Author Archives: Opinion

Rosenberg: Stock market rally has no fundamentals

MarketsInsider/Zahra Tayeb/7-7-2023

USAGOLD note: In short, stocks are in a bubble……Rosenberg says the “next 12 months are going to be really rough.”

Analysis-Bonds back in a tailspin as ‘higher for longer’ narrative hits

YAHOOFinance-Reuters/Yoruk Bahceli and Dhara Ranasinghe/7-7-2023

USAGOLD note: Two-year Treasuries and 10-year Treasuries broke through important levels on Friday, and the TLT ETF plunged to its lowest levels in over a decade.

How American consumers lost their optimism

Financial Times/Gillian Tett/7-6-2023

USAGOLD note: Tett probes what might be behind American gloom. Perhaps the headline statistics do not reflect what’s really going on in the US economy.

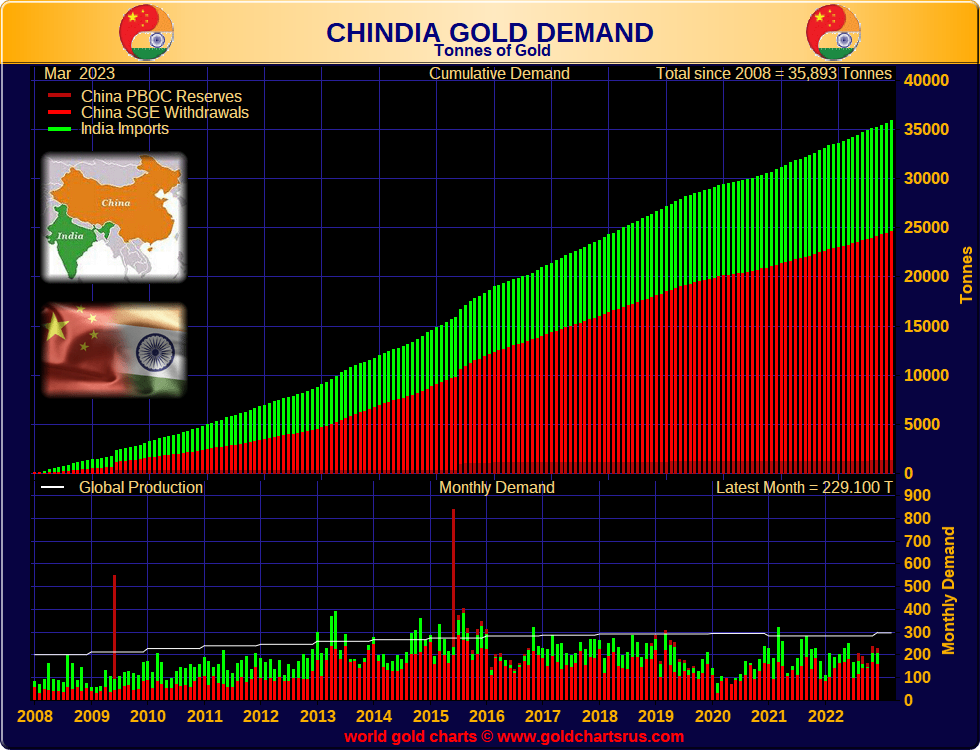

The Great Gold Migration: How Asia is dominating the global gold landscape

Value Walk/Eric Gozenput/6-30-2023

“The latter part of 2022 saw Western investors offloading bullion while their Asian counterparts capitalized on lower prices, buying jewelry, coins, and bars. This period saw more than 527 tons of gold leaving New York and London vaults, with Chinese gold imports peaking at a four-year high. In the East, gold is often the primary form of savings and wealth preservation. For millions, gold remains the ‘basic form of saving,’ an approach inherited from their ancestors, with the understanding that gold retains its purchasing power over time.”

Gold price target set at $2075 record level

Van Eck/Joe Foster and Imaru Casanova/6-14-2023

“The main drivers of past gold bull markets are extraordinary tail risks and a falling dollar. We are living in an age of tail risks as the world goes through sickness, war, social disorder and financial stress that most people thought were relegated to the past. The level of tail risks today are at least as significant as past bull markets.”

USAGOLD note: Foster and Casanova say that gold has been in a bull market since December 2015 – rising 87% over the period.

Gold’s bull market trend since 2015

(After Van Eck’s chart published at the link below)

Chart courtesy of TradingView.com and Van Eck • • • Click to enlarge

Why a US recession might happen in time for the 2024 election

Bloomberg/Molly Smith and Stephanie Flanders/6-29-2023

USAGOLD note: The Biden Administration will no doubt put considerable pressure on the Fed to quash a pre-election recession, but given the lag factor and more hikes down the road, time will tell whether the die has already been cast.

