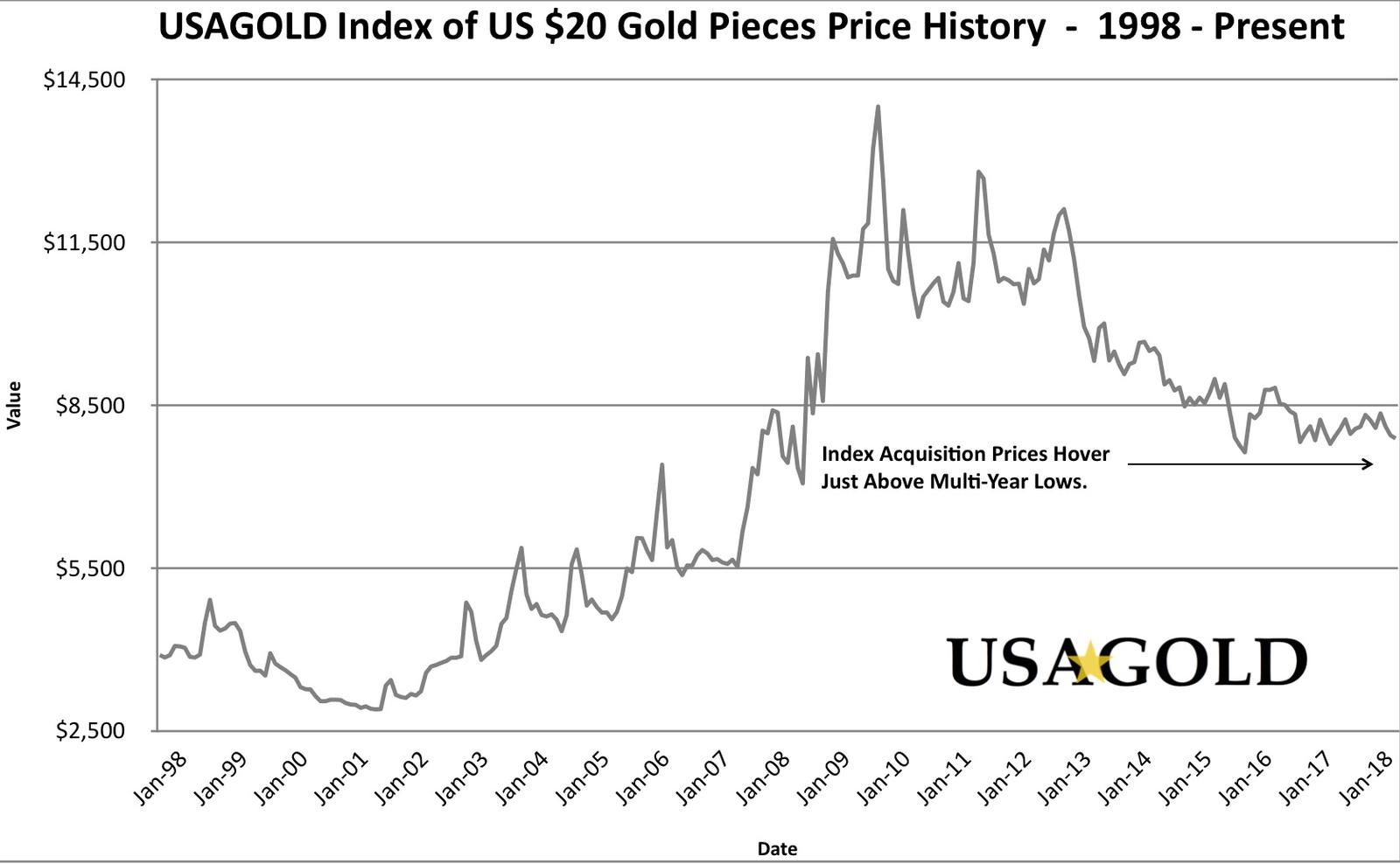

Below you will find both price history and premium history graphs for the five coin index set. The two charts can be used in conjunction to evaluate the current market conditions for these gold coins. Buying when the premium cycles are at or near all time lows has proven to be an ideal investment strategy.

Downside risk in these coins is divided into two categories: Premium risk, and the risk associated with the price of gold. By purchasing at a level where the premium is at or near an all time low, exposure to loss of value through declining premiums is mitigated. In other words, by buying ‘right’ investors can enjoy all the increased upside potential inherent in these coins without adding substantially more risk to their position than that of gold itself. Conversely, if one buys when premiums are too high, he stands to see compounded losses if both gold and premiums should decline together, or risks abbreviated gains should gold move higher, but premiums move lower.

Charted here is the USAGOLD Index of Graded $20 Gold Pieces – Premium (above) & Price (below). The Index of Graded $20 Gold Pieces contains one each Mint State (MS) 63 and MS 64 United States $20 Liberty and one each MS63, MS64, and MS65 $20 St. Gaudens gold coins and combines them into a five-coin market index. This index removes the volatility possible when tracking individual coins to provide a more accurate general market snapshot for graded $20 gold pieces. Take some time to study these charts closely. The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2 is equal to double the gold price, and a coin premium of 3 is equal to 3 times the gold price.

In short, the graded $20 gold piece market works well for those looking to increase the risk/reward factor in their gold holdings. If approached carefully and prudently, investors can enjoy great success in this market. Due simply to the fact that these coins trend with the gold price rather than track it directly (as seen in the price graph above), our advice is not to utilize these coins as the sole position in one’s gold holdings, but instead as a component in a balanced portfolio. We recommend a three to five year minimum holding period for these items.