Investor lessons from taking the temperature of markets

Financial Times/Howard Marks/7-10-2023

“However, once in a while, markets go so high or so low that the argument for action is compelling and the probability of being right is high. When markets are at these extremes, the key to generating superior future investment returns lies in understanding what is responsible for the current conditions.”

USAGOLD note: Marks explains how the ordinary investor can gain from “exploiting the differences between how things are supposed to work and how they actually do in the real world.” An important read at the link……

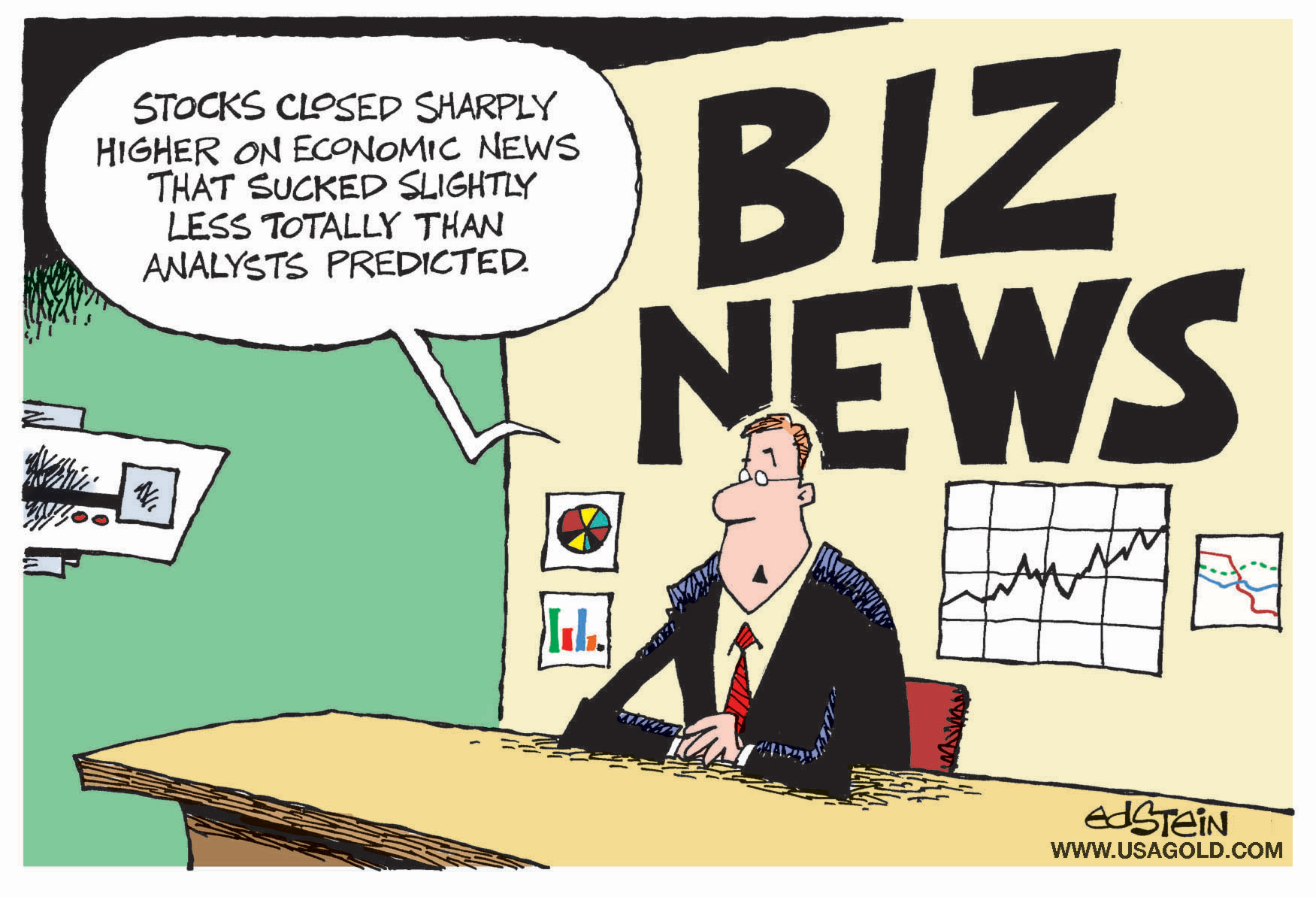

Trading legend Art Cashin is skeptical of stock market rally

Yahoo!Finance-CNBC/Filip DeMott/6-30-2023

“Sentiment is so great that a bump in the road could turn out to be a landmine. So far the trend is going. Am I skeptical? Yes.” – Art Cashin, UBS director of floor operations

USAGOLD note: A sense of unease lingers among Wall Street professionals despite the first half surge.

Bond fund giant Pimco prepares for ‘harder landing’ for global economy

Financial Times/Mary McDougall and Kate Martin/7-1-2023

“This could be more of an old fashioned cycle that lingers for a few years with inflation high but policymakers don’t come to the rescue.” – Daniel Ivascyn, chief investment officer, Pimco

USAGOLD note: Sounds like Pimco is worried about a 1970s-style stagflation. According to FT, the fund has become more defensive, more liquid.

China is hiding $3 trillion of foreign currency in ‘shadow reserves,’ adding unknown risks to the global economy, former Treasury official says

MarketsInsider/Filip DeMott/6-30-2023

USAGOLD note: Likewise, many gold market analysts believe China has significantly larger gold reserves than what it reports. These, too, they say, are housed in its state banking system.

Markets may be in for stormy second half

Blain’s Morning Porridge/Bill Blain/7-3-2023

USAGOLD note: Blain’s latest has to do with complacency, or in his case the lack of it……He says a “storm of consequences this way comes.”

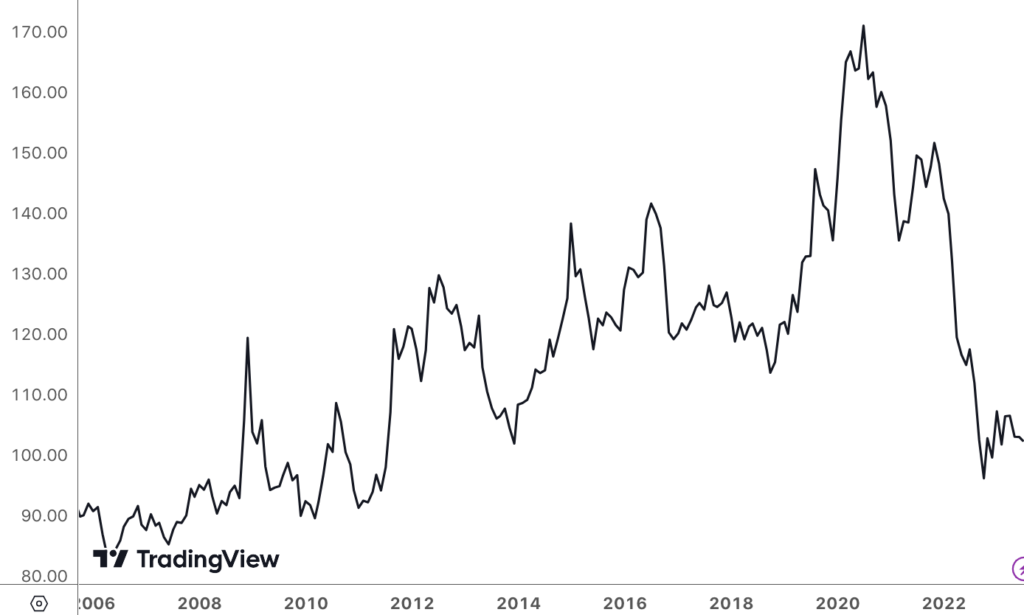

The great US Treasury bond rout is far from over

Bloomberg/Bill Dudley/6-29-2023

“Since last fall, the 10-year Treasury yield has remained in a narrow range near its current level of 3.75%. There’s little reason for it to stay there, and many reasons to expect it to move considerably higher.”

USAGOLD note: Dudley’s bond rout translates to higher rates…… He is the former head of the New York Federal Reserve. The TLT ETF, charted below, tracks the market value of US Treasuries. Dudley sees the yield on the 10-year Treasury going to at least 4.5 and “that’s a conservative estimate.”

TLT (Treasury Bond) ETF

Chart courtesy of TradingView.com

Investors must realise the pendulum of history is swinging to Bidenomics

Financial Times/Gillian Tett/6-29-2023

USAGOLD note: We spend a great of time in the financial business talking about Fed policy while overlooking the impact of fiscal recklessness. “Investors,” says Tett, “ignore it at their own peril.” If the pendulum is indeed swinging to even looser fiscal policies, investors would be well-served considering a greater loss of purchasing power and the wisdom of a long-term inflation hedge.

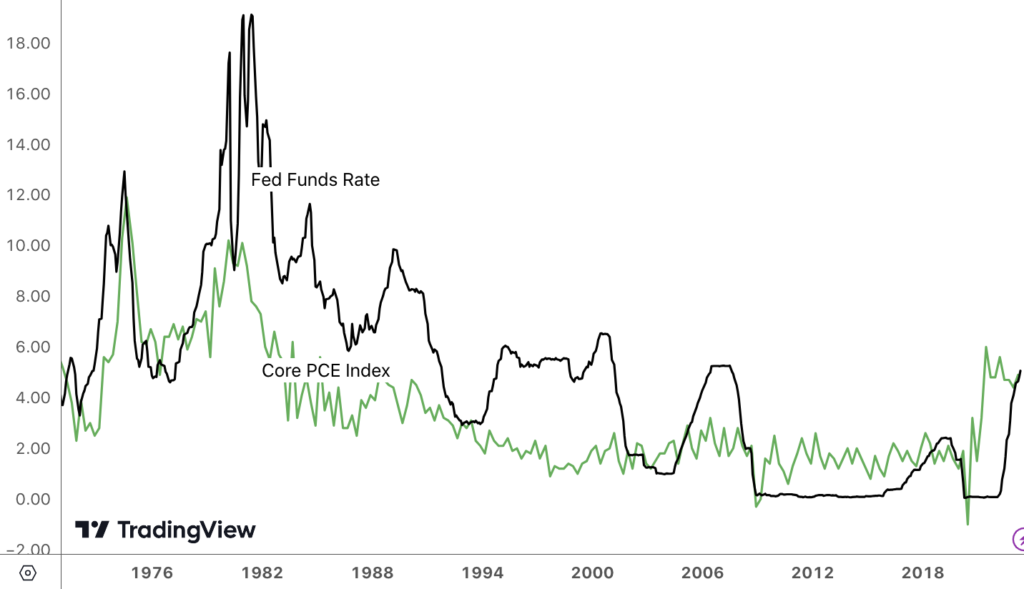

Authers says investors don’t see Fed policy as restrictive

Bloomberg/John Authers/6-29-2023

“For the time being, however, investors don’t seem to think that these higher rates will inflict an economic downturn. One explanation would be that the economy is resilient. A perhaps more plausible one is that investors still don’t buy that Fed policy is that restrictive.”

USAGOLD note: In our view, the Powell strategy is reminiscent of the 1970s wherein the lending rate rose but never enough to keep a lid on inflation until Paul Volcker became chairman of the Fed in 1979. As you can see in the chart below, the Fed pushed the Fed funds rate below the core PCE Index in the aftermath of the 2008 financial crisis, and excepting the small blip higher in 2019, has pretty much kept it there since.

Fed Funds Rate and Core PCE Index

Chart courtesy of Trading View.com • • • Click to enlarge

Why the world is on the brink of great disorder

“I’m a global macro investor who has been betting on what’s going to happen for over 50 years. I’ve been through all sorts of events and cycles in all sorts of places over a long time which led me to study how these events and cycles work. In the process, I learned that I needed to study history to understand what’s going on and what’s likely to happen.”

USAGOLD note: Dalio explains in detail the thought processes that led him to believe that the world is on the brink of a “big financial crisis.” Dailo is a long-time advocate of gold ownership to weather such crises.

The Federal Reserve thinks catastrophe is coming for US businesses

BusinessInsider/Phil Rosen/6-28-2023

USAGOLD note: Yet the Fed presses on with its tight monetary policies – a Hobson’s choice for the central bank.

How long will the dollar last as the world’s default currency?

Fortune/Mihaela Papa and The Conversation/6-25-2023

“In August 2023, South Africa will host the leaders of Brazil, Russia, India, China and South Africa – a group of nations known by the acronym BRICS. Among the items on the agenda is the creation of a new joint BRICS currency.”

USAGOLD note: Assuming the BRICS currency is launched, it will be interesting to see how it is priced against other currencies and how many it will take to buy an ounce of gold.

JPMorgan: ‘Boil the frog’ recession will feature of synchronized hard landing

Markets Insider/Jennifer Sor/6-25-2023

USAGOLD note: The calls for recessions have been ongoing for over a year, yet the recession has remained curiously sidelined. JPMorgan rates the ‘Goldilocks soft landing’ a 23% probability.

A mild global contraction is coming

Project Syndicate/Nouriel Roubini/6-27-2023

USAGOLD note: Even Dr. Doom feels a need to adjust his analysis…… Hard or soft landing, he still believes stocks will be subject to “significant declines.”

The return of quantitative easing

Financial Times/Michael Howell/6-27-2023

USAGOLD note: Quantitative easing as a permanent fixture in the economic mix…… Gold has responded quickly and vertically whenever the Fed revs up QE.